Transparent Electronics Market Size, Share & Trends Analysis Report By Product Type (Transparent Displays, Transparent Solar Panels, Transparent Windows), By Application (Consumer Electronics, Automotive, Construction, Healthcare, Military and Defense, Security Systems, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Transparent Electronics Market Size

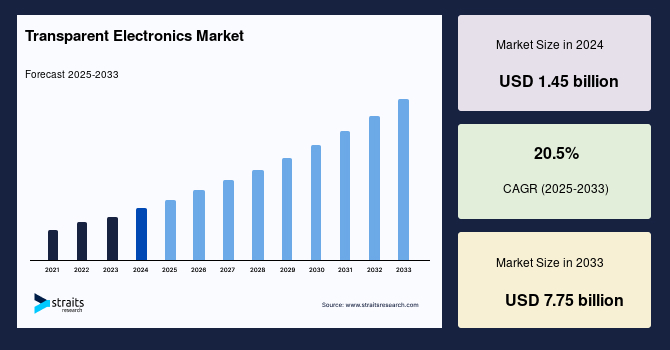

The global transparent electronics market size was valued at USD 1.45 billion in 2024 and is expected to grow from USD 1.74 billion in 2025 to reach USD 7.75 billion by 2033, growing at a CAGR of 20.5% during the forecast period (2025-2033).

Transparent electronics is a developing topic that aims to create electronic circuits and optoelectronics devices that are not visible. The technology entails substituting the typically non-transparent semiconductor materials used in producing electrical devices with transparent materials. Transparent electronics provide several advantages compared to traditional electronics, including increased mobility, reduced processing temperature, enhanced performance, and greater flexibility. Utilizing OLED technology for displays offers benefits such as increased luminosity and reduced power usage. Transparent solar cells have several advantages compared to traditional solar cells. They take less space, produce higher energy output, are environmentally benign, can be used as a replacement for regular window glass, and have the potential to function as a residential electricity generator.

The global transparent electronics market is projected to experience considerable growth during the forecast period due to technological improvements and the increasing need for advanced compact products worldwide. The growing demand for miniaturization of electrical gadgets likely drives market growth.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.45 Billion |

| Estimated 2025 Value | USD 1.74 Billion |

| Projected 2033 Value | USD 7.75 Billion |

| CAGR (2025-2033) | 20.5% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | BOE Technology Group Co., Brite Solar, Cambrios Technologies Corporation, ClearLED Ltd., Corning Incorporated |

to learn more about this report Download Free Sample Report

Transparent Electronics Market Growth Factor

Consumer Electronics Evolution and Rapid Advancements in Display Technologies

The transparent electronics industry is witnessing a significant increase in demand, primarily due to the progress in consumer electronics and the rapid improvements in display technology. Manufacturers are integrating transparent electronic components into their products to suit consumers' growing demand for stylish and cutting-edge designs.

In addition, the rapid development of smartphones, smartwatches, and wearables has become crucial in advancing transparent electronics. Consumers are attracted to products that have transparent screens, which provide a modern and visually appealing design while yet retaining functionality. Manufacturers are investing in transparent OLED and LED display technologies in response to this trend, driving the market's substantial expansion.

Moreover, the swift progress in transparent display technologies drives market demand. Transparent OLED and LED displays provide exceptional image quality, vivid colors, and distinctive design opportunities. Various industries, particularly the automobile sector, have been drawn to this for its state-of-the-art visual solutions. Transparent displays are utilized in the automotive industry for heads-up displays and bright windows, which improve driving experiences and safety features. The market's influence of consumer electronics advancements and continuous improvements in display technology support the market's growth.

Increased Investments

The increasing investments in research and development for transparent electronics technologies demonstrate a dedication to stimulating market growth. These investments provide funding for projects that aim to enhance performance, decrease expenses, and expand the scope of uses for transparent electronic components.

One example is Brite Solar, a Greek company that manufactures modules for agrivoltaics greenhouses and PV canopies. They are now constructing a production line with a capacity of 150 MW. Brite Solar has been targeting farming cooperatives, integrators, and installers with their modules since the end of 2022. The company has conducted experimental installations in North America, Southeast Asia, and Europe. In January, it disclosed securing USD 9.26 million in venture money.

In April 2024, BOE Technology Group, a leading Chinese display manufacturer that supplies Apple and Samsung, began construction on the BOE Vietnam bright terminal phase 2 project. The groundbreaking ceremony occurred on April 18 in Phu My 3 Specialised Industrial Park in Ba Ria-Vung Tau, a province in southern Vietnam. The project has a capital above USD 275 million and can produce more than 134.7 million goods annually. The project is projected to yield USD 1 billion annually for BOE and provide employment opportunities for over 4,000 individuals. Therefore, these activities stimulate market expansion.

Market Restraint

Limited Material Options and Complex Manufacturing Processes

The transparent electronics market faces significant obstacles and constraints due to the limited material possibilities and complex manufacturing procedures. The restricted availability of materials that possess both transparency and electronic capability hinders the development of transparent electronic components. Transparent conductive materials, essential for the functionality of displays and sensors, frequently encounter challenges in balancing transparency, conductivity, and flexibility. The limited availability of materials that meet these specific requirements hinders the manufacturing of transparent electrical devices that are both cost-effective and high-performing.

In addition, the intricate manufacturing procedures necessary for transparent electronics contribute to the limitations of the market. Creating transparent electronic components involves complex techniques such as thin-film deposition, patterning, and encapsulation, which can be difficult and require significant resources. The intricacies of the process lead to increased production expenses, which in turn restrict the capacity to expand and achieve widespread acceptance. Manufacturers need help optimizing procedures to attain the intricate equilibrium between transparency, conductivity, and cost-effectiveness, which hinders the smooth integration of transparent electronics into different applications. Tackling these obstacles is essential for harnessing the complete capabilities of transparent electronics in various sectors.

Market Opportunity

Emerging Applications and Flexible Electronics

The increase in demand for the transparent electronics market is primarily driven by the investigation of emerging applications and the advancement of flexible electronics. As companies actively pursue inventive solutions, transparent electronics are utilized in various emerging fields, including augmented reality (AR) devices and innovative fabrics. Incorporating transparent OLED and LED displays in AR glasses, headsets, and visors improves user experiences by effortlessly superimposing digital information onto the physical environment.

Furthermore, introducing flexible electronics, such as transparent flexible screens and sensors, drives the market forward. Flexible transparent electronics facilitate the development of pliable and adaptable electronic devices, providing opportunities for versatile design and long-lasting performance.

Moreover, a broad category of applications drives the market, like flexible and transparent electronic skins for wearables, foldable smartphones, and curved displays in automobile interiors. The combination of developing applications with flexible electronics increases the market presence and stimulates ongoing innovation in transparent electronic technologies, creating opportunities for revolutionary solutions in many industries.

Healthcare Integration

Transparent electronics have significant potential in the healthcare industry, namely in developing medical equipment and wearable sensors. The clarity of these electronic components enables unobtrusive monitoring and diagnostics, propelling breakthroughs in healthcare technology and improving patient care.

Recently, extensive research has been conducted to advance the development of flexible electronics and self-healing materials to build intelligent wearable devices. A new addition to the list is a recently created sensor capable of generating electricity. This sensor is incredibly flexible, allowing it to stretch without damage. Additionally, it is transparent and susceptible to the intricate responses of human skin. These qualities make it ideal for creating advanced wearable devices. The artificial ionic skin, also known as AISkin, was created by a team of researchers from the University of Toronto. This technology has potential applications in developing wearables and advancements in medical treatments and robotics.

Moreover, the critical aspect of healthcare visualization is the extraordinary capacity of transparent glass screens. Unlike typical opaque displays, these panels provide medical personnel with the distinct benefit of simultaneously examining digital imaging and the patient's anatomy. This innovative feature offers unparalleled clarity and precision in diagnostic processes, fundamentally transforming the approach healthcare professionals use to interpret and evaluate medical imaging. Therefore, these advancements and implementations in healthcare offer profitable prospects for market growth.

Regional Analysis

North America is the most significant global transparent electronics market shareholder and is estimated to grow at a CAGR of 20.3% over the forecast period. North America dominates the market in terms of revenue, primarily due to the concentration of essential market participants in the United States. One of the main factors contributing to North America's is usage of touch-enabled gadgets. The residential sector in the United States has a strong demand for poly-crystalline solar panels in North America. This is due to the widespread use and high acceptance of renewable energy sources in residential buildings. According to researchers at Michigan State University, very transparent solar cells are considered the future of solar technology for new uses. Solar power accounts for around 1.5% of electricity demand in the United States and worldwide.

However, the United States has approximately 5 billion to 7 billion square meters of glass surface when considering the total power capacity. The usage of transparent solar panels is increasing rapidly due to their potential to facilitate affordable and extensive solar utilization on various scales. In 2023, approximately 5% of individual residential buildings in the United States were outfitted with solar panels. Residential solar is expected to experience a rise in market penetration in the coming years, with a projected increase to approximately 18 percent by 2032.

Asia Pacific Transparent Electronics Market Trends

Asia-Pacific is anticipated to exhibit a CAGR of 20.7% over the forecast period. The Asia-Pacific area, specifically China, Japan, and South Korea has a crucial impact on the transparent electronics market. These nations are renowned for their robust manufacturing capacities and technological progress. The need for transparent displays and devices is driven by the region's consumer electronics sector, fast urbanization, and rising disposable incomes.

Europe Transparent Electronics Market Trends

Europe is crucial in transparent electronics, promoting innovation through solid research programs and collaborations. Transparent electronic applications are experiencing significant advancements in several regional areas, such as consumer electronics and automobiles. Europe has a prominent role in the worldwide transparent electronics industry, emphasizing technological advancement and environmental solutions.

Product Type Insights

The Transparent Displays segment dominated the market in 2023. Transparent displays are more deployed in the automotive, consumer electronics, and retail industries. The transparent displays market is projected to grow substantially due to the development of various applications, including smart glasses and vehicle windshields.

The Transparent Solar Panels segment is the fastest growing. Transparent solar panels are specifically engineered to produce electrical energy while permitting light transmission. These panels are seamlessly incorporated into windows and building facades, transforming them into surfaces that generate power. Transparent solar panels are becoming increasingly feasible for commercial and residential applications due to improvements in materials and efficiency. These panels support the increasing use of clean energy solutions and align with green construction practices and energy-efficient designs, emphasizing sustainability.

Application Insights

The consumer electronics segment dominated in 2023. Transparent electronics revolutionize consumer electronics by facilitating the development of cutting-edge products with transparent displays and touch-responsive surfaces. The current trend in this application revolves around the advancement of transparent OLED and LED displays for smartphones, tablets, and TVs, offering captivating and visually impressive experiences. In addition, integrating transparent touch sensors and interactive surfaces improves user interfaces, resulting in stylish and inventive designs in the consumer electronics industry.

The automotive segment is projected to grow at the fastest rate over the projected period. Transparent electronics revolutionize vehicle interiors in the automobile industry by introducing transparent displays, augmented reality windshields, and intelligent windows. Car windows with integrated transparent OLEDs provide heads-up displays and information overlays, improving driver safety and convenience.

In addition, transparent touch panels on entertainment systems and interactive dashboards enhance the driving experience by creating a smooth and interconnected environment. The automotive transparent electronics trend encompasses developments in augmented reality applications, heads-up display technology, and the integration of transparent displays in other car components.

List of Key and Emerging Players in Transparent Electronics Market

- BOE Technology Group Co.

- Brite Solar

- Cambrios Technologies Corporation

- ClearLED Ltd.

- Corning Incorporated

- Glass Apps, LLC

- LG Electronics Inc.

- OLEDWorks

- Raven Window

- Shenzhen AuroLED Technology Co., Ltd.

- Shenzhen NEXNOVO Technology Co., Ltd.

- SolarWindow Technologies, Inc.

- Street Communication

- Ubiquitous Energy

Recent Developments

- January 2024– LG Electronics (LG) introduced the inaugural wireless transparent OLED TV at CES 2024. The LG SIGNATURE OLED T is an extraordinary technological achievement, as it seamlessly integrates a clear 4K OLED panel with LG's wireless video and audio transmission technology, revolutionizing the screen viewing experience in unprecedented ways.

- January 2024– Veeo, a specialized display technology startup, planned to introduce three transparent OLED panels in 2024. These displays, developed in collaboration with LG, are designed specifically for video conferencing and incorporate eye contact technology.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.45 Billion |

| Market Size in 2025 | USD 1.74 Billion |

| Market Size in 2033 | USD 7.75 Billion |

| CAGR | 20.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Transparent Electronics Market Segments

By Product Type

- Transparent Displays

- Transparent Solar Panels

- Transparent Windows

By Application

- Consumer Electronics

- Automotive

- Construction

- Healthcare

- Military and Defense

- Security Systems

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Tejas Zamde

Research Associate

Tejas Zamde is a Research Associate with 2 years of experience in market research. He specializes in analyzing industry trends, assessing competitive landscapes, and providing actionable insights to support strategic business decisions. Tejas’s strong analytical skills and detail-oriented approach help organizations navigate evolving markets, identify growth opportunities, and strengthen their competitive advantage.