Citrus Fibers Market Size, Share & Trends Analysis Report By Type (Insoluble, Soluble), By Form (Lemon And Lime, Orange, Mandarians, Grapefruits, Others), By Function (Thickening Agent, Stabilizer, Gelling Agent, Fat Replacement, Others), By Application (Food and Beverage Industry, Pharmaceutical and Nutraceutical Industry, Personal Care and Cosmetics Industry, Animal Feed Industry, Others), By Distribution Channel (Online Retail, Convenience Stores, Supermarkets/Hypermarkets, Specialty Health Stores, Foodservice And Hospitality, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Citrus Fibers Market Overview

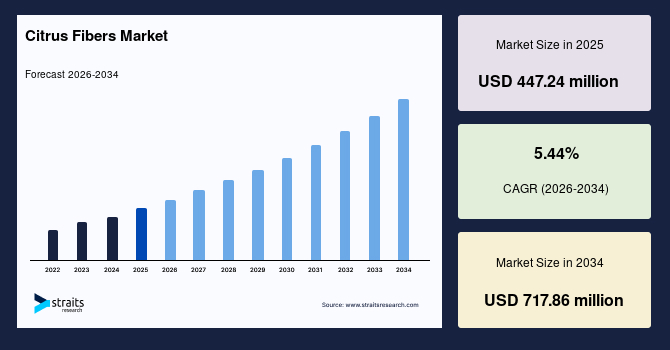

The global citrus fibers market size was valued at USD 447.24 million in 2025 and is estimated to reach USD 717.86 million by 2034, growing at a CAGR of 5.44% during the forecast period (2026–2034). Key drivers in this market include rising consumer focus on digestive health, growing demand for clean-label and natural ingredients, and increasing use of upcycled citrus fibers in sustainable food formulations.

Key Market Trends & Insights

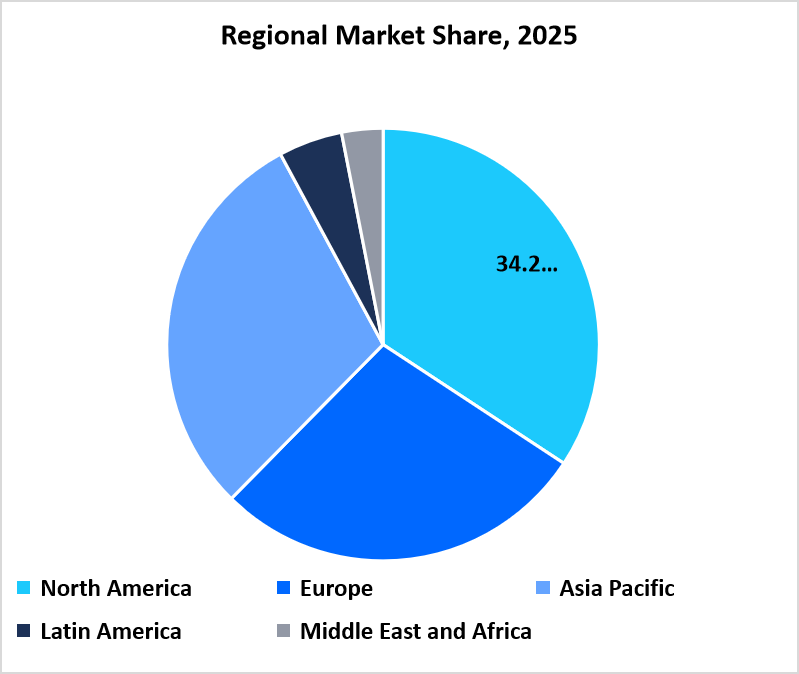

- North America held the largest market share, over 34.25% of the global market.

- Asia-Pacific is the fastest-growing region with a CAGR of 6.07%.

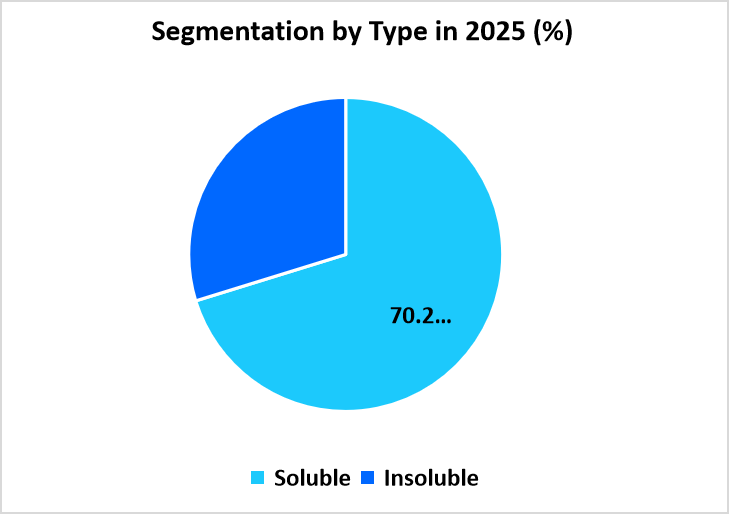

- By type, the soluble segment accounted for the largest market share of 70.23% in 2025.

- By form, the lemon and lime segment is projected to grow at the fastest CAGR of 6.01%.

- By function, the thickening agent segment held the major market share of 29.78%.

- By application, the food and beverage industry segment led the market with a 70.23% share.

- By distribution channel, the online retail segment is expected to register the fastest CAGR of 6.01%.

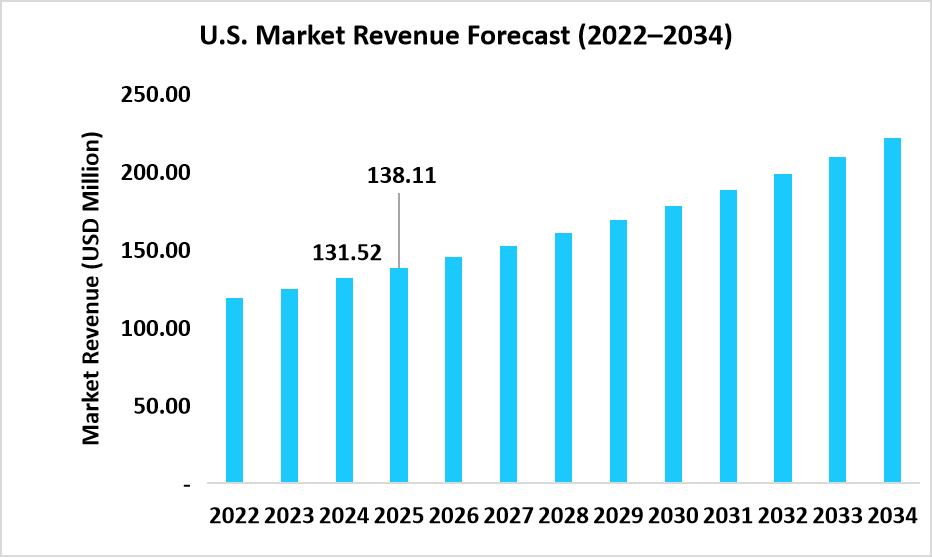

- The U.S. citrus fibers marketwas valued at USD 131.52 million in 2024 and reached USD 138.11 million in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 447.24 million

- 2034 Projected Market Size: USD 717.86 million

- CAGR (2026-2034): 5.44%

- North America: Largest market

- Asia-Pacific: Fastest growing

Citrus fibers are natural, plant-derived dietary fibers extracted from the peel and pulp of citrus fruits such as oranges, lemons, and grapefruits. They are rich in soluble and insoluble fibers, offering water-holding, emulsifying, and texturizing properties. Widely used in food, beverages, and nutraceuticals, citrus fibers enhance texture, improve stability, and provide clean-label, fiber-fortified solutions.

The global market is propelled by the functional versatility of citrus fibers, offering superior water-holding, emulsifying, and texturizing properties that reduce reliance on expensive ingredients. Additionally, sustainability initiatives converting citrus processing waste into value-added fibers support circular-economy goals. Furthermore, rising adoption in dairy alternatives, sauces, and nutraceuticals further drives demand, highlighting their broad applicability across diverse food formulations.

Latest Market Trends

Clean-label & upcycling

The growing clean-label and upcycling trend is a major force shaping the global market. Consumers increasingly prefer food and beverage products made with natural, recognizable ingredients, driving manufacturers to replace synthetic additives and hydrocolloids with plant-based alternatives like citrus fiber.

Derived from citrus peel and pulp byproducts of juice production, citrus fiber aligns perfectly with sustainability and circular economy goals by reducing food waste and maximizing resource utilization. Its multifunctional properties, such as water binding, emulsification, and stabilization, enable clean-label formulations without compromising texture or taste, making it highly attractive to eco-conscious brands and health-focused consumers worldwide.

Expansion into meat alternatives & plant-based foods

The expansion of citrus fiber applications into meat alternatives and plant-based foods is a key trend in the global market. Manufacturers are increasingly incorporating citrus fibers into vegan burgers, sausages, and nuggets to enhance texture, water retention, and juiciness while maintaining clean-label formulations.

These fibers act as natural binders and fat replacers, improving product quality and mouthfeel without synthetic additives. With the rising global demand for sustainable, plant-based protein sources, citrus fiber offers an ideal solution for improving formulation stability and nutritional content. This trend aligns with consumer preferences for natural, fiber-rich, and environmentally friendly food products.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 447.24 million |

| Estimated 2026 Value | USD 469.96 million |

| Projected 2034 Value | USD 717.86 million |

| CAGR (2026-2034) | 5.44% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | CP Kelco Inc., Cargill Inc., Fiberstar, Inc., Ingredion Incorporated, Tate & Lyle PLC |

to learn more about this report Download Free Sample Report

Global Citrus Fibers Market Driver

Consumer health & fibre demand

The surging global awareness of the importance of dietary fiber for digestive and overall health is significantly driving the global market growth. Consumers are increasingly seeking natural, plant-based ingredients that enhance gut health, support weight management, and contribute to clean-label food formulations.

- For example, Whole Foods’ 2026 forecast lists fiber-rich foods among the key trends reshaping the grocery aisle, pointing to the growing consumer emphasis on gut health. Similarly, a pilot study from Boston University published in May 2025 suggests that higher dietary fiber intake may reduce body burdens of PFAS by improving detoxification and digestive function.

As a result, the rising consumer focus on health and nutrition continues to propel the adoption of citrus fibers across the global food industry.

Market Restraint

Formulation limits & sensory impact

Formulation limits and sensory impact pose significant restraints in the global market. While citrus fibers offer excellent water-binding and emulsifying properties, their incorporation in food formulations can sometimes alter the product’s texture, taste, or mouthfeel. High inclusion levels may lead to a dry or grainy consistency, which affects consumer acceptance, particularly in sensitive applications like dairy or bakery products.

Additionally, replacing traditional stabilizers or emulsifiers with citrus fiber often requires extensive reformulation and process adjustments, increasing R&D costs. These functional and sensory challenges limit the widespread adoption of citrus fiber in large-scale commercial food manufacturing.

Market Opportunity

Product innovation

Product innovation is emerging as a major opportunity in the global market as companies focus on developing multifunctional, sustainable ingredients that meet evolving clean-label and performance needs. Manufacturers are investing in R&D to create next-generation citrus fiber grades with superior emulsification, water-binding, and gelling properties to enhance texture and stability across diverse food applications.

- For instance, in July 2024, Ingredion launched two new multi-benefit citrus fibers (CF 500 & CF 100) in EMEA, with roll-outs planned for APAC, North America, and LATAM. These minimally processed, upcycled fibers exhibit enhanced viscosity, texture, and gelling capabilities, along with improved emulsion and texture stability over shelf life.

Such innovations enable food producers to replace synthetic stabilizers naturally, expand product formulations, and strengthen market competitiveness globally.

Regional Analysis

The North American market is dominant with a market share of over 34.25%. The market benefits from a mature food processing infrastructure and high consumer awareness of clean-label, functional ingredients. Strong demand in plant-based foods, bakery, and dairy alternatives drives adoption, while advanced R&D facilities enable customized fiber solutions. Sustainability initiatives, coupled with efficient supply chains for citrus by-products, further support growth. Additionally, robust retail networks and health-focused consumption trends reinforce the region’s role as a leading market for innovative citrus fiber applications.

- The U.S. citrus fibers market is driven by growing consumer preference for clean-label, organic, and non-GMO ingredients. Fiberstar, Inc., a key domestic player, leads with its Citri-Fi® line produced in Wisconsin and Florida. Its USDA- and EU-certified organic Citri-Fi 400 series caters to demand for natural, vegan, and gluten-free ingredients, enhancing premium market growth.

Source: Straits Research

Asia Pacific: Significantly Growing Region

Asia Pacific’s market is the fastest growing, with a CAGR of 6.07%, driven by unique regional factors such as rapidly expanding urban populations with higher disposable incomes, rising demand for convenience and processed foods, and increasing adoption of plant-based and functional diets. The region’s robust fruit processing industry generates abundant citrus by-products, enabling cost-effective fiber extraction. Additionally, growing regulatory support for sustainable food practices and increasing awareness of fiber-enriched nutrition are driving strong market uptake.

- China’s citrus fiber market is expanding rapidly, driven by abundant citrus resources and growing demand for clean-label, fiber-rich foods. Companies like Golden Health Technology and Guangzhou Lemon Biotechnology are investing in upcycled citrus fiber production and certifications. Rising applications in dairy alternatives, beverages, and plant-based foods, along with government support for sustainable ingredients, further accelerate market growth.

Europe Market Trends

The European market is driven by stringent EU food safety and labeling regulations, promoting natural, clean-label ingredients. Rising demand for plant-based and functional foods positions citrus fiber as an effective fat replacer and texturizer in meat and egg alternatives. Strong F&B industries in Germany, France, and the UK boost usage in bakery, sauces, and beverages. Key players include CP Kelco, Fiberstar, CEAMSA, and Cifal Herbal.

- Germany’s citrus fiber market is driven by its advanced F&B industry, strong sustainability focus, and consumer preference for clean-label, fiber-enriched, plant-based products. Local R&D fosters innovative fiber grades for texture, emulsification, and fat reduction. Key players like JRS, Herbafood, Ingredion, Herbstreith & Fox, and Biesterfeld leverage upcycled citrus peel to meet domestic and export demand.

Latin America Market Trends

In Latin America, companies like FGF Trapani, Cargill, and Ingredion lead the citrus fiber market by producing clean-label fibers from citrus byproducts. The market growth is driven by abundant citrus production in Brazil, Argentina, and Mexico, rising demand for plant-based and functional ingredients, and sustainability initiatives converting waste into value-added fibers, while innovative uses in texture and emulsification boost food and beverage applications.

- Brazil’s citrus fiber market benefits from the country’s strategic location and established citrus production, giving it a competitive edge globally. To meet growing international demand, companies are expanding operations and distribution networks. In April 2024, CP Kelco completed a $60 million expansion at its Matão facility, increasing citrus fiber production capacity to approximately 5,000 tonnes annually, thereby driving the regional market growth.

The Middle East and Africa Market Trends

The MEA citrus fiber market is expanding as GCC countries diversify beyond oil, developing food processing industries that boost demand for functional ingredients. Cultural preferences for natural, minimally processed foods support the clean-label trend, increasing citrus fiber adoption. Key players, including Ingredion, Cargill, CP Kelco, Fiberstar, and CEAMSA, provide natural, functional solutions to meet regional consumer demands.

- Saudi Arabia’s citrus fiber market is expanding with companies like Saudi Carbon developing bioactive fibers from citrus waste, supporting Vision 2030’s sustainability goals. Global players such as CP Kelco and Ingredion are supplying clean-label fibers regionally. Growth is driven by rising health awareness, local food innovation, and import substitution initiatives.

Type Insights

The soluble segment held a 70.23% share in 2025, driven by its superior water-binding and stabilizing properties. Widely used in food and beverages for clean-label formulations, it enhances texture and viscosity. Rising replacement of synthetic additives with plant-based alternatives continues to fuel this segment’s dominance globally.

The insoluble segment is set to grow at a CAGR of 5.02%, propelled by its increasing use in functional foods and dietary supplements. Its digestive health benefits and fiber-enriching capability support consumer demand for high-fiber diets. Expanding health awareness and product innovation are further accelerating this segment’s growth trajectory.

Source: Straits Research

Form Insights

The orange segment dominated with a 50.76% market share in 2025, owing to its abundant availability and high fiber yield. Orange peels serve as a cost-effective raw material for fiber extraction, widely used in bakery, beverages, and dairy products due to their neutral taste and functionality.

The lemon and lime segment is projected to grow at the fastest CAGR of 6.01%, supported by their rising use in natural, clean-label, and organic formulations. Their mild flavor and antioxidant content make them ideal for nutraceuticals and beverages, reflecting strong consumer demand for premium and health-focused citrus ingredients.

Function Insights

The thickening agent segment captured 29.78% of the market share, attributed to its extensive application in sauces, dressings, and baked goods. Citrus fibers are valued for their ability to improve viscosity and stability naturally, aligning with the growing demand for clean-label alternatives to synthetic thickeners in food manufacturing.

The fat replacement segment is forecasted to expand at a CAGR of 5.45%, fueled by growing consumer interest in low-fat, calorie-reduced foods. Citrus fibers effectively mimic the texture and creaminess of fats, enabling healthier formulations in bakery, dairy, and meat products without compromising taste or sensory appeal.

Applications Insights

The food and beverage industry segment dominated the market with a 70.23% share, driven by extensive use of citrus fibers for emulsification, water retention, and texturizing. Their natural origin supports the clean-label movement, making them a preferred ingredient across bakery, beverages, and processed food categories globally.

The pharmaceutical industry segment is expected to grow at a CAGR of 5.89%, driven by the increasing inclusion of citrus fibers in nutraceuticals and drug formulations. Acting as natural binders and stabilizers, they enhance product quality and support digestive health, aligning with the rising trend toward natural and sustainable excipients.

Distribution Channel Insights

The supermarkets and hypermarkets segment held a 34.56% share in 2025, benefiting from wide product accessibility and brand visibility. Consumers prefer these outlets for exploring clean-label and functional food products. Effective merchandising and in-store promotions continue to strengthen this distribution channel’s dominance in the citrus fibers market.

The online retail segment is expected to record the fastest CAGR of 6.01%, driven by growing e-commerce penetration and consumer preference for convenient, health-oriented shopping. Online platforms enable wider product reach, easy comparison, and doorstep delivery, fueling strong sales of citrus fiber-based products across global markets.

Company Market Share

Key players in the global citrus fibers market are focusing on product innovation, including developing tailored soluble and insoluble fiber grades to enhance water-holding, emulsification, and texture properties. They are expanding applications across bakery, dairy alternatives, plant-based meats, beverages, and nutraceuticals. Companies are also investing in sustainable sourcing by upcycling citrus processing waste and strengthening regional distribution networks to capture emerging markets, while emphasizing clean-label and functional ingredient positioning to drive overall market growth.

Cargill Inc.

Cargill Inc., founded in 1865 and headquartered in Minnesota, USA, is a global leader in agriculture, food, and industrial ingredients. The company provides a wide range of products, including sweeteners, starches, texturizers, and specialty fibers such as CitriPure® citrus fiber. With operations in over 70 countries, Cargill focuses on sustainable sourcing, clean-label solutions, and innovative food ingredients, catering to bakery, meat, dairy, and plant-based industries worldwide.

List of Key and Emerging Players in Citrus Fibers Market

- CP Kelco Inc.

- Cargill Inc.

- Fiberstar, Inc.

- Ingredion Incorporated

- Tate & Lyle PLC

- DuPont

- Archer-Daniels-Midland Company (ADM)

- Kerry Group plc

- International Flavors & Fragrances Inc. (IFF)

- Florida Food Products, Inc.

- Herbafood Ingredients GmbH

- Golden Health

- Naturex

- Koninklijke DSM N.V.

- Cifal Herbal Private Ltd.

- Lemont

- FUYAN PHARM Inc.

- CEAMSA

- Edge Ingredients

- Carolina Ingredients

- The Green Labs, LLC

- Palmer Holland, Inc.

Recent Development

- August 2025- Remedy's Nutrition, a reputable dietary supplement brand established in 1972 and known for its small-batch herbal products, has introduced its new naturally Modified Citrus Pectin (MCP) supplement, a targeted fiber formula aimed at promoting immune health and cellular well-being.

- July 2025 - Tate & Lyle PLC presented an ice cream parfait at IFT First 2025, demonstrating the use of NUTRAVA® Citrus Fiber for indulgent mouthfeel in dairy formulations.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 447.24 million |

| Market Size in 2026 | USD 469.96 million |

| Market Size in 2034 | USD 717.86 million |

| CAGR | 5.44% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Form, By Function, By Application, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Citrus Fibers Market Segments

By Type

- Insoluble

- Soluble

By Form

- Lemon And Lime

- Orange

- Mandarians

- Grapefruits

- Others

By Function

- Thickening Agent

- Stabilizer

- Gelling Agent

- Fat Replacement

- Others

By Application

- Food and Beverage Industry

- Pharmaceutical and Nutraceutical Industry

- Personal Care and Cosmetics Industry

- Animal Feed Industry

- Others

By Distribution Channel

- Online Retail

- Convenience Stores

- Supermarkets/Hypermarkets

- Specialty Health Stores

- Foodservice And Hospitality

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.