Australia Sleep Tech Market Size, Share & Trends Analysis Report By Product Type (Wearable Devices, Non-Wearable Devices, Sleep Aids), By Application (Sleep Monitoring and Management, Sleep Diagnostics, Therapeutic Use), By Distribution Channel (Online Retail, Offline Retail), By End-User (Residential, Commercial) and Forecasts, 2025-2033

Australia Sleep Tech Market Size

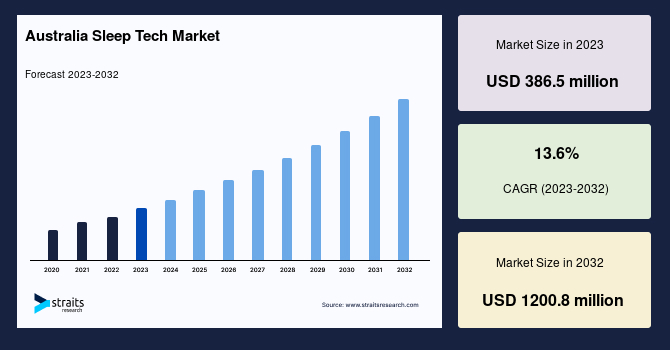

The Australia sleep tech market was valued at USD 439.06 million in 2024 and is projected to reach from USD 498.78 million in 2025 to USD 1383.35 million by 2033, growing at a CAGR of 13.6% during the forecast period (2025-2033).

This robust growth is attributed to the increasing prevalence of sleep disorders, technological advancements in sleep monitoring devices, and rising consumer awareness about the importance of sleep health.

Market Summary

| Market Metric | Details & Data (2023-2032) |

|---|---|

| 2023 Market Valuation | USD 439.06 Million |

| Estimated 2024 Value | USD 498.78 Million |

| Projected 2032 Value | USD 1383.35 Million |

| CAGR (2024-2032) | 13.6% |

| Key Market Players | Fitbit (Google), Apple Inc., Philips Healthcare, ResMed, Withings |

to learn more about this report Download Free Sample Report

Australia Sleep Tech Market Growth Factors

Increasing Prevalence of Sleep Disorders

Australia is witnessing a rise in sleep-related disorders, with recent studies revealing that approximately 15% of the adult population suffers from chronic sleep issues, including insomnia and sleep apnea. According to the Sleep Health Foundation (2024), inadequate sleep costs the Australian economy over AUD 66 billion annually due to productivity losses and healthcare expenses. This alarming trend has accelerated the adoption of sleep technologies, particularly wearable devices, and advanced monitoring systems that provide real-time data for effective intervention.

Government initiatives have also bolstered market growth. For instance, the "Better Access" program includes subsidies for cognitive behavioral therapy (CBT) for insomnia, increasing demand for complementary tech solutions. Additionally, the growing aging population further drives market expansion, as sleep disorders are more prevalent among older demographics.

Market Restraint

High Initial Costs and Limited Accessibility

While the market shows robust growth potential, the high initial costs of these products pose a significant restraint. Wearable sleep trackers and advanced CPAP (Continuous Positive Airway Pressure) machines, essential for managing sleep apnea, can cost upwards of AUD 1,000, deterring price-sensitive consumers. Additionally, the recurring expenses of software subscriptions and device maintenance exacerbate the financial burden.

Moreover, rural and remote areas, which house 30% of the Australian population, face additional challenges in accessing these technologies due to inadequate distribution networks and a lack of specialized sleep clinics, creating a disparity in market penetration. For example, devices like Oura Rings remain underutilized in remote regions due to affordability and lack of distribution channels. This challenge underscores the need for cost-effective solutions and government subsidies to enhance accessibility.

Market Opportunity

Technological Advancements in Ai and Iot Integration

The integration of artificial intelligence (AI) into sleep technology presents a transformative opportunity for the Australian market. AI-powered solutions like smart mattresses and advanced wearable devices can analyze sleep patterns, predict potential disorders, and provide tailored recommendations. The adoption of smart home technologies, such as IoT-enabled mattresses and lighting systems that adapt to circadian rhythms, further enhances the potential for market expansion. These innovations cater to a tech-savvy population eager for personalized and efficient solutions.

The Australian Digital Health Agency’s (ADHA) 2024 strategy emphasizes the adoption of AI in healthcare, encouraging investments in smart healthcare technologies.

For example, ResMed’s cloud-connected CPAP devices, integrated with AI algorithms, have shown a 25% improvement in adherence rates among sleep apnea patients. Such advancements not only enhance user experience but also improve the cost-efficiency of treatment, broadening the market’s appeal.

Regional Insights

The market is characterized by diverse growth patterns across Australia's major cities, driven by technological advancements and consumer demand.

Sydney leads the market due to its high population density and tech-savvy demographic. Companies like ResMed and Cochlear, headquartered in the city, play a pivotal role in developing and distributing advanced sleep tech solutions. The city’s healthcare infrastructure and awareness programs also dominate its market.

Melbourne is emerging as a key player in the market, focusing on innovative solutions. The city’s vibrant startup ecosystem fosters the development of smart home integrations and wearable devices. Retailers like The Good Guys and JB Hi-Fi are expanding their product portfolios to cater to growing consumer demand.

Brisbane’s market growth is driven by increasing health awareness and government initiatives. The Queensland Government’s health campaigns, such as "Healthy Queenslanders," emphasize sleep health, boosting demand for monitoring devices. The city also hosts numerous sleep clinics, providing a platform for product adoption.

In Perth, the market is characterized by the rising adoption of wearable devices among young professionals. The city’s focus on digital health solutions, supported by institutions like the Telethon Kids Institute, promotes the use of sleep tech for early diagnosis and management of sleep disorders.

Adelaide’s growth is attributed to its aging population, which demands advanced sleep monitoring solutions. Products like CPAP machines and smart mattresses are gaining traction, addressing older adults' sleep-related challenges. Local healthcare providers actively collaborate with sleep tech companies to enhance product accessibility.

Product Type Insights

Wearable devices dominate the product type segment and are expected to grow at a CAGR of 13.9% over the forecast period due to their portability and multifunctionality. Products like sleep-tracking smartwatches and fitness bands, including Apple Watch and Garmin devices, are gaining popularity. These devices provide real-time insights into sleep patterns, enabling users to make informed health decisions. The integration of features such as SpO2 monitoring and heart rate analysis further strengthens their adoption in the Australian market.

Application Insights

Sleep monitoring and management leads the application segment and is expected to grow at a CAGR of 13.8% during the forecast period. These applications are pivotal in addressing sleep disorders. These applications encompass CPAP devices, smart beds, and apps like Sleep Cycle, which analyze sleep quality and offer improvement tips. The prevalence of sleep apnea in Australia, affecting 5-10% of the population, underscores the demand for these solutions. Companies like ResMed continue to innovate, providing tailored products to meet consumer needs.

Distribution Channel Insights

Online dominates the distribution channel segment and is expected to grow at a CAGR of 14.1% over the forecast period. The online segment reflects the increasing consumer preference for e-commerce platforms. Online retailers like Amazon, eBay, and brand-specific websites offer a wide range of products with competitive pricing and doorstep delivery. The COVID-19 pandemic accelerated the shift to online shopping, and this trend is expected to persist as consumers prioritize convenience and accessibility.

End-User Insights

Residential leads the end-user segment and is expected to grow at a CAGR of 13.8% during the forecast period, highlighting the rising adoption of sleep tech products in homes. Consumers are investing in smart mattresses, white noise machines, and wearable trackers to improve sleep quality. The demand is further driven by growing awareness of the health benefits of quality sleep and the convenience of using these devices in a home setting.

List of Key and Emerging Players in Australia Sleep Tech Market

- Fitbit (Google)

- Apple Inc.

- Philips Healthcare

- ResMed

- Withings

- Dreem

- Xiaomi

- Huawei

- Garmin

- Bose

- Sleep Number

- Eight Sleep

Analyst Perspective

As per our analyst, the Australia sleep tech market is poised for rapid expansion in the coming years. This growth is primarily driven by technological advancements, rising awareness of sleep disorders, and increased disposable income among Australians. The integration of AI and IoT into sleep tech solutions offers personalized and efficient options that align with consumer preferences.

Moreover, government initiatives and partnerships with healthcare providers are expected to bridge accessibility gaps, ensuring widespread adoption of these technologies. The emphasis on innovation and consumer-centric solutions positions the Australia Sleep Tech Market for sustained growth, making it a promising landscape for investors and stakeholders.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2023 | USD 439.06 Million |

| Market Size in 2024 | USD 498.78 Million |

| Market Size in 2032 | USD 1383.35 Million |

| CAGR | 13.6% (2024-2032) |

| Base Year for Estimation | 2023 |

| Historical Data | 2020-2022 |

| Forecast Period | 2024-2032 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Application, By Distribution Channel, By End-User |

to learn more about this report Download Free Sample Report

Australia Sleep Tech Market Segments

By Product Type

- Wearable Devices

- Non-Wearable Devices

- Sleep Aids

By Application

- Sleep Monitoring and Management

- Sleep Diagnostics

- Therapeutic Use

By Distribution Channel

- Online Retail

- Offline Retail

By End-User

- Residential

- Commercial

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.