Premium Lager Market Size, Share & Trends Analysis Report By Product Type (Conventional Premium Lagers, Craft Premium Lagers), By Distribution Channel (On-Trade, Off-Trade) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Premium Lager Market Overview

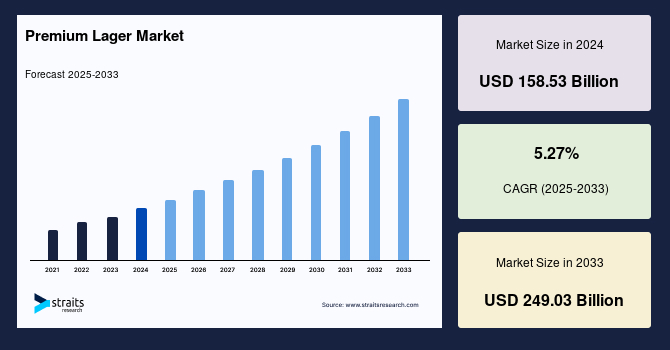

The global premium lager market size was valued at USD 158.53 billion in 2024 and is estimated to grow from USD 166.21 billion in 2025 to reach USD 249.03 billion by 2033, growing at a CAGR of 5.27% during the forecast period (2025–2033). Key market drivers include rising consumer preference for high-quality and craft beers, increasing disposable incomes, expansion of on-trade and off-trade distribution channels, growth of e-commerce platforms, and strong demand in emerging markets for premium alcoholic beverages.

Key Market Trends & Insights

- Europe held the largest market share, over 40% of the global premium lager industry.

- Based on product type, the conventional premium lagers segment dominated the market with a share of 50%.

- Based on the distribution channel, the off-trade segment is expected to witness the fastest CAGR of 4.38%.

Market Size & Forecast

- 2024 Market Size: USD 158.53 billion

- 2033 Projected Market Size: USD 249.03 billion

- CAGR (2025-2033): 5.27%

- Europe: Largest market in 2024

- Asia-Pacific: Fastest-growing region

Premium lager is a high-quality, bottom-fermented beer known for its crisp taste, refined aroma, and balanced bitterness. Brewed with carefully selected ingredients like malted barley, hops, and purified water, it typically has higher production standards than regular lagers. Premium lagers are widely consumed in bars, restaurants, and social events, as well as at home. They are often marketed as lifestyle beverages and are preferred for celebratory occasions, fine dining pairings, and international travel, appealing to consumers seeking a sophisticated drinking experience.

The market is driven by increasing consumer inclination toward premium alcoholic beverages, rising disposable incomes, and evolving lifestyle preferences. Urban populations are seeking sophisticated and authentic drinking experiences, boosting demand for premium lagers. Expanding tourism and hospitality sectors provide opportunities for on-trade growth in bars, hotels, and restaurants. Moreover, emerging markets present untapped potential for brand expansion, while marketing innovations, seasonal offerings, and collaborations with global beverage brands create avenues for increased visibility and consumer engagement.

Market Trend

Growing Popularity of Craft-Inspired Lagers and Limited-Edition Variants

The premium lager market is witnessing a strong shift as consumers seek unique, high-quality beer experiences beyond traditional offerings. Craft-inspired lagers and limited-edition variants are gaining momentum, especially among younger demographics who value exclusivity, authenticity, and innovative brewing techniques.

- According to Straits Research, this trend is being reinforced by breweries experimenting with seasonal flavors, artisanal methods, and small-batch productions. Limited-edition releases not only create excitement but also strengthen brand loyalty. This movement aligns with the growing premiumization trend, where consumers are willing to pay more.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 158.53 Billion |

| Estimated 2025 Value | USD 166.21 Billion |

| Projected 2033 Value | USD 249.03 Billion |

| CAGR (2025-2033) | 5.27% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Tsingtao Brewery Group, Bira 91, Anheuser-Busch InBev, Heineken N.V., China Resources Snow Breweries |

to learn more about this report Download Free Sample Report

Market Driver

Increasing Globalization of Beer Brands

The globalization of beer brands continues to be a strong driver for the market for premium lager, as companies leverage cross-border presence to expand their reach. Major brewers are not only capitalizing on established markets but also targeting emerging economies where demand for premium beverages is on the rise.

- For example, in May 2025, United Breweries’ Russian unit (formerly Heineken’s unit, now UBL-Russia / OPH) announced plans to raise premium brands’ revenue share from 30% in 2024 to 40% in 2025. It revived heritage labels like “Kalinkin” and launched new pilseners tailored for both domestic and export markets.

- Similarly, in September 2025, AB InBev (Budweiser) partnered with Netflix to boost its reach in global markets, using content integrations, digital promotions, and specially branded packaging tied to international events. This helps bring premium lager brands into entertainment and lifestyle domains across countries.

These initiatives highlight how globalization is reshaping strategies, driving premium lager availability, and strengthening consumer engagement worldwide.

Market Restraint

High Production Costs and Competition from Global Brands

Premium lager production often involves higher-quality ingredients, advanced brewing techniques, and sustainable packaging, which significantly raise costs compared to standard beer. Smaller breweries face added challenges as they struggle to balance premium positioning with affordability. At the same time, global beer giants dominate distribution channels and marketing networks, intensifying competition. Their scale allows them to offer competitive pricing and wider availability, making it harder for emerging premium brands to capture market share despite strong consumer interest in unique, high-quality lagers.

Market Opportunity

Growth of E-commerce and Direct-to-Consumer Channels

The rapid rise of digital platforms is transforming how consumers access premium lagers, creating significant growth opportunities for brewers worldwide. E-commerce and direct-to-consumer (D2C) models are allowing brands to bypass traditional retail limitations and deliver personalized experiences straight to customers’ doorsteps.

- For instance, in August 2025, Carlsberg Asia launched a Digital Acceleration Program, partnering with Meituan, Grab, and Delivery Hero to integrate its premium beer offerings into these platforms. This collaboration enables 30-minute delivery, personalized promotions, and curated product selections across key Asian markets.

- Similarly, in June 2025, in Europe, Untappd has partnered with Bierothek® to expand its Untappd Shop across nine countries, including Germany, France, and Sweden. This expansion allows consumers to access a curated selection of craft beers and premium lagers directly through the platform.

These developments show how digital sales strategies are becoming central to brand expansion, helping brewers strengthen visibility, tap into new markets, and engage consumers more effectively in the premium lager segment.

Regional Analysis

Europe is dominating the global premium lager market with a market share of over 40%, driven by high consumer preference for premium and craft beer varieties. A mature brewing industry, strong brand heritage, and sophisticated consumer taste for quality lagers contribute to sustained demand. Investments in innovative brewing techniques, flavor variations, and premium packaging are supporting market leadership. The presence of established breweries and robust distribution networks further consolidates dominance. Moreover, the rise of health-conscious and premium-seeking consumers is encouraging companies to introduce low-alcohol and specialty lagers, ensuring Europe remains a hub for the global market.

The UK market is dominant, with companies like Carlsberg, AB InBev, and Molson Coors actively expanding premium lager portfolios. Factors include introducing craft-style lagers, low-alcohol options, and limited-edition seasonal variants to appeal to diverse consumer preferences. Growing investments in marketing, digital platforms, and sustainable brewing practices strengthen brand recognition.

Germany’s premium lager market is growing, with breweries like Bitburger, Krombacher, and Paulaner innovating in premium lagers. Companies are focusing on craft-inspired brews, specialty flavor variants, and sustainable packaging to cater to evolving consumer tastes. Moreover, Germany’s premium lager industry remains a key contributor to Europe’s dominance, combining traditional brewing expertise with modern innovations to capture the growing demand for quality lagers.

Asia-Pacific Market Trends

As per the Straits Research, the Asia-Pacific is the fastest-growing region with a CAGR of 5.43. Rising disposable incomes, rapid urbanisation, and expanding food-and-beverage culture are driving demand for higher-quality beers. Consumers, particularly younger, urban demographics, are seeking international styles, craft influences, and lifestyle positioning, prompting brewers to introduce imported and locally brewed premium lagers. Moreover, strategic partnerships between global brands and regional brewers accelerate portfolio rollouts, while marketing that ties premium lager to moments of socialising and dining cements its appeal across the region.

China’s premium lager market is growing with a surge in premium and craft interest among urban consumers. National and regional breweries are launching refined lagers, seasonal editions, and collaborations with international brewers to meet demand for variety and quality. Growth is supported by expanding modern retail, horeca (hotels-restaurants-cafés) sophistication, and e-commerce channels that enable niche brands to reach affluent buyers.

India’s market for premium lager is the fastest growing, with urban consumers increasingly trading up to premium beer experiences. Domestic brewers and multinational players are introducing craft-inspired lagers, low-alcohol premium variants, and limited-edition releases tailored to local palates. Growth is enabled by expanding modern retail outlets, higher-end bars and restaurants, and digital channels that spotlight brand stories and tasting events.

North America Market Trends

North America’s premium lager segment is maturing into a landscape defined by innovation, craft influence, and experiential marketing. Companies such as Anheuser-Busch InBev, Molson Coors, and Boston Beer Company are strengthening their premium portfolios with clean-tasting, small-batch lagers and low-calorie premium options to target evolving preferences. Moreover, growing taproom experiences, limited seasonal releases, and digital engagement campaigns drive brand loyalty, while retail and DTC extend accessibility.

Latin America’s premium lager market is expanding steadily, supported by rising incomes, urbanization, and a growing appetite for premium beverages. Regional leaders such as Ambev (part of AB InBev), Grupo Modelo, and Heineken Latin America are driving growth through premium line extensions like Budweiser, Corona, and Heineken Silver. Local craft breweries in Brazil, Mexico, and Argentina are also introducing small-batch premium lagers, emphasizing authenticity and regional identity.

Product Type Insights

The conventional premium lagers segment accounts for over 50% of the global market, reflecting longstanding consumer preference for familiar, high-quality brews. Their dominance is supported by established brand recognition, consistent taste profiles, and wide availability across both urban and rural regions. These lagers continue to generate stable revenue streams and retain a strong foothold in the market, particularly in countries with mature beer consumption patterns.

The craft premium lagers segment is the fastest-growing product type, expanding at a CAGR of 5.35%. Rising consumer interest in artisanal flavors and experimental brewing techniques is fueling this growth, particularly in North America and Europe. These lagers attract younger, experience-driven drinkers seeking unique taste profiles, driving an increase in market share and prompting breweries to invest in small-batch, specialty production.

Distribution Channel Insights

The on-trade channel dominates the market with over 60% share, encompassing bars, restaurants, and pubs. This segment benefits from social consumption patterns, where consumers prefer enjoying premium beers in experiential settings. Moreover, high visibility and brand engagement in on-trade locations sustain steady sales, making this channel a core contributor to overall market revenue and brand loyalty.

The off-trade segment, including supermarkets and convenience stores, is the fastest-growing channel, registering a CAGR of 4.85%. Increased home consumption, convenience, and the expansion of retail networks in emerging regions are driving growth. Consumers increasingly purchase premium lagers for home enjoyment, contributing to rising market share and encouraging producers to strengthen their retail-focused strategies globally.

Company Market Share

The global premium lager market is characterized by a dynamic competitive landscape, with companies employing diverse strategies to enhance their market presence. Leading brewers focus on innovation, introducing unique flavors and health-conscious options to cater to evolving consumer preferences. Moreover, expanding distribution channels, including e-commerce and direct-to-consumer platforms, allows brands to reach a broader audience and strengthen customer engagement. Collaborations and partnerships further enable companies to tap into new markets and enhance their visibility.

Anheuser-Busch InBev (AB InBev) was established in 2008 through the merger of Belgium’s Interbrew and Brazil’s AmBev, later acquiring the U.S.-based Anheuser-Busch. Headquartered in Leuven, Belgium, AB InBev has grown into the world’s largest beer company, managing a portfolio of over 500 brands, including Budweiser, Stella Artois, and Corona. The company operates in more than 50 countries, focusing on innovation, sustainability, and expanding its global market presence.

- In 2025, AB InBev is making significant investments in its U.S. manufacturing operations. The company announced a $300 million investment in its U.S. manufacturing operations for 2025, including plans to establish a new facility in Columbus, Ohio.

List of Key and Emerging Players in Premium Lager Market

- Tsingtao Brewery Group

- Bira 91

- Anheuser-Busch InBev

- Heineken N.V.

- China Resources Snow Breweries

- Carlsberg Breweries A/S

- Molson Coors Brewing

- Asahi Group Holdings

- Constellation Brands

- B9 Beverages Pvt. Ltd.

- The Beijing Yanjing Beer Group Corporation

Recent Development

- August 2025 : Monte Carlo Beer partnered with Molson Coors to launch its first-ever super-premium lager in the UK. This new 4.8% ABV lager, crafted with French hops, is designed specifically for the British market. It became available on draught in select UK venues from July 28, 2025, with a bottled format launching in October.

- July 2025 : The Wrexham Lager Beer Co. expanded into Canada through partnerships with British Columbia Liquor Stores (BCLS) and the Liquor Control Board of Ontario (LCBO). Wrexham Lager is now available in 92 BCLS locations across British Columbia and in select Licensed Retail Stores (LRS) throughout the province.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 158.53 Billion |

| Market Size in 2025 | USD 166.21 Billion |

| Market Size in 2033 | USD 249.03 Billion |

| CAGR | 5.27% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Premium Lager Market Segments

By Product Type

- Conventional Premium Lagers

- Craft Premium Lagers

By Distribution Channel

- On-Trade

- Off-Trade

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.