Utility Communication Market Size, Share & Trends Analysis Report By Communication Technology (Fibre optic networks, Cellular (private LTE / public 4G/5G), RF Mesh / LoRaWAN, Power Line Communication (PLC), Satellite), By Product Type (Hardware, Software and Platforms, Services), By Application (Advanced Metering Infrastructure (AMI), Substation Automation, Distribution Automation (DA), Outage Management / OMS, EV Charging & Smart Charging Communications), By Deployment Mode (Private/on-premise utility networks, Managed services and hosted/cloud offerings, Hybrid (combination of private + managed)) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Utility Communication Market Overview

The global utility communication market size is valued at USD 21.4 billion in 2025 and is projected to reach USD 44.6 billion by 2034, expanding at a CAGR of 8.5% during the forecast period. The market’s growth is driven by the rapid digitalisation of power grids, rising investments in smart metering and substation automation, and increasing demand for secure, real-time communication networks that support modern utility operations.

Key Market Trends & Insights

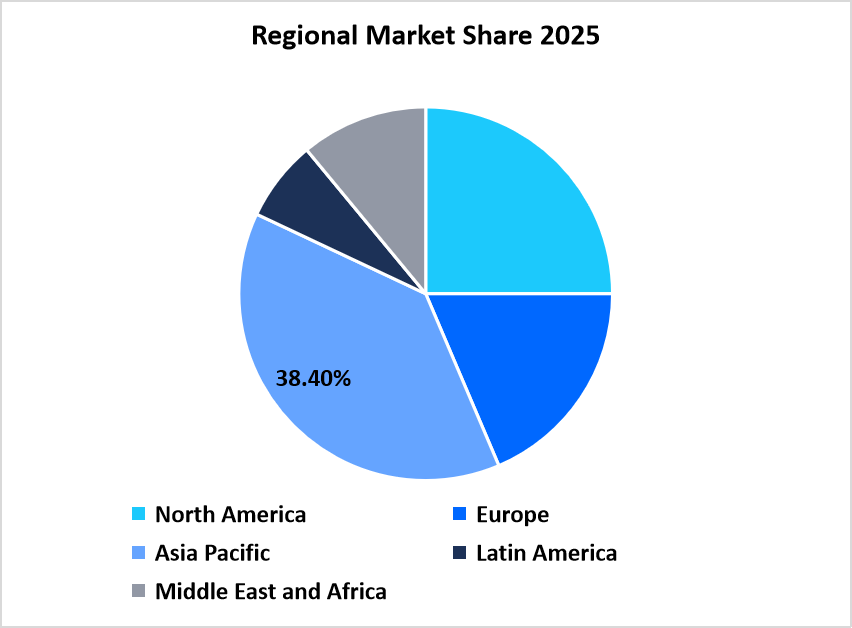

- Asia Pacific dominated the market with a revenue share of 38.4% in 2025.

- Latin America is anticipated to grow at the fastest CAGR of 9.1% during the forecast period.

- Based on Communication Technology, the Fibre optic networks segment held the highest market share of 35% in 2025.

- By Product Type, the Software and Platforms segment is estimated to register the fastest CAGR growth of 9.0%.

- Based on Application, the Advanced Metering Infrastructure category dominated the market in 2025 with a revenue share of 30%.

- Based on Deployment Mode, the Managed Services and Hosted/Cloud Offerings segment is projected to register the fastest CAGR of 10.0% during the forecast period.

- China dominates the market, valued at USD 3,801.60 million in 2024 and reaching USD 4,108.38 million in 2025.

China Utility Communication Market Size (USD Million)

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 21.4 billion

- 2034 Projected Market Size: USD 44.6 billion

- CAGR (2026-2034): 8.5%

- Dominating Region: Asia Pacific

- Fastest-Growing Region: North America

The utility communication market covers communication technologies, devices, and systems used across electricity, gas, and water utilities. This includes fibre-optic networks, wireless technologies, power line communication (PLC), routers, gateways, field-area networks, substation automation systems, and utility-grade cybersecurity solutions. These communication infrastructures enable utilities to monitor assets, enhance outage response, automate grid operations, and support smart metering, distributed energy integration, and regulatory compliance. The growth is supported by the shift toward resilient and digitally connected grids, advances in telecom standards, and utility investments in reliable field connectivity, combined with innovations in software, analytics, and cloud management platforms.

Latest Market Trends

Grid Digitalisation and Real-Time Operational Visibility

Grid digitalisation is accelerating as utilities modernise their outdated infrastructure and adopt connected devices that require fast and secure communication. Utilities increasingly rely on advanced metering infrastructure (AMI), IoT-enabled sensors, and substation automation systems, all of which depend on robust communication networks. The rising integration of distributed energy resources has further increased the need for real-time, bidirectional communication. In 2025, several utilities in North America and Europe expanded their digital transformation programs by upgrading to fibre-optic backbones and deploying wireless LTE-M/NB-IoT for field devices. This trend enhances market growth by establishing resilient, interoperable communication systems as a critical foundation for modern utility operations.

Rising Adoption of Private LTE, 5G, and Hybrid Communication Networks

Utilities worldwide are transitioning away from legacy narrowband networks toward private LTE, emerging 5G networks, and hybrid architectures that combine fiber, radio, PLC, and cellular technologies. Private LTE and early 5G deployments allow utilities to manage secure, high-capacity, low-latency networks tailored to critical infrastructure. Growing cybersecurity needs and higher data volumes from sensors, smart meters, and SCADA systems reinforce this shift. This trend supports market expansion by increasing demand for new communication hardware, specialised software, and long-term network service agreements.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 21.4 billion |

| Estimated 2026 Value | USD 23.2 billion |

| Projected 2034 Value | USD 44.6 billion |

| CAGR (2026-2034) | 8.5% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Latin America |

| Key Market Players | Siemens AG, ABB Ltd, Schneider Electric SE, Cisco Systems, Inc., Ericsson AB |

to learn more about this report Download Free Sample Report

Market Drivers

Expansion of Smart Metering and Automated Distribution Networks

Smart metering programs continue to expand across developed and emerging economies. AMI systems generate continuous data streams that require stable communication links for meter-to-grid integration, remote disconnection, consumption analytics, and billing optimization. Countries in the Asia Pacific, Europe, and North America accelerated AMI deployments in 2025 to meet efficiency targets and regulatory requirements. This driver sustains market demand by making strong communication networks essential to achieving financial, operational, and regulatory benefits.

Integration of Renewables and Distributed Energy Resources

The global energy transition is increasing the number of distributed resources, rooftop solar, home batteries, microgrids, and EV chargers, connected to utility networks. These assets require precise coordination to maintain grid stability, particularly during periods of peak demand and intermittent supply. Communication networks carry the real-time data needed for demand response, voltage optimization, and distribution management systems. This enhances long-term market growth by making communication infrastructure a central component of flexible, sustainable energy systems.

Market Restraint

High Deployment Costs and Budget Constraints

Building or upgrading utility-grade communication networks requires significant capital, especially for fiber installations, private LTE, and advanced substation communication systems. Utilities with older infrastructure or rural coverage areas face even higher costs. Budget constraints in 2025 led many municipal and small utilities in Latin America and parts of Africa to postpone communication upgrades despite long-term benefits. High initial investment slows market expansion and limits the adoption of next-generation systems in cost-sensitive regions.

Market Opportunity

Growth of Edge Intelligence and IoT-Based Distribution Automation

The rise of edge computing and IoT-driven field automation presents significant opportunities for communication vendors. Edge devices equipped with intelligence, fault indicators, reclosers, voltage regulators, and sensors require reliable communication systems for real-time performance. Utilities are increasingly deploying these devices to improve grid reliability and reduce outage durations. Such developments enable brands to capture new demand in next-generation grid modernization programs while enhancing long-term utility loyalty through scalable, future-proof solutions.

Regional Analysis

The Asia Pacific dominated the market in 2025, accounting for 38.4% market share. The growth is attributed to rapid urbanization, large-scale grid modernization programs, and concentrated manufacturing capacity for communications equipment. Countries across the region are simultaneously expanding AMI, deploying distribution automation, and upgrading substations to handle distributed generation and electrification of transport. High project velocity, combined with cost-sensitive procurement models and strong vendor competition, makes Asia Pacific the largest revenue contributor globally.

- China is the primary growth engine in APAC because of its national smart grid initiatives, extensive distribution automation programmes, and rapid rollout of smart meters and substation digitalisation. Large utility capex, domestic equipment manufacturing scale, and coordinated national planning accelerate deployments of fibre, PLC, and private cellular solutions. China’s focus on grid reliability and urban electrification positions it at the centre of regional demand.

Latin America Market Insights

Latin America is emerging as the fastest-growing region, with a CAGR of 9.1% from 2026 to 2034, as utilities modernize their networks to improve reliability, reduce losses, and support growing distributed generation. Investment in AMI, automated distribution, and telecom upgrades is rising, driven by urban growth, regulatory reform, and donor or public funding for infrastructure resilience. The interest of telecom operators in private LTE and partnerships with utilities has also accelerated wireless-based field connectivity. The combination of catch-up modernization needs and scalable managed solutions explains the region’s rapid forecast growth.

- Brazil leads Latin America due to its large electricity system, growing AMI programmes, and investments in rural electrification and telecom infrastructure. Utilities and distribution companies in Brazil have initiated larger smart metering and automation projects, with partnerships with local vendors and telecom operators supporting a broader rollout. These initiatives drive accelerating demand for communications, particularly in areas such as AMI, outage management, and feeder automation.

Regional Market share (%) in 2025

Source: Straits Research

North America Market Insights

North America is a high-value market shaped by advanced grid modernisation programmes, widespread AMI deployments, and early adoption of private LTE and 5G trials for utility use cases. The United States and Canada place strong emphasis on resilience, cybersecurity, and regulatory compliance, prompting utilities to upgrade substation communications, fibre backbones, and field-area networks. The combination of capital availability, regulatory drivers, and mature vendor ecosystems makes North America a significant contributor to global utility communication revenue.

- The U.S. leads North American demand because of utility scale, regulatory emphasis on grid resilience, and accelerated AMI and ADMS programmes. Large investor-owned utilities and municipal systems invest in fibre, private LTE pilots, and hardened field hardware, while telecom–utility partnerships expand managed connectivity options. Federal and state funding for grid upgrades in 2024-2025 supported project starts and vendor contracts, reinforcing the U.S. as the primary national market in the region.

Europe Market Insights

Europe’s market is characterised by regulated modernization plans, strong emphasis on interoperability standards (such as IEC 61850), and rigorous cybersecurity requirements. Distribution system operators invest in communication systems to integrate distributed generation, demand response, and advanced metering. Public policy and clean-energy targets accelerate investments in smart grid communications; however, procurement often follows conservative specifications and lengthy validation cycles. Overall, Europe offers stable, standards-driven demand focused on long-term operational benefits rather than short-term experimentation.

- Germany is a regional leader due to its industrial grid scale, active renewable integration, and utility sector investment in digitalisation. The nation’s supplier ecosystem, systems integrators, telecom partners, and equipment vendors support steady project pipelines for substation modernisation and AMI upgrades, sustaining moderate growth.

Middle East and Africa Market Insights

The Middle East and Africa present a mixed market with pockets of high investment in the Gulf and steady, incremental modernisation across parts of Africa. The Gulf countries invest heavily in mission-critical infrastructure, private networks, and secure communications to support utilities, petrochemical sites, and digital cities. In Africa, utilities prioritise pragmatic upgrades, hybrid wireless and satellite links for remote sites, and managed services where local expertise is limited. Infrastructure projects, diversified funding sources, and an emphasis on resilient connectivity in challenging environments support MEA’s growth.

- The UAE is the regional leader, driven by concentrated urban load centres, high telecom infrastructure density, and government-led smart city projects. Utilities in the UAE are adopting advanced substation communications, private LTE pilots, and fibre backbones to support high reliability and scalability, making them a primary entry point for vendors servicing the Gulf and wider MEA region.

Communication Technology Insights

Fibre optic networks dominated the market with a revenue share of 35% in 2025, due to their unmatched bandwidth, low latency, and high reliability, which are essential for substations, control centers, and grid backbone networks. Utilities rely on fibre to transmit large volumes of critical data, such as protection signals and real-time grid monitoring. Despite high upfront costs, long life, low maintenance, and future scalability continue to drive strong fibre demand.

Cellular technologies, such as private LTE and early 5G, are the fastest-growing, with a CAGR of 9.4%, due to their flexibility and ability to reach remote assets without full-fibre deployment. Utilities use cellular links for mobile field crews, drones, sensors, and substation backhaul. In 2025, several utilities launched private LTE pilots for safety and inspection use cases. Telecom-utility partnerships, secure SIM management, and the increasing availability of rugged, utility-grade communication equipment support growth.

By Communication Technology Market Share (%), 2025

Source: Straits Research

Product Type Insights

Hardware holds the largest market share of 45% because physical equipment, such as routers, switches, fibre panels, PLC modems, and rugged gateways, forms the foundation of all utility communication networks. Utilities invest heavily in certified, durable devices built for harsh grid environments and long operating lifecycles. Spending also includes fibre trenching and tower installations, further boosting revenue. The capital-intensive nature of infrastructure ensures hardware remains the largest revenue contributor.

Software and platforms are growing at the fastest rate, with a CAGR of 9.0%, as utilities adopt cloud-based network management, cybersecurity, analytics, and orchestration tools. These platforms help manage SIMs, devices, firmware updates, and network traffic from centralized dashboards. The shift toward subscription-based digital platforms supports recurring revenue, enables faster upgrades, and offers better scalability compared to traditional hardware-only models.

Application Insights

Advanced Metering Infrastructure (AMI) is the largest application segment, with a market share of 30%, due to the massive device rollouts and continuous data communication required for smart metering. Smart meters enable remote consumption tracking, billing accuracy, outage detection, and demand response. In 2025, utilities continued large-scale AMI deployments driven by regulatory pressure and efficiency targets. These projects generate long-term contracts for communication modules, network services, and maintenance.

EV charging communication is the fastest-growing application, exhibiting a CAGR of 12.0% in 2025 as electric vehicle adoption increases rapidly. Smart charging necessitates real-time, secure data exchange among chargers, utilities, and control platforms to facilitate load balancing, dynamic tariffs, and vehicle-to-grid services. The rapid rollout of public and depot chargers, along with policy support for managed charging, is driving strong investment in communication modules, platforms, and cybersecurity systems.

Deployment Mode Insights

Private utility networks dominate the market, accounting for a 40% revenue share, as they offer full operational control, high security, and predictable performance for critical infrastructure. Utilities prefer fibre backbones, private LTE, and microwave links for substations and control centers. Although capital-intensive, private networks provide long asset life, high reliability, and strong long-term value, driving stable equipment and infrastructure spending.

Managed services and cloud-hosted solutions are growing at the fastest rate, with a CAGR of 10.0%, as utilities shift from capital-intensive networks to outsourced, subscription-based models. These services include managed connectivity, SIM management, cybersecurity monitoring, and cloud control platforms. The appeal of rapid deployment, scalability, and vendor-managed compliance is driving strong demand and creating recurring revenue streams for service providers.

Competitive Landscape

The utility communication market is moderately fragmented, characterized by a mix of legacy leaders, diversified manufacturers, and a rising number of mid-tier and specialised communication providers. Established global engineering and industrial firms, especially those with long histories in grid automation, telecom infrastructure, and electrical equipment, continue to command substantial share through deep domain expertise, broad product portfolios, and long-standing relationships with utilities.

List of Key and Emerging Players in Utility Communication Market

- Siemens AG

- ABB Ltd

- Schneider Electric SE

- Cisco Systems, Inc.

- Ericsson AB

- Landis+Gyr (part of Toshiba)

- Itron, Inc.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- General Electric (GE) Grid Solutions

- GridLink Communications Inc.

- Eaton Corporation plc

- S&C Electric Company

- Hitachi Energy (formerly ABB Power Grids)

- Landis+Gyr / Toshiba Utility Solutions

- Calix, Inc.

- ZTE Corporation

- Telit Communications PLC

Strategic Initiatives

- December 2025 - ABB India launches next-gen ACS380-E machinery drive built for high performance, dual built-in Ethernet ports for plug-and-play industrial network connectivity, and integrated cybersecurity.

- October 2025 - Honeywell and LS ELECTRIC announce a global strategic collaboration to jointly develop and market solutions for Data Centers and Battery Energy Storage Systems (BESS). This includes integrating power management with building controls and creating grid-aware BESS solutions to improve grid resiliency.

- October 2025 - ABB partners with NVIDIA to accelerate the development of gigawatt-scale, next-generation AI data centers. This is a significant move as data centers are becoming major consumers of grid power, requiring new high-efficiency power and control solutions.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 21.4 billion |

| Market Size in 2026 | USD 23.2 billion |

| Market Size in 2034 | USD 44.6 billion |

| CAGR | 8.5% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Communication Technology, By Product Type, By Application, By Deployment Mode |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Utility Communication Market Segments

By Communication Technology

- Fibre optic networks

- Cellular (private LTE / public 4G/5G)

- RF Mesh / LoRaWAN

- Power Line Communication (PLC)

- Satellite

By Product Type

- Hardware

- Software and Platforms

- Services

By Application

- Advanced Metering Infrastructure (AMI)

- Substation Automation

- Distribution Automation (DA)

- Outage Management / OMS

- EV Charging & Smart Charging Communications

By Deployment Mode

- Private/on-premise utility networks

- Managed services and hosted/cloud offerings

- Hybrid (combination of private + managed)

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.