Thin Client Market Size, Share & Trends Analysis Report By Type (Hardware, Software, Services), By Enterprise Type (Large Enterprises , Small and Medium Enterprises (SMEs)), By End-User (Healthcare, Retail, Education, BFSI, Government, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Thin Client Market Size

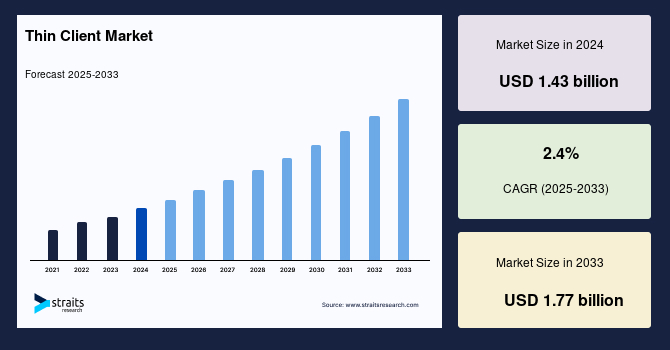

The global thin client market size was valued at USD 1.43 billion in 2024 and is projected to reach from USD 1.47 billion in 2025 to USD 1.77 billion by 2033, registering a CAGR of 2.4% during the forecast period (2025-2033).

A thin client is a lightweight computing device that relies on a central server for most of its processing and storage activities. The market refers to the industry that provides devices and solutions that use a centralized computing approach. These devices usually feature client-server architecture, enabling users to access apps and data stored on the server. This simplifies maintenance and updates for IT administrators. This market includes designing, producing, and integrating these devices and their accompanying software. It serves various industries, including IT and telecommunications, banking, financial services and insurance, healthcare, industrial, government, education, retail, and other sectors. The changing nature of remote and flexible work arrangements fuels the need for these solutions.

The rapid expansion of thin client usage in the education and healthcare sectors is projected to drive the highest growth rate for this category throughout the forecast period. The thin clients possess security measures to mitigate risks such as illegal account access, theft of third-party identities, and data leakage from external devices like USB memory sticks. These security features are anticipated to stimulate market growth. The increasing utilization of cloud computing and the expanding implementation of workspace-as-a-service (WaaS) in numerous companies are the primary factors driving market expansion.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.43 Billion |

| Estimated 2025 Value | USD 1.47 Billion |

| Projected 2033 Value | USD 1.77 Billion |

| CAGR (2025-2033) | 2.4% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Hewlett Packard Enterprise Company (HP Development Company LP.), Dell Technologies, Inc., Fujitsu Limited, Intel Corporation, LG Electronics (LG Corporation) |

to learn more about this report Download Free Sample Report

Growth Factor

Incorporation of Edge Computing into Thin Client Solutions

The trend of incorporating edge computing capabilities into these solutions drives the market's growth. This strategic evolution results from the increasing need for fast, decentralized data processing in many corporate settings. Historically dependent on centralized servers, these solutions are adjusting by integrating computing capabilities to fulfill enterprises' real-time analytical requirements. This move improves the flexibility of the solutions, broadening their potential for use in many scenarios.

- For example, in the manufacturing industry, using thin clients with embedded edge capabilities helps optimize decision-making processes by efficiently handling data collected from sensors on the production line. This ultimately leads to a reduction in operational delays. Similarly, in healthcare, these solutions allow for immediate analysis of patient data at the location where care is being provided, which promotes quicker and more knowledgeable medical decision-making.

Furthermore, this tendency guarantees that these solutions remain essential for effective regional processing while reaping centralized management's advantages. The integration of edge computing is becoming more critical for businesses as they emphasize obtaining quick and up-to-date information. This integration helps to increase the market share of thin client devices by meeting the changing requirements of modern companies.

Market Restraint

Latency Or Interruptions in Accessing Data

Thin clients depend highly on a reliable and robust network connection to contact centralized servers for computing operations. When there are inconsistencies or disruptions in network connectivity, it can have a negative impact on performance, causing operational difficulties and perhaps periods of downtime. In environments characterized by unstable internet connections, such as isolated or rural areas, the solutions may encounter latency issues or interruptions when accessing critical apps and data. The reliance on network reliability might be a limitation, especially for organizations operating in areas with unreliable or limited network infrastructure.

To tackle this limitation, allocating resources to robust network solutions and considering backup mechanisms to guarantee uninterrupted communication is necessary. Although there have been improvements in network technologies, organizations still need to carefully assess the reliability of their network before adopting it in their computing environments.

Market Opportunity

Increasing Need to Manage It Budgets without Compromising Performance

Traditional personal computers (PCs) require significant initial investments because they require powerful local processing capabilities and ample storage capacity. Thin clients, on the other hand, depend on a centralized server for performing computational operations. This enables them to have minimal hardware needs, reducing startup expenses. For example, a corporation that intends to enhance its computer infrastructure may discover that implementing these technologies necessitates a lower initial cost than buying conventional PCs. This is especially advantageous for businesses with a sizable workforce, as the total savings on hardware expenses can be more significant. The solution's lower initial expenses make it an attractive choice for enterprises that are mindful of their budget, particularly in areas such as education and healthcare, where extensive implementations are standard.

Furthermore, businesses increasingly use thin client technology to optimize their IT expenditures while maintaining high performance. The cost advantage of thin clients is a significant factor driving their adoption and fueling the market's growth. The growing necessity to effectively control IT budgets while maintaining optimal performance fuels market expansion. Conventional personal computers require more initial costs because they require local solid processing capabilities and storage capacity. Thin clients, in contrast, depend on a centralized server to carry out computing operations. This enables them to operate with minimal hardware needs, reducing startup expenses.

Regional Analysis

North America: Dominant Region

North America is the most significant global thin client market shareholder and is estimated to grow at a CAGR of 2.3% over the forecast period. The increasing inclination towards remote desktop services (RDS) and desktop as a service (DaaS) models fuels North America's acceptance of thin client technologies. RDS (Remote Desktop Services) and DaaS (Desktop as a Service) solutions allow enterprises to virtualize desktop environments and provide them to end-users as a service. This helps in lowering hardware expenses and streamlining IT administration. Thin clients act as terminals for accessing virtual desktops stored in the data center or cloud, offering users a reliable and protected computing experience from any place. The demand for adaptable and expandable IT solutions drives the trend towards desktop virtualization in North America.

Additionally, the region's businesses aim to enhance resource usage and boost labor productivity. IGEL announced in February 2022 that it is expanding its relationship with Nutanix Frame. The Frame Ready program, part of Nutanix Ready, enables thin client manufacturers to verify the compatibility of their operating systems and hardware with Nutanix Frame and the Frame App. IGEL OS achieves Nutanix Frame Ready accreditation by conducting collaborative compatibility testing, simplifying the configuration and administration of IGEL OS-powered devices on the Nutanix Frame Desktop-as-a-Service platform.

Subsequently, North America's IT and telecoms business is one of the largest compared to other regional marketplaces. Industries such as banking, healthcare, and government institutions that manage substantial quantities of sensitive data are eager to use thin client solutions. They are more likely to safeguard the intellectual property's authenticity than a bulky client. The strong position might be ascribed to multiple established thin client solution suppliers in the country. A recent collaboration between HP Inc. and Citrix is focused on providing secure and effective thin client solutions. The main goal is to improve remote work capabilities and ensure smooth access to virtual desktops and apps.

Asia Pacific: Growing Region

Asia Pacific is estimated to grow at a CAGR of 2.9% over the forecast period. The Asia Pacific area is projected to experience the highest pace of growth, driven mainly by the region's growing acceptance and use of cloud solutions. The market has had significant growth in several sectors, such as finance, healthcare, and education, due to the need for IT infrastructure that is efficient, secure, and cost-effective. As regional organizations adopt digital transformation, thin clients provide an attractive solution for centralized management and efficient operations. Moreover, an increasing focus on data security, compliance, and technological developments is anticipated to drive market growth in the forecast timeframe.

Europe holds a significant market share. The region's emphasis on installing sophisticated and secure computing solutions drives the European market. The market participants reacted to the changing requirements for flexible work arrangements by enabling secure remote access to centralized programs and data. European firms are actively investigating incorporating cloud computing to enhance scalability and operational efficiency.

Segmental Analysis

By Type

The market is further bifurcated based on type into Hardware, Software, and Services. The hardware segment holds a dominant position in the market. The increasing popularity of remote work and virtual desktop infrastructure (VDI) solutions has expedited the acceptance of thin client hardware. With the shift towards remote and hybrid work modes, there is an increasing demand for endpoint devices that effectively link remote workers to centralized computer resources. Furthermore, cloud computing and virtualization technological progress propels innovation in the thin client hardware sector. Contemporary thin client devices have enhanced computational capacity, superior graphics capabilities, and the ability to handle multimedia-intensive programs, meeting the increasing expectations of consumers for a smooth computing experience.

The services segment is the fastest growing. The increasing preference for remote work and scattered workforces has led to a higher need for remote assistance and monitoring services in the industry. As more employees adopt remote or hybrid work arrangements, organizations need remote support solutions that allow IT personnel to resolve problems, carry out maintenance activities, and oversee thin client setups from any location. Remote support services utilize remote access technologies and monitoring tools to offer prompt assistance and guarantee the optimal functioning of thin client devices and infrastructure.

By Enterprise Type

The market is bifurcated based on enterprise type into Large Enterprises and Small and Medium Enterprises (SMEs). The large enterprises segment dominated in 2023, primarily due to the product's compatibility with centralized management techniques, cost-effectiveness, advanced security features, and its capability to accommodate a geographically scattered workforce. These goods are a pragmatic and strategic option for enterprises with large and intricate operating needs.

The small and medium enterprises (SMEs) segment is the fastest growing due to the potential for rapid expansion or variations in workforce size. The methods enable more efficient and economically viable scalability than conventional PC configurations. Adaptability is crucial for small and medium-sized enterprises (SMEs) looking for adaptable solutions that can change and grow along with their business needs.

By End-User

Based on end-users, the market is subdivided into IT and Telecom, BFSI, Healthcare, Industrial, Government, Education, Retail, and Others. The BFSI segment dominated due to its strong focus on security, centralized administration, and scalability needs in handling large amounts of financial data and transactions. Due to their reliance on centralized servers, they provide advantages in scalability and throughput, making them well-suited for data-intensive tasks in the financial services sector.

The education segment is the fastest growing. The utilization of thin clients is widespread in the education industry due to various factors. Thin clients are typically more cost-effective than conventional PCs, enabling educational institutions, particularly those with financial limitations, to deploy them in large quantities. Centralized management is an additional notable advantage. Thin clients mitigate the potential for data breaches or unauthorized access by centralizing most computing activities on servers, minimizing the vulnerability of sensitive information on individual devices. Furthermore, the uncomplicated design and convenient size of thin clients play a significant role in the popularity of these devices in educational settings. This is particularly important at institutions where there is a requirement for efficient and adaptable solutions to cater to a large number of users, including students and professors. The healthcare segment is the second largest. These solutions are strategically chosen for updating healthcare IT infrastructure because of the industry's specific needs for security, compliance, digitization, flexibility, and cost-effective IT solutions.

List of Key and Emerging Players in Thin Client Market

- Hewlett Packard Enterprise Company (HP Development Company LP.)

- Dell Technologies, Inc.

- Fujitsu Limited

- Intel Corporation

- LG Electronics (LG Corporation)

- Arista Networks, Inc.

- Samsung Electronics Co., Ltd. (Samsung Group)

- Lenovo Group Limited

- Advantech Co., Ltd.

- Acer Inc.

Recent Developments

- April 2024– Kaspersky unveiled a revised operating system for thin clients that provides improved connectivity, faster application delivery, reduced total cost of ownership, a user-friendly graphical interface, and rapid deployment. Kaspersky Thin Client 2.0 is the primary element of Kaspersky's Cyber Immune solution. It is designed to provide thin client infrastructure in various areas such as healthcare, banking, education, and manufacturing.

- February 2024– The inventory of Amazon WorkSpaces Thin Client is now purchasable in France, Germany, Italy, and Spain through Amazon Business. The Amazon WorkSpaces Thin Client is an affordable device enterprises use to decrease virtual desktop expenses, enhance security measures, and streamline the deployment process for end-users.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.43 Billion |

| Market Size in 2025 | USD 1.47 Billion |

| Market Size in 2033 | USD 1.77 Billion |

| CAGR | 2.4% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Enterprise Type, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Thin Client Market Segments

By Type

- Hardware

- Software

- Services

By Enterprise Type

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End-User

- Healthcare

- Retail

- Education

- BFSI

- Government

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.