Stationary Catalytic Systems Market Size, Share & Trends Analysis Report By System Type (Selective Catalytic Reduction (SCR) systems, Oxidation catalytic systems, Reforming and process catalysts, Three-way and multi-functional catalytic systems, Others), By Catalyst Material (Precious metal-based catalysts, Base metal catalysts, Zeolite-based catalysts, Other advanced catalyst formulations), By End-use Industry (Power generation, Oil & gas refining and petrochemicals, Chemical manufacturing, Cement, metals, and mining, Pulp & paper and other heavy industries), By Application (NOx reduction, VOC and CO oxidation, Sulfur compound control, Process efficiency enhancement) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Stationary Catalytic Systems Market Overview

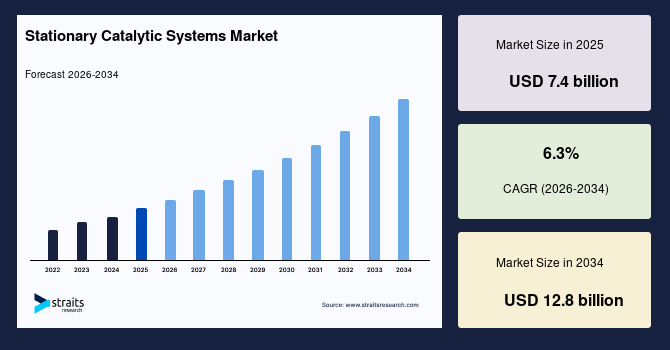

The global stationary catalytic systems market size is valued at USD 7.4 billion in 2025 and is projected to reach USD 12.8 billion by 2034, expanding at a CAGR of 6.3% during the forecast period. The market growth is primarily driven by tightening environmental regulations, rising industrial emissions control requirements, continuous advancements in catalyst materials, and increasing adoption of cleaner industrial processes across power generation, chemicals, refining, and manufacturing sectors.

Key Market Trends & Insights

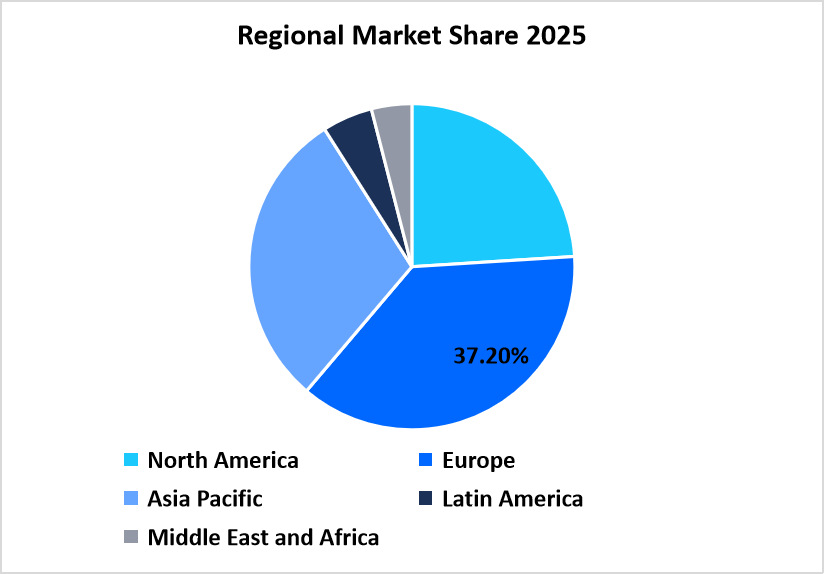

- Europe dominated the market with a revenue share of 37.2% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 7.8% during the forecast period.

- Based on System Type, the Selective catalytic reduction systems segment held the highest market share of 47.4% in 2025.

- By Catalyst Material, the Zeolite-based catalysts segment is estimated to register the fastest CAGR growth of 7.4%.

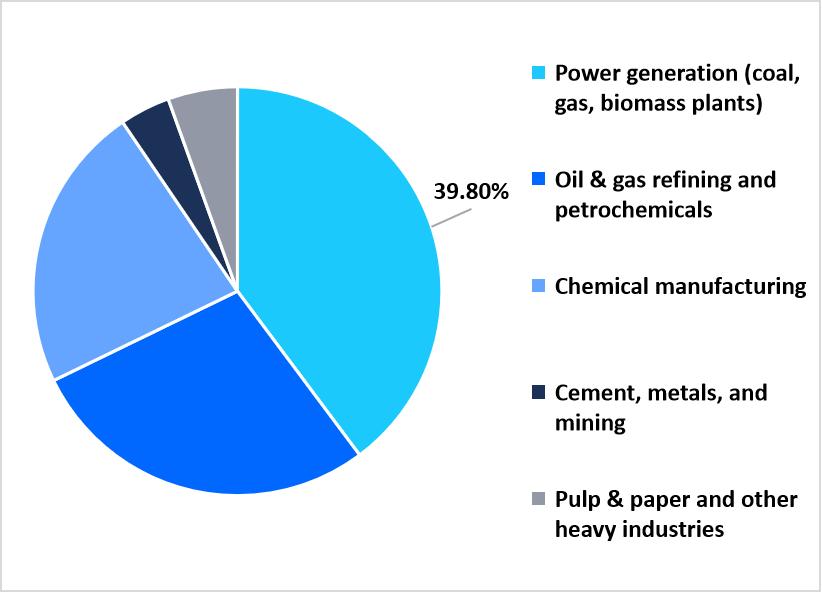

- Based on End-use Industry, the Power generation category dominated the market in 2025 with a revenue share of 39.8%.

- Based on Application, the VOC and CO oxidation segment is projected to register the fastest CAGR of 7.2% during the forecast period.

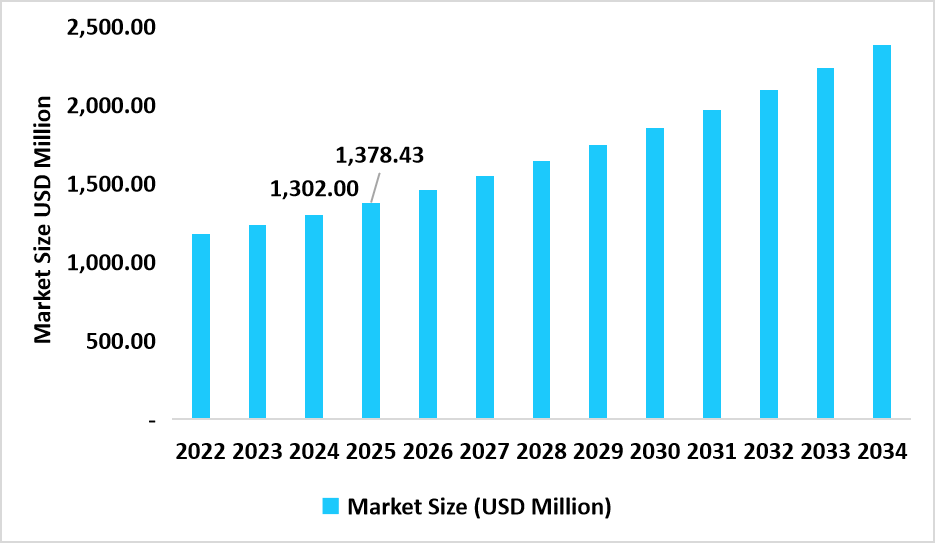

- Germany dominates the market, valued at USD 1,302.00 million in 2024 and reaching USD 1,378.43 million in 2025.

Germany Stationary Catalytic Systems Market Size (USD Million)

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 7.4 billion

- 2034 Projected Market Size: USD 12.8 billion

- CAGR (2026-2034): 6.3%

- Dominating Region: Europe

- Fastest-Growing Region: Asia Pacific

The stationary catalytic systems market covers fixed catalytic solutions used for emission control and chemical processing in stationary industrial sources. These systems include selective catalytic reduction (SCR), oxidation catalysts, reforming catalysts, and other catalytic units deployed in power plants, refineries, chemical production facilities, cement kilns, and large industrial boilers. Their core purpose is to reduce harmful emissions such as nitrogen oxides (NOx), sulfur compounds, volatile organic compounds (VOCs), and carbon monoxide, while improving process efficiency and regulatory compliance. Market growth is supported by stricter air-quality standards, industrial modernisation, ongoing catalyst innovation, and increased investments in sustainable and low-emission industrial infrastructure.

Latest Market Trends

Stricter Emission Regulations Driving Advanced Catalytic Adoption

Stricter environmental regulations are a major force shaping the stationary catalytic systems market. Governments are enforcing tighter limits on NOx, SO₂, and VOC emissions from power plants, refineries, and large industrial facilities. To meet these requirements, industries are increasingly adopting advanced catalytic systems, rather than relying solely on conventional filtration or thermal treatments. As emission standards become more demanding, operators are upgrading or retrofitting existing systems with advanced SCR and oxidation catalysts, driving steady replacement demand and long-term market growth.

Integration of Catalytic Systems with Digital Monitoring and Optimisation

Digital integration is transforming how stationary catalytic systems are designed and operated. Industrial users are combining catalysts with sensors, real-time monitoring platforms, and predictive analytics to optimise performance and extend catalyst lifespan. These tools enable continuous tracking of emissions, temperatures, and catalyst degradation, thereby reducing downtime and enhancing regulatory compliance. As smart manufacturing and automation gain traction, digital-enabled catalytic systems are becoming increasingly attractive, improving lifecycle efficiency and creating differentiation for equipment suppliers that offer integrated monitoring and service solutions.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 7.4 billion |

| Estimated 2026 Value | USD 7.85 billion |

| Projected 2034 Value | USD 12.8 billion |

| CAGR (2026-2034) | 6.3% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | BASF SE, Johnson Matthew, Clariant AG, Haldor Topsoe, Honeywell International (UOP) |

to learn more about this report Download Free Sample Report

Market Drivers

Rising Industrialisation and Power Generation Capacity

Growing industrial activity and expansion of power generation capacity are key drivers of the stationary catalytic systems market. Emerging economies are investing in power plants, refineries, cement facilities, and chemical complexes to support economic development and urbanisation. These new installations require effective emission control technologies from the outset. In developed regions, ageing infrastructure is being upgraded to improve efficiency and meet stricter environmental standards. Both new construction and modernisation projects rely heavily on catalytic systems, ensuring consistent demand.

Technological Advancements in Catalyst Materials

Advances in catalyst materials are strengthening the performance and cost efficiency of stationary catalytic systems. Manufacturers are developing catalysts that operate effectively at lower temperatures, resist poisoning, and maintain activity over longer service intervals. These improvements reduce operating and maintenance costs while expanding applicability across different industrial processes. As technology continues to improve, catalytic systems offer greater value through improved efficiency and reduced total cost of ownership, encouraging adoption across both large-scale and cost-sensitive industrial sectors.

Market Restraint

High Initial Investment and Maintenance Costs

High capital and maintenance costs remain a major restraint for the stationary catalytic systems market. Large-scale installations require significant upfront investment in catalyst materials, system integration, and installation. Ongoing expenses related to catalyst replacement, monitoring, and maintenance further increase lifecycle costs. These financial barriers can delay adoption, especially for smaller operators or facilities with limited budgets. In regions with weaker regulatory enforcement or restricted access to financing, companies may opt for short-term compliance solutions rather than full catalytic upgrades. Cost concerns can therefore slow market penetration despite strong regulatory and environmental drivers.

Market Opportunity

Growth in Retrofit and Aftermarket Services

The large global base of existing industrial facilities creates significant opportunities for retrofit and aftermarket services. Many plants are upgrading emission control systems to comply with evolving regulations without replacing entire installations. Retrofitting catalytic systems offers a cost-effective path to improved compliance and efficiency. In addition, ongoing demand for catalyst replacement, regeneration, performance monitoring, and optimisation services provides recurring revenue for suppliers. These aftermarket activities strengthen long-term customer relationships and support stable market growth by extending the value of catalytic systems throughout their operational life.

Regional Analysis

Europe dominated the market in 2025, accounting for 37.20% market share, supported by strict environmental regulations, mature industrial infrastructure, and early adoption of emission control technologies. The region has long enforced stringent limits on NOx, SOx, and VOC emissions across power generation, refining, cement, and chemical industries, driving sustained demand for advanced catalytic solutions. Ageing industrial facilities across Western Europe further support demand for retrofitting and replacement. Continuous investment in cleaner industrial operations and compliance-focused upgrades is expected to sustain moderate growth, reinforcing Europe’s position as the dominant regional market.

- Germany is the leading country in Europe due to its large industrial base, advanced power generation sector, and strong regulatory enforcement. The country’s chemical, refining, and manufacturing industries extensively deploy stationary catalytic systems to comply with national and EU emission standards. High engineering capabilities and continuous investments in process optimisation support the adoption of advanced catalyst technologies.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 7.8% from 2026 to 2034, driven by rapid industrialisation, expanding power generation capacity, and tightening emission regulations. Countries across the region are increasing investments in air pollution control to address urban air quality concerns and align with international environmental commitments. New coal, gas, and industrial plants are increasingly equipped with catalytic systems at the design stage, accelerating market expansion.

- China leads the Asia Pacific market due to its scale of industrial activity and aggressive environmental enforcement. The government’s focus on reducing industrial emissions has driven large-scale deployment of SCR and oxidation catalysts across power plants, refineries, and chemical facilities. Continued capacity additions and upgrades to older plants sustain strong demand, positioning China as the central contributor to regional growth.

Source: Straits Research

North America Stationary Catalytic Systems Market Insights

North America represents a high-value market characterised by strong regulatory oversight, advanced industrial operations, and steady investment in emission control technologies. The region is supported by the modernisation of power generation assets and compliance-driven upgrades in refining and chemical industries. Emphasis on operational efficiency and emission monitoring encourages the adoption of high-performance catalytic systems. Overall, the market is expected to grow, driven by replacement demand and incremental capacity expansion, rather than new large-scale installations.

- The United States dominates the North American market due to its large installed base of power plants and industrial facilities. Federal and state-level emission standards compel utilities and manufacturers to maintain advanced catalytic systems. Ongoing investments in gas-fired power plants and industrial retrofits support consistent demand, while technological upgrades improve catalyst performance and lifespan.

Latin America Market Insights

Latin America presents steady growth prospects. Industrial expansion, urbanisation, and the gradual tightening of environmental regulations are supporting the adoption of stationary catalytic systems. Power generation, cement, and refining sectors are the primary contributors to demand, particularly in larger economies. Growth is supported by infrastructure development and increasing awareness of industrial emission control, although budget constraints and uneven enforcement slow adoption in some markets.

- Brazil is the leading country in Latin America due to its large industrial base and expanding power generation sector. Increasing environmental oversight and modernisation of industrial facilities are driving demand for catalytic systems. Investments in refining and chemical production further support market growth, positioning Brazil as the regional anchor market.

Middle East and Africa Market Insights

The Middle East and Africa is a smaller but strategically important market. Oil & gas refining, petrochemical operations, and power generation in Gulf countries primarily drive demand. The increasing focus on environmental compliance and efficiency improvements supports a gradual adoption. The region is expected to grow, driven by industrial diversification and modernisation initiatives, particularly in energy-intensive economies.

- Saudi Arabia leads the MEA region due to its extensive refining and petrochemical capacity. Ongoing investments in cleaner production processes and emission control infrastructure support the adoption of stationary catalytic systems. National sustainability initiatives and industrial upgrades strengthen long-term demand, making the country a key driver of growth within the region.

System Type Insights

Selective catalytic reduction systems dominated the market with a revenue share of 47.4% in 2025, driven by their proven effectiveness in reducing nitrogen oxide emissions from power plants and large industrial boilers. SCR systems are widely deployed in coal- and gas-fired power generation, cement kilns, and refinery units where regulatory limits on NOx emissions are increasingly stringent. Their ability to achieve high removal efficiencies while operating at industrial-scale volumes makes them the preferred technology for meeting compliance requirements.

Oxidation catalytic systems are the fastest-growing system type, projected to expand at a CAGR of approximately 7.1% during the forecast period. These systems are increasingly used for controlling carbon monoxide and volatile organic compounds in industrial exhaust streams. Growth is supported by rising adoption in gas turbines, chemical plants, and industrial furnaces, where VOC control is becoming a regulatory priority.

Catalyst Material Insights

Precious metal-based catalysts hold the largest share of the market, accounting for approximately 42.5% of revenue in 2025. These catalysts are valued for their high catalytic activity, durability, and effectiveness across a wide range of temperatures. Industries with strict emission limits, such as petrochemicals and power generation, prefer precious metal catalysts for their reliability and long service life. Despite higher material costs, their superior performance and lower replacement frequency support continued adoption.

Zeolite-based catalysts are emerging as the fastest-growing material segment, with an expected CAGR of around 7.4% through 2034. Their strong thermal stability and resistance to poisoning make them suitable for modern industrial operations with variable load conditions. Increasing use in advanced SCR systems and next-generation emission control technologies supports growth.

By End-use Industry Market Share (%), 2025

Source: Straits Research

End-use Industry Insights

Power generation remains the largest end-use industry, accounting for approximately 39.8% of total market revenue in 2025. Large-scale fossil fuel and biomass power plants rely heavily on stationary catalytic systems to meet emission regulations for NOx and other pollutants. Ageing power infrastructure in developed regions and new capacity additions in emerging economies both contribute to steady demand.

Chemical manufacturing is the fastest-growing end-use segment, projected to expand at a CAGR of 7.6% over the forecast period. Increasing production of speciality chemicals, fertilisers, and industrial gases requires advanced emission control and process optimisation solutions. Catalytic systems are used not only for emission reduction but also to enhance reaction efficiency and consistency of output. Stricter environmental oversight and expansion of chemical capacity in the Asia Pacific are key growth factors.

Application Inssights

NOx reduction represents the largest application segment, accounting for nearly 46% of the market revenue in 2025. Regulatory emphasis on reducing nitrogen oxide emissions from stationary sources has made NOx control the primary function of catalytic systems. SCR technology remains central to compliance strategies across the power generation and heavy industry sectors. The segment is forecast to grow, driven by ongoing regulatory tightening and mandatory emission reporting.

VOC and CO oxidation applications are growing fastest, with an estimated CAGR of 7.2%. Industrial air-quality standards increasingly target organic emissions due to their environmental and health impacts. Expansion of chemical processing, coatings, and manufacturing facilities is accelerating demand for oxidation catalysts.

Competitive Landscape

The stationary catalytic systems market is moderately consolidated, characterised by a mix of legacy global leaders, diversified industrial manufacturers, and specialised providers of catalyst technology. Established companies dominate the market through long-standing expertise in catalyst chemistry, strong R&D capabilities, and deep integration with power generation, refining, and chemical industries. These players benefit from long-term supply contracts, regulatory know-how, and the ability to deliver customised solutions for complex industrial applications. Mid-tier and regional firms compete by offering cost-competitive systems, faster project execution, and localised service support, particularly in emerging markets.

Clariant Catalysts: A Technology-Focused Innovator

Clariant Catalysts has strengthened its position in the stationary catalytic systems market by focusing on advanced emission control technologies for the power generation, refining, and chemical processing industries. Its core strengths include proprietary catalyst formulations, strong application engineering, and a focus on improving catalyst efficiency and lifespan. Clariant primarily serves industrial operators seeking high-performance, regulation-compliant solutions rather than low-cost alternatives. Its model emphasises close technical collaboration with clients and continuous innovation, differentiating it from volume-focused suppliers.

Latest News:

- In October 2025, Clariant’s chromium-free HySat catalyst won "Best Catalyst Technology" at the 2025 Gulf Energy Excellence Awards for its sustainability and safety profile.

List of Key and Emerging Players in Stationary Catalytic Systems Market

- BASF SE

- Johnson Matthew

- Clariant AG

- Haldor Topsoe

- Honeywell International (UOP)

- R. Grace & Co.

- Umicore

- Mitsubishi Chemical Corporation

- Hitachi Zosen Corporation

- Cormetech

- Shell Catalysts & Technologies

- DuPont

- Axens

- Sinopec Catalyst Co.

- Johnson Controls (industrial catalyst solutions)

- Heraeus Holding

- Zeeco

- Yara International (industrial catalysts)

- KBR Inc.

- Tenneco (stationary emission solutions)

- Cataler Corporation

- Tianhe Chemicals

- Nippon Ketjen

- Albemarle Corporation

- JGC Catalysts and Chemicals

Strategic Initiatives

- December 2025 - BASF announced a major production expansion in Ludwigshafen (slated for 2026) for its X3D® 3D-printed catalysts, which drastically improve NOx reduction efficiency and reduce pressure drop in stationary reactors.

- November 2025 - Topsoe was named "Catalyst Producer of the Year" at ERTC 2025, specifically for their SiliconTrap™ and TK-3000 series catalysts for renewable and fossil feedstocks.

- May 2025 - Honeywell completed the acquisition of Johnson Matthey’s Catalyst Technologies business for £1.8 billion. This moved JM’s stationary and refinery catalyst assets under the Honeywell UOP umbrella.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 7.4 billion |

| Market Size in 2026 | USD 7.85 billion |

| Market Size in 2034 | USD 12.8 billion |

| CAGR | 6.3% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By System Type, By Catalyst Material, By End-use Industry, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Stationary Catalytic Systems Market Segments

By System Type

- Selective Catalytic Reduction (SCR) systems

- Oxidation catalytic systems

- Reforming and process catalysts

- Three-way and multi-functional catalytic systems

- Others

By Catalyst Material

- Precious metal-based catalysts

- Base metal catalysts

- Zeolite-based catalysts

- Other advanced catalyst formulations

By End-use Industry

- Power generation

- Oil & gas refining and petrochemicals

- Chemical manufacturing

- Cement, metals, and mining

- Pulp & paper and other heavy industries

By Application

- NOx reduction

- VOC and CO oxidation

- Sulfur compound control

- Process efficiency enhancement

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.