Process Mining Software Market Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Application (Strategic Sourcing, Contract Management, Category Management, Transactional Procurement, Supplier Management), By Industry Vertical (Manufacturing, Healthcare, BFSI, Consumer Goods & Services, Telecommunications & IT, Logistics & Transportation, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Process Mining Software Market Size

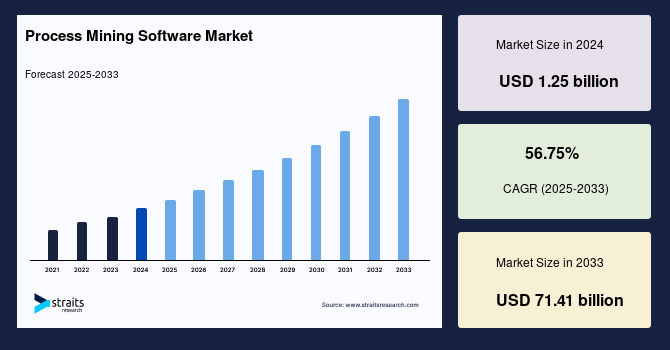

The global process mining software market size was valued at USD 1.25 billion in 2024 and is estimated to grow from USD 1.96 billion in 2025 to reach USD 71.41 billion by 2033, growing at a CAGR of 56.75% during the forecast period (2025–2033).

One of the key aspects fueling the growth of the global market is the rising need for enhanced compliance and risk management across industries. Organizations, especially in heavily regulated sectors such as banking, healthcare, and manufacturing, are increasingly adopting process mining tools to ensure adherence to internal policies and external regulations like GDPR, HIPAA, or SOX. These tools enable enterprises to monitor process conformance, detect deviations in real-time, and generate transparent audit trails, significantly reducing the risk of non-compliance.

Additionally, process mining software offers a high level of process visibility, which aids in identifying potential bottlenecks, fraudulent activities, and inefficiencies. As global businesses face mounting pressure to improve transparency and accountability, the demand for software that can deliver comprehensive process intelligence and governance insights is accelerating. Moreover, the increasing emphasis on business process optimization to achieve sustainable growth, along with the rising complexity of enterprise operations, is pushing organizations to adopt advanced tools like process mining that deliver actionable data-driven insights.

Latest Market Trend

Cloud-Based Deployments

Cloud-based deployments are becoming a cornerstone of growth in the global process mining software market, driven by the need for scalable, flexible, and cost-efficient solutions. These platforms allow organizations to access real-time insights, streamline integration with enterprise systems, and reduce IT overhead.

- A notable example of this trend is the launch of Infor's Velocity Suite in April 2025, integrated within its CloudSuite ERP. This cloud-native solution combines process mining, automation, and generative AI and offers prebuilt, industry-specific workflows through its Value+ library. These capabilities automate critical operations such as invoicing and procure-to-pay. Xpress Boats, an early adopter, leveraged the suite to enhance inventory accuracy and optimize accounts payable using RPA.

Such deployments highlight how cloud-based tools not only simplify process analysis but also enable businesses to respond quickly to operational challenges, making them essential for digital transformation across sectors.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.25 Billion |

| Estimated 2025 Value | USD 1.96 Billion |

| Projected 2033 Value | USD 71.41 Billion |

| CAGR (2025-2033) | 56.75% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Celonis, Software AG, UiPath, ABBYY, SAP SE |

to learn more about this report Download Free Sample Report

Process Mining Software Market Growth Factor

Digital Transformation across Industries

The rapid pace of digital transformation across industries is significantly fueling the growth of the global process mining software market. As organizations strive to modernize operations, they are increasingly turning to tools that offer deep visibility into business processes and enable data-driven decision-making. Process mining software helps companies analyze workflows, identify inefficiencies, and enhance operational performance by extracting data from core systems such as ERP, CRM, and supply chain platforms.

- According to Gitnux, as of 2025, 60% of organizations worldwide have undergone digital transformation, up from just 34% in 2020. Moreover, 60% of these organizations report improved competitive advantage, while 85% have seen notable revenue growth from these efforts.

This rising investment in digital infrastructure across sectors like manufacturing, healthcare, and finance is directly translating into greater adoption of process mining tools to support automation, compliance, and long-term strategic goals.

Market Restraint

Data Privacy and Integration Challenges

One of the key restraints in the global process mining software market is the challenge of data privacy and system integration. Process mining tools require access to vast amounts of sensitive organizational data, which raises concerns regarding compliance with strict data protection regulations like GDPR and HIPAA.

Additionally, integrating these tools with legacy IT infrastructures, especially in large enterprises, can be technically complex and resource-intensive. Disparate data sources, inconsistent data formats, and lack of interoperability hinder seamless implementation. These technical and regulatory hurdles slow down adoption and require significant investment in data governance and system upgrades, limiting the market's growth potential, especially in highly regulated industries.

Market Opportunity

Integration with Ai and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into process mining software is unlocking new growth avenues by transforming how businesses analyze and optimize their operations. AI and ML enhance the capabilities of traditional process mining by enabling real-time insights, predictive analytics, and automated decision-making. This not only helps organizations identify inefficiencies but also enables them to anticipate and prevent potential disruptions.

- A strong example of this innovation was demonstrated at bauma 2025, where Process.Science unveiled its AI-powered, IoT-enabled process mining solutions tailored for construction machinery. These tools convert raw IoT sensor data into actionable event logs, supporting predictive maintenance and deeper process analytics.

Such advancements illustrate how AI-infused process mining is evolving from a diagnostic tool into a strategic asset, offering greater value across industries like construction, manufacturing, and logistics.

Regional Analysis

Europe is experiencing significant growth in the process mining software market, supported by stringent regulatory requirements and a strong focus on business process transparency. Enterprises are increasingly deploying process intelligence tools to ensure auditability and improve process governance. The region's emphasis on operational resilience and efficiency, especially within the finance, manufacturing, and healthcare sectors, is driving demand. Integration of process mining with robotic process automation (RPA) and enterprise analytics platforms is gaining traction. The growing ecosystem of digital transformation initiatives and academic-industry collaboration further contributes to market expansion.

Germany's Market Trends

Germany's process mining software market is driven by its strong industrial base and focus on Industry 4.0. German manufacturing giants like Siemens and Bosch are leveraging process mining to optimize complex production workflows. The presence of leading vendor Celonis, headquartered in Munich, further accelerates adoption. Additionally, Germany's emphasis on digital transformation under the "Digital Strategy 2025" initiative supports enterprise-level deployment of advanced process optimization tools.

United Kingdom's Market Trends

UK's process mining software market is expanding due to rising demand in the financial services and public sectors. Organizations like Lloyds Banking Group and the NHS have adopted process mining to enhance compliance and service delivery. The UK government's focus on digital transformation through the "Digital Economy Strategy" and increasing partnerships between local enterprises and vendors like Software AG and UiPath are fueling further market growth and innovation.

Asia-Pacific: Significantly Growing Region

The Asia Pacific region is emerging as a high-potential market for process mining software, propelled by rapid digital transformation across service and industrial sectors. Organizations are adopting these solutions to gain insights into complex business operations and to support automation-driven growth strategies. Increasing IT spending, expansion of shared service centers, and the growing need for data-driven decision-making are fueling adoption. Cloud-native platforms and low-code integration capabilities are making process mining accessible to a wider base of enterprises. Additionally, vendor penetration and awareness campaigns are enhancing regional market visibility.

China's Market Trends

China's process mining software marketis rapidly growing due to aggressive digitalization in manufacturing and logistics. Government initiatives like "Made in China 2025" are pushing enterprises to enhance operational transparency. Chinese tech giants such as Huawei and Alibaba are investing in intelligent automation. For instance, Huawei integrates process mining to optimize its supply chain workflows, boosting demand for such tools across China's industrial ecosystem.

India's Market Trends

India's process mining software marketis expanding amid increasing IT automation and the government's Digital India initiative. With enterprises like Tata Consultancy Services (TCS) and Infosys adopting process mining to enhance business efficiency, demand is rising in BFSI and telecom sectors. For example, ICICI Bank uses process mining to analyze loan processing timelines, highlighting how Indian firms leverage this technology to streamline complex, high-volume operations.

North America: Substantial Potential for Growth

North America demonstrates strong adoption of process mining software driven by early digitalization and a mature enterprise technology landscape. The region's focus on enhancing business process intelligence, coupled with the widespread use of enterprise resource planning (ERP) and customer relationship management (CRM) systems, supports robust market growth. Organizations across various sectors are leveraging these tools to optimize operational workflows and compliance reporting. High investments in hyperautomation, along with growing partnerships between software vendors and consulting firms, are further stimulating demand for cloud-based and AI-integrated process mining platforms.

United States Market Trends

The United States process mining software market is driven by robust digital transformation across sectors like healthcare, finance, and retail. Major enterprises such as CVS Health and JPMorgan Chase use process mining tools to streamline workflows and boost efficiency. Leading vendors like Celonis and IBM actively partner with U.S. firms while increasing cloud adoption, which supports scalable deployments, particularly within Fortune 500 companies embracing data-driven operations.

Canadian Market Trends

The Canada process mining software market is expanding steadily as organizations invest in automation and analytics. Sectors like public services and banking (e.g., RBC and TD Bank) are leveraging process mining to enhance compliance and operational transparency. The federal government's digital strategy encourages the adoption of AI-powered process insights. Canadian firms increasingly adopt solutions from players like UiPath and Software AG to optimize business process mapping and cost control.

Component Insights

The software segment holds the largest share in the global process mining software market due to its crucial role in enabling real-time process visualization, conformance checking, and performance monitoring. These tools help organizations uncover inefficiencies and optimize business workflows with minimal human intervention. High demand across industries for advanced analytics and automation capabilities further boosts software adoption. Continuous upgrades, AI integration, and user-friendly dashboards also contribute to its dominance in driving operational excellence and digital transformation initiatives.

Deployment Insights

Cloud deployment is the dominant segment owing to its scalability, flexibility, and cost-effectiveness. Businesses increasingly prefer cloud-based process mining solutions for easy integration with existing systems and remote accessibility. Cloud models reduce the burden of infrastructure management and enable real-time collaboration across teams. Vendors offer subscription-based pricing and continuous updates, making cloud solutions more attractive, especially for rapidly transforming organizations. The rising demand for hybrid work environments and accelerated digital adoption further drives cloud deployment across all sectors.

Enterprise Size Insights

Large enterprises dominate the process mining software market due to their complex business processes and significant IT budgets. These organizations leverage process mining tools to manage vast data volumes, streamline operations, and ensure regulatory compliance. They are early adopters of digital transformation technologies and actively invest in automation, analytics, and performance optimization. Their global presence and industry-specific requirements necessitate robust, scalable solutions, making them the leading users of process mining software for continuous improvement and competitive advantage.

Application Insights

Transactional procurement emerges as the dominant application segment as organizations seek greater transparency and efficiency in routine procurement activities. Process mining enables real-time monitoring of purchase orders, invoice processing, and supplier interactions, helping identify delays and non-compliant behavior. By optimizing these transactions, companies can reduce procurement cycle times, minimize costs, and improve vendor performance. The emphasis on automation and error reduction in day-to-day procurement processes reinforces the growing importance of this application in enterprise ecosystems.

End-User Insights

The BFSI sector leads the process mining software market owing to its high reliance on data-driven operations and stringent regulatory requirements. Financial institutions use process mining tools to optimize workflows in loan processing, claims management, compliance auditing, and customer service. The ability to visualize end-to-end processes and ensure conformance with internal and external regulations makes process mining invaluable in BFSI. Moreover, the sector's ongoing digital transformation and focus on fraud detection and risk management drive significant software adoption.

Company Market Share

Companies in the process mining software market are focusing on enhancing product capabilities through AI integration, real-time analytics, and cloud-based platforms. They are investing in R&D, forming strategic partnerships, and acquiring niche players to expand their global footprint. Additionally, efforts are being made to offer industry-specific solutions, improve user experience, and provide robust data security features to meet compliance requirements and attract a broader customer base across various sectors.

Qpr Software

QPR Software Plc, headquartered in Finland, is a leading provider of process mining, performance management, and enterprise architecture solutions. Founded in 1991, the company is known for its QPR ProcessAnalyzer, which helps organizations visualize, analyze, and optimize business processes using real-time data. QPR serves clients across industries such as manufacturing, telecommunications, and public services. With a strong presence in Europe and growing international reach, QPR continues to innovate in the process mining space through AI integration and cloud capabilities.

- In November 2024, QPR Software released QPR ProcessAnalyzer as a native app on the Snowflake Marketplace. Users can now deploy process mining directly within their Snowflake account in minutes, with no heavy procurement or integrations required. This fully cloud-based offering brings real-time analysis, simplified security, and pay‑as‑you‑go pricing.

List of Key and Emerging Players in Process Mining Software Market

- Celonis

- Software AG

- UiPath

- ABBYY

- SAP SE

- Microsoft Corporation

- KPMG

- QPR Software

- myInvenio (an IBM Company)

- Minit (acquired by Microsoft)

to learn more about this report Download Market Share

Recent Developments

- May 2025- Celonis launched four pre‑configured “Solution Suites” for Supply Chain, Finance, Front Office, and Sustainability. These bundles integrate process intelligence with AI, improve their Process Intelligence Graph, and include a Process Management API, Microsoft Fabric support, a new event‑log builder, an enhanced dashboard studio, and a smarter PQL editor, streamlining deployments.

- April 2025- SAP Signavio’s released the Signavio Process Transformation Suite, which introduces a relational process data model that links event logs to master data like vendors, materials, and finance. It also features faster, incremental data-processing pipelines, eliminating the need to rebuild entire models enabling more agile, efficient process analytics for enterprise digital transformation.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.25 Billion |

| Market Size in 2025 | USD 1.96 Billion |

| Market Size in 2033 | USD 71.41 Billion |

| CAGR | 56.75% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Deployment, By Enterprise Size, By Application, By Industry Vertical |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Process Mining Software Market Segments

By Component

- Software

- Services

By Deployment

- On-Premise

- Cloud

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Application

- Strategic Sourcing

- Contract Management

- Category Management

- Transactional Procurement

- Supplier Management

By Industry Vertical

- Manufacturing

- Healthcare

- BFSI

- Consumer Goods & Services

- Telecommunications & IT

- Logistics & Transportation

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.