Thawing System Market Size, Share & Trends Analysis Report By Type (Manual, Automated), By Sample Type (Blood Plasma, Embryo, Ovum, Semen, Others), By End-Use (Blood Banks and Transfusion Centers, Hospitals and Diagnostic Laboratories, Cord Blood and Stem Cell Banks, Research and Academic Institutes, Biotechnology and Pharmaceutical Companies, Tissue Banks) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Thawing System Market Size

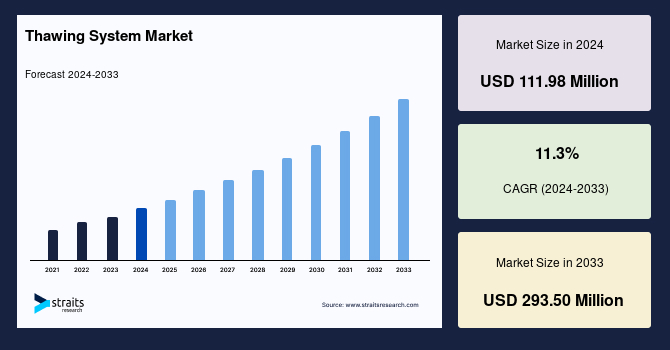

The global thawing system market size was valued at USD 111.98 million in 2024 and is expected to grow from USD 124.64 million in 2025 to USD 293.50 million by 2033, growing at a CAGR of 11.3% during the forecast period (2025-2033).

The increased prevalence of chronic diseases and technological developments in thawing devices are driving the growth of the thawing system market.

A thawing system is used in medical and scientific settings to safely and efficiently thaw frozen biological specimens such as blood products, plasma, embryos, sperm, and other natural materials. Thawing is necessary for using frozen materials, especially in industries like healthcare, biotechnology, and assisted reproductive technologies. The global market has grown significantly due to increased demand for thawing solutions in many industries. It is necessary in various sectors, including food and beverage, medicines, chemicals, and biotechnology.

In addition, traditional thawing procedures, such as room temperature or water bath thawing, must be revised as enterprises attempt to streamline their operations and fulfill consumer needs. As a result, there has been an increase in the adoption of technologically improved thawing equipment and systems that provide faster and more precise thawing operations. There is a growing demand for quick and effective thawing solutions to decrease product waste and maintain food safety in the food and beverage industry, which accounts for a considerable amount of the thawing system market share.

Top 4 Key Highlights

- Manual Devices account for the largest share of the market by type.

- Blood is a significant contributor to the market based on sample type.

- Research and Academic Institutes are the major end-users of the market.

- North America dominates the global market.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 111.98 Million |

| Estimated 2025 Value | USD 124.64 Million |

| Projected 2033 Value | USD 293.50 Million |

| CAGR (2025-2033) | 11.3% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Key Market Players | Thermo Fisher Scientific Inc., Merck KGaA, Bio-Rad Laboratories Inc., Agilent Technologies Inc., Danaher Corporation |

to learn more about this report Download Free Sample Report

Thawing System Market Growth Factors

Rising Incidence of Chronic Diseases

The increased frequency of chronic diseases increases the demand for thawing systems in the healthcare industry. Thawing systems prepare frozen blood products, plasma, and other biological specimens for medical treatments and transfusions. Chronic diseases, such as cardiovascular disease, cancer, respiratory disease, and diabetes, are the leading cause of death worldwide, according to the World Health Organization (WHO). The prevalence of these disorders is increasing, which contributes to an increase in the demand for medical interventions and therapies. Multiple chronic illnesses become more common as people get older. Almost half of individuals aged 45 to 64, and 80% of those aged 65 and up, have numerous chronic illnesses. Noncommunicable diseases (NCDs) also account for 74% of all fatalities worldwide.

Furthermore, blood transfusions are routine therapeutic interventions for patients with chronic conditions, such as cancer patients or those suffering from hematological disorders. The rising prevalence of chronic diseases increases demand for cryopreserved biological materials, especially blood products. Thawing devices are becoming increasingly important in the controlled and adequate preparation of these materials for medical procedures. Hence, As healthcare facilities try to improve patient care and treatment outcomes for people with chronic conditions, there will be a greater demand for enhanced thawing systems that efficiently and safely use cryopreserved materials. Consequently, the thawing system market trend will be positive over the forecast year.

Market Restraining Factors

High Cost

Adopting advanced thawing systems, particularly those with sophisticated features such as automation and precise temperature control, can be relatively inexpensive for some healthcare organizations and laboratories. Thawing systems can range in price from USD 3,455 to USD 5,999. The ThawSTAR CFT1.5 Automated Cell Thawing System for 1.5 mL Cryogenic Vials, for example, costs USD 3,455, as does the ThawSTAR CFT2 Automated Cell Thawing System for 1.8-2.0 mL Cryogenic Vials. A medical thawing system for a single user costs USD 4,599, while a multi-user system costs USD 5,999. Furthermore, cutting-edge thawing devices specialized for IVF applications might cost hundreds to tens of thousands of dollars. The high cost is linked to advanced technology, quality control procedures, and regulatory compliance.

As a result, the high cost of sophisticated thawing technologies can be a considerable barrier for smaller reproductive clinics or laboratories with limited financial means. This may need to be improved in implementing new technologies, affecting the quality of thawing procedures. Economic considerations for fertility treatments frequently involve balancing the cost of equipment with the overall costs of ART procedures. The affordability of modern thawing technologies becomes a critical issue in healthcare facility decision-making.

Market Opportunity

Expansion of Biopharmaceuticals Research and Development

The development of biologics and cell treatments has seen a tremendous increase in the biopharmaceutical business. Cryopreserved cells and biological materials, such as monoclonal antibodies and therapeutic proteins, are frequently used in biologics. Furthermore, cell treatments, such as CAR-T cell therapies, rely on the cryopreservation of patient-specific cells before injection. The Alzheimer's Association 2021 report states that the US Food and Drug Administration (FDA) has approved five medications to treat Alzheimer's. They are rivastigmine, galantamine, donepezil, memantine, and donepezil with memantine. According to the same source, the vast majority of people who develop Alzheimer's dementia are 65 and older. Demand for sophisticated biopharmaceutical research and development increases as the emphasis on personalized and targeted medicines grows.

Concurrently, cryopreservation is essential in biopharmaceutical research and development because it ensures the long-term storage and viability of cells and biological materials. Thawing systems are critical in regulating and effectively thawing cryopreserved materials for research, clinical trials, and medicinal product development. The expansion of biopharmaceutical research and the development of innovative medicines have led to an increased demand for cryopreserved material thawing systems. Precision control and quick freezing-thawing devices have become essential components of the biopharmaceutical workflow. The trend toward personalized medicine, in which patient-specific cells are used in therapies, emphasizes the need for precise and dependable thawing processes. Thawing systems that can accommodate various sample types and ensure high post-thaw viability align with the needs of advanced biopharmaceutical applications.

Regional Insights

North America: Dominant Region with 11.4% of the Market Share

North America is the most significant global thawing system market shareholder and is estimated to grow at a CAGR of 11.4% over the forecast period. North America is expected to maintain a significant market share throughout the forecast period due to several factors, including the development of blood bank and biobank infrastructure, rising research activities in regenerative medicine, cell and gene therapy, increasing interest in customized medicine and biomarker discovery, and an increasing number of biotechnology and pharmaceutical companies, as well as increased government funding. According to the American Red Cross, the United States requires around 29,000 units of red blood cells every day. According to the Red Cross, almost 16 million blood components are transfused annually in the United States. Thawed plasma is commonly held in blood banks to ensure its viability, defrosting arises when required, and thawing systems are projected to be used more frequently, supporting market expansion throughout the projection period.

Furthermore, an increase in strategic activities and product launches by critical competitors is projected to boost market growth. In January 2021, Thermo Fisher launched Controlled-Rate Freezers, which provide optimal sample protection. CryoMed Freezers provide repeatable, consistent temperature performance, improved data traceability, and GMP and 21 CFR Part 11 compliance. North America will likely experience considerable market growth during the forecast period due to rising demand for thawing systems and rapid technological advancement.

Europe: Fastest-Growing Region with A Cagr of 11.6%

Europe is anticipated to exhibit a CAGR of 11.6% over the forecast period. According to Thawing System Market insights, Europe is anticipated to account for a relatively significant revenue share throughout the projected period, owing to the increased emphasis on research and development activities in the healthcare industry. As more cutting-edge medical technologies and gadgets are implemented, the market for medical thawing system systems will likely rise. The United Kingdom, for example, has experienced a surge in the number of clinical trials for gene and cell therapies, which is projected to drive up demand for medical freezing system equipment in the region.

Additionally, according to a European Commission analysis, Germany has one of the world's largest hospital and diagnostics sectors, which is expected to develop even more. According to the data, Germany has the most acute care hospital beds per capita in the European Union (EU) - 529 beds per 100,000 inhabitants. This refers to the country's upcoming opportunities for blood-thawing system makers. The demand for medical thawing system systems in Europe is predicted to expand due to increased investments in the healthcare industry by private and public organizations, boosting market revenue growth in this region.

Asia-Pacific market accounts for a reasonably substantial revenue share. Rising demand for medical devices in developing countries such as China and India drives this region's market revenue growth. Several factors, including an expanding population, rising disposable incomes, and increased healthcare awareness, contribute to this region's need for medical thawing system systems. The Indian government has implemented various programs to help the healthcare industry, such as the Ayushman Bharat program, which aims to provide millions of people access to inexpensive healthcare and boost market revenue growth. Furthermore, biorepositories are progressively focusing on improving storage capacity, fueling market revenue growth in this region.

Type Analysis

The market is further segmented by type into Manual Devices and Automated Devices. Manual Devices account for the largest share of the market. In 2022, the manual segment generated the most revenue. Manual thawing devices are distinguished by their dependency on the operator's manual intervention throughout the thawing process. The user is frequently required to control and monitor various components of the thawing procedure, such as temperature modifications and sample handling, with these instruments. Manual devices are appropriate for applications that require a hands-on approach or when the user wants more control over the thawing parameters.

In contrast, automated thawing machines have automatic features that reduce the amount of manual intervention required. Sensors, programmable controls, and occasionally networking facilities for real-time monitoring are common aspects of these devices. Automated thawing systems are intended to offer exact and constant thawing conditions, reducing the possibility of operator mistakes and ensuring reproducibility.

Sample Type Analysis

The market is fragmented into Blood (Plasma, Stem Cells, Whole Blood, and Red Blood Cells), Embryo, Ovum, and Semen. Blood is a significant contributor to the market. In 2022, the blood segment accounted for a disproportionately large share of sales. Blood is further subdivided into Plasma, Stem Cells, Whole Blood, and Red Blood Cells. The demand for safe blood transfusions, which require thawed blood products, drives this segment's revenue growth. Thawing blood products to the right temperature is critical for maintaining blood products safe and effective. Furthermore, an increase in surgical operations is predicted to enhance demand for thawed blood products, supporting revenue growth in the blood transfusion industry.

Thawing systems for embryos are crucial in assisted reproductive technologies (ART), such as IVF. These technologies enable controlled thawing conditions for cryopreserved embryos, increasing the likelihood of successful implantation during reproductive treatments.

End-User Analysis

The market can be further bifurcated by end-users into Blood Banks and Transfusion Centers, Hospitals and Diagnostic Laboratories, Cord Blood and Stem Cell Banks, Research and Academic Institutes, Biotechnology and Pharmaceutical Companies, and Tissue Banks.

Research and Academic Institutes are the major end-users of the market. Research and Academic Institutes, In 2022, the research and academic institutes section generated the most revenue. Thawing systems in research and academic institutions support various scientific inquiries and experiments. These institutes may operate with multiple sample types, such as embryos, eggs, sperm, and stem cells, demanding flexible thawing techniques for research objectives. Rapid technology breakthroughs have opened up new prospects for academic and research institutions. Advances in artificial intelligence, machine learning, data analytics, and high-performance computing have significantly boosted research capacity and enabled institutes to handle complex difficulties more efficiently, propelling revenue growth in this area.

Thawing systems are used in hospitals and diagnostic laboratories for various purposes, including clinical diagnostics, medical treatments, and surgical operations. These devices meet the varying freezing requirements of healthcare facilities for different sample kinds.

List of Key and Emerging Players in Thawing System Market

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- Danaher Corporation

- BioMé

- rieux SA

- PerkinElmer Inc.

- QIAGEN N.V.

- Waters Corporation

- Becton

- Dickinson and Company

- Roche Holding AG

- Bruker Corporation

- Abbott Laboratories

- Eppendorf AG

- Shimadzu Corporation

- Beckman Coulter Inc.

- ThawStar

- Analytik Jena AG

- GE Healthcare

- Sartorius AG.

Recent Developments

- January 2024- Merck expanded Colorectal Cancer Portfolio with Inspirna Licensing Agreement.

- June 2023, Helmer Scientific introduced a new thawing technology for the food and beverage industries. The technology is said to be capable of fast and safely thawing frozen food goods without harming their quality.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 111.98 Million |

| Market Size in 2025 | USD 124.64 Million |

| Market Size in 2033 | USD 293.50 Million |

| CAGR | 11.3% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Sample Type, By End-Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Thawing System Market Segments

By Type

- Manual

- Automated

By Sample Type

-

Blood Plasma

- Stem Cells

- Whole Blood and RBCs

- Platelets

- Embryo

- Ovum

- Semen

- Others

By End-Use

- Blood Banks and Transfusion Centers

- Hospitals and Diagnostic Laboratories

- Cord Blood and Stem Cell Banks

- Research and Academic Institutes

- Biotechnology and Pharmaceutical Companies

- Tissue Banks

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.