Sheet Metal Fabrication Services Market Size, Share & Trends Analysis Report By Application (Automotive Component Manufacturing, Aerospace Parts Production, Construction and Infrastructure, Electronics and Enclosures, Renewable Energy Systems, Others (e.g., Medical Equipment)), By Material (Steel, Aluminum, Stainless Steel, Copper, Others (e.g., Titanium, Brass)), By Service Type (Cutting Services (Laser, Plasma, Waterjet), Forming and Bending, Welding and Assembly, Finishing (Coating, Polishing), Others (e.g., Prototyping, Additive Manufacturing)) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Sheet Metal Fabrication Services Market Overview

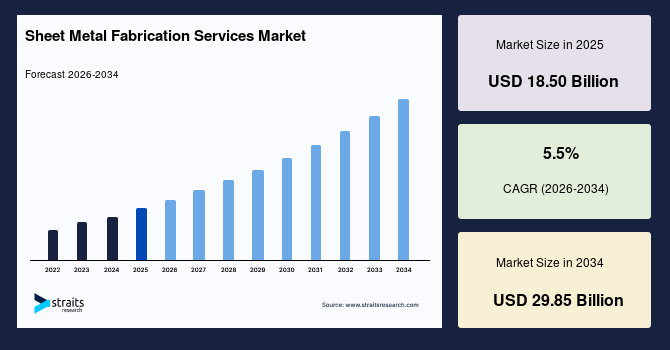

The global sheet metal fabrication services market size was projected at USD 18.50 billion in 2025 and is anticipated to grow from USD 19.43 billion in 2026 to USD 29.85 billion by 2034, growing at a CAGR of 5.5% over the forecast period (2026-2034). The market is expanding due to reshoring trends, diversified supply chains, and increasing demand from automotive, aerospace, construction, and renewable energy industries.

Key Market Indicators

- Asia Pacific held a dominant share of the global market with a market share of 45% in 2025.

- The North America region is growing at the fastest pace, with a CAGR of 6.2%.

- Based on service type, the cutting services segment dominates in 2025.

- Based on end-use industry, the automotive sector led the market share in 2025.

- The U.S. dominates the sheet metal fabrication services market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 18.50 billion

- 2034 Projected Market Size: USD 29.85 billion

- CAGR (2026-2034): 5.5%

- Dominating Region: Asia Pacific

- Fastest-Growing Region: North America

The sheet metal fabrication services market is driven by the surge in automotive production, requiring precision-fabricated parts for lightweight designs, and the growth of the aerospace sector, which needs high-strength alloys for fuel efficiency. The adoption of automation and CNC machining for enhanced precision, reducing waste, and the shift toward sustainable materials like recycled aluminium. These factors drive market growth amid stricter environmental regulations, Industry 4.0 adoption, and rising investments in smart factories, enabling cost-effective, high-quality production for diverse applications in electronics, energy, and industrial machinery.

Market Trends

Integration of Software-Controlled Fabrication Cells

Manufacturers are increasingly adopting software-controlled fabrication cells, which combine automated laser cutting, robotic handling, and press-brake systems. These integrated systems streamline job scheduling, material tracking, and process monitoring, leading to shorter cycle times and reduced material waste. For mid-sized contract fabricators, automation makes it possible to deliver faster and more complex orders, including specialised parts for medical and aerospace applications.

- For example, in May 2025, TRUMPF launched a Smart Factory in Farmington that uses high-tech fabricating equipment to produce sheet metal parts for its U.S. manufactured machinery.

Such technologies are most widely adopted in North America, Western Europe, and advanced manufacturing hubs in Asia, where labour costs are higher and customers demand strict tolerances.

On-Demand and Digital Manufacturing

The adoption of end-to-end digital workflows is enabling fabricators to deliver small-batch and custom parts profitably. These systems integrate design files directly into automated cutting, bending, and finishing processes, reducing lead times and scrap. Bystronic’s deployment at TMF Metal Solutions demonstrated that software-driven automation can significantly improve turnaround times. The demand for traceable, rapid production is especially strong in medical devices, semiconductors, and defence, where suppliers can secure long-term, premium contracts.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 18.50 Billion |

| Estimated 2026 Value | USD 19.43 Billion |

| Projected 2034 Value | USD 29.85 Billion |

| CAGR (2026-2034) | 5.5% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Ryerson Holding, O’Neal Manufacturing, Mayville Engineering, Komaspec, LancerFab Tech |

to learn more about this report Download Free Sample Report

Market Drivers

Reshoring and Supply Chain Diversification

Ongoing supply chain disruptions and geopolitical uncertainty are encouraging firms to bring production closer to end markets. Reshoring initiatives in the United States and Europe have increased local investment in fabrication capacity. Governments are also providing financial incentives.

- For instance, in May 2025, Connecticut awarded TRUMPF USD 2.5 million under its Strategic Supply Chain Initiative to strengthen domestic production.

These developments benefit contract fabricators, particularly in industries where certified local supply is essential, such as defence, energy, and infrastructure. By reducing dependency on global imports, reshoring also improves supply resilience for critical sectors.

Demand from Automotive, Aerospace, Construction, and Renewable Energy

Sheet metal is a core material in vehicles, aircraft, and building structures. The automotive sector requires lightweight components to improve fuel efficiency. Electric vehicles (EVs) in particular depend on precision-fabricated battery enclosures and brackets. Aerospace demand remains steady, with an increase in aircraft production in 2024 requiring high-tolerance alloys. Urbanisation and infrastructure development sustain construction demand, while renewable energy projects depend on fabricated structures for solar panels and wind turbines.

Market Restraint

Raw-Material Price Volatility and Tariff Risks

Steel and aluminium prices fluctuate significantly, affecting profitability and long-term planning for fabricators because metal is a large proportion of job cost and buyers demand price certainty. In 2024-2025, hot-rolled coil prices spiked due to tariff changes and supply disruptions, creating uncertainty for suppliers and customers alike. For smaller firms, volatility reduces investment capacity, while larger firms respond by consolidating supply chains, hedging costs, or integrating directly with local steel suppliers. Trade policies and tariff disputes further add to long-term unpredictability, limiting stable growth.

Market Opportunity

Material and Sustainability Shifts

The demand for lighter and more sustainable materials is rising, particularly in electric vehicles, renewable energy systems, and aerospace. Manufacturers are using high-strength steels, aluminium, and fossil-free steels to meet these needs. Manufacturers and material suppliers are collaborating to support this change.

- For example, in July 2025, Bystronic partnered with SSAB to optimise sheet metal fabrication processes for recycled and fossil-free steels.

These materials require new tooling and process adaptations, but also allow fabricators to compete for premium projects such as green buildings and low-carbon infrastructure. Local sourcing of recycled inputs is becoming a competitive advantage, as customers increasingly require proof of material sustainability and emissions reductions.

Regional Analysis

Asia Pacific leads the sheet metal fabrication services market, which is supported by rapid industrialisation, strong automotive output, and major infrastructure projects. China and India are central to this growth, with demand driven by EV production, urban housing, and renewable energy expansion. China’s EV sector, producing 12.4 million units in 2024 according to IEA, requires large volumes of precision-fabricated components. The region also benefits from competitive labour costs and expanding smart manufacturing initiatives. Governments in Japan, Korea, and Southeast Asia are encouraging automation adoption, making the Asia Pacific a hub for both high-volume production and advanced fabrication technologies.

China plays a central role in the global market, driven by its dominance in the automotive, construction, and renewable energy sectors. China’s Belt and Road Initiative continues to create demand for large-scale fabricated metal structures in rail and infrastructure projects. Government incentives for smart manufacturing push the adoption of automation and AI-driven systems, improving efficiency and reducing waste. Partnerships between local firms and international players, such as Komaspec’s role in EV component supply, highlight China’s importance as both a production hub and innovation leader.

India is one of the fastest-growing markets due to its large-scale infrastructure spending and strong manufacturing base. The government’s 2025 budget allocated INR 11.21 lakh crore for infrastructure, supporting demand for fabricated steel in railways, smart cities, and renewable energy. The automotive sector, particularly EVs, requires lightweight fabricated enclosures and body panels, driving orders for precision fabrication. SMEs dominate the market, but increasing automation adoption is improving output quality. Rising construction activity and modular building adoption also fuel growth.

North America Market Trends

North America is the fastest-growing region due to reshoring trends, digital manufacturing adoption, and strong demand from aerospace, defence, and EV sectors. The U.S. leads this growth, driven by large-scale incentives such as the CHIPS Act and the Inflation Reduction Act, which prioritise domestic production. Fabricators benefit from government-supported infrastructure projects and strict quality standards in industries like aerospace. The U.S. automotive sector is a major demand driver, with EV battery enclosures and lightweight structures fueling orders. High labour costs push the adoption of automation, with CNC and robotic systems increasingly used to meet customer demands for speed, precision, and traceability.

The U.S. dominates the global market, driven by high-value sectors such as aerospace, defence, automotive, and renewable energy. Federal incentives like the Inflation Reduction Act (2022) and CHIPS Act (2022) support local manufacturing, encouraging investment in advanced fabrication. Reshoring trends also strengthen domestic demand, with fabricators benefiting from localised supply chains and defence contracts that require certified U.S. production. Automation adoption is accelerating, as firms integrate CNC machining, robotic welding, and AI-driven platforms to reduce lead times and labour dependency. This makes the U.S. the clear leader within North America.

Canada’s sheet metal fabrication services market grows steadily, supported by infrastructure investments and clean energy projects. The government’s 2025 budget emphasised renewable energy expansion, boosting demand for fabricated components in wind and solar installations. Canadian aerospace also plays a vital role, with Bombardier and Pratt & Whitney Canada requiring precision components. The country’s construction sector, particularly in green building projects, increasingly uses fabricated steel and aluminium structures aligned with sustainability goals. Canada thus positions itself as a key market for sustainable, high-quality sheet metal fabrication.

Germany Market Trends

Germany is a leader in Europe’s sheet metal fabrication services industry, supported by its automotive, machinery, and renewable energy sectors. The country’s emphasis on Industry 4.0 drives automation, with companies integrating smart factories and IoT-enabled fabrication systems. Germany produced 4.2 million vehicles in 2024, requiring precision parts made through advanced fabrication methods. Germany’s sustainability goals, aligned with the EU’s Green Deal, encourage the use of recycled and fossil-free steels in sheet metal applications. Skilled labour shortages remain a challenge, but vocational training programs help maintain Germany’s leadership in high-value, precision fabrication.

Service Type Insights

Cutting services hold the largest share of the market because they offer precision and flexibility across applications. Techniques such as laser cutting, plasma cutting, and waterjet cutting are widely used in automotive, aerospace, and construction projects. The demand is supported by the growing adoption of computer-controlled cutting systems, which help reduce material waste and improve accuracy. As industries move toward more complex designs and shorter production cycles, cutting services remain essential for large-scale and high-precision fabrication.

Material Insights

Steel is the most widely used material in sheet metal fabrication due to its durability, affordability, and adaptability. It is heavily applied in construction, automotive, and heavy machinery sectors. The demand for steel fabrication is also reinforced by its recyclability, making it compatible with sustainability targets in both developed and emerging markets. Although lightweight materials such as aluminium are gaining attention, steel continues to dominate because of its balance between performance and cost.

End-Use Industry Insights

The automotive industry is the leading end-use segment for sheet metal fabrication services. The demand is increasing as automakers shift toward lightweight and durable components to improve efficiency and meet environmental standards. Electric vehicle production, in particular, is creating new opportunities for fabricators, as battery enclosures, frames, and heat management systems require high-precision fabrication. Other industries such as aerospace, construction, and renewable energy also provide steady demand, but the automotive sector continues to drive the largest share of global growth.

Competitive Landscape

The sheet metal fabrication services market is moderately fragmented, with key players leveraging automation, AI, and sustainable practices to maintain dominance. Companies invest heavily in R&D to enhance precision and efficiency. Strategic partnerships with OEMs and geographic expansions drive growth.

TRUMPF is a leading global supplier of machine tools and lasers for sheet metal fabrication. TRUMPF operates on an equipment-led and solutions model. It sells fibre-laser cutters, automation cells and a software stack, while offering installation, training and local service, generating recurring spares and service revenue.

Latest News

- In May 2025, TRUMPF opened a new Smart Factory in Farmington, Connecticut, to locally produce machine parts and showcase integrated fabrication workflows an explicit investment in North American, near-market capacity and proof-of-concept for automated sheet-metal production.

List of Key and Emerging Players in Sheet Metal Fabrication Services Market

- Ryerson Holding

- O’Neal Manufacturing

- Mayville Engineering

- Komaspec

- LancerFab Tech

- BTD Manufacturing

- Kapco Metal Stamping

- Standard Iron & Wire Works

- Noble Industries

- Metcam

- Classic Sheet Metal

- Marlin Steel Wire

- Ironform

- Summit Steel

Recent Developments

- In July 2025, MEC completed the acquisition of Accu-Fab, LLC. This move is part of MEC's strategic diversification efforts to expand into high-growth markets like data centres and critical power infrastructure, which rely heavily on fabricated sheet metal components.

- In May 2025, AMADA launched its new ORSUS-3015AJe fibre laser cutting machine and SRB-1003 press brake for overseas markets. These new products, along with automation modules, are designed to help contract fabricators achieve higher throughput and shorter setups.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 18.50 Billion |

| Market Size in 2026 | USD 19.43 Billion |

| Market Size in 2034 | USD 29.85 Billion |

| CAGR | 5.5% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Application, By Material, By Service Type |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Sheet Metal Fabrication Services Market Segments

By Application

- Automotive Component Manufacturing

- Aerospace Parts Production

- Construction and Infrastructure

- Electronics and Enclosures

- Renewable Energy Systems

- Others (e.g., Medical Equipment)

By Material

- Steel

- Aluminum

- Stainless Steel

- Copper

- Others (e.g., Titanium, Brass)

By Service Type

- Cutting Services (Laser, Plasma, Waterjet)

- Forming and Bending

- Welding and Assembly

- Finishing (Coating, Polishing)

- Others (e.g., Prototyping, Additive Manufacturing)

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.