Viral Vector Plasmid DNA Manufacturing Market Size, Share & Trends Analysis Report By Vector-Type (AAV, Retrovirus, Adenovirus, Plasmids, Lentivirus, Others), By Workflow (Upstream {Vector Amplification and Expansion, Vector Recovery/Harvesting}, Downstream {Purification, Fill-Finish}), By Application (Antisense and RNAi, Gene Therapy, Cell Therapy, Vaccinology, Research Applications), By End-User (Pharmaceutical and Biopharmaceutical Companies, Research Institutes), By Disease (Cancer, Genetic Disorders, Infectious Diseases, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Viral Vector Plasmid DNA Manufacturing Market Overview

The global viral vector plasmid dna manufacturing market size was valued at USD 4.26 billion in 2024 and is anticipated to grow from USD 5.04 billion in 2025 to reach USD 19.19 billion in 2033, growing at a CAGR of 18.2% during the forecast period (2025–2033). The growth of the market is attributed to robust pipeline for gene therapies and viral vector vaccines and technological advancements in manufacturing vectors.

Key Market Indicators

- North America dominated the viral vector plasmid dna manufacturing industry and accounted for a 50.69% share in 2024, driven by strong research institutions, federal investments, gene therapy advancements, and supportive regulations.

- Based on vector type, the AAV held the largest share of approximately 22.72% of the market in 2024, driven by high gene delivery accuracy, clinical trial success, non-pathogenicity, and growing therapeutic applications.

- Based on workflow, upstream segment dominates viral vector plasmid DNA manufacturing, driven by advanced bioreactors, automation, scalable processes, and efficient high-quality viral vector production.

- Based on application, antisense and RNAi segment leads viral vector plasmid DNA manufacturing, driven by siRNA delivery, gene silencing applications, and advancing therapeutic potential.

- Based on end-user, pharmaceutical and biopharmaceutical companies dominate viral vector plasmid DNA manufacturing, driven by rising gene therapy programs, biotech innovation, and therapeutic vector production.

- Based on diseases, cancer segment leads viral vector plasmid DNA manufacturing, driven by rising gene therapy trials, FDA approvals, and engineered vector-based cancer treatments.

Market Size & Forecast

- 2024 Market Size: USD 4.26 billion

- 2033 Projected Market Size: USD 19.19 billion

- CAGR (2025–2033): 18.2%

- North America: Largest market in 2024

- Europe: Fastest-growing region

Viral vector plasmid DNA refers to a genetic construct that combines elements of both a plasmid DNA and a viral vector. Plasmid DNA is a small, circular DNA molecule commonly found in bacteria and can replicate independently of the host genome. It is often used in molecular biology research and biotechnology applications for the cloning and expression of genes. On the other hand, a viral vector is a modified virus that is used to deliver genetic material into cells. Viruses can naturally infect cells and introduce their genetic material, making them effective vehicles for delivering therapeutic genes or vaccines. Viral vectors are also engineered to remove or deactivate the viral genes responsible for replication and pathogenicity while retaining the ability to enter target cells and deliver the desired genetic payload.

Viral vector plasmid DNA holds significant promise in gene therapy, which can be used to deliver therapeutic genes to treat genetic disorders or other diseases. It also plays a crucial role in vaccine development, enabling the delivery of antigens to stimulate an immune response for immunization. Viral vector plasmid DNA represents a powerful tool in genetic engineering and biotechnology, offering a versatile and efficient means of delivering genetic material into cells for therapeutic or research purposes.

Top 5 Key Highlights

- AAV dominates the vector-type segment.

- Upstream dominates the workflow segment.

- Antisense and RNAi dominate the Application segment.

- Pharmaceutical and Biopharmaceutical dominate the end-user segment.

- North America is the highest shareholder in the global market.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 4.26 Billion |

| Estimated 2025 Value | USD 5.04 Billion |

| Projected 2033 Value | USD 19.19 Billion |

| CAGR (2025-2033) | 18.2% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

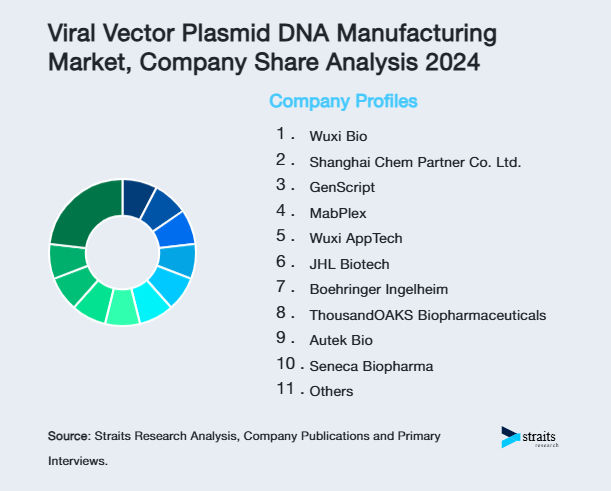

| Key Market Players | Wuxi Bio, Shanghai Chem Partner Co. Ltd., GenScript, MabPlex, Wuxi AppTech |

to learn more about this report Download Free Sample Report

Market Growth Factors

Robust Pipeline for Gene Therapies and Viral Vector Vaccines

Researchers are working to develop gene-based therapies for various diseases. Although the number of patients receiving gene therapies is less, the future of gene therapy holds great promise as it is expected to revolutionize the treatment regime by targeting the genes responsible for disease pathogenesis. Various universities and institutes have a broad portfolio of gene therapy products in the pipeline, which is expected to propel the gene therapy market. For example, the University of Massachusetts Medical School and the University of Utah are conducting several clinical trials to develop and introduce new gene therapies in the market.

Additionally, viral vector vaccines have great potential to be used as therapeutics owing to several advantages. For example, viral vectors comprise qualities of DNA vaccines as well as that of live attenuated vaccines. Viral vectors also help introduce DNA into a host cell to produce antigenic proteins, which can be customized to stimulate a range of immune responses, including cytotoxic T lymphocyte (CTL, CD8+ T cell), antibody, and T helper cell (CD4+ T cell) mediated immunity. In addition, viral vector vaccines can actively invade host cells and replicate, similar to live attenuated vaccines, further activating the immune system. However, DNA vaccines do not exhibit this property.

Technological Advancements in Manufacturing Vectors

In recent years, the number of manufactured vectors has been suitable only for phase I or II clinical trials. Currently, gene therapy vector manufacturing methods are not suitable for large-scale production. This is one of the main issues that companies in this industry face. Successful clinical trials pertaining to gene therapy-based treatments for common indications such as Parkinson's disease, Alzheimer's disease, and rheumatoid arthritis have facilitated the large-scale production of gene therapy vectors. This has led to a rise in the need for new technologies to support large-scale vector production.

For example, CEVEC, a company that designs manufacturing platforms for producing viral vectors, develops solutions to address the challenges by developing cell lines that can be grown in suspension in bioreactors of larger working volumes. The company introduced a novel helper-virus-free stable production system for scalable manufacturing AAV vectors to meet gene therapy companies' growing demand for vectors. Such factors drive market growth.

Market Restraint

Regulatory, Scientific, and Ethical Challenges

As gene therapy involves alterations or modifications in the set of genes, it has raised many ethical concerns. As a result of ethical issues surrounding gene therapy, the U.S. government prohibited using federal funds for research on germline gene therapy in people. Gene therapy can help save future generations of a family from acquiring a particular genetic disorder. However, it is anticipated to affect the fetus's development significantly.

Additionally, viral vector production is a complicated process. Thus, increased regulatory scrutiny would affect viral vector manufacturers engaged in collaborations. Academic institutions and biopharmaceutical firms have partnered with contract manufacturers because they have the necessary expertise in process development, manufacturing, and laws governing the production of viral vectors. Such factors hinder market growth.

Market Opportunity

Facility Expansion for Cell and Gene Therapies

Over the recent years, R&D for advanced therapies, such as cell and gene therapies, has increased considerably owing to the rise in the prevalence of genetic and chronic and terminal diseases, such as cancer, diabetes, and others. The market for such advanced therapies is still in the nascent stage and is constantly evolving. The lack of manufacturing capacity for commercial-scale gene therapy production and viral vector manufacturing is a major challenge for gene and cell therapy industries. As a result, several in-house facilities and CDMOs for gene therapy manufacturing have begun investing in enhancing their production capacity, which is forecasted to create lucrative opportunities for market players.

Additionally, developing countries are exhibiting higher growth in terms of capacity expansion compared to major Western markets. Asian countries, especially China and India, have made advances in gene and cell therapy manufacturing. China's new regulations make it possible for international contract development and manufacturing organizations to produce advanced therapy products for both the domestic market and internationally. This has resulted in a significant flow of investment.

Regional Insights

North America is the most significant global viral vector plasmid DNA manufacturing market shareholder and is anticipated to exhibit a CAGR of 18.1% over the forecast period. North America has a large portion of the viral vector and plasmid DNA manufacturing market, and several factors contribute to its dominance in this region. One of the key factors is the presence of a substantial number of research centers and institutes actively engaged in developing and researching advanced therapies, including gene therapy and cell therapy. These institutions strongly focus on exploring novel approaches for treating genetic disorders, cancers, and other diseases using viral vectors and plasmid DNA.

Moreover, the investments made by federal bodies in North America to support and expand the research base in cell therapy further contribute to the market's growth. These investments aim to enhance cell therapy's infrastructure, expertise, and capabilities, including manufacturing viral vectors and plasmid DNA. The support provided by the government and regulatory agencies creates a conducive environment for research and development activities, driving the growth of the viral vector and plasmid DNA manufacturing market in North America.

Europe Market Trends

Europe is predicted to exhibit a CAGR of 17.9% ogver the forecast period. Regulatory agencies regularly monitor and review Viral vector manufacturing facilities, ensuring vectors' safe and effective production. For example, the European facility of Advanced BioScience Laboratories, Inc. is regularly monitored by the French regulatory authorities (ANSM). This facility is a GMP-licensed site that manufactures viral vector products in compliance with EMA regulations. In addition, many companies that produce vaccines are expected to boost the manufacturing of vectors in European countries. In April 2018, the European Commission released its "Proposal for a Council Recommendation," which is expected to strengthen the cooperation between market players and Member States against vaccine-preventable diseases.

Asia Pacific Market Trends

In Asia-Pacific, gene therapy's clinical transformation and industrialization continue progressing steadily across Asian countries. For example, in August 2015, a team of scientists from Jichi Medical University began clinical research on gene therapy development for treating men with Parkinson's disease. The scientists developed a vector using an adeno-associated virus for their research activities. Several stem cell consortiums in Asian countries also aim to ensure coordinated and focused R&D programs on stem cells.

Latin America Market Trends

In Latin America, Cancer incidence is growing; however, cancer profiles differ from that in other Western nations. The growing prevalence of cancer is expected to influence the regional market throughout the forecast period positively. Effective regulatory structure in Colombia regarding gene therapy trials is expected to boost the vector manufacturing process in the country. However, gene therapy development faces IP and regulatory challenges in Mexico, hampering revenue generation in the LATAM market.

Middle East and Africa Market Trends

In the Middle East and Africa, cancer incidence is predicted to increase in the coming years. The presence of unmet medical needs has fueled the demand for robust cancer management, increasing the demand for viral vectors and plasmid DNAs. Rising demand for effective therapeutics for cancer is anticipated to propel the developments in the cell-based oncology landscape in African countries.

Market Segmentation

Vector Type Insights

The global viral vector plasmid DNA manufacturing market is bifurcated into AAV, retrovirus, adenovirus, plasmids, lentivirus, and others. The AAV segment dominates the global market and is predicted to exhibit a CAGR of 18.5% over the forecast period. Adeno-associated viruses are rapidly growing in demand because these viruses offer the highest accuracy in delivering the gene to the region of interest. The increase is due to clinical trials about the development of ocular and orthopedic gene therapy treatment exhibiting increased efficacy and efficiency. Recently, usage of AAV is rising considerably across several therapeutic areas, consequently witnessing a significant boost in adoption rate over the forecast period.

Proven records of non-pathogenicity are one of the important key factors boosting their adoption. These vector-based therapies must be carefully purified to remove empty viral particles as they reduce the effectiveness of the preparation. In addition, many companies are seeking support from contract manufacturers. However, few companies are opting to bring rAAV manufacturing in-house.

- For instance, BioMarin is one such company that manufactures AAV vectors in-house. The use of Adeno-Associated Virus (AAV)-based vectors is increasing in neuroscience research studies as a preclinical tool.

This research space uses AAV-based vectors for brain connectivity mapping and interrogating neurocircuit and cellular functions.

Workflow Insights

The global viral vector plasmid DNA manufacturing market is bifurcated into upstream and downstream. The upstream segment owns the highest market share and is estimated to exhibit a CAGR of 18.5% over the forecast period. Upstream processing entails infecting cells with the virus, cultivating cells, and harvesting the virus from cells. Development of advanced products such as the Ambr 15 microbioreactor system for high-throughput upstream process development is expected to drive the segment. Amber 15 microbioreactor system allows efficient cell culture processing with automated experimental setup and sampling, which requires less labor and laboratory space, and the time taken for cleaning and sterilization is also very less.

In addition, companies such as GE Healthcare are developing upstream cell culture processes using modern technologies and tools to meet the demand for cost-effective and scalable manufacturing processes of viral vectors. In viral vector plasmid DNA manufacture, upstream processing is crucial in producing high-quality viral vectors and plasmid DNA. Bioreactor systems, automation, and process optimization advancements have improved efficiency and scalability.

Application Insights

The global viral vector plasmid DNA manufacturing market is bifurcated into antisense and RNAi, gene therapy, cell therapy, vaccinology, and research applications. The antisense and RNAi segment dominates the global market and is expected to exhibit a CAGR of 17.9% over the forecast period. Small interfering RNAs (siRNAs) are currently considered important tools for gene silence after transcription during the genetic study of cells. SiRNA is generally delivered into mammalian cells by transfection using viral and plasmid vectors. Retroviral vectors are preferred for addressing the drawbacks of plasmid-based systems, which have relatively low transfection efficiency. However, these vectors still have certain limitations, such as oncogenic potential, gene silencing, the requirement of active cell division for gene transduction, and low titers.

AAV vectors are also used for the delivery of siRNA in mammalian cells. Antisense oligonucleotides have the potential to modulate RNA expression through gene silencing and splicing modulation. However, this technology still faces some issues, such as low efficacy in target tissues, poor cellular uptake, and rapid clearance from circulation.

End-User Insights

The global viral vector plasmid DNA manufacturing market is bifurcated into pharmaceutical and biopharmaceutical companies and research institutes. The pharmaceutical and biopharmaceutical companies segment owns the highest market share and is projected to exhibit a CAGR of 18.5% over the forecast period. The pharmaceutical and biotechnology businesses group had a big share in 2022 because of the continuous introduction of advanced therapies and a subsequent boost in gene therapy-based discovery programs by market players. In addition, the number of biotech companies employing vectors for therapeutic production continues to increase over the forecast period. Some biotech companies using adeno-associated viral vectors include GenSight, Lysogene, and Theravectys. Biotech companies are improving vector production, which is expected to benefit both biotech and pharmaceutical companies.

Diseases Insights

The global viral vector plasmid DNA manufacturing market is bifurcated into cancer, genetic disorders, infectious diseases, and others. The cancer segment dominates the global market and is projected to exhibit a CAGR of 19.1% over the forecast period. Although various cancer therapies have proven efficacious, cancer deaths account for most mortality cases. Viruses are found to be efficient for gene delivery, which makes them an ideal vector for gene therapy production. Viral vector-based clinical trials conducted for different cancer indications showed positive outcomes. In addition, the effectiveness can be enhanced through vector engineering and dose optimization, despite immune responses being relatively modest in some cases. The first Herpes Simplex Virus (HSV)-based cancer immunotherapy was approved by the FDA in October 2015, which encouraged market players to develop new therapies.

List of Key and Emerging Players in Viral Vector Plasmid DNA Manufacturing Market

- Wuxi Bio

- Shanghai Chem Partner Co. Ltd.

- GenScript

- MabPlex

- Wuxi AppTech

- JHL Biotech

- Boehringer Ingelheim

- ThousandOAKS Biopharmaceuticals

- Autek Bio

- Seneca Biopharma

- JW Therapeutics (Shanghai) Co Ltd.

- Shanghai Cell Therapeutics Group Co. Ltd

- APTBIO

- Shanghai ZhenGe Biotech

- Shanghai OPM Biosciences

- Shenzhen SiBiono Gene Tech Co. Ltd.

to learn more about this report Download Market Share

Recent Developments

- April 2023- Cellectis announced the acquisition of Bluebird Bio's viral vector manufacturing business. The acquisition will give Cellectis access to Bluebird Bio's expertise in manufacturing lentiviral vectors.

- March 2023- GenScript announced the launch of its new viral vector manufacturing service. The service offers a fully integrated solution for manufacturing viral vectors, from cell culture to purification.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 4.26 Billion |

| Market Size in 2025 | USD 5.04 Billion |

| Market Size in 2033 | USD 19.19 Billion |

| CAGR | 18.2% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Vector-Type, By Workflow, By Application, By End-User, By Disease |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Viral Vector Plasmid DNA Manufacturing Market Segments

By Vector-Type

- AAV

- Retrovirus

- Adenovirus

- Plasmids

- Lentivirus

- Others

By Workflow

- Upstream {Vector Amplification and Expansion, Vector Recovery/Harvesting}

- Downstream {Purification, Fill-Finish}

By Application

- Antisense and RNAi

- Gene Therapy

- Cell Therapy

- Vaccinology

- Research Applications

By End-User

- Pharmaceutical and Biopharmaceutical Companies

- Research Institutes

By Disease

- Cancer

- Genetic Disorders

- Infectious Diseases

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Dhanashri Bhapakar

Senior Research Associate

Dhanashri Bhapakar is a Senior Research Associate with 3+ years of experience in the Biotechnology sector. She focuses on tracking innovation trends, R&D breakthroughs, and market opportunities within biopharmaceuticals and life sciences. Dhanashri’s deep industry knowledge enables her to provide precise, data-backed insights that help companies innovate and compete effectively in global biotech markets.