Backflow Preventer Market Size, Share & Trends Analysis Report By Product Type (Reduced Pressure Zone (RPZ) Backflow Preventer, Double Check Valve Assembly (DCVA), Pressure Vacuum Breaker (PVB), Atmospheric Vacuum Breaker (AVB), Others), By Material (Bronze, Stainless steel, Plastic, Ductile iron, Others), By Application (Chemical Plant, Water distribution systems, Others), By End user (Residential, Commercial), By Regions (North America, Europe, Asia-Pacific, Latin America, The Middle East and Africa) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Backflow Preventer Market Size

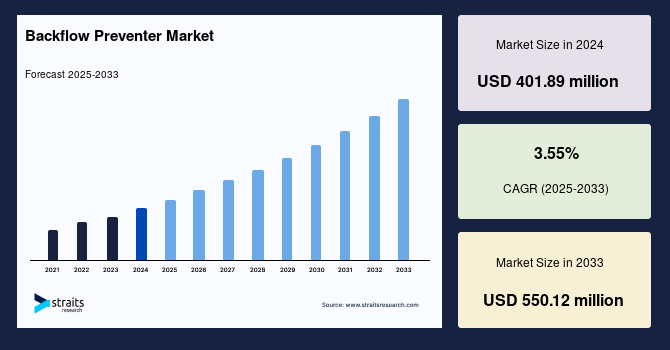

The global backflow preventer market size was valued at USD 401.89 million in 2024 and is estimated to grow from USD 416.15 million in 2025 to reach USD 550.12 million by 2033, growing at a CAGR of 3.55% during the forecast period (2025–2033).

The global backflow preventer market is propelled by rapid urbanization and the expansion of water distribution networks, especially in developing regions. As urban populations grow, there is an increasing demand for reliable water infrastructure to ensure safe and uncontaminated water supplies. Additionally, the rise in commercial and industrial construction projects boosts the need for efficient backflow prevention systems to meet plumbing regulations and protect water quality.

Furthermore, the growing awareness among residential users about the risks of backflow contamination is also encouraging more homeowners to install backflow preventors. These factors combined contribute to the steady growth of the market, highlighting the essential role of backflow preventors in modern water management. Moreover, increased investments in upgrading aging water systems further support market expansion, as municipalities aim to improve public health and comply with safety standards.

Latest Market Trend

Rising Adoption of Smart Backflow Preventers with Iot-Enabled Monitoring Systems

The backflow preventer market is witnessing a significant trend toward the adoption of smart devices integrated with IoT-enabled monitoring systems. These advanced backflow preventers offer real-time data and remote monitoring capabilities, allowing facility managers to detect potential issues proactively and reducing water contamination risks.

- For instance, in February 2022, Watts introduced the LF909-FS backflow preventer featuring SentryPlus Alert™ Technology. This system integrates a self-calibrating flood sensor that detects potential discharge from the relief valve. Upon activation via optional cellular or BMS kits, it provides real-time alerts through email, text, or phone calls, enabling prompt action to prevent flooding.

This innovation exemplifies the growing adoption of smart, IoT-enabled monitoring systems in backflow prevention, enhancing water safety and operational efficiency across commercial and industrial sectors.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 401.89 Million |

| Estimated 2025 Value | USD 416.15 Million |

| Projected 2033 Value | USD 550.12 Million |

| CAGR (2025-2033) | 3.55% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Watts Water Technologies, Inc., Zurn Industries, LLC, Reliance Worldwide Corporation, Emerson Electric Co., Apollo Valves (Aalberts N.V.) |

to learn more about this report Download Free Sample Report

Global Backflow Preventer Market Driver

Rising Concerns over Water Contamination and Public Health Risks

Rising concerns over water contamination and public health risks are key drivers propelling the demand for backflow preventers worldwide. Contaminated water sources can introduce harmful pathogens and chemicals into potable water systems, threatening public health and safety.

- For instance, according to the World Health Organization, in 2022, at least 1.7 billion people worldwide used drinking water sources contaminated with feces, posing substantial health risks. Microbial contamination of drinking water can transmit diseases such as diarrhoea, cholera, dysentery, typhoid, and polio, leading to approximately 505,000 diarrheal deaths annually.

To mitigate these risks, backflow preventors are increasingly installed to stop contaminated water from flowing backwards into clean water supplies, ensuring safer drinking water. Consequently, rising awareness of waterborne diseases and stringent health regulations drive market growth in both residential and commercial sectors.

Market Restraint

High Initial Cost of Installation and Maintenance of Backflow Prevention Systems

The high initial cost of installation and ongoing maintenance of backflow prevention systems poses a significant restraint to the growth of the global backflow preventer market. Many commercial and residential users find the upfront investment challenging, especially in regions with limited financial resources or where water safety awareness is low.

Additionally, regular maintenance is essential to ensure the devices function effectively, which adds to the overall expense. This can discourage building owners and facility managers from adopting or upgrading to advanced backflow prevention technologies. The cost factor is particularly restrictive in developing markets, where budget constraints often prioritize immediate infrastructure needs over preventive water safety measures.

Market Opportunity

Government Subsidies and Incentives for Water Safety Upgrades

Government subsidies and incentives for water safety upgrades present a significant growth opportunity for the global backflow preventer market. Governments worldwide are prioritizing the modernization of water infrastructure to combat contamination and ensure the delivery of safe drinking water. These initiatives often include financial support for the installation of backflow prevention devices in residential, commercial, and industrial settings.

- For instance, in the United States, the Environmental Protection Agency (EPA) has allocated substantial funding through programs like the Drinking Water State Revolving Fund (DWSRF) to enhance drinking water quality and infrastructure. Notably, in February 2023, the EPA announced $2 billion in grants under the Bipartisan Infrastructure Law to address emerging contaminants in drinking water, such as PFAS.

Such financial backing lowers the cost barriers for consumers and utilities, accelerating the adoption of reliable backflow prevention systems across various regions.

Regional Analysis

The North American market is driven by stringent regulations enforcing water safety standards, leading to the widespread adoption of backflow prevention in residential, commercial, and industrial sectors. Aging water infrastructure requires frequent upgrades and retrofits, boosting demand for advanced prevention systems. Increasing awareness about water contamination and public health, combined with technological advancements like smart monitoring, further supports market growth. Investment in sustainable water management and smart city initiatives also contributes to expanding opportunities within the region’s backflow prevention market.

United States Market Trends

The U.S. backflow preventers marketis expanding due to EPA regulations and state-level plumbing codes. Municipalities like Los Angeles and New York require annual testing and certified installation. High demand in commercial sectors such as hospitals, hotels, and schools drives growth. For instance, Florida mandates backflow preventers in irrigation systems to prevent contamination, spurring adoption in both residential and agricultural applications.

Canada’s backflow preventers marketis driven by strict municipal regulations and growing urban infrastructure. Cities like Toronto and Vancouver mandate backflow prevention in residential and commercial plumbing systems. The rising renovation of aging water systems and government initiatives for clean water safety boost demand. For example, British Columbia’s Cross Connection Control Program enforces testing and certification of backflow devices in industrial and institutional settings.

Asia Pacific: Fastest Growing Region

The Asia Pacific region experiences robust market growth due to large-scale urbanization and industrialization projects expanding water supply networks. Rising government initiatives to improve water quality and enforce plumbing safety standards enhance demand for backflow preventors. Increasing investments in smart city developments and infrastructure modernization further drive adoption. Additionally, expanding residential construction and heightened public awareness regarding health risks associated with water contamination create substantial opportunities. The region’s focus on sustainable water management solutions supports ongoing market expansion.

China's Market Trends

China's backflow preventers marketis expanding due to stringent water safety regulations and rapid urbanization. The “Healthy China 2030” initiative has accelerated infrastructure modernization, boosting demand for water safety systems. For example, major urban developments in cities like Shanghai and Shenzhen integrate smart plumbing with backflow prevention devices, driving market growth. Additionally, government-backed retrofitting projects in aging water systems present further opportunities for manufacturers.

India's backflow preventers marketis witnessing growth driven by increasing municipal water infrastructure projects and rising health awareness. The Smart Cities Mission, aimed at modernizing 100 cities, is incorporating advanced plumbing solutions, including backflow preventers. Cities like Pune and Ahmedabad are upgrading their water systems, offering opportunities for local and global players. Moreover, rising construction activity in the commercial and residential sectors enhances the demand for reliable backflow prevention.

Middle East & Africa: Substantial Potential for Growth

The global market growth in the Middle East & Africa is fueled by rapid urbanization and expanding water distribution infrastructure to meet the needs of increasing populations. Water scarcity issues encourage investments in water conservation technologies, including backflow prevention. The region’s focus on upgrading municipal water systems to ensure safety and comply with international standards drives demand. Additionally, infrastructural development in commercial and industrial sectors creates opportunities for advanced backflow preventer installations, supported by growing awareness of waterborne contamination risks.

Uae Market Trends

The UAE backflow preventers marketis driven by robust infrastructure development and strict plumbing codes mandated by municipalities like Dubai’s DEWA. With high-rise buildings, luxury hotels, and smart city projects such as NEOM and Masdar City, the demand for advanced water safety systems is rising. Additionally, the push for sustainable water management in arid zones fuels the adoption of backflow prevention devices across residential and commercial sectors.

The South Africa backflow preventers marketis expanding due to aging water infrastructure and growing concerns over potable water safety. Cities like Johannesburg and Cape Town are retrofitting systems to prevent water contamination. Government efforts under the National Water and Sanitation Master Plan are prompting increased investment in backflow solutions, especially in hospitals, schools, and commercial buildings, where maintaining a clean water supply is crucial to public health.

Product Type Insights

The reduced pressure zone (RPZ) backflow preventer segment holds a significant share in the global market due to its high reliability in preventing contamination in potable water systems. These devices are widely used in applications where there is a high risk of backflow from hazardous substances, such as in industrial facilities and irrigation systems. Their design features dual check valves and a relief valve, ensuring maximum protection against back pressure and back siphonage. Increasing regulatory compliance requirements and growing awareness of water safety have driven the adoption of RPZ preventers, particularly in high-risk environments, boosting demand across developed and developing regions.

Material Insights

The bronze segment dominates the backflow preventer market owing to its durability, corrosion resistance, and suitability for potable water applications. Bronze backflow preventers are widely preferred in residential and commercial plumbing systems due to their long lifespan and resistance to chemical reactions with water. Their ability to withstand extreme weather conditions and high water pressure further supports their widespread use. Additionally, bronze is compliant with various health and safety standards, making it a trusted material in backflow prevention devices. As the demand for high-performance and maintenance-friendly solutions grows, the bronze segment continues to witness strong growth across global markets.

Application Insights

Chemical plants represent a crucial application area in the global backflow preventer market due to the high risk of hazardous chemical backflow contaminating the water supply. These facilities require robust and reliable backflow prevention systems to ensure operational safety and environmental compliance. Devices like RPZ assemblies and DCVAs are commonly used in chemical plants to prevent cross-contamination. As industrial safety standards tighten and regulatory oversight increases, the demand for effective backflow prevention solutions in chemical manufacturing and processing plants is expected to rise steadily. This segment plays a pivotal role in driving innovation and the adoption of advanced backflow technologies.

End-User Insights

Theresidential segment is witnessing growing adoption of backflow preventers due to increasing awareness of water safety and stringent building codes. Homeowners are increasingly installing devices such as PVBs and AVBs to protect household plumbing from contamination risks caused by irrigation systems, hose bibs, and lawn sprinklers. The rising urban population and expansion of residential infrastructure globally have further contributed to the segment’s growth. Compact, easy-to-install, and cost-effective backflow prevention solutions are in high demand among residential users. As municipalities and governments promote water safety measures, the residential segment is expected to show steady and sustained market growth.

Company Market Share

Companies in the backflow preventer market are focusing on product innovation, such as developing compact, corrosion-resistant, and smart-enabled systems to meet modern infrastructure needs. They are expanding their global footprint through partnerships, mergers, and new distribution channels. Emphasis is also being placed on compliance with evolving regulatory standards and offering customized solutions for residential, commercial, and industrial applications to capture diverse customer segments and strengthen their market position.

Reliance Worldwide Corporation

Reliance Worldwide Corporation (RWC), founded in 1949, is a leading global manufacturer and supplier of innovative plumbing solutions, including backflow preventers, in Atlanta, Georgia, USA. With a strong focus on quality and technology, RWC offers a wide range of products designed to ensure water safety and prevent contamination in residential, commercial, and industrial settings. The company’s global presence, commitment to sustainability, and continuous product innovation have established it as a key player in the backflow preventer market, driving growth through reliable and advanced plumbing systems.

- In July 2024, RWC introduced Anti-Legionella Valves under the Reliance Valves brand. These valves are designed to enhance safety and efficiency in building water systems, helping to prevent the growth of Legionella bacteria.

List of Key and Emerging Players in Backflow Preventer Market

- Watts Water Technologies, Inc.

- Zurn Industries, LLC

- Reliance Worldwide Corporation

- Emerson Electric Co.

- Apollo Valves (Aalberts N.V.)

- Val-Matic Valve & Mfg. Corp.

- Wilkins (a Zurn Brand)

- Flomatic Corporation

- Febco

- Conbraco Industries Inc.

to learn more about this report Download Market Share

Recent Developments

- September 2024- Zurn Elkay Water Solutions introduced the Zurn Wilkins 900XL3 series, a compact backflow preventer designed for easier installation and maintenance. It boasts the shortest lay length of any all-bronze small backflow preventer on the market, facilitating drop-in installation for contractors. The design merges features from the 300 and 900 series, aiming to reduce installation time and enhance reliability.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 401.89 Million |

| Market Size in 2025 | USD 416.15 Million |

| Market Size in 2033 | USD 550.12 Million |

| CAGR | 3.55% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Material, By Application, By End user, By Regions |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Backflow Preventer Market Segments

By Product Type

- Reduced Pressure Zone (RPZ) Backflow Preventer

- Double Check Valve Assembly (DCVA)

- Pressure Vacuum Breaker (PVB)

- Atmospheric Vacuum Breaker (AVB)

- Others

By Material

- Bronze

- Stainless steel

- Plastic

- Ductile iron

- Others

By Application

- Chemical Plant

- Water distribution systems

- Others

By End user

- Residential

- Commercial

By Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Abhijeet Patil

Research Associate

Abhijeet Patil is a Research Associate with 3+ years of experience in Automation & Process Control and Automotive & Transportation sectors. He specializes in evaluating industry automation trends, mobility innovations, and supply chain shifts. Abhijeet’s data-driven research aids clients in adapting to technological disruptions and market transformations.