Precision Tool Market Size, Share & Trends Analysis Report By Tool Type (Cutting Tools, Drilling Tools, Milling Tools, Grinding Tools, Threading Tools, Other Tools), By Material Type (High-Speed Steel (HSS), Carbide, Ceramic, Cermet, Diamond, Other Materials), By Application (Automotive, Aerospace & Defense, Electronics & Electrical, Medical Devices, General Engineering, Energy & Power, Others), By End-User Industry (Manufacturing Industry, Metalworking Industry, Tooling Industry, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Precision Tool Market Size

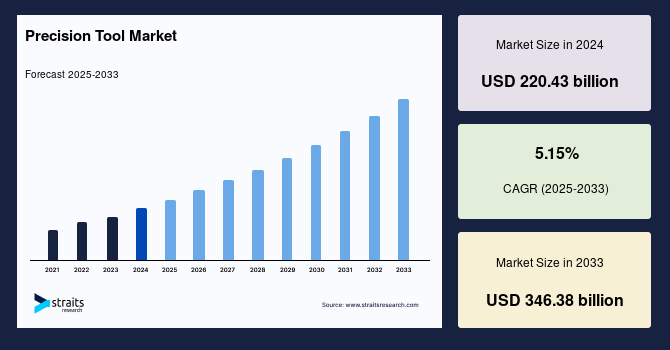

The global precision tool market size was valued at USD 220.43 billion in 2024 and is estimated to grow from USD 231.78 billion in 2025 to reach USD 346.38 billion by 2033, growing at a CAGR of 5.15% during the forecast period (2025–2033).

A precision tool is a specialized instrument designed to perform tasks with high accuracy and minimal error. These tools are essential in industries such as engineering, manufacturing, aerospace, and electronics, where exact measurements and fine tolerances are crucial. Examples include micrometers, calipers, torque wrenches, and CNC machines. Precision tools ensure consistency, improve product quality, and reduce material waste during production. They are made utilizing advanced technologies and high-quality materials to maintain their accuracy over time, playing a vital role in modern industrial and scientific applications.

The global market is primarily driven by the rising demand for enhanced precision and efficiency in manufacturing processes, especially in metalworking industries such as automotive and aerospace. The expanding electronics sector further fuels this growth by requiring tools capable of producing increasingly miniaturized and complex components. Additionally, significant investments in infrastructure and defense projects, particularly in emerging economies, are creating substantial demand for durable and high-performance precision tools. Moreover, continuous technological advancements in tool materials, such as the development of carbide and ceramic composites, have improved tool life and cutting efficiency, further propelling market growth.

Latest Market Trend

Growth in Additive Manufacturing

The growth of additive manufacturing (AM) is significantly complementing the market by enabling the production of complex parts with higher accuracy and reduced material waste. Additive manufacturing allows manufacturers to create intricate designs that are difficult or impossible to achieve with traditional subtractive methods, driving demand for precision tools that support hybrid manufacturing processes.

- For instance, in April 2025, RTX's Pratt & Whitney developed an additive repair process for its Geared Turbofan (GTF) engine components, aiming to cut repair process time by over 60%. This innovation is expected to recover $100 million worth of parts over the next five years.

As AM technologies evolve, they foster the need for specialized precision tools to handle post-processing, finishing, and quality assurance. This synergy is driving innovation and expanding applications across aerospace, automotive, and healthcare industries, reinforcing the market’s growth trajectory.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 220.43 Billion |

| Estimated 2025 Value | USD 231.78 Billion |

| Projected 2033 Value | USD 346.38 Billion |

| CAGR (2025-2033) | 5.15% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Sandvik AB, Kennametal Inc., Mitsubishi Materials Corporation, Seco Tools AB, Walter AG |

to learn more about this report Download Free Sample Report

Global Precision Tool Market Driver

Surge in Global Industrial Automation

The rapid surge in global industrial automation is a key driver for the market, as manufacturers increasingly adopt automated systems to enhance productivity and precision. This growing reliance on automation is especially evident in industries like automotive, aerospace, and electronics, where high accuracy and efficiency are critical.

- The latest World Robotics report highlights that 4,281,585 industrial robots were operational globally in 2023, reflecting a 10% growth from the previous year. For the third consecutive year, annual installations exceeded half a million units. Regionally, Asia dominated with 70% of new robot deployments in 2023, followed by Europe at 17%, and the Americas at 10%.

This widespread adoption of robotics drives demand for advanced precision tools designed to support automated machining and complex manufacturing processes, propelling the market forward.

Market Restraint

High Initial Costs

The high initial costs associated with precision tools and advanced machining equipment pose a significant restraint to the global market. These tools often require substantial capital investment, which can be prohibitive, especially for small and medium-sized enterprises (SMEs) operating with limited budgets. Additionally, precision tools often demand specialized maintenance and calibration to maintain accuracy, further increasing operational expenses.

The cost of raw materials such as carbide, ceramics, and other high-performance alloys also contributes to the overall expense. This financial barrier slows down the adoption rate of cutting-edge precision tools in various industries. Moreover, some manufacturers may hesitate to invest in expensive equipment without guaranteed returns, particularly in volatile market conditions, hindering market growth and limiting broader accessibility.

Market Opportunity

Advancement in 5-Axis Machining

The advancement in 5-axis machining technology presents a significant growth opportunity for the global market. This technology enables simultaneous movement across five axes, allowing for the production of intricate and highly precise components with fewer setups. Industries like aerospace, medical devices, and automotive benefit immensely from this innovation due to the complexity of their part geometries. The ability to machine complex surfaces in a single operation enhances efficiency, reduces lead times, and minimizes errors.

- For instance, in August 2024, FANUC America introduced the Series 500i-A CNC controller, enhancing machine performance with integrated 5-axis technology. This new control series offers 2.7 times higher CPU processing power than previous models, leading to faster cycle times and improved productivity. It also features updated hardware and graphically enhanced software to simplify operations and maintenance.

As demand for precision and flexibility grows, 5-axis solutions will gain traction.

Regional Insights

Asia Pacific is witnessing rapid growth due to expanding manufacturing bases and industrialization. Rising demand from electronics, automotive, and renewable energy sectors fuels precision tool adoption. The region’s growing middle class and infrastructure development boost production capabilities. Investments in automation and smart manufacturing accelerate market expansion. Moreover, the increasing number of small and medium enterprises upgrading to advanced tooling solutions offers significant opportunities. The focus on export-driven manufacturing and technological collaborations further supports the market growth in this region.

China’s Market Trends

China’s precision tool marketis rapidly expanding, driven by its booming automotive and electronics industries. Major manufacturers like BYD and Huawei demand high-precision components, boosting tool usage. The government's “Made in China 2025” initiative promotes advanced manufacturing, accelerating the adoption of CNC and smart tooling technologies. Additionally, growth in aerospace and renewable energy sectors further fuels demand for durable, high-precision cutting and drilling tools across the country.

India’s Precision Tool Market Trends

India’s market is growing steadily due to the surging investments in the automotive, aerospace, and medical device sectors. Companies such as Tata Motors and Bharat Electronics increasingly require precise machining tools for complex components. The government's “Make in India” campaign encourages manufacturing modernization, boosting CNC and robotic tool adoption. Moreover, expanding renewable energy projects and infrastructure development present lucrative opportunities for precision tooling manufacturers in the country.

North America: Significantly Growing Region

The North American precision tool market is driven by strong industrial automation and advanced manufacturing technologies. High demand from the aerospace, automotive, and electronics industries fuels growth. Increasing investments in research and development promote innovation in tool materials and design. The region’s focus on sustainability and precision manufacturing enhances the adoption of eco-friendly and high-performance tools. Additionally, the presence of major manufacturing hubs and skilled workforce supports expansion, while growing emphasis on digital integration and smart manufacturing accelerates precision tool advancements.

United States Precision Tool Market

The US precision tool marketis one of the largest globally, fueled by automotive giants like Ford and aerospace leaders such as Boeing. The demand for precision tools is boosted by the country’s focus on automation and smart manufacturing. Moreover, the defense sector requires advanced tooling for weaponry and aircraft. The rise of electric vehicle production and medical device manufacturing also creates robust opportunities for precision tooling in the US market.

Canada’s precision tool market is driven by its strong aerospace and automotive industries, requiring high-accuracy tooling for manufacturing aircraft components and vehicle parts. Companies like Bombardier rely heavily on precision tools for production. Additionally, the mining and energy sectors demand durable tools for equipment maintenance. The increasing adoption of advanced manufacturing technologies and government support for industrial innovation further propel market growth in Canada.

Europe: Substantial Potential for Growth

Europe’s precision tool market benefits from its robust automotive and aerospace sectors, which are focused on high-quality production. The region’s strong emphasis on Industry 4.0 adoption drives demand for smart, connected precision tools. Sustainable manufacturing initiatives and stringent quality standards push manufacturers to invest in advanced tooling technologies. The growing medical device industry also contributes significantly to precision tool requirements. Additionally, supportive government policies and investments in modernizing manufacturing infrastructure provide momentum for market growth.

Germany’s Precision Tool Market Trends

Germany’s precision tool marketis driven by its strong automotive and aerospace industries, requiring high-precision components. The country’s emphasis on Industry 4.0 and advanced manufacturing technologies, like CNC machining, boosts demand for precision tools. Leading companies such as Bosch and Siemens invest heavily in precision tooling for electric vehicle production and industrial automation, supporting sustained market growth.

The UK’s precision tool market benefits from growth in aerospace and defense sectors, with manufacturers like Rolls-Royce requiring ultra-precise machining tools. Increasing adoption of smart manufacturing and automation drives precision tool demand. The UK's focus on research and development in advanced materials and micro-machining supports innovation, particularly in medical device production and electronics, fostering market expansion.

Tool Type Analysis

The cutting tools segment holds a significant share in the precision tool market due to its critical role in shaping and finishing materials across industries. These tools, including drills, milling cutters, and inserts, are designed for high accuracy and efficiency in metalworking and machining processes. With advancements in tool coatings and materials, cutting tools offer enhanced durability and precision, catering to industries demanding complex and fine tolerances. The growing adoption of automated machining and CNC technologies further propels demand for cutting tools, especially in aerospace, automotive, and electronics manufacturing.

Material Type Analysis

High-Speed Steel (HSS) tools remain popular in the precision tool market for their excellent toughness, wear resistance, and cost-effectiveness. HSS is widely used for manufacturing cutting and drilling tools that operate at high temperatures without losing hardness. Despite competition from carbide and ceramic tools, HSS tools continue to be favored for applications involving softer materials and general-purpose machining. Their versatility, ease of re-sharpening, and lower cost make HSS tools ideal for small- and medium-scale manufacturers, sustaining steady demand in various sectors, including automotive and general engineering.

Application Analysis

The automotive industry is a major end-user of precision tools, driven by the need for high-quality components and enhanced manufacturing efficiency. Precision tools enable the production of intricate engine parts, transmission systems, and chassis components with tight tolerances. As automotive manufacturers focus on lightweight materials and electric vehicles, demand for advanced tooling solutions grows to meet complex machining requirements. The industry’s emphasis on automation and lean manufacturing further boosts precision tool adoption, making the automotive segment a key driver of market growth globally.

End-User Industry Analysis

The manufacturing industry broadly drives demand for precision tools across various processes such as machining, milling, and drilling. Precision tools enhance production accuracy, reduce waste, and improve surface finish quality, which are essential for maintaining competitiveness. The industry's push towards Industry 4.0 and smart manufacturing has increased reliance on advanced tooling solutions integrated with CNC machines. Additionally, rising demand for customized and high-precision components in sectors like aerospace, electronics, and medical devices supports steady growth. The manufacturing industry’s evolving technology landscape ensures continued innovation and expansion of the market.

Company Market Share

Leading companies in the precision tool market are focusing on innovation through advanced technology integration, such as smart sensors and automation, to enhance tool performance and efficiency. They are investing heavily in research and development to create durable, high-precision products tailored for emerging industries like aerospace and electric vehicles. Additionally, expanding their global manufacturing footprint and forming strategic partnerships are key strategies to capture new markets and meet rising customer demands worldwide.

List of Key and Emerging Players in Precision Tool Market

- Sandvik AB

- Kennametal Inc.

- Mitsubishi Materials Corporation

- Seco Tools AB

- Walter AG

- Iscar Ltd.

- Kyocera Corporation

- Sumitomo Electric Industries

- Dormer Pramet

to learn more about this report Download Market Share

Recent Developments

- February 2025 – BASF Digital Farming has revealed plans to launch its Xarvio Field Manager for Fruits & Vegetables in 2025. This precision agriculture tool is designed to provide growers with customized, field-specific recommendations to help them cultivate their crops more efficiently and effectively, using insights drawn from diverse data sources.

Analyst Opinion

As per our analyst, the global precision tool market is poised for robust growth driven by increasing automation and demand for high-accuracy components across key industries like aerospace, automotive, and electronics. Technological advancements in tool materials and smart tooling solutions are further fueling market expansion.

However, challenges such as high upfront costs and a shortage of skilled operators could slow adoption, especially among smaller manufacturers. Supply chain uncertainties and raw material price fluctuations also pose risks to steady growth.

Despite these challenges, the market’s potential remains strong due to rising industrialization in emerging economies and growing demand for precision in complex manufacturing processes. Manufacturers investing in innovative, cost-effective tools and tailored solutions are expected to capitalize on these opportunities, ensuring sustained growth in the coming years.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 220.43 Billion |

| Market Size in 2025 | USD 231.78 Billion |

| Market Size in 2033 | USD 346.38 Billion |

| CAGR | 5.15% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Tool Type, By Material Type, By Application, By End-User Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Precision Tool Market Segments

By Tool Type

- Cutting Tools

- Drilling Tools

- Milling Tools

- Grinding Tools

- Threading Tools

- Other Tools

By Material Type

- High-Speed Steel (HSS)

- Carbide

- Ceramic

- Cermet

- Diamond

- Other Materials

By Application

- Automotive

- Aerospace & Defense

- Electronics & Electrical

- Medical Devices

- General Engineering

- Energy & Power

- Others

By End-User Industry

- Manufacturing Industry

- Metalworking Industry

- Tooling Industry

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Abhijeet Patil

Research Associate

Abhijeet Patil is a Research Associate with 3+ years of experience in Automation & Process Control and Automotive & Transportation sectors. He specializes in evaluating industry automation trends, mobility innovations, and supply chain shifts. Abhijeet’s data-driven research aids clients in adapting to technological disruptions and market transformations.