Biotechnology Market Size, Share & Trends Analysis Report By Technology (Nanobiotechnology, Tissue Engineering and Regeneration, DNA Sequencing, Cell-based Assays, Fermentation, PCR Technology, Chromatography, Others), By Applications (Human Health, Food and Agriculture, Natural Resources & Environment, Industrial Processing, Bioinformatics, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Biotechnology Market Overview

The global biotechnology market size is estimated at USD 1,650 billion in 2025 and is projected to reach USD 5,220 billion by 2034, growing at a CAGR of 13.67% during the forecast period. The biotechnology market is driven by the integration of big data analytics, focus on research and development, and domestic manufacturing initiatives such as the United Kingdom’s Life Sciences Innovative Manufacturing Fund. Support from public-private venture capital firms, such as Germany’s High Tech Gründerfonds, boosts early-stage innovation. Moreover, technological developments and rising demand across healthcare, agriculture, and environmental sectors continue to fuel market growth.

Key Market Trends & Insights

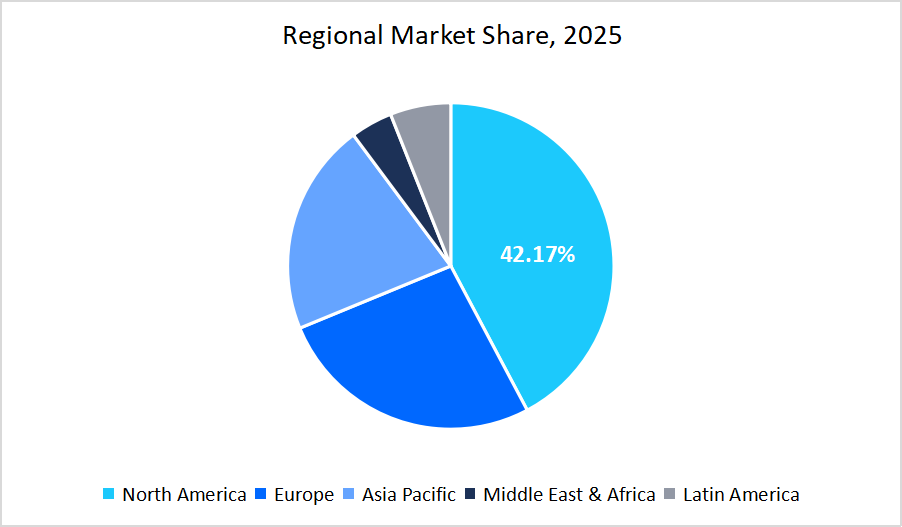

- North America held a dominant share of the global market, accounting for 42.17 % share in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 15.73 %.

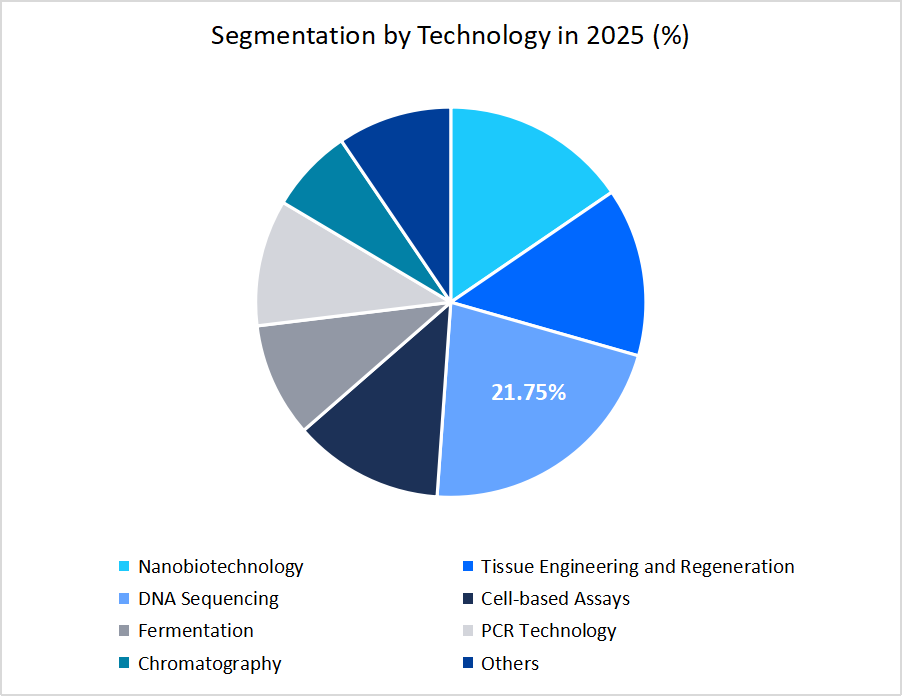

- Based on Technology, the DNA sequencing segment dominated the market in 2025 with a revenue share of 21.75%.

- Based on Applications, the bioinformatics segment is expected to register the fastest CAGR growth of 14.35%.

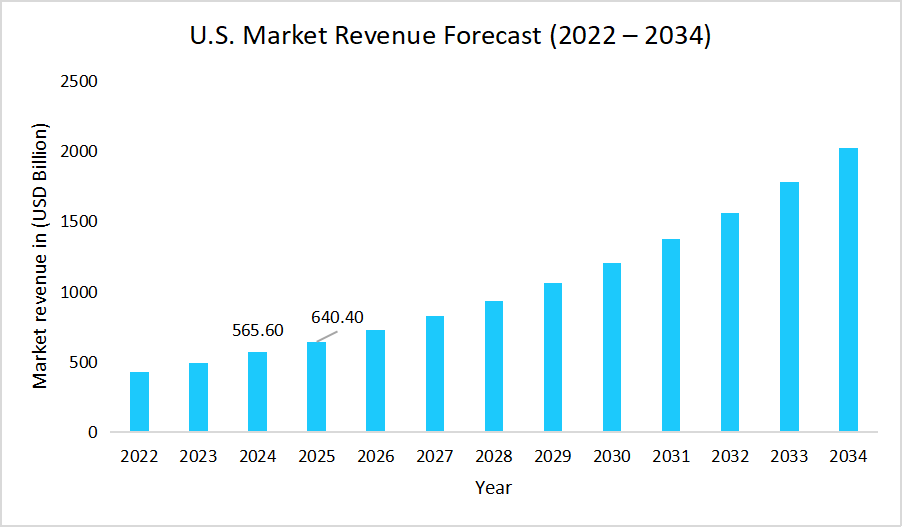

- The U.S. dominates the global market, valued at USD 565.60 billion in 2024 and reaching USD 640.40 billion in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 1,650 billion

- 2034 Projected Market Size: USD 5,220 billion

- CAGR (2025 to 2034): 13.67%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global market encompasses a diverse array of technologies and applications that are transforming sectors ranging from healthcare to agriculture and environmental management. Core technological pillars of the industry include nano-biotechnology, tissue engineering and regeneration, DNA sequencing, cell-based assays, fermentation, PCR technology, chromatography, and other advanced molecular tools. These technologies support a wide spectrum of applications such as human health (including diagnostics, therapeutics, and personalized medicine), food and agriculture, industrial processing, bioinformatics, and environmental sustainability. The market is fuelled by innovation across both public and private sectors, with biotechnology solutions increasingly integrated into national healthcare systems, precision agriculture platforms, industrial biomanufacturing, and climate resilience strategies. The continued convergence of life sciences with digital tools is reshaping the biotechnology landscape across global economies.

Latest Market Trends

Shift from Traditional Drug Discovery to AI-Powered Drug Discovery

A key trend shaping the biotechnology market is the shift from traditional drug discovery methods to artificial intelligence-driven approaches. These AI-powered systems significantly enhance the speed, accuracy, and efficiency of developing new therapeutics. For example, Insilico Medicine showcased its AI-based drug discovery platform at BioHK 2025, demonstrating how technologies like deep generative models and reinforcement learning can streamline molecule design and predict efficacy. This transition not only shortens development timelines but also reduces R&D costs, positioning AI as a transformative force in modern biotechnology and reinforcing its growing influence across the sector.

Transition towards digital PCR (DPCR) from Conventional PCR for Enhanced Precision and Sensitivity

The biotechnology industry is progressively shifting from conventional qPCR to advanced digital PCR (dPCR) to achieve higher precision and sensitivity in nucleic acid quantification. To strengthen their position in this evolving domain, companies are actively enhancing their dPCR capabilities through strategic expansions. Bio-Rad Laboratories, for instance, advanced its leadership in the molecular diagnostics space by integrating Stilla Technologies’ innovative digital PCR solutions into its portfolio, enabling broader adoption of high-resolution, data-driven quantification methods across research and clinical diagnostic applications worldwide.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 1,650 Billion |

| Estimated 2026 Value | USD 1,870 Billion |

| Projected 2034 Value | USD 5,220 Billion |

| CAGR (2026-2034) | 13.67% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | AstraZeneca, Gilead Sciences, Inc., Bristol-Myers Squibb Company, Sanofi, Biogen |

to learn more about this report Download Free Sample Report

Market Drivers

Advancements in Population Proteomics and Precision Medicine

The biotechnology market is propelled by strides in population proteomics, enhancing disease understanding and personalized treatment approaches, which presents as a significant driver for the market growth. For example, in January 2025, UK Biobank launched the world's most comprehensive protein study, aimed to measure upto 5,400 proteins in each of 600,000 samples.

Such unprecedented initiative, funded by a consortium of 14 leading biopharmaceutical companies, provided invaluable insights into disease mechanisms and fuelled the development of targeted therapies, thereby fostering market growth.

Market Restraint

Fragmented Regulatory Landscape Impeding Global Biotechnology Advancement

Regulatory variations across the global markets act as a limitation for the growth of the market and the timely commercialization of biological products, often leading to delays, increased development costs, and constraints on market access for manufacturers. The U.S. FDA indicated that certain genome editing products or related biologics required Investigational New Drug (IND) applications or Biologics License Applications (BLA) processes that could be time-consuming and expensive. Regulatory discrepancies across global markets underscored the challenges faced by the biotechnology industry in achieving global market integration and timely product availability.

Market Opportunity

Government Programs Fuel Biotechnology Growth

Government programs present a major opportunity for global market growth by driving research, innovation, and commercialization. Programs, such as India’s BioE3, aimed to boost high-performance biomanufacturing and entrepreneurship by providing funding, training, and infrastructure support to startups and research institutions, which fostered innovation in synthetic biology, biologics production, and advanced therapeutic development across the country.

Such government support enhanced global collaboration, accelerated technology adoption, and opened new avenues for companies, creating strong opportunities for commercialization and sustained expansion in the biotechnology market worldwide.

Regional Analysis

The North America region dominated the market with a revenue share of 42.17% in 2025. The growth is attributed to factors such as presence of leading biotechnology companies that fosters innovation, expertise, and also widespread adoption of advanced therapies.

The biotechnology market in U.S. is widely driven by the National Biotechnology Initiative Act (NBIA). This legislation aimed to enhance federal coordination on emerging biotechnology by establishing a National Biotechnology Coordination Office within the Executive Office of the President. The NBIA streamlined outdated regulatory structures that inhibited biotechnology innovation, thereby fostering a more efficient and supportive environment for biotech research and development.

Asia Pacific Market Insights

The Asia Pacific region is the fastest-growing region with a CAGR of 15.73% during the forecast timeframe. The growth is attributed to factors such as rapid adoption of advanced technologies, such as DNA sequencing, growing healthcare infrastructure, and the expansion of emerging biotech startups across countries such as China, India, Japan, and South Korea.

The biotechnology market in China is fuelled by the national push for domestic innovation under the ‘Made in China 2025’ initiative. This government program emphasized self reliance in advanced biopharmaceuticals, genomics, and synthetic biology, while encouraging local companies to develop high-quality biotechnology products. By reducing dependence on imports, it strengthened the Chinese biotechnology sector and accelerated market growth, positioning domestic firms as global leaders in innovation and advanced bio-manufacturing capabilities.

Source: Straits Research

Europe Market Insights

Europe’s market advanced as policymakers prioritized environmental sustainability. White biotechnology, including bio based materials, industrial enzymes, and biocatalysts scaled rapidly, supported by the EU Green Deal and carbon reduction measures that incentivized cleaner production and circular bio economy models across chemicals and manufacturing value chains, accelerating adoption and investment.

The market growth in UK is due to the foreign investment exemplified by BioNTech’s £1 billion commitment in 2025 to expand R&D and clinical trials for personalized cancer therapies. This investment is expected to generate over 400 skilled jobs and strengthen the UK’s position in advanced biotechnology research.

Middle East & Africa Market Insights

The market in MEA is growing due to the emergence of bioinformatics, genomics, and high-precision diagnostics, with bioinformatics witnessing rapid growth as the region increases its biotech R&D investments. Additionally, there is rising interest in genome editing technologies, particularly CRISPR, to address genetic disorders prevalent in the Middle East and Africa.

South Africa’s biotechnology market grew as partnerships between global health initiatives such as the Unitaid and local biopharmaceutical firms expanded capacity to develop and manufacture advanced products especially for infectious and epidemic-prone diseases, such as monoclonal antibodies. These collaborations strengthened biomanufacturing infrastructure, enabled technology transfer and skilled jobs, and improved access to regionally relevant therapies.

Latin America Market Insights

The factor driving the growth of the biotechnology market is the expansion of the biologics sector in Latin America, driven by rising demand for other biologic therapies, including recombinant proteins, and cell based treatments, which are increasingly being adopted to address diverse healthcare needs in the region.

Themajor factor driving the market factor in Argentina is the country's strong focus on agricultural biotechnology, particularly the development and adoption of genetically modified crops and biofertilizers, which enhance crop yields, improve pest resistance, and support sustainable farming practices

Technology Insights

The DNA sequencing segment held the largest market share of 21.75% in 2025, driven by advancements in next generation sequencing, its critical role in genomic mapping, and expanding use in precision diagnostics and drug discovery. Continuous innovation in sequencing accuracy and throughput reinforces its dominance across biotechnology applications worldwide.

The Nano-biotechnology segment is projected to register the fastest CAGR of 15.2%, supported by its expanding applications in nanomedicine, biosensors, and regenerative engineering. The convergence of nanotechnology with molecular biology enables precision drug delivery and disease monitoring, while growing R&D funding and commercialization of nanoscale therapeutics accelerate this segment’s rapid expansion globally.

Source: Straits Research

Application Insights

According to Straits Research, the bioinformatics segment is anticipated to grow at a CAGR of 14.35% during 2026 - 2034. This growth is attributed to the increasing integration of computational tools in genomics and proteomics, and the expansion of analytical data in the biotechnology sector.

The human health segment dominated the market with a revenue share of 35.6% in 2025. HTA-backed reimbursement had driven growth in the human health segment. Positive cost effectiveness reviews led to national coverage, quicker formulary placement, and clearer price agreements. Hospitals adopted therapies sooner, and guidelines included reimbursed options, reducing prior authorization hurdles. With more patients eligible for funded biologics, vaccines, and advanced diagnostics, real-world use rose across care pathways, reinforcing the segment’s position as the largest revenue contributor.

Competitive Landscape

The global market is highly fragmented in nature, with numerous established players and a growing number of emerging companies. The top players are AstraZeneca, Gilead Sciences, Inc., Bristol-Myers Squibb Company, Sanofi, Biogen and Others.

Ultima Genomics: An emerging market player

Ultima Genomics is an emerging player in the DNA sequencing market, focusing on delivering high-quality, low-cost next-generation sequencing via its UG 100 sequencing platform.

- In February 2025, Ultima Genomics expanded global access to affordable, high-throughput DNA sequencing by partnering with multiple premier genomic service providers, including Broad Clinical Labs, Eurofins, Novogene, Psomagen, and the Ontario Institute for Cancer Research, which joined existing collaborators such as Macrogen, Inocras, and the University of Minnesota Genomics Center.

List of Key and Emerging Players in Biotechnology Market

- AstraZeneca

- Gilead Sciences, Inc.

- Bristol-Myers Squibb Company

- Sanofi

- Biogen

- Abbott

- Pfizer Inc.

- Amgen Inc.

- Regeneron Pharmaceuticals Inc.

- Illumina, Inc.

- Moderna, Inc.

- Genmab A/S

- Alnylam Pharmaceuticals, Inc.

- bluebird bio, Inc.

- Alnylam Pharmaceuticals, Inc.

- Sarepta Therapeutics, Inc.

- Beam Therapeutics.

- Fate Therapeutics

- Sangamo Therapeutics

- Others

Strategic Initiatives

- August 2025: Ionis Pharmaceuticals announced the FDA approval of Dawnzera (donidalorsen) to prevent attacks of hereditary angioedema. It was the first and only RNA targeted prophylactic treatment for this condition.

- March 2025: AstraZeneca announced a USD 2.5 billion investment over the next five years in Beijing to establish its sixth global strategic R&D centre (its second in China), which featured an innovative AI and data science laboratory.

- September 2024: The U.S. National Science Foundation, along with partner agencies from Canada, Finland, Japan, the Republic of Korea, and the United Kingdom, announced nearly USD 82 million in funding through the Global Centers competition to advance bioeconomy research that focused on crop resilience, biomass conversion, and biotechnology applications.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 1,650 Billion |

| Market Size in 2026 | USD 1,870 Billion |

| Market Size in 2034 | USD 5,220 Billion |

| CAGR | 13.67% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Technology, By Applications |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Biotechnology Market Segments

By Technology

- Nanobiotechnology

- Tissue Engineering and Regeneration

- DNA Sequencing

- Cell-based Assays

- Fermentation

- PCR Technology

- Chromatography

- Others

By Applications

- Human Health

- Food and Agriculture

- Natural Resources & Environment

- Industrial Processing

- Bioinformatics

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.