E-commerce Logistics Market Size, Share & Trends Analysis Report By Service Type (Transportation, Warehousing, Value-Added Services), By Operation (Domestic, International), By Operational Model (First-Party Logistics (1PL), Second-Party Logistics (2PL), Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), Fulfilment-as-a-Service Providers), By Technology (AI & Automation, Robotics, IoT & Sensors, Blockchain), By Application (Electronics, Fashion & Apparel, Food, HealthCare, Automotive Parts & Accessories, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

E-commerce Logistics Market Overview

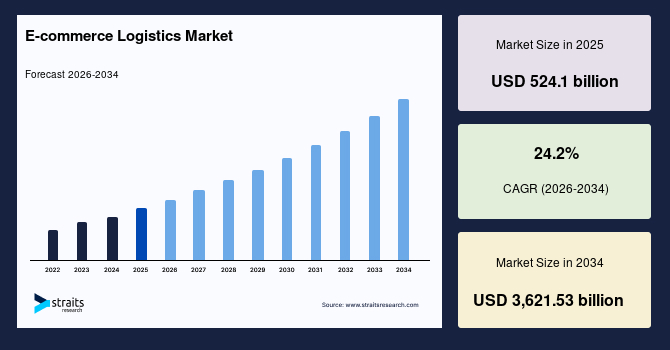

The global e-commerce logistics market size is valued at USD 524.1 billion in 2025 and is estimated to reach USD 3,621.53 billion by 2034, growing at a CAGR of 24.2% during the forecast period. The rapid expansion of the market is driven by the accelerating shift toward online retail, rising demand for same-day and next-day delivery, and the widespread adoption of AI-enabled fulfillment technologies. Advancements in automation, robotics, and real-time tracking are significantly improving delivery accuracy, reducing operational costs, and enabling logistics providers to scale efficiently as e-commerce volumes surge across global markets.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 35.42% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 28.64% during the forecast period.

- Based on service type, the Transportation segment held the highest market share of 52.17% in 2025.

- Based on Operation, The International segment is expected to grow at the fastest CAGR of 25.73% during the forecast period.

- Based on operational model, the Third-Party Logistics (3PL) segment held the highest market share of 49.26% in 2025.

- Based on technology, the AI & Automation segment accounted for the largest market share of 38.55% in 2025.

- Based on Applcation, The Automotive Parts & Accessories segment is expected to grow at the fastest CAGR of 25.84% during the forecast period.

- The U.S. dominates the e-commerce logistics market, valued at USD 168.53 billion in 2024 and reaching USD 186.94 billion in 2025.

Table: U.S e-commerce logistics market Size (USD Million)

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 524.1 billion

- 2034 Projected Market Size: USD 3,621.53 billion

- CAGR (2026-2034): 24.2%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global e-commerce logistics market encompasses the broad range of logistics functions needed to support online retail operations, including transportation, warehousing, and a wide range of value-added services that help further drive order accuracy, speed of delivery, and customer satisfaction. These logistics functions operate over separate shipment scopes, from domestic to international movements, ensuring smooth fulfilment in both cross-border and local e-commerce flows.

Furthermore, the market is organized around different operational models comprising First-Party Logistics (1PL), Second-Party Logistics (2PL), Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), and the rapidly emerging Fulfilment-as-a-Service providers, each providing specific capabilities for different scale online businesses. Technological integration lies at the very core of each operation, with advanced systems leveraging AI & automation, robotics, IoT & sensors, and blockchain for further optimization of fulfillment efficiency, better traceability, and enhanced end-to-end supply chain visibility.

E-commerce logistics solutions find their application in diverse fields such as electronics, fashion & apparel, food, healthcare, automotive parts & accessories, and other online product categories that allow retailers, marketplaces, and D2C brands to run highly scalable technology-driven delivery networks across global market.

Latest Market Trends

Shift from Traditional Delivery Models to Intelligent, Automation-driven Fulfilment Networks

E-commerce logistics is rapidly moving from conventional labor-intensive delivery models to intelligent fulfillment ecosystems powered by automation, robotics, and AI-driven decision systems. At an earlier stage, when logistics operations relied heavily on manual sorting, fragmented warehousing practices, and limited real-time visibility, the outcome was high error rates, rising costs, and slow last-mile performance. Today, automated fulfillment centers integrate robotic picking, dynamic batching, AI-based order routing, and real-time inventory synchronization for quicker delivery at higher operational precision.

Digital logistics platforms, in turn, provide live order tracking, predictive delay alerts, and automated customer communications-things that significantly improve transparency and the consumer experience. Companies that have embraced these integrated, automation-first logistics networks report significant gains in delivery accuracy, 24×7 operational capability, and scalability in fulfillment during peak shopping seasons, marking a structural shift in how modern e-commerce supply chains operate.

Mass Adoption of Same-Day and Hyperlocal Delivery Models

A trend visibly remolding the market is the explosive rise of hyperlocal logistics and same-day delivery. What was once considered premium or optional has turned mainstream, driven by urban consumers, competitive marketplaces, and rapid commerce platforms. In older times, the window for delivery used to be from three to seven days, which was not conducive to frequency and discouraged frequent online purchase of time-sensitive categories.

Today, hyperlocal networks tap into dense micro-warehouses, predictive stock placement, and algorithmic rider allocation to get orders delivered in hours. This shift has recently gained acceleration in sectors like food, healthcare, beauty, and electronics, where on-demand availability makes a difference in customer loyalty. Retailers following this hyperlocal fulfillment strategy are better off with increased order conversions, repeat purchase frequency, and improved last-mile efficiency-all signs of a major industry-wide turn toward speed-driven logistics.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 524.1 billion |

| Estimated 2026 Value | USD 649.36 billion |

| Projected 2034 Value | USD 3,621.53 billion |

| CAGR (2026-2034) | 24.2% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | DHL Supply Chain, FedEx Corporation, UPS Supply Chain Solutions, DB Schenker, XPO Logistics |

to learn more about this report Download Free Sample Report

Market Driver

Acceleration of National Digital Commerce Policies and Government-Backed Logistics Modernization

Governments across the world allows to rapidly accelerate policy frameworks that work towards strengthening digital trade, smart logistics, and infrastructure, consequently becoming one of the powerful growth drivers for the e-commerce logistics market. Many nations such as India, Singapore, the United States, the UAE, and a few EU economies have launched different types of modern trade corridors and logistics reforms at a national level, focused on reducing shipment delays, enhancing cross-border transparency, and allowing friction less digital transactions. Cases include a National Logistics Policy that instituted real-time digital documentation, multi-modal data exchange, and predictive visibility for transport networks, reducing average cargo processing time and significantly boosting reliability for e-commerce shipments.

Market Restraint

Regulatory Fragmentation Across Countries Is Slowing Cross-Border E-Commerce Growth

The main restraint in the e-commerce logistics market is increasing regulatory fragmentation across international trade corridors, which complicates cross-border fulfilment and slows delivery cycles. Many governments maintain inconsistent customs documentation rules, product compliance requirements, and import thresholds. These create a patchwork of regulatory mandates that logistics providers must navigate. For example, the IOSS framework of the European Union has now introduced multiple reporting obligations for sellers outside the EU, while it aimed to simplify VAT compliance. Countries in Southeast Asia and Latin America have instituted different de minimis values and product-specific import checks that extend times for clearance and cause shipment backlogs.

Market Opportunity

The expansion of category-specific fulfillment ecosystems is opening up new avenues of growth.

The rise of category-specific fulfillment ecosystems is a big opportunity for the e-commerce logistics market, which will be required to develop specialized delivery networks catering to the unique characteristics of various product segments. Thus, the creation of dedicated fulfillment frameworks by logistics players for high-growth categories like fashion, groceries, healthcare supplies, and auto spare parts-each having distinct handling protocols, storage environments, delivery windows, and return workflows-is increasingly in evidence.

For example, fashion-focused fulfillment centers are optimizing for a high return volume and fast item reprocessing, while grocery networks focus on cold-chain continuity and ultra-short delivery cycles. Similarly, automotive parts logistics is moving toward precision-based SKU tracking, urban micro-storage, and compatibility-driven picking systems that can satisfy both workshop and aftermarket demand.

Regional Analysis

North America dominated the market in 2025 with a market share of 35.42%, supported by its highly developed fulfilment infrastructure, dense parcel delivery networks, and strong presence of omnichannel retailers that have fully integrated online and offline inventory systems. Maturity in digital logistics ecosystems, wherein large marketplaces and 3PL providers use multi-node fulfilment centers featuring automation for high SKU diversity and fast-moving replenishment cycles, exists in this region.

Besides this, increased adoption of subscription-based delivery programs, doorstep return solutions, and high consumer preference for next-day delivery has accelerated the scaling and sophistication of logistics operations across the region. All these factors together strengthen the leading position of North America in global e-commerce logistics and enable retailers to manage peak-season surges with a high degree of reliability and service accuracy.

The growth of the e-commerce logistics market in the United States is driven by rapid expansion at regional fulfillment hubs and an increasing shift by retailers toward distributed inventory models that put products closer to consumers. Recently, various industry reports have indicated that large U.S. retailers are now managing significant portions of their online orders through same-day or next-day fulfillment nodes that sit within major metropolitan clusters, shaving delivery times and boosting consumer satisfaction. In addition to this, the growing momentum of curbside pickup, smart parcel lockers, and dedicated return-processing facilities will further strengthen last-mile efficiency across the country. These innovations further extend the scale and competitiveness of the U.S. e-commerce logistics and set it as a prime driver of growth in North America.

Asia Pacific E-commerce Logistics Market Insights

The Asia Pacific is emerging as the fastest-growing region, recording a strong CAGR of 28.64% during the forecast period, driven by the rising digital commerce penetration and the fast-expanding regional marketplace ecosystems. Indeed, the sharp spur in online shopping frequency, impelled by mobile-first consumers, growing cross-border demand, and the wider adoption of digital payment systems, cuts across countries in the region.

Logistics providers in Asia Pacific are investing increasingly in high-density sorting hubs, automated fulfilment centres, and micro-warehousing solutions to support high-volume, fast-moving online orders. Furthermore, the growth of social commerce and influencer-led retail models drives unprecedented demand for flexible, scalable last-mile delivery networks across urban and suburban areas. Structural shifts in this direction, therefore, underpin the robust, sustained growth scenario unfolding in the region's e-commerce logistics landscape.

India's e-commerce logistics market is growing rapidly, powered by the emergence of hyperlocal delivery networks, marketplace-led fulfillment programs, and increasing participation by small and mid-sized sellers across nationwide online platforms. Large logistics players in the country are developing specialized delivery networks for fashion, electronics, and fast-moving essentials supported by an expanding network of local delivery partners and decentralized fulfillment centers.

Furthermore, the high growth of tier-2 and tier-3 city adoption of e-commerce is encouraging logistics providers to strengthen regional distribution hubs and enhance rural delivery capabilities. Added to that, growing consumer trust in online shopping and the rapid scaling of digital-first brands are placing India among the most dynamic and high-potential markets within the Asia Pacific e-commerce logistics ecosystem.

Source: Straits Research

Europe Market Insights

In Europe, there is continued growth in e-commerce logistics, driven by the rapid development of omnichannel retail networks and the extensive application of integrated fulfillment strategies throughout major economies. Most large retailers increasingly use integrated inventory systems, synchronized store-to-home delivery models, and regional micro-hubs within the region to reduce delivery times and meet increasing demand for flexible fulfillment.

Additional integrations from consumers, powered by parcel lockers, automated return kiosks, and pick-up drop-off points, continue to drive changes in last-mile delivery efficiency. The region's continued focus on operational transparency and standards for sustainable packaging continues to push logistics providers to further enhance traceability frameworks and optimize delivery density, driving collectively strong growth in e-commerce logistics across European markets.

The growth of the e-commerce logistics market in Germany is driven by rapid development of high-capacity distribution centers, coupled with a shift toward decentralized fulfilment networks developed to manage high volumes of online orders with efficiency. Major retailers in Germany are developing store-based fulfilment and cross-docking models aimed at expediting next-day delivery across both metropolitan and suburban areas.

Increased utilization of automated parcel stations and temperature-controlled delivery solutions, particularly for pharmaceuticals, specialty foods, and electronics, enhance nationwide reliability of delivery. These, together with strong B2C and B2B online adoption, also position Germany as one of the leading contributors to the growth of e-commerce logistics in Europe.

Latin America Market Insights

Latin American e-commerce logistics are rapidly growing across countries like Brazil, Mexico, and Chile, driven by increased digital payment penetration and accelerated marketplace activity. Logistics providers in this region are investing in regional fulfillment centers, cross-border consolidation hubs, and flexible last-mile networks to overcome infrastructural gaps for serving diverse consumer landscapes. Increased mobile-first shopping, social commerce channels, and smart delivery applications are allowing logistics companies to scale up rapidly and address both urban and semi-urban populations. It's improving operational efficiency and boosting the overall participation of this region in global e-commerce flows.

The growth of the market in Brazil is driven by increasing penetration of nationwide fulfillment strategies among retailers and streamlining delivery operations for high-demand product categories such as apparel, electronics, home goods, and beauty products. The improvement in service speed and coverage has come from same-day delivery pilots across major cities, while expanding courier networks have improved localized sorting facilities.

Retailers also partner with regional carriers to optimize workflows on reverse logistics for product categories such as fashion and electronics that have higher volumes of returns. These developments allow Brazil to emerge as one of the most dynamic e-commerce logistics hubs in Latin America.

Middle East and Africa Market Insights

Acceleration in the growth of e-commerce logistics is expected within the Middle East and Africa region due to increased digital retail infrastructure and the development of regional delivery networks. Different retailers are trying to set flexible fulfillment models to handle increasing demand from online channels in an extended array of product categories. This would encourage the growing use of mobile shopping, enabling consumers to extend cross-border online purchasing, leading logistics players to invest in making transportation corridors more resilient and improving last-mile delivery capabilities. Such factors would probably drive robust market expansion across the region.

The development of digitally enabled retail ecosystems and an increase in demand for fast, dependable home-delivery services is also driving the growth of the e-commerce logistics market in Saudi Arabia. This has forced large online sellers to invest in urban fulfillment hubs, temperature-controlled logistics facilities meant to handle perishable items, and automated sorting facilities that reduce delivery errors and enhance delivery times.

Moreover, the strong momentum of e-commerce in the fashion, electronics, and beauty categories is encouraging the building up of last-mile capacity by logistics service providers and a reduction in return-processing times. Such innovations are enabling Saudi Arabia to emerge as a key growth market within the Middle East and Africa's e-commerce logistics landscape.

Service Type Insights

The transportation segment accounted for the maximum share of 52.17% in the market by revenue in the year 2025, owing to the rapid growth in the high-velocity categories of e-commerce, including electronics, fashion, food, and healthcare, which have higher demands for quick, reliable, and flexible delivery networks. With the increase in volumes of online orders and shifting customer expectations toward same-day and next-day fulfillment, transportation networks have turned into the backbone for e-commerce operations, everything from last-mile delivery to line-haul movements to cross-border shipping.

The segment of Value-Added Services is expected to grow the most and thus portray the largest expansion during the forecast period. Some of the drivers include fast-shifting customized packaging, on-demand labeling, kitting, product personalization, and specialized return-handling workflows. As online shoppers want their experiences more personalized and seamless, it follows that retailers want to eliminate friction across the purchase journey. Thus, value-added logistics solutions will be required increasingly.

By Service Type Market Share (%), 2025

Source: Straits Research

Operation Insights

The domestic segment had the major share of 51.02% in 2025, driven by the growth in e-commerce orders of electronics, fashion, food, healthcare, and auto parts across the country, all dependent on domestic delivery networks for speed and reliability. Moreover, growing traction for same-day and next-day delivery, coupled with expanding localized fulfillment centers and urban micro-warehouses, further sealed the leading position of domestic logistics.

The international segment is expected to record the fastest growth, with a projected CAGR of 25.73% in the forecast period. Increased volume of cross-border e-commerce, consumers demanding more international brands, and greater participation from small and medium online sellers in the global marketplaces have driven this accelerated growth.

Operational Model Insights

The segment of Third-Party Logistics accounted for 49.26% of the revenue share in 2025. Their lead is driven by the increasing dependence of e-retailers and online marketplaces on outsourced fulfilment networks that help them manage growing order volumes and deliver speedily with reduced inventory handling complexities. With the expansion of e-commerce in various product categories, 3PLs are being increasingly preferred due to their strong warehousing networks, established transportation capabilities, and integrated order-management systems.

The segment of Fulfilment-as-a-Service is expected to grow the fastest during the forecast period. High growth is ensured by increasing demand for on-demand, cloud-based fulfilment solutions that allow businesses access to real-time inventory visibility, flexible storage, and pay-as-you-use delivery services without long-term commitments. This model is particularly appealing to the D2C brands, cross-border sellers, and digitally native businesses that look toward rapid scalability and multi-node fulfilment without owning any physical logistics assets.

Technology Insights

The AI & Automation segment witness a market share of 38.55% in 2025, resulting from wider use of intelligent fulfillment and real-time decision systems across global e-commerce networks. Logistics providers are increasing their application of AI-driven order routing, automated sorting, predictive demand planning, and dynamic capacity allocation in managing high-volume online shipments of various categories. These technologies significantly minimize manual intervention while offering highly accurate delivery and optimal placement of inventory in distributed fulfillment situations.

The Robotics segment is expected to exhibit the fastest growth during the forecast period. This can be attributed to the rapid deployment of robotic picking arms, AMRs, AGVs, and high-speed sorting systems in fulfillment centers. With robotics-enabled logistics operations, providers will be able to scale throughput to meet peak shopping seasons, cut order cycle times, and improve accuracy across fast-moving product categories such as fashion, electronics, and healthcare.

Application Insights

The segment of Automotive Parts & Accessories is expected to record the highest CAGR of 25.84% during the forecast period, owing to increasing momentum in shifting automotive components, spare parts, and aftermarket products toward online commerce channels. With growing dependence of workshops, service centers, and individual vehicle owners on e-commerce platforms for high-precision components, the demand for specialized logistics solutions, including compatibility-based picking, secure packaging, and faster replenishment cycles, continues unabated. This is further accelerated by increasing online aftermarket marketplaces and better accessibility of long-tail automotive SKUs.

Competitive Landscape

The e-commerce logistics market is fragmented globally, with established logistics giants and specialized fulfillment providers offering diversified and high-volume delivery capabilities. A few leading names dominate a considerable share of the market based on their vast distribution networks, state-of-the-art fulfillment infrastructure, and highly integrated e-commerce service portfolios. Their end-to-end logistics solution offerings, from warehousing to transportation and further to cross-border delivery and reverse logistics, strengthen their competitive positions and drive strong client retention across both retail and marketplace ecosystems.

Major market participants include DHL Supply Chain, FedEx Corporation, and UPS Supply Chain Solutions. These industry leaders are involved in active competition for better market shares by making strategic moves such as automation-enabled modernization of warehouses, strategic expansion of large-scale fulfillment centers, acquisitions, and partnerships with leading online retailers. Continuous investment being carried out by these players in improving speed, visibility of parcels, and category-specific fulfillment capabilities have been enabling them to strengthen their positions in the fast-growing global e-commerce logistics landscape.

OnTrac: An emerging market player

U.S.-based OnTrac is an e-commerce logistics carrier that stands out with its innovative last-mile service enhancements and network claims.

- In September 2025, OnTrac debuted its product called “7-Day Play,” in partnership with Fenix Commerce, a fully integrated solution that married 7-day-per-week ground delivery with AI-powered predictive delivery promise capabilities. With this launch, OnTrac is positioned as a key disruptor in the U.S. market, enabling brands to convert online traffic into higher repeat purchase rates through enhanced delivery reliability.

Thus, OnTrac became one of the leaders in the global e-commerce logistics market by using advanced service cadence and predictive delivery technology to capture online merchant demand.

List of Key and Emerging Players in E-commerce Logistics Market

- DHL Supply Chain

- FedEx Corporation

- UPS Supply Chain Solutions

- DB Schenker

- XPO Logistics

- Kuehne + Nagel

- H. Robinson Worldwide

- CEVA Logistics

- Ryder Supply Chain Solutions

- Nippon Express

- Expeditors International

- Yusen Logistics

- Agility Logistics

- B. Hunt Transport Services

- Geodis

- Hellmann Worldwide Logistics

- Sinotrans Limited

- Bolloré Logistics

- Penske Logistics

- Panalpina

- Others

Strategic Initiatives

- May 2025: DHL Supply Chain announced the acquisition of IDS Fulfillment in the U.S., adding over 1.3 million sq ft of multi-customer warehouse and distribution space across Indianapolis, Salt Lake City and Atlanta.

- April 2025: UPS Supply Chain Solutions launched UPS Ground Saver® and UPS® Ground with Freight Pricing, expanding its ground shipping portfolio and adding two new delivery options; these enhancements aim to support shippers of all sizes by improving cost efficiency and delivery reliability.

- March 2025: FedEx Corporation announced the launch of FedEx Easy Returns, a low-cost, box-free, label-free returns service to be available at approximately 3,000 locations across the U.S., supported by Blue Yonder technology.

- December 2024: P. Moller – Maersk opened its first dedicated fulfilment warehouse in France a 75,000 m² facility to serve a global e-commerce customer, marking a major infrastructure expansion in European fulfilment.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 524.1 billion |

| Market Size in 2026 | USD 649.36 billion |

| Market Size in 2034 | USD 3,621.53 billion |

| CAGR | 24.2% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Service Type, By Operation, By Operational Model, By Technology, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

E-commerce Logistics Market Segments

By Service Type

- Transportation

- Warehousing

- Value-Added Services

By Operation

- Domestic

- International

By Operational Model

- First-Party Logistics (1PL)

- Second-Party Logistics (2PL)

- Third-Party Logistics (3PL)

- Fourth-Party Logistics (4PL)

- Fulfilment-as-a-Service Providers

By Technology

- AI & Automation

- Robotics

- IoT & Sensors

- Blockchain

By Application

- Electronics

- Fashion & Apparel

- Food

- HealthCare

- Automotive Parts & Accessories

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.