Wound Debridement Market Size, Share & Trends Analysis Report By Product Type (Mechanical Debridement Products, Enzymatic Debridement Products, Autolytic Debridement Products, Biological Debridement Products, Surgical Debridement Products, Ultrasonic Debridement Systems), By Wound Type (Burns, Diabetic Foot Ulcers, Pressure Ulcers, Surgical & Traumatic Wounds, Venous Leg Ulcers, Others), By End-User (Hospitals, Clinics, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Wound Debridement Market Size

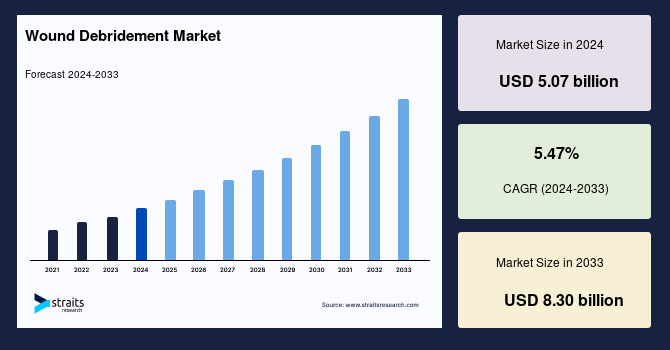

The global wound debridement market size was valued at USD 5.07 Billion in 2024 and is expected to grow from USD 5.35 Billion in 2025 to reach USD 8.19 Billion by 2033, exhibiting a CAGR of 5.47% during the forecast period (2025–2033).

Wound debridement is a medical procedure that involves removing dead, damaged, or infected tissue from a wound to facilitate healing. By eliminating non-viable tissue, debridement helps prevent infection, reduces complications, and accelerates the healing process by exposing healthy tissue beneath.

The procedure can be performed using various methods, including mechanical, enzymatic, autolytic, or surgical techniques, depending on the wound's type, size, and location. It is especially important for treating chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, where healing is often impaired.

Several factors are driving the growth of the wound debridement market, including the rising prevalence of diabetes, which contributes to an increase in diabetic foot ulcers, as well as the growing incidence of pressure ulcers and venous leg ulcers. Moreover, there is a rising demand for less painful, cost-effective debridement solutions, alongside increased focus on research and development, leading to the introduction of innovative products in the market.

Source: International Diabetes Federation (IDF), and Straits Research

Market Trends

Rising Emphasis on Enzymatic Debridement Solutions

Enzymatic debridement is gaining traction as a preferred solution due to its targeted approach, which selectively removes necrotic tissue without damaging healthy cells. This precision makes it a highly effective and sought-after method in wound care. As a result, companies are increasingly investing in the development of enzymatic debridement products to meet the growing demand.

-

For example, in October 2024, MediWound Ltd. announced the initiation of a controlled, multicenter Phase II clinical study evaluating EscharEx against collagenase ointment for the treatment of venous leg ulcers.

These investments highlight the growing preference for enzymatic debridement and underscore its significant potential in the wound care market.

Integration of Animal-Derived Materials in Wound Debridement Products

The incorporation of animal-derived materials into wound debridement products is emerging as a key trend, offering promising solutions that accelerate healing. These materials, such as collagen from animal origins, help speed up the recovery process by enhancing tissue regeneration at the wound site.

- For instance, in July 2022, materials scientists from Nanyang Technological University (NTU Singapore) developed clinical-grade collagen derived from discarded bullfrog skin, in collaboration with the medical technology firm Cuprina Wound Care Solutions.

By integrating such innovative, animal-based materials, wound debridement products are not only becoming more efficient but also enhancing the patient experience by enabling faster healing times and better outcomes.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 5.07 Billion |

| Estimated 2025 Value | USD 5.35 Billion |

| Projected 2033 Value | USD 8.19 Billion |

| CAGR (2025-2033) | 5.47% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Smith+Nephew, B. Braun SE, Coloplast Corp, Convatec, Mölnlycke AB |

to learn more about this report Download Free Sample Report

Wound Debridement Market Growth Factors

High Percentage of Diabetic Foot Ulcer Occurrence

The rising incidence of diabetic foot ulcers is a major driver for the wound debridement market. These ulcers, which are difficult to heal, require ongoing medical intervention, including frequent debridement, to prevent infection and promote healing. With diabetes becoming more widespread, the demand for effective wound debridement solutions continues to grow.

- According to the National Institutes of Health (NIH), approximately 18.6 million people worldwide are affected by diabetic foot ulcers, with 1.6 million cases in the U.S. Additionally, about 50-60% of these ulcers become infected, and 20% of moderate to severe infections result in lower extremity amputations.

The increasing prevalence of diabetic foot ulcers emphasizes the need for advanced wound care solutions, driving the demand for debridement products and treatments globally.

Continuous Research and Development

Ongoing research and development in wound healing technologies are accelerating the launch of more advanced wound debridement products. Innovations in materials and treatment methods are enhancing the effectiveness of debridement while improving the patient experience. These advancements focus on creating more targeted, efficient, and less painful solutions, significantly reducing recovery times and improving healing outcomes.

- For instance, in July 2024, researchers at Temple University’s College of Engineering developed OmegaSkin, a nanofibrous wound dressing made from engineered soy proteins. This dressing is specifically designed for severe burns, diabetic wounds, bed sores, and other large lesions, offering a novel approach to wound care.

Such continuous advancements in the wound debridement field are driving market growth as they lead to the creation of more effective, patient-friendly solutions.

Market Restraining Factor

High Cost of Enzymatic Debridement

The high cost associated with enzymatic debridement is a significant restraint for the market. While enzymatic debridement offers benefits, such as selective removal of necrotic tissue without harming healthy cells, its price can be prohibitive for many patients, limiting accessibility.

-

For example, MediWound Ltd. reports that the cost of enzymatic debridement treatment ranges from $1,600 to $2,000 per treatment cycle, including the cost of the enzymatic agent and the necessary medical care.

This high cost creates challenges in insurance coverage and reimbursement, particularly in regions with limited healthcare budgets, and may limit widespread adoption.

Market Opportunity

Growing Collaborative Investments for Product Development

The global market is witnessing significant growth, driven by a rising demand for novel and innovative solutions that offer superior results in wound healing. As the need for more effective debridement methods intensifies, industry players are increasingly collaborating to develop cutting-edge products, creating substantial opportunities for market expansion.

- For example, in July 2024, Mölnlycke AB made a strategic $15 million investment in MediWound Ltd. This partnership is focused on advancing wound care innovations, with an emphasis on providing alternative solutions to traditional debridement techniques. By introducing new approaches that enhance clinical outcomes and improve patient experiences, these investments are playing a pivotal role in reshaping the wound debridement landscape.

The surge in collaborative investments aimed at developing next-generation wound debridement products is a key factor fueling the market's growth, offering promising prospects for the future.

Regional Insights

North America holds the largest revenue share in the global market, driven by several key factors. The region benefits from substantial investments in research and development, fostering innovation in wound care technologies. A high prevalence of venous leg ulcers and diabetic foot ulcers further propels the demand for advanced debridement solutions.

- According to the National Institutes of Health (NIH), in 2023, North America accounted for the highest global prevalence of diabetic foot ulcers at 13%.

Moreover, the presence of well-established players such as Smith+Nephew, B. Braun SE, and Mölnlycke AB strengthens the market. Favorable regulatory policies, coupled with a robust healthcare infrastructure and increased awareness of wound care management, further contribute to the region’s market dominance.

U.s. Wound Debridement Market Trends

The U.S. continues to dominate the market due to the high prevalence of diabetes, increased investments in research and development, and strategic collaborations for innovative solutions. In January 2025, Mölnlycke Health Care invested $8 million in Siren, a company specializing in temperature-sensing textile technology for diabetic foot ulcers. These advancements, coupled with a robust healthcare infrastructure, ensure the U.S. remains at the forefront.

Canada’s market is growing steadily, supported by significant government investments in skin and wound care management. These initiatives are strengthening the healthcare system and enhancing wound care expertise. In January 2025, Ontario’s government allocated $9 million to train 400 long-term care home staff in advanced wound care. Such efforts are improving patient outcomes and driving market growth across the country.

Asia-Pacific is expected to register the fastest CAGR, fueled by a surge in diabetes prevalence, increasing health awareness, and significant investments in improving healthcare infrastructure. For instance, the International Diabetes Federation (IDF) projects that South-East Asia will reach 113 million diabetes cases by 2030, heightening the demand for effective wound care solutions. Moreover, the region's growing elderly population, prone to chronic wounds and diabetic foot ulcers, further drives market expansion.

China’s wound debridement industry is expanding rapidly due to the rising incidence of diabetic foot ulcers (DFUs), which drives the demand for advanced debridement products. The country accounts for 17.03% to 42.84% of global DFU cases one of the highest worldwide. Moreover, strategic investments in healthcare R&D and manufacturing facilities further support market growth, positioning China as a significant player in the global wound care industry.

India’s market is flourishing, fueled by increasing diabetes cases and frequent product launches. Rising healthcare investments also play a key role. For instance, in August 2024, Ipca Laboratories partnered with NovaLead through an IP licensing agreement to introduce Diulcus, a product targeting diabetic foot ulcers. With a growing diabetic population and heightened risk of DFUs, India’s market is poised for sustained growth and innovation.

Countries Insights

- Germany– Germany’s market is expanding due to continuous innovative product launches addressing chronic wounds such as diabetic foot ulcers and pressure ulcers. In June 2023, JeNaCell introduced "epicite balance," a wound dressing designed for chronic wound care. These developments meet the growing demand for effective wound management solutions, making Germany a key player in Europe’s wound care market.

- UK – The UK is experiencing market growth driven by increased funding for research and development in wound care solutions. This funding enables the launch of innovative products. For example, in March 2024, SOLASCURE received $497.94 thousand to develop Aurase wound gel, a hydrogel containing an enzyme cloned from medical maggots, offering a groundbreaking solution for chronic wound treatment and improving patient care.

Product Type Insights

The mechanical debridement products segment is the largest revenue-generating segment in the global market, owing to its widespread patient preference for faster debridement. These products are highly effective in removing larger areas of necrotic tissue. They offer a range of options, including pads, gauzes, irrigation systems, and whirlpools, each providing different methods of debridement. The versatility and efficiency of these products make them the preferred choice, contributing to their dominance in the market.

Wound Type Insights

Diabetic foot ulcers (DFUs) hold the largest market share in the wound debridement sector, largely due to the increasing global prevalence of diabetes, which significantly raises the risk of developing DFUs. According to the National Institute of Health (NIH), approximately 18.6 million people worldwide suffer from diabetic foot ulcers annually. The high incidence of diabetes and its complications, including foot ulcers, continues to fuel demand for effective wound debridement solutions, making the DFUs segment the dominant force in the market.

End-User Insights

The clinics segment dominates the wound debridement industry due to their essential role in delivering specialized, wound-specific care. Clinics are equipped to provide both short-term and long-term healing services, with some focusing exclusively on conditions like diabetic foot ulcers. This specialization ensures more effective, targeted treatments, attracting a significant patient base. The ability of clinics to cater to a wide range of wound types and offer tailored debridement solutions drives their strong market position, fostering growth in this segment.

List of Key and Emerging Players in Wound Debridement Market

- Smith+Nephew

- B. Braun SE

- Coloplast Corp

- Convatec

- Mölnlycke AB

- L&R Group

- INTEGRA LIFESCIENCES

- DeRoyal Industries, Inc.

- Sanara MedTech Inc.

- GUNZE LIMITED

- Monarch Labs

- Ferris Mfg. Corp.

- Plitek

- Cardinal Health

- BioStem Technologies, Inc.

Company Market Share

Key players in the market are actively engaging in strategic collaborations, acquisitions, and partnerships to strengthen their product portfolios, improve technological advancements, and expand their global footprint. These strategies enable companies to access innovative solutions, tap into new customer bases, and gain a competitive edge.

BioStem Technologies, Inc.: An emerging provider in the global wound debridement market

BioStem Technologies, Inc. is an emerging player in the global market, recognized for its expertise in developing, manufacturing, and commercializing placental-derived products for advanced wound care. The company focuses on leveraging cutting-edge biotechnology to address complex wound healing challenges, including chronic wounds and diabetic foot ulcers.

Recent Development by BioStem Technologies, Inc.:

-

In January 2025, BioStem Technologies launched a clinical trial to demonstrate the therapeutic benefits of its BioREtain technology in treating diabetic foot ulcers using Vendaje. The study of Vendaje versus standard of care aims to show superior wound treatment, supporting market expansion.

Recent Developments

- September 2024 – Solventum introduced its groundbreaking extended-wear wound dressing designed for V.A.C. (Vacuum-Assisted Closure) therapy. This innovative product integrates a dressing and drape, allowing for application in under two minutes, significantly reducing setup time for healthcare providers. Engineered for patient comfort and convenience, the dressing can be worn for up to seven days, minimizing the need for frequent replacements.

Analyst Opinion

As per our analysts, the global wound debridement industry benefits from the launch of innovative products, such as advanced pads and dressings, which offer efficient and valuable debridement solutions. Increasing investments in research and development, government funding for new product development, and strategic partnerships among market players are further bolstering innovation and expanding product portfolios.

Despite these growth drivers, the market faces challenges, including high costs associated with advanced wound care products, limited accessibility in low-income regions, and the complexity of treating chronic wounds. However, ongoing advancements and collaborative efforts are addressing these issues, ensuring the dominance of novel products in the market.

With strong governmental and private sector support, coupled with the introduction of cutting-edge technologies, the market is poised for sustained growth, overcoming obstacles, and meeting the growing demand for effective wound management solutions.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 5.07 Billion |

| Market Size in 2025 | USD 5.35 Billion |

| Market Size in 2033 | USD 8.19 Billion |

| CAGR | 5.47% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Wound Type, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Wound Debridement Market Segments

By Product Type

-

Mechanical Debridement Products

- Debridement Pads

- Medical Gauzes

- Others

- Enzymatic Debridement Products

-

Autolytic Debridement Products

- Foam Dressings

- Hydrocolloid Dressings

- Alginate Dressings

- Hydrogel Dressings

- Others

- Biological Debridement Products

- Surgical Debridement Products

- Ultrasonic Debridement Systems

By Wound Type

- Burns

- Diabetic Foot Ulcers

- Pressure Ulcers

- Surgical & Traumatic Wounds

- Venous Leg Ulcers

- Others

By End-User

- Hospitals

- Clinics

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Jay Mehta

Research Analyst

Jay Mehta is a Research Analyst with over 4 years of experience in the Medical Devices industry. His expertise spans market sizing, technology assessment, and competitive analysis. Jay’s research supports manufacturers, investors, and healthcare providers in understanding device innovations, regulatory landscapes, and emerging market opportunities worldwide.