Paper Straw Market Size, Share & Trends Analysis Report By Material (Virgin Paper, Recycled Paper), By Product (Non-printed, Printed), By Straw Length (<5.75 Inches, 75-7.75 Inches, 75-8.5 Inches, 5-10.5 Inches, >10.5 Inches), By Diameter (<0.15 Inches, 15 - 0.196 Inches, 196 - 0.25 Inches, 25 - 0.4 Inches, >0.4 Inches), By Sales Channel (B2B, B2C), By End-user (Foodservice, Institutional, Household, Food Processing Industry, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Paper Straw Market Size

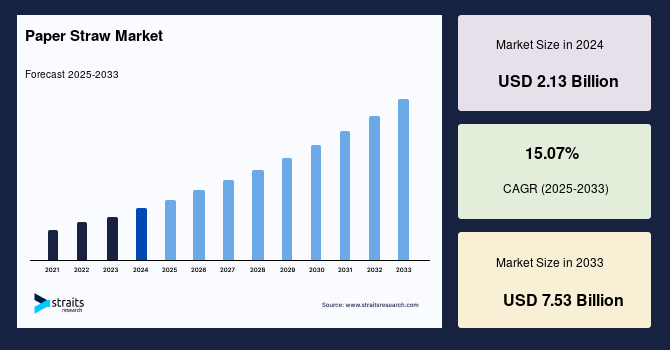

The global paper straw market size was valued at USD 2.13 billion in 2024 and is projected to grow from USD 2.45 billion in 2025 to reach USD 7.53 billion by 2033, growing at a CAGR of 15.07% during the forecast period (2025–2033).

The global paper straws market is primarily driven by stringent regulatory bans on single-use plastic straws implemented by governments worldwide, including countries like the United Kingdom, Canada, and various states in the U.S. These regulations aim to reduce plastic pollution and encourage sustainable alternatives. Additionally, the growing demand from the foodservice sector, such as restaurants, cafes, and airlines, has significantly boosted paper straw consumption as businesses strive to meet consumer preferences for eco-friendly products.

Furthermore, supportive government policies and subsidies designed to promote green manufacturing practices have further incentivized companies to invest in paper straw production. Moreover, many large corporations and FMCG brands are integrating sustainability into their core strategies, actively switching to paper straws as part of their corporate social responsibility initiatives. This collective push is propelling market growth and adoption across various regions.

Emerging Market Trends

Increasing Innovation in Paper Straw

A key trend shaping the global paper straw market is the surge in innovation aimed at enhancing product performance and sustainability. Manufacturers are developing solutions that overcome traditional limitations such as sogginess, breakage, and environmental degradation.

- For instance, in February 2025, bakery café chain TOUS les JOURS began introducing eco-friendly straws made from PHACT PHA biopolymer, developed by CJ Biomaterials. These innovative straws are durable, flexible, and resist becoming soggy. The initiative reflects the company’s commitment to sustainability and environmental responsibility as it continues to expand its presence across the United States.

Such innovations are not only improving user experience but also promoting greater adoption across foodservice providers. With increased consumer demand for plastic alternatives and growing pressure to meet environmental regulations, the paper straw industry is seeing accelerated technological evolution and market expansion.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 2.13 Billion |

| Estimated 2025 Value | USD 2.45 Billion |

| Projected 2033 Value | USD 7.53 Billion |

| CAGR (2025-2033) | 15.07% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Aardvark, Huhtamaki, Greenmunch, FinalStraw, Simply Straws |

to learn more about this report Download Free Sample Report

Paper Straw Market Growth Factors

Growing Environmental Awareness

Growing environmental awareness, fueled by proactive government-led campaigns, is a major driver for the global paper straw market. These initiatives aim to educate the public on the adverse effects of plastic pollution, promote sustainable practices, and enforce regulations on single-use plastics.

- A recent example is the campaign launched in May 2025 by the Jharkhand Biodiversity Board in India, which mobilized Biodiversity Management Committees across 50 panchayats. The campaign included plastic waste hotspot surveys, cleanup drives, and educational outreach through street plays, rallies, and competitions to highlight the environmental risks of plastic use.

Such grassroots efforts have a cascading effect, raising public consciousness, shaping eco-friendly behaviors, and prompting industries to adopt sustainable alternatives like paper straws, thus propelling the growth of the global market.

Market Restraint

Limited Durability in Liquids

One of the significant restraints for the global paper straw market is the limited durability of paper straws when exposed to liquids over extended periods. Unlike plastic straws, paper straws tend to become soggy, lose rigidity, and eventually disintegrate after prolonged use in beverages, especially in hot or acidic drinks.

This limitation affects user experience and discourages repeat usage in certain settings, such as cafes or fast-food outlets where customers may prefer longer-lasting alternatives. Although manufacturers are working on improving water-resistant coatings and multilayer designs, the current durability challenge remains a critical barrier to wider adoption, particularly where extended straw usage is needed.

Key Market Opportunities

Customization and Branding of Paper Straws

Customization and branding of paper straws present a promising opportunity for businesses to combine sustainability with effective marketing. By printing logos, slogans, or unique designs directly on the straws, companies can transform everyday items into powerful brand ambassadors that resonate with eco-conscious consumers.

- For instance, Roc Paper Straws, a women-owned business based in Rochester, New York, has been gaining attention for its colorful and durable paper straws. Launched in 2022, the company offers customizable straws that can be branded for promotional events, enhancing brand visibility while promoting sustainability. Their products have been featured in numerous media outlets, highlighting the growing trend of using branded paper straws as a marketing tool.

This approach not only boosts customer engagement but also aligns brands with the global shift toward greener, environmentally friendly products.

Regional Insights

The North American paper straw market is growing due to strong environmental regulations and increasing adoption across the foodservice and hospitality industries. Consumer preference for biodegradable products is influencing restaurant chains and beverage brands to adopt sustainable packaging. Retailers are also promoting eco-friendly alternatives, boosting product visibility. Additionally, R&D investments in improving the moisture resistance and durability of paper straws are fostering innovation. Local manufacturers are expanding production capabilities to meet rising demand, supported by public and private sustainability initiatives.

U.s. Paper Straw Market Trends

The U.S. market is growing due to state-level plastic bans in California, New York, and Washington. Major brands like Starbucks and McDonald’s have replaced plastic straws with paper alternatives. Eco-conscious consumers and sustainability pledges from corporations support this shift. Domestic producers such as Aardvark Straws are expanding capacity to meet demand from QSRs, hotels, and theme parks like Disney, which phased out plastic straws in 2019.

Canada's market for paper straw is driven by the federal ban on single-use plastics, implemented in 2022. Businesses like Tim Hortons have adopted paper straws across their outlets. The government's zero plastic waste initiative further accelerates the transition. Canadian manufacturers such as Greenlid and The Paper Straw Co. are scaling operations to meet rising demand from the foodservice and retail sectors committed to sustainability goals.

Asia-Pacific Market Trends

Asia Pacific is emerging as a high-growth region in the paper straw market due to rapid urbanization, rising eco-consciousness, and expanding middle-class consumption. The fast-growing foodservice and beverage sectors are driving the switch to biodegradable straws. Regional manufacturers are investing in advanced machinery to scale up production and cater to both domestic and export demands. Increasing awareness about ocean plastic pollution and the growing retail presence of eco-friendly goods are also fueling market expansion. In addition, strategic partnerships and innovation in affordable alternatives are aiding adoption.

China Paper Straw Market Trends

China’s market is expanding rapidly due to the country’s 2021 ban on single-use plastics. Local manufacturers like Soton Daily Necessities and YIWU JinDong Paper Products have scaled up production to meet rising domestic demand. Additionally, fast-food giants like McDonald's and KFC have transitioned to paper straws in Chinese outlets, further boosting adoption. Government incentives and a strong push for green packaging continue to drive market momentum.

India’s market is witnessing steady growth, driven by the 2022 nationwide ban on single-use plastic items. Domestic manufacturers such as UFlex and Patidar Corporation are capitalizing on the demand surge. Brands like Tata Starbucks and Café Coffee Day have switched to paper straws across outlets. Government support through schemes like the Swachh Bharat Mission and increased eco-conscious consumer behavior are fostering market expansion in urban and semi-urban areas.

Europe Market Trends

Europe is witnessing robust growth in the paper straw market, driven by stringent environmental directives restricting single-use plastics. The region’s focus on circular economy goals has accelerated the shift toward sustainable packaging solutions. Demand is surging in the food and beverage industry, particularly in cafes, restaurants, and ready-to-drink segments. Advanced recycling infrastructure and strong consumer awareness are supporting higher market penetration. Furthermore, government-backed campaigns and funding for green alternatives are encouraging domestic production and fostering partnerships across supply chains for sustainable material sourcing.

Germany Paper Straw Market Trends

Germany's paper straw market is thriving due to strict EU regulations on single-use plastics and high consumer environmental awareness. Major retailers like Aldi and Lidl have transitioned to paper straws across stores. Local manufacturers such as Bio-Strohhalme and Huhtamaki Germany are scaling production to meet demand. The hospitality industry, particularly eco-conscious cafes in Berlin and Munich, actively promotes paper straw usage to align with sustainability goals.

Italy's market for paper straw is growing steadily, driven by the EU plastics directive and increasing eco-friendly consumption habits. Brands like Esselunga and Coop Italia have replaced plastic straws in their private-label products. Local manufacturers, such as Dolci Colori, are innovating with food-safe dyes for decorative straws. Italian cafés and gelato shops, especially in Milan and Rome, are adopting paper straws as part of sustainable tourism and packaging practices.

Material Insights

In the global paper straw market, virgin paper holds the dominant share due to its superior quality, strength, and safety for food-grade applications. It provides better structural integrity and durability compared to recycled variants, making it the preferred choice for premium foodservice and beverage brands. Its smooth texture and uniform composition also ensure consistent performance in liquid environments, enhancing user experience. Additionally, increasing consumer preference for hygiene and safety further boosts the demand for virgin paper in manufacturing paper straws.

Product Insights

Non-printed paper straws dominate the market owing to their cost-effectiveness and growing preference for minimalistic, eco-friendly products. These straws are widely adopted across foodservice outlets where functional use outweighs aesthetic design. Their production involves fewer chemicals and dyes, aligning with clean-label trends and sustainability goals. The simplicity of non-printed variants also reduces contamination risks, making them ideal for large-scale food and beverage establishments seeking safe, sustainable alternatives to plastic.

Straw Length Insights

Straws measuring 7.75 to 8.5 inches lead the market as the standard size for most beverages served in restaurants, cafes, and quick-service outlets. This length is optimal for use with common cup sizes, ensuring user comfort and convenience. Their versatility across both cold and hot drinks further drives demand. Manufacturers favor this segment due to its high compatibility with automated production and packaging systems, enabling cost-efficient scalability and consistent supply to the foodservice industry.

Diameter Insights

The 0.196 to 0.25-inch diameter segment dominates due to its suitability for regular beverages like water, juice, and soft drinks. This size strikes a balance between structural strength and drinkability, offering a pleasant sipping experience. It is widely accepted across various applications, including cafes, fast-food chains, and event venues. Moreover, this diameter is compatible with most straw dispensers and packaging formats, making it the preferred choice for mass production and distribution in commercial foodservice operations.

Sales Channel Insights

The B2B segment leads the global paper straw market, driven by bulk demand from foodservice chains, hospitality sectors, and institutional buyers. These entities prioritize sustainable procurement to meet environmental regulations and brand image goals. B2B transactions ensure consistent, large-scale supply and often involve long-term contracts with manufacturers, promoting steady market growth. With increasing bans on plastic straws, businesses are shifting to paper alternatives in bulk, further strengthening B2B dominance in global sales and distribution channels.

End-User Insights

The foodservice segment dominates the market due to the high consumption of disposable straws in cafes, restaurants, and quick-service restaurants. These establishments are increasingly adopting paper straws to align with plastic ban regulations and sustainability commitments. High customer turnover in foodservice drives significant daily usage, creating steady demand. Additionally, partnerships between paper straw manufacturers and large food chains ensure consistent supply and product standardization, reinforcing the segment’s leading position in the global paper straw industry.

Company Market Share

Companies in the paper straw market are focusing on expanding production capacities, investing in advanced biodegradable materials, and enhancing product durability to meet rising demand. Strategic partnerships with foodservice chains and eco-conscious retailers are being leveraged to boost market presence. Firms are also adopting automation and sustainable manufacturing practices to lower costs and environmental impact while diversifying product offerings to cater to various consumer preferences and regulatory requirements globally.

Huhtamaki

Huhtamaki, founded in 1920 by Heikki Huhtamäki in Kokkola, Finland, began as a confectionery company and has evolved into a global leader in sustainable food packaging. In the market, Huhtamaki is a key player offering eco-friendly, food-grade paper straws designed to replace single-use plastic alternatives. The company has invested in advanced manufacturing technologies and has expanded production facilities in Europe and Asia to meet growing global demand. Huhtamaki's strong focus on recyclable and compostable products aligns with global environmental regulations and consumer preferences for sustainable packaging solutions.

- In August 2024, in partnership with Starbucks, Huhtamaki developed molded fiber lids for cold beverages as part of a compostable packaging initiative. The pilot program launched in 24 stores across California and Minnesota, aligning with local mandates on sustainable packaging. These lids are made using post-consumer recycled fiber, including materials like old newspapers, and are designed to fit snugly on cups, ensuring functionality while promoting compostability.

List of Key and Emerging Players in Paper Straw Market

- Aardvark

- Huhtamaki

- Greenmunch

- FinalStraw

- Simply Straws

- Eco-Products

- BioPak

- World Centric

- Avani Eco

- Strawtec

to learn more about this report Download Market Share

Recent Developments

- December 2024- Starbucks Japan introduced Green Planet™ straws made from a plant-based biodegradable biopolymer. These straws degrade naturally in seawater and soil, emitting less CO₂ than traditional paper straws. Initially launched in Okinawa, they are set for a nationwide rollout in March 2025, with a thicker version for Frappuccino® beverages following in April 2025.

- September 2024- MJ Global introduced the world's first single-ply, glue-free paper straw, utilizing patented Finnish technology. These straws are more durable, maintain their shape in liquids for over 30 minutes, and are fully biodegradable, addressing common issues associated with traditional paper straws.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 2.13 Billion |

| Market Size in 2025 | USD 2.45 Billion |

| Market Size in 2033 | USD 7.53 Billion |

| CAGR | 15.07% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Material, By Product, By Straw Length, By Diameter, By Sales Channel, By End-user |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Paper Straw Market Segments

By Material

- Virgin Paper

- Recycled Paper

By Product

- Non-printed

- Printed

By Straw Length

- <5.75 Inches

- 75-7.75 Inches

- 75-8.5 Inches

- 5-10.5 Inches

- >10.5 Inches

By Diameter

- <0.15 Inches

- 15 - 0.196 Inches

- 196 - 0.25 Inches

- 25 - 0.4 Inches

- >0.4 Inches

By Sales Channel

- B2B

- B2C

By End-user

- Foodservice

- Institutional

- Household

- Food Processing Industry

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Akanksha Yaduvanshi

Research Analyst

Akanksha Yaduvanshi is a Research Analyst with over 4 years of experience in the Energy and Power industry. She focuses on market assessment, technology trends, and competitive benchmarking to support clients in adapting to an evolving energy landscape. Akanksha’s keen analytical skills and sector expertise help organizations identify opportunities in renewable energy, grid modernization, and power infrastructure investments.