Smart Agriculture Market Size, Share & Trends Analysis Report By Agriculture Type (Precision farming, Livestock monitoring, Smart greenhouse, Others), By Offering (Hardware, Software, Services), By Application (Precision farming application, Livestock monitoring application, Smart greenhouse application) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Smart Agriculture Market Size

The global smart agriculture market size was valued at USD 22.38 billion in 2024 and is expected to grow from USD 25.07 billion in 2025 to reach USD 64.01 billion by 2033, growing at a CAGR of 12.43% during the forecast period (2025-2033).

Smart agriculture leverages information technology to revolutionize farming by optimizing operations, enhancing crop yields, and reducing manual effort. By integrating advanced tools and systems, farmers can access real-time data on weather, soil conditions, and crop performance, enabling informed decisions to maximize productivity and sustainability.

The adoption of smart agriculture systems also automates various processes, significantly cutting labor and material costs. Advanced sensors and monitoring tools play a pivotal role in efficient water usage, precise soil management, inventory tracking, and harvest planning. These technologies ensure resources are used effectively while minimizing waste.

Key applications of smart agriculture include irrigation control, water resource management, crop planting, and production tracking. Yield monitoring, a standout feature, allows farmers to map and record real-time output and humidity data. This capability enables quick assessments of crop performance, helping farmers make timely adjustments to improve outcomes.

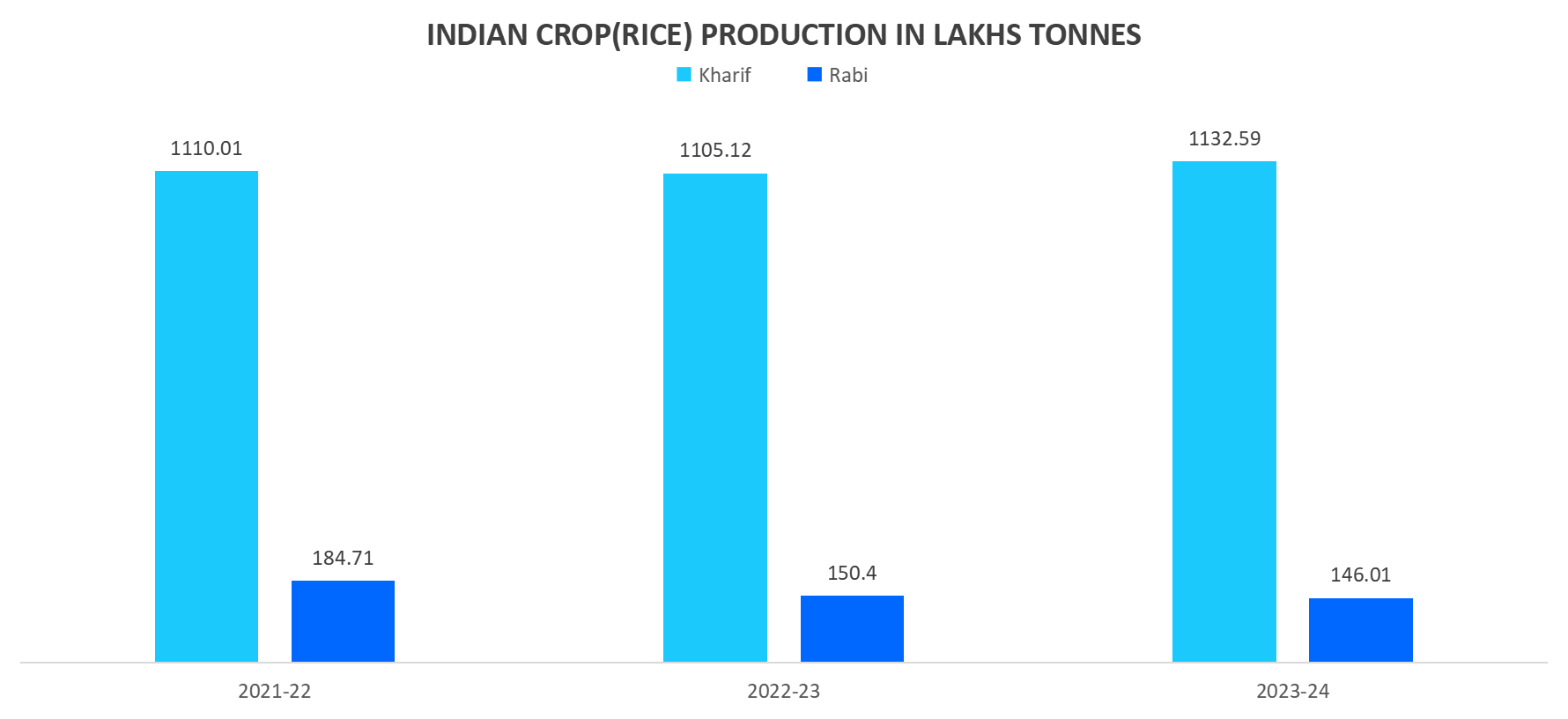

- For instance, India's rice production (in lakh tonnes) over three years (2021-22 to 2023-24) is categorized into Kharif and Rabi seasons. Kharif production consistently surpasses Rabi, with a slight increase in total production observed each year.

Source: Department of Agriculture & Farmers Welfare Ministry of Agriculture

Latest Market Trend

Increased Use of Drones for Precision Agriculture

Drones are revolutionizing the way farmers monitor and manage their fields, offering advanced solutions for field mapping, crop scouting, and precision spraying. These aerial devices provide real-time imagery and data, enabling farmers to gain deeper insights into crop health and soil conditions. Advanced drones equipped with multispectral sensors can detect early signs of plant stress, allowing for timely interventions to prevent crop damage.

- For instance, according to DJI Agriculture, the global agricultural drone industry is booming, with over 300,000 drones operating worldwide, covering more than 500 million hectares of farmland.

This widespread use of drones is enabling farmers to optimize field management and improve overall crop productivity.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 22.38 Billion |

| Estimated 2025 Value | USD 25.07 Billion |

| Projected 2033 Value | USD 64.01 Billion |

| CAGR (2025-2033) | 12.43% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Key Market Players | Ag Leader Technology, AGCO Corporation, AgJunction, Inc., AgEagle Aerial Systems Inc., Autonomous Solutions |

to learn more about this report Download Free Sample Report

Smart Agriculture Market Growth Factors

Rising Integration of Iot Technology in Agriculture

The integration of Internet of Things (IoT) technology is transforming agriculture by enabling real-time monitoring of crop growth and environmental conditions. IoT devices provide farmers with detailed insights into soil moisture, temperature, and weather, allowing for precise irrigation, fertilization, and pesticide use.

This reduces waste and resource consumption, optimizing land, water, and electricity usage while ensuring better crop quality for consumers. IoT also supports precision farming, reducing the need for excessive fertilizers and pesticides.

- According to the Indian Council of Agricultural Research, the adoption of IoT, along with AI/ML and precision farming technologies, is revolutionizing agriculture by fostering sustainable practices, increasing productivity, and improving profitability throughout the agricultural value chain.

Increased Adoption of Drones and Autonomous Equipment

Drones and autonomous equipment are reshaping farm operations by enabling more efficient field monitoring, precision spraying, and autonomous harvesting. These technologies significantly reduce labor costs and enhance accuracy in farming tasks, allowing farmers to apply fertilizers and pesticides precisely where needed. This targeted approach minimizes waste, cuts input costs, and reduces the environmental impact of farming activities.

- For instance, drones are projected to contribute USD 7 billion to the global agricultural economy. In the U.S., 84% of farmers use drones regularly, with 73% using them for crop monitoring and 43% for soil and field analysis. This widespread adoption highlights the transformative role drones play in modern agriculture.

Market Restraint

High Initial Investment Costs

Implementing smart agriculture technologies, such as IoT devices, robotics, sensors, and data analytics software, requires substantial upfront investment. These technologies, while offering long-term benefits, often come with a steep price tag, making them difficult to access for small-scale farmers who have limited financial resources.

Even when financing options are available, the complexity of these systems can deter investment, as farmers may struggle to see the immediate returns or fully understand the long-term advantages of these technologies.

- According to Catholic Relief Services, implementing Water Smart Agriculture requires significant upfront costs, averaging USD 273 per farmer annually over five years for demonstration plots and training.

While these technologies ultimately offer sustainable benefits, the initial financial burden remains a major hurdle for many farmers, limiting the broader adoption.

Market Opportunity

Agritech Startups Fueling Innovation and Adoption

Agritech startups are playing a pivotal role in driving the growth of smart farming practices, especially in the wake of the COVID-19 pandemic. By integrating AI, IoT, remote sensing, and data analytics, these startups have revolutionized how farmers access real-time data, optimize farm operations, and enhance productivity. These technologies have empowered farmers to improve market access and secure better prices for their produce, even during the pandemic's restrictions.

- For example, as of December 31, 2023, Startup India lists nearly 2,800 agritech startups, each contributing innovative solutions that are transforming traditional agricultural practices.

These startups are not only addressing local challenges but also creating scalable solutions that have the potential to enhance farm efficiency, sustainability, and profitability, marking a significant shift in India’s agricultural landscape.

Regional Insights

North America: Dominant Region with A Significant Market Share

North America remains a dominant player in the global smart agriculture market, holding a significant share due to its advanced agricultural practices and government support for innovation. The North America Climate Smart Agriculture Alliance (NACSAA) plays a key role in helping farmers adopt sustainable practices that not only boost productivity but also minimize environmental impact.

By offering resources, knowledge-sharing platforms, and networking opportunities, NACSAA supports the implementation of climate-smart technologies. Moreover, North American governments are offering financial incentives and subsidies to encourage the use of smart irrigation systems, further accelerating the adoption of smart agriculture practices across the region.

Europe: Rapidly Growing Region

Europe is quickly becoming a major hub for smart agriculture, driven by regional initiatives that focus on digital transformation in rural farming areas. Several European countries, including Germany, France, Italy, and the United Kingdom, are actively supporting the growth of smart agriculture through government policies, subsidies, and incentives.

- Italy, for example, is actively promoting smart agriculture through EU-backed programs like "Smart Rural 21." This initiative supports the digital transformation of rural agricultural areas, helping farmers integrate cutting-edge technologies to optimize farming practices and increase productivity.

By promoting sustainable farming and increasing efficiency, these initiatives are helping Europe maintain a strong growth trajectory in the smart agriculture market.

Country Insights

- United States:The U.S. agricultural sector plays a significant role in the economy, contributing 5.5% to GDP and supporting 10.4% of employment, according to the U.S. Department of Agriculture. Agriculture, food, and related industries have a far-reaching impact on the economy. On average, U.S. households allocate 12.9% of their budgets to food. This contribution underscores the importance of innovation and smart technologies in the agricultural sector to ensure continued productivity and growth.

- China:China’s agricultural sector is undergoing significant modernization, as highlighted by the country's "Smart Agriculture Action Plan 2024-2028." The Ministry of Agriculture and Rural Affairs aims to digitally integrate over 32% of agriculture by 2028, expanding from its 2019-2025 digitalization initiative. This plan represents China’s strategic move toward digital farming technologies that will enhance productivity, sustainability, and resource management.

- India:India faces unique challenges, including a rapidly growing population and the effects of climate change on agricultural yields. With an expected population of 1.64 billion by 2050, India will require 333 million tonnes of food grains annually. Digital farming technologies will be crucial in meeting these demands and ensuring food security. Climate change could reduce crop yields by 25%, highlighting the need for innovative solutions to sustain production and improve agricultural resilience.

- United Kingdom:Livestock farming is a major component of the UK agricultural market, accounting for 62% of agricultural production value, or £19.2 billion in 2023, according to the Department for Environment, Food & Rural Affairs. This dominance of livestock opens significant opportunities for smart farming solutions in precision livestock management, health monitoring, and resource efficiency. Advancements in these areas are essential for improving productivity and sustainability within the UK’s agricultural sector.

- Germany:Germany is a leading hub for innovation in smart farming technologies, largely due to its strength in agricultural machinery manufacturing. As the third-largest producer of agricultural machinery globally, following the U.S. and China, Germany continues to invest in cutting-edge solutions. The domestic market for agricultural machinery reached EUR 7.5 billion in 2022, underscoring the country’s commitment to advancing precision farming and enhancing agricultural efficiency.

- Japan:Japan’s commitment to modernizing its agricultural sector is evident through its substantial economic stimulus and agriculture-focused investments. In 2023, Japan unveiled a ¥17 trillion ($113 billion) stimulus package, followed by a ¥13.1 trillion supplementary budget. A portion of this, ¥818 billion, was allocated to the Ministry of Agriculture, Forestry, and Fisheries, aiming to foster innovation and sustainability in agriculture, addressing the sector’s evolving needs and global competitiveness.

- Brazil:Brazil is focusing on increasing agricultural productivity, as demonstrated by its record funding for the 2024/25 Crop Plan. The Brazilian government allocated R$ 475.5 billion (USD 88.2 billion), a 9% increase from the previous year’s funding. This financial commitment highlights Brazil’s ongoing efforts to modernize its agricultural sector, improve crop yields, and strengthen its position as a global leader. The country’s investment strategy underscores its dedication to sustainable farming.

Segmentation Analysis

By Agriculture Type

The Precision Farming segment leads the global smart agriculture market, driven by the widespread adoption of IoT and AI technologies that enable more efficient field management and crop monitoring. This segment focuses on optimizing resource utilization, reducing waste, and improving overall crop yields. Through advanced tools like sensors, drones, and data analytics, precision farming offers farmers the ability to monitor environmental conditions and crop health in real-time. As a result, it significantly enhances productivity and sustainability while reducing costs, making it the dominant agriculture type in the market.

By Offering

The Hardware segment has captured the largest share of the global market thanks to the rising demand for IoT-enabled sensors, drones, autonomous equipment, and other critical devices. These hardware solutions are integral to the successful implementation of smart agriculture systems. They form the backbone of essential farming operations like climate control, precision planting, and resource optimization. With the growing need for real-time data collection, automated processes, and precision technology, hardware plays a key role in enabling the transition to more efficient and sustainable agricultural practices, driving the segment's market dominance.

By Application

The Precision Farming segment has become the largest revenue-generating category in the smart agriculture market, primarily due to the extensive use of IoT, AI, and advanced analytics. These technologies enable precise field monitoring, resource optimization, and enhanced crop management, improving productivity and reducing waste. Precision farming applications allow farmers to monitor environmental conditions and adjust practices accordingly to boost yield while conserving resources like water and fertilizers. The accuracy in operations offered by this application has led to its dominance, positioning it as the primary driver of market growth within the application segment.

Company Market Share

Key market players in the smart agriculture industry are investing heavily in advanced technologies, such as AI, IoT, robotics, and drone systems, to develop more efficient and sustainable farming solutions. These companies are pursuing strategies like collaborations, acquisitions, and partnerships to accelerate innovation and enhance their product offerings.

Deere & Company: An Emerging Player in the Global Smart Agriculture Market

Deere & Company, a leading player in the smart agriculture market, is at the forefront of integrating advanced technologies such as AI, IoT, and automation into farming equipment. Known for its iconic John Deere brand, the company focuses on precision agriculture, offering smart machinery that helps farmers optimize resources, reduce waste, and increase productivity.

Recent Developments:

- In January 2024, Deere & Company partnered with SpaceX to enable farmers to receive better satellite communications. This solution uses the Starlink network, thus allowing farmers in rural areas with limited connectivity to gain full access and benefit from precision agriculture technologies.

List of Key and Emerging Players in Smart Agriculture Market

- Ag Leader Technology

- AGCO Corporation

- AgJunction, Inc.

- AgEagle Aerial Systems Inc.

- Autonomous Solutions

- Argus Control Systems Ltd

- BouMatic Robotic B.V.

- CropMetrics

- CLAAS KGaA

- CropZilla

- Deere & Company

- DroneDeploy

- DeLaval Inc

- Farmers Edge Inc

- Grownetics, Inc

Recent Developments

- April 2024 – Trimble Inc. and Holmen, a Swedish forestry company, announced a partnership in which Holmen chose Trimble's Connected Forest to serve as its new all-encompassing forest management platform for Holmen Skog. This collaboration aims to enhance forest management practices by integrating advanced GPS and data analytics tools to optimize forest inventory, growth, and harvesting processes.

- March 2024 – Deere & Company, Kinze Manufacturing, and Ag Leader Technology teamed up to make it easier for farmers to integrate their equipment and agronomic data into the John Deere Operations Center. This partnership allows seamless connectivity between different agricultural equipment and software systems, enabling farmers to centralize their data for better decision-making and increased productivity.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 22.38 Billion |

| Market Size in 2025 | USD 25.07 Billion |

| Market Size in 2033 | USD 64.01 Billion |

| CAGR | 12.43% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Agriculture Type, By Offering, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Smart Agriculture Market Segments

By Agriculture Type

- Precision farming

- Livestock monitoring

- Smart greenhouse

- Others

By Offering

-

Hardware

-

Automation & control systems

- Drones

- Application control devices

- Guidance system

- Remote sensing

- Driverless tractors

- Mobile devices

- VRT

- Wireless modules

- Milking robots

-

Sensing devices

- Soil sensor

- Water sensors

- Climate sensors

- Others

- HVAC system

- LED grow light

- RFID tags & readers

-

Automation & control systems

-

Software

- Web-based

- Cloud-based

-

Services

- System integration & consulting

- Maintenance & support

-

Managed services

- Data services

- Analytics services

- Farm operation services

-

Assisted professional services

- Supply chain management services

- Climate information services

By Application

-

Precision farming application

-

Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

-

Yield monitoring

-

Livestock monitoring application

- Milk harvesting

- Breeding management

- Feeding management

- Animal comfort management

- Others

-

Smart greenhouse application

- Water & fertilizer management

- HVAC management

- Yield monitoring

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.