Xylitol Market Size, Share & Trends Analysis Report By Form (Powder, Liquid), By Application (Chewing Gum, Confectionery, Bakery & Other Foods, Oral Care, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Xylitol Market Size

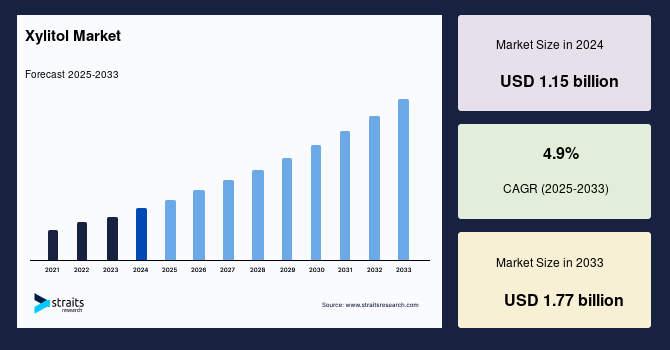

The global xylitol market size was valued at USD 1.15 billion in 2024 and is projected to grow from USD 1.21 billion in 2025 to USD 1.77 billion by 2033, exhibiting a CAGR of 4.9% during the forecast period (2025-2033).

Xylitol is a naturally occurring sugar alcohol used as a low-calorie sweetener in food, oral care, and pharmaceuticals. Derived from plants like birch trees and corn cobs, it has a sweetness similar to sugar but fewer calories and a lower glycemic index. Xylitol is known for its dental benefits, as it reduces cavity-causing bacteria. It is popular among diabetic and health-conscious consumers, and widely used in products like chewing gum, toothpaste, candies, and sugar-free foods. The global market refers to the worldwide industry surrounding the production, distribution, and consumption of xylitol, a naturally occurring sugar alcohol used as a low-calorie sweetener.

The global market is driven by rising health awareness, growing demand for sugar alternatives, and increased prevalence of diabetes. The market encompasses manufacturers, raw material suppliers, and regional distributors, with key developments focused on expanding applications and sustainable, cost-effective production methods. The market will likely grow extensively with the increasing demand for this natural sweetener for food and nutraceutical applications. The growing preference for healthier, low-calorie alternatives to sugar in food and nutraceutical products will likely increase demand for xylitol.

Latest Market Trends

Growing Demand for Natural Sweeteners

The increasing global shift toward health-conscious lifestyles drives demand for natural sweeteners like xylitol. Consumers are actively avoiding artificial additives and high-sugar diets due to growing concerns over obesity, diabetes, and heart disease. Xylitol stands out for its low glycaemic index, which makes it safe for diabetic individuals, and its lower calorie count about 2.4 calories per gram versus sugar’s four calories.

- For instance, a 2024 survey by the Food and Beverage Innovation Forum found that 40% of North American consumers actively seek sugar alternatives in products aligned with keto, low-carb, or diabetic-friendly diets.

With its natural origin and health-friendly profile, xylitol is increasingly preferred across food, beverage, and nutritional supplement categories. This trend is expected to grow steadily as wellness trends dominate consumer choices globally.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.15 Billion |

| Estimated 2025 Value | USD 1.21 Billion |

| Projected 2033 Value | USD 1.77 Billion |

| CAGR (2025-2033) | 4.9% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Key Market Players | Roquette Frères, ZuChem, Inc., Thomson Biotech (Xiamen) Co., Ltd., NovaGreen, Inc., DFI Corp. |

to learn more about this report Download Free Sample Report

Xylitol Market Growth Factors

Applications Expanding beyond Food

Xylitol is seeing robust demand beyond traditional food and beverage applications, with rapid adoption in oral care, pharmaceuticals, and cosmetics. In oral hygiene products like toothpaste and chewing gum, xylitol helps reduce dental cavities by inhibiting bacteria. Its humectant and skin-conditioning properties also make it ideal for moisturizers, lip balms, and anti-aging creams in the cosmetics industry. As beauty and wellness sectors increasingly favor multifunctional, natural ingredients, xylitol fits these evolving consumer preferences. Additionally, it is used in throat lozenges, syrups, and pediatric medicines for its taste and dental benefits.

- For instance, Colgate-Palmolive launched a new line of natural toothpaste in early 2024 under the "Colgate Naturals" brand in Europe and Asia, prominently featuring xylitol for its cavity-prevention benefits and natural profile.

- Similarly, Dr. Reddy's Laboratories incorporated xylitol into its new pediatric cough syrup line launched in Q1 2025, promoting better taste and dental safety for children.

This cross-industry versatility is significantly expanding its market scope. With growing consumer awareness of ingredient transparency and efficacy, xylitol’s multifunctional profile enables steady growth across both edible and non-edible sectors, making it a critical growth driver in the global market.

Market Restraining Factors

Limited Raw Material Availability

The xylitol industry faces a significant limitation due to the restricted availability of raw materials. Traditional xylitol is produced from plant-based sources such as birch wood, hardwood trees, and corn cobs, making its production reliant on agricultural and forestry outputs. This dependence on natural biomass renders the supply chain vulnerable to climate disruptions, geopolitical instability, or regional deforestation regulations.

As demand increases in food, pharma, and personal care sectors, raw material sourcing becomes more strained, causing potential supply shortages and price volatility. Although alternative feedstocks like oat hulls and sugarcane bagasse are gaining attention, these remain in the nascent stages of commercial-scale production. The transition to newer sources requires substantial investment and time, making the short-term availability of raw materials a serious bottleneck. This constraint could hinder the rapid scale-up needed to meet growing global demand.

Market Opportunities

Sustainable and Alternative Raw Materials

The push for sustainability in the food and chemical industries offers strong growth opportunities for xylitol producers. Transitioning to alternative raw materials, such as agricultural waste and non-wood biomass, can alleviate the pressure on traditional resources and support circular economy practices. Other promising feedstocks include sugarcane bagasse and wheat straw, which are abundant and underutilized. Companies like Fazer Group lead this shift, reflecting environmental responsibility and supply chain resilience.

- For instance, Roquette, a French plant-based ingredients leader, launched an initiative in July 2024 to source sugarcane bagasse from Brazil for experimental xylitol manufacturing. The project aligns with the company’s sustainability goals and ESG commitments.

By embracing these sustainable raw materials, manufacturers can cut costs and carbon emissions and attract eco-conscious consumers. These factors position alternative sourcing as a critical opportunity for long-term market growth.

Regional Insights

Asia-Pacific: Dominant Region with 60% Market Share

The Asia-Pacific region dominates the global market, accounting for more than 60% of the market share. China is the largest producer and exporter of xylitol, supplying key markets across North America, Europe, and South Asia. The widespread use of xylitol in applications such as chewing gum, functional beverages, diabetic foods, and nutraceuticals has significantly contributed to regional demand. Markets like India, Thailand, and South Korea are also experiencing rising consumption due to growing health consciousness and increasing demand for sugar substitutes. The region’s strong manufacturing capabilities, cost-efficient production, and favorable regulatory environment further enhance its leadership position. As consumers seek healthier alternatives to sugar, the demand for xylitol in Asia is expected to maintain a robust growth trajectory.

China Xylitol Market Trends

- China is the global leader in xylitol production and consumption, leveraging its expansive manufacturing capacity to meet domestic and international demand. Thanks to its low glycaemic index and dental health benefits, xylitol is widely used in sugar-free gum, diabetic food products, and nutraceuticals. China’s large-scale production and competitive pricing position it as a key exporter to North America and Europe. As demand for healthier sweeteners rises globally, China’s strategic role in the xylitol supply chain, both a major consumer and supplier, continues to expand.

India Xylitol Market Trends

- India is emerging as one of the largest consumers of xylitol in the Asia-Pacific region, alongside Thailand. Rising disposable incomes, increasing health awareness, and the growing prevalence of diabetes are driving demand for sugar substitutes in India. Xylitol is gaining popularity in diabetic-friendly foods and beverages and oral care products like toothpaste and sugar-free gums. Similarly, Thailand's cultural shift toward health and wellness contributes to the adoption of xylitol in the food and hygiene sectors. This regional growth is reinforced by consumers’ preference for natural, low-calorie sweeteners.

Europe: Fastest-Growing Region with the Highest Market Cagr

Europe is projected to witness the highest growth in the global market, with a forecasted CAGR of 7.0% during the review period. This growth is fueled by increasing consumer awareness about the health risks associated with high sugar consumption and the corresponding shift toward low-calorie, sugar-free alternatives. Countries such as Finland one of the world’s key xylitol producers play a pivotal role in supplying intra-European markets. The demand is particularly strong in health-forward economies like Germany, France, and the United Kingdom, where consumers embrace products with functional health benefits and clean-label ingredients. Moreover, rising adoption in oral care and food and beverage sectors, combined with a robust trend toward healthier lifestyles, is expected to sustain Europe’s momentum as the fastest-growing regional market for xylitol.

Finland Xylitol Market Trends

- Finland is a key exporter of xylitol in Europe, supplying significant volumes to countries such as Germany, France, and the UK. With rising consumer demand for sugar-free and low-calorie products, Finland’s production capabilities are central to meeting regional needs. Xylitol’s appeal lies in its natural origin, low glycaemic index, and dental benefits qualities that align well with the growing health consciousness in European markets. As awareness around sugar reduction intensifies, Finland’s role as a supplier to health-driven markets across Europe continues to strengthen.

Country Insights

- The U.S – In the United States, xylitol consumption is high, largely due to its widespread use in sugar-free gums, low-calorie foods, and oral care products. Increasing awareness of sugar-related health issues, such as diabetes and dental problems, has driven demand for healthier sweetener alternatives. Xylitol’s proven oral health benefits have led to its inclusion in toothpaste, mouthwashes, and chewing gums. Major players like Cargill and Roquette Frères continue to invest in technological advancements and product innovation, keeping the U.S. market at the forefront of xylitol adoption and development.

Form Insights

The powder segment leads the global market due to its high versatility, ease of use, and widespread applicability across multiple industries. Powdered xylitol is favored for its ease of handling, efficient storage, and seamless transport, making it highly practical for manufacturers and end-users. It dissolves quickly in liquids, facilitating its integration into various product formulations such as beverages, pharmaceutical syrups, and sugar-free foods. This form is especially prominent in producing health-conscious consumables, including diabetic-friendly foods and chewing gum. As consumer demand for sugar alternatives continues to rise, the powder form remains the preferred choice, offering superior convenience and functionality across diverse application sectors.

Application Insights

The oral care segment accounts for the largest share of the market, primarily driven by the compound's well-documented dental health benefits. Xylitol is clinically proven to reduce the risk of dental caries, stimulate saliva production, neutralize oral pH, and inhibit the growth of harmful bacteria such as Streptococcus mutans. The growing consumer preference for natural and non-carcinogenic ingredients in oral hygiene products is fueling further demand. Additionally, heightened awareness of oral health, supported by endorsements from dental professionals and regulatory bodies, accelerates market penetration. As a result, xylitol’s role in improving oral hygiene is expected to remain a key growth driver over the forecast period.

Company Market Share

The xylitol industry is highly competitive as many global and regional players contribute a considerable amount to its growth. Among the key companies that dominate the market are Cargill, Inc., DuPont Danisco, and Roquette Freres, which offer various xylitol products, including their applications in food, beverages, and oral care products. These companies and others contribute to the dynamic and competitive landscape of the market. Innovation, sustainability, and strategic regional expansions are necessary to capture market share.

Dupont Danisco: An Emerging Player in the Xylitol Market

DuPont Danisco takes the xylitol market with technology-driven, eco-friendly production methods to yield high-grade xylitol for both food and pharmaceutical industries. Having an asset base of renewable resources and maximum production output, this company is aligned with the trends of environment-friendly and healthy products. Its advanced biotechnology makes it more effective but lessens the ecological footprint of such a product, following consumer trends in natural sweeteners. DuPont Danisco is at the head of a dynamic market with xylitol for food, beverages, and health supplements, focusing on sustainability.

Recent Developments at Dupont Danisco Include:

- In April 2020, Positive modulation on the growth of skin microbes was noted in a study carried out in the Korean Journal of Microbiology involving DuPont's XIVIA® Xylitol, whose potential, besides its applications concerning food and oral hygiene, is significant in many other applications.

List of Key and Emerging Players in Xylitol Market

- Roquette Frères

- ZuChem, Inc.

- Thomson Biotech (Xiamen) Co., Ltd.

- NovaGreen, Inc.

- DFI Corp.

- Zhejiang Huakang Pharmaceutical Co., Ltd.

- Jining Hengda Green Engineering Co., Ltd.

- Shandong Biobridge Technology Co., Ltd.

- Shandong Futaste Co., Ltd.

- Foodchem International Corp.

- Mitsubishi Shoji Foodtech Co., Ltd.

- A & Z Food Additives Co., Ltd.

- Herboveda India

- Shandong Lujian Biological Technology Co., Ltd.

- Godavari Biorefineries Ltd.

- Shandong Longlive Bio-Technology Co., Ltd.

- Phoenix Contact

- Belden Inc.

- ABB

- Schneider Electric

- Bosch Rexroth AG

to learn more about this report Download Market Share

Recent Developments

- March 2025- CJ CheilJedang, a major South Korean food and bio company, partnered with a biotechnology startup to develop microbial fermentation techniques for producing corn-fiber xylitol. This partnership aims to reduce reliance on traditional hardwood feedstocks for xylitol production.

Analyst Opinion

As per our analyst, the global xylitol market is experiencing robust growth fueled by rising health consciousness, increasing prevalence of diabetes, and growing demand for natural sugar substitutes. Xylitol’s unique properties such as a low glycaemic index and proven oral health benefits make it highly attractive across industries including food and beverages, pharmaceuticals, and personal care. The oral care segment remains a major driver, particularly in developed economies like the U.S. and Germany, where consumers are shifting towards sugar-free, functional hygiene products. Production is concentrated in China and Finland, ensuring global supply continuity and competitive pricing.

Meanwhile, emerging markets like India and Thailand present new growth opportunities due to expanding middle-class health awareness and dietary shifts. Innovation by key players in sustainable and efficient production methods further enhances market dynamics. Overall, the xylitol market is well-positioned for sustained expansion, supported by increasing global demand for clean-label, health-enhancing sweeteners.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.15 Billion |

| Market Size in 2025 | USD 1.21 Billion |

| Market Size in 2033 | USD 1.77 Billion |

| CAGR | 4.9% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Form, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Xylitol Market Segments

By Form

- Powder

- Liquid

By Application

- Chewing Gum

- Confectionery

- Bakery & Other Foods

- Oral Care

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.