Thermo Compression Forming Market Size, Share & Trends Analysis Report By Foam Type (Thermoplastic Foams, Needle-Punch Nonwovens, Lightweight Glass Mat Thermoplastic), By Process Type (Hot Compression Forming, Cold Compression Forming, Multi-layer Compression Forming), By End-Use Industry (Automotive & Transportation, Aerospace & Defense, Healthcare, Electrical & Electronics, Building & Construction, Packaging, Industrial Equipment, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Thermo Compression Forming Market Size

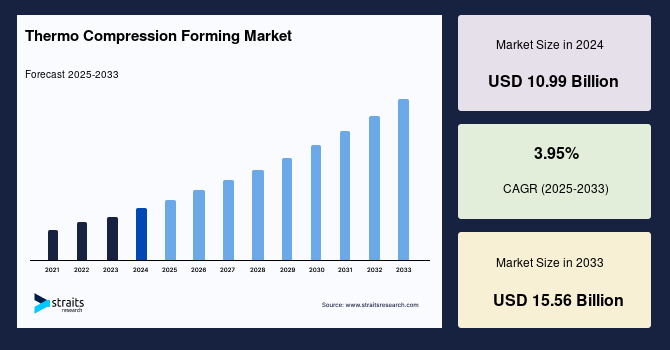

The global thermo compression forming market size was valued at USD 10.99 billion in 2024 and is projected to grow from USD 11.41 billion in 2025 to reach USD 15.56 billion by 2033, growing at a CAGR of 3.95% during the forecast period (2025–2033).

The global market is witnessing robust growth, primarily driven by the surging demand for lightweight, durable, and cost-effective packaging across sectors such as food, electronics, and consumer goods. This technique enables the production of rigid and semi-rigid packaging with high precision, strength, and customization, which enhances product safety and shelf life.

Additionally, technological advancements in automation and mold design have further improved production efficiency, reducing cycle times and manufacturing costs. The healthcare sector also fuels demand with the increased use of thermoformed trays, housings, and protective components that require hygienic and robust materials.

Furthermore, the growing need for aesthetically appealing and ergonomically designed products is pushing manufacturers to adopt thermo compression forming for producing complex shapes and fine details. Its versatility, combined with consistent quality and cost benefits, makes it an increasingly preferred solution in modern industrial manufacturing.

Latest Market Trends

Growth in Electric Vehicles (evs)

The surging adoption of electric vehicles (EVs) worldwide is significantly boosting the thermo compression forming market. This technology is increasingly used in manufacturing lightweight, durable EV components such as battery enclosures, structural parts, and interior panels. As automakers prioritize weight reduction and performance, thermo compression forming enables the use of advanced composites that meet these needs.

- According to the IEA, global electric vehicle (EV) sales surged to 17.1 million units in 2024, marking a 25% increase from 2023. This upward trend continues, with projections estimating over 20 million EVs to be sold in 2025, marking about 17% growth from last year.

With major EV manufacturers such as Tesla, BYD, and Volkswagen adopting composite-intensive designs, the demand for thermo compression forming processes is expected to grow steadily across the EV supply chain.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 10.99 Billion |

| Estimated 2025 Value | USD 11.41 Billion |

| Projected 2033 Value | USD 15.56 Billion |

| CAGR (2025-2033) | 3.95% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Ensinger GmbH, Rochling Group, Covestro AG, Toray Industries Inc., Solvay S.A. |

to learn more about this report Download Free Sample Report

Thermo Compression Forming Market Growth Factor

Expansion of the Construction Sector

The global thermo compression forming market is gaining significant momentum, largely driven by the robust expansion of the construction sector. As governments and private players invest heavily in infrastructure and real estate development, the need for lightweight, durable, and energy-efficient materials has grown considerably. Thermo compression forming offers an ideal solution for producing components like insulation panels, wall claddings, and architectural fittings that meet modern construction demands.

- For instance, India’s construction industry is rapidly expanding and is projected to become the world’s third-largest by 2025, with a market size of $1.4 trillion. Similarly, Saudi Arabia is advancing its Vision 2030 initiative, launching massive “Giga-projects” such as NEOM and The Red Sea Project, which are expected to push the construction sector to $91 billion by 2029.

These developments are generating high demand for innovative and cost-effective materials, positioning thermo compression forming as a key enabler in modern construction.

Market Restraint

High Initial Setup Cost

One of the major restraints in the global market is the high initial setup cost associated with machinery, tooling, and skilled labor. The process requires precision-engineered molds and advanced compression machines, which involve significant capital investment. Small and medium-sized enterprises (SMEs), especially in emerging economies, often struggle to allocate funds for such high-end equipment.

Additionally, the maintenance and operation of these machines demand skilled technicians, adding to recurring operational expenses. These financial barriers can limit market penetration for new entrants and slow down adoption across price-sensitive industries, thereby restraining overall market growth despite the rising demand for thermoformed components.

Market Opportunity

Bioplastics and Advanced Composites

The rising global focus on sustainability is unlocking significant opportunities for the thermo compression forming market, particularly through the integration of bioplastics and advanced composites. These materials offer an ideal balance of environmental friendliness and high performance, making them suitable for diverse applications such as automotive interiors, electronics casings, and eco-friendly packaging.

- A notable example is from April 2024, when Toray Industries developed marine-biodegradable polyamide-4 (PA4) spherical fine particles to replace conventional cosmetic microplastics. These innovative microspheres are capable of degrading in ocean environments, including lowmicrobe activated sludge, as confirmed by OECD and ASTM standards.

Such developments reflect a broader industry shift toward materials that reduce plastic waste without compromising functionality. As governments tighten environmental regulations, the adoption of biodegradable thermoplastics and fiber-reinforced composites presents a compelling growth avenue for manufacturers.

Regional Analysis

The North American thermo compression forming market is experiencing steady growth owing to rising demand for lightweight, durable materials across the automotive and aerospace industries. The region’s focus on advanced manufacturing technologies and automation has further improved production efficiency and consistency in formed components. Moreover, expanding applications in the medical device and electronics packaging sectors are driving market expansion. Investments in sustainable materials and the increasing shift towards electric mobility are also fostering the adoption of thermo compression forming across industrial and consumer applications.

- The United States thermo compression forming industry is witnessing strong growth driven by the expanding automotive and aerospace sectors. Companies like Boeing and Ford increasingly use thermoformed composites for lightweighting and fuel efficiency. Moreover, advancements in automation and tooling are enhancing manufacturing precision. The packaging industry also contributes significantly, with players like Pactiv Evergreen adopting thermo compression forming for durable, recyclable food containers and medical trays.

- Canada’s market is growing steadily, fueled by demand in the construction and renewable energy sectors. Canadian firms are using thermo compression to produce weather-resistant building panels and lightweight solar components. Companies like Magna International are investing in thermoformed composite parts to support EV development. Sustainability goals also encourage the adoption of recyclable and bio-based thermoplastics in packaging and consumer product manufacturing.

Asia-Pacific Thermo Compression Forming Market Trends

Asia Pacific is witnessing the fastest growth in the thermo compression forming market, fueled by rapid industrialization and infrastructural development. Expanding automotive production and increasing use of lightweight components in transportation and consumer electronics are key drivers. The region’s cost-effective manufacturing capabilities and growing demand for packaged food, electronics, and consumer goods are further boosting market penetration. The rising adoption of automation and precision forming technology in local manufacturing setups is enhancing productivity. Additionally, increased focus on sustainable product development is fostering regional adoption of recyclable thermoformed materials.

- China's market for thermo compression forming is witnessing robust growth, driven by its expanding automotive and electronics industries. The government's push for electric vehicles has increased the demand for lightweight composite components. Companies like BYD and NIO are incorporating thermoformed parts to reduce vehicle weight. Additionally, China's growing packaging sector, especially for electronics and consumer goods, is further accelerating the adoption of thermo compression forming technologies.

- India's thermo compression forming industry is gaining traction due to rapid industrialization and infrastructure development. The rise of FMCG and pharmaceutical sectors has led to greater use of thermoformed packaging. Additionally, automotive manufacturers like Tata Motors are exploring lightweight composite panels made through thermo-compression forming. Government initiatives like "Make in India" are also encouraging local production of molded components for sectors like construction, healthcare, and transportation.

Europe Thermo Compression Forming Market Trends

Europe’s thermo compression forming market is being shaped by stringent environmental regulations and sustainability mandates. The push for recyclable, low-emission materials in the automotive, packaging, and construction sectors is creating demand for advanced thermoplastics and biocomposites. Innovations in forming techniques and material engineering are enabling precision manufacturing, especially in high-performance applications. Additionally, the rise of smart manufacturing and digitization of industrial processes are supporting efficiency gains and higher production volumes. The region’s commitment to reducing carbon footprints is expected to sustain long-term demand for compression-formed eco-friendly solutions.

- Germany's market is witnessing strong growth, driven by its advanced automotive sector. German carmakers like BMW and Volkswagen are increasingly adopting lightweight thermoformed composite parts to enhance fuel efficiency and sustainability. The country’s focus on green manufacturing, along with robust R&D in material science, supports innovations in recyclable and biodegradable thermoplastics. Additionally, government initiatives promoting e-mobility further accelerate the use of thermo-compression forming technologies.

- The UK thermo compression forming industry is growing steadily, supported by advancements in the aerospace and healthcare sectors. Companies like BAE Systems integrate thermoformed composites for aircraft interiors and structural parts to reduce weight and improve performance. The UK’s strong packaging industry also uses thermo compression forming for eco-friendly, rigid packaging solutions. Moreover, rising demand for bioplastics, encouraged by the UK Plastics Pact, opens new opportunities for sustainable thermoformed product development.

Foam Type Insights

Thermoplastic foams hold a significant share in the thermo compression forming market due to their lightweight nature, excellent insulation properties, and recyclability. These foams are widely used in applications requiring impact resistance, thermal insulation, and structural integrity, making them ideal for automotive interiors, protective packaging, and construction panels. Their ability to be reshaped and reprocessed also aligns with sustainable manufacturing practices. Increasing demand for energy-efficient and cost-effective materials across industries has further propelled the adoption of thermoplastic foams in compression forming applications, especially in sectors like building & construction, where lightweight and thermal performance are key.

Process Type Insights

Hot compression forming is a widely adopted process in the market due to its ability to mold complex shapes with high structural integrity. This process involves heating the material above its softening point before applying pressure, allowing for enhanced flow and consolidation. It is commonly used in producing automotive panels, electronic casings, and aerospace components. The process ensures stronger bonding and uniformity in composite structures, offering improved mechanical performance. With increasing demand for durable, high-performance components in critical industries, hot compression forming is expected to remain a dominant segment in the overall market landscape.

End-Use Industry Insights

The building & construction industry is a dominant end-use segment in the thermo compression forming market, driven by the demand for lightweight, durable, and thermally efficient materials. Thermoformed components are used in insulation panels, wall cladding, decorative fixtures, and roofing applications, offering advantages such as easy installation, moisture resistance, and design flexibility. The surging emphasis on green building standards and energy-efficient infrastructure has accelerated the adoption of advanced foams and thermoplastics in construction. Additionally, urbanization and infrastructure development in emerging economies are further fueling market growth, making building & construction a key revenue-generating sector for thermo compression forming technologies.

Company Market Share

Companies in the thermo compression forming market are focusing on expanding production capacities, investing in R&D for advanced composite materials, and integrating automation to improve efficiency and precision. They are also targeting strategic collaborations and entering emerging markets to broaden their global footprint. Additionally, firms are developing eco-friendly and lightweight solutions to cater to automotive, aerospace, and packaging industries, aligning with sustainability trends and regulatory demands.

Röchling Group

Röchling Group, founded in 1822 and headquartered in Mannheim, Germany, is a global leader in plastic engineering with three divisions: Automotive, Industrial, and Medical. With ~12,000 employees across 90 locations in 25 countries, the company reported €2.723 billion in revenue in 2023. In thermo‑compression forming, its Industrial division excels in SMC/BMC composite parts, further boosted by the 2023 acquisition of Compotech AG, enhancing large-format fiber‑reinforced capabilities.

- In August 2024, Röchling invested €10 million in expanding its sustainability center and recycling facility in GeesteDalum, Germany. The site will quadruple in size (to ~30,000 m²), aiming to process over 10,000 tonnes of PE/PP annually by 2027 under the RöchlingReLoop brand.

List of Key and Emerging Players in Thermo Compression Forming Market

- Ensinger GmbH

- Rochling Group

- Covestro AG

- Toray Industries Inc.

- Solvay S.A.

- DuPont de Nemours, Inc.

- Lanxess AG

- Hexcel Corporation

- SABIC

- Teijin Limited

to learn more about this report Download Market Share

Recent Developments

- February 2025- ULMA Packaging has introduced its new Width-Flex technology for thermoforming machines, aimed at significantly reducing film waste by as much as 80% while enhancing operational efficiency and cutting downtime. This innovation addresses the issue of format variability by featuring a motorized system that automatically adjusts the width of the bottom film reel. According to ULMA, this allows for quick and smooth reel width changes, helping to lower packaging costs and making the solution ideal for sectors that depend heavily on thermoformed packaging.

- October 2024- ExxonMobil introduced an innovative thermo‑compression forming solution featuring packaging composed of 95% polyethylene. This development delivers excellent barrier performance, enhanced formability, and recyclability while substantially reducing multi‑material content. It represents a strategic leap toward sustainability in packaging, aligning with industry demands for eco‑friendly, high‑performance materials.

- August 2024- Kulicke & Soffa launched its latest APTURA™ Thermo‑Compression platform, targeting advanced chiplet and stacked‑die applications across AI, HPC, mobile, and edge devices. The APTURA supports fluxless bonding, including hybrid chip‑to‑wafer Cu‑Cu connections, and has secured multiple commercial wins while joining the US‑Joint consortium for advanced packaging R&D.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 10.99 Billion |

| Market Size in 2025 | USD 11.41 Billion |

| Market Size in 2033 | USD 15.56 Billion |

| CAGR | 3.95% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Foam Type, By Process Type, By End-Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Thermo Compression Forming Market Segments

By Foam Type

- Thermoplastic Foams

- Needle-Punch Nonwovens

- Lightweight Glass Mat Thermoplastic

By Process Type

- Hot Compression Forming

- Cold Compression Forming

- Multi-layer Compression Forming

By End-Use Industry

- Automotive & Transportation

- Aerospace & Defense

- Healthcare

- Electrical & Electronics

- Building & Construction

- Packaging

- Industrial Equipment

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.