Australia Erosion and Sedimentation Control Market: Information By Product Type (Mats, Turfs, Blankets, Filter Socks, Logs, and Wattles, Woven Sediment Fences and Silt Fences, Filtration Systems, Sediment Basin), By End-User (Highway and Road Construction, Energy and Mining, Government and Municipality, Landfill Construction and Maintenance, Infrastructure Development, Industrial Manufacturing), and By Country—Forecast Till 2033

Australia Erosion and Sediment Control Market Size

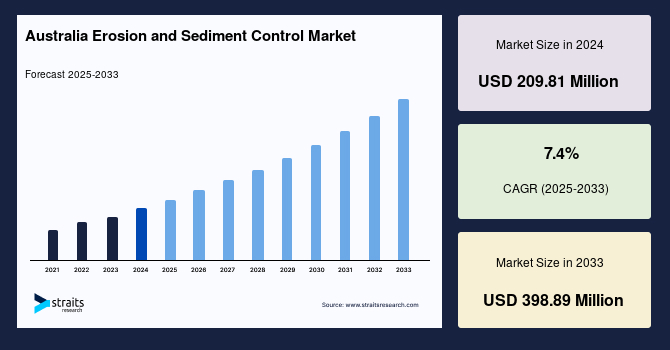

The global australian erosion and sediment control market size was valued at USD 209.81 million in 2024 and is projected to grow from USD 225.33 million in 2025 to reach USD 398.89 million by 2033, growing at a CAGR of 7.4% during the forecast period (2025–2033).

Australia's erosion and sediment management industry is driven by growing urbanization, environmental conservation consciousness, and the detrimental impacts of soil erosion on ecosystems and water quality. Significant investments in mining and construction projects and government land management and rehabilitation programs also fuel the need for cutting-edge erosion and sediment control techniques.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 209.81 Million |

| Estimated 2025 Value | USD 225.33 Million |

| Projected 2033 Value | USD 398.89 Million |

| CAGR (2025-2033) | 7.4% |

| Key Market Players | Erizon, Hunter Civilab, Aussie Environmental, Precise Environmental, Scott Paten Consulting (SPC) |

to learn more about this report Download Free Sample Report

Australia Erosion and Sediment Control Market Growth Factor

Engineering Activities Such as Road and Highway Construction

Around 18.6 billion Australian dollars were spent on private-sector engineering construction projects on Australian roads, highways, and subdivisions as of 2023. Due to the lack of protective vegetative cover, engineering activities like building roads and highways can produce many erodible materials. This exposes steep cut and fill slopes to scour difficulties and significant sedimentation, which is inevitable downstream. Australia's largest road infrastructure project, WestConnex, connects Western and South Western Sydney to the city, airport, and port by a 33-kilometer continuous freeway. In collaboration with the government of New South Wales, the Australian government has pledged USD 1.5 billion in funding to build WestConnex, with an anticipated project cost of USD 16.8 billion.

Comparably, the West Gate Tunnel project extended Melbourne's West Gate Freeway and built a bridge across the Maribyrnong River and two tunnels beneath Yarraville. Transurban and the Victorian Government are executing the USD 6.7 billion project. Due to stakeholders' inability to reach a consensus on the intended transfer destination of contaminated soil from the tunnel's anticipated location, construction was put on hold in 2019. The decision was made in June 2021 to use the soil at Hi-Quality's landfill in Bulla. Since then, work has continued, with a revised completion date of 2024. As a result, these construction-related activities fuel Australia's market expansion.

Market Restraint

Enforcement and Compliance

In response to official complaints about environmental nuisances and violations of restrictions for activities that require a license, enforcement and compliance actions about erosion and sediment control during urban development are primarily reactive. Improving erosion and sediment control compliance is frequently attributed to the costs of enforcement for governments. This is because a significant violation necessitating the issuance of an infringement notice, especially in cases where prosecution might be the result, calls for resource-intensive procedures such as gathering information for reports, gathering evidence, and interviewing witnesses.

According to Healthy Land and Water (2019), SEQ Councils may incur frequently invisible and unmeasured expenditures due to complaints about sediment pollution from building projects. According to knowledgeable Council Regulatory staff members, the average cost of handling Erosion and Sediment Control (ESC) complaints is at least USD 800 and up to USD 4,100 per complaint. According to stakeholder consultation, some larger councils can get hundreds of these complaints annually.

In addition, it has been determined that the possibility of land developers and operators of building sites being "caught," fined, or prosecuted for non-compliance with erosion and sediment control legislation requirements in SEQ is decreased by the absence of enforcement or uneven enforcement of such regulations. The likelihood of a significant enforcement action (such as an Environmental Protection Order, "stop work notice," or prosecution) for erosion and sediment control non-compliance at an SEQ construction site is, on average, only 2.2%.

However, according to 2013 data, the cost to developers and civil contractors of adhering to current erosion and sediment control-related legislation is 14 times higher than the cost of not complying. As a result, rather than allocating the entire cost of appropriate erosion and sediment control implementation in their construction and building projects, some industry members were ready to take a chance at being discovered. These elements create a commercial operating environment where employees wish to comply with erosion and sediment control regulations but are hindered by inadequate funding or when compliance is usually viewed as a low priority. These elements impede market expansion.

Market Opportunity

Increasing Mining Activities

Nearly 70% of Australia's overall export earnings come from the mining and metals industry, leading globally in production and export. The mining sector is one of the main drivers of the country's economic expansion. As per the Australian Bureau of Statistics, the mining industry made a noteworthy contribution of USD 455 billion to Australia's export revenue during the 2022–2023 financial year. This underscores the industry's ability to extract and process minerals, making it a crucial player in fulfilling the global resource demand.

Additionally, economic ventures such as mining operations have the potential to directly introduce significant amounts of silt into natural streams, with mine dumps and spoil banks gradually eroding when exposed to rains after mining operations have ceased. Because disturbed soil can lead to sources of erosion and silting into water bodies, mining and exploration often occur at the expense of natural drainage.

Therefore, erosion management is essential to ensuring that exploration is conducted without endangering the environment. Queensland, Australia, serves as an example to illustrate the effects of infrastructure deterioration. According to research, about 45% of Queensland's soil is sodic, meaning that when the clay is wet, it expands, and the particles scatter, weakening the aggregate in the soil and eventually causing it to collapse and lose porosity. This negatively impacts air and water movement, leading to structural problems. In most cases, roads are affected by soil erosion, which is far more common in sodic soils. As a result, Australia's growing mining industry fuels market expansion.

Country Insights

Western Australia's varied climate and fast urbanization rate have further exacerbated the region's environmental issues. In Western Australia, erosion occurs frequently in many forms.

- For example, wind erosion occurs in the state every year. This phenomenon is influenced by the late and dry growing seasons, rising temperatures, and decreased rainfall.

Moreover, coastal erosion seriously threatens a significant section of Western Australia. The authorities have classified the state's 55 beaches as hotspots for coastal erosion. The worst thing is that several beaches could be washed away in the upcoming years. Numerous sources cause these looming catastrophes. Among the examples are artificial constructions that alter how sand moves naturally and variations in the weather and wave conditions. In the meantime, water erosion is another significant kind of soil degradation in Western Australia. The state spends ten million dollars each year to mitigate the impacts of water erosion. Such investments fuel the expansion of the market.

Additionally, governmental organizations have already launched awareness efforts to educate the public about these erosion agents and the problems that go along with them. These awareness campaigns also offer strategies for reducing the many forms of erosion.

- For example, the Department of Primary Industries and Regional Development lists pasture erosion management strategies. They also penned policies to reduce erosion caused by wind. These recommendations included windbreaks to slow wind speed, maintaining adequate ground cover, safeguarding regions with significant soil disturbance, and seasonal management choices. The Department of Planning, Lands, and Heritage has also created a strategy for coastal zones. Some goals are preserving, improving, and upholding natural processes and coastal values.

As a result, this program supports the erosion and sedimentation management market. The expansion of the Australian erosion and sedimentation control market is expected to be aided by the factors above.

Product Type Insights

The Mats holds a significant market share and is expected to register a CAGR of 7.8% over the forecast period. Mats are essential in Australia's erosion and sediment control demand because they effectively stabilize soil, lessen surface erosion, and encourage vegetation growth. Frequently composed of synthetic or natural fibers, these mats reduce the environmental impact by controlling sediment flow during land development and building projects. Their application supports sustainable practices and strict environmental requirements, which propels market expansion. Erosion control mats are in high demand due to the growing emphasis on environmental protection and infrastructure development, highlighting their critical role in preserving water quality and soil integrity.

End-Use Insights

The highway and road construction holds a significant market share and is expected to register a CAGR of 8.2% over the forecast period. Effective erosion and sediment management methods are essential for large-scale infrastructure projects to prevent environmental deterioration, especially during the considerable land disturbance of building roads. The need for erosion and sediment management goods and services is increased by regulatory frameworks that impose strict controls to manage runoff and preserve water quality. Increased infrastructure spending drives this market expansion, which calls for using cutting-edge methods and supplies to maintain ecologically friendly construction practices while adhering to environmental regulations.

List of Key and Emerging Players in Australia Erosion and Sediment Control Market

- Erizon

- Hunter Civilab

- Aussie Environmental

- Precise Environmental

- Scott Paten Consulting (SPC)

- Vidgil Silt Fencing

Recent Developments

- December 2023 –IECA released Best Practices for Sediment and Erosion Control. The term "Best Practice Erosion and Sediment Control" refers to the substantial contribution that other professions, such as engineers, ecologists, and civil contractors, make to urban soil erosion and sediment management. It includes the tactics and methods required to help erosion and sediment control practitioners lessen the damage that unchecked erosion and sedimentation do to land and water.

- January 2024 - Aussie Environmental introduced a coir blanket. These blankets break up heavy rainwater runoff and disperse wind and water energy. By absorbing water and halting soil evaporation, coir fiber encourages vegetation growth. As lignin makes up a large portion of coir fiber, it has a higher lignin content than other natural fibers and, hence, is more robust and lasts longer. Because of this, coir blankets survive longer than other organic textiles; depending on the climate, they can last up to two or three years.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 209.81 Million |

| Market Size in 2025 | USD 225.33 Million |

| Market Size in 2033 | USD 398.89 Million |

| CAGR | 7.4% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By End-Use |

to learn more about this report Download Free Sample Report

Australia Erosion and Sediment Control Market Segments

By Product Type

- Mats

- Turfs

- Blankets

- Filter Socks

- Logs and Wattles

- Woven Sediment Fences and Silt Fences

- Filtration Systems

- Sediment Basin

- Others

By End-Use

- Highway and Road Construction

- Energy and Mining

- Government and Municipality

- Landfill Construction and Maintenance, Infrastructure Development

- Industrial Manufacturing

- Others

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.