Skin Care Supplement Market Size, Share & Trends Analysis Report By Product Type (Oral Supplements, Topical Supplements), By Content Type (Organic, Chemical), By Formulation (Tablets & Capsules, Powder, Liquid, Others), By Application (Skin Aging, Skin Hydration, Acne & Blemishes, Skin Brightening, Others), By Distribution Channel (Online, Offline) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Skin Care Supplement Market Size

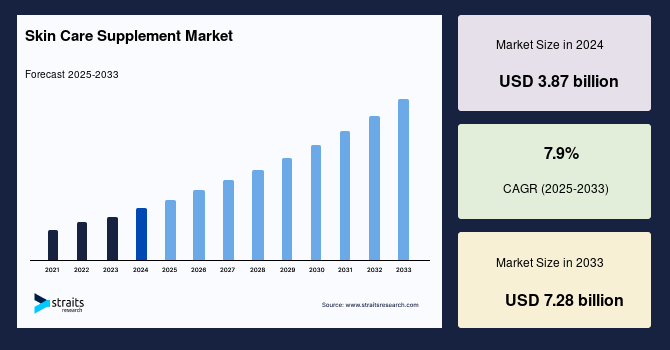

The global skin care supplement market size was valued at USD 3.87 billion in 2024 and is expected to grow from USD 4.18 billion in 2025 to reach USD 7.28 billion in 2033, exhibiting a CAGR of 7.9% during the forecast period (2025-2033).

The global skin care supplement market includes developing and selling ingestible products, such as capsules, powders, gummies, and drinks, formulated to enhance skin health from within. These supplements often contain ingredients like collagen, vitamins (A, C, and E), hyaluronic acid, biotin, and antioxidants to improve skin hydration, elasticity, and brightness and reduce signs of aging. The market caters to preventive and therapeutic skincare needs, driven by increasing consumer awareness of holistic wellness, aging populations, and the rising popularity of beauty-from-within concepts. Innovations in nutraceutical formulations and personalized nutrition further fuel demand.

The global skin care supplement market is driven by E-commerce, influencer marketing, and dermatological and aesthetic expertise integration. Increased consumer awareness about the necessity to keep their skin healthy from within is responsible for growing market for supplements skin care. Consumers are increasingly demanding supplements that help support glowing and healthy-looking skin, consistent with holistic practices in skincare and general well-being. This rising interest in "beauty from within" is a movement towards more natural, holistic ways of taking care of the skin and gaining treatment for wrinkles, fine lines, and acne in a manner that also supports customer goals of healthier-looking skin.

Skin Care Supplement Market Trends

Increased Consumer Focus on Natural and Clean Ingredients

The growing consumer preference for natural, clean-label ingredients is a significant trend shaping the global skin care supplement market. As awareness of health and wellness rises, consumers are scrutinizing product labels, seeking transparency, and avoiding synthetic additives, parabens, sulfates, and artificial preservatives. This trend is also aligned with rising environmental concerns, pushing consumers to support sustainable brands that align with their values. Companies respond by emphasizing ingredient purity, eco-friendly packaging, and ethical sourcing. This shift is influencing product formulation and transforming marketing strategies, with brands highlighting their sustainability credentials and ingredient sourcing practices.

- For example, in August 2025, Unilever acquired Wild Cosmetics, a brand renowned for its refillable deodorants and body care products aimed at reducing single-use plastics. This acquisition aligns with Unilever's shift towards premium, sustainable brands.

As this trend deepens, the demand for supplements that are as gentle on the planet as they are on the skin continues to rise, prompting innovation in green chemistry and botanical extract formulations that enhance performance and sustainability.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 3.87 Billion |

| Estimated 2025 Value | USD 4.18 Billion |

| Projected 2033 Value | USD 7.28 Billion |

| CAGR (2025-2033) | 7.9% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Amway, Hum Nutrition, Inc., Nestle, Meiji Holdings Co., Ltd., Plix The Plant Fix |

to learn more about this report Download Free Sample Report

Skin Care Supplement Market Growth Factors

Growing Awareness about the Benefits of Skin Care Supplements for Anti-Aging and Skin Health

Growing awareness of the holistic nature of skin care is one of the primary factors driving the demand for skin care supplements. Consumers increasingly recognize that achieving radiant, youthful skin requires more than just the external application of creams and serums. The concept of "beauty from within" has gained credibility through scientific research linking nutrients like collagen peptides, antioxidants, hyaluronic acid, and vitamins A, C, and E to enhanced skin elasticity, hydration, and reduced signs of aging. Educational campaigns by dermatologists, influencers, and wellness experts have further fueled this awareness, making skincare supplements essential to daily beauty routines.

- For example, in February 2024, Nestlé Health Science introduced Resource Activ, a high-protein supplement enriched with calcium, vitamin D, and hyaluronate, targeting active millennials to support muscle, bone, and skin health.

- Additionally, in March 2024, Nestlé's Garden of Life brand launched Sport Whey+ Younger, Healthier Looking Skin, a protein powder designed to aid workout recovery and enhance skin radiance.

As lifestyle-related skin issues such as premature aging and dryness become more common due to pollution and stress, the demand for preventive and restorative skin care solutions is poised to rise further.

Market Restraining Factors

Lack of Standardization and Regulation

Despite the growing popularity of skin care supplements, one of the significant barriers to market expansion is the lack of regulatory standardization. Unlike pharmaceutical products, dietary and skin care supplements are often under less stringent oversight in many countries, allowing considerable variation in product quality, ingredient sourcing, safety, and efficacy. This regulatory gap can result in misleading product claims, underdosed active ingredients, and even the presence of potentially harmful substances.

Furthermore, consumers may face difficulty discerning reputable brands from those with questionable practices, leading to skepticism and hesitance in product adoption. Inconsistent labeling, vague terminology (e.g., “natural” or “clinically tested”), and limited third-party testing further erode consumer trust. Additionally, the absence of a unified global regulatory framework creates challenges for brands looking to expand internationally, as compliance standards differ across regions. These hurdles can restrict innovation, delay product launches, and increase operational costs.

Market Opportunity

Expanding Consumer Base in Emerging Markets

Emerging markets represent a major growth opportunity for the global skincare supplement industry, driven by rising disposable incomes, urbanization, and increasing awareness of personal wellness. Countries in Asia-Pacific, Latin America, and the Middle East are experiencing a surge in middle-class populations with higher purchasing power and greater exposure to global beauty trends. As these consumers prioritize self-care and appearance, there’s growing interest in functional beauty products, including ingestible skincare supplements. Social media, beauty influencers, and expanding e-commerce platforms are accelerating product discovery and awareness in these regions.

- For instance, in July 2024, SkinInspired, an Indian skincare startup, secured $1.5 million in seed funding led by Unilever Ventures, aiming to cater to the growing demand in India's $3 billion skincare market.

Local and international brands increasingly tailor offerings to regional preferences, introducing skin tone-specific, climate-appropriate, and culturally resonant formulations. With continued digital penetration and health education, these regions are expected to be high-growth hotspots in the coming years, presenting immense opportunities for brands to expand their global footprint.

Regional Insights

North America: Dominant Region with 44% Market Share

North America dominates the global skin care supplement market, holding the largest share due to high consumer awareness, strong purchasing power, and the presence of leading wellness and beauty brands. The U.S. is a major contributor, driven by a growing emphasis on preventative skincare and "beauty from within" trends. Consumers increasingly prefer supplements that support anti-aging, hydration, and acne treatment. The region also benefits from technological advancements, such as personalized nutrition and DNA-based beauty solutions. Expanding e-commerce, especially through platforms like Amazon and brand-direct websites, further strengthens accessibility and market growth while clean-label and organic trends continue to gain momentum.

Asia-Pacific: Fastest-Growing Region

Asia-Pacific is experiencing rapid growth, nearly matching North America in market share. The region benefits from a rich herbal and holistic skincare tradition, with a growing demand for supplements rooted in Ayurveda, Traditional Chinese Medicine (TCM), and K-beauty principles. Consumers across China, Japan, South Korea, and India are embracing skin care supplements for brightening, hydration, and anti-aging. Rising disposable incomes, urbanization, and increasing interest in self-care among younger demographics fuel expansion. E-commerce giants like Alibaba and Rakuten facilitate easy access to domestic and international brands. Moreover, government initiatives promoting wellness and rising health awareness further solidify the region’s long-term growth potential.

Countries Insights

- The U.S.: The U.S. skin care supplement market is expanding rapidly due to an increasing focus on wellness and inner beauty. With companies like Hum Nutrition, Amway, and Neutrogena, innovation remains a strong growth factor. The rising demand for personalized supplements and beauty-from-within products is also notable.

- Japan: Japan blends traditional herbal practices with advanced skincare science. Products infused with collagen peptides, matcha extract, and rice ceramides appeal to consumers who value long-term skin health. The country also leads in minimalistic skincare routines and holistic wellness.

- China: China’s market is highly competitive, with both international and domestic brands vying for dominance. Increased interest in anti-aging and brightening supplements among young professionals is a major driver. E-commerce channels like Tmall and JD.com are key to distribution.

- Europe: Europe sees strong growth due to sustainability-driven innovation, growing vegan and organic preferences, and tech-enhanced skincare. Collaboration, like that between Nourished and Neutrogena for 3D-printed vitamins, exemplifies the shift toward personalized wellness.

- Germany: German consumers prefer clean-label and plant-based supplements. Aloe vera, biotin, and green tea extracts are widely used. The market is influenced by strict safety regulations and a well-educated consumer base seeking healthy and ethical consumption.

- Brazil: Brazil’s tropical climate drives UV-protective and hydrating supplements demand. Anti-aging ingredients like collagen and vitamin E are highly popular. The Brazilian market is also influenced by its vibrant beauty culture and increasing health-consciousness.

- France: France has a long-standing association with skincare and dermocosmetics. Ingredients like grape seed extract, marine collagen, and coenzyme Q10 are widely accepted for their antioxidant and anti-aging properties. French consumers also value eco-friendly packaging and clean ingredients.

Segmentation Analysis

By Product Type

The oral Supplements segment holds the largest market share. Oral supplements, such as capsules, pills, and powders, are consumed to target skin issues from within, addressing underlying factors like collagen depletion, oxidative stress, and nutrient deficiencies. They offer comprehensive benefits such as hydration, elasticity, and anti-aging effects. This segment is favored for convenience and holistic results. Topical alternatives, including serums, masks, and creams, are commonly used to target specific issues like pigmentation or acne. Many consumers adopt a dual approach, combining topical and oral methods for synergistic skincare.

By Content Type

The organic segment holds the largest market share. Organic supplements are gaining more traction due to their safety, sustainability, and natural appeal. Organic skincare supplements, including aloe vera, green tea extract, turmeric, and chamomile, are free from synthetic additives, parabens, and artificial fragrances. They are well-regarded for their antioxidant, anti-inflammatory, and skin-repairing properties. Increasing consumer awareness about clean beauty, cruelty-free practices, and minimal skin irritation has fueled demand for organic options.

By Formulation

Tablets and capsules are the dominant formulations, preferred for their precision in dosage, portability, and extended shelf life. They often contain vitamins, collagen, ceramides, and antioxidants to combat aging, acne, and dehydration. Powders offer customization and easy blending into drinks, while liquid formulations enable quicker absorption and are ideal for those with swallowing difficulties. Consumers are increasingly drawn to innovative formats like gummies and effervescent tablets, which combine effectiveness with user experience, contributing to the diversity and appeal of the segment.

By Application

The skin aging segment dominates due to rising concerns about wrinkles, fine lines, and sagging skin, especially among the aging population. These supplements use key ingredients like collagen, hyaluronic acid, coenzyme Q10, and resveratrol to improve elasticity, stimulate regeneration, and reduce oxidative stress. Hydration supplements focus on restoring moisture, using compounds like ceramides and essential fatty acids. Brightening and anti-acne supplements target uneven skin tone and inflammation using zinc, probiotics, glutathione, and vitamin C, often appealing to younger demographics and beauty-conscious consumers.

By Distribution Channel

Online distribution channels hold the largest share. Online channels have transformed the distribution landscape for skin care supplements, with platforms like Amazon, iHerb, and brand-specific websites offering consumers easy access to global product ranges, subscription options, and promotional discounts. These platforms enhance consumer engagement with detailed descriptions, reviews, and influencer recommendations, driving preference among younger and tech-savvy audiences. Social commerce and D2C models have further strengthened brand loyalty.

Company Market Share

The market for skin care supplements worldwide is highly competitive, with major firms such as Amway, Nestlé, and Unilever. These companies hold substantial market shares because of their diversified product lines and famous brands. The Nutrilite line of Amway, focusing on scientifically backed vitamins for healthy skin, strengthens its position. While Unilever, having acquired Murad, is the one to focus on clinically proven, dermatologist-tested supplements, Nestlé Health Science leads with collagen-based products targeting globally distributed consumers. Perricone MD and Neutrogena from Johnson & Johnson are holding onto big shares of the market with good beauty and healthcare product portfolios. More and more products from companies like Plix the Plant Fix and Hum Nutrition, which are eco-friendly and vegan-friendly, are gaining popularity.

List of Key and Emerging Players in Skin Care Supplement Market

- Amway

- Hum Nutrition, Inc.

- Nestle

- Meiji Holdings Co., Ltd.

- Plix The Plant Fix

- Unilever (Murad LLC)

- Johnson & Johnson Services, Inc. (Neutrogena)

- Perricone MD

- TCH, Inc (Researveage)

- Vitabiotics Ltd.

to learn more about this report Download Market Share

Recent Developments

- March 2025- Australian firm Vincent has entered the US market with a range of skincare and dietary supplements amid growing demand for solutions that address beauty and wellness from the inside out.

Analyst Opinion

As per our analyst, the global skin care supplement market is developing significantly, with a higher awareness of holistic beauty treatments among individuals. Analysts have identified the trend towards "beauty from within," with millennials and Gen Zers, who highly value preventive wellbeing, displaying an increased appetite for supplements like collagen, antioxidants, and vitamins. Increased issues such as acne and premature aging are also fuelling this demand. The demand for natural, clean-label products is also shaping the industry, which will help plant-based companies like Hum Nutrition and Plix the Plant Fix. Another innovation set to revolutionize the market is customized skincare in terms of supplement regimens based on DNA.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 3.87 Billion |

| Market Size in 2025 | USD 4.18 Billion |

| Market Size in 2033 | USD 7.28 Billion |

| CAGR | 7.9% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Content Type, By Formulation, By Application, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Skin Care Supplement Market Segments

By Product Type

- Oral Supplements

- Topical Supplements

By Content Type

- Organic

- Chemical

By Formulation

- Tablets & Capsules

- Powder

- Liquid

- Others

By Application

- Skin Aging

- Skin Hydration

- Acne & Blemishes

- Skin Brightening

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Mitiksha Koul

Research Associate

Mitiksha Koul is a Research Associate with 2 years of experience in market research. She focuses on analyzing industry trends, competitive landscapes, and growth opportunities to support strategic decision-making. Mitiksha’s strong analytical skills and research expertise enable her to deliver actionable insights that help businesses adapt to evolving market dynamics and achieve sustainable growth.