Payment Gateway Market Size, Share & Trends Analysis Report By Type (Hosted Payment Gateways, Non-Hosted (Self-Hosted) Payment Gateways, Local Bank Integrated Payment Gateways), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Application (Retail & E-commerce, BFSI (Banking, Financial Services, and Insurance), Travel & Hospitality) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Payment Gateway Market Size

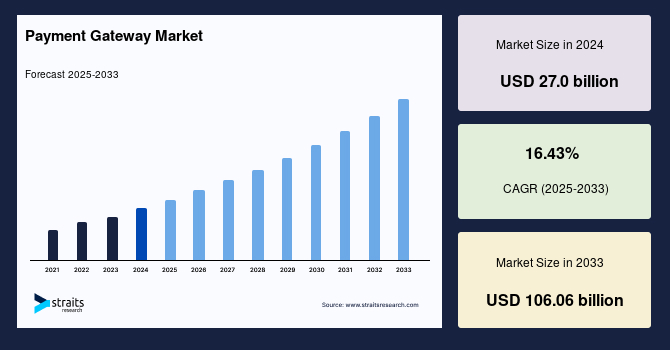

The global payment gateway market size was valued at USD 27.0 billion in 2024 and is projected to grow from approximately USD 31.44 billion in 2025 to USD 106.06 billion in 2033, exhibiting a CAGR of 16.43% during the forecast period (2025-2033).

The global payment gateways market is expanding rapidly due to changes in commerce and consumer preferences. Both businesses and consumers use mobile-friendly payment methods, encouraging providers to develop new security, fast processing, and AI technologies. The rise of e-commerce, more people using smartphones, and contactless and cross-border payments have transformed payment gateways into a key part of the digital economy.

The market has recently seen the use of artificial intelligence, machine learning, and blockchain, improving the speed, safety and reliability of transactions. Now, payment gateways are required to develop various methods, including digital wallets, recurring billing, and alternative options, to meet the needs of different consumers. The market is growing quickly because of new regulations, the elevation of subscription services, and the need for infrastructure that can handle many transactions simultaneously.

Latest Market Trend

Ai-Driven Security and Real-Time Payments

The market is growing with the use of artificial intelligence, which is at the centre of better security and support for instant payments. They are designed to meet the rising demand for quick, safe, and easy transactions, especially as digital wallets and mobile experiences become more popular.

- For instance, in May 2025, Stripe Inc. introduced the world's first AI-based foundation to detect fraud and increased its real-time payment options for merchants worldwide. As a result, businesses can now avoid transaction failures, prevent fraud more efficiently, and provide a better checkout process.

Furthermore, the payments sector is seeing more innovations focused on making things clearer and more compliant with monetary regulations. The latest services use blockchain technology to ensure transactions cannot be changed and faster settlements, which is important for industries to track every detail. Biometric authentication, such as facial recognition and fingerprint scanning, is being integrated to make digital wallets and mobile payments safer.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 27.0 Billion |

| Estimated 2025 Value | USD 31.44 Billion |

| Projected 2033 Value | USD 106.06 Billion |

| CAGR (2025-2033) | 16.43% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Adyen, Razorpay, Square, Authorize.Net, Checkout.com |

to learn more about this report Download Free Sample Report

Payment Gateway Market Growth Factor

Digitalisation of Commerce

The rise in e-commerce and digital payments drives the global payment gateway market. Online transactions are made safer and easier with payment gateways, which also help meet the growing need for data security and compliance. These transactions are made possible by payment gateways that need to ensure data safety, prevent fraud, and follow new regulations.

- For example, in 2024, Amazon Pay received a payment aggregator (PA) licence and declared that it was joining forces with various Indian fintech companies to offer its payment gateway to small and medium-sized businesses (SMBs). Their goal was to make digital payments more accessible for millions of merchants since e-commerce is expanding rapidly, and more payment options are required in developing countries.

This demonstrates that the digital transformation of commerce is the main reason for new developments leading towards industry growth. With businesses and consumers expecting faster, safer, and more convenient e-commerce, payment gateway providers are updating their services just as quickly.

Market Restraint

Regulatory Compliance

The rising difficulty of following regulations with governments worldwide making data protection and payment rules stricter, payment gateway providers are required to invest a lot in upgrading their systems to remain compliant. This leads to higher expenses and can slow the introduction of new features and the company’s entry into new markets, affecting the market's growth.

The current rollout of Europe's revised Payment Services Directive (PSD2) is a good example of this constraint. Strong Customer Authentication (SCA) has caused many payment gateways in the region to struggle, resulting in delays and more people abandoning their purchases at checkout. Due to these regulations, many providers have had to spend a lot on compliance, which has slowed their efforts to innovate and expand.

Market Opportunity

Digital Transformation

The rise of digital payments and increased online businesses are pushing emerging economies to grow the payment gateway market. Vietnam, South Africa, and Mexico are seeing strong growth in e-commerce thanks to more people using the internet and government efforts to include everyone in the financial system. The introduction of "Pix" by the Central Bank in Brazil has made digital payments quicker and more convenient for everyone, which has increased the need for advanced payment gateways.

- For instance, in March 2025, the Mexican government partnered with Mercado Pago and Stripe to introduce QR codes for payments everywhere in the country. The initiative was designed to help small businesses, informal vendors, and rural areas that had not used digital payment systems much before. The government offered lower transaction fees, free registration for micro-entrepreneurs, and classes to teach people about digital services.

With more digital infrastructure and fintech in these countries, payment gateways are expected to be used more in e-commerce. The government policies and efforts to help more people access financial services act as strong evidence of that.

Regional Analysis

North America holds the largest share of about 36% of the global market. It has a strong position due to its advanced technology. A majority of its population uses digital payments, and it has a well-developed online shopping system. Secure payment methods, major investments in fintech, and in-line regulations strengthen the region’s leadership. With major payment gateway providers and a tech-savvy population, North America is expected to remain a leader in the global market.

United States Market Trends

The US’s payment gateway market is a key reason North America leads the global market. Companies like PayPal, Stripe and Square help the U.S. build a well-working fintech ecosystem. The market is growing due to more people shopping online, and online retail sales are expected to reach over $1 trillion by 2025. Strong cybersecurity and trust from consumers help the industry grow. Mobile payment innovations are popular in the U.S., with Apple Pay and Google Pay gaining more exposure, which allows North America to cover the most market share.

Canada's Market Trends

Canada’s payment gateway market is also a key factor in North America’s leadership in the global payment gateway market. The country’s support for advanced technology encourages digital transactions, and the e-commerce sector is expanding thanks to companies like Shopify, a top payment gateway provider. The modernisation initiatives by Payments Canada, like the Real-Time Rail (RTR), projected to launch in 2026, provide 24/7 processing with data-rich transactions. This earns people's trust by ensuring a proper flow of money.

Asia-Pacific – Fastest-Growing Region

The Asia-Pacific (APAC) region is experiencing the fastest growth in payment gateway use worldwide. This growth is driven by e-commerce, more people using mobile and internet services, government support for cashless payments, and new payment methods. This is made possible because over 90% of people in the Asia-Pacific region have mobile connectivity, making it undergo a digital transformation on a considerable scale. Expanding middle class, and regulatory support for fintech innovation makes it a hotspot for payment gateway expansion.

China's Market Trends

China’s payment gateway market is a powerhouse for the Asia-Pacific region, largely because of its huge population and advanced digital environment. Nearly a billion Chinese people rely on mobile payment apps like Alipay and WeChat Pay as of 2024, so digital wallets are now common for all kinds of transactions. The government’s efforts to introduce a digital yuan and improve internet access everywhere have made it easier for payment gateway providers to operate. China’s fintech industry is very innovative, and it is quickly adopting new technologies such as blockchain and mobile wallets, which help the country lead the region’s growth in payment gateways.

Indian Market Trends

India’s payment gateway market is also a key player in the Asia-Pacific region, due to consistently increasing government support and adoption of digital payments. The Reserve Bank of India’s rules for Bharat Bill Pay, Paytm, and Mobikwik have made digital transactions safer and more reliable, increasing consumer trust. The Direct Benefit Transfer (DBT) program gave out ₹6.91 lakh crore in 176 crore instances during 2023-24. This demonstrates the scale of digital payments, smartphone use, the growth of e-commerce, and policies supporting cashless payments, making India a major driver for payment gateways in Asia.

Europe - Significant Growth

Europe’s payment gateway market is experiencing rapid growth and expansion due to the mobile payments trend and a strong digital infrastructure. PayPal, Stripe, and Adyen are some of the key players driving this change through advanced technology and easy-to-use platforms. The government support for digitalisation and cashless payments also works in the region's favour, moving quickly from using traditional payment methods to adopting new ones. Consequently, Europe is now a top player in digital payments, thanks to its fintech sector constantly introducing new ideas and expanding the market.

Germany's Industry Trends

Germany’s payment gateway market in Europe is a great contributor, as many people in the country use the internet and prefer online banking over traditional methods. Payment gateways have become more popular, and German people are using contactless payments and mobile wallets more often, with increased trust in the country’s banking system and strong cybersecurity. In 2023, there was a 40% increase in contactless payments in Germany, which brought them closer to Nordic countries and showed a big change in how people pay. Moreover, the government’s focus on digitalisation and less use of cash has helped payment gateway providers make Germany a major force behind the region’s digital payment growth.

France’s payment gateway market has proved prominent in Europe. Mobile payment adoption is leading the way toward modern trading methods. In 2024, 94% of bank customers in France were using their respective mobile banking apps and websites, which shows a significant rise in daily digital activities. Support from the government for digital transformation and financial inclusion has helped France become a key player in digital payment technology. As a result, France’s economy is becoming more efficient and beneficial to its population.

Type Insights

Hosted payment gateways are the main players in the global payment gateway market because they are easy to use and secure, and help merchants comply with PCI standards. They send customers to a third-party payment site, allowing for smooth e-commerce transactions. Many online retailers use PayPal’s hosted solution because it is scalable and trusted. In 2022, the market was mostly driven by hosted gateways, which accounted for more than 57% of the total revenue due to the rise in online shopping and digital wallets. Their position will likely remain strong since companies focus on secure and easy-to-use payment methods.

Enterprise Size Insights

Large enterprises are leading the payment gateway market, using advanced gateways to manage many transactions and complicated payment systems. They also require flexible and secure systems that help them handle their worldwide operations. For handling millions of daily transactions in different regions, Amazon uses its advanced gateways, such as Aurora and MSK Serverless. The market grew mainly because large companies adopted digital solutions and expanded their e-commerce activities across borders. The need for gateways that can handle large volumes and detect fraud encourages new developments. With more global trade, large companies will keep leading, thanks to investments in secure payment systems.

Application Insights

E-commerce has made the application-based payment gateway market dependent on providing smooth, secure, and quick digital transactions. As more people are shopping online due to global connectivity and mobile phones, payment systems must be able to work smoothly with e-commerce sites. They allow businesses to handle payments smoothly, improving how users feel and trust the company. PayPal has succeeded as a payment gateway by providing its services to e-commerce companies such as eBay and Shopify. Its easy-to-use API and worldwide presence allow merchants to easily accept payments, showing that e-commerce growth leads to more merchants using and improving application-based payment gateways.

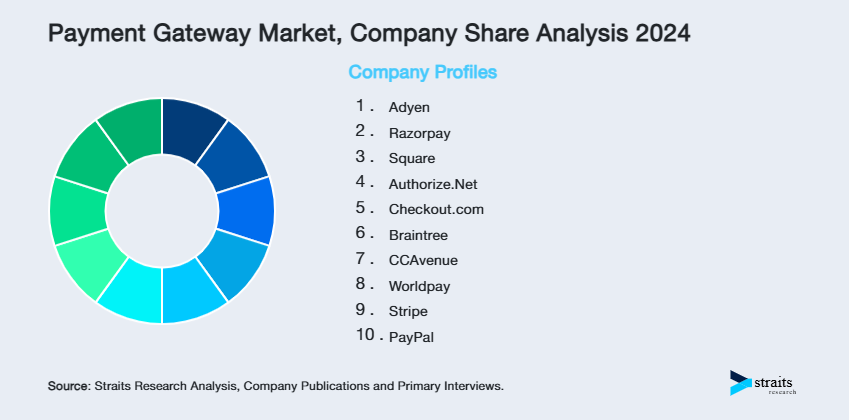

Company Market Share

The global payment gateway market is highly competitive, with major players working on new ideas, forming partnerships and expanding worldwide to boost their presence. Companies are putting much effort into research and development to create new payment technologies that meet the needs of e-commerce, retail and other digital payment areas.

PayPal Holdings, Inc. - As of January 2025, PayPal holds around 45% of the global payment gateway market. The company is famous for making safe online, mobile, and peer-to-peer payments, and many major e-commerce sites use it. PayPal has regularly seen its revenue increase, especially during the pandemic, when people have used digital transactions more.

- In 2025, a notable recent development by PayPal is the introduction of real-time bank transfers at near-zero cost. This advancement allows users to access deposited funds within seconds, significantly reducing delays and enhancing the convenience of moving money between PayPal and bank accounts.

List of Key and Emerging Players in Payment Gateway Market

to learn more about this report Download Market Share

Recent Developments

- April 2025 - PayPal enabled users to connect their digital wallets and some cryptocurrencies to its payment gateway. As a result, merchants could serve more people, and the number of transactions worldwide rose, showing that more people are looking for different ways to pay online.

- March 2025 - Stripe introduced AI and machine learning-based fraud detection tools for its payment gateway, making transactions safer and reducing the number of chargebacks for merchants. As a result, other companies in the industry began to speed up their efforts to use AI for fraud prevention.

- February 2025 - Razorpay, one of India’s main payment gateways, revealed a new infrastructure to process over 10,000 transactions each second. As a result, merchants could handle large sales events without interruptions, which helped improve the scalability and reliability of online shopping in new markets.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 27.0 Billion |

| Market Size in 2025 | USD 31.44 Billion |

| Market Size in 2033 | USD 106.06 Billion |

| CAGR | 16.43% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Enterprise Size, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Payment Gateway Market Segments

By Type

- Hosted Payment Gateways

- Non-Hosted (Self-Hosted) Payment Gateways

- Local Bank Integrated Payment Gateways

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application

- Retail & E-commerce

- BFSI (Banking, Financial Services, and Insurance)

- Travel & Hospitality

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.