Telematics Control Unit Market Size, Share & Trends Analysis Report By Type (Embedded OEMs, Aftersales), By Application (Safety &Security, Information & Navigation), By Vehicle Type (Passenger Vehicle, Commercial Vehicle) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Telematics Control Unit Market Size

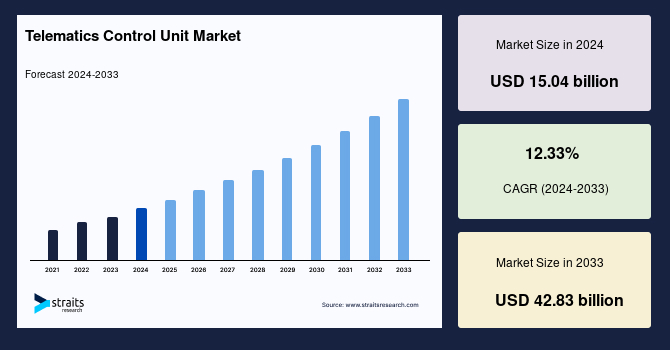

The global telematics control unit market size was worth USD 15.04 billion in 2024 and is estimated to reach an expected value of USD 16.89 billion in 2025 to USD 42.83 billion by 2033, growing at a CAGR of 12.33% during the forecast period (2025-2033).

A Telematics Control Unit (TCU) is an embedded system within a vehicle that enables wireless communication between the vehicle and external networks, including cloud-based services, GPS satellites, and mobile networks. It is crucial in modern automotive technology to facilitate vehicle tracking, remote diagnostics, infotainment, and emergency response services. TCUs integrate various communication technologies, such as 4G/5G, Wi-Fi, and Bluetooth, to enhance vehicle connectivity, making them essential for fleet management, predictive maintenance, and autonomous driving applications. As the automotive industry moves toward increased digitalization and connectivity, TCUs are becoming a standard feature in smart and electric vehicles.

The global market is growing because the demand for fleet management systems and connected automobiles is increasing. The TCUs market will grow substantially due to consumers' increasing tendency towards telematics-supported services, which will revolutionize automobile connection and operational efficiency. As automakers incorporate cutting-edge technologies to improve customer experiences, telematics use in automobiles is quickening. The Telematics Control Unit (TCU), an embedded device that uses V2X standards to facilitate smooth data transfer between automobiles and cloud storage via mobile networks, is a major force behind this evolution.

Source: SIAM

Latest Market Trends

Adoption of 5g-Enabled Telematics for Enhanced Connectivity

The transition from 4G to 5G networks revolutionizes the telematics control unit (TCU) industry, supporting next-gen vehicle connectivity. With ultra-low latency, greater bandwidth, and quicker data transfer, 5G improves high-priority applications like autonomous driving, predictive maintenance, and V2X (vehicle-to-everything) communication. The innovation provides effortless real-time data exchange, enhancing vehicle safety, efficiency, and performance. With automotive producers accelerating the adoption of 5G-capable telematics, the business is set to achieve explosive growth, redefining the future of connected transportation and smart mobility.

- For instance, in January 2025, Mahindra & Mahindra Ltd. and Qualcomm Technologies collaborated to power the BE 6 and XEV 9e with 5G-enabled Snapdragon Digital Chassis, delivering cutting-edge connectivity, AI, and next-generation in-car experiences.

Increased Government Mandates for Vehicle Safety and Compliance

Governments worldwide are enacting strong regulations to promote connected vehicle safety, requiring emergency call (eCall) systems and real-time location tracking. These regulatory schemes are spurring telematics take-up in passenger and commercial cars, driving enhanced road safety, and preventing accidents. Adhering to changing safety standards fuels market growth, making telematics a key element of contemporary vehicle systems.

- For instance, under the EU General Safety Regulation II, Continental is leading the way in vehicle safety by providing cutting-edge solutions to reach Vision Zero, which aims to eradicate traffic accidents and improve road safety for all vehicle types.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 15.04 Billion |

| Estimated 2025 Value | USD 16.89 Billion |

| Projected 2033 Value | USD 42.83 Billion |

| CAGR (2025-2033) | 12.33% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Valeo, Harman International, Zonar Systems, Magneti Marelli, Autotalks |

to learn more about this report Download Free Sample Report

Telematics Control Unit Market Growth Factors

Increasing Demand for Fleet Management Solutions

The expansion of the transportation and logistics sectors has increased the need for effective fleet management. Telematics solutions provide real-time vehicle monitoring, allowing organizations to track fuel consumption, review driver behavior, and optimize routes. The technologies decrease operation costs through fleet fuel efficiency, increased safety, and timely delivery. With data from telematics, organizations can make informed business decisions, enhance the fleet's performance, and optimize operations. With the growth of logistics, telematics has become a key player in increasing efficiency and promoting cost-saving solutions in the industry.

- For instance, in May 2024, Geotab and Rivian collaborated to offer an integrated data solution for Rivian’s commercial vehicles in North America, enabling fleet managers to optimize performance, improve safety, and boost efficiency through seamless telematics integration.

Rising Popularity of Electric and Autonomous Vehicles

The increasing demand for electric vehicles (EVs) and autonomous driving technologies is fueling the growing demand for telematics control units (TCUs). EVs rely on telematics for proper battery management, remote diagnostics, and navigation assistance to ensure efficient performance and connectivity. Autonomous cars also need perpetual data exchange between infrastructure and other cars to make safe and uninterrupted operation possible. As the EV and autonomous vehicle markets grow, real-time communication, data processing, and system integration in advanced TCUs become essential in filling the needs of new mobility solutions.

- For instance, At CES 2025, LG Electronics and Qualcomm introduced the Cross Domain Controller (xDC) platform, integrating IVI and ADAS into one solution, enhancing vehicle performance with Snapdragon Ride™ Flex SoC.

Market Restraint

High Cost of Implementation and Data Privacy Concerns

High upfront costs, cybersecurity threats, and data privacy risks challenge the adoption of Telematics Control Units (TCUs). Implementing advanced telematics solutions requires significant investment in hardware, software, connectivity infrastructure, and cloud storage, making it financially burdensome for smaller fleet operators and individual consumers. Additionally, maintenance, software updates, and integration with legacy vehicle systems further increase operational expenses, slowing down market penetration.

Beyond cost, data security and privacy concerns pose significant challenges. Telematics systems continuously collect and transmit vast amounts of sensitive vehicle and driver information, including GPS location, driving behavior, engine diagnostics, and real-time fleet activity. This makes them highly susceptible to cyberattacks, hacking attempts, and unauthorized data access, leading to identity theft, vehicle tracking, and business espionage.

- For instance, in December 2024, Volkswagen Group experienced a massive data breach affecting 800,000 electric vehicle (EV) owners due to a misconfigured Amazon cloud storage system, exposing personal and location data for months.

Market Opportunity

Integration of Ai and Iot in Telematics for Predictive Maintenance

The fusion of Artificial Intelligence (AI) and the Internet of Things (IoT) is transforming predictive maintenance in telematics, driving operational efficiency, cost savings, and improved fleet performance. AI-driven analytics continuously monitor vehicle health, analyze sensor data, and detect early signs of component wear and failure, allowing for proactive maintenance interventions before critical breakdowns occur. This prevents costly vehicle downtimes, reduces repair expenses, and enhances fleet reliability.

IoT-enabled telematics devices collect real-time data on engine performance, tire pressure, fuel efficiency, battery health, and braking system conditions, which AI algorithms then analyze to predict potential failures. This predictive approach minimizes unplanned breakdowns, extends vehicle lifespan, and optimizes maintenance schedules, significantly benefiting commercial fleets, logistics providers, and ride-sharing services.

- For example, Tesla's AI-powered telematics system monitors battery performance and alerts owners about potential failures, improving EV longevity and safety. Volvo’s Connected Vehicle Cloud integrates AI-driven predictive maintenance, reducing truck breakdowns by 30% and increasing uptime by 25%.

As AI and IoT technologies advance, the telematics industry is expected to widely adopt predictive maintenance solutions across passenger cars, commercial fleets, construction equipment, and public transportation systems. This will enhance vehicle safety and performance and drive long-term cost savings and operational efficiency for businesses worldwide.

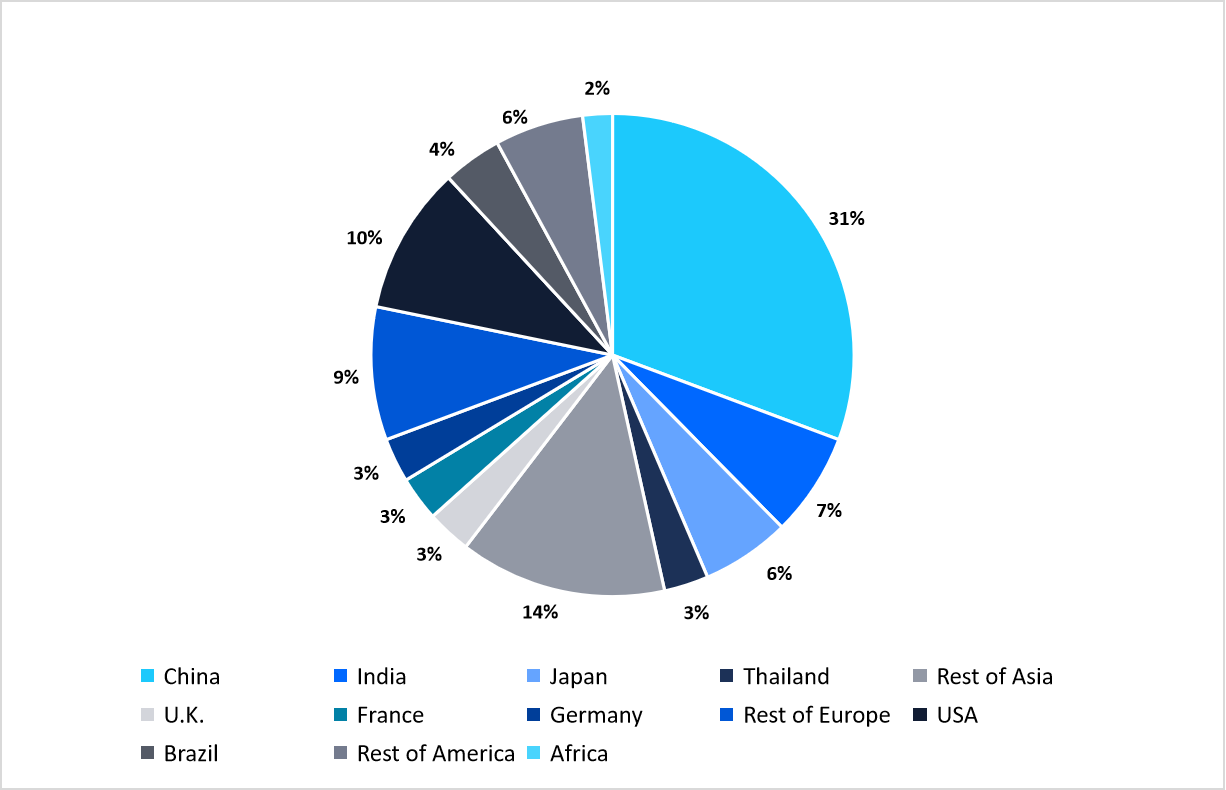

Regional Insights

North America is poised to lead the global telematics control unit market for telematics control unit (TCU) in 2024 due to sophisticated automotive infrastructure, high-level consumer awareness for vehicle safety, and large-scale adoption of connected car solutions. The United States, leading the charge, is propelled by incessant technological upgradation, hefty investments in research and development (R&D), and favorable government policies favoring vehicle safety. The growing need for electric vehicles and connected car technologies, alongside a swift 5G rollout, presents immense opportunities for TCU makers. The region's strong emphasis on advanced driver assistance systems (ADAS) accelerates market growth.

- For instance, United States-based companies AT&T and GM will bring 5G cellular connectivity to select Cadillac, Chevy, and GMC vehicles by 2024, enhancing navigation, coverage, and software updates for in-vehicle infotainment systems.

- The U.S. is the market leader for telematics control units, with investments in autonomous driving technology. In January 2025, Zonar introduced its next-generation Zonar LD Telematics Control Unit, propelling vehicle intelligence. The U.S. Commerce Department's plan to prohibit Chinese "connected vehicles" and components due to cybersecurity issues is set to impact the adoption of telematics across the automotive sector.

Asia-Pacific Market Trends

The Asia Pacific is poised for the fastest substantial growth in the global telematics control unit market due to urbanization, increasing vehicle production, and increased vehicle safety awareness. Due to robust automotive production and technological innovation, China and Japan dominate the market. The transition towards electric vehicles, connected car technologies, and government support for road safety and intelligent transport systems fuels market growth. Higher disposable incomes and aspirations for advanced features in premium cars drive further growth. Also, growth in fleet management solutions and the rollout of 5G open up new business opportunities for market players.

- For instance, in August 2024, China's new energy vehicle (NEV) market surpassed fuel-powered cars, with NEV retail sales reaching 878,000 units in July, accounting for 51.1% of the total market.

Countries Insights

- Canada: Canada is seeing more adoption of telematics, especially among commercial fleets. Telematics technology helps fleet operators increase efficiency and lower operational costs. In the first half of 2024, Canada saw an uptick in telematics demand, with fleet operators adopting GPS tracking, vehicle diagnostics, and driver behavior monitoring. This trend follows the nation's move towards modernizing fleet management solutions.

- China: China is witnessing substantial growth in the market for telematics control units, as it is led by government regulations on new energy vehicles (NEVs). TCU sales increased by 9% YoY during Q1 2024, indicating growth in NEV and electric vehicle (EV) sales. The upsurge is driving the usage of high-end telematics solutions with improved connectivity and vehicle safety features.

- Germany: Germany remains at the forefront of intelligent transportation by prioritizing using vehicle telematics to improve road safety, mobility, and traffic congestion. Bosch Rexroth has introduced its Series 20 telematics units, which are engineered to address sophisticated applications with increased computing capabilities, memory, and connectivity. The units provide effortless over-the-air management, furthering Germany's sustainable, connected transportation vision.

- India: India's telematics control unit market is witnessing tremendous growth due to the increasing demand for fleet tracking and management solutions. The market will reach 50 million units by 2030. This is spurred by the growing demand for fleet management, vehicle monitoring, and safety technologies in the commercial vehicle industry, which boosts operational efficiency and safety.

- Australia: Australia is tackling the privacy threats of networked cars, as noted in a recent study by the University of New South Wales. Data collection has brought concerns about exploitation. At the same time, the nation's telematics market is on the rise, especially in the fleet management area, where newer technologies are maximizing operational effectiveness, lowering costs, and enhancing drivers' safety.

- South Korea: South Korea is at the forefront of 5G-capable telematics solutions for connected cars. Focusing heavily on 5G infrastructure, South Korea has advanced considerably in combining telematics with 5G networks, providing quicker data transfer and real-time vehicle tracking, and improving efficiency and safety in the automotive industry.

- Japan: Japan spends a lot on AI-based connected car technology and is a front-runner in telematics. Government initiatives for innovation and sustainability are compelling the uptake of connected car technologies. New subsidy guidelines promoting domestic infrastructure development at the expense of foreign EVs, such as BYD's Atto 3 SUV, have limited support, which has affected market penetration.

Type Insights

The embedded OEM sector will dominate the global telematics control unit market in 2024, with the most vigorous expansion. Encouraged by onboard integration at vehicle manufacturing times, OEMs look toward factory installation of telematics due to their consistency and straightforward implementation. Advanced functions, such as forecasted maintenance, live vehicle information management, and over-the-air updates, become possible with such systems. Government policies worldwide are also driving the uptake of embedded telematics in passenger cars, bolstering the segment's dominance in the market and keeping cars updated with the newest software and security updates.

Application Insights

The Information & Navigation segment dominates the global market for telematics control units. This dominance is driven by automotive players focusing on advanced features such as integrated navigation and high-level infotainment systems. Increased demand for real-time traffic information, voice navigation, and personal assistance continues to propel segment growth. The segment's telematics control units provide higher connectivity via Bluetooth, Wi-Fi, and cellular networks, effortlessly integrating with vehicle subsystems. Developing connected car services and coupling advanced driver assistance systems (ADAS) with navigation functions also help drive strong performance.

Vehicle Type Insights

The passenger vehicle segment is the largest in the global market of telematics control units, led by the adoption of advanced driver assistance systems (ADAS) and connected car technology. The increased use of electric vehicles and government regulatory pressure on safety and emissions also propel demand. Increased middle-class purchasing power in developing economies and an emphasis by car manufacturers on high-end telematics solutions are also driving growth in the market.

Company Market Share

Key market players are investing in advanced Telematics control unit technologies and pursuing strategies such as collaborations, acquisitions, and partnerships to enhance their products and expand their market presence.

Samsara: An Emerging Player in the Telematics Control Unit Market

Samsara is an emerging player offering IoT fleet, industrial, and connected vehicle solutions. Their cloud solution allows real-time data insights for better asset tracking, safety, and performance monitoring.

Recent Developments:

- In June 2024, At the Beyond '24 conference, Samsara introduced innovative trailer telematics features and frontline efficiency tools to enhance fleet safety and operations.

List of Key and Emerging Players in Telematics Control Unit Market

- Valeo

- Harman International

- Zonar Systems

- Magneti Marelli

- Autotalks

- Qualcomm Technologies, Inc.

- Aptiv

- Veoneer

- Denso Corporation

- Bosch Rexroth

- Continental AG

- LG Electronics

to learn more about this report Download Market Share

Recent Developments

- March 2024- HARMAN launches the Ready Connect 5G Telematics Control Unit, powered by Qualcomm's Snapdragon® Digital Chassis and Auto 5G Modem-RF Gen 2, advancing automotive connectivity and enhancing in-cabin experiences.

Analyst Opinion

As per our analyst, the global telematics control unit market is poised for massive growth with increasing demand for connected cars, regulatory requirements, and advancements in 5G and artificial intelligence (AI). As safety, efficiency, and predictive analytics become a priority for automobile manufacturers and fleet operators, telematics solutions are vital to maximize vehicle performance, enhance safety features, and facilitate real-time data transfer. As autonomous driving, vehicle-to-everything (V2X) communication, and smart infrastructure gain greater traction, TCUs will center stage in defining mobility's future. Market growth is also driven by rising consumer interest in connected, data-enriched vehicle experiences.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 15.04 Billion |

| Market Size in 2025 | USD 16.89 Billion |

| Market Size in 2033 | USD 42.83 Billion |

| CAGR | 12.33% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Application, By Vehicle Type |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Telematics Control Unit Market Segments

By Type

- Embedded OEMs

- Aftersales

By Application

- Safety &Security

- Information & Navigation

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Tejas Zamde

Research Associate

Tejas Zamde is a Research Associate with 2 years of experience in market research. He specializes in analyzing industry trends, assessing competitive landscapes, and providing actionable insights to support strategic business decisions. Tejas’s strong analytical skills and detail-oriented approach help organizations navigate evolving markets, identify growth opportunities, and strengthen their competitive advantage.