Bioprocess Automation Software Market Size, Share & Trends Analysis Report By Type (Distributed Control Systems (DCS), Supervisory Control and Data Acquisition (SCADA), Manufacturing Execution Systems (MES), Laboratory Information Management Systems (LIMS), Process Analytical Technology (PAT)), By Application (Upstream Processing, Downstream Processing, Quality Control, Manufacturing Operations, Data Management), By End-User (Biopharmaceutical Companies, Contract Manufacturing Organizations (CMOs), Research and Development Laboratories, Academic and Research Institutes) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Bioprocess Automation Software Market Overview

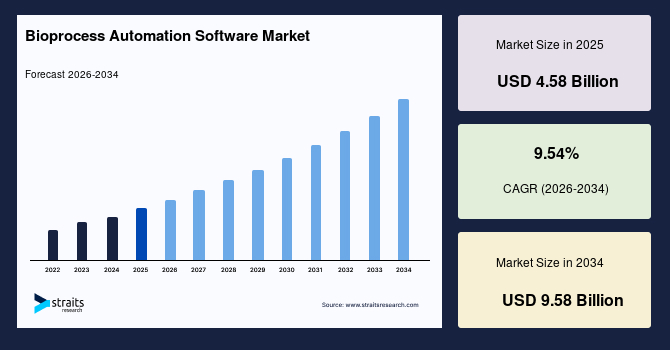

The global bioprocess automation software market size is estimated at USD 4.58 billion in 2025 and is projected to reach USD 9.58 billion by 2034, growing at a CAGR of 8.58% during the forecast period. Sustained growth of the market is propelled by the rising transition of biomanufacturing facilities toward unified digital oversight systems that streamline culture management, purification sequences, documentation workflows, and batch release pathways across diverse production scales.

Key Market Trends & Insights

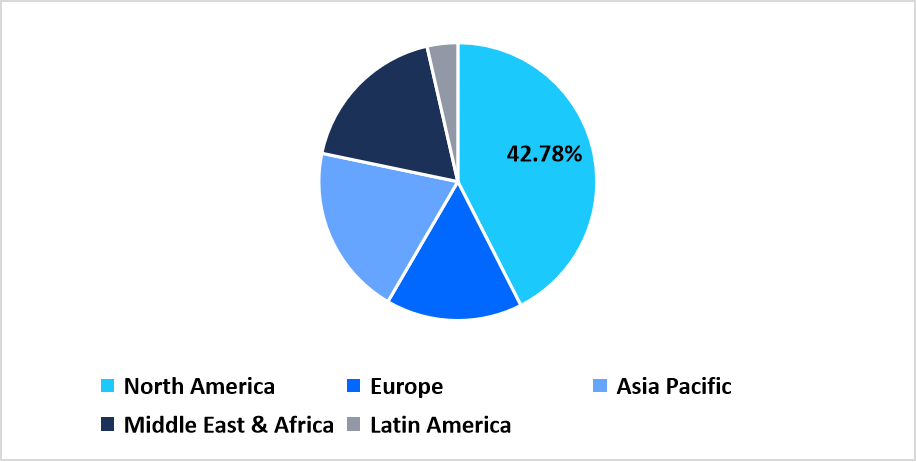

- North America held a dominant share of the global market, accounting for 42.78%.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 10.58%.

- By Type, the Process Analytical Technology (PAT) segment dominates the market in 2025 with a share of 32.35%.

- By Application, Downstream Processing dominates the market in 2025 with a share of 36.78%.

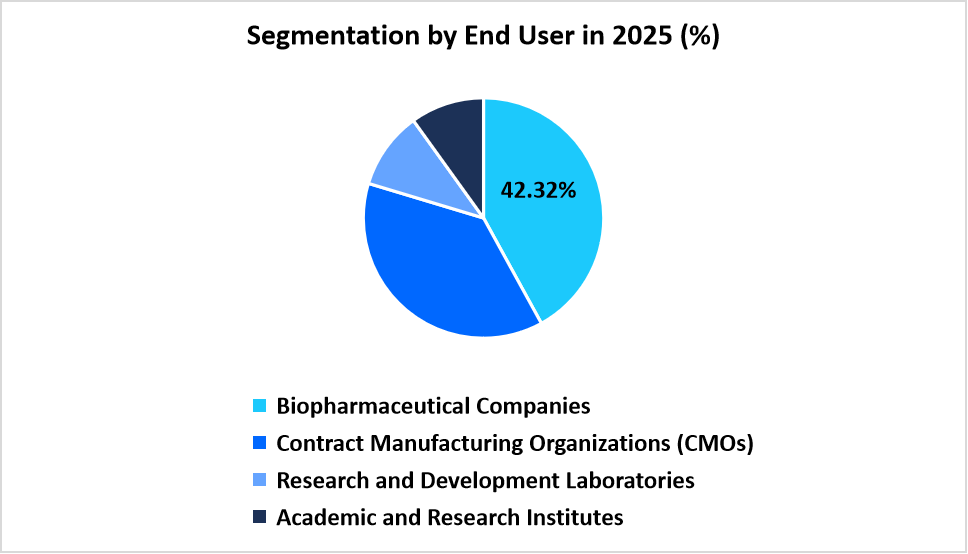

- By End User, Biopharmaceutical Companies dominate the market in 2025 with a share of 42.32%.

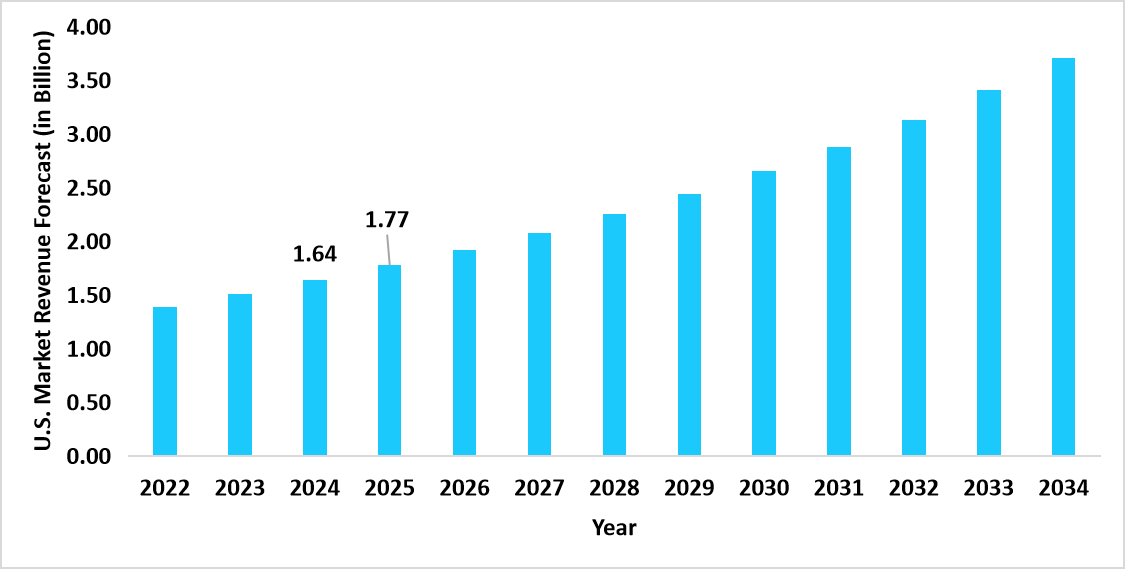

- The U.S. dominates the global bioprocess automation software market, valued at USD 1.64 billion in 2024 and reaching USD 1.77 billion in 2025.

Graph: U.S. Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 4.58 billion

- 2034 Projected Market Size: USD 9.58 billion

- CAGR (2025 to 2034): 8.58%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The Bioprocess Automation Software Market refers to the collection of digital platforms, control architectures, and data-driven systems that manage, monitor, and coordinate end-to-end biomanufacturing activities across upstream, downstream, quality, and operational workflows. This market includes solutions such as Distributed Control Systems (DCS), Supervisory Control and Data Acquisition (SCADA) platforms, Manufacturing Execution Systems (MES), Laboratory Information Management Systems (LIMS), and Process Analytical Technology (PAT) suites that streamline real-time oversight of culture conditions, purification steps, documentation pathways, and batch release processes. Adoption spans biopharmaceutical companies, contract manufacturing organizations, research and development laboratories, and academic institutes seeking standardized production environments, consistent regulatory compliance, and integrated data ecosystems across biologics development and commercial scale operations.

Latest Market Trends

Rise of Integrated Digital Twins for Bioprocess Modeling

A notable trend is the rising adoption of digital twin environments that simulate cell culture and purification behavior through virtual replicas of production lines. These platforms allow researchers to test process adjustments without intervening in physical equipment, creating a structured layer of predictive control across development and scale up stages. As digital replicas become more detailed, manufacturers are moving toward software-guided decision systems that refine processing patterns before each batch run.

Expansion of Closed Loop Control Frameworks in Microbial and Cell-Based Systems

The major trend is the growing shift toward closed-loop control frameworks where sensors, analytics, and autonomous adjustments operate within a single software ecosystem. These frameworks maintain stable culture states by continuously adjusting feeding rates, aeration, and agitation without manual oversight. This shift is transforming process supervision models by allowing continuous production units to operate with higher consistency during long-duration cycles.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 4.58 Billion |

| Estimated 2026 Value | USD 4.96 Billion |

| Projected 2034 Value | USD 9.58 Billion |

| CAGR (2026-2034) | 9.54% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Sun Pharmaceutical Industries Ltd., Teva Pharmaceuticals USA, Inc., Novo Nordisk A/S , Xeris Pharmaceuticals, Inc., Recordati |

to learn more about this report Download Free Sample Report

Bioprocess Automation Software Market Driver

Rising Adoption of Modular Production Pods with Software-Centered Operation

A key driver arises from the growing installation of modular biomanufacturing pods that depend on unified software layers for scheduling, tracking, and environmental control. These pods are deployed in facilities that aim to expand capacity without large structural upgrades. Each pod operates on a central automation suite that coordinates reactor control, filtration timing, and material movement within a contained space, resulting in a higher preference for streamlined software platforms.

Market Restraint

Limited Cross-Vendor Interoperability Across Legacy Equipment

A restraint emerges from interoperability challenges between older facility equipment and newer automation software. Several biomanufacturing plants operate diverse generations of reactors, filtration units, and monitoring devices that do not share uniform communication protocols. Integration teams frequently manage extended calibration cycles to achieve stable connectivity, which reduces the pace of software implementation across mixed hardware environments.

Market Opportunity

Growth of AI-Supported Process Deviation Prediction Platforms

A strong opportunity develops from the rising interest in AI-driven systems that forecast deviations before they affect batch outcomes. These platforms review historical datasets, equipment signatures, and pattern variations to identify early shifts in cultural behavior. Early alerts allow production teams to adjust operating conditions in real time, creating wider demand for software suites that include advanced predictive modules within both development and commercial biomanufacturing settings.

Regional Analysis

North America holds a leading share of 42.78% in the bioprocess automation software market due to the widespread incorporation of automated biomanufacturing workflows across biotech and pharmaceutical facilities. Growth across the region originates from expanded deployment of digital control systems, SCADA platforms, and PAT-aligned monitoring modules in both development and GMP operations. U.S. and Canadian companies maintain broad installation footprints for upstream and downstream automation tools, ensuring consistent adoption across contract manufacturers, vaccine producers, and cell-gene therapy developers.

The U.S. market expands through federal and state-level initiatives that support the modernization of biologics production infrastructure, which creates higher adoption of supervisory control platforms and validated process-management tools across commercial manufacturing sites. These initiatives strengthen software procurement across CDMOs, precision-medicine developers, and large biologics producers.

Asia Pacific Market Insights

Asia Pacific registers the fastest growth of 10.58% driven by the rising establishment of biomanufacturing clusters across East Asia and South Asia. Regional biotechnology hubs introduce structured production-readiness programs that encourage adoption of digital batch-record tools, automated reactor control, and electronic process-tracking suites across local facilities. Companies across China, South Korea, Japan, India, and Southeast Asia expand facility-level automation to support larger biomanufacturing volumes and stronger regulatory compliance.

Growth in India is influenced by national digital-health and pharmaceutical-modernization missions that promote centralized data exchange between production sites and regulatory bodies. These programs encourage deployment of compliant process-control software across public-private biologics units, improving automation across cell culture, purification, and fill-finish lines.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

Europe records steady expansion supported by a regional focus on harmonized manufacturing standards across biopharmaceutical production zones. Regulatory agencies emphasize electronic documentation, controlled processing, and data-driven batch release frameworks, which increase utilization of automation software across upstream and downstream operations. Cross-border collaboration among European biotechnology networks strengthens the deployment of compliant process-governance systems and enhances operational continuity across member states.

Growth in Germany is influenced by sustained federal funding directed toward the modernization of biologics production sites. These programs prioritize digital plant operations and promote the adoption of integrated process-control architectures across facilities working with monoclonal antibodies, vaccines, and microbial fermentation workflows.

Middle East and Africa Market Insights

Middle East and Africa observe rising adoption of bioprocess automation software owing to the expansion of national biotechnology initiatives and regional manufacturing partnerships. New production units in urban biotechnology hubs implement digital control architectures, electronic validation systems, and remote-monitoring suites to support compliant biologics output. Governments collaborate with international automation vendors to enhance software deployment across diagnostic kit manufacturing, local fill-finish operations, and planned biomanufacturing parks.

In Saudi Arabia, market progression is influenced by national biotechnology strategies that encourage advanced facility development in collaboration with global technology groups. These partnerships promote the installation of centralized control rooms, electronic batch-tracking systems, and automated quality-governance modules across new bioprocessing centers.

Latin America Market Insights

Latin America experiences growing utilization of bioprocess automation software as regional facilities expand capabilities for vaccines, biosimilars, and recombinant therapies. Collaborative projects across countries promote remote monitoring, digital workflow management, and standardized control systems that connect production teams with centralized technical centers. This framework strengthens the adoption of automation suites across both public laboratories and private manufacturers.

In Brazil, growth is driven by coordinated national and state-level programs that upgrade biologics production infrastructure. These efforts support the installation of distributed control platforms and validated automation software across federal institutes and regional manufacturing clusters, widening adoption throughout key biotechnology corridors.

Type Insights

The Process Analytical Technology (PAT) segment dominates the market in 2025 with a share of 32.35%. This leadership arises from the wider adoption of real-time monitoring suites that support consistent control of critical quality attributes across upstream and downstream workflows. Facilities that scale production rely on PAT-aligned software environments to maintain standardized processing conditions, which reinforces the dominant position of this segment.

The Manufacturing Execution Systems (MES) segment records the fastest expansion with a growth rate of 9.12% during the forecast period. This rise is influenced by growing preference for electronic batch management and unified tracking of production stages across large biomanufacturing units. MES platforms streamline task coordination across operators and equipment groups, resulting in stronger yearly uptake across both new and upgraded facilities.

Application Insights

Downstream Processing dominates the market in 2025 with a share of 36.78%. Expanded focus on purification consistency and batch release accuracy increases the deployment of automated control modules within chromatography, filtration, and final formulation stages. Software-managed oversight of purification steps supports higher throughput and more structured workflow execution, maintaining the dominant position of this segment.

Upstream Processing emerges as the fastest growing application with a growth rate of 9.32% during the forecast period. Rising emphasis on precise bioreactor control and electronic capture of culture parameters encourages wider use of automated platforms in cell culture and fermentation systems. This trend supports stronger adoption of upstream automation software across new bioproduction lines.

End User Insights

Biopharmaceutical Companies dominate the market in 2025 with a share of 42.32%. Large and mid-sized biologics developers expand digital production programs to support consistent output across monoclonal antibodies, recombinant proteins, and advanced therapies. These companies maintain high deployment volumes for automation suites that manage routine operations, strengthening the leading position of this segment.

Contract Manufacturing Organizations (CMOs) record the fastest rise with a growth rate of 9.45% during the forecast period. Growing demand for outsourced production encourages CMOs to implement integrated control systems, audit-ready documentation tools, and structured digital process environments that support client-specific manufacturing runs. This drives steady expansion of automation software adoption across the CMO landscape.

Source: Straits Research

Competitive Landscape

The global bioprocess automation software market is moderately fragmented with competition spread across several multinational life-science conglomerates, specialist bioprocess control vendors, industrial automation providers, and innovative lab-automation software challengers.

Sartorius AG: An emerging market player

Sartorius AG positions itself as a specialist provider that ties bioprocess controllers, single-use bioreactors, and digital control suites into modular automation bundles for upstream and downstream operations.

List of Key and Emerging Players in Bioprocess Automation Software Market

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceuticals USA, Inc.

- Novo Nordisk A/S

- Xeris Pharmaceuticals, Inc.

- Recordati

- Pfizer Inc.

- Novartis Pharmaceuticals Corporation

- Ipsen Biopharmaceuticals Canada Inc.

- Crinetics Pharmaceuticals, Inc.

- Ionis Pharmaceuticals

- Camurus AB

- Debiopharm

- Other

Strategic Initiatives

- June 2025: Sartorius Stedim Biotech completed a major expansion at its Aubagne, France headquarters, nearly doubling its cleanroom and lab space, adding automated production and logistics systems, and enhancing R&D for innovative bioprocess solutions.

- June 2025: Cytiva announced a $1.6 billion program of strategic investments aimed at expanding its global bioprocessing supply and capacity — including manufacturing, media capacity, and related automation and supply-chain capabilities.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 4.58 Billion |

| Market Size in 2026 | USD 4.96 Billion |

| Market Size in 2034 | USD 9.58 Billion |

| CAGR | 9.54% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Application, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Bioprocess Automation Software Market Segments

By Type

- Distributed Control Systems (DCS)

- Supervisory Control and Data Acquisition (SCADA)

- Manufacturing Execution Systems (MES)

- Laboratory Information Management Systems (LIMS)

- Process Analytical Technology (PAT)

By Application

- Upstream Processing

- Downstream Processing

- Quality Control

- Manufacturing Operations

- Data Management

By End-User

- Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Research and Development Laboratories

- Academic and Research Institutes

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.