Software Defined Vehicle Market Size, Share & Trends Analysis Report By Vehicle Type (Passenger Cars, Commercial Vehicles), By Technology (Service-Oriented Architecture (SOA), Cloud Connectivity and Edge Computing, Domain Controllers and Centralized Computing, Artificial Intelligence and Machine Learning, Others), By Vehicle Architecture (Level 0: Mechanically controlled vehicle, Level1: E/E controlled vehicle, Level 2: Software‑controlled vehicle, Level3: Partial software‑defined vehicle, Level 4: Full software‑defined vehicle, Level 5: Software‑defined ecosystem), By Application (Infotainment systems, Advanced Driver Assistance Systems (ADAS), Autonomous driving, Telematics, Powertrain control, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Software Defined Vehicle Market Overview

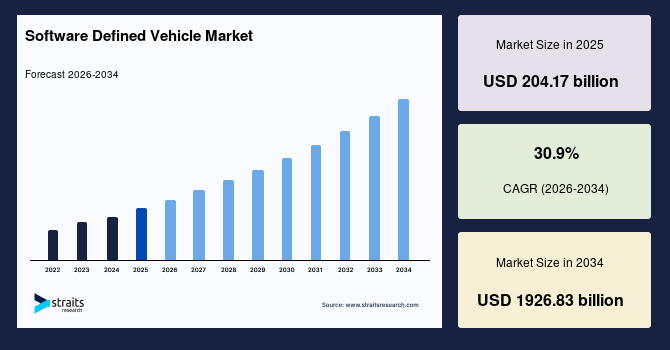

The global software defined vehicle market size is valued at USD 204.17 billion in 2025 and is estimated to reach USD 1,926.83 billion by 2034, growing at a CAGR of 30.9% during the forecast period. Consistent growth of the market is supported by the increasing adoption of software-centric vehicle architectures, over-the-air (OTA) updates, and advanced connectivity solutions, which enhance vehicle functionality, enable autonomous driving features, and encourage OEMs and consumers to embrace next-generation software-defined mobility solutions proactively.

Key Market Trends & Insights

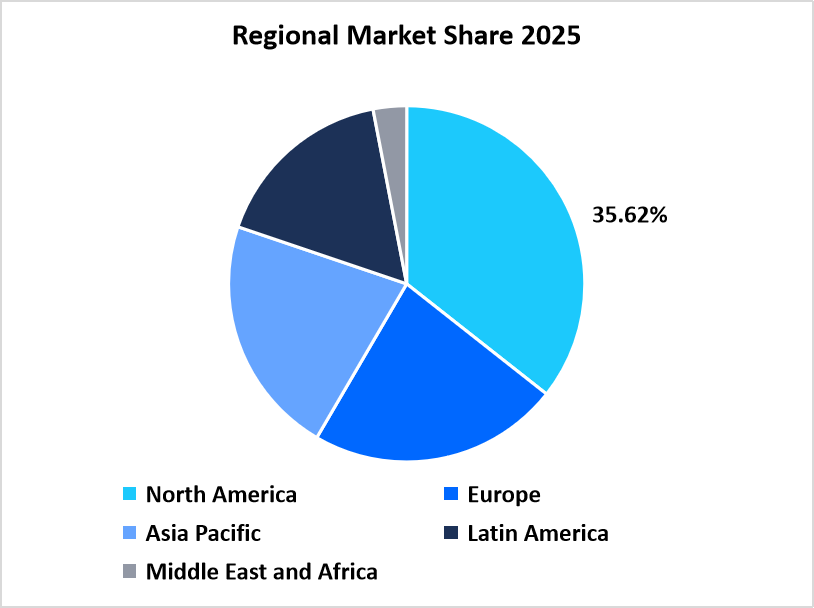

- North America dominated the market with a revenue share of 35.62% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 31.2% during the forecast period.

- Based on vehicle type, the Passenger Vehicle segment held the highest market share of 63.5% in 2025.

- By technology, the Artificial Intelligence and Machine Learning (AI/ML) segment is estimated to register the fastest CAGR growth of 36.6%.

- Based on vehicle architecture, Level 0: Mechanically controlled vehicle segment dominated the market in 2025 with an 38.5% of share.

- Based on application, the Autonomous Driving segment is projected to register a CAGR of 28.4% from 2025 to 2034.

- The U.S. dominates the software defined vehicle market, valued at approximately USD 88 billion in 2024 and estimated to reach USD 115 billion in 2025.

U.S Software Defined Vehicle Market Size (USD Million)

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 204.17 billion

- 2034 Projected Market Size: USD 1926.83 billion

- CAGR (2026-2034): 30.9%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global SDV Market deals with a wide range of software-centric vehicle functionalities, including over-the-air updates, service-oriented architecture, cloud connectivity and edge computing, domain controllers and centralized computing, artificial intelligence and machine learning, and other advanced vehicle software technologies.

These solutions are deployed across various vehicle types, such as passenger cars and commercial vehicles, and integrated through multiple vehicle architectures, including mechanically controlled vehicles, E/E controlled vehicles, partial and full software-defined vehicles, and software-defined ecosystems. Furthermore, SDV technologies are applied in diverse applications, including infotainment systems, advanced driver assistance systems, autonomous driving, telematics, and powertrain control, addressing the mobility, connectivity, and automation needs of drivers and fleet operators through comprehensive, technology-driven solutions across global automotive market.

Latest Market Trends

Shift from Hardware-Centric Vehicles to Software-Defined Mobility

The automotive sector is in the process of changing from the traditional hardware-dominated cars to the software-based platforms that provide the possibility of continuous updates, the customer’s choice of the features and the advanced intelligence of the vehicle. Today's SDVs can allow the manufacturers to send new features over the air, which decreases the need for physical recalls and lets the cars grow even after the sale. This change is making the Original Equipment Manufacturers (OEMs) and suppliers to re-evaluate their development cycles by giving importance to software incorporation, creation of modular structures, and establishing the foundation of digital service platforms in order to keep track of the changing customer expectations.

Rise of Connected and Autonomous Vehicle Ecosystems

Centralized computing, AI/ML, and cloud connectivity are the main factors that help the connected and autonomous vehicles to be smarter, safer, and more personalized in their driving experiences. This communication between the different parts of the system can happen in real-time (vehicle-to-everything or V2X), and one can get predictive maintenance and advanced driver assistance capabilities as well. By offering a wide range of autonomous driving features along with the mobility services, carmakers are moving towards the adoption of the SDV framework that guarantees scalability, interoperability, and continuous innovation.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 204.17 billion |

| Estimated 2026 Value | USD 267.34 billion |

| Projected 2034 Value | USD 1926.83 billion |

| CAGR (2026-2034) | 30.9% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Tesla, BMW Group, Mercedes-Benz Group, Volkswagen AG, General Motors |

to learn more about this report Download Free Sample Report

Market Driver

Government Incentives to Accelerate Software-Defined Vehicle Adoption

Various governments around the world are actively supporting the development and establishment of SDVs through different regulatory frameworks, subsidies, and tax incentives. The US Department of Transportation and the National Highway Traffic Safety Administration have issued guidelines in support of connected and autonomous vehicle testing. Similarly, Europe's "Horizon Europe" program has allocated billions for digital mobility and smart vehicle initiatives. Such policies further encourage investment by OEMs into SDV platforms, leading to very high growth rates in the market and rapid technology integration.

Market Restraint

Regulatory Uncertainty Slows SDV Deployment

Key restraints in the software-defined vehicle market is the doubt about the future regulatory conditions for autonomous, connected, and software-driven vehicles. Governments are supporting SDVs but, at the same time, inconsistencies in safety standards, certification requirements, and legal liabilities across the regions are the factors that slow down the introduction of vehicles to the market. To illustrate, the situation in the U.S. is that there are no federal regulations for Level 4 or Level 5 autonomous vehicles that are uniform, thus, manufacturers are relying on a patchwork of state-level guidelines. This uncertainty regarding regulation is one of the barriers preventing SDVs from being adopted on a large scale worldwide since car makers are apprehensive about compliance risks and possible liabilities.

Market Opportunity

Increased expansion of MaaS platforms

The rapid rise of mobility-as-a-service solutions is a key factor in contributing to significant growth opportunities for the software-defined vehicle market. Leading automakers and fleet operators are increasingly integrating SDVs into shared mobility ecosystems, such as ride-hailing, car-sharing, and subscription-based services. These leverage a centrally managed software architecture for dynamic vehicle allocation, route optimization, and real-time user experience that creates demand for vehicles to adapt and upgrade at par with the ever-changing demands continuously through software-defined systems.

Regional Analysis

North America accounted for the largest share of 35.62% in the SDV market in 2025, driven by its strong automotive software ecosystem, high investments in the infrastructure of connected vehicles, and strong collaborations between OEMs and cloud providers. All major automakers in the region are moving from hardware-centric models to software-first architecture, integrating OTA updates and AI-driven diagnostics into their vehicles as standard features. Additionally, increasing focus on centralized computing platforms and compliance with cybersecurity will expedite the integration of SDV frameworks in both passenger and commercial vehicle segments across the region.

The U.S. software-defined vehicle market is seeing a rapid surge owing to an increasing number of cross-industry collaborations between automotive companies, semiconductor providers, and cloud computing firms. Key U.S.-based OEMs are deploying unified software stacks that provide a means for performing real-time processing and edge intelligence for connected and automated driving. Increasing federal funding toward smart mobility testbeds and digital road infrastructure is further enabling large-scale testing and validation of software-defined vehicle functionalities. The growing demand by consumers for in-vehicle customizable experiences along with increasing ADAS feature specifications motivates these automakers to adopt subscription-based models for their vehicles, making them upgradable continuously like other digital platforms.

Asia Pacific Software Defined Vehicle Market Insights

The Asia Pacific is expected to become the fastest-growing region, at a CAGR of 31.2% during 2026–2034, driven by rapid automotive industry digitalization and strong policy initiatives to promote intelligent mobility ecosystems. Large-scale investments in high-performance computing for SDV architectures have been noted in countries such as China, Japan, and South Korea, while connected mobility pilots integrating telematics, V2X communication, and over-the-air updates have been rapidly implemented in India and Southeast Asia. Development across the region could be further stimulated by large consumer bases for connected cars and the availability of local manufacturing incentives for SDVs.

The rapid rise of indigenous automotive software start-ups in India has been driving the country's software-defined vehicle market, alongside strategic partnerships with global Tier-1 suppliers. Domestic OEMs are increasingly adopting domain-centralized architectures as part of an effort to reduce ECU complexity and enhance scalability. Several other ongoing initiatives include the establishment of automotive software testing zones and local data centers, enabling real-time analytics for predictive maintenance and autonomous navigation. With the increasing availability of 5G connectivity and affordable edge computing solutions, India is fast emerging as a competitive hub for SDV innovation and export-oriented software development in the Asia Pacific region.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

The strong focus on automotive digitalization and sustainability across Europe has positioned the region for rapid expansion in the software-defined vehicle market. The region’s leadership in automotive software engineering and cross-border 5G corridor initiatives is a driver of connected, software-driven mobility solution deployment. Major European OEMs are transitioning to centralized vehicle architectures that integrate multiple ECUs within a consolidated computing domain for reduced complexity and enable seamless over-the-air software updates. The increasing focus on data-driven regulatory frameworks and interoperability standards across the EU is also driving the adoption of SDV platforms and ensuring cybersecurity and functional safety across passenger and commercial fleets.

This sets the context: Germany's software-defined vehicle market growth is triggered by its position as a global hub for automotive software innovation. Leading automakers and Tier-1 suppliers are making big investments in next-generation electronic architectures that embed AI-driven predictive maintenance, V2X, and dynamic driver assistance systems. Local automotive clusters are bringing together chip manufacturers, software developers, and mobility start-ups to speed up the deployment of SDV. Additionally, vast digital twin and real-time simulation test facilities enable accelerated validation of both autonomous and software-defined features. The embedding of software-centric design principles in the traditional production workflow of vehicles is reshaping Germany's automotive manufacturing landscape to ensure long-term competitiveness in the global SDV ecosystem.

Latin America Market Insights

The growth of the Latin American SDV market is backed by the modernization of regional production lines through various automotive OEMs and connected vehicle platforms across Mexico, Brazil, and Argentina. Telematics-enabled fleet management systems and cloud-based mobility analytics are seeing increased adoption, thereby transforming the regional automotive landscape. Edge computing deployment is being facilitated through various collaborations between the telecom providers and automakers, which enables real-time monitoring of vehicles and enhances OTA software updates. Moreover, expanding electric and hybrid vehicles in the key Latin markets are driving demand for integrated software solutions that can optimize energy management and connectivity performance.

The integration of digital cockpit platforms, vehicle cybersecurity solutions, and cloud-native software architecture into passenger and commercial segments propels the software-defined vehicle market in Brazil. Local automotive assemblers are partnering with global software firms to develop middleware solutions especially for Latin American road conditions and the preferences of local drivers. Smart mobility startups, offering subscription-based connected car services, are also gaining traction in the marketplace. These innovations collectively are helping Brazil grow from a traditional automotive manufacturing base into a regional center for intelligent mobility and SDV-driven innovation.

Middle East and Africa Market Insights

The MEA region is seeing a gradual penetration of software-defined vehicle solutions, with increased investments in connected infrastructure and smart city ecosystems. Next-generation mobility frameworks are being deployed by several countries like the UAE, Saudi Arabia, and South Africa, incorporating SDVs into the intelligent transport network. Similarly, automotive distributors in this region are launching vehicles having features that can be configured through software and remotely upgradeable over the air to meet the digital inclinations of citizens who live in cities.

The SDV market in South Africa is gaining momentum due to regional partnerships based on the development of local software and vehicle connectivity infrastructure. Firms dealing in automotive technologies have committed to supporting mobility service providers in the integration of cloud-connected telematics, predictive analytics, and advanced driver monitoring. The country's growing electric mobility initiatives are increasingly accelerating the readiness of SDVs, with South Africa poised to play a key enabling role in smart, software-defined mobility across the African continent.

Vehicle Type Insights

Passenger cars held 63.5% of the revenue share in the market in 2025, driven by rapid deployment across new passenger vehicles using software-defined platforms that allow for real-time data processing, enhanced connectivity, and over-the-air feature updates. Increasing consumer preference for personalized driving experiences and digitization of in-car ecosystems have accelerated the adoption of SDV technologies across the segment.

The commercial vehicles segment is expected to grow at a CAGR of 33.1% during the forecast period, driven by growing usage of fleet management platforms, predictive maintenance tools, and AI-enabled logistics systems that depend upon centralized vehicle software architectures. The market is shifting toward connected, data-driven logistics.

By Vehicle Type Market Share (%), 2025

Source: Straits Research

Technology Insights

In the year 2025, the segment of Advanced Driver Assistance Systems (ADAS) and Connectivity Solutions dominated the market with a revenue share of 41.8%. The reason for this was mainly the quick adoption of driver-assist technologies, real-time telematics, and connected infotainment systems that are all dependent on centralized software-defined architectures.

Artificial Intelligence and Machine Learning (AI/ML) segment is going to see the fastest expansion, with a CAGR of around 36.6% during the period of the forecast. The use of AI-based algorithms for predictive maintenance, autonomous decision making, and personalized vehicle experience is one of the main factors that is driving the strong growth.

Vehicle Architecture Insights

The segment Level 0: Mechanically Controlled Vehicle accounted for the maximum share of revenue, 38.5%, in the market in 2025, mainly due to the large pool of conventional vehicles still operational with minimal software integration, especially within developing markets where affordability and ease of maintenance remain strong purchasing factors.

The segment of Level 3–5: Highly Automated & Fully Software-Defined Vehicles is anticipated to see the fastest growth in the forecast period owing to the accelerated transition of the automotive industry towards autonomous and software-centric architectures.

Application Insights

Spurred by rapid advances in sensor fusion, AI algorithms, and real-time data analytics that significantly improve vehicle perception and decision-making, the Autonomous Driving segment is expected to grow at a CAGR of 28.4% during the forecast period of 2025-2034. Most global automakers and technology companies invest in R&D activities in regards to the development of self-driving platforms; therefore, huge demand for software-defined vehicle architecture capable of supporting autonomous functionalities is seen. In addition to this, there is improvement in the regulatory landscape regarding testing automated mobility, while expansion of smart city infrastructure accelerates the pace of autonomous driving applications in both passenger and commercial vehicles.

Competitive Landscape

The global software-defined vehicle market is considered moderately consolidated, with leading automotive manufacturers, cloud service providers, and software integration specialists combining to drive market growth. A few big players dominate the competition based on their in-depth technological know-how, strong ecosystem partnerships, and sizeable investments in connected mobility infrastructure.

The major industry players in the market include Amazon Web Services, Inc. (AWS), Aptiv PLC, General Motors Company, and others. Several of these companies have reportedly been focusing on strategic alliances, cloud-native vehicle platforms, and scalable software architectures to further their standing in the SDV ecosystem. For example, AWS is supporting automakers in deploying and managing in-vehicle applications via edge-to-cloud connectivity. Aptiv continues to develop centralized domain controller technologies for Level 4 and Level 5 architectures. General Motors, through its Ultifi software platform, is rewriting the in-car experience with real-time updates and feature-on-demand models. Collectively, these efforts are shaping the future of connected, intelligent, and software-defined mobility worldwide.

REE Automotive Ltd.: An emerging market player

REE Automotive Ltd. is an Israel-based automotive technology firm that develops modular software-defined platforms for vehicles. It has differentiated its offerings with complete by-wire electric truck solutions and the development of SDV architectures.

- In February 2025, REE unveiled its new P7-C softwaredefined electric truck built on the REE P7 platform at the NTEA Work Truck Week, offering a walk-through option and ride-and-drive for fleet customers.

Thus, REE Automotive, with its 2025 product launch of a commercially demonstrated SDV platform for fleets and advanced mobility, arose as one of the key players in the global market.

List of Key and Emerging Players in Software Defined Vehicle Market

- Tesla

- BMW Group

- Mercedes-Benz Group

- Volkswagen AG

- General Motors

- Ford Motor Company

- Hyundai Motor Company

- Toyota Motor Corporation

- Amazon Web Services, Inc

- General Motors Company

- Volvo Cars

- Audi AG

- Panasonic Automotive

- Aptiv PLC

- Intel

- Qualcomm Technologies

- Bosch Mobility Solutions

- Continental AG

- Aptiv PLC

- ZF Friedrichshafen AG

- Others

Strategic Initiatives

- August 2025: Hyundai Motor Group hosted its Pleos SDV Standard Forumwith 58 core partners (including suppliers like Bosch, HL Mando) to establish a softwarefirst ecosystem and supply chain roadmap for SDVs, marking a formal shift towards software-centric vehicle development.

- June 2025: Volvo Group and Daimler Truck AG launched their joint venture Coretura AB, aimed at developing a softwaredefined vehicle platform for commercial trucks and buses; the venture began operations “early June 2025” with the goal of stand-alone digital vehicle applications.

- May 2025: Tata Elxsi announced that it was selected by Mercedes Benz Research and Development India (MBRDI) for vehicle software engineering and SDV development, enabling next-gen SDV platforms across Mercedes Benz models

- January 2025: LG Electronics revealed its new Cross Domain Controller (xDC) platform, built around the Snapdragon Ride™ SoC and announced at CES 2025, as a unified vehicle controller combining In-Vehicle Infotainment (IVI) and ADAS into a single architecture.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 204.17 billion |

| Market Size in 2026 | USD 267.34 billion |

| Market Size in 2034 | USD 1926.83 billion |

| CAGR | 30.9% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Vehicle Type, By Technology, By Vehicle Architecture, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Software Defined Vehicle Market Segments

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Technology

- Service-Oriented Architecture (SOA)

- Cloud Connectivity and Edge Computing

- Domain Controllers and Centralized Computing

- Artificial Intelligence and Machine Learning

- Others

By Vehicle Architecture

- Level 0: Mechanically controlled vehicle

- Level1: E/E controlled vehicle

- Level 2: Software‑controlled vehicle

- Level3: Partial software‑defined vehicle

- Level 4: Full software‑defined vehicle

- Level 5: Software‑defined ecosystem

By Application

- Infotainment systems

- Advanced Driver Assistance Systems (ADAS)

- Autonomous driving

- Telematics

- Powertrain control

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.