Stockbroking Market Size, Share & Trends Analysis Report By Service Type (Execution, Advisory, Discretionary), By Trading Type (Short-term Trading, Long-term Trading), By Broker Type (Full-service Brokers, Discount Brokers, Online Brokers, Robo-Advisors), By Mode (Online, Offline), By End-User (Retail Investor, Institutional Investor) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Stockbroking Market Size

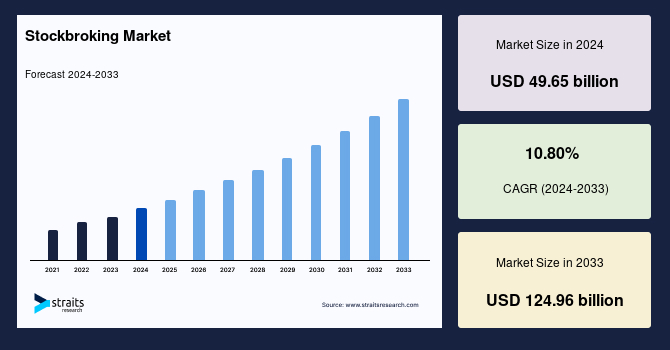

The global stockbroking market size was valued at USD 49.65 billion in 2024 and is expected to grow from USD 55.01 billion in 2025 to reach USD 124.96 billion by 2033, growing at a CAGR of 10.80% during the forecast period (2025-2033).

Stockbroking is the process of buying and selling financial securities, such as stocks, bonds, and derivatives, through brokerage firms and trading platforms. It plays a vital role in financial markets by connecting investors with trading opportunities. Over the years, technological advancements have transformed stockbroking, shifting from traditional human brokers to online and algorithmic trading, making transactions faster, more efficient, and cost-effective.

Regulatory bodies, including the U.S. Securities and Exchange Commission (SEC), the UK's Financial Conduct Authority (FCA), and India's Securities and Exchange Board (SEBI), enforce transparency, fairness, and investor protection. The market witnessed a surge in retail trading during the COVID-19 pandemic, fueled by commission-free platforms like Robinhood and investment trends influenced by social media.

Moreover, the rise of ESG (Environmental, Social, and Governance) investing and growing interest in cryptocurrency trading have reshaped market dynamics. However, challenges such as market volatility, regulatory scrutiny, and cybersecurity threats remain significant concerns. Looking ahead, AI-driven trading strategies, blockchain integration for enhanced security, and the increasing adoption of robo-advisors are set to redefine the industry.

The table below shows the top 10 largest stock exchanges globally by market capitalization (November 2024)

| Rank | Stock Exchange | Country/Region | Market Capitalization (in USD million) |

|---|---|---|---|

| 1 | New York Stock Exchange (NYSE) | USA | 31,649,898.66 |

| 2 | NASDAQ | USA | 30,128,325.47 |

| 3 | Shanghai Stock Exchange (SSE) | China | 7,170,382.22 |

| 4 | Japan Exchange Group (Tokyo Stock Exchange) | Japan | 6,400,158.03 |

| 5 | Euronext | Pan-European | 5,687,221.75 |

| 6 | National Stock Exchange of India (NSE) | India | 5,245,474.11 |

| 7 | Shenzhen Stock Exchange (SZSE) | China | 4,672,988.34 |

| 8 | Hong Kong Exchanges and Clearing (HKEX) | Hong Kong | 4,373,121.89 |

| 9 | TMX Group (Toronto Stock Exchange) | Canada | 3,573,335.19 |

| 10 | Saudi Exchange (Tadawul) | Saudi Arabia | 2,664,791.34 |

Source: WFE - The World Federation of Exchanges

The table above ranks the world's largest stock exchanges based on market capitalization, with the New York Stock Exchange (NYSE) and NASDAQ in the United States leading the list, followed by major exchanges in China, Japan, India, and Europe. A higher market capitalization reflects a larger number of listed companies and greater investment activity, which drives higher trade volumes and enhances investor participation. This strengthens the stockbroking market by increasing demand for brokerage services and trading platforms.

The presence of well-established stock exchanges across different regions fosters global investment, encouraging cross-border trading and the expansion of brokerage services. Moreover, as emerging markets such as India and Saudi Arabia continue to grow, stockbroking firms have significant opportunities to expand their offerings, enhance technological capabilities, and cater to the evolving needs of investors.

Exclusive Market Trend

Increasing Robo-Advisory Platforms

The rapid expansion of robo-advisory platforms is revolutionizing the stockbroking market by making investment management more accessible, data-driven, and cost-effective. These platforms cater to retail investors by offering personalized investment strategies, automated portfolio management, and real-time market insights.

- For instance, in November 2024, SoFi Technologies, Inc., a leading digital financial services provider, launched an advanced robo-advisor platform in partnership with BlackRock Inc. (BLK). This expansion enhances automated investment offerings and provides a seamless user experience.

As a result, brokerage firms are increasingly integrating robo-advisory solutions to attract a broader client base, enhance portfolio management efficiency, and provide investors with a seamless, technology-driven trading experience.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 49.65 Billion |

| Estimated 2025 Value | USD 55.01 Billion |

| Projected 2033 Value | USD 124.96 Billion |

| CAGR (2025-2033) | 10.80% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Zerodha Broking Ltd., Charles Schwab & Co., Inc., NinjaTrader, Tethys Technology, MetaQuotes Ltd |

to learn more about this report Download Free Sample Report

Stockbroking Market Growth Factors

Rising Retail Investor Participation

The democratization of investing through digital trading platforms and commission-free trading has fueled a surge in retail investor participation. Social media and online financial education have further empowered individual investors, enabling them to make more informed investment decisions. This shift has significantly boosted market liquidity and driven demand for innovative, user-friendly trading tools.

- For instance, according to Forbes, retail investors' share of total equities trading volume hit a record 23% between January 25 and February 1, 2024.

In response, brokerage firms are continuously enhancing their digital offerings by integrating advanced analytics, real-time market insights, AI-powered recommendations, and seamless commission-free trading models. These innovations are helping attract and retain retail investors, further accelerating the growth of the market.

Favorable Government Policies and Frameworks

Governments worldwide are introducing investor-friendly policies and regulatory frameworks to drive digitalization, lower transaction costs, and enhance investor protection. These efforts aim to create a more secure, transparent, and accessible trading environment, attracting both retail and institutional investors.

- For instance, in February 2025, the Securities and Exchange Board of India (SEBI) issued a circular facilitating retail investor participation in algorithmic trading. Under this framework, retail investors will only have access to approved algorithms from registered brokers, ensuring greater transparency and investor security.

Such advancements are expected to increase retail participation, enhance liquidity, and promote transparency in algorithmic trading, ultimately fostering long-term market growth.

Market Restraint

Cybersecurity Risks

With the rise of online trading, brokerage firms face increasing risks from cyber-attacks such as data breaches, phishing, and ransomware. High-profile incidents have exposed security vulnerabilities, leading to stricter regulations and compliance requirements. Moreover, any breach can result in financial losses, reputational damage, and regulatory penalties, making cybersecurity a critical concern.

- For example, in January 2025, the U.S. Securities and Exchange Commission (SEC) fined 12 firms over USD 63 million for failing to maintain and preserve electronic communications, underscoring the need for robust cybersecurity measures. Such breaches erode investor trust, escalate compliance costs, and hinder market growth.

Market Opportunity

Growing Focus on Sustainable Investing

As sustainability becomes a key priority for investors, Environmental, Social, and Governance (ESG) investing is creating new opportunities in the stockbroking industry. Investors are increasingly seeking ethical and sustainable investment products that align with global sustainability goals, driving demand for ESG-compliant securities.

- For instance, a Deutsche Bank AG survey conducted between April 2024 and June 2024 revealed that 51% of respondents planned to increase their share of sustainable investments in their portfolios over the next five years.

This shift is prompting brokerage firms to offer a wider range of ESG-focused investment products, integrate sustainability metrics into their platforms, and provide research-driven insights to help investors make informed, sustainable investment decisions.

Regional Insights

North America: Dominant Region with Approximately 48.44% Market Share

North America, particularly the U.S., leads the global stockbroking market due to its highly developed financial infrastructure, vast market capitalization, and strong institutional presence. The U.S. is home to major stock exchanges such as the New York Stock Exchange (NYSE) and NASDAQ, which collectively facilitate trillions of dollars in daily trading activity. The presence of leading brokerage firms such as Goldman Sachs, Morgan Stanley, and Charles Schwab enhances market depth by offering diverse investment services, including algorithmic trading, wealth management, and commission-free brokerage options. Moreover, the rise of fintech platforms and regulatory advancements supporting retail investing have further strengthened market growth.

United States Stockbroking Industry Trends

The U.S. dominates the global stockbroking market, driven by major exchanges such as the New York Stock Exchange (NYSE) and NASDAQ. As of December 2024, NYSE remains the world’s largest exchange, with a market capitalization of USD 31.65 trillion, followed by NASDAQ at USD 30.13 trillion. These exchanges facilitate global investment, attracting institutional and retail investors with advanced trading platforms, deep liquidity, and innovative financial products.

Asia-Pacific: Rapidly Growing Region

Asia-Pacific is experiencing rapid growth in the global stockbroking market, driven by digital transformation, expanding financial markets, and increasing retail investor participation. Countries like China, India, and Japan are at the forefront of this surge, with mobile-first trading platforms and fintech innovations making investing more accessible. Rising smartphone penetration, improved internet connectivity, and government-led financial inclusion programs have further accelerated market expansion.

- For instance, in 2023, the Shanghai Stock Exchange reached a market capitalization of USD 7.3 trillion, reflecting strong institutional strength and liquidity.

Japanese Market Trends

Japan remains a major global stock market participant, anchored by the Tokyo Stock Exchange (TSE), part of the Japan Exchange Group (JPX). As of November 2024, TSE holds a market capitalization of USD 6.40 trillion, ranking third in Asia. The exchange is home to leading global corporations, including Toyota, Sony, and SoftBank. Driven by technological advancements and export-driven industries, Japan's stockbroking market continues to play a vital role in the global economy.

Countries Insights

- India: India’s stock market has experienced significant growth, led by the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). As of November 2024, NSE holds a market capitalization of USD 5.25 trillion, while BSE follows at USD 4.80 trillion. The rise of retail investors, digital trading platforms, and government policies promoting financial inclusion have fueled market expansion. With a young, tech-savvy investor base, India is emerging as one of the world’s top five stock markets.

- UK: The London Stock Exchange remains a key global financial center, supporting international investments. As of December 2024, LSE’s market capitalization stands at USD 4.40 trillion, hosting major multinational corporations such as HSBC and Shell. As a leading European stock exchange, LSE plays a crucial role in global capital markets. The UK’s strong regulatory framework and deep financial expertise continue to attract institutional investors, maintaining its influence in global stockbroking.

- Saudi Arabia: Saudi Arabia’s stock market, led by the Saudi Exchange (Tadawul), is the largest in the Middle East. As of November 2024, Tadawul’s market capitalization stands at USD 2.66 trillion, driven by major state-owned companies such as Saudi Aramco. The government’s Vision 2030 initiative is enhancing market transparency, attracting foreign investments, and expanding financial markets. With a focus on economic diversification, Saudi Arabia is strengthening its position as a regional financial powerhouse.

Segmentation Analysis

By Service Type

The execution segment holds the largest market share, driven by the expansion of electronic trading platforms and increasing retail investor participation. This segment focuses on executing trades without offering advisory services or portfolio management. The rise of algorithmic trading, commission-free models, and low-cost brokerage services has further strengthened its dominance. Moreover, platforms like Robinhood have revolutionized trade execution by eliminating commissions, making trading more accessible and cost-efficient, thereby accelerating growth in this segment.

By Trading Type

Short-term trading leads the global market due to its ability to capitalize on swift market movements and liquidity. This segment benefits from real-time market analysis and algorithmic trading tools, enabling traders to maximize returns through frequent transactions. With approximately 70% of equity capital held as non-tradable and an additional 20% as long-term investments, only about 10% remains actively available for trading, increasing competition in short-term strategies. This demand for immediate returns drives high trading volumes and market volatility.

By Broker Type

Discount brokers dominate the market due to their cost-effective services and user-friendly online platforms. They attract value-conscious investors by providing commission-free or low-cost trade execution without advisory fees. The shift towards self-directed trading and the growth of mobile investing apps have fueled the expansion of this segment. As market deregulation and technological advancements continue, discount brokers are reshaping the industry, offering seamless digital experiences and broadening access to financial markets for retail and institutional investors alike.

By Mode

The online trading segment leads the market, driven by rapid digitalization and investor preference for speed and convenience. Advanced web-based platforms and mobile applications provide real-time data, seamless execution, and enhanced security features. Widespread internet penetration and shifting investor behavior toward self-directed trading have further boosted adoption. Online trading has become the preferred mode for both retail and institutional investors, significantly increasing transaction volumes and reshaping brokerage services with AI-driven analytics and automated trading strategies.

By End-User

Retail investors hold the largest market share, fueled by the accessibility of digital trading platforms and growing financial literacy. The democratization of investing, led by commission-free brokers and online educational resources, has empowered individuals to trade independently. Retail investors benefit from real-time market insights, algorithmic tools, and greater control over their investments. Their active participation is reshaping brokerage services, increasing competition, and driving innovation in trading platforms, ultimately enhancing market liquidity and broadening financial market participation.

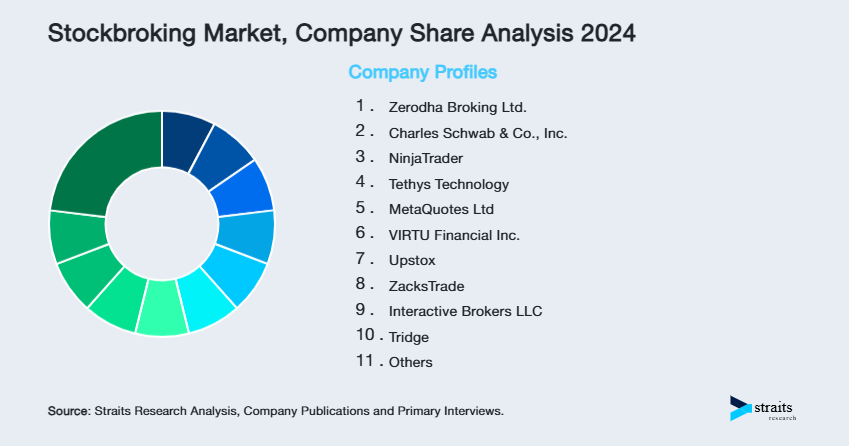

Company Market Share

Leading firms in the global market are leveraging advanced technologies, strategic partnerships, and acquisitions to strengthen their market presence. The integration of artificial intelligence (AI), algorithmic trading, and robo-advisory services is enhancing efficiency and attracting a wider investor base.

Revolut: An Emerging Player in the Global Stockbroking Market

Revolut is rapidly emerging as a digital-first stockbroker, revolutionizing the industry with its seamless mobile platform and commission-free trading model. By integrating traditional equities, ETFs, and cryptocurrencies into a unified ecosystem, it offers instant execution, real-time analytics, and cost-effective investment products. Its customer-centric approach, coupled with effortless access to international markets, challenges traditional brokerage firms.

Recent Developments:

- In November 2024, Revolut Trading achieved a major milestone by obtaining a UK trading license from the Financial Conduct Authority. This transition from an appointed representative to a fully authorized investment firm enables Revolut to offer UK-listed shares, enhancing its investment services. With over 650,000 UK customers, the license sets the stage for expanded trading functionality and future plans to introduce UK and EU stocks and ETFs by 2025.

List of Key and Emerging Players in Stockbroking Market

- Zerodha Broking Ltd.

- Charles Schwab & Co., Inc.

- NinjaTrader

- Tethys Technology

- MetaQuotes Ltd

- VIRTU Financial Inc.

- Upstox

- ZacksTrade

- Interactive Brokers LLC

- Tridge

- Axis Direct

- E-Trade

- FMR LLC

- Angel One Limited

- Revolut

- Groww Invest Tech Pvt. Ltd.

- Others

to learn more about this report Download Market Share

Recent Developments

- March 2025 – Virtu Financial, Inc. launched Virtu Technology Solutions (VTS), a product suite designed to provide sell-side broker-dealers access to its advanced execution and workflow technology. This initiative strengthens Virtu’s position in the stockbroking market by expanding its client base among broker-dealers, increasing demand for its technology-driven solutions, and driving revenue growth.

- February 2025 – Vanguard expanded its fixed-income offerings by introducing two new ETFs: the Vanguard Ultra-Short Treasury ETF (VGUS) and the Vanguard 0-3 Month Treasury Bill ETF (VBIL). These ETFs provide investors with enhanced short-term liquidity solutions, bridging the gap between money market funds and ultra-short bonds. By diversifying its fixed-income portfolio, Vanguard strengthens its position in the evolving stockbroking landscape.

Analyst Opinion

As per our analyst, the market is experiencing significant growth, driven by rapid digitalization, evolving regulatory landscapes, and shifting investor behavior. The rise of zero-commission trading platforms and discount brokers has intensified competition, forcing traditional brokerage firms to innovate through technology integration and value-added services.

Despite these positives, the global stockbroking market faces several challenges. Regulatory changes, such as stricter compliance requirements and evolving taxation policies, continue to shape industry dynamics. Market volatility, influenced by macroeconomic factors, geopolitical tensions, and interest rate fluctuations, affects trading volumes and revenue stability.

However, the future remains promising. Stockbroking firms that successfully leverage AI-driven analytics, expand into diversified financial products, and enhance customer engagement through personalized digital experiences will maintain a competitive edge.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 49.65 Billion |

| Market Size in 2025 | USD 55.01 Billion |

| Market Size in 2033 | USD 124.96 Billion |

| CAGR | 10.80% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Service Type, By Trading Type, By Broker Type, By Mode, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Stockbroking Market Segments

By Service Type

- Execution

- Advisory

- Discretionary

By Trading Type

- Short-term Trading

- Long-term Trading

By Broker Type

- Full-service Brokers

- Discount Brokers

- Online Brokers

- Robo-Advisors

By Mode

- Online

- Offline

By End-User

- Retail Investor

- Institutional Investor

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Tejas Zamde

Research Associate

Tejas Zamde is a Research Associate with 2 years of experience in market research. He specializes in analyzing industry trends, assessing competitive landscapes, and providing actionable insights to support strategic business decisions. Tejas’s strong analytical skills and detail-oriented approach help organizations navigate evolving markets, identify growth opportunities, and strengthen their competitive advantage.