Smart Contact Lenses Market Size, Share & Trends Analysis Report By Type (Rigid gas permeable, Extended-wear Lenses, Others), By Application (Health Monitoring, Therapeutics, Others), By Distribution Channel (Retail Stores, Online Stores, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Smart Contact Lenses Market Size

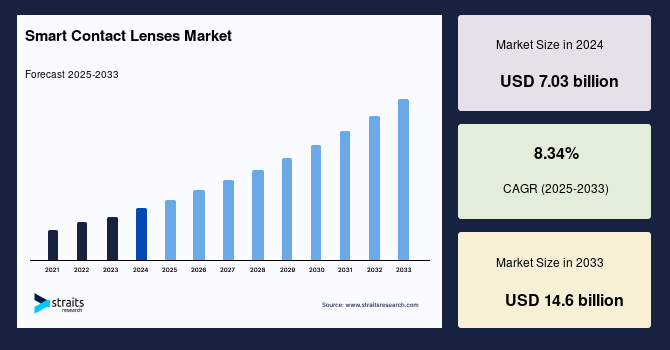

The global smart contact lenses market size was valued at USD 7.03 billion in 2024 and is projected to grow from USD 7.8 billion in 2025 to reach USD 14.6 billion by 2033, exhibiting a CAGR of 8.34% during the forecast period (2025-2033).

Smart contact lenses are advanced wearable devices designed to go beyond vision correction by integrating innovative technology for real-time health monitoring and enhanced visual capabilities. Equipped with miniature sensors, microchips, and wireless connectivity, these lenses can track health metrics such as glucose levels in tears, intraocular pressure for glaucoma detection, and even augmented reality displays.

Major tech and healthcare companies are actively developing smart contact lenses to revolutionize medical diagnostics, personalized healthcare, and immersive digital experiences. The global market is experiencing rapid growth, driven by advancements in biosensing technology, miniaturized electronics, and increasing demand for non-invasive health monitoring solutions. The integration of sensors for glucose monitoring, intraocular pressure measurement, and AR applications is driving the market growth.

Moreover, the expansion of the wearable tech ecosystem and the growing adoption of IoT-driven health solutions are further fueling market growth. Leading companies are investing in drug-eluting lenses, energy-efficient wireless power solutions, and AI-powered vision enhancement, broadening the potential of smart lenses beyond traditional eye care.

Market Trends

Health Monitoring Integration

The integration of health monitoring capabilities in smart contact lenses enables real-time tracking of vital health parameters, including glucose levels, intraocular pressure (IOP), and tear chemistry. These advanced lenses utilize miniaturized sensors and wireless connectivity to provide continuous, non-invasive diagnostics for conditions such as diabetes and glaucoma.

- For instance, in August 2024, a study published in Nature Electronics introduced a liquid crystal (LC) contact lens sensor designed for ultra-sensitive IOP monitoring. By incorporating liquid metal into stretchable inductive and capacitive components, the sensor significantly enhances flexibility and sensitivity, marking a major breakthrough in non-invasive glaucoma monitoring.

Such advancement highlights the growing potential of smart contact lenses in revolutionizing ophthalmic care, offering a seamless, non-invasive solution for real-time health monitoring and disease management.

Advancements in Sensor Technology

Ongoing advancements in sensor technology are equipping smart contact lenses with highly sophisticated biosensors, flexible electronics, and wireless communication capabilities. These developments enhance accuracy, comfort, and functionality, positioning smart lenses as powerful tools in both medical diagnostics and wearable technology.

- For example, in January 2022, engineers from the University of Surrey developed a smart contact lens sensor system with a groundbreaking manufacturing process. This system integrates a photodetector for capturing optical data, a temperature sensor for detecting corneal diseases, and a glucose sensor for monitoring glucose levels in tear fluid.

Such innovations highlight the transformative potential of sensor technology in smart contact lenses, paving the way for enhanced diagnostics, personalized healthcare, and next-generation wearable solutions.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 7.03 Billion |

| Estimated 2025 Value | USD 7.8 Billion |

| Projected 2033 Value | USD 14.6 Billion |

| CAGR (2025-2033) | 8.34% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Sensimed, Mojo Vision, Innovega Inc., InWith Corporation, Johnson & Johnson |

to learn more about this report Download Free Sample Report

Smart Contact Lenses Market Growth Factors

Rising Prevalence of Chronic Diseases

The increasing global incidence of chronic conditions such as diabetes and glaucoma is significantly driving the demand for smart contact lenses with real-time health monitoring capabilities. As these diseases require continuous monitoring for effective management, smart lenses offer a non-invasive, convenient solution for early detection and disease tracking.

For instance,

- In March 2023, an article published in the National Library of Medicine projected that glaucoma cases in Asia will rise by 27.8 million by 2040, underscoring the urgent need for advanced ophthalmic monitoring solutions.

- Similarly, in November 2022, the WHO reported that approximately 830 million individuals worldwide were diagnosed with diabetes, highlighting the widespread prevalence of this metabolic disorder.

This growing disease burden is expected to drive demand for smart contact lenses equipped with real-time intraocular pressure (IOP) monitoring, offering a non-invasive, continuous tracking solution for early detection and better disease management.

Growing Adoption of Wearable Technology

The increasing shift toward wearable health monitoring devices is fueling the adoption of smart contact lenses as part of a broader trend in digital healthcare. These lenses, integrated with biosensors for tracking glucose levels and intraocular pressure, are becoming a crucial component of health-focused IoT ecosystems. Advances in miniaturized electronics and flexible biosensors are further accelerating market growth.

- For example, in July 2024, an article published in the National Library of Medicine explored the integration of wearable and implantable biosensors in precision medicine. The study highlighted how smart contact lenses, equipped with electronics and biomaterials, enable real-time health monitoring by tracking key parameters such as glucose levels and intraocular pressure.

Therefore, the expanding role of smart technologies in healthcare is revolutionizing diagnostics, continuous monitoring, and personalized treatment.

Market Restraining Factors

High Development and Production Costs

High development and production costs are a significant barrier to the widespread adoption of smart contact lenses. The manufacturing process involves intricate steps, including the integration of miniaturized biosensors, flexible electronics, and biocompatible materials, which contribute to elevated R&D and production expenses.

Moreover, incorporating wireless communication, power sources, and data processing capabilities adds complexity and cost. The lack of economies of scale in production and the necessity of complying with strict regulatory approvals further compound the issue, making it challenging for manufacturers to scale up efficiently.

These high costs can limit affordability, particularly in price-sensitive markets, and may slow down the overall market growth, restricting access to smart contact lenses for a broader consumer base.

Market Opportunity

Smart Contact Lenses for Targeted Drug Delivery

The integration of drug-delivery systems into smart contact lenses represents a transformative opportunity in ophthalmic care. These lenses can provide controlled and sustained medication release, improving treatment outcomes for conditions such as glaucoma, dry eye syndrome, and post-surgical recovery. By delivering drugs directly to the eye, smart lenses enhance bioavailability and reduce systemic side effects, offering a more efficient alternative to traditional eye drops.

- For instance, in March 2022, Johnson & Johnson Vision Care received FDA approval for ACUVUE Theravision with Ketotifen, the world's first drug-eluting contact lens. This breakthrough underscores the potential of smart lenses in targeted ocular therapy, improving patient adherence and convenience.

Such innovations pave the way for pharmaceutical and MedTech companies to develop advanced drug-delivery solutions, expanding the market for smart contact lenses while addressing unmet medical needs in ophthalmology.

Regional Insights

North America holds the dominant position in the global smart contact lenses market, driven by high healthcare expenditure, advanced R&D capabilities, and strong regulatory support. The region benefits from a well-established healthcare infrastructure, fostering rapid adoption of innovative medical technologies. The presence of major industry players such as Johnson & Johnson Vision, Mojo Vision, and Alcon further accelerates market growth.

Moreover, collaborations between leading research institutions, universities, and tech firms contribute to continuous advancements in biosensing, AI integration, and miniaturized electronics. Favorable reimbursement policies and increasing awareness of non-invasive health monitoring solutions also play a crucial role in sustaining market leadership.

U.s. Smart Contact Lens Market Trends

The U.S. dominates the smart contact lens market, driven by high R&D investments, strong technological advancements, and strategic collaborations among key players. Major companies such as Mojo Vision, Johnson & Johnson, and Alcon are pioneering breakthroughs in biosensing and AR-enabled lenses. In January 2022, Mojo Vision partnered with Adidas to develop smart lenses for sports and fitness applications, integrating real-time performance tracking. Such advancements highlight the expanding role of AR and health monitoring in wearable technology.

Asia-Pacific is expected to register the highest CAGR, driven by rising healthcare awareness, increasing prevalence of diabetes and glaucoma, and rapid adoption of wearable medical technologies. Countries such as China, India, and Japan are fueling market expansion with their growing healthcare infrastructure, rising disposable incomes, and strong government support for digital health initiatives. Moreover, the region's booming consumer electronics sector and expanding telemedicine services create new opportunities for smart contact lens adoption in personalized healthcare.

China’s smart contact lens market is expanding due to significant R&D investments and breakthroughs in ophthalmic care. In May 2024, an article by the American Chemical Society highlighted a Chinese research team’s development of a smart contact lens capable of accurately measuring eye pressure unaffected by temperature fluctuations. This innovation improves glaucoma monitoring and enhances adoption in ophthalmic diagnostics.

South Korea is witnessing strong growth in the smart contact lens market, driven by advancements in AR-enabled technology and increased R&D activities. In March 2023, researchers developed AR-enabled smart contact lenses using a 3D printing process for real-time navigation overlays, enhancing hands-free AR applications. These innovations are unlocking new possibilities in interactive displays and digital interfaces. The country’s strong electronics industry and collaborations between MedTech startups and universities further accelerate market expansion.

Countries Insights

- Germany - Germany is a key player in the smart contact lens market, fueled by the growing adoption of advanced ophthalmic technologies and rising cases of glaucoma and presbyopia. The country's strong medical research sector supports innovations in biometric sensors and AR-enabled lenses. Moreover, increasing consumer demand for smart healthcare solutions and government-backed digital health initiatives are driving market growth. The presence of leading MedTech firms and collaborations between research institutions and technology companies further boost the market.

- UK - The UK’s smart contact lens market is expanding due to the rising prevalence of eye disorders, increased adoption of wearable health-monitoring devices, and strong government support for medical innovation. The growing diabetic population and advancements in biosensor technology are accelerating demand. Moreover, strategic collaborations between universities, MedTech startups, and healthcare providers are fostering R&D in smart contact lenses, enhancing the integration of continuous glucose monitoring, intraocular pressure tracking, and augmented reality features.

Type Insights

The extended-wear lens segment leads the global smart contact lenses market due to its widespread adoption in medical and health monitoring applications. These lenses offer continuous wearability, allowing users to monitor intraocular pressure, glucose levels, and other health parameters without frequent removal. The integration of advanced materials, improved oxygen permeability, and moisture retention enhances comfort and usability. Moreover, extended-wear smart lenses are increasingly utilized in drug delivery systems, making them a preferred choice in ophthalmic care.

Application Insights

The health monitoring segment dominates the global smart contact lenses market, driven by the increasing prevalence of chronic conditions such as diabetes and glaucoma. Smart lenses integrated with biosensors enable real-time glucose monitoring, intraocular pressure tracking, and tear analysis, providing a non-invasive alternative to traditional methods. The demand for continuous health tracking and early disease detection has fueled the adoption of these lenses. Moreover, advancements in IoT and AI-powered analytics are further enhancing the effectiveness of smart health-monitoring lenses.

Distribution Channel Insights

Retail stores remain the primary distribution channel for smart contact lenses due to consumer preference for in-person consultations, product trials, and expert recommendations. Optical stores, specialty eye clinics, and hospitals play a crucial role in ensuring proper lens fitting, customization, and immediate availability. The ability to receive professional guidance from optometrists enhances customer confidence, boosting retail sales. Moreover, strategic partnerships between eyewear brands and retailers continue to strengthen market presence, making retail stores the dominant sales channel.

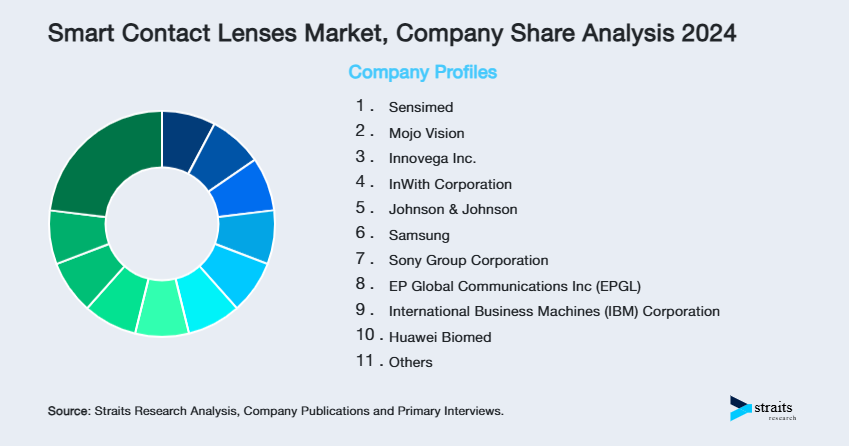

Company Market Share

Key players in the smart contact lens industry are actively adopting key business strategies, including strategic collaborations, product approvals, acquisitions, and product launches, to strengthen their market position. Companies are investing in research and development to enhance biosensor technology, miniaturized electronics, and AR-enabled functionalities.

Innovega Inc.: An emerging player in the global smart contact lenses market

Innovega Inc. is a pioneering company that is developing smart contact lens systems designed for augmented reality (AR) and vision enhancement. Its technology combines soft contact lenses with wearable display eyewear to provide a seamless AR experience. The company focuses on high-resolution, wide-field-of-view displays for medical and consumer applications.

Recent Developments by Innovega Inc.:

- In February 2022, Innovega announced positive clinical results from a Phase II study of its eMacula system, a smart contact lens designed for enhanced vision and augmented reality applications.

List of Key and Emerging Players in Smart Contact Lenses Market

- Sensimed

- Mojo Vision

- Innovega Inc.

- InWith Corporation

- Johnson & Johnson

- Samsung

- Sony Group Corporation

- EP Global Communications Inc (EPGL)

- International Business Machines (IBM) Corporation

- Huawei Biomed

- RaayonNova LLC

- Azalea Vision

- GlakoLens Biyomedikal Biyoteknoloji San. ve Tic. A.S.

- Mediprint

- e-Vision Smart Optics, Inc

to learn more about this report Download Market Share

Recent Developments

- August 2024 – Researchers at Nanyang Technological University (NTU) Singapore developed an ultra-thin, flexible battery designed to power smart contact lenses. This innovative battery, as thin as a human cornea, generates electricity when immersed in saline solution, potentially utilizing human tears as a power source.

Analyst Opinion

As per our analyst, the global smart contact lenses market is poised for substantial growth, driven by breakthroughs in miniaturized electronics, biosensors, and wireless connectivity. The increasing demand for non-invasive health monitoring, especially for conditions such as glaucoma and diabetes, is fueling adoption. Moreover, the integration of AR and drug delivery systems opens up exciting opportunities, making smart lenses a multi-functional tool for both medical and consumer markets.

With significant investments from major tech and healthcare companies and growing regulatory approvals, market expansion is accelerating. Despite these advances, challenges remain, particularly in the high development and production costs of these lenses. The complexity of manufacturing, stringent regulatory processes, and scalability issues pose hurdles to widespread adoption, especially in price-sensitive regions.

However, as the technology matures and cost efficiencies are realized, these challenges are expected to lessen, paving the way for greater market penetration. Asia-Pacific stands as a region of significant opportunity, fueled by rising healthcare awareness, rapid R&D activities, and an expanding patient base for vision-related disorders.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 7.03 Billion |

| Market Size in 2025 | USD 7.8 Billion |

| Market Size in 2033 | USD 14.6 Billion |

| CAGR | 8.34% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Application, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Smart Contact Lenses Market Segments

By Type

- Rigid gas permeable

- Extended-wear Lenses

- Others

By Application

- Health Monitoring

- Therapeutics

- Others

By Distribution Channel

- Retail Stores

- Online Stores

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Jay Mehta

Research Analyst

Jay Mehta is a Research Analyst with over 4 years of experience in the Medical Devices industry. His expertise spans market sizing, technology assessment, and competitive analysis. Jay’s research supports manufacturers, investors, and healthcare providers in understanding device innovations, regulatory landscapes, and emerging market opportunities worldwide.