SGLT2 Inhibitors Market Size, Share & Trends Analysis Report By Drug (Canagliflozin, Dapagliflozin, Empagliflozin, Ertugliflozin, Ipragliflozin, Sotagliflozin, Others), By Indication (Type 2 Diabetes, Cardiovascular, Chronic Kidney Disease, Weight Management, Others), By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, Online Pharmacies) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

SGLT2 Inhibitors Market Overview

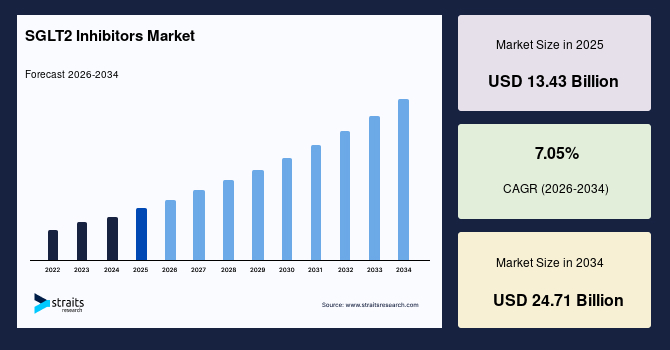

The global SGLT2 inhibitors market size is valued at USD 13.43 billion in 2025 and is estimated to reach USD 24.71 billion by 2034, growing at a CAGR of 7.05% during 2026-2034. The global market is growing impressively, driven by expanding clinical adoption of SGLT2 inhibitors for heart failure and chronic kidney disease beyond diabetes management, supported by strong outcome trials and updated global treatment guidelines.

Key Market Trends & Insights

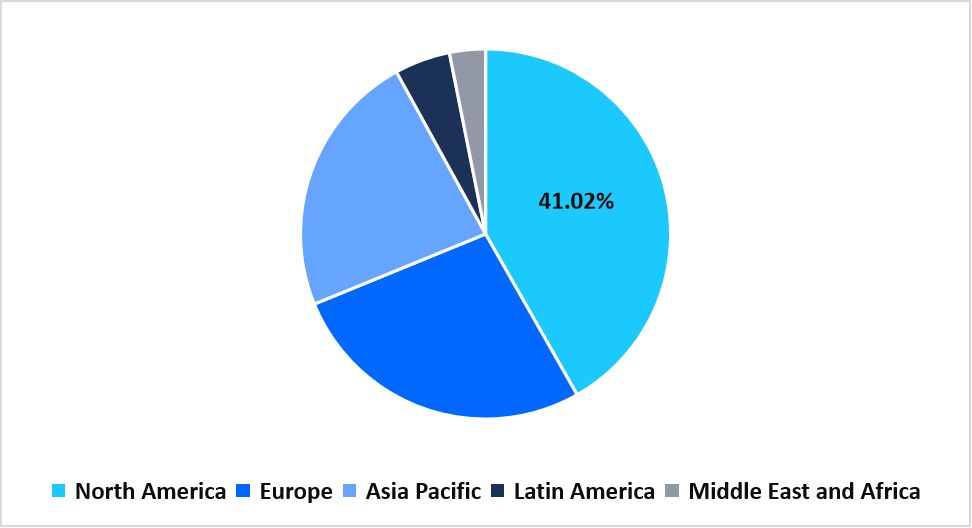

- North America held a dominant share of the global market, accounting for 41.02% in 2025.

- The Asia Pacific region is estimated to grow at the fastest pace, with a CAGR of 8.69% during the forecast period.

- Based on drug type, the Ertugliflozin segment is expected to register the fastest CAGR of 7.85% during the forecast period.

- On the basis of indication, the type 2 diabetes segment dominated the market in 2025, with a revenue share of 69.53%.

- Based on the distribution channel, the hospital pharmacies segment dominated the market in 2025, accounting for 51.06% market share in 2025.

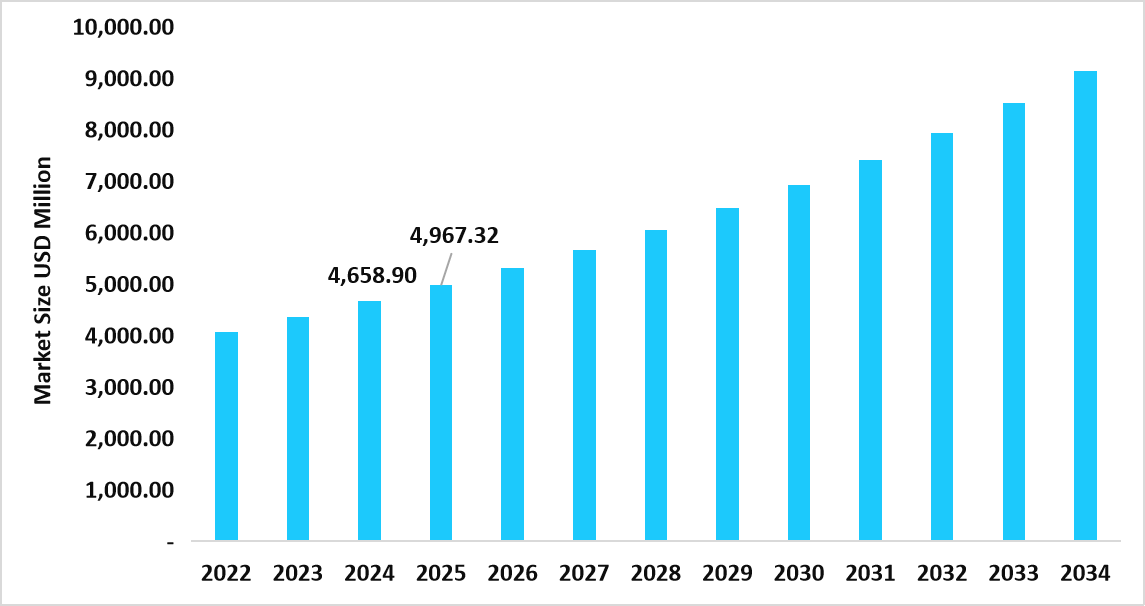

- The U.S. dominates the market, valued at USD 4,658.90 million in 2024 and reaching USD 4,967.32 million in 2025.

Table: U.S. SGLT2 Inhibitors Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 13.43 billion

- 2034 Projected Market Size: USD 24.71 billion

- CAGR (2026-2034): 7.05%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The global SGLT2 inhibitors market comprises a class of oral antidiabetic drugs, including canagliflozin, dapagliflozin, empagliflozin, ertugliflozin, ipragliflozin, sotagliflozin, and other emerging molecules. These therapies are widely prescribed for managing type 2 diabetes, cardiovascular conditions, chronic kidney disease, weight management, and related disorders. SGLT2 inhibitors are distributed through hospital pharmacies, retail and drug stores, as well as rapidly expanding online pharmacy channels.

Latest Market Trends

Expansion of Indications Beyond Diabetes

A key trend in the global SGLT2 inhibitors market is the rapid expansion of therapeutic indications beyond traditional type 2 diabetes management into cardiovascular and chronic kidney disease treatment. Leading clinical guidelines, including those from ADA, ESC, and EASD, increasingly recommend SGLT2 inhibitors for heart failure and renal protection, driving broader adoption by cardiologists and nephrologists and reinforcing their position as a foundational therapy across multiple specialties.

Growing Development of Fixed-Dose Combination Therapies

The rising development and adoption of fixed-dose combination therapies to improve treatment adherence and outcomes is a major market trend. Pharmaceutical companies are combining SGLT2 inhibitors with DPP-4 inhibitors or metformin to simplify dosing. For instance, Boehringer Ingelheim’s 2024 annual report emphasized continued demand growth for Jardiance-based combination products, driven by physician preference for a single-pill regimen that enhances patient compliance and long-term disease management.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 13.43 Billion |

| Estimated 2026 Value | USD 14.33 Billion |

| Projected 2034 Value | USD 24.71 Billion |

| CAGR (2026-2034) | 7.05% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Arena Pharmaceuticals, Astellas Pharma, AstraZeneca, Boehringer Ingelheim, Chong Kun Dang |

to learn more about this report Download Free Sample Report

Market Drivers

Global Burden of Diabetes and Cardio-renal Disorders

The rising global prevalence of diabetes is a substantial driver of the SGLT2 inhibitors market, as the expanding patient population increases demand for effective glucose-lowering therapies. According to the International Diabetes Federation’s 2025 Diabetes Atlas, nearly 589 million adults aged 20–79 are living with diabetes worldwide, about one in nine adults, and this figure is projected to reach 853 million by 2050, underscoring a rapidly growing treatment requirement.

This escalating diabetes burden, highlighted by the IDF, strongly reinforces long-term demand for SGLT2 inhibitors.

Market Restraints

Safety Concerns and Adverse Event Risks Associated With The Drugs

A major restraint in the global SGLT2 inhibitors market is the growing concern over drug-related adverse events, including urinary tract and genital infections, volume depletion, and rare cases of diabetic ketoacidosis. These safety risks have been highlighted in post-marketing surveillance and company disclosures, prompting cautious prescribing among physicians. As noted in recent pharmaceutical annual reports, such concerns can negatively impact patient adherence and limit broader adoption, thereby restraining overall market growth despite strong clinical benefits.

Market Opportunity

Expansion of Clinical Trials and New Drug Development

A key opportunity in the SGLT2 inhibitors market is the robust clinical trial pipeline and development of next‑generation molecules, which drive long‑term growth and broaden therapeutic applications. According to pipeline insights from industry reports, there are 21 SGLT2 inhibitor molecules currently in clinical development across Phase 1, Phase 2, and Phase 3 stages as of early 2025, reflecting active R&D investment and innovation in this class of therapies.

|

Company |

Product |

Clinical Phase |

|

Tofogliflozin |

Chugai Pharmaceuticals |

Phase 3 |

|

LX 4211 |

Lexicon Pharmaceuticals |

Phase 2 |

|

Ertugliflozin |

Pfizer Inc. / Merck & Co., Inc. |

Phase 2 |

|

Remogliflozin etabonate |

BHV Pharma / Kissei Pharmaceutical Co. |

Phase 2 |

This expanding clinical pipeline highlights a strong industry commitment to advancing SGLT2 inhibitors beyond current indications, optimizing efficacy and safety, and exploring novel combinations and formulations.

Regional Analysis

North America dominated the SGLT2 inhibitors market in 2025, accounting for 41.02% market share. This growth is driven by the expansion of Medicare Part D and major commercial insurer reimbursement for SGLT2 therapies across endocrinology, cardiology, and nephrology uses, reducing out‑of‑pocket costs and encouraging broader multispecialty prescribing in the U.S. This payer support, uncommon in many regions, strengthens long‑term therapy uptake and market dominance.

In Canada, the market growth is supported by the progression toward universal pharmacare initiatives, including Bill C‑64, which aims to provide national, single‑payer coverage for diabetes medications such as SGLT2 inhibitors, reducing patient cost burdens and expanding access across provinces. This policy momentum uniquely positions Canada to accelerate the uptake and penetration of advanced therapies nationwide.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 8.69% from 2026-2034. The growth is driven by the accelerated launch and scaling of domestically manufactured generic SGLT2 inhibitors in China and India, which notably lowers prices and expands treatment access compared to prior years. This rise in local production has boosted affordability, widened patient reach, and strengthened regional market adoption beyond multinational brand dominance.

The Australian SGLT2 inhibitors market is expanding due to the recent Pharmaceutical Benefits Scheme (PBS) policy change allowing subsidised SGLT2 inhibitor prescriptions for type 2 diabetes patients with established cardiovascular disease, high CV risk, or identifying as Aboriginal or Torres Strait Islander, enabling earlier, broader access and tailored treatment support across high‑risk regional populations.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

In Europe, the SGLT2 inhibitors market growth is accelerated by the EU-funded SGLT2‑HYPE clinical program, testing dapagliflozin for hypertension reduction in older adults across 13 European countries. This pioneering project aims to establish SGLT2 inhibitors as a potential new standard for blood pressure management, potentially creating a novel regional indication beyond diabetes and heart failure.

In Germany, the market is experiencing growth due to the integration of these therapies into structured regional diabetes care networks that coordinate endocrinologists, primary care physicians, and disease management programs, improving early initiation and continuity of SGLT2 treatment in routine practice. Such organized care models enhance patient follow‑up, adherence, and therapy optimization across diverse clinical settings.

Latin America Market Insights

In Latin America, the SGLT2 inhibitors market growth is propelled by Brazil’s Unified Health System evaluation and gradual inclusion of SGLT2 inhibitors in national diabetes treatment protocols, enhancing public sector access and prescription uptake in the region’s largest pharmaceutical market. This policy move strengthens affordability and broadens reach across diverse patient populations.

In Argentina, the market growth is supported by the introduction of domestically marketed SGLT2 therapy by national pharmaceutical company Gador, offering combined glucose control and cardio‑renal benefit, which enhances local clinician confidence and broadens patient demand beyond imported brands. This Argentina‑centric product launch is strengthening regional market adoption.

Middle East and Africa Market Insights

In the Middle East, the market is expanding due to the emergence of region-specific real‑world evidence from long‑term telehealth and clinical follow-up studies in the UAE, showing sustained glycemic control and reduced cardiovascular risk in local T2DM patients. These localized outcome data improve clinician confidence and support therapeutic adoption tailored to Middle Eastern populations.

In South Africa, the expanding coverage of private medical schemes now includes newer antidiabetic classes such as SGLT2 inhibitors in their Prescribed Minimum Benefits (PMBs). This broader insurer support improves access among insured populations, particularly in urban provinces, enabling greater uptake of advanced therapies in a market traditionally dominated by older oral drugs.

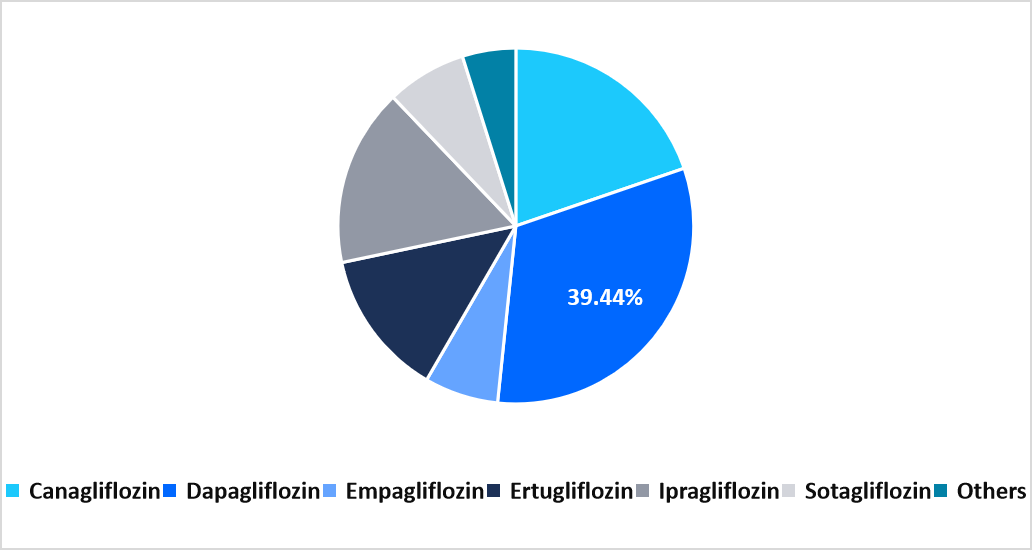

Drug Insights

The Dapagliflozin segment dominated the market in 2025, accounting for 39.44% revenue share in 2025. This growth is driven by a surge in post‑patent strategic market penetration and pricing expansion in China and other emerging markets, where record sales and inclusion in national insurance schemes have notably broadened access and volume despite generic competition. This approach has bolstered regional revenue and sustained global market share growth for Dapagliflozin.

The Ertugliflozin segment is projected to witness the fastest CAGR of 7.85% during the forecast timeframe. This growth is augmented due to its superior glycemic control when used as add‑on therapy to metformin, where clinical meta‑analyses have shown greater HbA1c reduction compared with equivalent doses of certain other SGLT2 inhibitors, strengthening physician preference and prescription uptake.

By Drug Market Share (%), 2025

Source: Straits Research

Indication Insights

The type 2 diabetes segment dominated the market in 2025, with a revenue share of 69.53% in 2025, owing to the inclusion of SGLT2 inhibitors as preferred first-line therapy alongside metformin in updated ADA treatment algorithms, prompting earlier initiation in newly diagnosed patients and expanding long-term prescription volumes.

The cardiovascular segment is expected to register the fastest CAGR growth of 7.91% during the forecast period. This growth is supported by the efficacy of SGLT2 inhibitors in reducing hospitalizations for heart failure regardless of patients’ diabetes status, including heart failure with preserved ejection fraction.

Distribution Channel Insights

The hospital pharmacies segment dominated the market in 2025, accounting for a 51.06% market share 2025. This growth is driven by increasing integration of electronic prescribing systems that enable seamless initiation, monitoring, and discharge planning for SGLT2 inhibitor therapies in complex cardiometabolic patients.

The online pharmacies segment is estimated to grow at a CAGR of 8.14% during the forecast period. This growth is stimulated by the integration of telemedicine platforms with direct-to-patient SGLT2 inhibitor delivery, enabling physicians to prescribe and monitor therapy virtually, which expands access for remote or mobility-limited patients and accelerates adoption in emerging markets.

Competitive Landscape

The global SGLT2 inhibitors market is moderately consolidated, with leading pharmaceutical companies holding major revenue shares. Key players, including AstraZeneca, Boehringer Ingelheim, Eli Lilly, Pfizer, Novartis, and others, are actively pursuing product innovation, expanded indications, and strategic partnerships to strengthen market presence. Continuous R&D, combination therapy development, and regional expansion initiatives are intensifying competition, enabling these companies to maintain a competitive edge while addressing growing demand for diabetes, cardiovascular, and renal therapeutic solutions worldwide.

Youngene Therapeutics: An Emerging Market Player

Youngene Therapeutics is an emerging biopharmaceutical company advancing YG1699, a novel dual SGLT1/SGLT2 inhibitor currently in clinical development that targets both renal glucose reabsorption and intestinal glucose absorption, potentially offering superior glycemic control and renal protection compared to traditional SGLT2‑selective drugs. This innovative mechanism aims to address unmet requirements in diabetes and cardio-renal care, enhancing therapeutic differentiation and future market competitiveness

List of Key and Emerging Players in SGLT2 Inhibitors Market

- Arena Pharmaceuticals

- Astellas Pharma

- AstraZeneca

- Boehringer Ingelheim

- Chong Kun Dang

- Cipla Ltd.

- Dr Reddy's Laboratories

- Eli Lilly and Company

- Glenmark Pharma

- Janssen Pharmaceuticals

- Lupin Ltd.

- Merck & Co. Inc.

- Otsuka Pharmaceutical

- Sumitomo Pharma

- Sun Pharmaceutical Ltd.

- Taisho Pharma

- Torrent Pharma

- Zydus Lifesciences

- Others

Strategic Initiatives

- September 2025: AstraZeneca launched the online platform designed to create a convenient way for eligible patients to access prescriptions for FARXIGA (dapaglifozin) and AIRSUPRA.

- June 2024: The U.S. FDA approved AstraZeneca’s dapagliflozin for treating type-2 diabetes in patients aged 10 years and older.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 13.43 Billion |

| Market Size in 2026 | USD 14.33 Billion |

| Market Size in 2034 | USD 24.71 Billion |

| CAGR | 7.05% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Drug, By Indication, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

SGLT2 Inhibitors Market Segments

By Drug

- Canagliflozin

- Dapagliflozin

- Empagliflozin

- Ertugliflozin

- Ipragliflozin

- Sotagliflozin

- Others

By Indication

- Type 2 Diabetes

- Cardiovascular

- Chronic Kidney Disease

- Weight Management

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.