Electric Boiler Market Size, Share & Trends Analysis Report By Type (Resistance/Immersion, Electrode, Induction), By Capacity (Up to 24 kW, 24–60 kW, Above 60 kW), By End-use (Residential, Commercial, Industrial), By Application (Space Heating, Domestic Hot Water, Process Steam/Process Heating) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Electric Boiler Market Overview

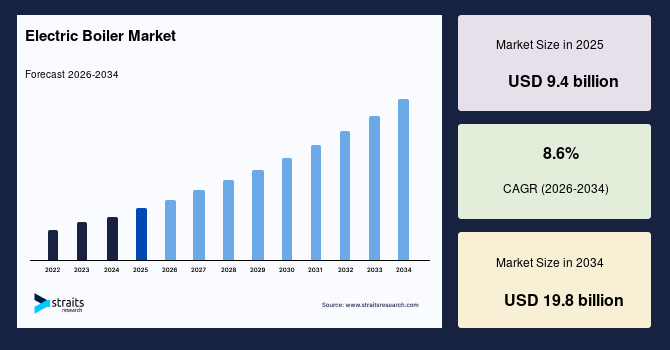

According to Straits Research, the electric boiler market was valued at USD 9.4 billion in 2025 and is projected to reach USD 19.8 billion by 2034, supported by policy-led electrification of heat, expanding at a CAGR of 8.6% from 2026 to 2034. Regulatory pressure to decarbonise buildings and industry acted as a consistent growth catalyst. Incentives for low-carbon heating, grid decarbonization, and new peak-shaving use cases within district energy supported adoption. Electric boilers offered lower local emissions and simpler mechanical architectures compared to combustion units, which reduced maintenance burdens and accelerated replacement cycles in commercial and industrial facilities. The market also benefited from growth in data centres and cold-climate retrofits, where electric boilers served as backup or peak-load sources in hybrid systems.

In 2025, gas price volatility and concerns over energy security prompted fuel switching in Europe and parts of North America. Municipal decarbonization programs in major cities favoured power-to-heat projects, particularly where surplus renewable power existed. Manufacturers expanded product portfolios from compact residential units to modular high-capacity electrode and resistance designs for process steam. Digital controls and IoT-enabled maintenance raised reliability and integration with building automation systems. With rising corporate sustainability targets and the increasing procurement of green power, the electric boiler market is expected to sustain multi-year growth across both new installations and retrofits.

Key Market Trends & Insights

- Dominant region (2025): Europe at 34% share; fastest-growing region (2026–2034): Asia Pacific at 9.8% CAGR

- By Type: Resistance/Immersion led with 56% share (2025); fastest-growing: Electrode at 9.9% CAGR

- By Capacity: 24–60 kW led with 38% share (2025); fastest-growing: Above 60 kW at 10.2% CAGR

- By End-use: Commercial led with 41% share (2025); fastest-growing: Industrial at 9.7% CAGR

- By Application: Space Heating led with 49% share (2025); fastest-growing: Process Steam at 10.5% CAGR

- Dominant country: United States at USD 1.80 billion (2025) and USD 1.96 billion (2025)

Latest Market Trends

Power-to-Heat Integration in District Energy and Industry

The electric boiler market saw increased integration of boilers into power-to-heat schemes that absorbed surplus wind and solar. Utilities and district energy operators deployed high-capacity electrode units for peak-load management, providing ancillary services, and charging thermal storage. This trend will accelerate as grids incorporate variable renewable energy and seek to balance with fast-responding loads. The approach reduces curtailment and converts low-cost electrons into thermal energy for space heating or process use, aligning with decarbonization goals and system flexibility needs.

Modular, Digitally Managed Systems

Vendors enhanced modular architectures, enabling scalable capacity from tens of kW to multi-megawatt units. Digital control platforms, remote monitoring, and predictive maintenance improved uptime and lifecycle economics. In the Electric Boiler Market, connectivity supported fault detection, energy optimisation under dynamic tariffs, and seamless integration with building management systems. Such advances will continue to improve the total cost of ownership and create value for facility managers, EPCs, and utilities seeking interoperable, software-defined heat assets.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 9.4 billion |

| Estimated 2026 Value | USD 10.21 billion |

| Projected 2034 Value | USD 19.8 billion |

| CAGR (2026-2034) | 8.6% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Bosch Thermotechnology, Viessmann Climate Solutions, Cleaver-Brooks, Chromalox, PARAT Halvorsen AS |

to learn more about this report Download Free Sample Report

Market Drivers

Policy-Driven Heat Decarbonization

National and municipal policies targeting building emissions set deadlines for phasing out fossil-fueled boilers. Compliance with carbon pricing, emissions caps, and efficiency standards pushed commercial buildings and public facilities toward electric options. The electric boiler market gained from procurement preferences for low-emission heating in schools, hospitals, and government offices. Coupled with access to green power contracts, buyers aligned capital investment with corporate and regulatory targets to reduce Scope 1 emissions.

Simplified Operations and Maintenance

Electric boilers featured fewer moving parts and no flue-gas handling, which reduced maintenance complexity and floor space requirements relative to combustion systems. Rapid start-up and precise control improved process quality in light manufacturing and food and beverage applications. In multi-tenant buildings, compact wall-hung units freed space while lowering service calls. These operational advantages supported the electric boiler market as facility managers prioritised reliability and predictable service budgets over fuel-switching risks.

Market Restraint

Electricity Price Volatility and Grid Capacity Limits

Exposure to fluctuating electricity prices constrained economic use in certain regions, particularly where peak tariffs were high or demand charges were substantial. Industrial users weighed electricity costs against gas or district heat alternatives and delayed transitions without supportive tariffs. Grid capacity limits in older urban areas also delayed projects due to required service upgrades. In parts of Eastern Europe and Latin America, limited substation capacity extended connection timelines. Although smart controls and time-of-use optimisation can mitigate costs, the electric boiler market will face procurement delays where tariff reforms, grid reinforcements, or behind-the-meter storage solutions are not yet available.

Market Opportunities

Corporate PPAs and Green Tariffs for Process Heat

As corporate buyers expand their renewables procurement, cost-stable green electricity opens a path for replacing fossil-fueled process steam in the light industry. Breweries, pharmaceuticals, and food processing plants can utilise electric boilers to align their energy needs with low-carbon power sources. Vendors that bundle equipment, long-term service, and energy supply advisory services can unlock new addressable demand. The electric boiler market will benefit from turnkey offerings that align capital plans with decarbonization roadmaps and predictable electricity costs.

Retrofit and Hybridisation in Existing Buildings

Ageing boiler rooms in hotels, hospitals, and universities present an upgrade potential. Electric boilers can be added as peak-load or shoulder-season units alongside existing systems, thereby improving redundancy and reducing emissions during periods of high renewable output. Integration with thermal storage and advanced controls helps shift loads to off-peak times, thereby reducing energy consumption. This hybrid approach creates a gradual transition path rather than a one-time, rip-and-replace approach. The electric boiler market will capture retrofit demand by enabling staged capex and operational flexibility.

Type Insights

Resistance/Immersion electric boilers dominated the market by type, accounting for a 56% share in 2025. These units offered straightforward design, broad capacity ranges, and low maintenance. Adoption in commercial buildings and light industry reflected their reliability and compatibility with existing hydronic systems. OEMs supplied standardised modules and controls, supporting rapid retrofits.

Electrode boilers will be the fastest-growing type at a projected 9.9% CAGR through 2034. Their ability to deliver high-capacity steam with rapid response will suit power-to-heat and industrial applications. Grid operators and district heating providers will deploy electrode units for peak-load management and to utilise surplus renewable generation, driving growth in this segment of the electric boiler market.

Capacity Insights

The 24–60 kW capacity range held the largest share at 38% in 2025. This band aligns with small commercial buildings, multifamily properties, and institutional facilities that need mid-scale space heating or domestic hot water. Installers favoured these units for their balance of output and electrical service requirements.

Above 60 kW will be the fastest-growing capacity band, rising at a 10.2% CAGR through 2034. Industrial users, district energy schemes, and large campuses will adopt higher-capacity electric boilers for process steam, redundancy, and load shifting. Modular designs and improved power electronics will facilitate easier integration, thereby enhancing the high-capacity segment of the electric boiler market.

End-use Insights

Commercial applications led the electric boiler market with a 41% share in 2025. Hotels, hospitals, schools, offices, and retail facilities installed electric boilers to meet hot water and space heating needs while meeting emissions and safety requirements. Lower maintenance and the absence of flues were compelling in dense urban areas.

Industrial end-use will post the fastest growth at a 9.7% CAGR through 2034. Light manufacturing, pharmaceuticals, electronics, and food and beverage will add electric steam capacity to reduce on-site combustion and to align with renewable power procurement. Process integration and quality control benefits will accelerate adoption within this part of the market.

Application Insights

Space Heating accounted for 49% of the electric boiler market revenue in 2025. Deployment was strong in retrofits where building shells and hydronic systems already existed, allowing rapid substitution or hybridisation with legacy equipment. Public-sector buildings and multifamily properties contributed to steady demand.

Process Steam will be the fastest-growing application, advancing at a 10.5% CAGR to 2034. As firms electrify low- to medium-temperature processes, electric boilers will provide precise temperature control and fast start-up. Integration with thermal storage and demand response will optimise operations, supporting expansion of this high-growth application in the market.

Regional Analysis

North America Market Insights

North America held 28% of the electric boiler market in 2025. The region will register an 8.3% CAGR during 2026–2034, driven by state-level building codes, electrification incentives, and data centre expansions that require reliable backup and heat rejection management. Utility programs and municipal ordinances will support retrofits in public buildings and universities. As the electric boiler market expands in North America, demand will also reflect the replacement of ageing combustion units and new installations in the healthcare and hospitality sectors.

The United States dominated regional revenue. Federal tax credits for clean energy improvements, local carbon caps, and lifecycle cost considerations supported purchasing decisions. A key growth factor will be the integration of electric boilers into campus energy systems, allowing for the utilisation of off-peak power and providing fast-response thermal capacity for resilience planning.

Europe Market Insights

Europe accounted for 34% of the electric boiler market in 2025. The region is expected to grow at a 7.9% CAGR through 2034, driven by the implementation of Fit for 55 policies, municipal heat planning, and power-to-heat deployments in district heating. Electric boilers will complement heat pumps and thermal storage to handle peak demand in colder months. Procurement frameworks in public and commercial buildings will favour low-emission heating assets as the electric boiler market advances across the EU and the UK.

Germany was the dominant country in 2025. A distinct growth factor will be the use of high-capacity electrode boilers as flexible assets in district energy schemes that absorb surplus wind power, reducing curtailment while supporting heating networks in urban areas undergoing gas grid downsizing.

Asia Pacific Market Insights

Asia Pacific captured 27% of the market in 2025 and will be the fastest-growing region at a 9.8% CAGR between 2026 and 2034. Expansion will be supported by industrial decarbonization mandates in developed markets and grid modernisation paired with rising renewable generation. New commercial construction and technology facilities will adopt compact, electrically driven heating solutions. The electric boiler market in the Asia Pacific will also benefit from increased local manufacturing and competitive pricing.

China dominated regional demand. A distinct growth factor will be industrial parks that sign green power contracts and replace small coal or oil units with modular electric steam systems, improving air quality and compliance in manufacturing clusters.

Middle East & Africa Market Insights

The Middle East & Africa held 6% of the electric boiler market in 2025 and will grow at an 8.1% CAGR during 2026–2034. Utility-scale solar buildouts and energy efficiency programs in commercial real estate will encourage the use of electric boilers for domestic hot water and process applications. Hotels and healthcare facilities will adopt electric units where gas infrastructure is limited and where electricity from renewable sources is available.

The United Arab Emirates was the dominant market. A distinct growth factor will be the use of electric boilers in hospitality and district cooling-related applications, leveraging daytime solar generation to supply hot water and to improve overall building energy balance.

Latin America Market Insights

Latin America represented 5% of the electric boiler market in 2026 and will post an 8.5% CAGR from 2026 to 2034. The region will see gradual adoption in commercial buildings and select industrial segments where renewable power availability and emissions goals support fuel switching. Public sector retrofits and private sector ESG commitments will reinforce momentum.

Brazil led the regional market. A distinct growth factor will be the alignment of industrial electrification with abundant hydro and wind power, enabling the deployment of electric boilers in food and beverage processing and in institutional facilities that seek predictable, low-emission heat sources.

Competitive Landscape

The electric boiler market featured a mix of global HVAC firms and specialised boiler manufacturers. Bosch Thermotechnology was the market leader, with a broad portfolio spanning residential to industrial electric boilers and a strong distribution network across Europe and North America. Viessmann Climate Solutions, Cleaver-Brooks, Chromalox, and PARAT Halvorsen held prominent positions with differentiated industrial and commercial offerings. Bosch Thermotechnology’s latest development included a 2025 modular, high-capacity electrode series with advanced controls for district energy and industrial process steam. Players continued to invest in digital monitoring, modularity, and service agreements to improve lifecycle value and address diverse regional requirements.

List of Key and Emerging Players in Electric Boiler Market

- Bosch Thermotechnology

- Viessmann Climate Solutions

- Cleaver-Brooks

- Chromalox

- PARAT Halvorsen AS

- ACME Engineering Products

- Babcock Wanson

- VAPEC

- Atlantic Group

- Stiebel Eltron

- Ariston Group

- Vaillant Group

- The Electric Heating Company (EHC)

- Fulton

- Hoval

- Lochinvar (A. O. Smith)

- Danstoker

- Miura

- Thermona

Strategic Initiatives

- February 2025 - Viessmann Climate Solutions launched the new compact Vitodens 025-W combi boiler (up to 28 kW). While a gas boiler, the launch confirms Viessmann's strategy to fill out its compact wall-mounted range, competing directly in the space where electric and hybrid retrofits are growing.

- February 2025 - Cleaver-Brooks launched the LVR Electric Hydronic Boiler at the AHR Expo. The LVR is a compact, zero-emissions solution that offers nearly 100% efficiency in capacities ranging from 90 to 540 kW.

- March 2025 - PARAT Halvorsen announced the successful delivery of three $50 \text{ MW}$ IEH Electrode Hot Water Boilers to Vattenfall in the Netherlands. This zero-emission project significantly expands Power-to-Heat capacity for a major European utility.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 9.4 billion |

| Market Size in 2026 | USD 10.21 billion |

| Market Size in 2034 | USD 19.8 billion |

| CAGR | 8.6% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Capacity, By End-use, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Electric Boiler Market Segments

By Type

- Resistance/Immersion

- Electrode

- Induction

By Capacity

- Up to 24 kW

- 24–60 kW

- Above 60 kW

By End-use

- Residential

- Commercial

- Industrial

By Application

- Space Heating

- Domestic Hot Water

- Process Steam/Process Heating

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.