Sequencing Consumables Market Size, Share & Trends Analysis Report By Product (Reagents & Kits, Accessories), By Platform (1st Generation sequencing Consumables, 2nd Generation sequencing Consumables, 3rd Generation sequencing Consumables), By Application (Cancer Diagnostics, Infectious Disease Diagnostics, Reproductive Health Diagnostics, Pharmacogenomics, Agrigenomics, Drug Discovery/Functional Genomics, Others), By End Use (Pharmaceutical and biotechnology companies, Hospitals and laboratories, Academic research institutes, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Sequencing Consumables Market Overview

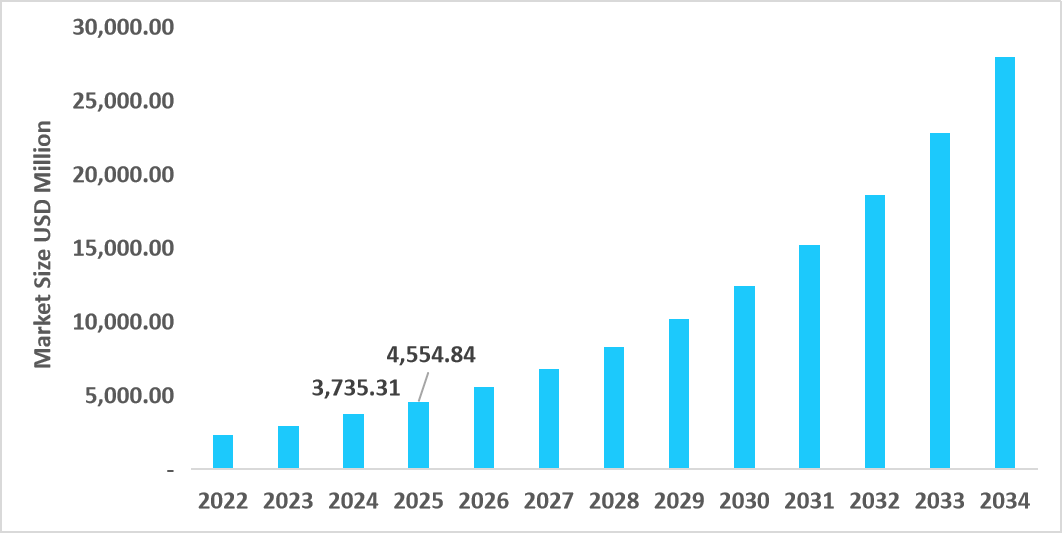

The global sequencing consumables market size is valued at USD 10.25 billion in 2025 and is estimated to reach USD 62.90 billion by 2034, growing at a CAGR of 22.37% during 2026-2034. The global market observed impressive growth, stimulated by increasing demand for low input library preparation consumables for high fidelity sequencing.

Key Market Trends & Insights

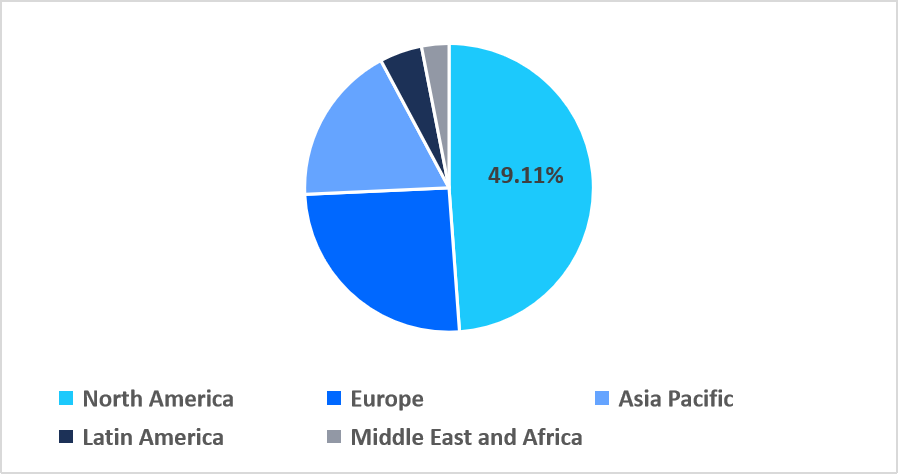

- North America held a dominant share of the global market, accounting for 49.11% in 2025.

- The Asia Pacific region is estimated to grow at the fastest pace, with a CAGR of 24.34%.

- Based on product, the accessories segment is expected to register the fastest CAGR of 22.96%.

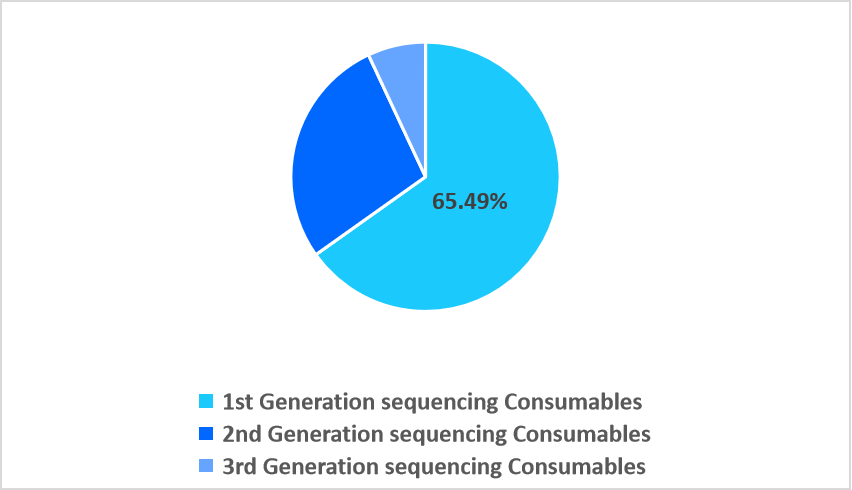

- Based on the platform, the 2nd generation sequencing consumables segment dominated the market, accounting for 65.49% share in 2025.

- Based on the application, the cancer diagnostics segment dominated the market in 2025 with a revenue share of 26.13% in 2025.

- Based on end use, the hospitals and laboratories segment dominated the market in 2025.

- The U.S. dominates the market, valued at USD 3.75 billion in 2024 and reaching USD 4.55 billion in 2025.

Table: U.S. Sequencing Consumables Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 10.25 billion

- 2034 Projected Market Size: USD 62.90 billion

- CAGR (2026-2034): 22.37%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The sequencing consumables market includes a wide range of reagents, kits, and accessories essential for preparing, processing, and analyzing genetic material across various sequencing platforms, including first-, second, and third-generation technologies. These consumables support critical steps such as template, library, sample preparation, sequencing reactions, barcoding, and others. They are widely used in applications like cancer and infectious disease diagnostics, reproductive genetics, pharmacogenomics, agrigenomics, and drug discovery. Key end users include pharmaceutical and biotechnology companies, hospitals, laboratories, and academic research institutes.

Latest Market Trends

Growing Adoption of Rapid Automation-Ready Consumables

A major recent trend in the sequencing consumables market is the rising adoption of rapid, automation-compatible consumables designed to streamline high-throughput sequencing workflows. Laboratories are shifting toward pre-optimized, integrated reagent cartridges and automated library preparation kits that reduce hands-on time and error rates. This trend is accelerating due to expanding decentralized genomic testing, where faster turnaround, minimal technical expertise, and seamless instrument integration are becoming critical performance requirements.

Expansion of Single Cell Consumables for High Resolution Genomics

The rapid expansion of consumables specifically engineered for single-cell sequencing, driven by the demand for ultra-high-resolution genomic insights, is a key trend for market growth. Manufacturers are developing low-input, contamination-resistant reagents and microfluidic-compatible kits that enable precise amplification and barcoding of individual cells. For instance, in February 2025, Parse Biosciences launched a new kit Evercode WT Penta Kit, which enables single-cell RNA sequencing of up to 5 million cells in a single run. This release pushes the boundaries of scale and throughput for single-cell experiments.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 10.25 Billion |

| Estimated 2026 Value | USD 12.51 Billion |

| Projected 2034 Value | USD 62.90 Billion |

| CAGR (2026-2034) | 22.37% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Agilent Technologies, Beckman Coulter, Inc, BGI Genomics, Bio-Rad Laboratories, Danaher |

to learn more about this report Download Free Sample Report

Market Drivers

Rapid Expansion of Clinical Genomics and Companion Diagnostics

A major recent driver in the sequencing consumables market is the accelerating adoption of clinical genomics for companion diagnostics, driven by the surge in targeted therapies and precision oncology. Pharmaceutical companies now require high accuracy sequencing reagents and kits to validate genetic biomarkers that guide therapy selection. The growing number of FDA-approved companion diagnostic tests since 2023 has substantially boosted consumable demand, positioning clinical genomics as a central force behind sustained market expansion.

Market Restraint

High Variability in Sequencing Accuracy Due to Reagent Batch Inconsistencies

The rising concern over batch-to-batch variability in high-sensitivity reagents, which notably impacts sequencing accuracy, reproducibility, and downstream clinical interpretation, is a major restraint for market growth. As healthcare systems increasingly rely on genomic data for diagnostics and treatment decisions, even minor inconsistencies create delays, additional validation costs, and regulatory scrutiny. These quality control challenges hinder large-scale adoption in clinical laboratories pursuing standardized, high-throughput sequencing workflows.

Market Opportunity

Rapid Expansion of Decentralized Genomic Testing in Emerging Healthcare Systems

A major opportunity in the sequencing consumables market is the accelerating shift toward decentralized genomic testing across emerging economies, where hospitals and diagnostic chains are rapidly integrating compact NGS platforms. This transition is creating strong demand for pre-assembled consumable kits optimized for low infrastructure settings. For example, various Southeast Asian diagnostic networks are adopting cartridge-based sequencing reagent systems in 2024 to enable faster infectious disease and oncology testing across regional satellite laboratories.

Regional Analysis

North America dominated the sequencing consumables market in 2025, accounting for 49.11% market share. This growth is driven by increasing adoption of CLIA-aligned pre-calibrated consumable cartridges, which are uniquely tailored to meet stringent U.S. clinical testing standards. These region-specific cartridges reduce validation time for hospitals and reference labs, accelerating integration of advanced sequencing workflows.

In Canada, the rising use of cold chain optimized sequencing consumables engineered for performance in long-distance, low temperature logistics, a requirement unique to Canada’s widely dispersed healthcare network. These specialized formulations ensure nucleic acid stability during transport to centralized genomic hubs, accelerating nationwide adoption of advanced sequencing workflows.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 24.34% from 2026-2034. The growth is driven by the adoption of barcoded sequencing consumables tailored for diverse, multi-ethnic populations across the region. These kits enable high-throughput genomic analysis with reduced cross-sample errors, supporting population genomics studies and precision medicine initiatives unique to the Asia Pacific’s heterogeneous demographics

The Chinese sequencing consumables market is expanding due to increasing use of high-throughput, automation-ready consumables tailored for the country’s national genomic initiatives, enabling rapid processing of large population-scale sequencing projects and supporting precision medicine programs specific to China’s healthcare strategy.

Regional Market share (%) in 2025

Source: Straits Research

In Europe, the market growth is accelerated by the early adoption of EU-specific 1st-generation sequencing consumables designed to meet stringent GDPR and IVDR standards. These specialized consumables enable secure, traceable genomic data handling across clinical and research laboratories, promoting wider integration of sequencing in Europe’s highly regulated healthcare environment.

In Germany, the sequencing consumables market is experiencing growth due to the increasing use of ISO 15189-certified sequencing consumables designed for the country’s accredited clinical laboratories. These consumables ensure precise, standardized workflows that comply with Germany’s strict quality and diagnostic regulations, accelerating adoption in hospitals and diagnostic centers.

In Germany, the sequencing consumables market is experiencing growth due to the increasing use of ISO 15189-certified sequencing consumables designed for the country’s accredited clinical laboratories. These consumables ensure precise, standardized workflows that comply with Germany’s strict quality and diagnostic regulations, accelerating adoption in hospitals and diagnostic centers.

Latin America Market Insights

In Latin America, the sequencing consumables market growth is propelled by heat-stable, field-deployable sequencing consumables tailored for regions with limited cold chain infrastructure. These specialized consumables enable reliable genomic testing in remote clinics and research centers, supporting large-scale infectious disease surveillance and precision medicine initiatives unique to Latin America’s diverse and resource-constrained settings.

In Argentina, the increasing use of portable sequencing consumables is being seen for decentralized agricultural genomics and infectious disease monitoring in rural areas. These specialized kits enable reliable DNA and RNA analysis without dependence on stable electricity, supporting region-specific research and diagnostics across Argentina’s remote and diverse landscapes.

Middle East and Africa Market Insights

In the Middle East, the sequencing consumables market is expanding due to the adoption of thermally stable sequencing consumables capable of withstanding extreme temperatures during transport and storage. These specialized consumables support large-scale genomic research and clinical diagnostics in regions with limited infrastructure and harsh environmental conditions, uniquely facilitating market expansion.

In South Africa, the high-sensitivity sequencing consumables are specifically developed for large-scale viral load monitoring and drug-resistance profiling. These specialized consumables enable accurate, high-throughput genomic analysis in public health programs, addressing the country’s unique epidemiological demand and accelerating adoption across clinical and research laboratories.

Product Insights

The reagents & kits segment dominated the market in 2025. This growth is driven by enzymatically enhanced error correction chemistries within reagents and kits, which enable ultra-clean amplification for high precision applications like liquid biopsy and low-frequency mutation detection. This specialized capability is increasing demand for premium, next-generation consumable formulations.

The accessories segment is projected to witness the fastest CAGR of 22.96% during the forecast timeframe. This growth is augmented by growing adoption of microfluidic-compatible consumable accessories, such as retention plates and precision-engineered collection tubes designed for automated single-cell handling. These specialized accessories enhance throughput, reduce sample loss, and support next-generation sequencing workflows, driving rapid segment expansion.

Platform Insights

The 2nd-generation sequencing consumables segment dominated the market in 2025 with a revenue share of 65.49%, owing to increasing demand for error-resilient barcoding chemistries uniquely compatible with 2nd-generation platforms, enabling highly multiplexed runs without cross-sample interference. This advanced barcoding capability notably boosts throughput and data fidelity, reinforcing the segment’s strong market dominance.

The 3rd generation sequencing consumables segment is expected to register the fastest CAGR growth of 23.09% during the forecast period. This growth is supported by the rising use of long fragment stabilization buffers specifically engineered for 3rd generation sequencing, enabling intact megabase-scale DNA reads without degradation. This highly specialized chemistry is expanding adoption among researchers targeting structural variants and complex genome assemblies.

By Platform Market Share (%), 2025

Source: Straits Research

Application Insights

The cancer diagnostics segment dominated the market in 2025 with a revenue share of 26.13% in 2025. This growth is driven by increasing dependence on tumor microenvironment profiling kits, which allow simultaneous sequencing of cancer cells and surrounding immune components.

The pharmacogenomics segment is estimated to grow at a CAGR of 23.82% during the forecast period. This growth is stimulated by the rising adoption of allele-specific amplification consumables designed to detect pharmacogenetic variants that influence drug metabolism. These precision chemistries enable highly sensitive genotype-to-phenotype mapping, driving increased utilization of sequencing consumables in personalized therapy.

End Use Insights

The hospitals and laboratories segment dominated the market in 2025, due to the integration of clinically validated consumable panels specifically designed for routine diagnostic workflows. These panels meet stringent hospital compliance standards, allowing labs to seamlessly run standardized genomic tests, accelerating adoption across high-throughput clinical environments.

Competitive Landscape

The global sequencing consumables market is moderately consolidated, with a few major players capturing a major revenue share. Leading companies, including Illumina, Thermo Fisher Scientific, Pacific Biosciences, and QIAGEN, are driving competition through continuous product innovation, automation-ready consumables, and expansion of high-throughput sequencing solutions. Strategic initiatives such as collaborations, acquisitions, and regional market expansion are being pursued to strengthen market positioning and maintain a competitive edge globally.

MGI Tech: An emerging market player

MGI Tech is an emerging player in the global market, focusing on cost-efficient, high-throughput sequencing platforms and matching consumables. The company offers a diverse portfolio of reagents, kits, and accessories tailored for research and clinical applications. For instance, in 2024, MGI launched its DNBSEQ-T10 reagent kits, enabling scalable, high-accuracy sequencing, supporting broader adoption among academic laboratories and smaller institutions globally.

List of Key and Emerging Players in Sequencing Consumables Market

- Agilent Technologies

- Beckman Coulter, Inc

- BGI Genomics

- Bio-Rad Laboratories

- Danaher

- Element Biosciences

- Eurofins Genomics

- Hoffmann-La Roche Ltd

- Fluidigm

- Illumina

- Merck KGaA

- New England Biolabs

- Oxford Nanopore Technologies Ltd

- Pacific Biosciences

- PerkinElmer

- QIAGEN.

- Singular Genomics

- Takara Bio Inc

- Tecan Group

- Thermo Fisher Scientific, Inc

- Others

Strategic Initiative

- October 2025: Illumina, Inc. launched its novel 5-base solution, allowing researchers to pursue broader biological questions with accuracy and ease.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 10.25 Billion |

| Market Size in 2026 | USD 12.51 Billion |

| Market Size in 2034 | USD 62.90 Billion |

| CAGR | 22.37% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Platform , By Application, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Sequencing Consumables Market Segments

By Product

-

Reagents & Kits

- Template Preparation

- Library Preparation

- Sample Preparation

- Sequencing Reaction

- Barcoding/ Indexing

- Others

-

Accessories

- Collection tubes

- Plates

- Others

By Platform

- 1st Generation sequencing Consumables

- 2nd Generation sequencing Consumables

- 3rd Generation sequencing Consumables

By Application

- Cancer Diagnostics

- Infectious Disease Diagnostics

- Reproductive Health Diagnostics

- Pharmacogenomics

- Agrigenomics

- Drug Discovery/Functional Genomics

- Others

By End Use

- Pharmaceutical and biotechnology companies

- Hospitals and laboratories

- Academic research institutes

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.