Solar Photovoltaic Glass Market Size, Share & Trends Analysis Report By Product Technology (Anti-Reflective (AR) Coated Glass, Tempered Glass, Transparent Conductive Oxide (TCO) Glass, Patterned / Textured Glass, Others), By Module Type (Crystalline Silicon (c-Si) Modules, Thin-Film Modules, Perovskite Modules), By Application (Solar PV Panels, Building-Integrated PV, Agrivoltaics / Greenhouses, Automotive, Others), By End-user (Residential, Commercial, Industrial, Utilities) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Solar Photovoltaic Glass Market Overview

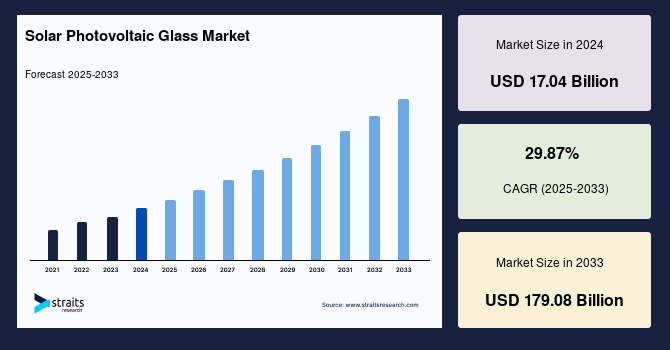

The global solar photovoltaic glass market size was valued at USD 17.04 billion in 2024 and is estimated to grow from USD 22.13 billion in 2025 to reach USD 179.08 billion by 2033, growing at a CAGR of 29.87% during the forecast period (2025–2033).

Solar Photovoltaic (PV) Glass is a specialized building material that integrates solar cells into glass panels to generate electricity from sunlight. It serves a dual purpose: allowing natural light to pass through while converting solar energy into power. Commonly used in windows, facades, and skylights, PV glass supports sustainable building designs and reduces dependence on traditional energy sources. It comes in various transparency levels, balancing aesthetics and energy efficiency. As the demand for green energy solutions surges, solar PV glass plays a crucial role in promoting eco-friendly infrastructure.

The global solar photovoltaic (PV) glass market is experiencing significant growth due to rising investments in renewable energy infrastructure across both developed and developing regions. Additionally, the continuous decline in the cost of solar modules and PV systems has made solar energy more accessible and financially viable, encouraging widespread adoption. Furthermore, the growing emphasis on sustainable construction practices has driven the integration of solar PV glass in energy-efficient buildings, supporting green building certifications and environmental goals. Net metering policies and favorable regulatory frameworks in various countries are also stimulating rooftop solar installations, thereby increasing the demand for high-quality, durable photovoltaic glass products.

Key Market Trends & Insights

- Based on product technology, the Tempered glasssegment held the highest market share of 42.8% in 2025.

- By Module Type, the Perovskite modulessegment is estimated to register the fastest CAGR growth of 10.1%.

- Based on application, the Solar PV panelscategory dominated the market in 2025 with a revenue share of 74.6%.

- Based on end user, the Commercial end-userssegment is projected to register the fastest CAGR of 7.6% during the forecast period.

Latest Market Trends

Development of Ultra-Thin and Lightweight Solar Glass Solutions

Technological advancements in ultra-thin and lightweight solar glass solutions are significantly shaping the global solar photovoltaic glass market. Manufacturers are focusing on developing thinner, more durable glass to meet the growing demand for high-efficiency solar panels across diverse applications.

- For instance, at SNEC 2024, JA Solar introduced lightweight n-type single-glass modules featuring a low-moisture permeability backsheet and a dust prevention design. These modules are particularly suitable for residential rooftop applications, offering enhanced water flow across the surface to prevent dust accumulation, thereby improving energy generation and operational stability.

Such innovations are not only enhancing performance but also reducing installation costs and structural load requirements, making solar solutions more accessible for residential, commercial, and industrial sectors worldwide.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 17.04 Billion |

| Estimated 2025 Value | USD 22.13 Billion |

| Projected 2033 Value | USD 179.08 Billion |

| CAGR (2025-2033) | 29.87% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | AGC Inc., Saint-Gobain S.A., Nippon Sheet Glass Co., Ltd., Guardian Glass, Xinyi Solar Holdings Limited |

to learn more about this report Download Free Sample Report

Solar Photovoltaic Glass Market Growth Factors

Supportive Government Incentives and Subsidies

Government incentives and subsidies promoting solar energy deployment are significantly driving the global solar photovoltaic (PV) glass market. Various countries are aggressively supporting solar energy projects to meet their carbon neutrality goals.

- For example, in 2022, the U.S. government expanded the Investment Tax Credit (ITC), offering a 30% tax credit for solar system installations through 2032, encouraging widespread adoption. Similarly, India's "PM Surya Ghar Muft Bijli Yojana," launched in 2024, aims to install rooftop solar panels in 10 million households, creating substantial demand for solar PV glass.

Subsidized loans, tax rebates, and feed-in tariffs across Europe and Asia are further pushing solar installations. These initiatives not only stimulate large-scale solar farms but also boost demand for advanced, durable PV glass essential for maximizing energy efficiency.

Market Restraining Factors

Fragility and Limited Mechanical Strength of Certain Types of Solar Glass

The fragility and limited mechanical strength of certain types of solar photovoltaic (PV) glass present a significant restraint for the market. Traditional solar glass, while effective in energy conversion, can be prone to cracking, shattering, or degradation under mechanical stress, extreme weather conditions, or during transportation and installation. This vulnerability raises maintenance and replacement costs, deterring widespread adoption, particularly in regions prone to harsh climates. Additionally, concerns about long-term durability impact consumer confidence and large-scale project investments. Manufacturers are investing in developing more robust and durable glass, but achieving the ideal balance between strength, efficiency, and cost remains a challenge.

Market Opportunities

Development of Next-Gen Perovskite and Bifacial Solar Cells

The development of next-generation perovskite and bifacial solar cells is creating significant opportunities for the solar photovoltaic (PV) glass market. Advanced PV glass is essential for improving efficiency, durability, and light absorption in these innovative technologies.

- For instance, in April 2024, Bluebird Solar introduced 600 Wp n-type TOPCon dual-glass bifacial modules with a power conversion efficiency of 23.25% in India. These modules feature a 16-busbar design and anti-reflective coatings to maximize sunlight absorption, making them highly suitable for high-temperature climates like India.

Such advancements underline the growing need for high-performance solar glass solutions. As demand for more efficient, longer-lasting solar panels increases globally, manufacturers focusing on specialty PV glass will find robust growth opportunities in the coming years.

Regional Analysis

Asia Pacific dominates the solar photovoltaic glass market due to surging renewable energy investments and government initiatives promoting solar energy adoption. Rapid urbanization, coupled with the growing construction of smart cities and green buildings, is fueling demand for advanced solar glass technologies. Expansion of manufacturing facilities and a strong focus on cost-efficient solar module production are supporting regional growth. Furthermore, rising environmental awareness and supportive feed-in tariff programs are accelerating the integration of photovoltaic glass across diverse applications.

India's Solar Photovoltaic Glass Market Trends

India's market is growing rapidly, fueled by government initiatives like the National Solar Mission. Companies such as Borosil Renewables are expanding their capacity to meet the surging demand for solar modules. The push for solar parks, rooftop installations, and green buildings is boosting the market, making India a significant player in the global solar glass landscape.

- China's solar photovoltaic glass market dominates globally, driven by large-scale solar farm projects and manufacturing excellence. Leading firms like Xinyi Solar and Flat Glass Group are expanding production to supply both domestic and export markets. Initiatives like China's 2060 carbon neutrality goal further accelerate demand, positioning the country as the world's largest producer and consumer of solar PV glass.

North America: Significantly Growing Region

The North American solar photovoltaic glass market is witnessing robust growth driven by aggressive renewable energy targets and large-scale solar installations. The rising adoption of solar energy in commercial and residential sectors, alongside advancements in energy-efficient building materials, is strengthening market expansion. Favorable policies supporting solar rooftop systems and increasing investments in grid modernization projects are further propelling demand. Technological innovations in smart solar glass and increased focus on net-zero building designs are also contributing significantly to regional market growth.

United States Solar Photovoltaic Glass Market Trends

The United States market for solar photovoltaic glass is witnessing strong growth, fueled by federal tax credits like the Investment Tax Credit (ITC) and state-level incentives. Projects such as the Gemini Solar Project in Nevada highlight the rising demand for high-efficiency solar glass. Increased BIPV installations in cities like New York and Los Angeles further boost market momentum.

- The Canada solar photovoltaic glass industry is expanding, driven by government initiatives like the Greener Homes Grant and net-zero building targets. Projects such as Alberta's Travers Solar Project, one of Canada's largest, showcase the growing need for advanced solar glass. Provinces like Ontario and Alberta are leading in adopting PV glass for commercial and residential solar applications.

Europe: Substantial Potential for Growth

Europe's solar photovoltaic glass market benefits from strong regulatory mandates for carbon neutrality and sustainable construction practices. The region's emphasis on integrating solar energy solutions into new and existing infrastructures is creating a strong demand for BIPV applications. Increasing R&D investments in high-transparency and anti-reflective solar glass technologies support market innovation. Additionally, the widespread adoption of energy-efficient renovations and growing participation in community solar projects are key factors driving the continuous expansion of the market across the region.

Uk Solar Photovoltaic Glass Market Trends

The UK solar photovoltaic glass industry is expanding rapidly, supported by the Smart Export Guarantee (SEG) scheme and net-zero carbon goals by 2050. Firms like Polysolar are advancing transparent solar glass technologies for commercial buildings. The integration of solar façades in projects like the Crystal Building in London highlights the growing application of PV glass.

- France's solar photovoltaic glass market is witnessing steady growth, fueled by initiatives like the "Plan Solaire," aiming for 45 GW of solar capacity by 2030. Companies such as Sunpartner Technologies are innovating with building-integrated PV (BIPV) glass solutions. Increased solar panel installations in public infrastructure and new housing developments further boost market demand.

Product Technology Insights

Tempered glass dominated the market with a revenue share of 42.8% in 2025, owing to its high mechanical strength, durability, and thermal stability. Tempered glass is widely used in both rooftop solar and utility-scale projects, as it provides shatter resistance and low breakage rates, ensuring a long operational life. As solar installations increasingly adopt double-sided panel technologies, tempered glass continues to gain preference. Additionally, national renewable initiatives encouraging high-efficiency solar adoption, particularly in the Asia-Pacific and Europe regions, further support the tempered glass segment across both industrial and residential deployments.

Transparent Conductive Oxide (TCO) glass is the fastest-growing segment and is anticipated to register a CAGR of 7.4% in 2025. Its growth is primarily driven by its use in thin-film solar cells, where it functions as a clear layer that also conducts electricity. Manufacturing improvements and better access to TCO materials (like ITO and AZO) are boosting panel efficiency. Moreover, the rise of building-integrated PV (BIPV) systems and smart glass solutions in commercial real estate is boosting TCO glass demand due to its dual role in power generation and light control.

Module Type Insights

Crystalline silicon modules held the largest market share of 78.5% in 2025, driven by their superior efficiency, stability, and cost-effectiveness. Solar glass used in c-Si modules, including tempered and AR-coated variants, is highly standardised, making them the preferred choice for large-scale solar parks and rooftop installations. The growing adoption of high-efficiency monocrystalline modules, driven by automation and economies of scale in manufacturing, has further solidified their market dominance.

Perovskite modules are projected to grow at the fastest rate, with a CAGR of 10.1% through 2034. The rapid advancements in glass encapsulation technologies are enabling perovskite solar cells to approach commercial viability. Perovskite layers are highly sensitive to environmental conditions, and specialised PV glass with precise barrier properties is crucial for moisture and UV protection. Their lightweight and flexible applications in portable solar and agrivoltaics are also fuelling growth.

Application Insights

Solar PV panels lead the market, accounting for a 74.6% market share in 2025. The massive deployment of utility-scale solar farms and increasing rooftop installations globally have led to high demand for anti-reflective and tempered glass in standard panels. The move towards distributed energy and the continually falling cost of solar energy (LCOE) encourage major bulk purchases by utility companies, businesses, and homeowners, ensuring the segment’s dominance.

The Building-Integrated PV (BIPV) segment is expected to witness the fastest CAGR of 9.2%, driven by greater emphasis on energy-positive architecture and net-zero building policies. PV glass, when integrated directly into building structures such as facades, windows, and skylights, meets both energy needs and aesthetic goals. As architecture firms and green building initiatives increasingly adopt this dual-purpose glass, demand is surging, particularly in Europe and Southeast Asia.

End User Insights

Utilities held the dominant market position with a 51.8% share in 2025, primarily driven by their huge investments in solar farms and large-scale grid projects. Demand for high-strength tempered and anti-reflective glass is concentrated in these utility-scale procurement programs. Utility companies are rapidly expanding solar capacity through long-term contracts (PPAs) to meet renewable energy quotas and decarbonization goals, fueling a stable, high volume of deployment.

Commercial end-users are projected to grow at the fastest rate of 7.6% CAGR, driven by surging interest in rooftop solar for warehouses, retail spaces, and corporate campuses. Demand for durable, lightweight glass solutions in BIPV and building-mounted PV systems is increasing as organisations seek to reduce energy bills and achieve ESG compliance. Incentives such as federal tax credits in the U.S. and clean energy funds in the EU are encouraging commercial properties to install PV glass systems as part of energy retrofits, significantly promoting the adoption of solar PV glass.

Company Market Share

Companies in the solar photovoltaic glass market are focusing on expanding production capacities, investing in advanced manufacturing technologies, and enhancing product efficiency through research and development. They are also forming strategic partnerships, acquiring specialized firms, and exploring innovations like ultra-thin, anti-reflective, and bifacial-compatible glass. Additionally, firms are strengthening their global distribution networks and targeting emerging markets to capitalize on the growing demand for renewable energy solutions and green building initiatives.

List of Key and Emerging Players in Solar Photovoltaic Glass Market

- AGC Inc.

- Saint-Gobain S.A.

- Nippon Sheet Glass Co., Ltd.

- Guardian Glass

- Xinyi Solar Holdings Limited

- Flat Glass Group Co., Ltd.

- Borosil Renewables Limited

- Sisecam Group

- Interfloat Corporation

- Taiwan Glass Industry Corporation

Recent Developments

- January 2025 – Borosil Renewables Limited, a leading producer of solar glass, announced plans to boost its manufacturing capacity by 50%. With this expansion, the company's daily production will rise from 1,000 tons to 1,500 tons. The move comes in response to challenges faced by India’s solar glass industry, particularly the influx of low-cost solar glass from Chinese-owned firms.

Analyst Opinion

As per our analyst, the global solar photovoltaic glass market is poised for robust growth, driven by accelerating investments in renewable energy and the push for sustainable construction practices. Governments across regions are increasingly mandating solar adoption, creating a favorable policy environment for PV glass manufacturers. Technological advancements in ultra-thin, high-efficiency solar glass are also opening new application avenues, particularly in building-integrated photovoltaics (BIPV) and smart cities.

However, challenges such as high initial investment costs, raw material price volatility, and durability concerns of certain solar glass types could slightly hinder the market's pace. Despite these hurdles, the long-term outlook remains highly positive. Continuous innovation, coupled with expanding solar capacity targets and rising awareness of green energy solutions, is expected to outweigh the challenges, ensuring a steady demand for advanced solar PV glass products globally over the coming years.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 17.04 Billion |

| Market Size in 2025 | USD 22.13 Billion |

| Market Size in 2033 | USD 179.08 Billion |

| CAGR | 29.87% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Technology, By Module Type, By Application, By End-user |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Solar Photovoltaic Glass Market Segments

By Product Technology

- Anti-Reflective (AR) Coated Glass

- Tempered Glass

- Transparent Conductive Oxide (TCO) Glass

- Patterned / Textured Glass

- Others

By Module Type

- Crystalline Silicon (c-Si) Modules

- Thin-Film Modules

- Perovskite Modules

By Application

- Solar PV Panels

- Building-Integrated PV

- Agrivoltaics / Greenhouses

- Automotive

- Others

By End-user

- Residential

- Commercial

- Industrial

- Utilities

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Akanksha Yaduvanshi

Research Analyst

Akanksha Yaduvanshi is a Research Analyst with over 4 years of experience in the Energy and Power industry. She focuses on market assessment, technology trends, and competitive benchmarking to support clients in adapting to an evolving energy landscape. Akanksha’s keen analytical skills and sector expertise help organizations identify opportunities in renewable energy, grid modernization, and power infrastructure investments.