Wearable Cardiac Devices Market Size, Share & Trends Analysis Report By Product (Defibrillator, Holter monitors, Patch, Others), By Application (Coronary artery disease (CAD), Cardiomyopathies, Post-myocardial infarction, Congenital heart diseases, Post-surgical cardiac care, Others), By End Use (Hospitals, Specialty centers, Home care settings, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Wearable Cardiac Devices Market Overview

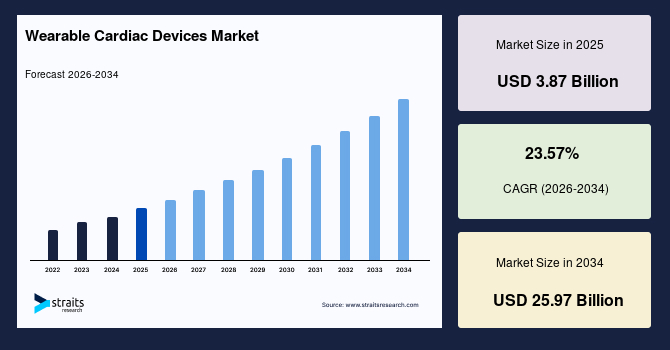

The global wearable cardiac devices market size is estimated at USD 3.87 billion in 2025 and is projected to reach USD 25.97 billion by 2034, growing at a CAGR of 23.57% during the forecast period. Remarkable growth of the market is propelled by the increasing convergence of wearable technology and digital cardiology, enabling real-time, continuous monitoring of heart activity through compact, patient-centric devices integrated with data analytics and cloud connectivity.

Key Market Trends & Insights

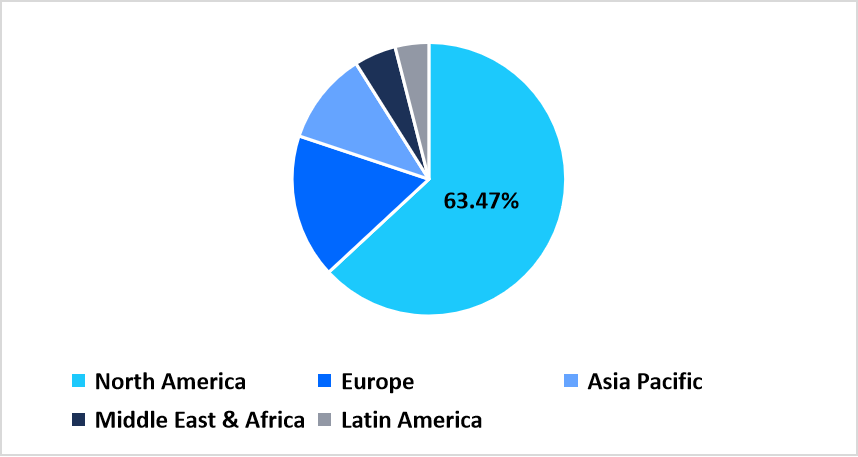

- North America holds a dominant share of the global market, accounting for 63.47% share in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 25.57%.

- Based on Product, defibrillators dominated the market in 2025 with a revenue share of 32.24%.

- Based on the Application, coronary artery disease (CAD) dominated the market with a revenue share of 40.13%.

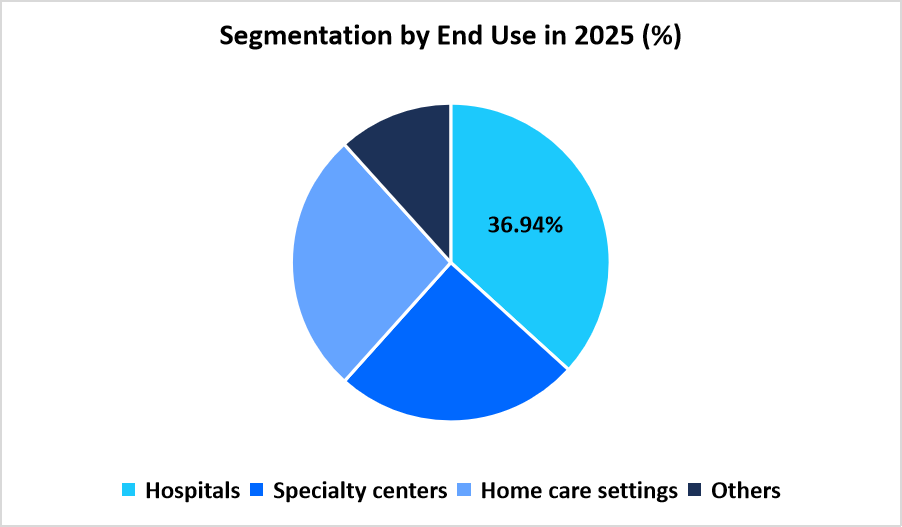

- Based on End Use, home care settings dominated the market in 2025, with a revenue share of 37.84%.

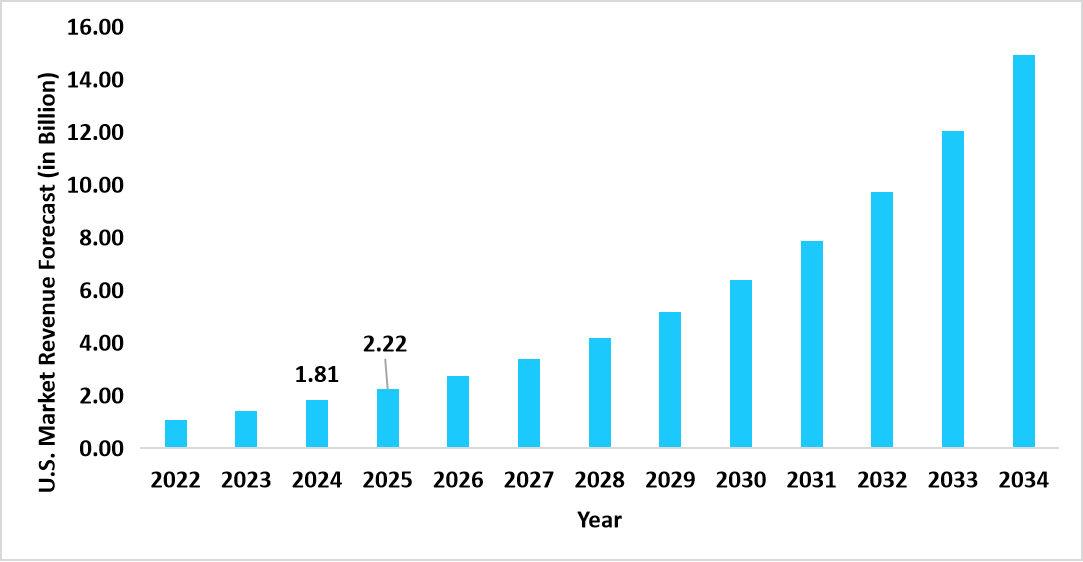

- The U.S. dominates the global wearable cardiac devices market, valued at USD 1.81 billion in 2024 and reaching USD 2.22 billion in 2025.

Graph: U.S. Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 3.87 billion

- 2034 Projected Market Size: USD 25.97 billion

- CAGR (2025 to 2034): 23.57%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The wearable cardiac devices market refers to the industry encompassing medical technologies designed for continuous, non-invasive monitoring of cardiac activity through portable, patient-friendly devices. These include defibrillators, Holter monitors, wearable ECG patches, and other heart rhythm tracking systems used for early detection, diagnosis, and long-term management of cardiovascular conditions such as coronary artery disease (CAD), cardiomyopathies, post-myocardial infarction, congenital heart diseases, and post-surgical cardiac care. These devices are adopted across various end-use settings, including hospitals, specialty cardiac centers, and home care environments, where they facilitate continuous ECG recording, real-time data transmission, and timely medical intervention. The market’s expansion is supported by the rising prevalence of heart disorders, growing awareness of preventive cardiac health, and technological progress in wireless connectivity, biosensors, and data analytics, which together enable efficient remote monitoring and personalized cardiac management.

Latest Market Trends

Integration of Predictive Analytics and AI in Cardiac Monitoring

The incorporation of artificial intelligence and predictive analytics into wearable cardiac devices has transformed the way in which heart rhythm data is analyzed. Machine learning algorithms can detect early signs of arrhythmia, atrial fibrillation, and ischemic episodes with higher precision, allowing physicians to make faster, data-driven clinical decisions. In 2025, several leading manufacturers introduced AI-integrated ECG monitoring platforms capable of identifying subtle cardiac rhythm deviations in real time. This trend is enhancing diagnostic efficiency, supporting personalized treatment planning, and improving long-term cardiac event prevention.

Transition Toward Miniaturized and Patient-Centric Wearable Designs

Manufacturers are increasingly developing compact, flexible, and skin-friendly wearable cardiac devices that ensure continuous monitoring without restricting user comfort. The growing preference for discreet and durable devices such as adhesive ECG patches and smart bands is reshaping the market landscape. These miniaturized devices cater to patient lifestyles while maintaining medical-grade accuracy. The trend reflects a shift from bulky, clinic-based systems to consumer-friendly designs that enable seamless integration of cardiac monitoring into daily routines.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 3.87 Billion |

| Estimated 2026 Value | USD 4.77 Billion |

| Projected 2034 Value | USD 25.97 Billion |

| CAGR (2026-2034) | 23.57% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Nihon Kohden Corporation, Dr Trust, EMAY, SmartCardia Inc. , Bardy Diagnostics, Inc. |

to learn more about this report Download Free Sample Report

Wearable Cardiac Devices Market Driver

Increasing Integration of Wearable Devices into Preventive Healthcare Programs

The growing inclusion of wearable cardiac monitors within preventive healthcare frameworks is driving market growth. Healthcare providers are shifting from episodic treatment models to continuous health management systems, emphasizing early identification of cardiac abnormalities. Insurance companies and corporate wellness programs are encouraging employees and patients to use wearable ECG devices for routine health tracking. This integration not only enhances patient engagement but also reduces hospital readmissions by enabling physicians to detect potential cardiac issues before they escalate. The expansion of preventive care initiatives across public and private health sectors is therefore fueling sustained adoption of wearable cardiac devices worldwide.

Market Restraint

Limited Connectivity Infrastructure in Emerging Economies

Despite growing demand, limited digital health infrastructure in low- and middle-income countries restrains widespread adoption of wearable cardiac devices. Many regions lack the broadband capacity and data integration systems necessary to support continuous monitoring and remote transmission of ECG readings. In addition, fragmented interoperability between devices and healthcare platforms reduces data usability for clinical decision-making. These infrastructural gaps slow adoption in rural areas and limit the scalability of remote cardiac care programs.

Market Opportunity

Expansion of Remote Cardiac Monitoring Programs through Telehealth Integration

The growing acceptance of telemedicine and remote consultation services offers new opportunities for wearable cardiac device manufacturers. Integration of wearable ECG monitors into telehealth platforms enables physicians to assess patients’ cardiac data in real time and intervene promptly in case of irregularities. Several healthcare systems in 2025 expanded reimbursement coverage for remote cardiac diagnostics, paving the way for broader implementation in both hospital and outpatient settings. This transition is creating a scalable opportunity for device makers to collaborate with digital health providers, extend service networks, and enhance access to continuous cardiac monitoring worldwide.

Regional Analysis

North America dominated the wearable cardiac devices market with the largest revenue share of 63.47% in 2025. The region’s strong performance arises from its deep integration of cardiac monitoring technologies into clinical practice and continuous policy support for digital healthcare expansion. The widespread use of remote cardiac diagnostics among heart disease patients, combined with established reimbursement programs for remote monitoring, has sustained high product adoption. Strong collaborations between technology developers, hospitals, and insurance providers strengthened the ecosystem for continuous cardiac monitoring.

The U.S. market advanced due to the rapid acceptance of artificial intelligence–based arrhythmia detection tools integrated within wearable ECG systems. Hospitals and outpatient centers increasingly deploy these devices to shorten diagnosis time for cardiac abnormalities. Growing participation in chronic disease management programs under federal health initiatives increased the volume of patients using connected ECG devices, enhancing clinical workflow efficiency and patient outcomes.

Asia Pacific Market Insights

Asia Pacific is anticipated to register the fastest CAGR of 25.57%, driven by rapid urbanization, high cardiovascular disease prevalence, and rising healthcare spending fostered widespread demand for wearable cardiac monitors. Governments are investing in digital healthcare ecosystems, promoting early disease detection and continuous care outside hospital environments. Growing middle-class populations, coupled with expanding private health insurance coverage, are improving the affordability and acceptance of wearable cardiac technologies.

China’s market expanded due to government-led digital health reforms that prioritize smart medical devices in chronic disease programs. Provincial reimbursement frameworks now include heart rhythm monitoring under basic medical insurance, which has encouraged hospitals to adopt wearable ECG devices for long-term cardiac assessments. Domestic tech firms are developing cost-conscious cardiac wearables tailored for primary care centers and urban populations.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

Europe accounted for a considerable share of the wearable cardiac devices market in 2025. The region benefited from structured cardiac care programs emphasizing home-based rehabilitation and remote patient tracking. The presence of public insurance systems that reimburse wearable cardiac devices encouraged adoption among elderly populations with heart conditions. European research institutions are actively validating long-duration ECG patches, leading to broader clinical acceptance and integration into hospital discharge programs.

Germany’s market expanded due to its medical device industry’s focus on precision engineering and hospital-grade reliability. The country’s healthcare model supports prescription-based wearable monitoring for post-surgery cardiac recovery, promoting usage among patients transitioning from inpatient to home care. The collaboration between healthcare authorities and technology manufacturers improved device standardization and hospital interoperability.

Middle East & Africa Market Insights

The Middle East and Africa displayed consistent market growth, supported by government-led programs aimed at modernizing cardiac healthcare systems. The region is witnessing an expansion in tertiary cardiac hospitals and digital monitoring facilities. Increased awareness of cardiovascular disease prevention among younger populations and expansion of insurance coverage for chronic illness management contributed to market expansion.

Saudi Arabia’s market expanded due to major healthcare transformation programs aligned with Vision 2030. Hospitals began integrating wearable ECG devices into cardiac rehabilitation programs to monitor patients post-discharge. The country’s investment in medical device localization encouraged partnerships with international firms for local production of cardiac wearables, improving supply chain accessibility.

Latin America Market Insights

Latin America exhibited moderate growth driven by healthcare modernization and government policies aimed at reducing cardiac mortality. Regional efforts to enhance screening programs and improve access to affordable monitoring tools boosted the adoption of wearable cardiac devices. Increasing collaborations between hospitals, telemedicine providers, and device manufacturers facilitated the integration of cardiac wearables into chronic disease management frameworks.

Brazil’s market grew as public health authorities implemented nationwide cardiac screening programs under the Unified Health System (SUS). These initiatives incorporated wearable ECG devices for early identification of arrhythmias in high-risk populations. Local production partnerships with technology firms reduced device costs, allowing wider distribution through both public and private hospitals.

Product Insights

The defibrillator segment dominated the market in 2025, accounting for 32.34% of share. Its dominance is due to the widespread use of wearable defibrillators for patients at high risk of sudden cardiac arrest. The growing number of individuals with ventricular arrhythmia and chronic heart failure has encouraged clinicians to prescribe these devices as part of preventive therapy. Continuous improvements in defibrillator comfort, portability, and connectivity have also made them suitable for long-term use, particularly among patients awaiting implantable devices. The segment’s growth is further supported by favourable insurance coverage and increasing awareness of cardiac emergency management across developed markets.

The patch segment is projected to record the fastest growth, with a share of 24.12% during the forecast period. The expansion of this segment is attributed to the growing preference for lightweight, skin-adhesive ECG patches that provide continuous monitoring without restricting patient movement. These devices are increasingly used for arrhythmia detection, post-operative rhythm tracking, and outpatient diagnostics. The rising use of wireless ECG patches integrated with cloud-based platforms for real-time data transmission is creating new opportunities for both clinical and home-based cardiac monitoring applications.

Application Insights

The coronary artery disease segment held the largest market share of 40.13% in 2025. The dominance of this segment is driven by the high global prevalence of CAD and the clinical necessity for continuous rhythm assessment in these patients. Hospitals and cardiology centers are incorporating wearable ECG devices into CAD management programs to monitor ischemic episodes and track post-angioplasty recovery. The emphasis on secondary prevention, early detection of cardiac abnormalities, and reduction of hospital readmissions has further reinforced demand for wearable cardiac monitoring solutions among CAD patients.

The post-myocardial infarction (MI) segment is expected to be the fastest-growing application area, accounting for 24.52% during the forecast period. Growth in this segment stems from the rising number of individuals recovering from heart attacks who require continuous cardiac observation to prevent complications such as arrhythmia or recurrent infarction. Physicians increasingly recommend wearable ECG devices and external loop recorders during rehabilitation and follow-up periods. The growing availability of advanced telemetry systems that transmit real-time cardiac data to healthcare professionals enhances post-MI patient management and supports the segment’s upward trajectory.

End Use Insights

The home care settings segment dominated the market in 2025, contributing 37.84% of revenue. The segment’s dominance is attributed to the rapid shift toward remote patient monitoring and self-managed cardiac care. Patients recovering from cardiac events or living with chronic heart conditions are increasingly adopting wearable ECG devices at home to avoid frequent hospital visits. The availability of smartphone-connected patches, Bluetooth-enabled defibrillators, and portable ECG sensors has simplified home-based diagnostics. Growing healthcare awareness and favourable telehealth reimbursement policies further promote the use of wearable cardiac technologies in household environments.

The specialty centers segment is projected to witness the fastest growth, accounting for 24.63% during the forecast period. The expansion of dedicated cardiac specialty centers offering advanced diagnostic and monitoring services is fueling this trend. These centers are increasingly adopting wearable cardiac devices for arrhythmia screening, patient evaluation, and long-term rhythm assessment. The combination of expert cardiology care, data interpretation services, and remote monitoring infrastructure enables specialty centers to deliver comprehensive cardiac management, driving higher device utilization and patient referrals.

Source: Straits Research

Competitive Landscape

The global wearable cardiac devices market is moderately fragmented, featuring a mix of established medical device leaders and innovative startups specializing in cardiac monitoring, defibrillation, and remote patient management technologies.

iRhythm Technologies, Inc.: An emerging market player

iRhythm Technologies, Inc. has emerged as a pioneer in the wearable ECG monitoring segment, with its flagship Zio patch enabling continuous cardiac rhythm analysis for up to 14 days. The company integrates AI analytics to detect atrial fibrillation and other arrhythmias with clinical-grade accuracy.

- In February 2024, iRhythm Technologies, Inc. announced the expansion of its Zio XT platform to new markets across Europe and Asia-Pacific following CE and regulatory clearances, strengthening its global footprint in long-term ambulatory cardiac monitoring.

List of Key and Emerging Players in Wearable Cardiac Devices Market

- Nihon Kohden Corporation

- Dr Trust

- EMAY

- SmartCardia Inc.

- Bardy Diagnostics, Inc.

- Garmin Ltd.

- Beurer GmbH

- Koninklijke Philips N.V.

- Medtronic

- Boston Scientific Cardiac Diagnostics Inc.

- Asahi Kasei Corporation

- Baxter

- ACS Diagnostics

- GE HealthCare

- Qardio, Inc.

- VitalConnect

- Kinetec Medical Products Ltd

- Others

Strategic Initiatives

- January 2024: India Medtronic Private Limited announced a strategic collaboration with Cardiac Design Labs (CDL) to launch, scale up, and expand access to CDL’s novel diagnostic technology, Padma Rhythms, an external loop recorder (ELR) patch designed for comprehensive, long-term heart monitoring and diagnosis in India.

- July 2024: BIOTRONIK reported that Dr. Fadi Mansour successfully performed the first Canadian implant of its newest pacemaker and CRT-P generation at the Centre Hospitalier de l’Université de Montréal. The patient received an Amvia Sky HF-T QP triple-chamber pacemaker, marking a major milestone for advanced cardiac rhythm management solutions in Canada.

- January 2024: Rudolf Riester GmbH, a global leader in medical technology, announced the full market launch of its comprehensive Telemedicine offering, already in use across Europe, the Middle East, and Africa. The solution integrated a wide range of medical devices to enable remote cardiac and general health assessments with industry-leading quality and versatility.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 3.87 Billion |

| Market Size in 2026 | USD 4.77 Billion |

| Market Size in 2034 | USD 25.97 Billion |

| CAGR | 23.57% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Application, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Wearable Cardiac Devices Market Segments

By Product

- Defibrillator

- Holter monitors

- Patch

- Others

By Application

- Coronary artery disease (CAD)

- Cardiomyopathies

- Post-myocardial infarction

- Congenital heart diseases

- Post-surgical cardiac care

- Others

By End Use

- Hospitals

- Specialty centers

- Home care settings

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.