Vacuum Circuit Breaker Market Size, Share & Trends Analysis Report By Product Type (Indoor/panel-mounted VCBs, Outdoor/standalone VCBs, Ring Main Units (RMU) with VCB, GIS-integrated VCB modules), By Voltage Level (Up to 12 kV, 12–36 kV, 36–72.5 kV, Above 72.5 kV), By End-User (Utilities (Transmission and Distribution), Industrial and Manufacturing, Transportation and Rail/Metro, Commercial and Data Centres), By Application (New substations and greenfield projects, Retrofit and replacement, Compact urban/data-centre installations, Renewable export/offshore cable terminals) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Vacuum Circuit Breaker Market Overview

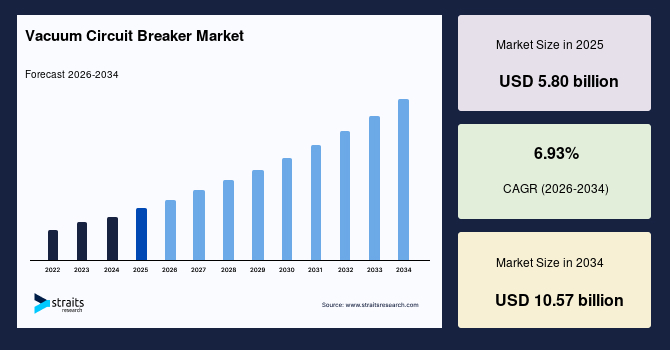

The global vacuum circuit breaker (VCB) market size is valued at USD 5.80 billion in 2025 and is estimated to reach USD 10.57 billion by 2034, growing at a CAGR of 6.93% during the forecast period. The increasing modernization of power grids drives the market, the growth of renewable energy integration, rising industrial electrification, and heightened global attention to electrical safety, reliability, and low-maintenance switching solutions.

Key Market Trends & Insights

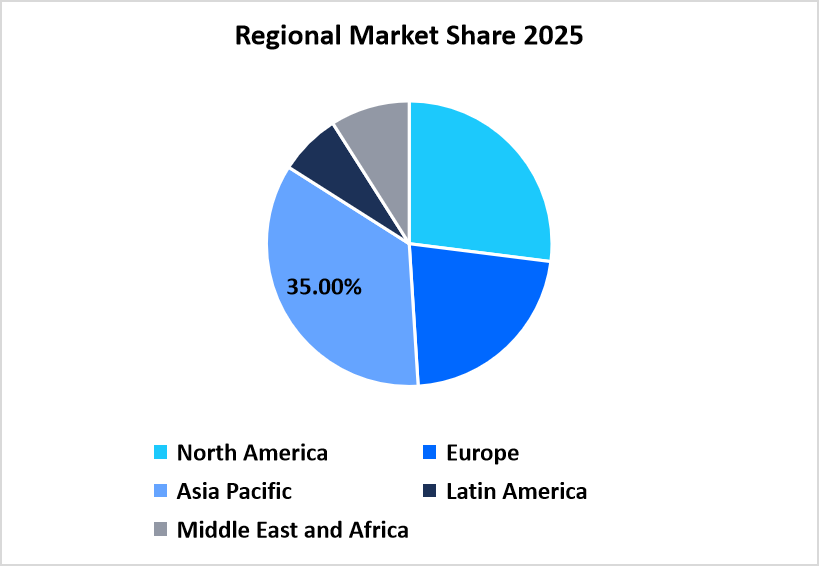

- Asia Pacific dominated the market with a revenue share of 35% in 2025.

- Middle East and Africa is anticipated to grow at the fastest CAGR of 8.8% during the forecast period.

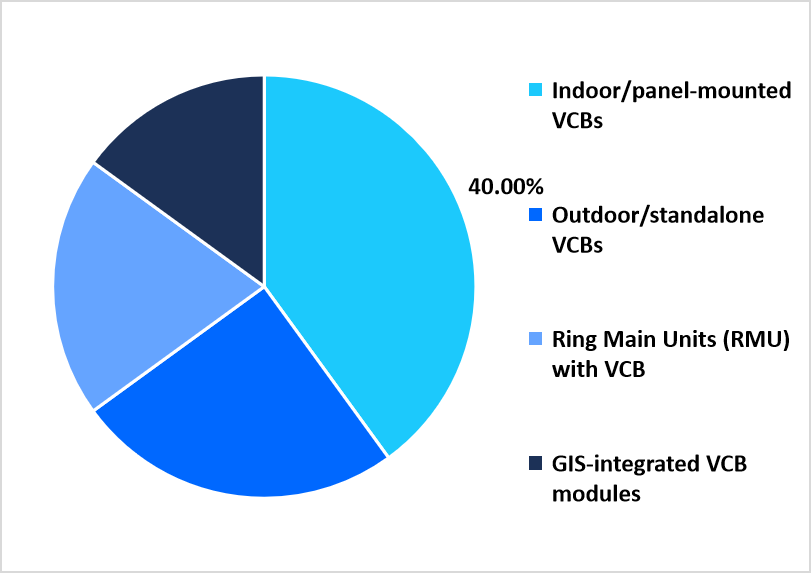

- Based on product type, the Indoor or panel-mounted vacuum circuit breakerssegment held the highest market share of 40% in 2025.

- By voltage level, the EHV applications above 72.5 kV segment is estimated to register the fastest CAGR growth of 7.8%.

- Based on End-User, the Utilitiescategory dominated the market in 2025 with a revenue share of 55%.

- Based on application, the Compact installations for urban deployments and data centressegment is projected to register the fastest CAGR of 8.0% during the forecast period.

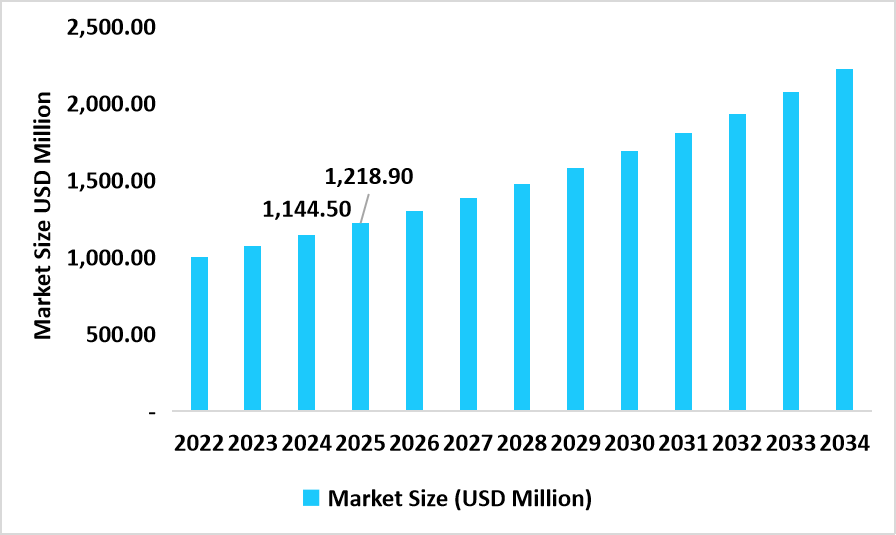

- China dominates the market, valued at USD 1,144.50 million in 2024 and reaching USD 1,218.90 million in 2025.

Table: China Vacuum Circuit Breaker Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 5.80 billion

- 2034 Projected Market Size: USD 10.57 billion

- CAGR (2026-2034): 6.93%

- Dominating Region: Asia Pacific

- Fastest-Growing Region: Middle East and Africa

The global VCB market encompasses medium-voltage and high-voltage vacuum circuit breakers used across utilities, transmission and distribution (T&D) infrastructure, industrial plants, transportation systems, commercial buildings, and renewable energy installations. The market growth is reinforced by utility investments, industrial automation, demand for compact substation equipment, and innovations in digital switchgear, remote monitoring, and eco-friendly alternatives to SF₆-based products.

Latest Market Trends

Grid Modernization and Digital Switchgear Adoption

Grid modernisation is one of the most influential trends shaping the vacuum circuit breaker market. Utilities across regions are upgrading ageing networks and installing equipment compatible with real-time monitoring, predictive maintenance, and enhanced fault diagnostics. Digital switchgear, integrating sensors, communication modules, and Intelligent Electronic Devices (IEDs), is increasingly paired with VCBs due to their long lifecycle and safety benefits. This shift enables the implementation of automation and self-healing grid concepts in urban and high-load zones.

- For example, Siemens Energy expanded its medium-voltage digital switchgear offerings in March 2025, enabling utilities to deploy condition-monitoring features across distribution substations.

These developments reflect a growing interest in real-time asset intelligence, reduced operational downtime, and lifecycle optimization, thereby strengthening long-term market demand for advanced VCB systems that support grid intelligence.

Renewable-Energy Expansion and MV Substation Growth

The accelerating integration of renewable energy is driving demand for medium-voltage substations, upgrades to switchgear, and grid stability components. Vacuum circuit breakers have become the preferred technology in renewable power evacuation due to their high reliability, environmental safety, and compatibility with frequent switching operations typical of renewable variability. Many countries also aim to phase out SF₆-based breakers, creating further opportunity for VCB adoption. The deepening connection between renewable energy expansion and electrical safety ensures that VCBs continue to play a critical role in supporting global clean energy targets.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 5.80 billion |

| Estimated 2026 Value | USD 6.18 billion |

| Projected 2034 Value | USD 10.57 billion |

| CAGR (2026-2034) | 6.93% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Key Market Players | Siemens Energy, ABB Ltd, Schneider Electric, Eaton Corporation, GE Vernova (Grid Solutions) |

to learn more about this report Download Free Sample Report

Market Growth Factors

Growing Industrial Electrification and Safety Standards

Across manufacturing, mining, oil and gas, data centres, railways, and commercial infrastructure, rising electrification levels are elevating the need for fault protection, safe switching, and long-lived distribution equipment. Many industries are replacing older air circuit breakers with VCB-based systems to reduce maintenance downtime and enhance operational continuity. This transition is reinforced by tightening electrical safety standards and corporate ESG commitments that prioritise eco-friendly, low-leakage protection technologies. This shift toward robust safety infrastructure sustains consistent demand across industrial and commercial sectors.

Utility Investments in T&D Expansion

Utilities worldwide are investing in grid extensions, rural electrification, smart grid pilots, and reliability improvements, creating stable demand for medium-voltage equipment. Upgrades to legacy substations, ageing distribution networks, and transformer replacement cycles naturally increase VCB installation rates. Utility procurement also favours standardised, cost-efficient products with minimal maintenance requirements, an area where VCBs outperform many alternatives. Multiple countries in Latin America and Africa launched substation revamp programmes involving MV vacuum breaker installations. Combined with steady demand from North American and European utilities, such modernisation cycles create long-term market momentum.

Market Restraint

Competition from Alternative Technologies and Slow Replacement Cycles

Although VCBs are increasingly preferred, air circuit breakers and older switchgear technologies continue to be functional in many substations and industrial facilities. Replacement cycles for electrical infrastructure are typically long, slowing the pace at which VCBs are deployed. In some regions, regulatory processes for approving new substation designs remain slow, further delaying modernisation. As observed in 2025, several grid projects in Eastern Europe and Africa experienced procurement delays due to permit issues and supply-chain constraints. These factors collectively limit the speed of VCB market expansion.

Market Opportunity

Modular, Compact, and Smart MV Switchgear for Urban Growth

Rapid urbanisation and growth in metro rail networks, commercial buildings, hospitals, and data centres are fuelling demand for compact, modular medium-voltage equipment that is easy to install, digitise, and maintain. VCB-based systems are well-suited to such applications as they support compact configurations, operate quietly, and integrate smoothly with digital monitoring platforms. Multiple manufacturers expanded their compact VCB offerings for high-density installations, including smart ring-main units and plug-in switchgear modules for data center electrical rooms. These newer formats reduce installation footprints and improve energy efficiency. The trend supports manufacturers in capturing emerging urban demand and building deeper customer loyalty in high-growth infrastructure segments.

Regional Analysis

The Asia Pacific dominated the market in 2025, accounting for 35% market share. The region combines strong demand from utilities, rapid industrialization, and one of the world’s largest renewable integration pipelines. Large national programmes for rural electrification, transmission upgrades, and urban distribution expansion create continuous procurement cycles for medium-voltage switchgear. Domestic manufacturing capacity and competitive local OEMs reduce lead times and lower project costs, enabling faster rollout of VCB-based substations.

- China is the principal growth engine in APAC, with wide-ranging investments in transmission corridors, distributed generation interconnections, and industrial electrification. Large-scale solar and wind projects require medium-voltage substations and compact switchgear that favour vacuum interrupter technology for reliability and low maintenance. Policy emphasis on grid resilience and renewable integration in 2024-2025 kept China as the largest single-country market for VCBs in the region.

Middle East and Africa Market Insights

The Middle East and Africa is emerging as the fastest-growing region with a CAGR of 8.8% from 2026-2034, as governments invest heavily in new power generation, large-scale solar parks, offshore developments, and interconnector projects. Sovereign wealth and development finance are underwriting grid expansions and substations to support industrial zones, mega-cities, and power export ambitions. The technical need to manage reactive power and protect long cable runs favors reliable, low-maintenance VCB installations, particularly in coastal and desert environments, where SF₆-free, low-maintenance solutions are attractive.

- The UAE leads regional activity by combining robust public investment, ambitious renewable targets, and extensive urban infrastructure projects. National programs for solar generation, grid reinforcement, and interconnection to neighboring grids create demand for modern VCB-based switchgear. The UAE’s tendency to pilot advanced, compact, and digitally integrated switchgear solutions makes it a primary entry point for suppliers targeting the broader Gulf and East Africa markets.

Source: Straits Research

North America Market Insights

North America is a high-value market characterized by steady investment in grid modernisation, stringent safety standards, and significant replacement demand from ageing infrastructure. Utilities and independent power producers are upgrading distribution and substation equipment to improve reliability and meet stricter environmental and operational requirements. The region’s propensity to fund resilience projects and replace legacy breakers with low-maintenance VCBs sustains solid growth through the forecast period.

- The United States accounts for most North American demand due to federal and state investments in transmission upgrades, storm-hardening, and renewable interconnection. Aging substations and incentive programs for grid resilience drive replacement cycles that favor vacuum circuit breakers due to their reliability and low lifecycle costs.

Europe Vacuum Circuit Breaker Market Insights

Europe’s market is shaped by aggressive renewable targets, cross-border interconnectors, and strict environmental regulation that favour low-leakage, low-maintenance switching technologies. Offshore wind, urban distribution densification, and refurbishment of legacy substations contribute to steady VCB demand. European utilities prioritise equipment with demonstrable lifecycle advantages and digital monitoring capabilities to meet asset-management goals.

- Germany leads European VCB demand due to its strong energy-transition agenda, extensive offshore and onshore renewables, and intensive substation reinforcement programmes. Germany’s engineering ecosystem supports custom solutions and high-specification equipment for demanding projects, reinforcing its role as a primary national market for both conventional and modular VCB designs.

Latin America Market Insights

Latin America exhibits steady growth driven by transmission upgrades, renewable project expansion, and industrial electrification in urban centres. Hydropower, new solar parks, and interregional transmission projects require medium-voltage protection and switching equipment, creating recurring demand for VCBs. Financing support from development banks and bilateral programs often accelerates grid modernization in larger economies. These factors combine for stable growth across regional markets in 2025.

- Brazil is the largest Latin American market, driven by long transmission spans linking hydropower and new renewable plants to coastal load centres. Grid reinforcement programmes and rural electrification projects increase VCB procurement for both new substations and replacements. Domestic manufacturers and local content provisions help accelerate project delivery, while urbanisation and industrial power needs sustain demand. Public and private investment in transmission infrastructure throughout 2024–2025 reinforced Brazil’s position as the primary national growth market in the region.

Product Type Insights

Indoor or panel-mounted vacuum circuit breakers dominated the market with a revenue share of 40% in 2025 because they address the broadest set of medium-voltage distribution needs in utilities, industry, and commercial buildings. These units are designed for enclosed switchgear panels and are suitable for substations, industrial switchrooms, and building services where space is limited and environmental protection is required. Their combination of reliability, safety, and modularity ensures steady replacement demand and consistent revenue contribution across mature and emerging regions.

RMUs incorporating vacuum breakers are the fastest-growing segment at a CAGR of 7.5%, as they offer a complete and compact distribution solution for urban networks, secondary substations, and distributed generation tie-ins. RMUs reduce installation time by combining switching, protection, and sectionalising functions in a sealed package, which appeals to utilities and developers seeking quick deployment and low lifecycle costs. These factors, compactness, ease of installation, and suitability for distributed-energy architectures, underpin RMUs’ above-market growth.

By Product Type Market Share (%), 2025

Source: Straits Research

Voltage Level Insights

The 12–36 kV band is expected to hold the largest revenue share of 45% in 2025, as it captures the largest portion of medium-voltage distribution infrastructure worldwide. This voltage range is widely used for primary distribution feeders, industrial supply points, and medium-sized substations, making it the most commonly specified band for vacuum circuit breakers. Network planners and utilities favour standardised equipment in this range to simplify spares, training, and procurement.

EHV applications above 72.5 kV are the fastest-growing voltage subsegment, exhibiting a CAGR of 7.8%. The segment is driven by the need to connect large renewable clusters, long-distance evacuation lines, and cross-border interconnectors. As grid projects push to higher voltages for efficiency over long spans, vacuum interrupter technology is being adapted into specialized high-voltage modules and hybrid switchgear.

End-User Insights

Utilities represent the largest end-user group with a revenue share of 55% owing to their central role in constructing and maintaining distribution and sub-transmission networks. Utility procurement covers both large-scale greenfield substations and incremental replacements across extensive asset portfolios. Moreover, regulatory programmes for grid reliability and disaster resilience consistently allocate funding to utility upgrades, sustaining steady market demand from this dominant subsegment.

Transportation applications, including rail traction substations and metro systems, are among the fastest-growing end-user segments with a CAGR of 7.0% in 2025. Urbanisation and mass transit expansion require reliable medium-voltage protection with low maintenance and high fault-interruption performance. VCBs are preferred for traction power due to their tolerance for frequent operation and their compact integration within traction substations.

Application Insights

New substation construction remains the largest application, with a market share of 40%, as expanding grids, rural electrification, and new industrial zones create ongoing demand for new installations. As governments and private developers invest in electrification and distribution capacity, new substations continue to be the principal source of volume for VCB manufacturers.

Compact installations for urban deployments and data centres are the fastest-growing application, projecting a CAGR of 8.0%. The growth of hyperscale data centres, edge computing nodes, and dense urban electrical rooms demands plug-and-play, low-footprint switchgear that can be installed quickly and serviced with minimal disruption. The willingness of data-centre operators to pay for reliability and remote monitoring accelerates the adoption of digital-ready, compact VCB solutions, making this application area a high-growth niche within the broader market.

Competitive Landscape

The market is moderately fragmented, characterized by a mix of legacy leaders, diversified manufacturers, and specialised switchgear producers. Alongside these heritage companies, mid-tier regional players and newer switchgear specialists compete based on cost-effectiveness, faster delivery, digital integration, and sustainability credentials. As manufacturers adopt digital channels, remote monitoring services, and electrification-led procurement, competition is intensifying in areas such as innovation, lifecycle services, and value-chain responsiveness.

Siemens Energy: A Heritage Innovator

Siemens Energy entered the circuit breaker landscape through decades of power-transmission equipment manufacturing and has evolved into a leader in vacuum-based switching and SF₆-free designs. The company distinguishes itself by integrating vacuum switching technology within its “Blue” portfolio of clean-air and vacuum solutions, enabling it to supply next-generation substations and large export projects with a minimal greenhouse-gas footprint.

Latest News:

- In August 2025, Siemens Energy announced a prototype 420 kV SF₆-free vacuum circuit breaker to be tested in France and Norway in partnership with transmission system operators.

List of Key and Emerging Players in Vacuum Circuit Breaker Market

- Siemens Energy

- ABB Ltd

- Schneider Electric

- Eaton Corporation

- GE Vernova (Grid Solutions)

- Mitsubishi Electric Corporation

- Fuji Electric Co., Ltd.

- CG Power & Industrial Solutions Ltd.

- C&S Electric Ltd.

- LS ELECTRIC Co., Ltd.

- Kirloskar Electric Company

- TBEA Co., Ltd.

- Rockwell Automation, Inc.

- WEG Equipamentos Elétricos S.A.

- Hyundai Electric & Energy Systems Co.

- NOJA Power Pty Ltd.

- Chuanli Electric Co., Ltd.

- KBN Group (Q-Tec Switchgear)

- Powell Industries, Inc.

Strategic Initiatives

- October 2025 – Eaton unveiled a new reference architecture for 800 VDC power infrastructure designed to accelerate the adoption of Artificial Intelligence data centers.

- June 2025 - Siemens Energy and Pfeiffer Vacuum+Fab Solutions completed a major project to develop vacuum-based leak detection for clean-air switchgear, reinforcing the company’s sustainability and innovation roadmap.

- May 2025 - Hitachi Energy announced it would deliver the world's first SF₆-free 550 kV GIS to the Central China Branch of the State Grid Corporation of China (SGCC).

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 5.80 billion |

| Market Size in 2026 | USD 6.18 billion |

| Market Size in 2034 | USD 10.57 billion |

| CAGR | 6.93% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Voltage Level, By End-User, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Vacuum Circuit Breaker Market Segments

By Product Type

- Indoor/panel-mounted VCBs

- Outdoor/standalone VCBs

- Ring Main Units (RMU) with VCB

- GIS-integrated VCB modules

By Voltage Level

- Up to 12 kV

- 12–36 kV

- 36–72.5 kV

- Above 72.5 kV

By End-User

- Utilities (Transmission and Distribution)

- Industrial and Manufacturing

- Transportation and Rail/Metro

- Commercial and Data Centres

By Application

- New substations and greenfield projects

- Retrofit and replacement

- Compact urban/data-centre installations

- Renewable export/offshore cable terminals

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.