Automotive Seat Belts Market Size, Share & Trends Analysis Report By Type (Two-point seat belts, Three-point seat belts), By Vehicle Type (Passenger cars, Light commercial vehicles, Heavy commercial vehicles), By Component (Webbing strap, Retractor, Buckle, Tongue, Pillar loop), By Sales Channel (OEM, Aftermarket) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Automotive Seat Belts Market Size

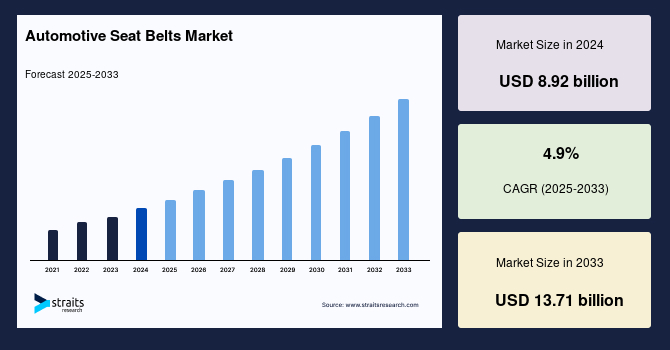

The global automotive seat belts market size was valued at USD 8.92 billion in 2024 and is projected to grow from USD 9.35 billion in 2025 to USD 13.71 billion by 2033, exhibiting a CAGR of 4.9% during the forecast period (2025-2033).

The global market involves the manufacturing and supplying of safety restraints designed to protect passengers in vehicles by reducing injury risks during accidents. Regulatory mandates, increasing automotive production, and heightened awareness of vehicle safety drive market growth. Technological advancements, such as pre-tensioners and load limiters, enhance seatbelt efficiency, boosting adoption in both passenger and commercial vehicles. Major manufacturers invest in lightweight, durable materials and smart seatbelt technologies to improve safety standards.

The global automotive seat belt industry will likely grow during the forecast period because of increasing awareness of safety and more stringent traffic rules worldwide. Seat belts ensure the safety of occupants, and they keep a body from getting seriously hurt in an accident by maintaining a stationary position and providing comfort in sharp turns. The global prevalence of road accidents will continue to fuel market demand as seat belts are considered an integral safety feature. Government campaigns on the need for seat belts, coupled with ratings on safety by organizations such as the New Car Assessment Program (NCAP), will be some of the factors that can improve demand.

Latest Market Trend

Integration of Smart Seat Belts

The integration of smart seat belts is becoming a dominant trend in the automotive industry. These advanced systems offer dynamic safety features, such as real-time belt tension adjustments and positioning based on driving conditions and crash severity. Sensors and electronic controls help optimize restraint, reducing injury risks by adapting to occupants' needs.

- For instance, in January 2024, ZF Passive Safety Systems launched a cutting-edge seat belt technology, the Multi-Stage Load Limiter (MSLL), which adjusts belt force limitations based on occupant size and weight, enhancing safety during collisions.

This shift towards smart seat belts is transforming occupant protection, with advanced technology providing a more effective, tailored approach to safety during accidents.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 8.92 Billion |

| Estimated 2025 Value | USD 9.35 Billion |

| Projected 2033 Value | USD 13.71 Billion |

| CAGR (2025-2033) | 4.9% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Autoliv Inc., Continental AG, Denso Corporation, Far Europe Inc., Goradia Industries |

to learn more about this report Download Free Sample Report

Automotive Seat Belts Market Growth Factor

Increased Focus on Advanced Safety Features

The global automotive seat belt market is witnessing significant growth due to the rising demand for advanced vehicle safety features. Automotive manufacturers are prioritizing the integration of seat belts with other critical safety mechanisms, such as airbags, automatic emergency braking (AEB), and lane departure warning systems, to enhance overall passenger protection. Smart seat belts, equipped with pre-tensioners and load limiters, automatically adjust based on crash severity, further improving occupant safety.

- For example, Toyota introduced an advanced pre-collision system in 2024, which optimizes seat belt functionality during sudden braking to mitigate crash impact.

With increasing road accidents and fatalities, vehicle manufacturers continuously innovate to comply with stringent safety regulations, making advanced seat belts a fundamental component of modern automobiles.

Market Restraint

Complex Integration with Vehicle Systems

One of the significant challenges in the automotive seat belt market is the complex integration of smart seat belts with other vehicle safety technologies. Modern seat belt systems rely on advanced sensors, electronic control units (ECUs), and AI-driven mechanisms to function efficiently alongside airbags, adaptive cruise control, and collision mitigation systems. However, ensuring seamless compatibility between seat belts and other in-vehicle safety features requires extensive research, testing, and development, increasing production costs.

Additionally, automakers face compatibility issues when retrofitting smart seat belts into older vehicle models, further complicating adoption in cost-sensitive markets. Despite these challenges, technological advancements and investments in AI-driven safety solutions are expected to gradually overcome these barriers, leading to more widespread adoption of integrated seat belt systems.

Market Opportunity

Focus on Lightweight and Durable Materials

As the automotive industry shifts towards sustainability and fuel efficiency, manufacturers are exploring lightweight and durable materials for seat belt production. Advanced polymers, high-strength steel, and composite materials are being increasingly adopted to develop seat belts that are both durable and lightweight. These innovations reduce overall vehicle weight, enhance fuel efficiency, and lower carbon emissions.

- For instance, in March 2015, TRW Automotive Holdings Corp. launched the RNS5s seat belt buckle, which is approximately 15% lighter and 20% smaller in packaging volume compared to previous models. This reduction in weight and size contributes to overall vehicle weight savings, aiding manufacturers in meeting emissions and fuel economy targets.

With stringent environmental regulations encouraging automakers to prioritize sustainability, the demand for lightweight and durable seat belts is expected to surge, presenting a significant growth opportunity for manufacturers in the coming years.

Regional Insights

Asia-Pacific: Dominant Region with 55% Market Share

Asia-Pacific is the dominant region, holding 55% of the market share. The growth of the automotive industries in China, India, and Japan is driving this dominance. Increased vehicle production, particularly in China, and the growing middle class in India contribute to higher demand for seat belts. Additionally, road safety awareness and government regulations mandating seat belt use further boost adoption. In China, seat belt usage has grown significantly over the last decade. The rise of electric vehicles and advanced safety technologies also supports the demand for high-tech seat belts integrated with airbags and braking systems.

North America: Fastest Growing Region with the Highest Market Cagr

North America is the fastest-growing region, with the highest market CAGR. Strong regulatory standards, such as the National Highway Traffic Safety Administration’s (NHTSA) seat belt mandates, drive growth in this region. With some of the strictest safety regulations globally, North America’s car manufacturers are adopting advanced seat belt technologies, including smart seat belts, to meet consumer demands for higher safety standards. As of 2020, seat belt use in the U.S. was 90.7%, and further enhancements in vehicle safety systems are expected to increase the demand for advanced seat belts that feature adjustable tension and integration with airbags.

Countrywise Insights

- The U.S.: The U.S. remains a leader in the global automotive seat belt market, driven by stringent National Highway Traffic Safety Administration (NHTSA) regulations that mandate the use of seat belts across all passenger vehicles. High automobile production and growing consumer demand for enhanced safety features have boosted the market as automakers increasingly adopt advanced seat belt technologies, such as smart seat belts integrated with airbags.

- Germany: Germany stands at the forefront of automotive safety innovations in Europe, with manufacturers like Volkswagen, BMW, and Mercedes-Benz championing advanced seat belt systems. Strict regulations, including the Euro NCAP rating system, encourage the development and adoption of smart seat belts with integrated airbags and tensioning systems.

- China: As the world’s largest automotive market, China is experiencing rapid growth in seat belt demand, driven by increased vehicle ownership, stringent safety regulations, and heightened public awareness of road safety. The government’s road safety reforms mandate seat belt usage and are spurring compliance. Additionally, the surge in electric vehicle production fosters demand for next-generation seat belts that integrate with advanced safety systems.

- India: India’s automotive seat belt market is expanding rapidly, fueled by rising middle-class incomes, increasing vehicle ownership, and stricter road safety regulations. The government mandates seat belts for front-seat passengers and tightens laws to ensure higher compliance. Recent data from the Ministry of Road Transport and Highways (MoRTH) shows a significant increase in seat belt usage in urban areas, reflecting stronger law enforcement and heightened public awareness of road safety.

- Japan: Japan is a highly developed automotive market with an unparalleled commitment to road safety. Strict regulations ensure near-total adoption of seat belts, with more than 95% usage in front and rear seats. Japanese automakers like Toyota and Honda have led the implementation of advanced seat belt systems, particularly in the context of electric and autonomous vehicles. The demand for smart seat belts integrated with airbags and collision detection systems is increasing, driven by the growing popularity of next-generation vehicles.

Segmentation Analysis

By Type

By type, the market is bifurcated into two-point seat belts and three-point seat belts. The Three-Point Seat Belt segment holds the largest market share. The three-point seat belt is passenger and commercial vehicles most common safety restraint system. This seat belt comprises three essential components: the lap belt, shoulder belt, and buckle. The lap belt immobilizes the lower body, especially the pelvis and hip joints, while the shoulder belt provides restraint across the chest and shoulder. Compared to the older two-point seat belt, the three-point system distributes the forces of a crash across the body's strongest bones and muscles, reducing serious injuries, especially to the head, chest, and abdomen. This enhanced protection has made the three-point seat belt the standard in many vehicles, further consolidating its market dominance.

By Vehicle Type

By vehicle type, the market is bifurcated into passenger cars, light commercial vehicles, and heavy commercial vehicles. The Passenger Cars segment holds the largest market share. The ongoing concern with traffic-related injuries and the increasing awareness of the importance of seat belts for occupant safety are driving the growth of this segment. Car manufacturers and fleet operators prioritize seat belts that reduce the risk of injury and death in case of an accident. With stricter safety regulations and heightened customer expectations for vehicle safety, the demand for advanced seat belts in passenger cars is strong, especially as manufacturers seek to make vehicles safer during crashes and comply with increasing global safety standards.

By Sales Channel

By sales channel, the market is bifurcated into OEM and aftermarket. The OEM (Original Equipment Manufacturer) segment holds the largest market share. OEM seat belts are tailored to specific vehicle models, ensuring proper fit and integration with the vehicle’s safety systems. These seat belts undergo rigorous testing and certification to meet stringent safety standards required for crash scenarios. OEM seat belts offer optimal compatibility and safety performance, making them the preferred choice for manufacturers looking to ensure that vehicles meet regulatory safety requirements.

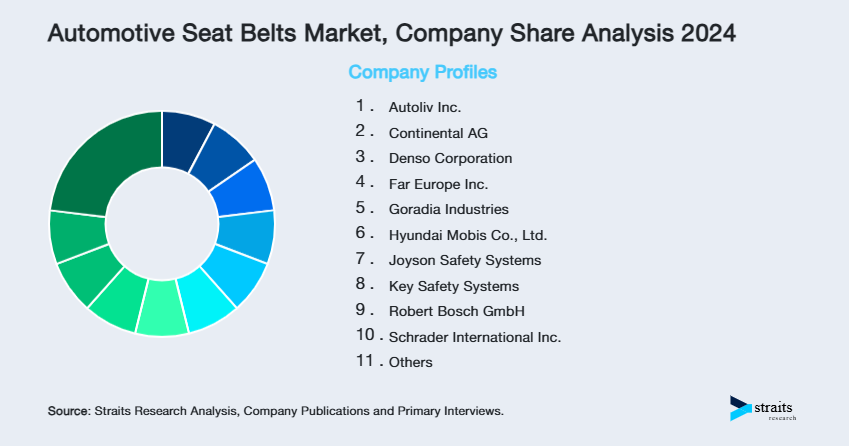

Company Market Share

The key players utilize advanced technology and a strong R&D capability to stay ahead. These players continue to increase their market share through strategic partnerships, acquisitions, and technological innovation in the Asia-Pacific and North American regions.

Autoliv Inc.: An Emerging Player in the Automotive Seat Belts Market

Being one of the world's leaders in automotive safety systems, Autoliv Inc. has a significant share of the global market for automotive seat belts. It specializes in seat belts, airbags, and other safety systems and is one of the major suppliers of many OEMs worldwide. This product's major innovation is smart seat belts; features like advanced tensioning and load limiting further elevate demand for their products.

Recent developments at Autoliv Inc. include:

- In September 2023, Autoliv China, a subsidiary of the worldwide leader in automotive safety systems, Autoliv, Inc., and Great Wall Motor ("GWM"), a prominent Chinese vehicle manufacturer, jointly seized opportunities and challenges in the fast-changing global automotive landscape. Autoliv further consolidates its position with Chinese OEMs through this new cooperation.

List of Key and Emerging Players in Automotive Seat Belts Market

- Autoliv Inc.

- Continental AG

- Denso Corporation

- Far Europe Inc.

- Goradia Industries

- Hyundai Mobis Co., Ltd.

- Joyson Safety Systems

- Key Safety Systems

- Robert Bosch GmbH

- Schrader International Inc.

- Takata Corporation

- Tokai Rika Co., Ltd.

- Toyoda Gosei Co., Ltd.

- TRW Automotive

- ZF Friedrichshafen AG

to learn more about this report Download Market Share

Recent Developments

- January 2024- ZF Passive Safety Systems introduced a new seat belt system featuring the Multi-Stage Load Limiter (MSLL). This technology allows for better adaptation of belt force limitation to the size and weight of vehicle occupants, aiming to reduce injury severity during accidents.

Analyst Opinion

As per our analyst, the global automotive seat belt market is experiencing robust growth driven by heightened safety regulations, technological advancements, and increasing consumer demand for enhanced vehicle safety. Strict government regulations, such as those from the NHTSA in the U.S. and Euro NCAP in Europe, are pushing manufacturers to adopt advanced seat belt technologies, including smart seat belts integrated with airbags and automatic tensioning systems.

Additionally, rising awareness about road safety and the growing production of electric and autonomous vehicles are spurring demand for next-generation seat belts that integrate with broader vehicle safety systems. The shift toward lightweight and durable materials is another key trend, as manufacturers seek to reduce vehicle weight and improve fuel efficiency while maintaining high safety standards. As vehicle safety becomes a top priority for consumers and regulators alike, the automotive seat belt market is poised for continued expansion, with innovation and compliance driving future growth.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 8.92 Billion |

| Market Size in 2025 | USD 9.35 Billion |

| Market Size in 2033 | USD 13.71 Billion |

| CAGR | 4.9% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Vehicle Type, By Component, By Sales Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Automotive Seat Belts Market Segments

By Type

- Two-point seat belts

- Three-point seat belts

By Vehicle Type

- Passenger cars

- Light commercial vehicles

- Heavy commercial vehicles

By Component

- Webbing strap

- Retractor

- Buckle

- Tongue

- Pillar loop

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Abhijeet Patil

Research Associate

Abhijeet Patil is a Research Associate with 3+ years of experience in Automation & Process Control and Automotive & Transportation sectors. He specializes in evaluating industry automation trends, mobility innovations, and supply chain shifts. Abhijeet’s data-driven research aids clients in adapting to technological disruptions and market transformations.