Cell Therapy Technologies Market Size, Share & Trends Analysis Report By Product (Raw Materials, Instruments, Software, Consumables & Accessories), By Workflow (Separation, Expansion, Apheresis, Fill- Finish, Cryopreservation, Others), By Cell Type (T-cells, Stem Cells, Other Cells), By End Use (Biopharmaceutical & Biotechnology Companies, CMOs & CROs, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Cell Therapy Technologies Market Overview

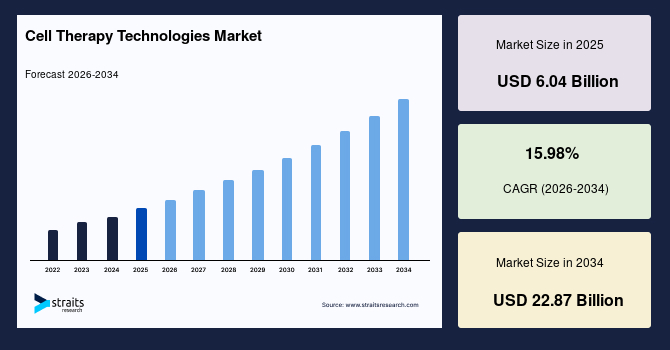

The global cell therapy technologies market size is estimated at USD 6.04 billion in 2025 and is projected to reach USD 22.87 billion by 2034, growing at a CAGR of 15.98% during the forecast period. Sustained growth of the market is propelled by the expanding adoption of advanced manufacturing platforms that support precise cell handling, controlled expansion cycles, and streamlined preparation of therapeutic cell products across clinical and commercial pipelines.

Key Market Trends & Insights

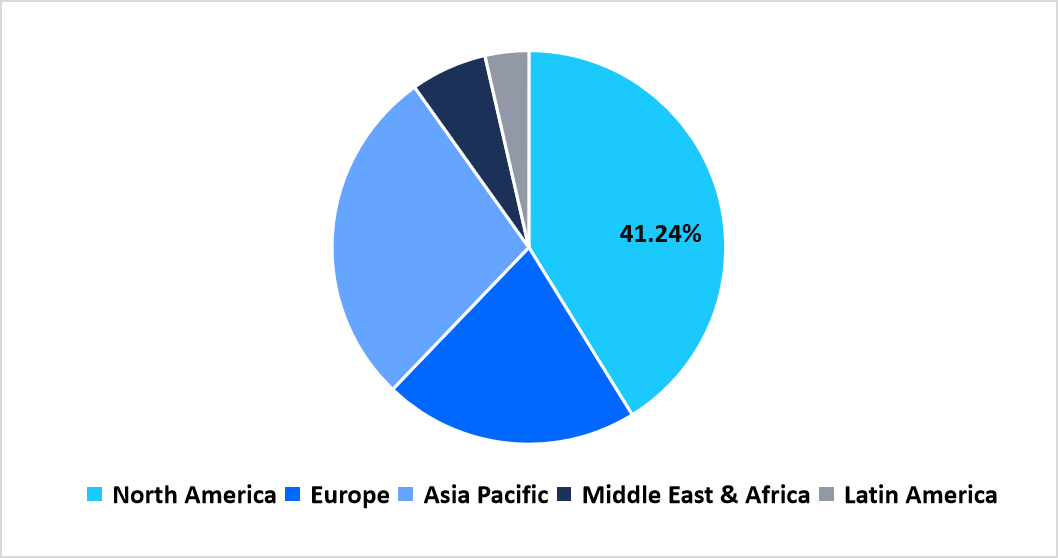

- North America held a dominant share of the global market, accounting for 41.24%.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 15.98%.

- Based on Product, Consumables & Accessories dominated the market with a revenue share of 43.75%.

- Based on Workflow, Separation dominated the market with a revenue share of 35.67%.

- Based on Cell Type, T-cells dominated the market with a revenue share of 58.79% in 2025.

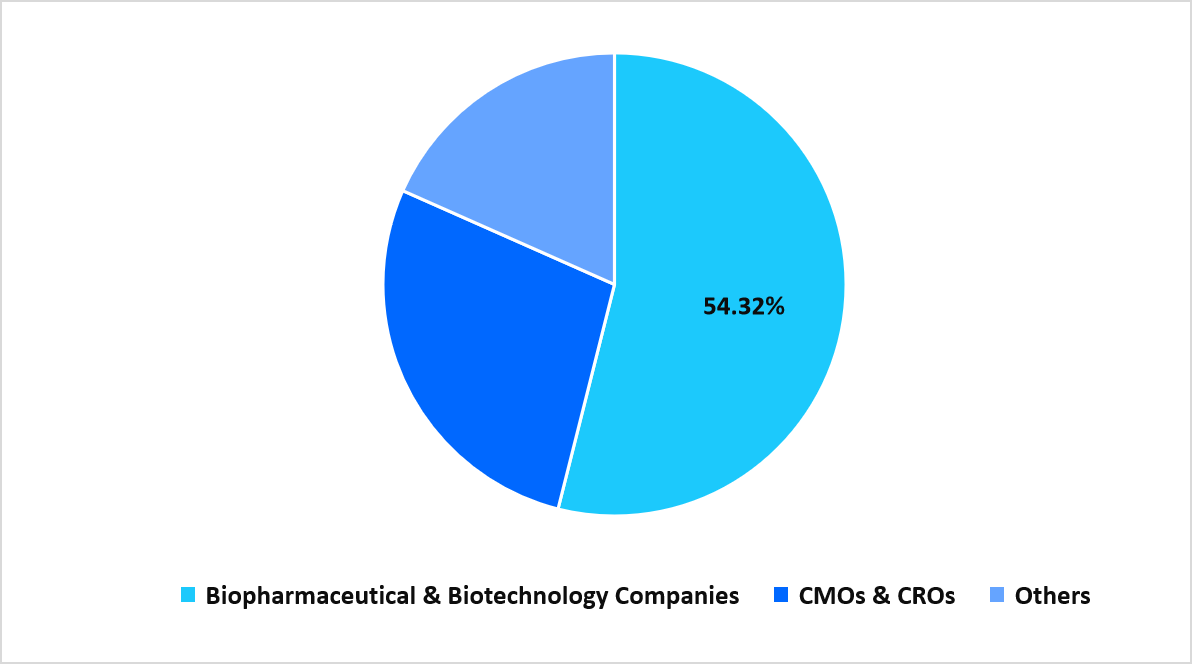

- Based on End Use, the Biopharmaceutical & Biotechnology Companies segment dominated the market with 54.32% in 2025.

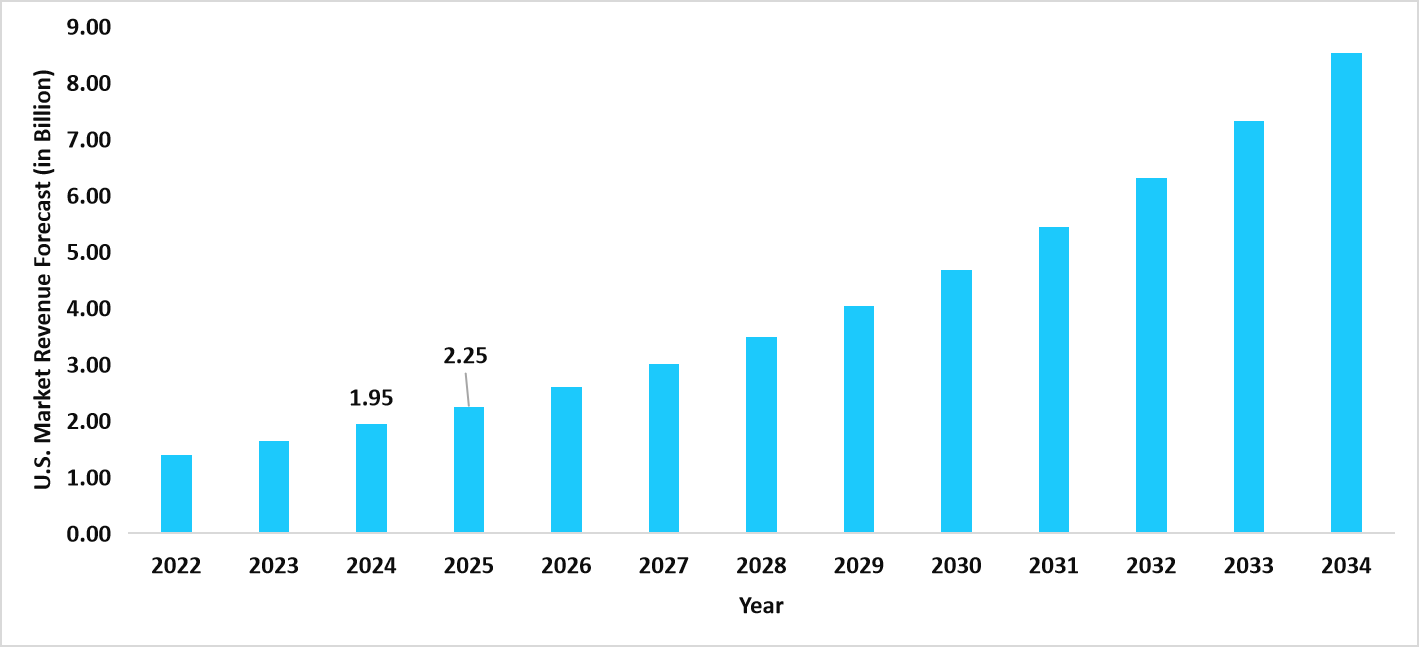

- The U.S. dominates the global cell therapy technologies market, valued at USD 1.95 billion in 2024 and projected to reach USD 2.25 billion in 2025.

Graph: U.S. Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 6.04 billion

- 2034 Projected Market Size: USD 22.87 billion

- CAGR (2025 to 2034): 15.98%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The cell therapy technologies market encompasses a wide spectrum of tools, materials, digital platforms, and workflow solutions that enable the development, manufacturing, and delivery of cell-based therapies across research, clinical, and commercial settings. This market includes raw materials such as media, sera, culture supplements, antibodies, and reagents that support cell growth and manipulation, along with instruments ranging from processing systems and culture platforms to separation technologies required for high-quality cell preparation. It also spans software solutions that coordinate manufacturing activities and consumables that sustain routine laboratory operations. Across workflows such as separation, expansion, apheresis, fill-finish, and cryopreservation, these technologies maintain controlled environments for diverse cell types, including T-cells, stem cells, and other therapeutic cells. Key users include biopharmaceutical and biotechnology companies, contract manufacturers, and research organizations that depend on these technologies to advance cell therapy pipelines from early discovery through large-scale production.

Latest Market Trends

Rise of Microenvironment-Responsive Production Platforms

A major trend emerges as developers introduce production platforms designed to adjust culture conditions in response to real-time microenvironment cues. These platforms rely on sensors that monitor shifts in cellular behavior and automatically alter feeding schedules, gas flow, or agitation patterns. This approach supports a more tailored manufacturing strategy, allowing producers to refine growth trajectories for diverse cell populations. Research institutes and therapy sponsors adopt these platforms to explore nuanced cellular responses that vary across developmental stages, creating fresh avenues for customizing cell attributes during scale-up.

Transition Toward Compact, Modular Manufacturing Pods

The evolving trend is the growing deployment of compact manufacturing pods that function as self-contained units for cell expansion, formulation, and storage. These pods integrate filtration systems, environmental controls, and automated handling tools within a compact footprint, enabling flexible placement inside research campuses, hospital-based production wings, and innovation hubs. Their modular structure allows rapid reconfiguration for different therapy types, supporting a decentralized production model. This shift aligns with increasing interest in distributed manufacturing, where therapies are processed closer to treatment sites, reducing logistical hurdles for time-sensitive cell products.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 6.04 Billion |

| Estimated 2026 Value | USD 6.98 Billion |

| Projected 2034 Value | USD 22.87 Billion |

| CAGR (2026-2034) | 15.98% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Celyad Oncology, IOVANCE Biotherapeutics, Inc., CARsgen Therapeutics Holdings Limited, JW Therapeutics (Shanghai) Co., Ltd., Takeda Pharmaceutical Company Limited. |

to learn more about this report Download Free Sample Report

Market Driver

Increasing Adoption of Data-Linked Analytical Loops in Cell Processing

A major driver arises from the stronger integration of analytical instruments that feed continuous data streams into manufacturing workflows. Facilities incorporate real-time imaging devices, metabolic sensors, and molecular assays that track cell progression during each production stage. The insights produced guide rapid adjustments in process parameters, enabling researchers to refine culture pathways with greater precision. Therapy developers embrace these data-linked loops because they enhance oversight of critical quality attributes and streamline decision-making across early research and late-stage production.

Market Restraint

Challenges Associated with Standardizing Donor-Derived Material Inputs

A notable restraint surfaces from the variability observed in donor-derived cell samples used for autologous and allogenic therapies. Differences in baseline cell quality, genetic profiles, and viability create additional steps in screening, preparation, and process calibration. Facilities must devote extended time to harmonize starting material before initiating expansion or modification cycles, which slows throughput and increases operational demands. These inconsistencies across donor batches present ongoing challenges for scaling clinical and commercial production lines.

Market Opportunity

Emergence of AI-Supported Predictive Modeling for Optimizing Cell Behavior

A strong opportunity develops as researchers integrate AI-based modeling tools that simulate cell behavior under different processing conditions. These models evaluate shifts in gene expression, nutrient uptake, and phenotypic changes to forecast optimal pathways for culture, modification, and preservation. Adoption of predictive modeling allows developers to shorten trial-and-error cycles and design manufacturing protocols with greater clarity before executing wet-lab steps. Widespread use of these digital models is expected to create new momentum for innovation across cell processing equipment, software platforms, and development pipelines.

Regional Analysis

North America maintains a dominating presence in the global landscape with 41.24% share as research institutions, biomanufacturing centers, and therapy developers expand cell-based programs across oncology, neurology, and regenerative applications. Laboratories across the region adopt closed-system processing units, automated expansion platforms, and high-precision storage equipment to maintain uniformity across clinical and commercial workflows. Academic medical centers collaborate closely with technology suppliers to refine production environments, strengthening the ecosystem for advanced therapy development. Venture funding channels continue to flow toward startups focused on scalable cell processing, allowing broader integration of modular production suites across both regional biopharma clusters and emerging innovation zones.

The U.S. widens its footprint as developers invest in upgraded GMP suites, digital manufacturing tools, and validated workflow instruments to support higher batch throughput. Collaborative programs linking federal institutions, universities, and private therapy manufacturers enhance the domain of translational research, creating fertile ground for innovation in CAR-T and stem-cell-based production. Large therapy sponsors expand partnerships with equipment vendors to establish multi-site manufacturing networks that prioritize consistent batch outputs across dispersed facilities.

Asia Pacific Market Insights

Asia Pacific is anticipated to register the fastest CAGR of 17.98% as healthcare providers, research centers, and biopharmaceutical companies strengthen cell-based clinical pipelines. Regional laboratories adopt automated culture platforms, high-fidelity cryopreservation systems, and specialized analytical devices to streamline operations from early research to patient-ready therapies. Technical training programs held across urban science parks allow laboratory personnel to refine competency in cell cultivation and characterization, fostering a skilled workforce capable of supporting advanced manufacturing environments. Local developers introduce accessible technology packages tailored for mid-sized institutions, increasing technology penetration throughout the region.

India progresses as national biomedical clusters incorporate cell therapy manufacturing modules within broader life science expansions. Public research agencies and private developers work together to build standardized infrastructure for cell expansion, viral vector development, and quality assessment. Wider participation in multicenter clinical studies creates demand for flexible production platforms that suit both academic laboratories and commercial-scale units.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

Europe experiences steady advancement supported by an expanding regulatory and scientific environment that encourages structured adoption of advanced manufacturing technologies. Harmonized approval systems across member states shorten entry timelines for new processing instruments, facilitating their introduction into hospital-based manufacturing units and independent research facilities. Consortium-based initiatives unite universities, therapy sponsors, and engineering firms to establish controlled manufacturing workflows that reinforce high-grade cell processing practices. Integrated documentation systems adopted across multiple care networks lay the groundwork for uniform production standards.

Germany enhances its position as partnerships between healthcare providers, academic institutes, and therapy developers concentrate on the modernization of cell therapy manufacturing. Public funding initiatives accelerate projects that introduce automated processing lines, real-time analytical sensors, and high-capacity storage solutions. Hospital networks integrate centralized cell handling centers into their broader oncology and regenerative medicine programs, supporting cohesive expansion across the country.

Middle East and Africa Market Insights

Middle East and Africa observe rising adoption as government-led modernization programs invest in biomedical innovation, with cell therapy manufacturing emerging as a strategic focal area. Public hospitals and research foundations acquire modular processing units and controlled-environment systems to advance early-stage development pipelines. Cloud-based quality tracking tools and international vendor partnerships expand accessibility to advanced workflow solutions. Growing private healthcare networks in metropolitan areas promote interest in technologies that enhance batch consistency and end-product stability.

Saudi Arabia strengthens its presence as national healthcare transformation frameworks allocate resources toward cell therapy development infrastructure. Enterprise-level hospitals incorporate specialized cell handling suites into their clinical research divisions, widening capacity for advanced therapy trials. Collaboration with international biotech and engineering firms further expands technical capabilities across rapidly developing medical ecosystems.

Latin America Market Insights

Latin America captures growing attention as healthcare systems and academic centers invest in specialized infrastructure for cell-based R&D. Mobile-accessible laboratory monitoring platforms support remote oversight of culture parameters, enabling consistent supervision across distributed research sites. Government-supported biological science programs introduce training initiatives aimed at raising technical proficiency in cell processing disciplines. Collaborative ventures between regional distributors and technology providers ensure wider placement of critical instruments across public and private research hubs.

Brazil elevates its market position as state-funded research organizations transition toward integrated digital manufacturing records and unified cell processing frameworks. Newly established regional bioparks house shared cell expansion and analytical testing facilities, creating opportunities for startups and established developers alike. Long-term national health programs incorporate advanced therapy modules, encouraging broader development of cell-based innovations across both urban and rural scientific environments.

Product Insights

The Consumables and Accessories segment dominates the market with 43.75% as laboratories, therapy developers, and manufacturing units continually utilize single-use items for cell expansion, preparation, and preservation. These items support uninterrupted workflow cycles across research and production environments, leading to steady, recurring demand from facilities operating at varied batch scales. Continuous usage during routine culture setup, sampling, and quality assessment drives sustained adoption across both small and large production facilities.

The Software segment grows at the fastest pace with 16.12% as digital platforms for workflow coordination, data management, batch tracking, and process automation gain wider traction across cell therapy manufacturing. Facilities integrate software modules to streamline batch documentation, enhance traceability, and maintain structured oversight of each stage in the cell processing lifecycle, leading to deeper digital transformation within the sector.

Workflow Insights

The Separation segment dominates the market with 35.67% due to its foundational role in isolating targeted cell populations from heterogeneous samples. Laboratories increasingly adopt advanced separation platforms to improve purity levels across downstream stages such as expansion, formulation, and cryopreservation. Growing adoption of magnetic separation tools, flow-based techniques, and density-driven protocols further reinforces usage across research and pre-commercial programs.

The Expansion segment grows at the fastest pace with 16.42% as producers scale up manufacturing lines to accommodate rising demand for cell-based therapies. Automated expansion platforms capable of supporting controlled growth conditions drive broader utilization across academic production centers and commercial facilities. Continued improvements in culture media formulations and monitoring tools further promote the adoption of expansion systems across early and late development phases.

Cell Type Insights

The T-cells segment dominates the market with 58.79% as T-cell–based therapies, including CAR-T constructs and engineered lymphocyte products, gain traction across oncology programs. Production workflows for T-cells utilize specialized activation, expansion, and modification technologies, creating strong demand for instruments, raw materials, and consumables tailored for immune-based therapies. Large trial pipelines for engineered T-cell therapies further reinforce the segment’s leadership.

The Stem Cells segment grows at the fastest pace with 16.78% as regenerative medicine initiatives widen the scope of cell-based treatments across neurological, orthopedic, and metabolic disorders. Advancements in induced pluripotent stem cell platforms and growing academic interest in allogenic stem cell lines encourage broader incorporation of stem-cell–oriented tools, media formulations, and analytical systems across global research programs.

End Use Insights

The Biopharmaceutical and Biotechnology Companies segment dominates the market with 54.32% as therapy developers expand in-house manufacturing capabilities, invest in modular production suites, and enhance pre-clinical and clinical pipelines. These organizations require integrated platforms for separation, expansion, storage, and quality assessment, driving sustained purchasing cycles for instruments, consumables, and software tools across the production continuum.

The CMOs and CROs segment grows at the fastest pace, with 16.88% as outsourcing trends escalate across early-stage and late-stage development. Therapy sponsors increasingly partner with external manufacturers to access specialized expertise, advanced equipment, and flexible capacity. CROs and CMOs deploy scalable processing lines and digital oversight platforms to accommodate diverse client requirements, elevating adoption across a wide range of workflow functions.

Segmentation by End Use in 2025 (%)

Source: Straits Research

Competitive landscape

The cell therapy technologies market is moderately consolidated, featuring a mix of established bioprocessing companies, emerging biotechnology firms, automation specialists, and cell-manufacturing solution providers that collectively shape a dynamic and innovation-driven ecosystem.

Cytiva: An Emerging Market Player

- Cytiva reinforces its position by offering advanced bioprocessing tools, automated cell-handling systems, and closed manufacturing solutions that enable standardized, reproducible workflows for CAR-T and stem-cell–based therapies. The company’s expansion of modular and flexible manufacturing platforms, combined with partnerships with therapy developers and CDMOs, supports enterprise-level adoption across both early-stage R&D labs and large commercial production facilities. Cytiva’s continued investment in end-to-end manufacturing suites creates strong growth opportunities in high-volume cell therapy development segments, particularly as global demand for scalable, cost-efficient cell therapy production increases.

List of Key and Emerging Players in Cell Therapy Technologies Market

- Celyad Oncology

- IOVANCE Biotherapeutics, Inc.

- CARsgen Therapeutics Holdings Limited

- JW Therapeutics (Shanghai) Co., Ltd.

- Takeda Pharmaceutical Company Limited.

- Autolus Therapeutics.

- CELLARES

- Cytovia Therapeutics

- Novartis AG

- Gilead Sciences, Inc.

- Bristol-Myers Squibb Company

- Johnson & Johnson and its affiliates

- Legend Biotech

- Fate Therapeutics

- bluebird bio, Inc.

- ALLOGENE THERAPEUTICS

- Sangamo Therapeutics

- CRISPR Therapeutics

- Mesoblast Limited

- Vericel Corporation

- Others

Strategic Initiatives

- December 2024: BioCentriq invested USD 12 million in a new cell therapy manufacturing facility in Princeton, NJ, which also became its headquarters. This expansion strengthened the company’s capabilities in cell therapy development and large-scale production.

- September 2024: Vertex Pharmaceuticals entered a long-term supply partnership with Lonza to manufacture Casgevy, its gene-edited cell therapy for sickle cell disease and β-thalassemia. The collaboration aimed to secure consistent commercial-scale production for the therapy.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 6.04 Billion |

| Market Size in 2026 | USD 6.98 Billion |

| Market Size in 2034 | USD 22.87 Billion |

| CAGR | 15.98% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Workflow, By Cell Type, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Cell Therapy Technologies Market Segments

By Product

-

Raw Materials

- Media

- Sera

- Cell Culture Supplements

- Antibodies

- Reagents & Buffers

- Others

-

Instruments

- Cell Therapy Processing Systems

- Cell Culture Systems

- Cell Sorting & Separation Systems

- Other Instruments

- Software

- Consumables & Accessories

By Workflow

- Separation

- Expansion

- Apheresis

- Fill- Finish

- Cryopreservation

- Others

By Cell Type

- T-cells

- Stem Cells

- Other Cells

By End Use

- Biopharmaceutical & Biotechnology Companies

- CMOs & CROs

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.