Automated and Closed Cell Therapy Processing Systems Market Size, Share & Trends Analysis Report By Workflow (Separation, Expansion, Apheresis, Fill- Finish, Cryopreservation, Others), By Type (Stem Cell Therapy, Non-stem Cell Therapy), By Scale (Pre-commercial/ R&D Scale, Commercial Scale) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Automated and Closed Cell Therapy Processing Systems Market Overview

The global automated and closed cell therapy processing systems market size is valued at USD 1.64 billion in 2025 and is estimated to reach USD 7.61 billion by 2034, growing at a CAGR of 18.62% during the forecast period. The robust market growth is fuelled by the expanding adoption of microfluidic sensor-embedded closed modules, which allow real-time sterility assurance during cell manipulation workflows in regulated production.

Key Market Trends & Insights

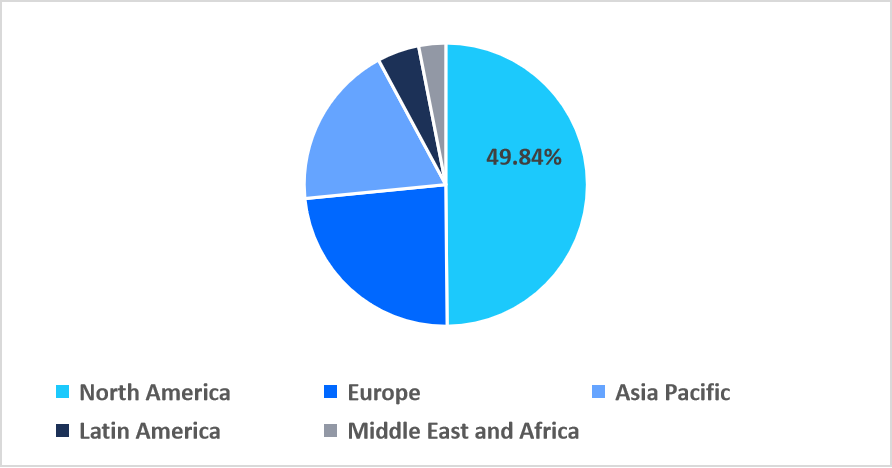

- North America held a dominant revenue share of the global market, accounting for 49.84% in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 20.11%.

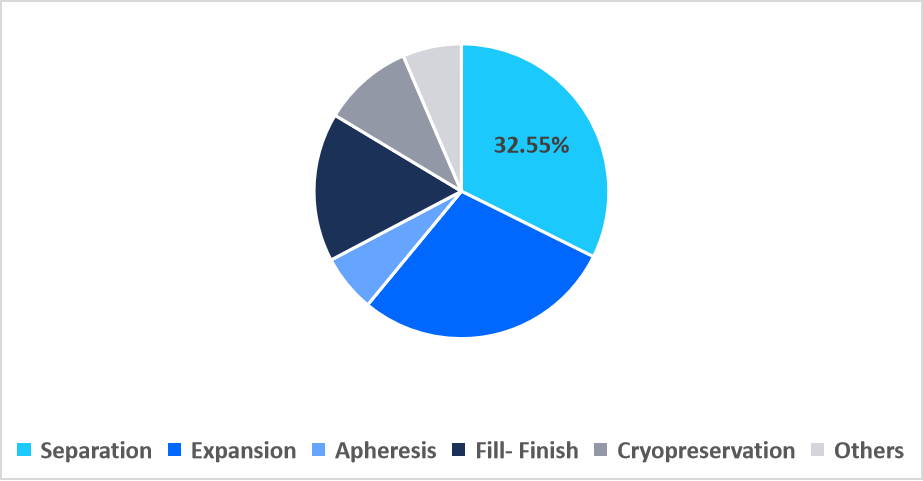

- Based on workflow, the separation segment held the highest market share of 32.55% in 2025.

- By type, the stem cell therapy segment is expected to register the fastest CAGR growth of 19.62% during the forecast period.

- Based on scale, the R&D scale segment dominated the market in 2025.

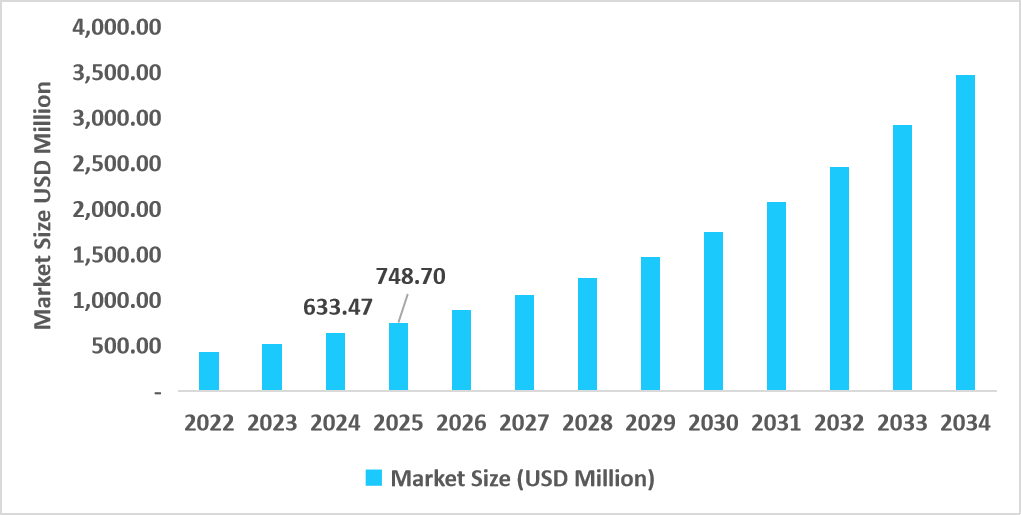

- The U.S. dominates the market, valued at USD 633.47 million in 2024 and reaching USD 748.70 million in 2025.

Table: U.S. Automated and Closed Cell Therapy Processing Systems Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 1.64 billion

- 2034 Projected Market Size: USD 7.61 billion

- CAGR (2026-2034): 18.62%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The automated and closed cell therapy processing systems market encompasses advanced platforms that streamline cell handling across critical workflows such as separation, expansion, apheresis, fill-finish, cryopreservation, and other specialized steps. Supporting both stem cell and non-stem cell therapies, these systems ensure controlled, contamination-free processing. These systems are deployed for R&D and commercial-scale operations.

Latest Market Trends

Growing Adoption of AI-Supported Closed-System Manufacturing Platforms

A major trend in the automated and closed cell therapy processing systems market is the rapid integration of AI-driven automation into closed bioprocessing platforms. These systems use machine learning based predictive controls, sensor-embedded monitoring, and automated decision support to optimize critical workflows such as separation, expansion, and fill-finish. Recent launches featuring adaptive process optimization and deviation detection are enabling higher batch consistency, reduced manual intervention, and improved manufacturing efficiency across both R&D and commercial scale production.

Strategic Collaborations to Accelerate Automated Cell Therapy Manufacturing

The rise of strategic partnerships aimed at advancing fully automated cell therapy manufacturing platforms is a key trend expanding market growth. Recently, Cytiva partnered with Cellares to integrate its bioprocessing expertise into the Cell Shuttle automated manufacturing platform, enabling scalable, closed system production for complex cell therapies.

Such collaborations are strengthening innovation pipelines, reducing manufacturing bottlenecks, and accelerating the adoption of next-generation automated cell therapy processing solutions across the industry.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 1.64 Billion |

| Estimated 2026 Value | USD 1.94 Billion |

| Projected 2034 Value | USD 7.61 Billion |

| CAGR (2026-2034) | 18.62% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Bio-Rad Laboratories, BioSpherix, LLC, CELLARES, CellGenix GmbH, Corning Incorporated |

to learn more about this report Download Free Sample Report

Market Drivers

Rising Demand for Scalable Cell Therapy Manufacturing Capacity

A key driver in the automated and closed cell therapy processing systems market is accelerating global demand for scalable, contamination-free cell therapy manufacturing. As the recent regulatory expansions for CAR-T therapies have intensified the demand for high-throughput, closed automated platforms. For example, in 2024, Cellares partnered with multiple cell therapy developers to deploy its Cell Shuttle system, enabling scalable automated production. As treatment volumes grow, healthcare and biopharma facilities are increasingly adopting such closed platforms to ensure consistent, GMP-compliant manufacturing.

Market Restraints

Limited Technical Integration Capacity Across Smaller Manufacturing Facilities

The limited technical integration capacity of smaller GMP facilities is a major restraint for market growth. Various regional manufacturers struggle to adopt advanced closed automated platforms due to complex installation requirements, advanced sensor calibration, and specialized operator training. Therefore, several mid-sized therapy developers reported delays in deploying closed automated expansion systems after failing facility readiness audits, highlighting the impact of infrastructure and skills gaps that continue to hinder widespread adoption.

Market Opportunity

Rising Adoption of Modular, Plug-and-Play Manufacturing Suites

The growing demand for modular, plug-and-play cleanroom and manufacturing suites presents a new scope for market growth. As therapy developers seek rapid facility deployment and flexible capacity expansion, interest in pre-engineered, automation-ready modules are increasing. These environments seamlessly integrate closed processing systems, reduce construction timelines, and lower operational complexity, enabling manufacturers to scale production efficiently and accelerate market entry for emerging cell therapy programs.

Regional Analysis

North America dominated the market in 2025, accounting for 49.84% market share. A key factor supporting North America’s leading share is the dense network of clinical trial pipelines and GMP‑certified contract manufacturing organizations (CMOs/CDMOs). This concentration enables rapid scaling from research to commercial production, driving high demand for automated, closed-cell therapy processing systems.

The U.S. automated and closed cell therapy processing systems market benefits uniquely from a concentrated ecosystem of more than 70 GMP-certified cell and gene therapy CDMO facilities, robust biotech hubs such as Massachusetts, California, and North Carolina, which create high demand for automated, closed cell processing platforms to support scalable, compliant manufacturing.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 20.11% from 2026-2034. This growth is attributed to the expansion of domestic CDMO facilities in China, Japan, and India. Streamlined regulatory pathways and increased local manufacturing capacity enable faster adoption of automated, closed-cell therapy processing systems, supporting scalable production and meeting rising regional therapeutic demand.

China's automated and closed cell therapy processing systems market is experiencing strong growth during the forecast period, due to highly supportive regulatory reforms from the National Medical Products Administration (NMPA), which, in 2022–2024, fast‑tracked numerous cell and gene therapy approvals and accelerated IND filings. This regulatory update has notably increased demand for automated, closed-cell therapy processing systems.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe is witnessing strong growth in the automated and closed cell therapy processing systems market, as the region’s clinical trial and manufacturing organizations are launching automated, hospital-based cell therapy production hubs. These decentralized facilities, backed by collaborative EU funding and shared infrastructure, allow clinics across member states to adopt closed system processing without building in-house GMP facilities.

The UK market is benefiting from a robust pipeline developed through the Cell and Gene Therapy Catapult’s apprenticeship program. Since 2018, over 280 apprentices have been trained in cell and gene therapy manufacturing, providing a skilled workforce that facilitates the rapid adoption and deployment of automated closed cell therapy processing systems across expanding facilities.

Latin America Market Insights

The Latin America automated and closed cell therapy processing systems market is driven by a surge in region-wide adoption of automated cell therapy manufacturing through the expansion of local CDMO infrastructure. For example, Terumo Blood and Cell Technologies is actively deploying automated platforms across Brazil, Colombia, and Mexico to meet rising demand. This increases access, lowers logistics burden, and drives demand for closed processing systems.

The Brazilian automated and closed cell therapy processing systems market is propelled by new domestic CDMO infrastructure, such as Biotimize, which offers GMP-compliant cell bank storage, single-use bioprocessing, fill‑finish, and API manufacturing services under local regulation. This reduces reliance on imports, slashes production timelines by up to 50%, and notably lowers costs for both clinical trial and commercial scale cell therapies.

Middle East and Africa Market Insights

The Middle East & Africa market is being driven by the rise in adoption of automated closed cell therapy processing systems, is the establishment of large‑scale, hospital‑linked manufacturing facilities. For instance, the new 5,000 m² GMP-certified cell and gene therapy campus at King Faisal Specialist Hospital & Research Centre began operations in late 2025. This development creates an in‑region infrastructure for advanced therapy production, reducing reliance on imports, enabling local access to CAR‑T and stem cell therapies, which, in turn, supports market growth.

The Saudi Arabia automated and closed cell therapy processing systems market is growing due to a surge in early-stage biotech funding, with the 2025 R29 million pre-seed investment into the first African cell and gene therapy startup. This injection of capital fosters local development of cell therapy pipelines and increases demand for automated processing platforms to support clinical translation and scalable manufacturing.

Workflow Insights

The separation segment dominated the market with a revenue share of 32.55% in 2025. This dominance is attributed to the adoption of acoustic wave-based cell separation modules that isolate target cells without mechanical stress. These non-contact systems preserve cell viability, reduce downstream purification burdens, and are increasingly preferred for delicate stem cell and CAR-T workflows.

The expansion segment is projected to grow at the fastest CAGR of 19.17% during 2026-2034, owing to the emergence of microcarrier-free, single-use bioreactors equipped with metabolic sensing. These systems enable uniform large-scale cell proliferation, minimize shear stress, and support higher expansion efficiency for sensitive stem cell and immunotherapy applications.

By Workflow Market Share (%), 2025

Source: Straits Research

Type Insights

Non-stem cell therapy segment dominated the market in 2025, due to the integration of closed, vector-optimized processing modules designed specifically for immune cell engineering. These systems enhance transduction precision, reduce variability, and support high-throughput manufacturing of CAR-T, TCR-T, and NK-cell therapies.

The stem cell therapy segment is anticipated to register the fastest CAGR of 19.62% during 2026-2034. Rising clinical adoption of personalized regenerative therapies is driving the stem cell therapy segment, as hospitals and biopharma increasingly utilize automated closed systems to expand patient-specific stem cells for targeted treatments in degenerative diseases.

Scale Insights

The R&D scale segment dominated the market in 2025, owing to the widespread adoption of compact, automated closed systems that enable high-throughput stem cell and immune cell experimentation, allowing researchers to optimize protocols, monitor cell quality, and accelerate preclinical development efficiently.

The commercial scale segment is expected to register a 19.29% CAGR growth during the forecast timeframe, due to increasing demand for centralized manufacturing hubs capable of producing large volumes of CAR-T and stem cell therapies, allowing manufacturers to meet global therapeutic demand while maintaining regulatory compliance and consistent product quality.

Competitive Landscape

The global automated and closed cell therapy processing systems market is moderately consolidated, dominated by key players such as Danaher, Cellares, Miltenyi Biotec, Terumo BCT, Lonza, Sartorius, and GE Healthcare. These companies focus on strategic initiatives, including launching advanced closed-system platforms, integrating AI-driven automation, forming partnerships with biopharma firms, and expanding manufacturing and service networks globally, thereby enhancing their technological capabilities and strengthening their market presence.

Mytos: An emerging market player

Mytos is an emerging manufacturer of automated and closed-cell therapy processing systems, focusing on scalable, GMP-compliant production of stem cell and immune cell therapies. In 2025, the company launched its iDEM automation platform at its UK facility, capable of producing up to 1,500 autologous or 25,000 allogeneic doses annually, enhancing access to high-quality, fully automated cell therapy manufacturing.

List of Key and Emerging Players in Automated and Closed Cell Therapy Processing Systems Market

- Bio-Rad Laboratories

- BioSpherix, LLC

- CELLARES

- CellGenix GmbH

- Corning Incorporated

- Danaher Corporation

- Eppendorf AG

- Fresenius Kabi

- MaxCyte

- GE Healthcare

- Lonza

- Merck KGaA

- Miltenyi Biotec

- Sartorius AG

- Terumo Corporation

- Thermo Fisher Scientific Inc.

- ThermoGenesis Holdings, Inc.

- Wuxi AppTec

- Others

Strategic Initiatives

- September 2025: Multiply Labs, a robotics company, collaborated with Thermo Fisher Scientific for integrating Thermo Fisher’s automated Gibco CTS DynaCellect Magnetic Separation System with Multiply Labs’ state-of-the-art robotic platforms.

- March 2025: Limula, a cell therapy developer, launched its LimONE system that automates complex processes into a closed, single-use consumable system.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 1.64 Billion |

| Market Size in 2026 | USD 1.94 Billion |

| Market Size in 2034 | USD 7.61 Billion |

| CAGR | 18.62% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Workflow, By Type, By Scale |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Automated and Closed Cell Therapy Processing Systems Market Segments

By Workflow

- Separation

- Expansion

- Apheresis

- Fill- Finish

- Cryopreservation

- Others

By Type

- Stem Cell Therapy

- Non-stem Cell Therapy

By Scale

- Pre-commercial/ R&D Scale

- Commercial Scale

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.