Pouches Market Size, Share & Trends Analysis Report By Material (Plastic, Metal, Paper, Bioplastics), By Product (Flat Pouches, Stand-up Pouches), By Closure Type (Zipper, Spout, Tear Notch), By End-Use (Food & Beverages, Healthcare, Personal Care & Cosmetics, Homecare, Others), By Treatment Type (Aseptic, Standard, Retort, Hot-Filled) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Pouches Market Size

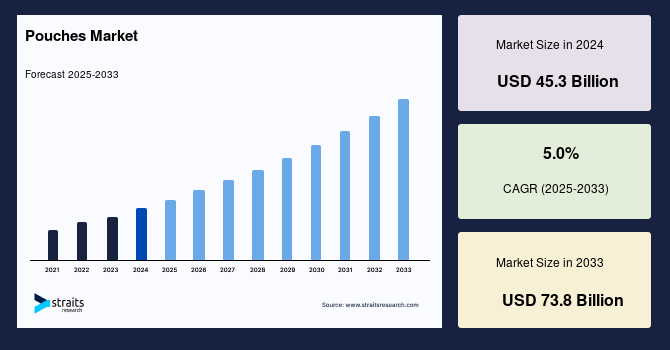

The global pouches market size was valued at USD 45.3 billion in 2024 and is projected to grow from USD 47.6 billion in 2025 to reach USD 73.8 billion in 2033, exhibiting a CAGR of 5.0% during the forecast period (2025-2033).

The global market encompasses flexible packaging solutions designed to store and protect various products across industries such as food and beverages, pharmaceuticals, personal care, and household goods. Pouches are favoured for their lightweight, durable, and space-efficient characteristics, offering advantages over traditional rigid packaging. They come in various formats, including stand-up, flat, spouted, and resealable designs, catering to diverse consumer needs. Materials from plastics and bioplastics to paper and metalised films, often incorporating advanced barrier properties to extend shelf life and maintain product integrity. Pouches' versatility and customisation potential make them a preferred choice for brands that enhance product appeal and functionality.

The pouches market is driven by increasing consumer demand for convenient, portable, and sustainable packaging solutions. Urbanisation and changing lifestyles have led to a surge in ready-to-eat meals and on-the-go products, boosting the adoption of pouch packaging. Environmental concerns are prompting manufacturers to develop eco-friendly pouches using recyclable and biodegradable materials, aligning with global sustainability goals. Technological advancements, such as high-barrier films and smart packaging features, enhance pouch functionality and appeal. E-commerce has further amplified the need for lightweight and durable packaging, with pouches offering cost-effective shipping and improved product protection. Additionally, regulatory pressures and consumer preferences steer the market towards innovative designs that reduce material usage and environmental impact.

Market Trend

Smart and Sustainable Packaging

Integrating smart technologies and sustainable materials continues to transform the pouches market. Manufacturers are embedding QR codes, RFID tags, and time-temperature indicators into pouch packaging to enhance traceability, product authentication, and consumer interaction. This aligns with growing demands for transparency and real-time data throughout the supply chain. At the same time, sustainability remains a core focus. Brands are rapidly shifting toward recyclable, compostable, and biodegradable materials to reduce their carbon footprint and meet tightening global regulations. Innovations in mono-material pouches and solvent-free adhesives are also gaining traction.

- For instance, in April 2025, Constantia Flexibles unveiled a high-barrier recyclable laminate pouch for dry food applications, using fewer materials while maintaining performance.

These advances meet environmental goals while enhancing brand engagement, solidifying the trend’s role in driving market evolution.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 45.3 Billion |

| Estimated 2025 Value | USD 47.6 Billion |

| Projected 2033 Value | USD 73.8 Billion |

| CAGR (2025-2033) | 5.0% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

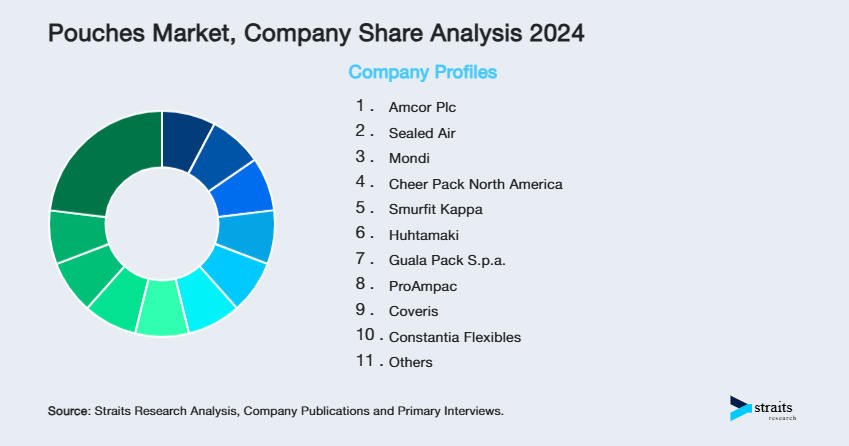

| Key Market Players | Amcor Plc, Sealed Air, Mondi, Cheer Pack North America, Smurfit Kappa |

to learn more about this report Download Free Sample Report

Pouches Market Growth Factor

E-Commerce Expansion

The surge in global e-commerce continues to act as a robust growth driver for the pouches market. Online platforms require packaging that is not only lightweight and durable but also efficient for warehousing and shipping. Pouches excel by offering product protection, cost-effective logistics, and enhanced shelf appeal for digital browsing. Their resealable designs make it convenient for consumers, while custom printing helps brands communicate identity and usage. Food & beverage, health supplements, and personal care increasingly adopt pouch formats to meet evolving online demand.

- For example, in January 2025, ProAmpac launched e-commerce-optimised flat-bottom pouches with reinforced seals to reduce leakage and transit damage for food delivery services.

As online shopping becomes the norm across diverse regions, flexible packaging is positioned to benefit from increased digital logistics and brand differentiation needs.

Market Restraint

Environmental Concerns and Recycling Challenges

Despite innovation in sustainable packaging, the pouches market faces environmental constraints, especially regarding end-of-life treatment. Multi-layered structures, often combining plastics, foils, and adhesives, are difficult to separate and recycle, contributing to persistent waste challenges. Regulatory bodies are increasing pressure on brands to adopt mono-material or curbside recyclable formats. Failure to comply risks regulatory backlash and erosion of consumer trust, especially among sustainability-conscious demographics.

The Green Alliance UK published a study highlighting that only 17% of flexible pouches used in major supermarket products are recyclable through standard curbside programs. Similarly, the EU proposed stricter Extended Producer Responsibility (EPR) laws targeting non-recyclable multilayer pouches, which could impact imports and domestic sales across member states. These limitations could slow growth in markets with stringent environmental standards unless comprehensive recycling solutions are scaled.

Market Opportunity

Innovation in Biodegradable and Compostable Materials

The increasing global commitment to environmental sustainability creates fertile ground for innovation in biodegradable and compostable pouch materials. Manufacturers are exploring renewable and plant-based resources like polylactic acid (PLA), cellulose derivatives, and starch-based resins. These alternatives match traditional plastics' functionality while offering natural degradation, making them suitable for organic and green-certified product lines. This shift also aligns with circular economy models, encouraging packaging to return to the ecosystem without lasting harm.

- For example, in March 2024, Südpack introduced a certified recyclable and compostable high-barrier film for food pouches, optimised for hot filling and pasteurisation.

- Similarly, FlexSea, a startup founded in 2025, developed seaweed-based biodegradable pouches to replace single-use sachets in the cosmetics and personal care industry.

Such advancements meet consumer expectations and regulatory demands, opening new premium market segments and enhancing corporate ESG credentials.

Regional Analysis

Asia-Pacific held the largest market share of 37.45% in 2024 and is projected to witness the fastest CAGR of 6.67% during the forecast period. Rapid urbanisation, expanding middle-class populations, and rising demand for packaged food and personal care products drive this growth. Countries like China, India, and Indonesia are leading pouch consumption due to their large consumer bases and increasing e-commerce penetration. Additionally, local players are investing in cost-effective yet innovative pouch solutions.

- China dominates the Asia Pacific pouch packaging market, propelled by increasing consumer spending on packaged food items and a growing middle class. The country's rapid urbanisation and busy lifestyles have led to a surge in demand for convenient and efficient packaging solutions, including pouches. The booming e-commerce sector also fuels demand for pouch packaging, as it provides flexible and lightweight options suitable for online retail and shipping.

- India is emerging as the fastest-growing market for pouch packaging in the Asia-Pacific region, driven by rapid urbanisation and changing consumer preferences. The demand for convenient and ready-to-consume products underscores the significance of efficient and innovative packaging solutions like flexible pouches. Government initiatives, such as the India Plastics Pact established in 2021, aim for 100% of plastic packaging to be recyclable or reusable by 2030, further promoting the adoption of sustainable pouch packaging.

North America Market Trends

North America is projected to grow at a CAGR of 4.59%, driven by a mature retail environment, strong demand for convenience, and sustainability-led innovation. A well-established e-commerce infrastructure supports pouch formats suited for direct-to-consumer models. Consumers increasingly favour resealable, single-use pouches for on-the-go snacks, drinks, and personal care items. Additionally, regulatory push and consumer awareness encourage companies to adopt eco-friendly alternatives.

- The U.S. remains a dominant force in the global pouches market, driven by the country's robust food and beverage industry, where pouches are extensively used for packaging snacks, beverages, and pet foods. The convenience and portability offered by pouches align well with the fast-paced American lifestyle. The combination of consumer demand for convenience and environmental consciousness continues to drive innovation and growth in the U.S. pouches market.

- Canada is emerging as one of the fastest-growing markets in North America for pouch packaging, with a projected CAGR of approximately 5% from 2024 to 2029. This growth is fueled by increasing consumer preference for convenient and portable packaging solutions across various sectors, including food, pharmaceuticals, and personal care products. Manufacturers are responding by investing in advanced pouch technologies that offer superior barrier properties, ensuring product freshness and extended shelf life.

Europe Market Trends

Europe continues to see steady growth in the pouch market, largely due to stringent environmental regulations and high consumer expectations for sustainable packaging. The EU’s policy toward circular economy practices has driven significant R&D in recyclable and compostable materials. Consumer preference is shifting toward brands offering low-impact packaging options, increasing pressure on companies to innovate. For example, in March 2024, the European Parliament passed revised packaging laws mandating recyclability for all consumer packaging by 2030, prompting major FMCG brands to revamp pouch designs to comply.

- The UK pouches market is experiencing steady growth, driven by increasing consumer demand for sustainable and convenient packaging solutions. The shift towards eco-friendly packaging aligns with the UK's broader environmental goals and consumer preferences. The emphasis on reducing plastic waste and enhancing recyclability prompts manufacturers to develop innovative pouch solutions that meet functional and ecological requirements.

- Germany leads the European market. The country's strong manufacturing base and technological expertise contribute to its market leadership, with continuous innovations in sustainable packaging solutions. German consumers are increasingly environmentally conscious, prompting manufacturers to introduce eco-friendly and recyclable plastic pouch packaging. The food and beverage industry, a significant sector in Germany, extensively uses pouches for products like bakery, confectionery, and dairy, further driving market growth.

Material Insights

Plastic continues to dominate the global pouches market, holding about 60.8% of the market share in 2024. Its popularity stems from its lightweight, durable, and cost-efficient properties, making it the material of choice for industries such as food, beverage, pharmaceuticals, and personal care. Plastic pouches provide excellent moisture and oxygen barriers, extending shelf life and preserving product integrity. However, growing environmental concerns and rising regulatory scrutiny push manufacturers to invest in recyclable, mono-material plastics and biodegradable solutions.

Product Insights

Stand-up pouches are projected to lead the market owing to their superior functionality, visual appeal, and space-saving characteristics. These pouches are widely adopted in food and beverage applications such as snacks, sauces, coffee, tea, and frozen foods, thanks to their ability to stand upright on shelves and enhance product visibility. They also offer better storage efficiency and lower transportation costs than rigid packaging. The increasing urbanisation and shift toward single-serve packaging are further fueling this segment.

Type Insights

Zipper closures accounted for over 40% of the global pouch packaging market in 2024, owing to their convenience and resealability features. These closures help maintain product freshness, reduce waste, and enhance user experience, especially in food packaging where resealing is essential for snacks, cereals, and frozen items. Additionally, zipper closures are gaining popularity in non-food applications such as pet care, personal hygiene, and household products. Their growing adoption in emerging markets is driven by changing lifestyles and increased demand for practical, portion-controlled packaging.

End-Use Insights

The food and beverages sector remains the largest end-use segment, capturing over 55% of the market share in 2024. Factors such as rising urbanisation, busier lifestyles, and growing demand for convenience foods have contributed to this segment's strong uptake of pouch packaging. Ready-to-eat meals, snacks, dairy products, baby food, and functional beverages are key categories that are adopting flexible pouches for portability and product protection. The trend toward smaller portions and sustainable packaging has also reinforced the demand for pouches in this sector.

List of Key and Emerging Players in Pouches Market

- Amcor Plc

- Sealed Air

- Mondi

- Cheer Pack North America

- Smurfit Kappa

- Huhtamaki

- Guala Pack S.p.a.

- ProAmpac

- Coveris

- Constantia Flexibles

- Südpack

- Sonoco Products Company

to learn more about this report Download Market Share

Recent Developments

- February 2024- Amcor Plc. collaborated with Stonyfield Organic to manufacture a polyethylene-based spouted pouch for YoBaby refrigerated yoghurt packaging. This new pouch eliminates metalised or foil-based film layers, providing superior heat resistance for spout insertion.

- March 2024- Südpack introduced a certified recyclable film designed for its in-house production of food pouches. This film is suitable for pasteurisation and hot filling and will be used for producing stand-up pouches with spouts

Analyst Opinion

The global pouches market is poised for significant growth. This growth is driven by increasing demand for convenient, lightweight, and sustainable packaging solutions across various industries, including food and beverage, pharmaceuticals, and personal care. Consumer preferences are shifting towards packaging that offers ease of use, portability, and environmental friendliness. Manufacturers are responding by developing innovative pouch designs, such as stand-up and resealable pouches, and incorporating eco-friendly materials like biodegradable films and recyclable plastics. Regulatory pressures and sustainability goals further accelerate this trend, prompting companies to invest in research and development of sustainable packaging solutions.

In addition, the rise of e-commerce and online shopping has also contributed to the demand for pouches, as they offer cost-effective and efficient packaging options for shipping a wide range of products. Additionally, advancements in digital printing technology allow for personalised and custom-designed pouches, enabling brands to differentiate themselves in a competitive market. The pouches market is expected to continue its upward trajectory, driven by innovation, sustainability, and evolving consumer needs.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 45.3 Billion |

| Market Size in 2025 | USD 47.6 Billion |

| Market Size in 2033 | USD 73.8 Billion |

| CAGR | 5.0% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Material, By Product, By Closure Type, By End-Use, By Treatment Type |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Pouches Market Segments

By Material

- Plastic

- Metal

- Paper

- Bioplastics

By Product

- Flat Pouches

- Stand-up Pouches

By Closure Type

- Zipper

- Spout

- Tear Notch

By End-Use

- Food & Beverages

- Healthcare

- Personal Care & Cosmetics

- Homecare

- Others

By Treatment Type

- Aseptic

- Standard

- Retort

- Hot-Filled

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Akanksha Yaduvanshi

Research Analyst

Akanksha Yaduvanshi is a Research Analyst with over 4 years of experience in the Energy and Power industry. She focuses on market assessment, technology trends, and competitive benchmarking to support clients in adapting to an evolving energy landscape. Akanksha’s keen analytical skills and sector expertise help organizations identify opportunities in renewable energy, grid modernization, and power infrastructure investments.