Pepperoni Foods Market Size, Share & Trends Analysis Report By Type (Pork-Based, Pork and Beef-Based, Beef-Based, Plant-Based, Others), By End User (Food Manufacturer, Foodservice Industry, Retail), By Application (Pizza, Sandwiches, Burgers, Dips and Sauces, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Pepperoni Foods Market Overview

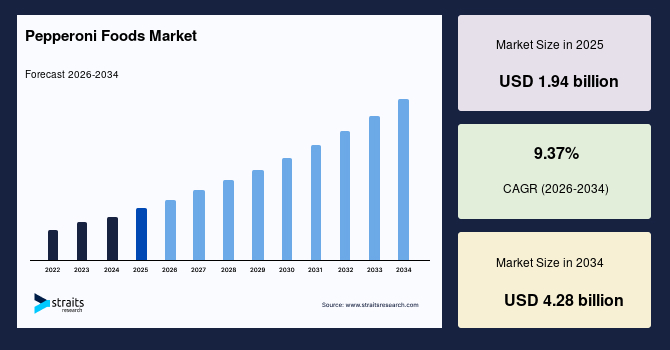

The global pepperoni foods market size was valued at USD 1.94 billion in 2025 and is estimated to reach USD 4.28 billion by 2034, growing at a CAGR of 9.37% during the forecast period (2026–2034). The market is driven by rising global pizza and fast-food consumption, expanding QSR chains, and growing demand for convenient, protein-rich snacks. Technological advancements in meat processing and flavor innovation are further supporting sustained growth in pepperoni-based food products worldwide.

Key Market Trends & Insights

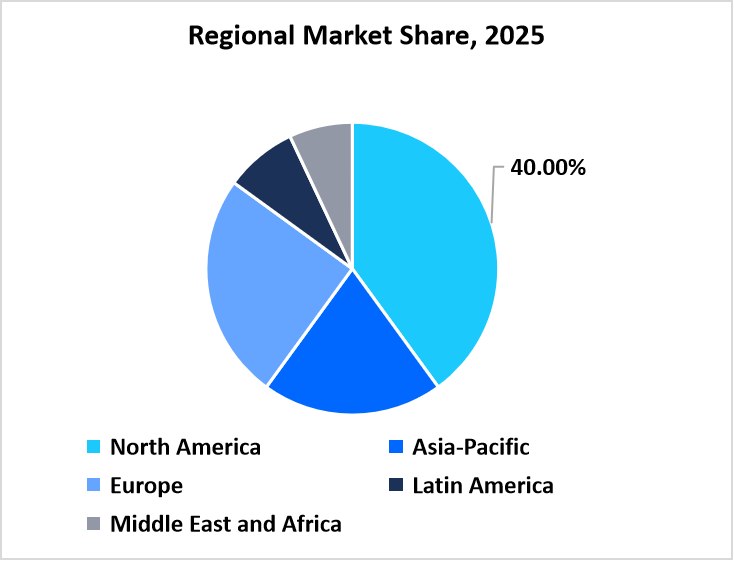

- North America held the largest market share, over 40% of the global market.

- Asia-Pacific is the fastest-growing region, with a CAGR of 10.54%.

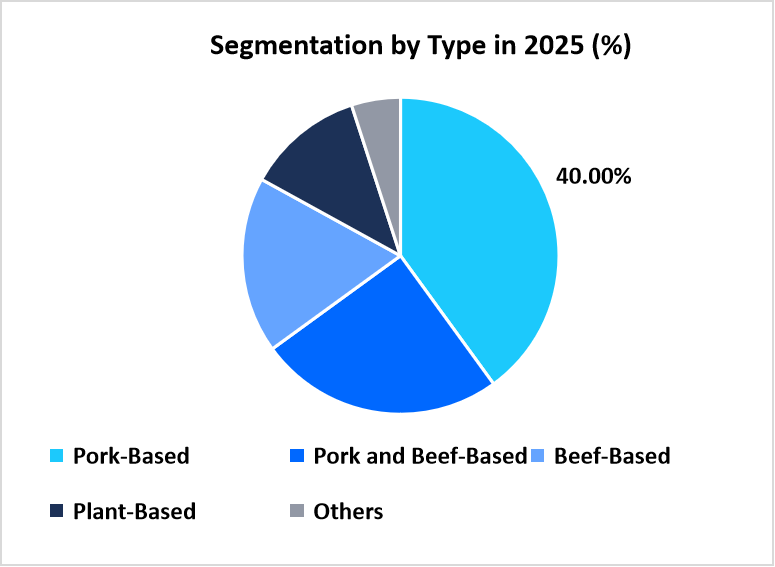

- By Type, the pork-based segment held the highest market share of over 40%.

- By Application, the sandwich segmentis expected to witness the fastest CAGR of 10.12%.

- By End User, the food service industry segment held the highest market share of over 45%.

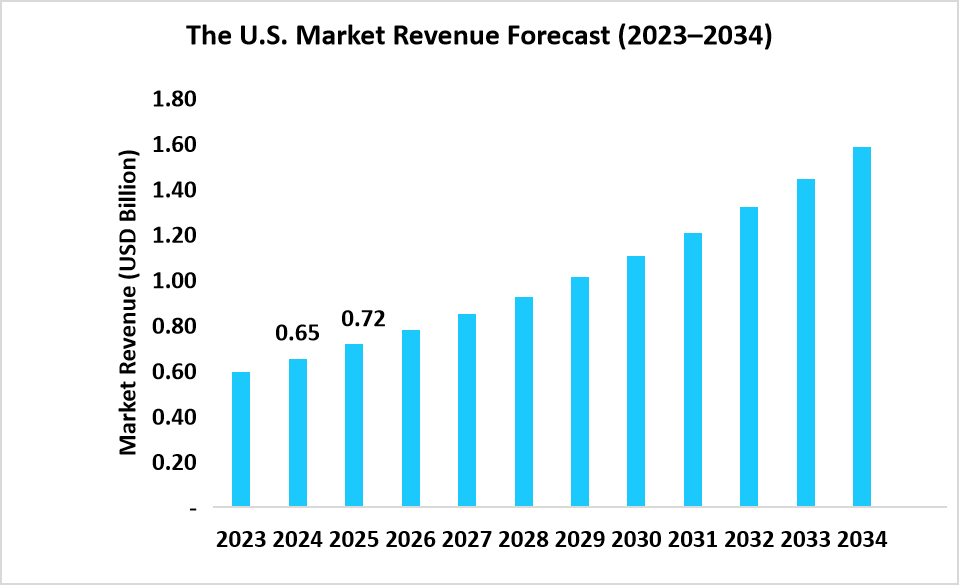

- The U.S. pepperoni foods market was valued at USD 0.65billion in 2024 and reached USD 0.72 billion in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 1.94 billion

- 2034 Projected Market Size: USD 4.28 billion

- CAGR (2026-2034): 9.37%

- North America: Largest market

- Asia-Pacific: Fastest-growing region

Pepperoni is a popular cured meat product made from a blend of pork and beef, seasoned with paprika, chili, and other spices. Known for its distinctive flavor and vibrant red color, it’s widely used as a pizza topping, sandwich filling, and ingredient in pasta, wraps, and snack items. Beyond traditional meat-based varieties, innovative producers now offer turkey, chicken, and plant-based alternatives, expanding pepperoni’s use in retail, foodservice, and quick-service restaurants across global cuisines.

The market is propelled by increasing globalization of Western cuisines, expansion of quick-service restaurant chains, and higher disposable incomes, driving premium meat consumption. Advances in meat processing and preservation technologies support product quality and shelf life. Moreover, the growth of online delivery services creates new distribution opportunities. Rising consumer experimentation with fusion and gourmet pizzas, along with innovation in flavor profiles and healthier protein options, opens lucrative growth avenues.

Latest Market Trends

Rising demand for ready-to-eat and convenience foods

The market is witnessing strong momentum driven by the growing preference for ready-to-eat and convenience-based meals. Urban lifestyles, busier work schedules, and the increasing popularity of frozen pizzas and snackable meat options have significantly boosted pepperoni consumption. Consumers are prioritizing taste, accessibility, and time-saving meal formats.

Moreover, the expansion of modern retail formats, quick-service restaurants, and online delivery platforms has further enhanced product visibility. Pepperoni is increasingly featured in sandwiches, wraps, and pre-packaged meals, reflecting its versatility and global appeal. This trend continues to define innovation in both frozen and chilled meat categories.

Growth in clean-label and nitrate-free options

A growing shift toward health-conscious eating has prompted consumers to seek clean-label and nitrate-free pepperoni options. Brands are reformulating products with natural preservatives such as celery powder and rosemary extract, reducing sodium, and emphasizing transparency. This has led to the rise of premium and organic pepperoni variants.

Manufacturers are leveraging consumer demand for naturally cured meats by adopting sustainable processing techniques and emphasizing “no artificial additives” claims. The clean-label trend is not only enhancing brand trust but also expanding market share among wellness-focused consumers, particularly in North America and Europe.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 1.94 billion |

| Estimated 2026 Value | USD 2.12 billion |

| Projected 2034 Value | USD 4.28 billion |

| CAGR (2026-2034) | 9.37% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Hormel Foods Corporation, Tyson Foods, Inc., Smithfield Foods, Inc., Bridgford Foods Corporation, Boar’s Head Provisions Co., Inc. |

to learn more about this report Download Free Sample Report

Market Driver

Surging global consumption of pizza and fast food

The surging global appetite for pizza and fast food continues to drive pepperoni consumption, with international chains rapidly expanding into new regions. The growing preference for convenient, flavorful, and indulgent meal options has made pizza one of the most accessible comfort foods worldwide.

- For instance, in June 2025, Little Caesars entered India, launching its first outlet in Delhi NCR and planning a swift rollout of dozens of new stores in the coming years. The company aims for 100 stores by the end of the decade, reflecting the strong market potential in emerging economies.

Such expansions by major pizza brands are directly fueling pepperoni demand, as the ingredient remains a staple topping that defines the taste and appeal of modern fast-food menus.

Market Restraint

Rising vegan and vegetarian population

The market faces restraint from the rapidly growing vegan and vegetarian population worldwide. As more consumers adopt plant-based diets driven by health, ethical, and environmental concerns, demand for traditional pork- and beef-based pepperoni has seen a gradual decline. Foodservice chains and retailers are also diversifying their offerings to include meat-free alternatives, reducing reliance on conventional pepperoni. This shift in consumer preference is compelling manufacturers to rethink formulations, invest in plant-based innovation, and adapt to the evolving definition of protein-rich convenience foods.

Market Opportunity

Expansion of plant-based or hybrid pepperoni segments

The growing focus on sustainable eating and clean-label formulations is opening new opportunities in the pepperoni foods segment. Consumers are increasingly seeking plant-based or hybrid alternatives that deliver the same flavor experience as traditional meat products while reducing environmental impact.

- For instance, in February 2025, Before the Butcher launched The Original Butcher Stick – Pepperoni Style, a sunflower-protein-based snack replicating the bold and spicy taste of classic pepperoni. Similarly, in September 2025, Plantaway introduced its pea-protein-based pepperoni in India, offering a juicy, authentic texture suited for pizzas and sandwiches.

These innovations reflect a broader industry shift toward plant-based protein diversity and flavor precision, positioning meat-free pepperoni as a promising category.

Regional Analysis

North America’s pepperoni foods market is dominant with a market share of over 40%, driven by a strong presence of fast-food chains, pizza manufacturers, and meat processing industries. North America’s thriving quick-service restaurant (QSR) culture, coupled with consumer preference for protein-rich and spicy foods, continues to drive demand for pepperoni-based products. Advancements in cold storage, packaging, and meat preservation have also strengthened supply chains. Moreover, companies are innovating with low-fat and nitrate-free pepperoni variants, which appeal to health-conscious consumers and expand their retail shelf presence across major markets.

- The United States market is led by major producers like Hormel Foods Corporation, Smithfield Foods, and Bridgford Foods, focusing on expanding product diversity and clean-label pepperoni. These companies are investing in advanced curing technologies and flavor innovations, introducing turkey-based and plant-forward pepperoni options to meet the evolving preferences of consumers.

- Canada’s pepperoni foods market is expanding with key players such as Maple Leaf Foods, Sofina Foods, and Olymel, emphasizing locally sourced ingredients and improved processing efficiency. These companies are launching premium pepperoni ranges tailored for both foodservice and retail channels, catering to rising demand for ready-to-eat and artisanal meat snacks.

Asia-Pacific: Significantly Growing Region

The Asia-Pacific pepperoni foods market is the fastest growing with a CAGR of 10.54%, supported by the increasing Westernization of diets, urbanization, and a rise in international pizza and sandwich chains. Consumers in Asia-Pacific are showing a strong inclination toward processed meat products with bold flavors, including pepperoni-infused snacks and frozen meals. Regional manufacturers are modernizing production facilities and forming partnerships with global food brands to enhance distribution. Moreover, the growth of e-commerce and convenience food outlets is expanding market accessibility across emerging economies.

- China’s pepperoni foods market is led by domestic and international companies such as Yurun Group, WH Group (Shuanghui), and Tyson Foods China, focusing on diversifying meat-based offerings and improving processing technologies. These firms are investing in Western-style meat products, including pizza toppings and pepperoni slices, tailored to Chinese taste preferences.

- India’s market is developing rapidly, driven by rising demand from quick-service restaurants, cafes, and online food platforms. Companies like Prasuma, Godrej Tyson Foods, and Venky’s India are introducing halal-certified, chicken-based, and plant-based pepperoni alternatives to suit local preferences. These brands are also focusing on expanding their cold-chain networks and frozen storage facilities.

Source: Straits Research

Europe Market Trends

Europe’s pepperoni foods market holds a strong position in the global pepperoni foods market, supported by a well-established meat processing industry and widespread consumption of pizza and deli meats. European consumers are increasingly drawn to authentic, high-quality, and sustainably sourced pepperoni products, driving innovation among regional producers. As per Straits Research, advanced cold-chain logistics and exports to neighboring regions further strengthen Europe’s market dominance, while rising vegan and flexitarian lifestyles are encouraging the development of plant-based pepperoni alternatives.

- Germany’s market is led by companies like Herta Foods, Westfleisch, and Rügenwalder Mühle, which are pioneering in sustainable meat production and meat-free alternatives. The country’s thriving retail and foodservice sectors also enhance product availability and market expansion across Europe.

Latin America Market Trends

Latin America’s pepperoni foods market is witnessing steady growth, driven by increasing meat consumption and rising demand for Western-style ready-to-eat meals. The expansion of fast-food chains and convenience stores has fueled the popularity of pepperoni-based products. Local manufacturers are focusing on enhancing production capacity and quality standards, while consumers are showing a growing interest in spicy, protein-enriched snacks and frozen foods. Moreover, regional governments are also supporting advancements in meat processing, thereby strengthening Latin America’s role in the global supply network.

- Brazil’s market is led by major producers like BRF S.A., JBS Foods, and Aurora Alimentos, which are expanding product portfolios through premium cured meats and export-grade pepperoni products. These companies are modernizing manufacturing lines and adopting innovative preservation techniques to maintain freshness and quality.

The Middle East and Africa Market Trends

The Middle East and Africa’s pepperoni foods market is emerging as a promising market for pepperoni foods, supported by growing urbanization, expanding retail networks, and rising global food brand penetration. Increasing Western dining habits and higher disposable incomes are boosting the consumption of frozen and processed meat products. Manufacturers are focusing on halal-certified and poultry-based pepperoni, aligning with cultural preferences. Moreover, partnerships with global QSR chains and supermarket expansions are strengthening product accessibility and consumer awareness across the region.

- The UAE’s market is advancing rapidly, driven by brands like Al Islami Foods, BRF Sadia, and IFFCO Group, which focus on halal-compliant and innovative meat solutions. The nation’s strong import infrastructure and focus on food innovation position it as a key pepperoni hub in the Middle East.

Type Insights

Pork-based pepperoni dominates the global market with a share exceeding 40%, owing to its traditional flavor profile and wide culinary acceptance across Western cuisines. It remains the preferred choice in pizza chains, frozen meals, and ready-to-eat snacks due to its rich taste and superior fat-to-meat balance. Moreover, major producers continue refining curing and seasoning processes, ensuring consistent texture and quality that sustain pork-based pepperoni’s leadership worldwide.

Pork and beef-based is the fastest-growing type segment, advancing at a CAGR of 9.87%. This hybrid blend appeals to diverse consumer preferences seeking balanced flavor, higher protein content, and better texture retention. The expansion of global pizza chains and gourmet sandwich outlets is driving its adoption. Moreover, growing innovation in clean-label curing methods and spice blends further supports growth, positioning it as the preferred modern alternative to traditional varieties.

Source: Straits Research

End-User Insights

The foodservice industry leads the market with a share of over 45%, reflecting pepperoni’s integral role in quick-service restaurants, pizzerias, and fast-casual dining outlets. Rising global consumption of Western-style foods and the expansion of delivery platforms have amplified demand. Continuous menu innovation and bulk procurement by international chains strengthen the segment’s dominance, ensuring a stable pepperoni supply for large-scale commercial food preparation and mass consumer appeal.

Food manufacturers represent the fastest-growing end-user segment, registering a CAGR of 9.37%, fueled by rising demand for packaged and frozen pepperoni-based products. Growth in ready-to-cook meals, snack fillings, and convenience foods has increased bulk production needs. Manufacturers are adopting advanced preservation and slicing technologies to extend shelf life and flavor stability, ensuring consistent quality across global markets while catering to evolving consumer convenience preferences.

Application Insights

Pizza remains the dominant application segment, capturing over 50% of the market share due to its global popularity and cultural ubiquity. Pepperoni’s strong flavor, ideal fat content, and compatibility with cheese and sauces make it a staple topping across quick-service and artisanal pizza brands. Moreover, the rising demand for frozen pizzas and delivery innovations ensures sustained growth, reinforcing pepperoni’s status as a core pizza ingredient worldwide.

Sandwiches represent the fastest-growing application, expanding at a CAGR of 10.12%, driven by the rising popularity of pepperoni-infused deli sandwiches, paninis, and wraps. Consumers seeking high-protein, flavorful options are increasingly embracing pepperoni as a premium filling. Moreover, foodservice brands and retail delis are innovating with heat-stable, low-fat pepperoni slices, appealing to on-the-go consumption trends and enhancing product diversity within global sandwich offerings.

Company Market Share

Leading companies are focusing on expanding product portfolios with innovative flavors, healthier formulations, and clean-label options. Many producers are investing in advanced curing and preservation techniques to enhance shelf life while maintaining authentic taste. Moreover, firms are developing plant-based and hybrid variants to attract health-conscious consumers and exploring strategic collaborations with pizzerias, retailers, and e-commerce platforms to strengthen market presence and global distribution.

Smithfield Foods, Inc.

Smithfield Foods, Inc. was founded in 1936 in Smithfield, Virginia, USA, by Joseph W. Luter and his son. Originally a small ham-processing business, it has grown into one of the world’s largest pork producers and food-processing companies. The company operates numerous production, packaging, and distribution facilities across North America and Europe. Smithfield is renowned for its commitment to quality meat products, sustainability initiatives, and animal welfare practices. Since 2013, it has been a wholly owned subsidiary of WH Group Ltd., a leading global meat company based in China.

List of Key and Emerging Players in Pepperoni Foods Market

- Hormel Foods Corporation

- Tyson Foods, Inc.

- Smithfield Foods, Inc.

- Bridgford Foods Corporation

- Boar’s Head Provisions Co., Inc.

- Battistoni Italian Specialty Meats, LLC

- Maple Leaf Foods Inc.

- WH Group Ltd.

- Cargill Incorporated

- Performance Food Group Company

- US Foods Holding Corp.

- Simply Good Foods Co.

- Jack Link’s Protein Snacks, Inc.

- Golden Harvest Agro Industries Ltd.

- Johnsonville LLC

- CTI Foods LLC

- Carl Buddig & Company

- Creminelli Fine Meats

- Pocino Foods Company

- Old Wisconsin Sausage Company

- Liguria Foods

- Vienna Beef Ltd.

Recent Development

- March 2025 - Margherita, a brand of authentic Italian specialty meats under Smithfield Culinary, turned up the heat with the launch of its Jalapeño Pepperoni. Crafted with passion and premium ingredients, this bold twist on the classic delivers a perfect balance of spicy heat and rich flavor, enabling foodservice operators to elevate menus with trending, crowd-pleasing tastes.

- August 2025 - Hormel has launched two bold new pepperoni flavors: Dill Pickle and Jalapeño. The Dill Pickle version blends its classic pork-beef base with tangy pickle notes, while the Jalapeño variant adds a spicy kick using dehydrated jalapeño peppers. Both come in 5-oz, ready-to-eat packs (~75 slices), ideal for pizzas, sandwiches, or straight snacking.

- January 2025 - Round Table Pizza launched a limited-time Pepperoni, Grilled Chicken & Bacon Pizza. The pizza features a three-cheese blend, creamy garlic white sauce, pepperoni, red onion, roma tomatoes, grilled chicken, bacon, and green onions. A large starts at US$19.99, aiming to deliver value with classic, hearty flavors.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 1.94 billion |

| Market Size in 2026 | USD 2.12 billion |

| Market Size in 2034 | USD 4.28 billion |

| CAGR | 9.37% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By End User, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Pepperoni Foods Market Segments

By Type

- Pork-Based

- Pork and Beef-Based

- Beef-Based

- Plant-Based

- Others

By End User

- Food Manufacturer

- Foodservice Industry

- Retail

By Application

- Pizza

- Sandwiches

- Burgers

- Dips and Sauces

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.