Rapid Pathogen Detection Diagnostics Market Size, Share & Trends Analysis Report By Product (Consumables & Reagents, Rapid Test Kits, Instruments, Software), By Technology (Next-Generation Sequencing, Immunoassays, Nucleic Acid Amplification Tests, Microfluidics, Others), By Application (Sexually Transmitted Infections, Respiratory Infections, Bloodborne & Hepatic Infections, Gastrointestinal Pathogens, Vector-Borne Diseases, Others), By End Use (Hospitals & Clinics, Diagnostic Laboratories, Point-of-Care, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Rapid Pathogen Detection Diagnostics Market Overview

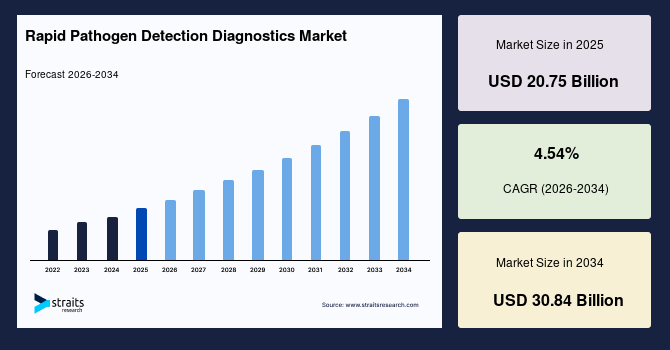

The global rapid pathogen detection diagnostics market size is valued at USD 20.75 billion in 2025 and is estimated to reach USD 30.84 billion by 2034, growing at a CAGR of 4.54% during 2026-2034. The global market observed impressive growth, stimulated by increasing adoption of portable microfluidic cartridges enabling rapid onsite pathogen analysis in remote settings.

Key Market Trends & Insights

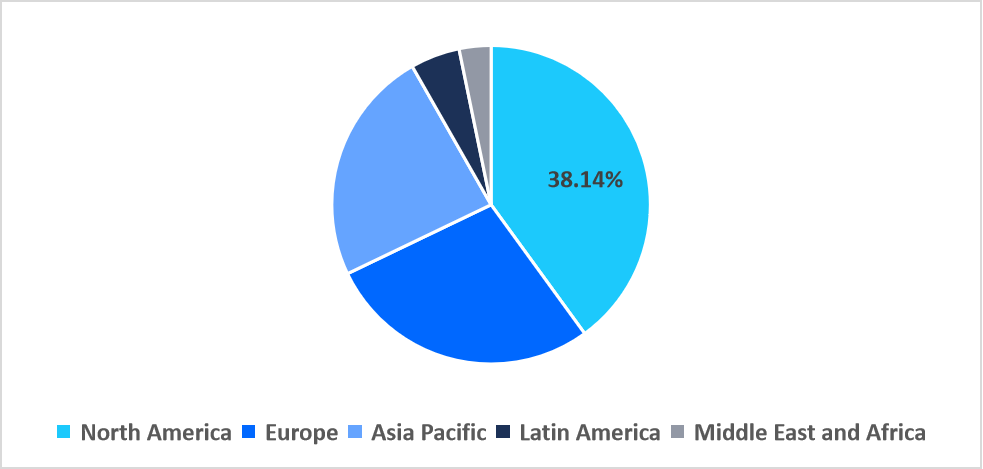

- North America held a dominant share of the global market, accounting for 40.89% in 2025.

- The Asia Pacific region is estimated to grow at the fastest pace, with a CAGR of 6.12%

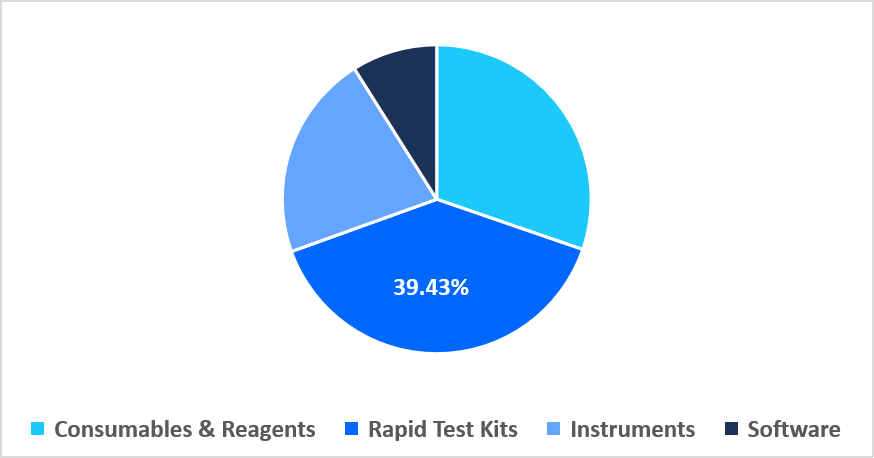

- Based on product, the rapid test kits segment dominated the market in 2025, accounting for 39.43% revenue share.

- By technology, the next-generation sequencing segment is demonstrated to grow at the fastest CAGR of 5.65% during the forecast period.

- Based on the application, the respiratory infections segment dominated the market in 2025.

- By end use, the hospitals & clinics segment dominated the market in 2025.

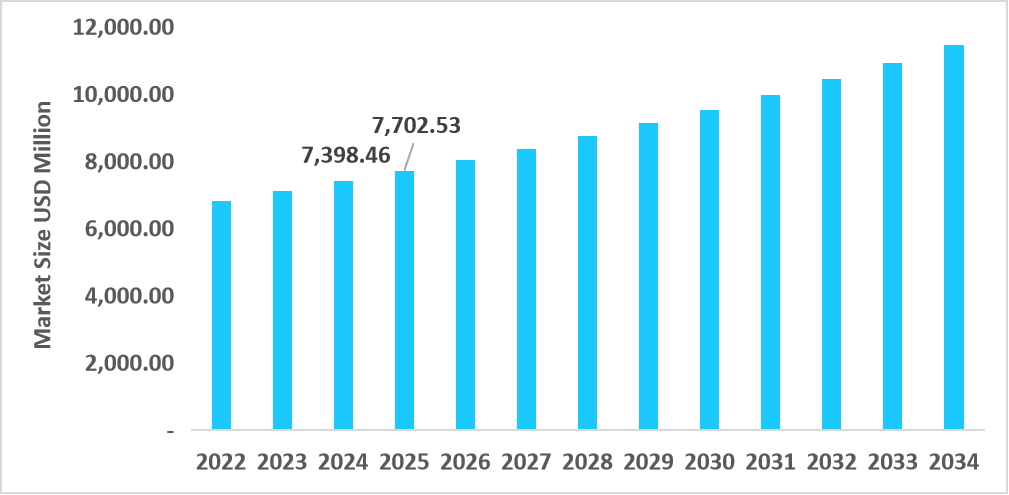

- The U.S. dominates the market, valued at USD 7.39 billion in 2024 and reaching USD 7.70 billion in 2025.

Table: U.S. Rapid Pathogen Detection Diagnostics Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 20.75 billion

- 2034 Projected Market Size: USD 30.84 billion

- CAGR (2026-2034): 4.54%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The global market comprises key products such as consumables and reagents, rapid test kits, instruments, and supporting software, catering to diverse diagnostic requirements. Advanced technologies, including next-generation sequencing, immunoassays, nucleic acid amplification tests, microfluidics, and others, are widely employed for accurate and timely pathogen identification. These solutions are applied across sexually transmitted infections, respiratory infections, bloodborne and hepatic infections, gastrointestinal pathogens, and vector-borne diseases. End users include hospitals and clinics, diagnostic laboratories, point-of-care settings, and other healthcare facilities.

Latest Market Trends

Shift Toward Point-of-Care and Portable Rapid Diagnostics

A major trend in the rapid pathogen detection diagnostics market is the increasing adoption of point-of-care and portable diagnostic platforms, which allow immediate pathogen identification outside traditional laboratory settings. This shift is driven by the demand for faster decision-making during outbreaks, improved patient management, and enhanced accessibility in resource-limited regions.

The trend is fostering innovation in compact molecular devices, microfluidics, and AI-enabled diagnostic tools, improving accuracy, turnaround time, and overall clinical confidence.

Increasing Adoption of Multiplex and Syndromic Testing

The growing adoption of multiplex and syndromic testing is transforming diagnostic approaches into rapid pathogen detection markets. Modern platforms allow simultaneous detection of multiple pathogens from a single sample, improving efficiency, accuracy, and patient management. Hospitals and diagnostic laboratories in the U.S., Europe, and Asia are increasingly using these technologies to rapidly identify co-infections and guide targeted treatment.

This trend is driving market growth by meeting the demand for faster, comprehensive, and cost-effective diagnostic solutions.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 20.75 Billion |

| Estimated 2026 Value | USD 21.62 Billion |

| Projected 2034 Value | USD 30.84 Billion |

| CAGR (2026-2034) | 4.54% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Accelerate Diagnostics, Inc., Agilent Technologies, Inc., BD, BIOMÉRIEUX, Bio-Rad Laboratories, Inc. |

to learn more about this report Download Free Sample Report

Market Drivers

Rising Incidence of Infectious Diseases Driving Diagnostic Demand

The increasing prevalence of infectious diseases globally is a major driver for the rapid pathogen detection diagnostics market. Outbreaks of respiratory infections, antimicrobial-resistant pathogens, and emerging viral diseases are fueling the demand for fast and accurate diagnostic solutions. According to the WHO, infectious diseases remain a leading cause of morbidity worldwide, creating an expanded patient base for rapid testing. In 2024-2025 U.S. reported a peak positivity rate for influenza, highlighting urgent clinical demand. This growing clinical demand is accelerating the adoption of advanced diagnostic platforms across hospitals, laboratories, and point-of-care settings.

Market Restraint

High Cost and Infrastructure Requirements are Limiting Adoption

A major restraint in the rapid pathogen detection diagnostics market is the high cost and infrastructure demands of advanced diagnostic platforms. Sophisticated instruments, such as next-generation sequencing devices, automated molecular systems, and multiplex testing kits, require high investment, trained personnel, and laboratory support. Consequently, the high cost and complex infrastructure requirements continue to restrain overall market growth.

Market Opportunities

Integration of AI and Digital Health Solutions

A major opportunity in the rapid pathogen detection diagnostics market is the integration of artificial intelligence and digital health technologies with diagnostic platforms. AI-powered systems analyze complex pathogen data more accurately, reduce false positives and negatives, and enable predictive outbreak monitoring. This digital integration allows real-time decision-making, supports remote and decentralized testing, and enhances workflow efficiency in hospitals, laboratories, and point-of-care settings, creating new avenues for market growth and innovation.

Regional Analysis

North America dominated the rapid pathogen detection diagnostics market in 2025, accounting for 40.89% market share. This growth is driven by widespread integration of hospital networks with electronic health record (EHR) systems, enabling pathogen data sharing across facilities. This interoperability enhances outbreak management, streamlines reporting to public health authorities, and accelerates clinical decision-making, boosting regional market adoption.

In the U.S., market growth is fueled by the expansion of federally funded antimicrobial resistance surveillance programs, which encourage hospitals and diagnostic laboratories to adopt rapid pathogen detection technologies. This initiative supports early identification of resistant strains, enhances infection control measures, and drives demand for advanced diagnostic platforms nationwide.

Asia Pacific Rapid Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 6.12% from 2026-2034. The growth is driven by a rise in government-supported infectious disease control initiatives in countries like China, India, and Japan, which fund the deployment of rapid pathogen detection systems in public hospitals and rural healthcare centers, improving early diagnosis, outbreak management, and regional healthcare infrastructure.

Japan’s rapid pathogen detection diagnostics market growth is being propelled by the nation’s accelerated adoption of automated molecular diagnostics within its aging population care network, where long-term care hospitals and eldercare facilities increasingly rely on rapid pathogen detection to manage pneumonia and other infection risks. This demographic-driven diagnostic demand uniquely strengthens Japan’s rapid testing ecosystem.

Regional Market share (%) in 2025

Source: Straits Research

Europe Rapid Market Insights

In Europe, the market growth is accelerated by the region’s stringent cross-border infectious disease surveillance framework, which requires member states to harmonize rapid diagnostic reporting through systems like the European Centre for Disease Prevention and Control (ECDC). This coordinated surveillance structure drives widespread adoption of rapid pathogen detection tools to ensure compliance and maintain regional health security.

In Uk, the rapid pathogen detection diagnostics market is experiencing growth due to the National Health Service’s (NHS) rollout of rapid diagnostic hubs, which integrate molecular testing for infectious diseases within community healthcare settings. This decentralized model enhances early detection, reduces hospital burden, and drives sustained demand for rapid pathogen detection technologies across the country.

Latin America Rapid Market Insights

In Latin America, the market growth is propelled by the expansion of regional genomic surveillance networks, particularly in Brazil and Chile, where public health agencies are investing in rapid sequencing and molecular detection tools to monitor emerging viral variants. This infrastructure push is increasing the adoption of rapid pathogen diagnostics across laboratories and national health systems.

In Brazil, the rapid pathogen detection diagnostics market growth is supported by the government’s expansion of mobile infectious disease testing units, designed to serve remote Amazonian and underserved rural regions. These mobile laboratories rely heavily on rapid pathogen detection tools to deliver timely diagnostics, improving public health response capacity and boosting nationwide adoption of rapid testing technologies.

Middle East and Africa Rapid Market Insights

In the Middle East, the market is expanding due to the scale-up of donor-funded laboratory capacity-building programs, particularly through initiatives by the Africa CDC and the Global Fund. These programs prioritize rapid pathogen detection technologies to strengthen outbreak preparedness, enhance decentralized diagnostics, and improve surveillance across low-resource and high-risk regions in the MEA market.

In South Africa, the rapid pathogen detection diagnostics market is growing due to the integration of rapid molecular diagnostics into the country’s mining sector health programs, where routine infectious-disease screening is mandated to protect workers in high-density underground environments. This industry-specific demand drives the continuous adoption of rapid pathogen detection tools across occupational health clinics nationwide.

Product Insights

The rapid test kits segment dominated the market in 2025, accounting for 39.43% revenue share in 2025. This growth is driven by the rising demand for multiplex lateral flow assays, which enable simultaneous detection of multiple pathogens from a single sample. This innovation enhances diagnostic efficiency, reduces sample volume requirements, and accelerates clinical decision-making.

The software segment is projected to witness the fastest CAGR of 5.21% during the forecast timeframe. This growth is augmented by the rising implementation of cloud-based laboratory information management systems (LIMS), enabling secure data storage, remote access, seamless integration with diagnostic instruments, and streamlined reporting, which enhances operational efficiency and supports large-scale pathogen surveillance.

By Product Market Share (%), 2025

Source: Straits Research

Technology Insights

The nucleic acid amplification tests segment dominated the market in 2025, accounting for 38.76% revenue share. This growth is driven by rising adoption of isothermal amplification techniques, which enable rapid, highly sensitive pathogen detection without the requirement for thermal cyclers, making these tests suitable for decentralized and point-of-care diagnostic applications.

The next-generation sequencing segment is expected to register the fastest CAGR growth of 5.65% during the forecast period. This growth is supported by the increasing use of metagenomic sequencing for pathogen discovery, which allows comprehensive identification of known and novel microorganisms in a single test, enhancing outbreak investigation, antimicrobial resistance tracking, and precision infectious disease diagnostics.

Application Insights

The respiratory infections segment dominated the market in 2025. This growth is driven by rising demand for syndromic respiratory panels, which allow simultaneous detection of multiple viral and bacterial pathogens from a single sample, improving diagnostic speed, reducing unnecessary antibiotic use, and enhancing patient management in clinical settings.

The bloodborne & hepatic infections segment is estimated to grow at a CAGR of 5.46% during the forecast period. This growth is stimulated by the increasing adoption of microfluidic-based rapid detection platforms, which allow low-volume, high-precision testing of pathogens like hepatitis and HIV, reducing turnaround time and enabling point-of-care diagnostics in resource-limited settings.

End Use Insights

The hospitals & clinics segment dominated the market in 2025 because of the growing implementation of integrated bedside diagnostic systems, which allow clinicians to perform rapid pathogen testing directly within patient wards, improving turnaround times, enabling immediate treatment decisions, and enhancing overall clinical workflow efficiency.

Competitive Landscape

The global rapid pathogen detection diagnostics market is moderately competitive, with several established players holding major revenue share. Leading companies such as Roche Diagnostics, Thermo Fisher Scientific, bioMérieux, QIAGEN, and Danaher Corporation continue to strengthen their portfolios through advancements in molecular diagnostics, multiplex testing, and point-of-care platforms. Emerging innovators like T2 Biosystems, Oxford Nanopore Technologies, and Sherlock Biosciences are intensifying competition with novel technologies, including CRISPR-based detection and rapid sequencing. Strategic collaborations, product launches, and R&D investments remain central to sustaining market leadership.

Mammoth Biosciences: An emerging market player

Mammoth Biosciences is an emerging player in the market, specializing in CRISPR-based molecular testing technologies designed for ultra-fast and highly sensitive pathogen identification. The company is advancing compact, decentralized diagnostic platforms suitable for point-of-care and field use.

For example, in 2024, Mammoth expanded clinical validation of its CRISPR-enabled DETECTR system to support rapid screening of respiratory diseases, positioning it as a next-generation innovator in the market.

List of Key and Emerging Players in Rapid Pathogen Detection Diagnostics Market

- Accelerate Diagnostics, Inc.

- Agilent Technologies, Inc.

- BD

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- Charles River Laboratories

- Danaher Corporation

- DiaSorin S.p.A.

- Eurofins Scientific

- Hoffmann-La Roche Ltd

- GenMark Diagnostics

- Hologic, Inc.

- Illumina, Inc.

- Luminex Corporation

- PerkinElmer

- QIAGEN

- Seegene, Inc.

- Siemens Healthineers AG

- T2 Biosystems, Inc.

- Thermo Fisher Scientific Inc.

- Others

Strategic Initiatives

- July 2025: Neogen Corporation launched the molecular detection assay, Listeria Right Now, an enrichment-free solution for detecting Listeria species in the environment.

- May 2025: Eurofins launched its new quantitative real-time PCR assays for dimorphic fungi for the accurate diagnosis of infections caused by Blastomyces spp., Histoplasma spp., Coccidioides spp., and Cryptococcus.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 20.75 Billion |

| Market Size in 2026 | USD 21.62 Billion |

| Market Size in 2034 | USD 30.84 Billion |

| CAGR | 4.54% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Technology , By Application, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Rapid Pathogen Detection Diagnostics Market Segments

By Product

- Consumables & Reagents

- Rapid Test Kits

- Instruments

- Software

By Technology

- Next-Generation Sequencing

- Immunoassays

- Nucleic Acid Amplification Tests

- Microfluidics

- Others

By Application

- Sexually Transmitted Infections

- Respiratory Infections

- Bloodborne & Hepatic Infections

- Gastrointestinal Pathogens

- Vector-Borne Diseases

- Others

By End Use

- Hospitals & Clinics

- Diagnostic Laboratories

- Point-of-Care

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.