Small Molecule Healthcare Contract Manufacturing Market Size, Share & Trends Analysis Report By Service (Active Pharmaceutical Ingredient (API), Development & Scale-up Services, Finished dose formulations, Packaging), By Therapeutic Area (Oncology, Cardiovascular Disease, Neurological Disorders, Infectious Diseases, Orthopedic Diseases, Metabolic Disorders, Autoimmune Diseases, Gastrointestinal Disorders, Respiratory Diseases, Ophthalmology, Dental Diseases, Others), By End Use (Pharmaceutical Companies, Biotechnology Companies, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Small Molecule Healthcare Contract Manufacturing Market Overview

The global small molecule healthcare contract manufacturing market size is valued at USD 122.26 billion in 2025 and is estimated to reach USD 353.43 billion by 2034, growing at a CAGR of 12.56% during the forecast period. The consistent growth of the market is augmented by rising outsourcing of complex chemical synthesis, expanding reliance on external partners for development and commercial scale production, and increasing preference among pharmaceutical and biotechnology companies for asset-light manufacturing models that support flexibility across diversified drug pipelines.

Key Market Trends & Insights

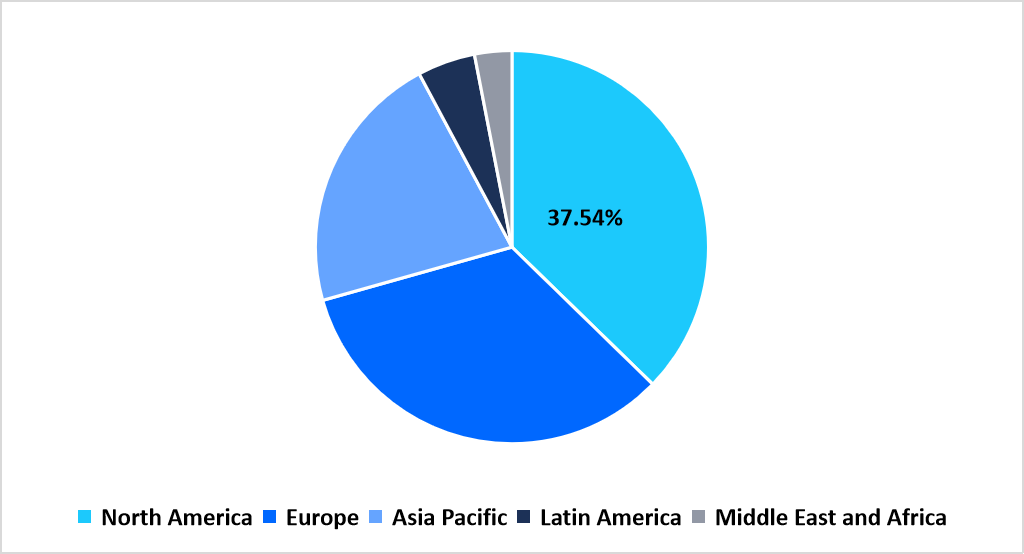

- North America held a dominant share of the global market, accounting for 54% in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 14.56% during the forecast period.

- Based on Service, active pharmaceutical ingredient (API) dominated the market with a revenue share of 37.89% in 2025.

- Based on Therapeutic Area, the oncology segment dominated the market with a revenue share of 33.95% in 2025.

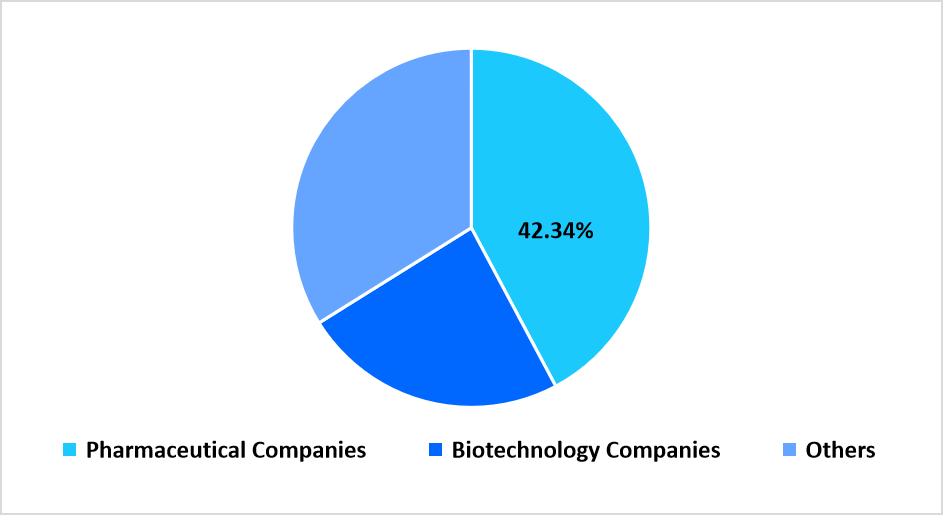

- Based on End Use, the pharmaceutical companies segment dominated the market revenue share of 42.34% in 2025.

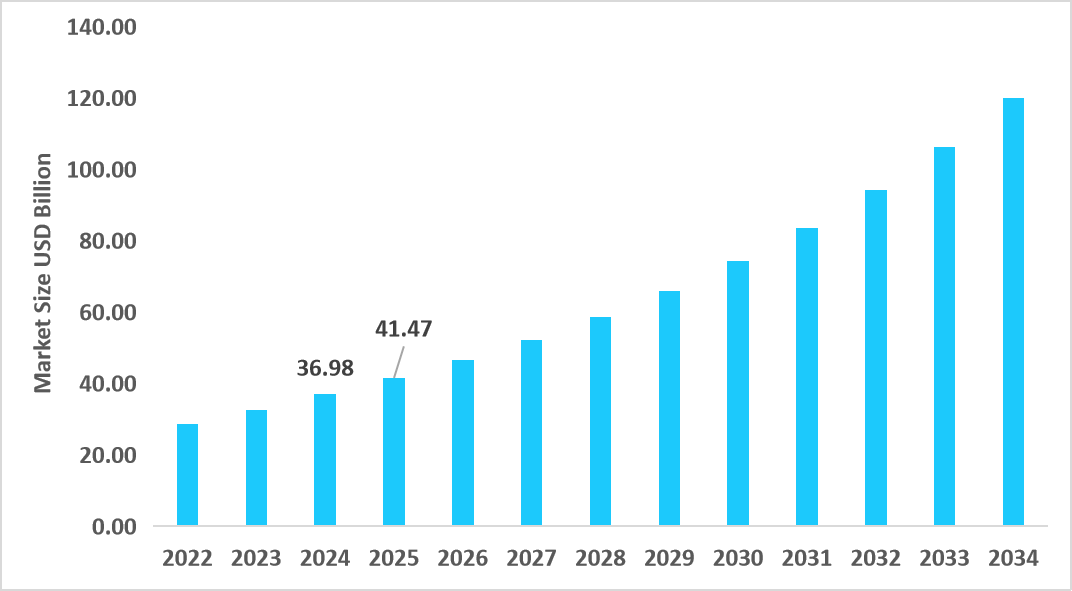

- The U.S. dominates the market, valued at USD 36.98 billion in 2024 and reaching USD 41.47 billion in 2025.

Table: U.S. Small Molecule Healthcare Contract Manufacturing Market Size (USD Billion)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 122.26 billion

- 2034 Projected Market Size: USD 353.43 billion

- CAGR (2026-2034): 12.56%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The small molecule healthcare contract manufacturing market comprises outsourced services that support the development, production, and commercialization of chemically synthesized drug products across the pharmaceutical value chain. This market includes active pharmaceutical ingredient manufacturing, development, and scale-up services, finished dose formulation production, and packaging operations delivered under regulatory-aligned environments. By therapeutic area, contract manufacturing activity spans oncology, cardiovascular disease, neurological disorders, infectious diseases, orthopedic diseases, metabolic disorders, autoimmune diseases, gastrointestinal disorders, respiratory diseases, ophthalmology, dental diseases, and other indications, reflecting the broad application of small molecule drugs across acute and chronic conditions. By end use, the market serves pharmaceutical companies that outsource chemistry, formulation, and commercial manufacturing to manage portfolio scale and complexity, biotechnology companies that rely on external partners to advance asset-light pipelines from development through commercialization, and other organizations involved in drug development and supply. The market functions as a critical extension of in-house manufacturing by providing scalable capacity, specialized chemistry expertise, and end-to-end production support across diverse small molecule drug programs.

Latest Market Trends

Shift from single route synthesis to multi-pathway chemistry outsourcing

A defining trend in the small molecule healthcare contract manufacturing market is the shift from single route synthesis to multi-pathway chemistry outsourcing. Pharmaceutical sponsors increasingly favor contract manufacturers capable of redesigning synthetic routes, managing alternate intermediates, and optimizing yield across diverse chemical classes. This transition reflects rising demand for manufacturing partners that support risk mitigation, supply continuity, and cost control across complex small molecule pipelines rather than executing fixed process recipes.

Shift from isolated manufacturing services to integrated chemistry platforms

The notable trend is the shift from isolated manufacturing services to integrated chemistry platforms. Sponsors increasingly engage contract manufacturers that combine process development, analytical validation, scale-up, and commercial production within unified operating frameworks. This evolution supports smoother technology transfer, faster process refinement, and consistent quality management across the full lifecycle of small molecule products.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 122.26 Billion |

| Estimated 2026 Value | USD 137.18 Billion |

| Projected 2034 Value | USD 353.43 Billion |

| CAGR (2026-2034) | 12.56% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Lonza Group, Catalent Inc., Recipharm AB, Thermo Fisher Scientific Inc., WuXi AppTec |

Market Driver

Rising complexity of small-molecule drug design

The small molecule healthcare contract manufacturing market is driven by the rising complexity of modern small molecule drug design. Increasing use of chiral compounds, high potency actives, and multi-step synthesis pathways elevates the technical burden on in-house manufacturing teams, prompting pharmaceutical and biotechnology companies to rely on specialized external partners with advanced chemistry and containment capabilities.

Market Restraint

Capital intensity of advanced small molecule manufacturing infrastructure

A key restraint in the market is the capital intensity of advanced small molecule manufacturing infrastructure. High costs associated with containment systems, specialized reactors, analytical laboratories, and compliance-aligned facilities limit rapid capacity expansion and increase financial exposure for contract manufacturers supporting diverse client portfolios.

Market Opportunity

Growth of virtual and asset-light pharmaceutical companies

A strong opportunity exists in the growth of virtual and asset-light pharmaceutical companies that operate without internal manufacturing assets. These organizations increasingly outsource development, active ingredient production, and finished dosage manufacturing to external partners, creating sustained demand for contract manufacturers offering flexible capacity, development-focused engagement models, and long-term supply support.

Regional Analysis

North America held a dominant position in the small molecule healthcare contract manufacturing market in 2025, with a market share of 37.54% 2025 due to strong outsourcing adoption for oral solid, injectable, and controlled release formulations. Pharmaceutical sponsors increasingly rely on contract manufacturers to manage complex synthesis, scale-up operations, and compliance-aligned commercial production. Consistent demand from chronic disease, oncology, and central nervous system therapies supports steady manufacturing volumes across development and commercial phases.

The U.S. small molecule healthcare contract manufacturing market is driven by advanced capabilities in high potency active pharmaceutical ingredient synthesis, sterile injectables, and continuous manufacturing platforms. Contract manufacturers focus on end-to-end lifecycle support, including process optimization, validation, and commercial supply management for branded and generic drug portfolios.

Asia Pacific Market Insights

Asia Pacific is expected to register the highest growth rate of 14.56% during the forecast period due to the rapid expansion of chemical synthesis infrastructure and increased global outsourcing from multinational pharmaceutical companies. Competitive production economics combined with rising regulatory alignment strengthen the region’s role within global supply networks. Regional contract manufacturers expand integrated services spanning development, active ingredient production, finished dosage manufacturing, and packaging.

China's small molecule healthcare contract manufacturing market growth is supported by large-scale active pharmaceutical ingredient manufacturing capacity and growing expertise in complex synthetic chemistry. Increased participation in global supply agreements and rising investments in compliance-aligned facilities support sustained market expansion.

Regional Market share (%) in 2025

Source: Straits Research

Europe Small Market Insights

Europe records stable market growth supported by strong regulatory harmonization and demand for precision manufacturing of small molecule therapeutics. Contract manufacturers emphasize process reproducibility, impurity control, and advanced analytical validation to meet strict safety expectations. Outsourcing activity remains steady among mid-sized pharmaceutical companies seeking specialized chemistry and formulation partners.

Germany's small molecule healthcare contract manufacturing market growth is driven by demand for high-quality active pharmaceutical ingredient synthesis and specialized oral dosage manufacturing. Strong engineering expertise and established pharmaceutical manufacturing clusters reinforce long-term contract manufacturing relationships.

Latin America Market Insights

Latin America demonstrates measured market development with increasing focus on regional manufacturing to support domestic pharmaceutical consumption and reduce dependency on imports. Contract manufacturing activity centers on formulation customization, scale-up production, and regulatory alignment with local health authorities.

Brazil's small molecule healthcare contract manufacturing market growth is driven by rising demand for locally produced generics and branded pharmaceuticals. Expansion of domestic manufacturing facilities and favorable government initiatives support the gradual strengthening of regional contract manufacturing capacity.

Middle East and Africa Market Insights

The Middle East and Africa market remains in an early growth phase, supported by targeted investments aimed at enhancing domestic pharmaceutical production capabilities. Contract manufacturing activities primarily include secondary manufacturing, formulation transfer, and packaging for established small molecule therapies.

Saudi Arabia's small molecule healthcare contract manufacturing market growth is driven by national healthcare localization strategies and increasing investment in pharmaceutical manufacturing infrastructure aligned with industrial diversification objectives.

Service Insights

The active pharmaceutical ingredient segment dominated the market in 2025 with a revenue share of 37.89%, driven by sustained outsourcing of complex chemical synthesis and large-scale production for branded and generic small molecule drugs. Pharmaceutical sponsors continue to prioritize external partners for route development, impurity control, and commercial API supply to streamline internal operations.

The finished dose formulations segment is projected to register the fastest growth during the forecast period with a share of 13.33%, supported by rising demand for integrated manufacturing that combines formulation, scale-up, and commercial dosage production under a single contract framework.

Therapeutic Area Insights

The oncology segment dominated the market in 2025, accounting for a revenue share of 33.95%, supported by high clinical activity and continuous production requirements for cytotoxic and targeted small molecule therapies. Contract manufacturers play a central role in supporting synthesis complexity and controlled manufacturing environments required for oncology pipelines.

The autoimmune diseases segment is expected to witness the fastest growth with a share of 13.67%, driven by the expanding development of oral small molecule immunomodulators and increasing outsourcing for long-term commercial supply.

End Use Insights

The pharmaceutical companies segment led the market in 2025 with a revenue share of 42.34%, reflecting high reliance on contract manufacturing partners for development, API production, and finished dosage manufacturing across diversified portfolios.

The biotechnology companies’ segment is anticipated to record the fastest growth with a share of 13.87%, supported by pipeline expansion among emerging biotech firms and preference for asset-light manufacturing models that rely on external production expertise.

By End Use Market Share (%), 2025

Source: Straits Research

Competitive Landscape

The global small molecule healthcare contract manufacturing market is moderately fragmented, comprising multinational pharmaceutical service providers alongside region-focused manufacturers offering development, active ingredient production, finished dosage manufacturing, and packaging services. Competitive positioning is shaped by synthetic chemistry depth, regulatory compliance strength, scalability of production assets, and the ability to support diverse therapeutic portfolios. Market participants emphasize long-term supply contracts, integrated service offerings, and manufacturing flexibility to align with evolving sponsor requirements.

Cambrex Corporation: An emerging market player

Cambrex Corporation is recognized as an emerging market player in the small molecule healthcare contract manufacturing market due to its focused expansion across active pharmaceutical ingredient development, process chemistry, and commercial scale manufacturing. The company strengthens its market presence through specialized capabilities in complex small molecule synthesis, high potency compounds, and regulatory-aligned manufacturing services. Cambrex supports pharmaceutical sponsors across early phase development through commercial supply, enabling streamlined technology transfer and lifecycle continuity. Strategic investments in capacity expansion, analytical development infrastructure, and compliance-driven operations enhance its appeal among mid-sized and virtual pharmaceutical companies. Growing demand for outsourced chemistry services and long-term manufacturing partnerships continues to support Cambrex’s progression within the emerging tier of global small molecule contract manufacturing providers.

List of Key and Emerging Players in Small Molecule Healthcare Contract Manufacturing Market

- Lonza Group

- Catalent Inc.

- Recipharm AB

- Thermo Fisher Scientific Inc.

- WuXi AppTec

- Cambrex Corporation

- Siegfried Holding AG

- Eurofins Scientific

- PCI Pharma Services

- CordenPharma

- Others

Strategic Initiatives

- October 2025: Cambrex announced it to invest USD 120 million to enhance its U.S. facilities, with an aim to meet the rising demand for API development and production while strengthening the company’s position in the rapidly growing peptide therapeutics sector.

- July 2025: Thermo Fisher Scientific Inc. announced it to expand its partnership agreement with Sanofi to enable additional U.S. drug product manufacturing.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 122.26 Billion |

| Market Size in 2026 | USD 137.18 Billion |

| Market Size in 2034 | USD 353.43 Billion |

| CAGR | 12.56% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Service, By Therapeutic Area, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Small Molecule Healthcare Contract Manufacturing Market Segments

By Service

- Active Pharmaceutical Ingredient (API)

- Development & Scale-up Services

- Finished dose formulations

- Packaging

By Therapeutic Area

- Oncology

- Cardiovascular Disease

- Neurological Disorders

- Infectious Diseases

- Orthopedic Diseases

- Metabolic Disorders

- Autoimmune Diseases

- Gastrointestinal Disorders

- Respiratory Diseases

- Ophthalmology

- Dental Diseases

- Others

By End Use

- Pharmaceutical Companies

- Biotechnology Companies

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.