Unsecured Business Loans Market Size, Share & Trends Analysis Report By Loan Type (Short-Term Working Capital Loans, Medium-Term Term Loans, Business Lines of Credit, Merchant Cash Advances, Invoice & Receivables Financing, Embedded Business Credit), By Borrower Size (Micro Enterprises (<10 employees), Small Enterprises (10–49 employees), Medium Enterprises (50–249 employees), Sole Proprietors), By Distribution Channel (Bank Direct Lending, Fintech Digital Lending Platforms, P2P Lending Platforms, Embedded Finance Providers, NBFCs), By Interest Rate (Fixed interest rate loans, Variable interest rate loans), By End Industry (Retail, Professional Services, Logistics, Hospitality, Healthcare, Manufacturing, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Unsecured Business Loans Market Overview

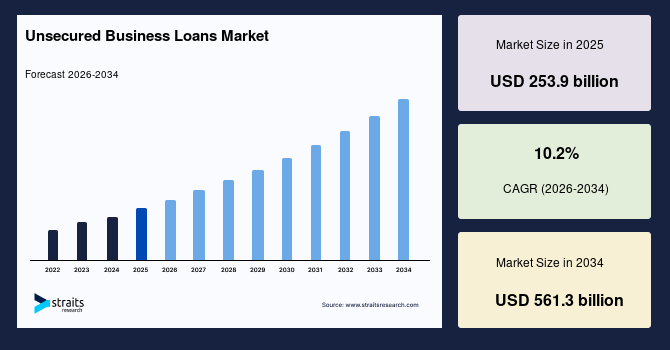

The global unsecured business loans market size is valued at USD 253.9 billion in 2025 and is estimated to reach USD 561.3 billion by 2034, growing at a CAGR of 10.2% during the forecast period. Consistent growth of the market is supported by the rapid expansion of fintech-driven lending platforms and the increasing adoption of digital underwriting technologies, which enhance loan accessibility, streamline approval processes, and enable small and medium-sized enterprises (SMEs) to secure financing without traditional collateral requirements.

Key Market Trends & Insights

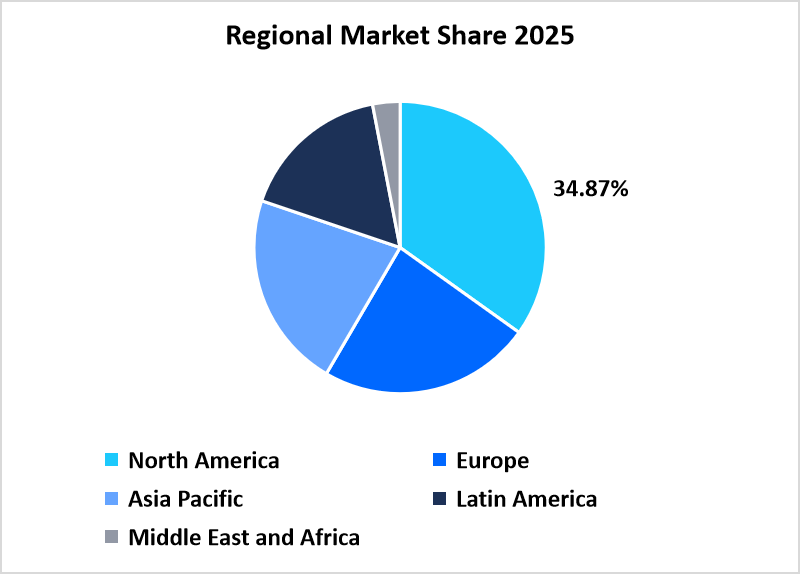

- North America dominated the market with a revenue share of 34.87% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 10.84% during the forecast period.

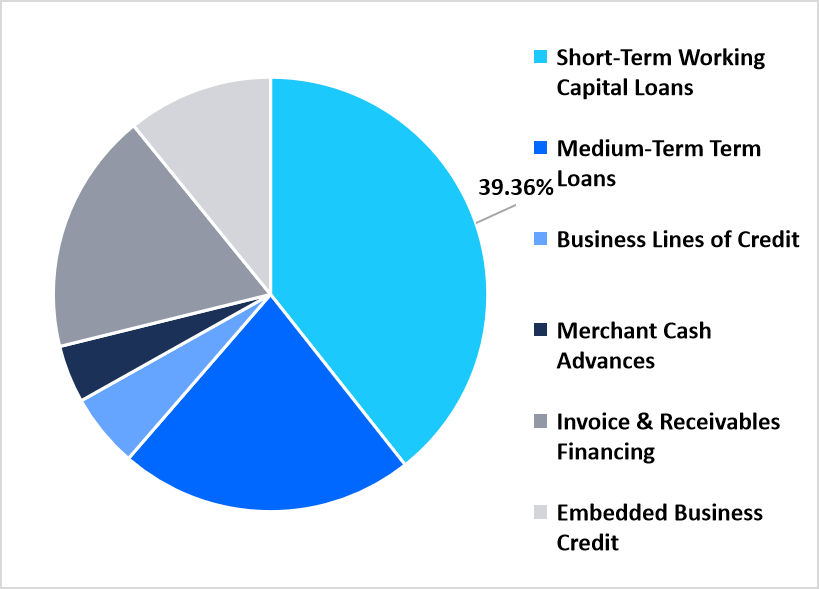

- Based on loan type, the Short-Term Working Capital Loans segment held the highest market share of 39.36% in 2025.

- By borrower size, the Micro Enterprises (<10 employees) segment is projected to record the fastest CAGR of 10.91%.

- Based on distribution channel, the Bank Direct Lending segment dominated the market with a share of 37.12% in 2025.

- Based on interest rate, the Fixed Interest Rate Loans segment held a market share of 56.47% in 2025.

- By end-industry, the Professional Services segment is anticipated to witness the fastest CAGR of 11.05%.

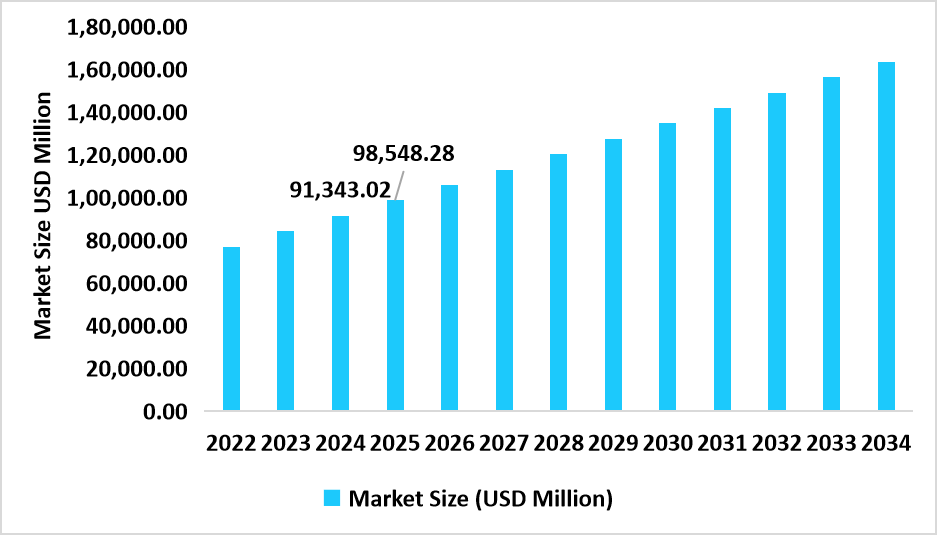

- The U.S. dominates the Unsecured Business Loans Market, valued at USD 91.3 billion in 2024 and projected to reach USD 98.5 billion in 2025.

Table: U.S Unsecured Business Loans Market Size (USD Million)

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 253.9 billion

- 2034 Projected Market Size: USD 561.3 billion

- CAGR (2026-2034): 10.2 %

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global unsecured business loans market deals in collateral-free funding solutions targeted at various funding needs of micro, small, and medium-scale enterprises, and sole proprietors. These range from short-term working capital loans to medium-term term loans, business lines of credit, merchant cash advances, invoice and receivables financing, and integrated business credit products offered through digital platforms.Loans are extended through bank direct lending, fintech digital lending platforms, P2P lending platforms, embedded finance providers, and NBFCs that offer flexible fixed and variable interest rate structures.

Key end-industries catered to include retail, professional services, logistics, hospitality, healthcare, and manufacturing, among others, where seamless access to funds for operations, expansion, and digital transformation is enabled. Unsecured business loans are revolutionizing the way SMEs and self-employed entrepreneurs access credit across the world, enabled by technology-driven underwriting and data-driven lending models.

Latest Market Trends

Digital Transformation of SME Lending Using AI-driven Credit Models

Unsecured business lending is in the midst of a structural transition from traditional paper-based credit assessment to a fully digital, data-driven underwriting ecosystem. Whereas earlier, small enterprises suffered from long approval times, high documentation, and limited access to formal credit because of a lack of collateral, today, AI-based credit scoring, alternative data analytics, and open banking integration mean that lenders can assess borrower risk in real time using transaction data, cash flow patterns, and digital footprints.

Today, platforms harnessing automated underwriting systems offer instant loan approvals and same-day disbursements, dramatically changing the paradigm toward speed, precision, and inclusion. Therefore, this trend toward predictive credit models has helped millions of small businesses access finance without traditional collateral-a transformative evolution to faster, fairer, and technology-enabled lending ecosystems.

Embedded Finance Revolution Reshaping Credit Distribution

The rise of embedded finance is bringing about a paradigm shift in the unsecured lending market, with credit integrated as seamlessly as possible into digital ecosystems-be it an e-commerce platform, a payment gateway, or accounting software. Companies today can gain access to pre-approved credit without approaching any bank, all while managing sales, inventory, or even vendor payments on their existing platforms.

This has reduced customer acquisition costs for lenders and improved credit access for SMEs in underserved markets. Working capital solutions are being embedded by payment giants, marketplaces, and ERP platforms directly into the user interface, creating a frictionless way for them to borrow. The embedded model is rewriting the rules of how credit is delivered-actually transforming loan distribution from a standalone service into a contextual, data-driven feature in business workflows.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 253.9 billion |

| Estimated 2026 Value | USD 279.8 billion |

| Projected 2034 Value | USD 561.3 billion |

| CAGR (2026-2034) | 10.2% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | American Express, Bank of China, Bank of America, JPMorgan Chase, Wells Fargo |

to learn more about this report Download Free Sample Report

Market Driver

Government-Backed Credit Inclusion Programs Empowering MSMEs

Targeted unsecured lending programs for financial inclusion and SME empowerment have emerged as one of the prime driver of global governments, driving the market significantly. Initiatives such as India's CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) and the U.S. Small Business Administration's 7(a) loan program are extending credit accessibility without collateral to small enterprises.

These programs lessen the risk for lenders by offering partial guarantees and, consequently, drive financial institutions to lend more aggressively to underserved businesses. Similarly, the SME Finance Initiative by the World Bank and similar frameworks by the EU are channeling low-cost capital toward unsecured credit lines.

Consequently, millions of micro and small enterprises are drawn toward formal credit markets, accelerating entrepreneurship and eventually job creation. This government-backed push toward collateral-free financing remains one of the most powerful growth enablers of the unsecured business loans market globally.

Market Restraint

Delinquency Rates on the Rise-Lenders' Confidence Affected

Key factors restraining growth in the unsecured business loans market are growing concern related to rising delinquency and default rates, which could shake confidence among lenders and deteriorate portfolio quality. More than 35% of all U.S. small businesses reported missed loan payments or partial defaults during the last fiscal year, recorded by the Federal Reserve Bank in its 2025 Small Business Credit Survey.

A similar trend has been observed across several emerging economies too, where delayed repayments among micro and small enterprises have gained momentum after disruptions related to the pandemic. The continued stress on credit has been forcing financial institutions to tighten underwriting standards, reduce exposure to high-risk borrowers, and raise interest margins, thus constraining credit flow and ultimately moderating expansion in unsecured lending globally.

Market Opportunity

Expanding Credit Access Through Embedded Business Ecosystems

The growing integration of credit solutions within digital ecosystems, such as e-commerce platforms, accounting software, and payment gateways, is creating major opportunities for the unsecured business loans market. The accessibility of pre-approved working capital for businesses operating within these ecosystems, without them having to leave their operational platforms, is significantly enhancing convenience and speed.

Under this embedded finance model, the traditional credit distribution will get transformed since lending merges with the daily flow of business activities, particularly in merchants, logistics providers, and service SMEs. It also offers the ability to analyze real-time transactional data in these ecosystems so that lenders can tailor loan products to cash flow behavior, leading to higher engagement and lower default risk. As more industries move toward platform-oriented business models, embedded finance will emerge as one of the strongest growth catalysts for unsecured lending globally.

Regional Analysis

North America accounted for a share of 34.87% in the global revenue in 2025, due to its well-established credit infrastructure, fully developed fintech ecosystem, and increased adoption of digital lending solutions among SMEs in the region. The fully established data analytics capability and integration of sophisticated credit risk modeling in the region have significantly improved underwriting accuracy, thereby increasing the approval rates for unsecured loans. Increased digital-first lenders and credit marketplaces have further simplified borrowers' access to funding and ensured continuous growth in loan origination. Strategic partnerships among traditional financial institutions and technology providers are further strengthening market maturity to ensure a stable and scalable unsecured lending environment in North America.

The growth in the unsecured business loans market in the United States is primarily driven by increasing demand for short-term financing among small businesses and independent contractors who are seeking fast, collateral-free funding. Acceleration of access to business credit through digital channels, with several lenders offering same-day disbursal and dynamic repayment options, happens because of the country's robust fintech landscape.

Increased utilization of cloud-based credit management platforms and API-driven loan integrations also enhance lender efficiency and borrowers' convenience. The growth of small business ecosystems across retail, professional services, and logistics sectors continues to push the demand for unsecured loans. An increase in investor participation in private credit and securitised loan products is strengthening liquidity across the unsecured lending value chain and positioning the United States as an anchor market for innovation and scale in global unsecured business financing.

Asia Pacific Market Insights

APAC will be the fastest-growing region, expected to grow at a CAGR of 10.84% due to rapid financial digitization, increased entrepreneurial activity, and expanding access to digital credit infrastructure in developing economies. High growth in the adoption of unsecured loans through mobile-first lending platforms for unserved MSME segments has driven demand in markets such as India, Indonesia, and Vietnam. Meanwhile, developed nations like Japan, South Korea, and Singapore are exploring the scaling of AI-driven credit scoring and cross-border SME lending frameworks. Proliferation of real-time payments and open banking interfaces also helps lenders offer tailored financing propositions at lower operational costs, further scaling up the market across the region.

The India unsecured business loans market continues to grow rapidly, with the increasing formalization of small businesses and rapid adoption of digital lending channels. The ease of credit access has been facilitated for merchants, gig workers, and self-employed professionals by the proliferation of mobile-based loan apps and accounting-integrated credit tools.

Revenue-based financing, daily repayment microloans, and digitally embedded business credit are some of the innovative financial products gaining traction among MSMEs looking for flexibility over traditional banking loans. Moreover, deepening fintech partnerships with retail and e-commerce ecosystems facilitate seamless credit distribution across tier-2 and tier-3 cities. These factors put India among the most dynamic markets in Asia Pacific for growth in unsecured business lending.

Source: Straits Research

Europe Market Insights

The unsecured business loans market is seeing consistent growth in Europe, driven by rapid digitalization in SME financing and the expanded usage of open banking frameworks across major economies. The surging involvement of neobanks and online lenders reshapes the credit landscape with quicker approval procedures for SMEs and paperless onboarding. This trend will be further driven by alternative credit marketplaces that have emerged in countries like the UK, Germany, and the Netherlands, providing flexible options for borrowers beyond traditional banking systems.

Increasing investor interest in SME debt instruments coupled with the move toward cashless economies across the EU further bolsters demand for unsecured lending. Europe's continued commitment to cross-border harmonization of digital finance continues to create a single lending environment, further scaling up unsecured business credit overall.

The unsecured business loans market is growing in Germany, as small and mid-sized enterprises increasingly look to leverage digital, collateral-free loans for modernization and export-driven operations. The country's strong fintech ecosystem and high SME density continue to push demand toward online lending platforms that grant instantaneous access to working capital. Innovative lenders are adding data-driven underwriting models that analyze real-time sales and accounting information, significantly reducing the credit approval times for small businesses.

In addition, partnerships between regional banks and fintech startups now allow co-lending frameworks to take shape, which blends traditional stability in finance with technological agility. Germany, with its growing focus on competitiveness at the level of SMEs and financial inclusivity, becomes one of the primary European hubs for unsecured business lending growth.

Latin America Market Insights

The Latin America unsecured business loans market is being driven by rising entrepreneurial activity and the expansion of fintech credit platforms across Mexico, Brazil, and Colombia. These economies are increasingly adopting digital lending solutions to cater to the needs of micro and small businesses that were hitherto excluded from formal banking services. Mobile-first loan applications and instant KYC verification have expedited access to credit across both urban and rural enterprises. Moreover, regional lenders and payment processors are leveraging regional collaborations in support of the emergence of embedded credit solutions from within digital marketplaces. This increasing fintech penetration, along with growing investor confidence in SME debt instruments, is rapidly changing the unsecured lending ecosystem in Latin America.

The unsecured business loans market is growing fast in Brazil, driven by increasing demand from small businesses to finance working capital requirements for sustaining operations in a high-growth e-commerce and services-led economy. Alternative data, such as payment history and marketplace transaction records, is being utilized by local fintech platforms to estimate the creditworthiness of borrowers. Newer repayment structures, like revenue-linked installments and daily micro-deductions, are allowing greater flexibility for the small enterprise. These, along with increasing digital literacy among entrepreneurs, are making Brazil one of the most vibrant unsecured lending markets in the Latin American region.

Middle East and Africa Unsecured Business Loans Market Insights

The unsecured business loans market of the Middle East and Africa is growing owing to the increasing adoption of digital financial services for filling short-term liquidity gaps among SMEs. Fintech lenders in the UAE, Saudi Arabia, and South Africa are offering streamlined credit products with minimal documentation and automated risk assessment tools. A move toward cashless transactions and increased adoption of digital wallets are creating valuable trails of data that are enhancing the accuracy of credit scores among small business borrowers. Further, collaborative efforts by commercial banks and technology companies are developing new ways of access to funds for startups and local businesses, paving the way for improved unsecured lending within the region.

The South Africa unsecured business loans market is growing steadily, with fintech platforms and micro-lenders focusing on financing the country's growing informal and SME sectors. Digital credit scoring powered by transaction analytics and behavioral data is improving access to finance for those businesses that conventionally did not have any formal credit history.

Increased smartphone penetration and digital payment adoption are paving the way for seamless processes of loan origination and disbursement. Local lenders are also introducing innovative repayment models aligned to the seasonal cash flows of the businesses, making unsecured loans more sustainable and accessible for small enterprises. These developments mark South Africa as a key growth frontier in the region's evolving business credit landscape.

Loan Type Insights

The segment of Short-Term Working Capital Loans dominated the market share with 39.36% revenue in 2025. This segment is driven by the rise of immediate financing needs among small and micro enterprises to manage cash flow, purchase inventories, and meet short-term operational costs. Demand has surged as supply chains continue their recovery across the globe and SMEs more and more move to digital payment systems in search of flexible, collateral-free working capital solutions.

The Embedded Business Credit segment is expected to record the highest growth rate of approximately 11.42% CAGR during the forecast period. This can be attributed to the integration of lending capabilities into digital platforms such as e-commerce marketplaces, accounting software, and payment gateways. Businesses increasingly access financing within their operational ecosystems that allow the use of credit in real time, with automated mechanisms of repayment.

By Loan Type Market Share (%), 2025

Source: Straits Research

Borrower Size Insights

Small Enterprises (10–49 employees) held the largest market share, with 33.58% in 2025. This segment is mainly driven by increased demand for credit from well-established small businesses that require unsecured funding for business expansion, procuring inventory, and digital transformation. Most of these enterprises ensure steady cash flows and digital transaction records that facilitate collateral-free lending with minimal risk for lenders.

It is expected that the Micro Enterprises (<10 employees) segment will grow the fastest, at a CAGR of about 10.91%, during the forecast period. This growth is driven by rapidly increasing formalization of microbusinesses, especially in developing economies where the pace of digital payment acceptance and government-driven initiatives for inclusions is increasing.

Distribution Channel Insights

Bank Direct Lending sector held the largest market share of 37.12% in 2025. This is because banks have earned strong trust and developed relationships with SMEs over time. Traditional banks remain key credit suppliers since they have widespread branch networks, lower borrowing rates, and access to a wide range of funding sources. Additionally, regulatory support for SME financing has catalyzed banks to stay at the leading edge in unsecured business lending, along with an introduction of simplified credit approval processes.

The segment of Fintech Digital Lending Platforms is expected to have the fastest growth, with an estimated CAGR of approximately 11.36% in the forecast period. This rapid growth is due to the adoption of digital-first credit models with instant approvals and minimal documentation, driven by data-based risk assessment. Fintech platforms utilize alternative data in the form of transaction records, e-commerce sales, and digital payment history to assess a borrower's creditworthiness, thus addressing the financing gap for the small businesses left unserved by mainstream banks.

Interest Rate Insights

Fixed Interest Rate Loans segment accounted for 56.47% of market share in 2025, driven by the growing inclination of borrowers toward fixed and payable repayment structures in view of fluctuating interest rates in the global economy. Fixed-rate unsecured loans are preferred by SMEs to maintain stable financial planning without being exposed to market volatility. Lenders, in response, especially banks and NBFCs, have been offering fixed-rate products with flexible tenures to lure such risk-averse borrowers.

The segment of Variable Interest Rate Loans is poised to show the fastest growth during the forecast period. The growth of this sector is underpinned by the growing adoption of market-linked loan structures among digitally enabled fintech lenders and agile SMEs. In variable-rate loans, the advantages lie in lower initial interest costs and the ability to flexibly adjust to monetary policy shifts.

End-Industry Insights

The Professional Services segment is projected to show the highest growth rate of 11.05%, driven by growing consulting, legal, IT, and accounting firms that are in urgent need of flexible financing options to manage their project-based cash flow against irregular payment cycles of their clients. While service-oriented enterprises are embracing digital and work-from-home activities more intensely, their demand for unsecured working capital loans has further accelerated.

Competitive Landscape

The global market for unsecured business loans is moderately fragmented, with a number of established traditional banking institutions, fintech lenders, and non-bank financial companies offering diversified unsecured credit solutions. A few leading financial organizations hold a significant share of this market owing to their large product portfolios, digital lending infrastructure, and wide reach among small and medium enterprise segments.

The major players in the market include American Express, Bank of America, Bank of China, and other regional financial institutions that are aggressively expanding their unsecured business lending operations. The leading names compete fiercely to gain a foothold in the market by forging strategic partnerships with fintech platforms, innovating products, and integrating AI-driven credit assessment tools. Additionally, several digital loan origination initiatives, flexible repayment structures, and multi-currency lending further enhance customer reach and retention. Continuous investments in digital transformation, along with cross-border lending capabilities, are likely to strengthen these players' leading positions in the global unsecured business loans market.

Kriya Finance Ltd: An emerging market player

Kriya Finance Ltd, a UK-based fintech specialising in unsecured business lending to SMEs, has quickly emerged as a standout player in the global unsecured business loans market.

- In October 2025, it was acquired by Allica Bank, with the combined entity targeting USD 1 billion in working capital finance to SMEs by 2028.

This strategic move reflects Kriya’s significant growth momentum and innovation capability, positioning it as a key driver of growth for unsecured business lending globally.

List of Key and Emerging Players in Unsecured Business Loans Market

- American Express

- Bank of China

- Bank of America

- JPMorgan Chase

- Wells Fargo

- HSBC

- Barclays

- Santander

- PayPal

- Block Capital

- Amazon Lending

- Intuit QuickBooks Capital

- Funding Circle

- OnDeck

- BlueVine

- Fundbox

- OakNorth

- Revolut Business

- Payoneer

- Bajaj Finserv

- Others

Strategic Initiatives

- October 2025: American Express updated its Business Line of Credit product to enable access up to USD 250,000 in unsecured credit for eligible small businesses, simplifying online approval and bolstering credit availability.

- September 2025: Bank of America announced that it held USD 46.7 billion in small business loan balances (original amounts up to USD 1 million) for the 17th consecutive quarter as the No. 1 U.S. small business lender, reinforcing its leadership in unsecured business funding.

- August 2025: DMI Finance launched a collateral-free business loan product offering unsecured business loans of up to USD 30,000 with a fully digital approval process and disbursal in as little as 24-72 hours.

- September 2025: CredAble projected its MSME unsecured business loan portfolio to surpass USD 51 billion by FY25, up from a lower base the previous year, as it scales unsecured credit access for micro- and small enterprises.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 253.9 billion |

| Market Size in 2026 | USD 279.8 billion |

| Market Size in 2034 | USD 561.3 billion |

| CAGR | 10.2% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Loan Type, By Borrower Size, By Distribution Channel, By Interest Rate, By End Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Unsecured Business Loans Market Segments

By Loan Type

- Short-Term Working Capital Loans

- Medium-Term Term Loans

- Business Lines of Credit

- Merchant Cash Advances

- Invoice & Receivables Financing

- Embedded Business Credit

By Borrower Size

- Micro Enterprises (<10 employees)

- Small Enterprises (10–49 employees)

- Medium Enterprises (50–249 employees)

- Sole Proprietors

By Distribution Channel

- Bank Direct Lending

- Fintech Digital Lending Platforms

- P2P Lending Platforms

- Embedded Finance Providers

- NBFCs

By Interest Rate

- Fixed interest rate loans

- Variable interest rate loans

By End Industry

- Retail

- Professional Services

- Logistics

- Hospitality

- Healthcare

- Manufacturing

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.