Sustainable Manufacturing Market Size, Share & Trends Analysis Report By Technology (Advanced Process Controls, Renewable Energy Integration, IoT & Smart Manufacturing Platforms, 3D Printing, AI & Predictive Analytics), By Application (Semiconductor Fabrication, Assembly & Packaging, Testing & Quality Assurance, Electronics Manufacturing Services), By Industry Vertical (Automotive, Aerospace and Defense, Electronics and Semiconductors, Chemicals and Materials, Food and Beverage, Textiles and Apparel, Pharmaceuticals, Other Industry Verticals) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Sustainable Manufacturing Market Overview

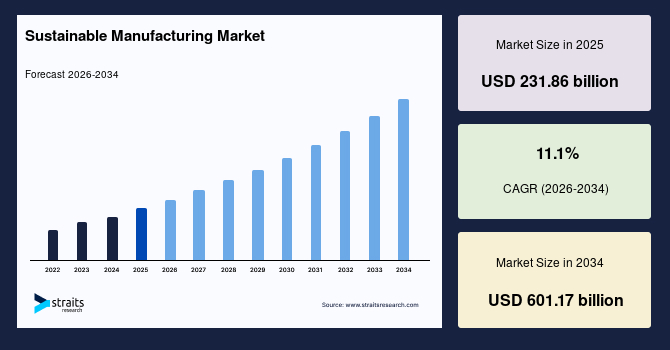

The global sustainable manufacturing market size is valued at USD 231.86 billion in 2025 and is estimated to reach USD 601.17 billion by 2034, growing at a CAGR of 11.1% during the forecast period. The market is experiencing accelerated expansion as manufacturers progressively integrate energy-efficient production methods amid the increasing use of renewable power within industrial operations. There has been a shift toward adopting digitally enabled manufacturing systems, which is structurally reshaping production models. This helps improve resource efficiency and enables alignment with long-term sustainability and regulatory objectives.

Key Market Trends & Insights

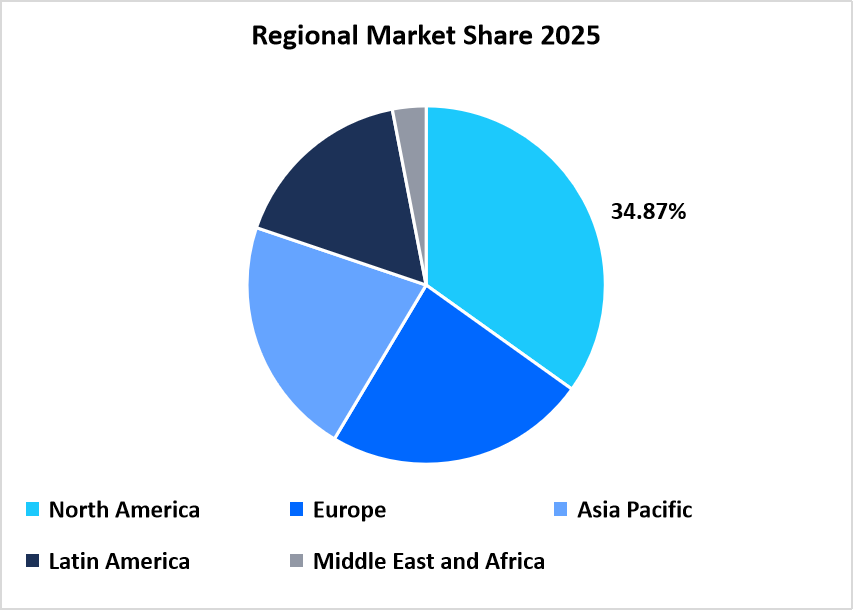

- North America dominated the market with a revenue share of 34.87% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 12.46% during the forecast period.

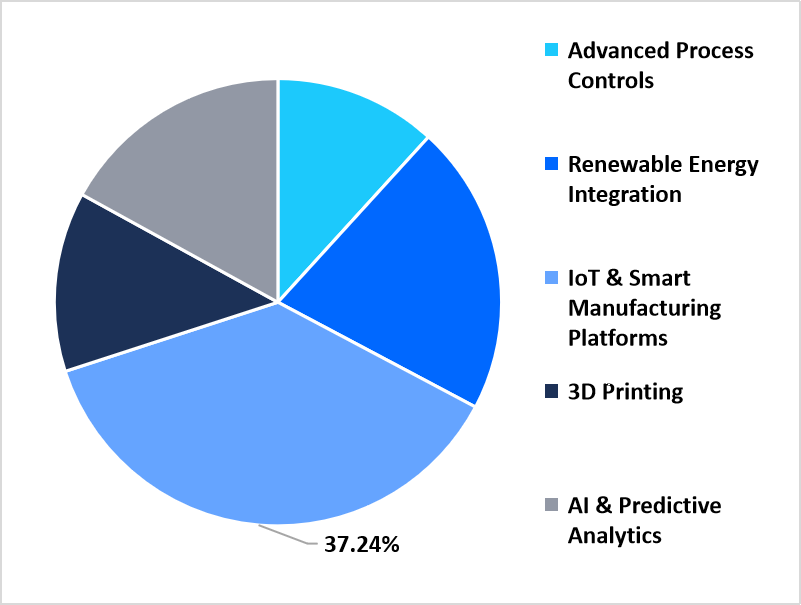

- By technology, the IoT & smart manufacturing platforms segment held the largest market share of 37.24% in 2025.

- By application, the semiconductor fabrication segment dominated the market in 2025, accounting for a market share of 36.67%.

- By industry vertical, the electronics and semiconductors segment is projected to grow at a CAGR of 11.84% during the forecast period.

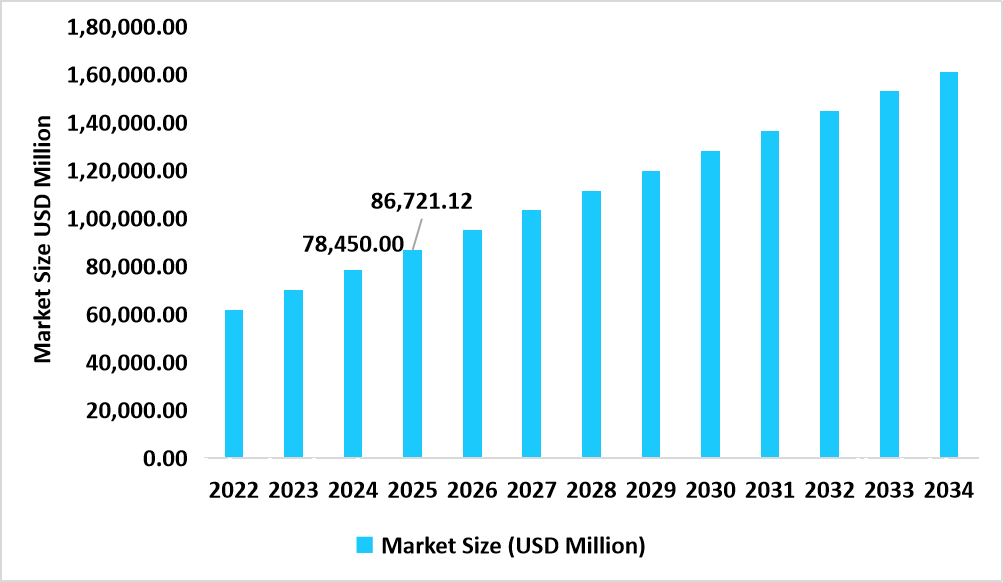

- The US leads the global sustainable manufacturing market, valued at USD 78.45 billion in 2024, and is projected to reach USD 86.72 billion in 2025.

Table: U.S Sustainable Manufacturing Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 231.86 Billion

- 2034 Projected Market Size: USD 601.17 Billion

- CAGR (2026-2034): 11.1%

- Dominating Region: North America

- Fastest-growing Region: Asia Pacific

The global sustainable manufacturing market encompasses a comprehensive range of technologies and practices to minimize environmental impact and optimize resource efficiency across industrial production. These include advanced process controls, renewable energy integration, IoT, smart manufacturing platforms, 3D printing, and AI-driven predictive analytics. They are designed to enhance productivity and reduce waste and emissions. Sustainable manufacturing applications span semiconductor fabrication, assembly and packaging, testing and quality assurance, and electronics manufacturing services that drive eco-efficient transformation across industries. Sustainable manufacturing solutions are being adopted across multiple verticals, such as automotive, aerospace & defense, electronics and semiconductors, chemicals and materials, food & beverage, textiles and apparel, and pharmaceuticals. Thus, companies worldwide are progressing toward operational resilience, regulatory compliance, and long-term environmental sustainability.

Latest Market Trends

Transition from Linear Production to Circular Value Chains

Manufacturing is moving away from conventional linear models of production into circular value ecosystems. This is because manufacturers are emphasizing the reuse, remanufacturing, and recycling of materials. Designs aim for longevity, while modular component architectures facilitate easier recovery and reassembly. The trend is further enforced by growing regulatory pressure on extended producer responsibility and a rising consumer preference for low-carbon and sustainable products. The integration of circular economic frameworks reduces cost, increases brand equity, and marks resource independence as a priority. This is bringing a structural transition in global industrial strategies.

Integration of AI and Digital Twins toward Green Optimization

Artificial Intelligence, machine learning, and digital twin technologies are essentially changing the ways of sustainability with real-time monitoring and predictive optimization of energy consumption, emissions, and waste output. Digital twins virtually replicate factory operations that let manufacturers simulate scenarios, identify inefficiencies, and deploy energy efficient configurations without disrupting physical production. This intelligent automation supports compliance with global environmental standards and accelerates the achievement of net-zero manufacturing goals through precise, data-driven sustainability management.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 231.86 billion |

| Estimated 2026 Value | USD 257.66 billion |

| Projected 2034 Value | USD 601.17 billion |

| CAGR (2026-2034) | 11.1% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | 3M, Braskem, Cirba Solutions, NatureWorks LLC, Schneider Electric |

to learn more about this report Download Free Sample Report

Market Drivers

Government-led Decarbonization Principles Accelerating Sustainable Manufacturing Adoption

Rapidly implemented decarbonization frameworks and green industrial policies are significant drivers contributing to the growth of the sustainable manufacturing market. Governments in the European Union, the US, China, and India offer broad-based carbon pricing, green tax incentives, and industrial emission caps to fast-track the shift toward low-carbon production. The EU's Fit for 55 package and the US Inflation Reduction Act are investing heavily in renewable-powered manufacturing facilities and clean technology innovations. Such initiatives drive industries to adopt sustainable manufacturing technologies and make compliance economically favorable, hence bringing strong policy-backed growth momentum.

Market Restraints

Insufficient Infrastructure to Support the Circular Economy

Despite strong interest in policy, most emerging economies still lack the infrastructure required for a circular manufacturing ecosystem, including waste recovery, material recycling, and closed-loop logistics systems. According to UNIDO, more than 60% of industrial waste in developing regions is set to land in landfill sites due to inadequate facilities for recycling and remanufacturing. This infrastructural gap limits manufacturers in attaining end-to-end sustainability and deters investments in large-scale projects for circular manufacturing.

Market Opportunity

Supply Chain Reconfiguration around Sustainability Performance

An emerging opportunity lies in the restructuring of manufacturing supply chains based on sustainability performance metrics. Large manufacturers are increasingly evaluating suppliers on cost, delivery, environmental footprint, material efficiency, and process transparency. This shift is creating opportunities for manufacturers who are demonstrating measurable sustainability outcomes at the process and facility levels. As sustainability criteria become embedded in procurement frameworks, companies with advanced sustainable manufacturing capabilities are gaining preferential access to long-term contracts and strategic partnerships.

Regional Analysis

North America accounted for the largest market share of 34.87% in 2025, driven by the extensive use of energy-efficient infrastructure for manufacturing and protocols for sustainable production at different key industrial hubs in the US and Canada. Collaborative industry consortia and multi-company sustainability initiatives drive the fast-tracked deployment of circular material flows, renewable-powered factories, and eco-efficient assembly lines. The increasing corporate ESG commitments also push the adoption of sustainable manufacturing practices across industries in North America.

Industry-led green certification programs and voluntarily set targets for reducing emissions are driving growth in the US sustainable manufacturing market. For instance, zero-waste-to-landfill and advanced water recycling have already been achieved in many industrial parks in 2024, thereby minimizing environmental footprints considerably. Closed-loop material recovery and energy-efficient cleanrooms are increasingly being integrated by leading companies engaged in the manufacturing of electronics and semiconductors. This further improves their brand reputation and investor confidence, thereby driving up the US market growth.

Asia Pacific Market Insights

Asia Pacific is expected to emerge as the fastest-growing region, with a CAGR of 12.46% from 2026 to 2034, driven by the rapid industrial expansion of countries such as China, India, South Korea, and Taiwan. Regional sustainability programs and industrial clusters are being targeted at low-emission technologies in countries such as India and Malaysia. Smart factory networks and renewable-powered manufacturing hubs are being built in China and South Korea. Regional initiatives on sustainable production methods, private sector investments, and awareness will lead to increased adoption of sustainable manufacturing solutions throughout the Asia Pacific region.

The Indian sustainable manufacturing market is growing rapidly through industrial modernization programs and eco-efficiency grants for SMEs and large enterprises. Major electronics and automotive manufacturers are setting up renewable energy-powered plants, recovering waste heat, and using circular material usage frameworks. Private consultancies support companies in carbon footprint audits and green process certifications to further accelerate the wide dispersal of eco-friendly manufacturing practices. These programs, along with supportive private networks, are preparing India to become a growth hub in the global sustainable manufacturing market.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

The market in Europe shows stable growth in sustainable manufacturing, driven by strict environmental policies and industrial decarbonization initiatives across major economies. Such environmental policies keep focusing on the increasing integration of renewable energies, consequently ensuring energy efficiency in production and circular material flows. This necessitates the development of eco-conscious behavior among manufacturers. Collaborative networks between industrial associations and green technology providers help accelerate the deployment of sustainable solutions for the automotive, electronics, and chemical industries, thus supporting consistent market growth.

The growth of the Germany sustainable manufacturing market is driven by the Industry 4.0 Green Initiative, which merges smart factory solutions with renewable energy and low-emission production technologies. The utilization of closed-loop recycling systems, digital energy monitoring, and waste-to-resource technologies by leading companies in the automotive and semiconductor industries puts them on par with the EU environmental mandates. These are further supported by regional innovation clusters and private sustainability funds that enhance operational efficiency. This positions Germany as a leader within Europe's sustainable manufacturing landscape.

Latin America Market Insights

The Latin American market for sustainable manufacturing is leading the region, driven by countries such as Brazil, Chile, and Mexico investing in renewable-powered industrial parks, green material sourcing programs, and eco-certification initiatives. Industrial modernization programs based on energy efficiency and emission reductions have offered stimuli to manufacturers for low-carbon processes. The rising level of corporate ESG responsibility is also expected to pace the adoption of sustainable manufacturing practices across Latin America.

Various industrial clusters in the states of São Paulo and Minas Gerais have been driving the development of Brazil's sustainable manufacturing market by integrating solar- and wind-powered production facilities, water recycling systems, and circular material programs into their operations. Leading electronic and automotive product manufacturers are embracing eco-efficient assembly lines and green logistics, thus fostering environmental compliance, along with operational efficiency. Initiatives such as these among public-private sustainability collaborations will position Brazil as a key growth hub in the region for sustainable manufacturing.

Middle East & Africa Market Insights

The Middle East & Africa sustainable manufacturing market is likely to grow with the UAE, Saudi Arabia, and South Africa working on clean energy mandates, eco-industrial parks, and low-carbon infrastructure programs. Among industrial zones currently under development are integrated renewable energy grids, waste recovery facilities, and energy-efficient production systems. They will enable manufacturers to meet their sustainability targets while becoming more competitive in regional and global markets.

The UAE has been developing its sustainable manufacturing market through the eco-industrial zone at Masdar City, which focuses on renewable energy-powered manufacturing, waste-to-resource conversion, and the use of green materials. Energy-efficient smart factories and circular supply chains of leading electronics and automotive manufacturers in the region are increasingly improving operational resilience while reducing the environmental footprint. The UAE, therefore, will become one of the major markets for sustainable manufacturing in the Middle East, driven by such government-backed initiatives and the adoption of corporate sustainability.

Technology Insights

The IoT & smart manufacturing platforms segment accounted for 37.24% of the revenue share in 2025. The growth of digitalized production lines and real-time monitoring systems in semiconductor and electronics manufacturing has driven segment growth. This has enabled better operational efficiency, waste reduction, and improved energy use.

The AI & predictive analytics segment is expected to grow at the fastest CAGR of 13.38% during the forecast period. This rapid growth is majorly driven by emerging demand for predictive maintenance, process optimization, and energy efficiency analytics. This growth will help manufacturing organizations proactively minimize their emissions, improve equipment uptime, and reach their sustainability targets across the automotive, electronics, and aerospace verticals.

By Technology Market Share (%), 2025

Source: Straits Research

Application Insights

The semiconductor fabrication segment held the largest market share in 2025, with a revenue share of 36.67%. Several leading semiconductor manufacturers are increasingly adopting sustainable production practices. This includes energy-efficient cleanrooms, waste recycling systems, and water conservation.

The growth of the electronics manufacturing services segment is anticipated to be the highest during the forecast period, driven by high demand for outsourced and sustainable production solutions in automotive, aerospace, and consumer electronics.

Industry Vertical Insights

The electronics and semiconductors segment is expected to witness the highest CAGR of 11.84% during the forecast period, owing to emerging adoption of low-emission manufacturing processes, circular material usage, and energy-efficient production technologies. Since companies focus on sustainability to meet environmental regulations and consumer demand for green products, this segment is experiencing higher investments in eco-friendly operations, which drives the overall market growth.

Competitive Landscape

The global sustainable manufacturing market is moderately fragmented, comprising well-established multinational manufacturers and specialized green technology solution providers. A selected few players hold a major market share through comprehensive portfolios of sustainable solutions, including energy-efficient manufacturing systems, circular material management, and smart factory platforms.

The major players in the market are 3M, Braskem, Cirba Solutions, Siemens, and Schneider Electric. These participants in the industry are engaging in strategic collaborations, mergers and acquisitions, the deployment of eco-efficient solutions, and the release of innovative sustainability programs to compete and gain a better position in the market to take advantage of the increasing demand for sustainable manufacturing solutions on a global scale.

Carbon Clean: An Emerging Market Player

Carbon Clean is a UK-based industrial decarbonization company that is gaining traction in the sustainable manufacturing market through its modular carbon capture products designed for hard-to-abate manufacturing sectors such as cement, steel, chemicals, and refining.

- In March 2024, Carbon Clean launched its next-generation CycloneCC carbon capture product, a modular system capable of capturing up to 100,000 tons of CO₂ per year per unit. The product is engineered for integration into existing manufacturing plants, enabling emissions reduction without major process redesign.

Thus, Carbon Clean has emerged as a notable player in the global sustainable manufacturing market by commercializing scalable carbon-capture products that allow manufacturers to decarbonize production processes while maintaining operational continuity.

List of Key and Emerging Players in Sustainable Manufacturing Market

- 3M

- Braskem

- Cirba Solutions

- NatureWorks LLC

- Schneider Electric

- Siemens

- Tesla

- Umicore

- Unilever

- Veolia

- ArcelorMitta

- Dow Inc.

- Indorama Ventures

- Novelis (Hindalco Industries)

- ABB

- Honeywell

- Johnson Controls

- Rockwell Automation

- Fujitsu

- Interface, Inc.

- Others

Strategic Initiatives

- In October 2025, Tata Consultancy Services (TCS) entered into a five-year sustainability platform partnership with Tata Motors to digitize ESG data across 100+ manufacturing plants, enabling real-time emissions computation, circularmaterial tracking, and regulatory compliance across the automotive value chain.

- In May 2025, UBQ Materials launched its UBQ Masterbatch product line, a price-stable circular material that transforms mixed household waste into a sustainable plastic alternative, capable of diverting up to 95% of waste from landfills while integrating seamlessly into existing production lines for manufacturers worldwide.

- In April 2025, BASF launched its new high-performance polyurethane solutions at the PU TECH 2025, designed to reduce lifecycle carbon emissions and support circular economy principles in multiple end-use industries.

- In January 2025, Fujitsu partnered with Sustainable Shared Transport Inc. (SST) to deploy a standardized pallet logistics platform, aimed at eliminating redundant transport miles and lowering supply chain CO₂emissions across industrial manufacturing.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 231.86 billion |

| Market Size in 2026 | USD 257.66 billion |

| Market Size in 2034 | USD 601.17 billion |

| CAGR | 11.1% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Technology, By Application, By Industry Vertical |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Sustainable Manufacturing Market Segments

By Technology

- Advanced Process Controls

- Renewable Energy Integration

- IoT & Smart Manufacturing Platforms

- 3D Printing

- AI & Predictive Analytics

By Application

- Semiconductor Fabrication

- Assembly & Packaging

- Testing & Quality Assurance

- Electronics Manufacturing Services

By Industry Vertical

- Automotive

- Aerospace and Defense

- Electronics and Semiconductors

- Chemicals and Materials

- Food and Beverage

- Textiles and Apparel

- Pharmaceuticals

- Other Industry Verticals

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.