Respiratory Care Devices Market Size, Share & Trends Analysis Report By Product (Therapeutic Devices, Monitoring Devices, Diagnostic Devices, Consumables and Accessories), By Application (Chronic Obstructive Pulmonary Disease (COPD), Sleep Apnea, Asthma, Infectious Diseases, Others), By End-User (Hospitals, Specialty Clinics, Home Care, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Respiratory Care Devices Market Overview

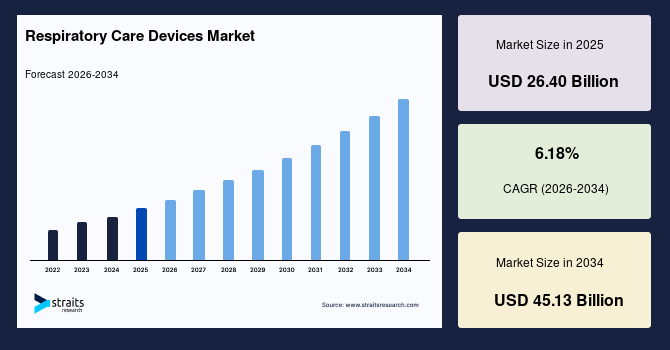

The global respiratory care devices market size is estimated at USD 26.40 billion in 2025 and is projected to reach USD 45.13 billion in 2034, growing at a CAGR of 6.18% during the forecast period. Remarkable growth of the market is propelled by the rising air pollution levels and various technological advancements in respiratory care devices.

Key Market Trends & Insights

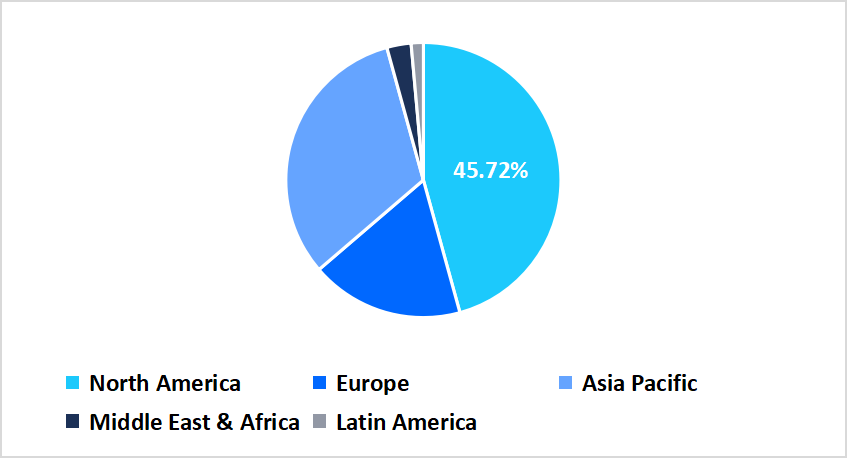

- North America held a dominant share of the global market, accounting for 45.72% share in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 7.12%.

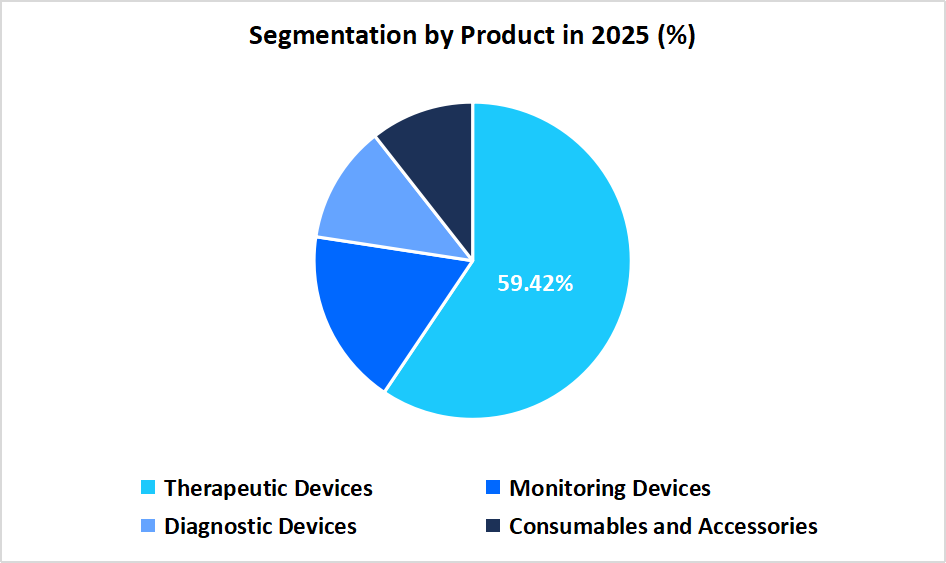

- Based on Product, the therapeutic devices segment dominated the market in 2025 with a revenue share of 59.42%.

- Based on the Application, the sleep apnea segment is expected to register the fastest CAGR growth of 8.12%.

- Based on End User, the hospitals segment dominated the market in 2025, with a revenue share of 35.23%.

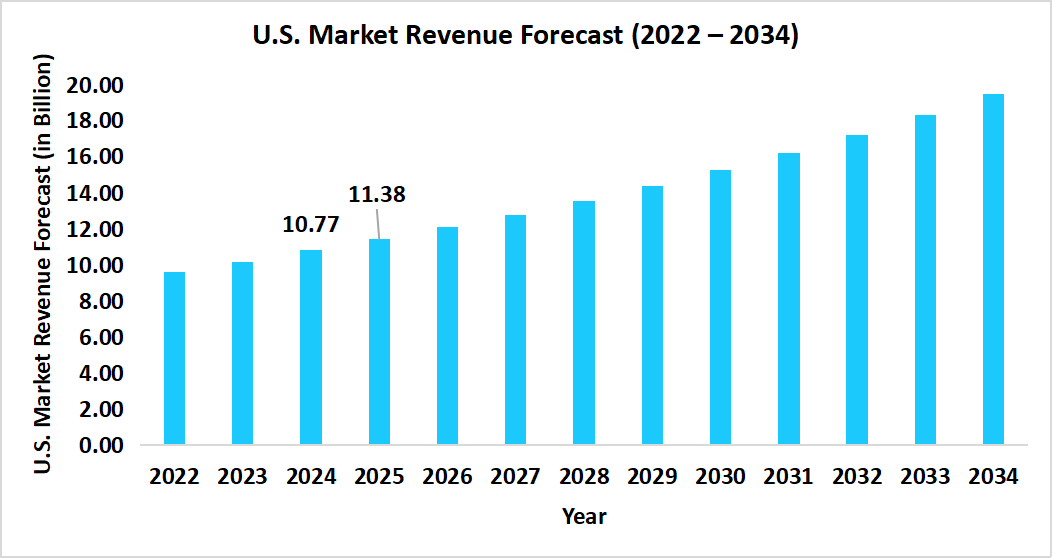

- The U.S. dominates the global respiratory care devices market, valued at USD 10.77 billion in 2024 and reaching USD 11.38 billion in 2025.

Graph: U.S. Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 26.40 billion

- 2034 Projected Market Size: USD 45.13 billion

- CAGR (2025 to 2034): 6.18%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global respiratory care devices market encompasses a wide range of products and technologies designed to support, monitor, and enhance respiratory function in patients across diverse healthcare settings. The market includes therapeutic devices such as positive airway pressure devices, masks, ventilators, nebulizers, humidifiers, oxygen concentrators, inhalers, reusable resuscitators, nitric oxide delivery units, capnographs, gas analyzers, and oxygen hoods, which are essential for efficient respiratory therapy and oxygen management. Monitoring devices include various pulse oximeters such as pediatric, wrist-worn, hand-held, fingertip, and table-top models, used to continuously assess oxygen saturation and respiratory performance, while diagnostic devices such as spirometers, polysomnography systems, and peak flow meters enable precise evaluation of lung capacity, airflow, and sleep-related breathing disorders. Additionally, consumables and accessories, including disposable masks, nasal cannulas, and other related products, play a vital role in ensuring hygiene, comfort, and infection control during respiratory care. These devices are widely used for applications such as chronic obstructive pulmonary disease, sleep apnea, asthma, infectious diseases, and other respiratory conditions. They are utilized across hospitals, specialty clinics, home care settings, and other healthcare facilities, each adopting specific technologies and treatment approaches according to patient requirements, disease severity, and care delivery models.

Latest Market Trends

Shift Towards Home Healthcare Solutions and Remote Patient Monitoring

With the increasing prevalence of respiratory diseases and a growing emphasis on patient convenience, healthcare systems are encouraging at-home management of conditions, such as COPD, asthma, and sleep apnea, from traditional hospital or clinic-based respiratory care. As per the data published by Imperial College London, AcuPebble, developed by Acurable is a sleep apnea home testing device recommended for use by the NHS by the National Institute for Health and Care Excellence.

Such transition reduced hospital admissions, improved patient convenience, and enhanced the adoption of advanced, connected respiratory care devices.

Emergence of Smart, Portable, and IoT-Enabled Ventilators

The development of smart, portable, and IoT-enabled ventilators has emerged as a trend driving the respiratory care devices market. As per the data published by the Government of India, Ministry of Science & Technology, Pune-based Nocca Robotics developed a solar-powered, low-wattage ventilator with invasive and noninvasive modes, app control, and IoT connectivity.

This advancement underscored the shift towards connected, energy-efficient, and patient-centric ventilators, which further enhanced mobility, remote monitoring, and efficient management of respiratory conditions.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 26.40 Billion |

| Estimated 2026 Value | USD 27.94 Billion |

| Projected 2034 Value | USD 45.13 Billion |

| CAGR (2026-2034) | 6.18% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Koninklijke Philips N.V., 3M, Medtronic, Resmed, Masimo |

to learn more about this report Download Free Sample Report

Respiratory Care Devices Market Driver

Global Burden of Chronic Obstructive Pulmonary Disease (COPD)

The global burden of COPD has contributed to the growth of the respiratory care devices market. For example, in November 2024, as per the data reported by the World Health Organization, COPD was the eighth leading cause of poor health worldwide, with approximately 392 people affected by the same.

Such a factor underscores the urgent requirement for enhanced care devices, preventive strategies, early diagnosis, and efficient management to reduce the global impact of COPD.

Market Restraint

High Cost of Advanced Respiratory Devices

The high cost of advanced respiratory devices remains a barrier to access, particularly in critical care settings. According to Nodri Meditech, during the early stages of the COVID-19 pandemic, the price of mechanical ventilators increased from an average of USD 25,000 to upwards of USD 50,000 due to heightened demand and limited supply.

Surge in prices underscored the financial challenges associated with acquiring advanced respiratory equipment, which was prohibitively expensive for various healthcare facilities, especially in low-resource settings.

Market Opportunity

Development of Sustainable and Eco-Friendly Devices

The growing emphasis on environmental sustainability has led to the development of eco-friendly respiratory devices, which presents as a market opportunity. Manufacturers are focusing on producing devices with reduced carbon footprints and using sustainable materials, aligning with global environmental goals and attracting environmentally conscious consumers. Recently, AstraZeneca's Trixeo Aerosphere was approved in the UK as the first inhaled respiratory medicine to use a next-generation propellant with near-zero global warming potential for the treatment of chronic obstructive pulmonary disease in adults. This advanced propellant offered a 99.9% reduction in global warming potential compared to current propellants used in pressurised metered-dose inhalers (pMDIs).

Regional Analysis

The North America region dominated the market with a revenue share of 45.72% in 2025. The growth is attributed to factors such as well-established healthcare infrastructure, advanced technology adoption in medical devices, and government initiatives supporting respiratory care programs.

The respiratory care devices market in the U.S. is widely driven by the recent CMS National Coverage Determination (NCD) for home non-invasive positive pressure ventilation (NIPPV) in patients with chronic respiratory failure due to COPD. This policy expands coverage for respiratory assist devices (RADs) and home mechanical ventilators under specific clinical criteria. By increasing reimbursement access, this factor directly boosts the market size and stimulates the respiratory care devices market growth as more patients qualify for home ventilatory support.

Asia Pacific Market Insights

The Asia Pacific region is the fastest-growing region with a CAGR of 7.12% during the forecast timeframe. The growth is attributed to factors such as increasing awareness of respiratory care, and rising demand for home-based respiratory care devices.

India continues to position itself in the respiratory care devices market, due to the government's strategic initiatives, particularly the National Medical Devices Policy 2023. This policy aims to position India as a global hub for medical device manufacturing, offering incentives, such as the Production Linked Incentive (PLI) scheme, and establishing medical device parks. Such measures enhance domestic production capabilities, reduce import dependency, and make respiratory care devices more accessible and affordable.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

The European respiratory care devices market is witnessing growth due to the increasing integration of environmentally sustainable and energy-efficient respiratory devices driven by regional regulations and hospital sustainability initiatives. Hospitals and clinics are increasingly adopting low-power ventilators, reusable resuscitators, and eco-friendly consumables to reduce carbon footprint while maintaining high-quality patient care. This focus on green healthcare technologies, combined with incentives for eco-conscious medical equipment procurement and rising patient demand for devices that are both efficient and environmentally responsible, is creating a unique growth driver for the European respiratory care devices market.

The respiratory care devices market in UK is propelling due to the expansion of home mechanical ventilation (HMV) services commissioning, under NHS England’s “Complex Home Mechanical Ventilation” Model of Care. This guidance requires Integrated Care Boards (ICBs) to fund home ventilators, MI-E devices, suction machines and nebulisers, boosting market size by increasing device prescriptions. This element makes respiratory care devices market growth stronger because more patients can access these equipment at home.

Middle East and Africa Market Insights

The Middle East and Africa respiratory care devices market is experiencing growth due to the expansion of mobile and temporary healthcare facilities in remote and underserved regions, which rely heavily on portable respiratory devices such as compact oxygen concentrators, mobile ventilators, and handheld pulse oximeters. Frequent outbreaks of respiratory infections and environmental challenges like high dust and pollution levels have increased the demand for on-the-go therapeutic and monitoring solutions.

The South African respiratory care devices market is growing due to the rising demand for cold-chain compatible and battery-operated respiratory devices in remote and off-grid areas, where consistent electricity supply is limited. This has driven the adoption of portable oxygen concentrators, battery-powered nebulizers, and solar-assisted ventilators that can function efficiently in rural clinics and mobile healthcare units.

Latin America Market Insights

The Latin American respiratory care devices market is witnessing growth due to the increased prevalence of environmental and climate-related respiratory challenges, such as frequent wildfires, and seasonal dust storms. These factors have driven demand for portable air filtration devices, inhalers, nebulizers, and monitoring tools that support managing acute respiratory episodes and preventing complications.

The Argentina respiratory care devices market is witnessing growth due to the increasing adoption of digital health platforms for remote respiratory monitoring and patient education. Hospitals, specialty clinics, and home care providers are leveraging connected devices such as smart pulse oximeters, wireless spirometers, and app-integrated PAP systems to track patient progress, adjust therapies, and improve adherence.

Product Insights

The therapeutic devices segment dominated the market in 2025 with a revenue share of 59.42%. The growth is attributed to the rising demand for advanced treatment options, hospitals and clinics investing in therapeutic equipment, and technological advancements in ventilators, nebulizers, and oxygen therapy devices.

The monitoring devices are anticipated to register the fastest CAGR of 7.12% during the forecast period, owing to the rising adoption of wearable and compact pulse oximeters for pediatric and geriatric patients, the increasing use of remote monitoring platforms in home care settings, and the integration of AI-driven analytics for early detection of respiratory complications.

Source: Straits Research

Application Insights

The sleep apnea devices segment is anticipated to grow at a CAGR of 8.12% from 2026 - 2034. This growth is attributed to the rising prevalence of sleep apnea, increasing awareness about sleep disorders, growing adoption of home-based BiPAP devices, technological advancements in wearable and connected devices, and supportive insurance coverage.

The chronic obstructive pulmonary disease (COPD) segment dominates the market, with a revenue share of 37.82%, owing to the increasing geriatric population globally, which is more susceptible to chronic respiratory disorders, and the rising adoption of long-term oxygen therapy for COPD management.

End-User Insights

The hospitals segment dominated the market in 2025, with a revenue share of 35.23%. The growth is attributed to the high demand for advanced respiratory care treatments, increasing hospital admissions for chronic and acute respiratory diseases, the availability of specialized respiratory equipment, and hospitals’ capacity to invest in advanced devices.

The home care segment is estimated to register the fastest CAGR of 8.35% during the forecast period, owing to the growing demand for portable and compact respiratory devices that allow patients to manage chronic conditions, and the rising preference for non-hospital-based care among elderly and post-COVID-19 patients.

Competitive Landscape

The global Respiratory Care Devices (IVF) market is highly fragmented with the presence of numerous multinational corporations such as Koninklijke Philips N.V., Medtronic, 3M, ResMed and Others.

The industry participants are inclined towards developing technologically advanced, portable, and cost-effective respiratory care devices to address rising demand across critical care, emergency, and home care settings, which further enhances the growth of respiratory care devices.

CorVent Medical Inc: An emerging market player

CorVent Medical Inc. is an emerging player in the respiratory care devices market, focused on advanced ventilator solutions.

- In November 2024, CorVent Medical received U.S. FDA 510(k) clearance for its RESPOND Ventilator, a next-generation critical care system designed to provide versatile, cost-effective respiratory support for hospitals facing capacity challenges.

List of Key and Emerging Players in Respiratory Care Devices Market

- Koninklijke Philips N.V.

- 3M

- Medtronic

- Resmed

- Masimo

- Fisher & Paykel Healthcare Limited

- Getinge

- Drägerwerk AG & Co. KGaA

- Nihon Kohden Corporation

- GE HealthCare

- Vyaire

- Air Liquide Medical Systems

- ICU Medical, Inc.

- OMRON Healthcare Co., Ltd.

- Teleflex Incorporated

- Pulmodyne, Inc.

- Drive Devilbiss International

- Breas Medical AB

- GE HealthCare

- Others

Strategic Initiatives

- May 2025: ResMed acquired VirtuOx, a leading independent diagnostic testing facility for sleep, respiratory as well as cardiac conditions.

- March 2025: Fisher & Payel Healthcare launched the F&P Nova Nasal mask in New Zealand and Australia.

- November 2024: Fisher & Paykel Healthcare launched F&P Nova Micro, the smallest and lightest CPAP therapy mask.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 26.40 Billion |

| Market Size in 2026 | USD 27.94 Billion |

| Market Size in 2034 | USD 45.13 Billion |

| CAGR | 6.18% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Application, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Respiratory Care Devices Market Segments

By Product

-

Therapeutic Devices

- Positive Airway Pressure (PAP) devices

- Mask

- Ventilators

- Nebulizers

- Humidifiers

- Oxygen Concentrators

- Inhalers

- Reusable Resuscitators

- Nitric Oxide Delivery Units

- Capnographs

- Gas Analyzers

- Oxygen hoods

-

Monitoring Devices

-

Pulse Oximeters

- Pediatric pulse oximeters

- Wrist-worn pulse oximeters

- Hand-held pulse oximeters

- Fingertip pulse oximeters

- Table-top/bedside pulse oximeters

-

Pulse Oximeters

-

Diagnostic Devices

- Spirometers

- Polysomnography (PSG) Device

- Peak flow meters

-

Consumables and Accessories

- Disposable masks

- Nasal Cannulas

- Others

By Application

- Chronic Obstructive Pulmonary Disease (COPD)

- Sleep Apnea

- Asthma

- Infectious Diseases

- Others

By End-User

- Hospitals

- Specialty Clinics

- Home Care

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.