Automotive Camshaft Market Size, Share & Trends Analysis Report By Product Type (Cast Camshaft, Forged Camshaft, Assembled Camshaft), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Two-wheelers (For performance and sports bikes), Off-road & Agricultural Vehicles), By Fuel Type (Gasoline Engines, Diesel Engines, Hybrid & Electric Vehicles (EVs)), By Distribution Channel (OEMs (Original Equipment Manufacturers), Aftermarket), By End Use (Standard Consumer Vehicles, Racing & Performance Vehicles, Commercial & Industrial Applications) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Automotive Camshaft Market Size

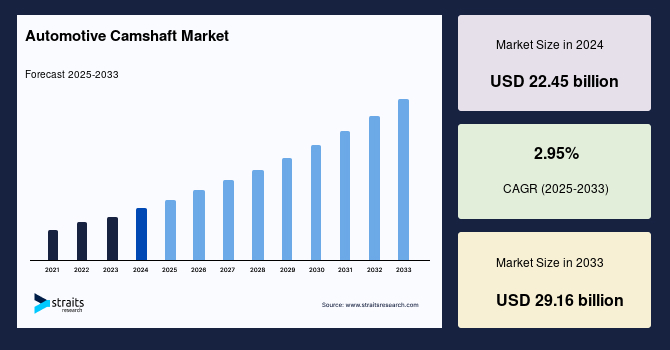

The global automotive camshaft market size was valued at USD 22.45 billion in 2024 and is projected to reach from USD 23.11 billion in 2025 to USD 29.16 billion by 2033, growing at a CAGR of 2.95% during the forecast period (2025-2033).

An automotive camshaft is a critical engine component that controls an internal combustion engine's timing and movement of the intake and exhaust valves. It consists of a rotating shaft with precisely designed lobes (cams) that push against the engine’s valve lifters, ensuring proper airflow and fuel mixture for combustion. Camshafts can be made from materials like cast iron or forged steel and may feature variable valve timing (VVT) technology to optimize engine efficiency and performance. Found in both gasoline and diesel engines, camshafts play a vital role in determining power output, fuel economy, and overall engine reliability.

The global market is critical to modern internal combustion engines, directly impacting vehicle performance, fuel efficiency, and emissions control. Camshafts regulate the opening and closing of engine valves, ensuring optimal air-fuel mixture intake and exhaust gas expulsion. As automakers strive to enhance engine efficiency and meet stricter emissions standards, the demand for advanced camshaft technologies is rising. Manufacturers increasingly utilize lightweight materials such as aluminum and composites, improving engine responsiveness and reducing overall vehicle weight for better fuel economy.

With the growing focus on hybrid and electric vehicles (EVs), the camshaft market is evolving to accommodate alternative powertrain solutions. While traditional camshafts remain essential for internal combustion engines, hybrid cars require efficient valve timing systems to balance electric and gasoline power sources. Meanwhile, the rise of fully electric powertrains, eliminating the need for camshafts, pushes manufacturers to diversify their offerings. Companies are investing in research and development to create adaptable solutions, such as camless engine technologies and digital valve control systems, to stay competitive in an industry transitioning toward electrification.

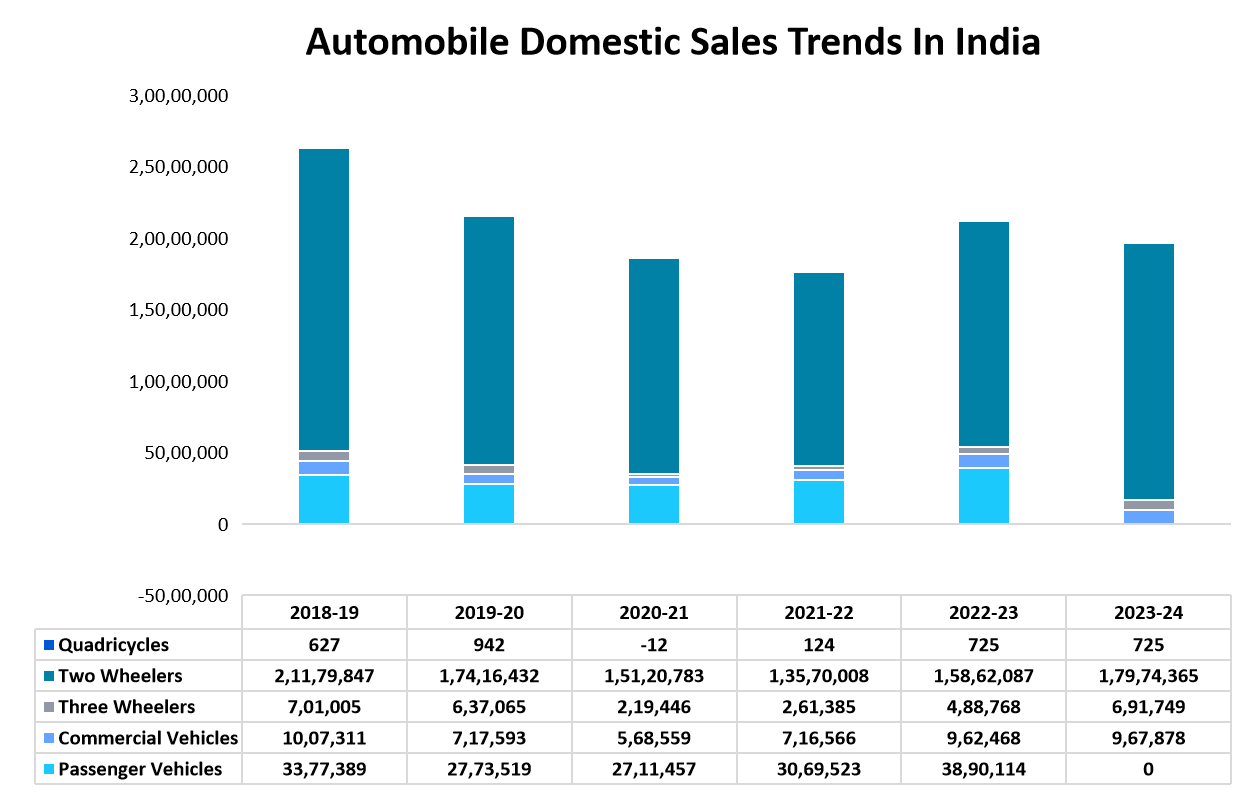

Source: Society of India Automobile Manufactures

Latest Market Trends

Adoption of Lightweight Camshafts

To enhance fuel efficiency and comply with stringent global emission regulations, automotive manufacturers are increasingly integrating lightweight camshafts into engine designs. These camshafts, made from advanced materials like aluminum and composites, reduce overall engine weight, improving fuel economy and lowering carbon emissions. Additionally, lightweight camshafts contribute to better engine responsiveness and durability. As automakers continue innovating for sustainability, the demand for such high-performance, eco-friendly components is expected to grow, influencing future camshaft production and design trends.

- For instance, the U.S. Department of Energy states that a 10% reduction in vehicle weight can improve fuel efficiency by 6-8%, emphasizing the growing demand for lightweight camshafts.

Increasing Demand for Performance Camshafts

The rising popularity of high-performance and racing vehicles has significantly increased the demand for precision-engineered camshafts. These advanced camshafts optimize engine output by improving torque delivery, enhancing fuel combustion efficiency, and ensuring superior power delivery. Racing and performance-focused engines require durable, high-strength camshafts capable of withstanding extreme conditions. As consumers seek enhanced driving experiences and manufacturers focus on performance-driven innovations, the market for precision-engineered camshafts continues to expand across both mainstream and niche automotive segments.

- For instance, according to the Specialty Equipment Market Association (SEMA), the global performance parts market, including camshafts, is expected to reach USD 52.3 billion by 2025.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 22.45 Billion |

| Estimated 2025 Value | USD 23.11 Billion |

| Projected 2033 Value | USD 29.16 Billion |

| CAGR (2025-2033) | 2.95% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Key Market Players | Mahle GmbH, Federal-Mogul LLC, Linamar Corporation, Schrick GmbH, Kautex Textron GmbH |

to learn more about this report Download Free Sample Report

Global Automotive Camshaft Market Growth Factors

Growth in Vehicle Production and Sales

The growing demand for passenger and commercial vehicles, especially in emerging markets, is a key driver for increased camshaft production. Rising disposable income, urbanization, and improved road infrastructure in countries like India, China, and Brazil are boosting vehicle sales, directly influencing the need for high-quality camshafts. Additionally, government incentives for automotive manufacturing and the expansion of logistics and transportation sectors are fueling demand. As vehicle production scales up globally, camshaft manufacturers ramp up operations to meet the growing automotive industry's requirements.

- For instance, the World Bank reports that global vehicle production reached approximately 90 million units in 2021, highlighting the growing demand for camshafts in new vehicles.

Technological Advancements in Variable Valve Timing (vvt) Camshafts

Variable Valve Timing (VVT) camshafts have gained significant traction with the automotive sector shifting toward fuel-efficient and low-emission engine technologies. VVT camshafts allow precise control over valve timing, improving power output, optimizing fuel consumption, and reducing emissions. Automakers are increasingly adopting VVT technology to comply with stringent environmental regulations and enhance engine performance. This trend is particularly prominent in hybrid and downsized turbocharged engines, where efficiency gains are crucial for maintaining competitive advantages in the evolving automotive landscape.

- For instance, the European Automobile Manufacturers Association (ACEA) states that over 70% of new passenger vehicles in Europe now incorporate VVT technology.

Market Restraint

High Manufacturing Costs of Advanced Camshafts

One of the key challenges restraining the growth of the automotive camshaft market is the high production cost associated with precision-engineered camshafts. These camshafts require high-grade materials such as forged steel, titanium, advanced composites, and sophisticated manufacturing processes like CNC machining and heat treatment. The high cost of raw materials, coupled with complex engineering requirements, makes production expensive, impacting affordability for automakers and aftermarket suppliers.

Additionally, the stringent quality control measures and testing standards further escalate costs, as manufacturers must ensure durability, performance, and compliance with emission norms. Moreover, supply chain disruptions, fluctuating raw material prices, and labor costs contribute to financial challenges. As a result, cost-sensitive markets may hesitate to adopt advanced camshaft technologies, slowing market expansion. Companies aiming for profitability must find innovative ways to reduce manufacturing expenses without compromising performance and quality, posing a persistent challenge to industry players.

Market Opportunity

Expansion of the Automotive Aftermarket

The increasing global vehicle population presents a significant growth opportunity for the aftermarket camshaft segment. Many vehicle owners seek aftermarket camshafts for performance tuning, engine upgrades, and replacements, driving demand in enthusiast and repair markets. Performance enthusiasts opt for high-performance camshafts to enhance acceleration, power output, and engine efficiency, while repair and maintenance services require reliable replacements.

Furthermore, the need for cost-effective, high-quality replacement parts becomes crucial as vehicle ownership duration increases. With an aging vehicle fleet in North America and Europe, aftermarket camshaft sales are expected to grow substantially. Developing markets in Asia-Pacific and Latin America are also experiencing a rise in demand due to increasing vehicle modification trends and expanding independent repair networks. Additionally, technological advancements in aftermarket camshafts, including lightweight materials and optimized cam profiles, are attracting a broader customer base.

- For instance, according to the Automotive Aftermarket Suppliers Association (AASA), the global automotive aftermarket is projected to exceed USD 1 trillion by 2025. This growth trend highlights the increasing opportunities for aftermarket camshaft manufacturers to expand their product offerings and capitalize on rising consumer demand.

Regional Insights

North America: Dominant Region with A Significant Market Share

North America holds a leading position in the global automotive camshaft market, driven by a well-established automotive manufacturing base, high vehicle sales, and continuous advancements in engine technology. The presence of major automakers and Tier 1 suppliers fosters innovation in camshaft design, focusing on fuel efficiency and performance enhancement.

In addition, stringent emission regulations push manufacturers to develop lightweight and precision-engineered camshafts. The region’s growing demand for high-performance and commercial vehicles further expands the market. Ongoing research in advanced materials and manufacturing techniques, such as 3D printing and CNC machining, also strengthens North America’s dominance in the industry.

Europe: Rapidly Growing Region

Europe is experiencing significant growth in the global automotive camshaft market, primarily driven by its strong emphasis on vehicle electrification and emission reduction. Stringent European Union (EU) regulations push automakers to adopt innovative camshaft technologies, such as Variable Valve Timing (VVT) and lightweight materials, to enhance fuel efficiency and lower carbon footprints.

Additionally, leading European automotive manufacturers invest in research and development to optimize internal combustion engine (ICE) efficiency alongside hybrid powertrains. As the region moves toward sustainable mobility, camshaft design advancements are crucial in meeting evolving environmental standards while maintaining performance and reliability.

Countrywise Trends

- United States:The increasing adoption of fuel-efficient engines and stringent emission regulations also contribute to the demand for advanced camshaft technologies. Key players in the U.S. market, such as General Motors, Ford, and Chrysler, are investing in innovative camshaft designs to enhance engine efficiency and performance. Additionally, aftermarket giants like COMP Cams and Crane Cams are expanding their product portfolios to meet the growing demand for performance-oriented camshafts.

- Germany:The German market is driven by stringent environmental regulations, pushing manufacturers to develop lightweight, high-performance camshafts. As per GTAI (German Trade and Invest), Germany manufactured around 4.1 million vehicles in 2023, with major automakers like BMW, Mercedes-Benz, and Volkswagen leading the market. This strong production base fuels the demand for advanced camshaft solutions.

- China:The market is influenced by China's push towards electric and hybrid vehicles, requiring advanced camshaft technologies to optimize engine efficiency. In 2024, China produced over 31.28 million vehicles, solidifying its position as the world's largest automobile market. This massive production scale drives significant demand for both performance and electric camshafts.

- Japan:Japan's automotive industry produced approximately 9 million vehicles in 2023, reflecting its leadership in automotive innovation. Major manufacturers increasingly adopt advanced camshaft technologies to enhance engine performance and efficiency. Japanese companies such as Toyota, Honda, and Nissan are at the forefront of camshaft innovation, focusing on reducing engine friction and improving fuel economy.

- India:Increasing localization efforts and government initiatives such as "Make in India" encourage domestic camshaft production. This growth and rising middle-class demand for passenger cars boost the camshaft market. Companies like Bharat Forge and Precision Camshafts Limited are expanding their manufacturing capabilities to cater to the growing demand for high-quality camshafts in OEM and aftermarket segments.

- South Korea:South Korea manufactured approximately 4.24 million vehicles in 2023, focusing strongly on hybrid and electric vehicle components. This emphasis on advanced powertrain technologies increases the demand for specialized camshafts. Leading automakers like Hyundai and Kia are integrating cutting-edge camshaft designs to enhance fuel efficiency and reduce emissions.

- Brazil:The increasing preference for flex-fuel vehicles and ethanol-powered engines drives innovation in camshaft designs tailored for alternative fuels. In 2023, Brazil's automotive sector produced around 2.32 million vehicles, indicating an expanding market. This growth generates demand for OEM and aftermarket camshafts to support vehicle manufacturing and maintenance.

- United Kingdom:The UK produced approximately 1.03 million vehicles in 2023, catering to a luxury and high-performance automotive market. This niche market necessitates advanced camshaft solutions to meet the performance standards of premium vehicles. Leading suppliers like Kent Cams and Piper Cams specialize in high-performance camshafts designed for motorsport and luxury applications, ensuring superior engine efficiency and power delivery.

Segmentation Analysis

By Product Type

Cast camshafts dominate the market due to their cost-effectiveness, high durability, and suitability for mass production. Cast camshafts are widely used in both passenger and commercial vehicles and offer a balance between performance and affordability. Their ability to withstand wear and tear while maintaining efficiency makes them a preferred choice for automakers worldwide.

By Vehicle Type

Passenger cars hold the largest market share in the global automotive camshaft market, driven by their high production volume and growing demand for fuel-efficient engine components. Automakers are increasingly adopting lightweight and precision-engineered camshafts to enhance fuel economy and reduce emissions. As consumer preference shifts toward eco-friendly vehicles, demand for advanced camshaft designs continues to rise.

- For instance, the International Organization of Motor Vehicle Manufacturers (OICA) reports that over 68 million passenger cars were produced worldwide in 2023, driving demand for camshafts.

By Fuel Type

Gasoline-powered vehicles remain the primary driver of camshaft demand, given their widespread adoption in global markets. Despite the rise of electric vehicles, gasoline engines dominate due to their affordability, established infrastructure, and technological advancements. Camshaft manufacturers are focusing on improving efficiency and durability to meet the evolving needs of modern gasoline-powered engines.

- For instance, the International Energy Agency (IEA) states that gasoline vehicles accounted for nearly 60% of global vehicle sales in 2023.

By Distribution Channel

Original Equipment Manufacturers (OEMs) lead the global automotive camshaft market as they integrate these essential components into new vehicle production. Automakers prioritize high-quality camshafts to ensure engine reliability, performance, and compliance with emission standards. With the shift toward advanced engine technologies, OEMs continue to drive innovation in camshaft manufacturing to enhance efficiency and longevity.

By End Use

Standard consumer vehicles account for the largest market share in the camshaft industry due to the rising demand for daily-use passenger cars and commercial fleets. As urbanization and mobility needs grow, automakers focus on developing efficient and durable camshafts for mass-market vehicles. This segment's dominance is expected to persist with increasing vehicle production and sales worldwide.

- For instance, according to SIAM, standard passenger cars constituted over 80% of total vehicle sales in India in 2023.

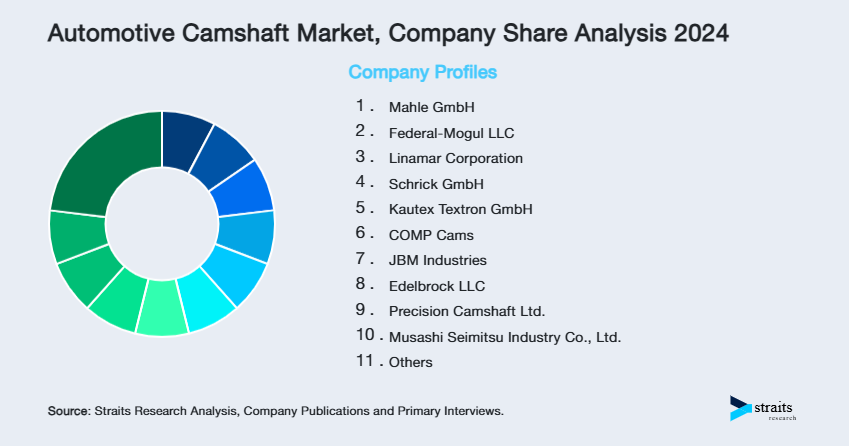

Company Market Share

Key market players are investing in advanced Global Automotive Camshaft technologies and pursuing collaborations, acquisitions, and partnerships to enhance their products and expand their market presence.

Precision Camshafts Ltd: An Emerging Player in the Global Automotive Camshaft Market

Mahle GmbH is rapidly establishing itself as a dynamic force in the global automotive camshaft market by harnessing its longstanding precision engineering and innovation expertise. The company is leveraging advanced digital design and sustainable production techniques to enhance camshaft performance, meeting evolving industry demands for greater fuel efficiency and lower emissions while expanding its global footprint.

Recent Developments:

- In August 2023, Mahle announced a strategic collaboration with Ballard to develop fuel cell propulsion systems for heavy‑ and medium‑duty trucks. This partnership aims to accelerate the integration of clean fuel cell technology into commercial transport, reinforcing both companies’ commitment to sustainable mobility.

List of Key and Emerging Players in Automotive Camshaft Market

- Mahle GmbH

- Federal-Mogul LLC

- Linamar Corporation

- Schrick GmbH

- Kautex Textron GmbH

- COMP Cams

- JBM Industries

- Edelbrock LLC

- Precision Camshaft Ltd.

- Musashi Seimitsu Industry Co., Ltd.

- Meritor Inc.

- Thyssenkrupp AG

- NSK Ltd.

- Performance Camshafts Ltd.

- Xiamen Golden Egret Special Alloy Co., Ltd.

- Others

to learn more about this report Download Market Share

Recent Developments

- February 2025- BorgWarner expanded its partnership with a major East Asian original equipment manufacturer (OEM) to supply Variable Cam Timing (VCT) technology for the latest hybrid and gasoline engines.

- January 2025- Elgin Industries introduced five precision-matched performance camshaft kits CK-1838A, CK-1840A, CK-1841A, CK-1250A, and CK-1251A designed to enhance racing and street-performance engines.

Analyst Opinion

As per our analyst, the global automotive camshaft market will experience steady, moderate growth driven by robust vehicle production and evolving engine technologies prioritizing fuel efficiency and emission control. Innovations such as adopting lightweight materials, precision-engineered VVT and OHC configurations, and advanced manufacturing techniques like 3D printing and CNC machining enhance engine performance and durability. At the same time, the industry is gradually diversifying to cater to hybrid powertrains and emerging electrification trends, ensuring manufacturers remain competitive even as fully electric vehicles reshape traditional powertrain markets.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 22.45 Billion |

| Market Size in 2025 | USD 23.11 Billion |

| Market Size in 2033 | USD 29.16 Billion |

| CAGR | 2.95% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Vehicle Type, By Fuel Type, By Distribution Channel, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Automotive Camshaft Market Segments

By Product Type

- Cast Camshaft

- Forged Camshaft

- Assembled Camshaft

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-wheelers (For performance and sports bikes)

- Off-road & Agricultural Vehicles

By Fuel Type

- Gasoline Engines

- Diesel Engines

- Hybrid & Electric Vehicles (EVs)

By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Aftermarket

By End Use

- Standard Consumer Vehicles

- Racing & Performance Vehicles

- Commercial & Industrial Applications

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Abhijeet Patil

Research Associate

Abhijeet Patil is a Research Associate with 3+ years of experience in Automation & Process Control and Automotive & Transportation sectors. He specializes in evaluating industry automation trends, mobility innovations, and supply chain shifts. Abhijeet’s data-driven research aids clients in adapting to technological disruptions and market transformations.