Spinning Machinery Market Size, Share & Trends Analysis Report By Machine Type (Ring Spinning Machine, Rotor Spinning Machine (Open-End Spinning), Air-Jet Spinning Machine, Friction Spinning Machine, Others), By Operation Type (Automatic, Semi-Automatic, Manual), By Material Type (Natural Fibers (Cotton, Wool), Synthetic Fibers (Polyester, Nylon), Blended Fibers), By End-Use Industry (Apparel & Fashion, Home Textiles, Industrial Textiles, Medical Textiles, Automotive Textiles, Others), By Spinning Process (Short Staple Spinning, Long Staple Spinning), By Sales Channel (Direct Sales, Distributors & Dealers, Online Channels), By Regions (North America, Europe, Asia-Pacific, Latin America, The Middle East and Africa) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Spinning Machinery Market Overview

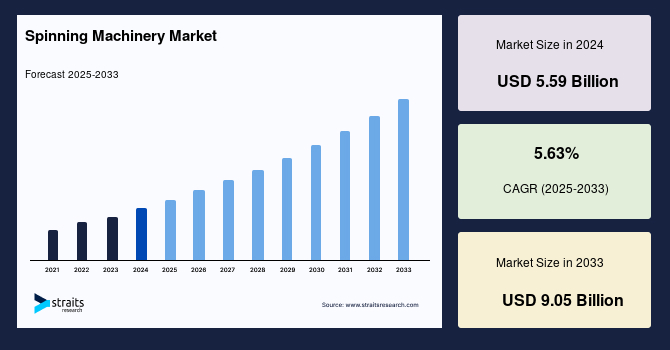

The global spinning machinery market size was valued at USD 5.59 billion in 2024 and is projected to grow from USD 5.88 billion in 2025 to reach USD 9.05 billion by 2033, growing at a CAGR of 5.63% during the forecast period (2025–2033). The market is driven by rising demand for high-quality yarns, rapid modernization of textile industries, adoption of energy-efficient and automated machinery, growing technical textile applications, and supportive government policies promoting sustainable and advanced manufacturing solutions.

Key Market Insights

- Asia-Pacific held the largest market share, over 50% of the global spinning machinery industry.

- By Machine Type, the air-jet spinning machine segment is expected to witness the fastest CAGR of 5.23%.

- By Operation Type, the automatic segment held the highest market share of over 40%.

- By Material Type, the natural fibers segment held the highest market share of over 45%.

- By End-Use Industry, the industrial textiles segment is expected to witness the fastest CAGR of 5.58%.

- By the Spinning Process, the long staple spinning segment is expected to witness the fastest CAGR of 4.98%.

- By Sales Channel, the online channels segment is expected to witness the fastest CAGR of 5.45%.

Market Size & Forecast

- 2024 Market Size: USD 5.59 billion

- 2033 Projected Market Size: USD 9.05 billion

- CAGR (2025-2033): 5.63%

- Largest market in 2024: Asia-Pacific

- Fastest-growing region: Europe

Spinning machinery refers to equipment used to convert fibers into yarn or thread, forming the backbone of the textile manufacturing process. It includes machines for carding, drawing, roving, and spinning, capable of handling natural fibers like cotton and wool, as well as synthetic fibers. These machines are widely applied in textile mills, technical textile production, and industrial yarn manufacturing. They ensure consistent yarn quality, optimize production efficiency, and support large-scale textile operations across apparel, home textiles, and specialty fiber industries.

The market is driven by increasing investments in sustainable manufacturing practices, stringent energy efficiency regulations, and the demand for high-performance and specialized yarns in industrial and technical textiles. Opportunities exist in expanding markets for eco-friendly fibers, recycled textiles, and advanced filament production. Moreover, governments’ initiatives to modernize textile infrastructure, along with the establishment of textile parks and green industrial zones, are creating favorable conditions for growth, enabling manufacturers to offer innovative solutions and capture new market segments worldwide.

Market Trend

Rising adoption of automated and digitally controlled spinning machines

The global spinning machinery market is undergoing a shift toward automation and digital control as manufacturers prioritize efficiency, precision, and reduced labor dependence. Automated systems streamline the spinning process, ensuring consistent yarn quality while minimizing human error. This trend aligns with growing demand for cost-effective and scalable textile production worldwide.

Furthermore, the integration of digitally controlled machinery supports smart manufacturing practices. Features such as real-time monitoring, predictive maintenance, and advanced data analytics enhance operational performance. By adopting these technologies, textile companies can optimize productivity, reduce downtime, and remain competitive in a rapidly evolving market where innovation drives long-term sustainability.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 5.59 Billion |

| Estimated 2025 Value | USD 5.88 Billion |

| Projected 2033 Value | USD 9.05 Billion |

| CAGR (2025-2033) | 5.63% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Key Market Players | Rieter Holding AG, Saurer Intelligent Technology AG, Lakshmi Machine Works Ltd. (LMW), Truetzschler Group, Marzoli Machines Textile S.r.l. |

to learn more about this report Download Free Sample Report

Market Drivers

Rising Global Demand for Textiles and Apparel

The global spinning machinery market is being driven by the rising demand for textiles and apparel across both developed and emerging economies. Increasing consumer preference for fashion, home textiles, and technical fabrics is boosting production requirements, encouraging manufacturers to adopt efficient and high-capacity spinning technologies.

- A clear example of this demand surge can be seen in India, where textile and apparel exports (including handicrafts) grew by nearly 7% in April–October FY 2024-25, reaching USD 21.35 billion, compared to about USD 20 billion in the same period last year. Ready-Made Garments (RMG) led the segment with around 41% share, followed by cotton and man-made textiles.

This rising global consumption trend continues to fuel investments in modern spinning machinery.

Market Restraint

Substantial Upfront Costs and Volatility in Raw Material Prices

The global spinning machinery market faces restraints due to the substantial upfront costs associated with advanced machinery. High investment requirements often deter small and medium-sized manufacturers from upgrading to automated or digitally controlled systems, slowing adoption rates. This financial barrier limits modernization, especially in emerging markets with tighter capital availability.

Moreover, volatility in raw material prices, particularly cotton and synthetic fibers, creates uncertainty in production planning and profitability. Fluctuating input costs make it challenging for textile companies to maintain consistent margins, thereby reducing their willingness to invest heavily in new machinery. These factors collectively constrain the market’s overall growth potential.

Market Opportunity

Technological Advancements

The global market for spinning machinery is witnessing significant growth opportunities driven by continuous technological advancements. Manufacturers are increasingly focusing on developing machines that enhance productivity, reduce energy consumption, and support sustainable operations. Automation and digitalization are playing a key role in optimizing production efficiency while maintaining consistent product quality.

- For instance, in February 2025, Saurer showcased its latest innovations, including the Zinser 51 ring-spinning machine and the Autocoro 11 automated rotor-spinning machine at the Egypt Stitch & Tex 2025 exhibition. These machines can process a wide range of fibers, from long staple cotton to short recycled materials, ensuring high output with minimal labor requirements.

Such innovations highlight the market’s potential for integrating advanced technologies and driving long-term growth.

Regional Analysis

Asia-Pacific leads the global market for spinning machinery, which is driven by rapid industrialization, urbanization, and a strong emphasis on energy-efficient manufacturing. Countries in this region are investing heavily in upgrading their textile industries with advanced spinning technologies to meet the growing demand for high-quality yarns. The adoption of automation and smart manufacturing practices is enhancing productivity and reducing operational costs. Moreover, favorable government policies and initiatives to promote the textile sector are further fueling the growth of the spinning machinery market in Asia-Pacific, solidifying its position as the dominant force in the global market.

China’s spinning machinery industry is characterized by a robust manufacturing sector and significant investments in textile machinery. Companies like Jingwei Textile Machinery Co., Ltd. and JWELL Extrusion Machinery Co., Ltd. are at the forefront, offering a wide range of yarn-spinning machines, including blow room lines, cotton carding, draw frames, and ring spinning machines. These companies are pivotal in meeting the domestic demand for high-quality yarns and contributing to China's position as a global textile manufacturing hub.

India’s spinning machinery industry is experiencing growth due to the expansion of the textile industry and increasing demand for high-quality yarns. Companies such as Lakshmi Machine Works Ltd (LMW) and Piotex are leading the way in manufacturing spinning machinery. LMW offers end-to-end textile solutions with innovation, quality, and performance, while Piotex provides a range of spinning machinery catering to various textile production needs. These companies are instrumental in supporting India's textile manufacturing sector.

Europe Market Trends

Europe is experiencing significant growth, fueled by the demand for high-quality yarns and the adoption of advanced manufacturing technologies. Manufacturers in this region are focusing on producing energy-efficient and automated spinning machines to meet the evolving needs of the textile industry. The emphasis on sustainability and eco-friendly production processes is driving innovation in spinning machinery. Moreover, the presence of established textile clusters and a skilled workforce is contributing to the growth of the spinning machinery industry in Europe, making it a key player in the global market.

The UK spinning machinery industry is evolving, with companies focusing on innovation and meeting the demands of the textile industry. Firms are investing in advanced technologies to enhance the efficiency and quality of spinning machinery. The market is characterized by a shift towards automation and sustainable practices, aligning with global trends in textile manufacturing. These developments are positioning the UK as a competitive player in the European market.

Germany’s spinning machinery industry is robust, with companies like Trützschler Group SE leading the way in manufacturing machines and installations for the spinning and nonwovens industry. Trützschler is recognized as a technology market leader in spinning preparation in the cotton and man-made fiber sectors. The country's emphasis on high-quality textile manufacturing and technological innovation contributes to its significant share in the European spinning machinery market.

Machine Type Insights

Ring spinning machines dominate the global market for spinning machinery due to their versatility and ability to produce high-quality yarn with consistent strength and uniformity. These machines efficiently handle a wide variety of fibers, including cotton and blended materials, making them suitable for multiple end-use industries. Their robust design, combined with advancements in automation and digital controls, allows manufacturers to achieve higher productivity while reducing operational downtime, solidifying their position as the preferred choice in modern spinning mills.

Operation Type Insights

Automatic spinning machines lead the market because they significantly enhance production efficiency and reduce labor dependency. These machines integrate advanced controls, monitoring systems, and automated processes that minimize human intervention, ensuring consistent yarn quality and higher output. By streamlining operations, automatic machines also reduce errors and energy consumption, making them highly cost-effective for large-scale spinning facilities. Their ability to handle diverse fibers and meet industry standards positions them as the dominant choice in contemporary textile manufacturing.

Material Type Insights

Natural fibers, particularly cotton and wool, dominate the market for spinning machinery due to their widespread demand in apparel and home textiles. These fibers are preferred for their softness, comfort, and breathability, making them essential for high-quality textiles. Spinning machines are increasingly optimized to process natural fibers efficiently, accommodating variations in fiber length and quality. Rising consumer preference for natural, sustainable, and eco-friendly fabrics further reinforces their dominant position in the global market.

End-Use Industry Insights

The apparel and fashion sector remains the dominant end-use industry for spinning machinery, driven by the continuous demand for high-quality fabrics. Fast-changing fashion trends, increasing consumer spending, and the rise of fast fashion have fueled the need for versatile yarn production. Spinning machines catering to apparel manufacturing are designed for efficiency, consistency, and adaptability to various fibers. This sector’s scale and demand for premium textiles make it a key driver of market growth.

Spinning Process Insights

Short staple spinning dominates the market as it is highly suitable for cotton and other natural fibers commonly used in textiles. This process efficiently produces fine, uniform yarn for apparel, home textiles, and industrial fabrics. Advances in ring and rotor spinning machines have enhanced short staple yarn quality, reduced waste, and improved operational speed. Its adaptability, cost-effectiveness, and compatibility with high-volume production make short staple spinning the preferred choice for manufacturers worldwide.

Sales Channel Insights

Direct sales dominate the market for spinning machinery as manufacturers prefer to engage directly with buyers to ensure product customization, after-sales support, and service reliability. This channel allows suppliers to offer tailored solutions, technical guidance, and timely maintenance, strengthening client relationships. Direct sales also enable competitive pricing and faster delivery of technologically advanced machines. By building trust and ensuring operational efficiency, direct sales remain the most effective and preferred channel for spinning machinery distribution globally.

Company Market Share

The global spinning machinery market share is moderately consolidated, with leading players focusing on technological innovation and market expansion to strengthen their positions. Companies are investing in high-speed, energy-efficient, and automated spinning machines to meet growing demand from the textile and technical fiber sectors. Emphasis is also placed on sustainable production processes, IoT integration for smart manufacturing, and customization to cater to niche markets.

Rieter Holding AG: Founded in 1795, Rieter Holding AG is a Swiss-based global leader in textile machinery and systems. Specializing in spinning solutions, the company designs and manufactures high-speed, energy-efficient machines for both natural and synthetic fibers. Rieter serves textile manufacturers worldwide, providing complete spinning systems from fiber processing to yarn production. The company emphasizes innovation, automation, and sustainability, integrating digital solutions for smart manufacturing.

- In May 2025, Rieter announced its acquisition of Barmag from OC Oerlikon Corporation AG for approximately CHF 810 million. This strategic move aims to strengthen Rieter's position in the filament and man-made fiber segments, enhancing its technological capabilities and market reach. The acquisition is expected to contribute to Rieter's growth strategy and market leadership.

List of Key and Emerging Players in Spinning Machinery Market

- Rieter Holding AG

- Saurer Intelligent Technology AG

- Lakshmi Machine Works Ltd. (LMW)

- Truetzschler Group

- Marzoli Machines Textile S.r.l.

- Toyota Industries Corporation

- Murata Machinery Ltd. (Muratec)

- Savio Machine Tessili S.p.A.

- Jingwei Textile Machinery Co., Ltd.

- Zhejiang Tatian Co., Ltd.

- Jiangsu Jinlong Machinery

- Electro-Jet S.A.

- SSM Scharer Schweitzer Mettler AG

- Perfect Equipements

- T.E. Enterprises

- Veejay Lakshmi Engineering Works Ltd.

- TMT Machinery, Inc.

- Pacific Associates

- Bhagat Textile Engineers Pvt. Ltd.

- Zhejiang Rifa Textile Machinery Co., Ltd.

Recent Development

- In September 2025, Savio's AI-driven innovations, including the Proxima Smartconer, Phoenix assembly winder, and Lybra Smartspinner, were showcased at ITMA Asia Singapore 2025. These machines feature real-time monitoring, adaptive automation, precision yarn preparation, and digital integration, highlighting the industry's move towards smart manufacturing solutions.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 5.59 Billion |

| Market Size in 2025 | USD 5.88 Billion |

| Market Size in 2033 | USD 9.05 Billion |

| CAGR | 5.63% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Machine Type, By Operation Type, By Material Type, By End-Use Industry, By Spinning Process, By Sales Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Spinning Machinery Market Segments

By Machine Type

- Ring Spinning Machine

- Rotor Spinning Machine (Open-End Spinning)

- Air-Jet Spinning Machine

- Friction Spinning Machine

- Others (e.g., Vortex, Electrostatic)

By Operation Type

- Automatic

- Semi-Automatic

- Manual

By Material Type

- Natural Fibers (Cotton, Wool, etc.)

- Synthetic Fibers (Polyester, Nylon, etc.)

- Blended Fibers

By End-Use Industry

- Apparel & Fashion

- Home Textiles

- Industrial Textiles

- Medical Textiles

- Automotive Textiles

- Others

By Spinning Process

- Short Staple Spinning

- Long Staple Spinning

By Sales Channel

- Direct Sales

- Distributors & Dealers

- Online Channels

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.