Exterior Wall System Market Size, Share & Trends Analysis Report By Product Type (Curtain Walls (Unitised and Stick-Built), Cladding Panels (Metal, Composite, Stone, and Fibre Cement), Exterior Insulation and Finish Systems (EIFS), Ventilated Facades, Prefabricated Modular Wall Systems), By Material (Aluminum, Glass, Stone and Natural Materials, Fibre Cement, Composites (e.g., HPL, Aluminium Composite Panels)), By End-Use (Residential Buildings, Commercial Buildings, Industrial Buildings), By Distribution Channel: (Direct Sales (to construction companies and developers), Dealer/Distributor Network, E-commerce Platforms) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Exterior Wall System Market Overview

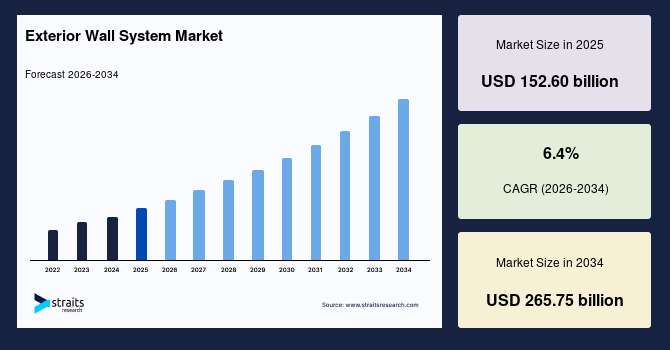

The global exterior wall system market size is valued at USD 152.60 billion in 2025 and is estimated to reach USD 265.75 billion by 2034, growing at a CAGR of 6.4% during the forecast period. The market is driven by accelerating investments in residential and commercial construction, heightened focus on energy efficiency, and the rising adoption of sustainable building practices across mature and emerging economies.

Key Market Trends & Insights

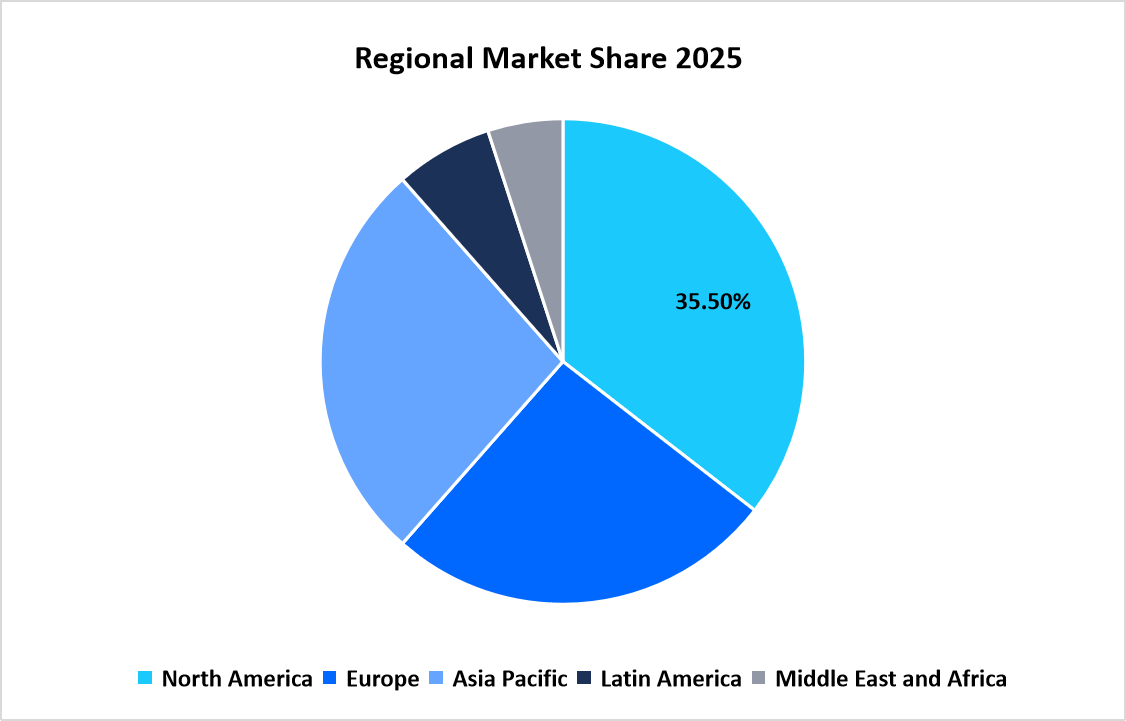

- North America dominated the market with a revenue share of 35.5% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 8.5% during the forecast period.

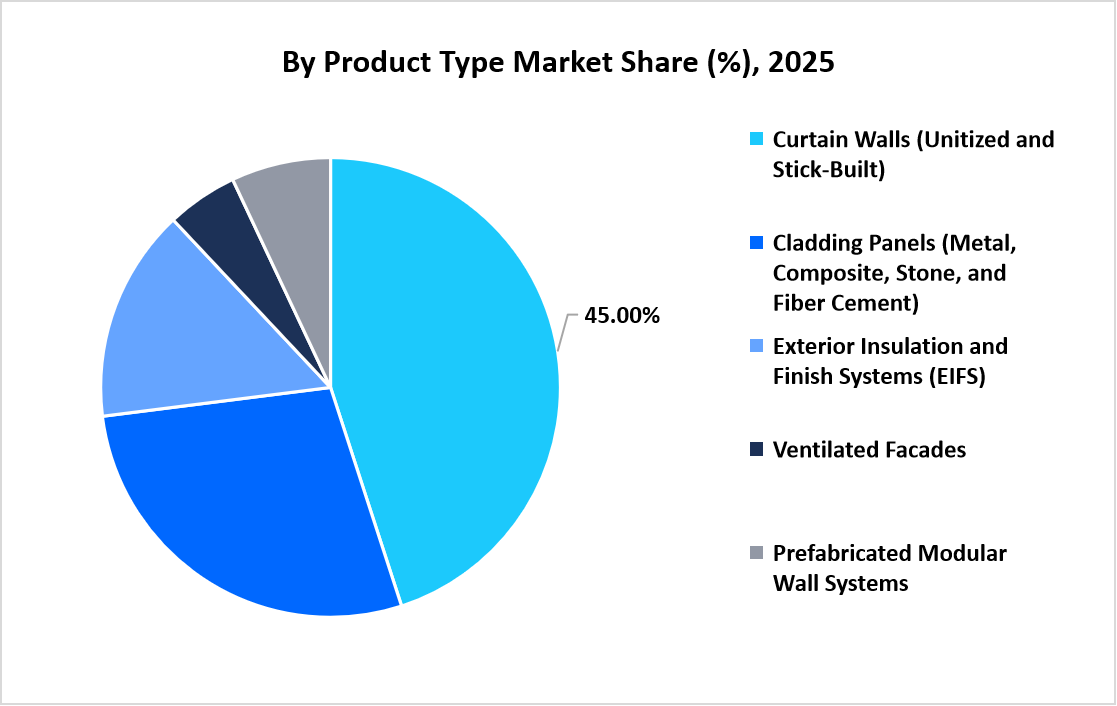

- Based on Product Type, the Curtain wallssegment held the highest market share of 45% in 2025.

- By Material, the Composite materials segment is estimated to register the fastest CAGR growth of 8.5%.

- Based on End Use, the Commercial constructioncategory dominated the market in 2025 with a revenue share of 48%.

- Based on Distribution Channel, the Dealer and distributor channelssegment is projected to register the fastest CAGR of 7.6% during the forecast period.

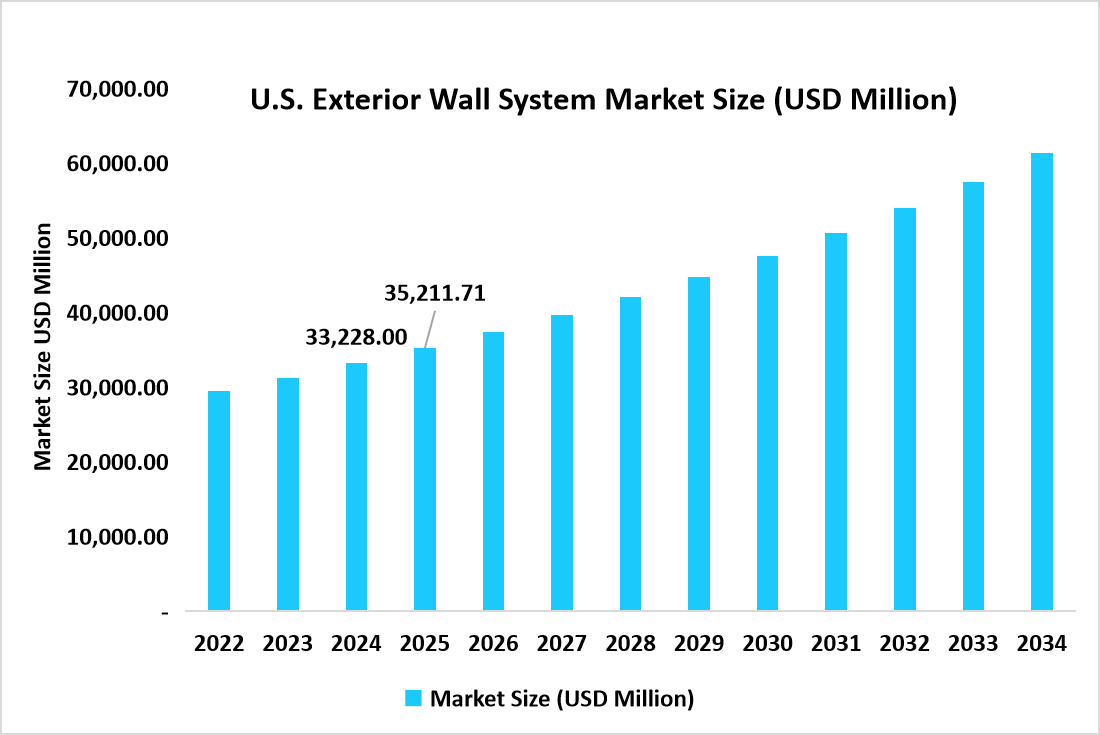

- U.S. dominates the market, valued at USD 33,228.00 million in 2024 and reaching USD 32,211.71 million in 2025.

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 152.60 billion

- 2034 Projected Market Size: USD 265.75 billion

- CAGR (2026-2034): 6.4%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global exterior wall system market covers a broad range of solutions used to protect and finish the building envelope, including cladding materials, curtain walls, EIFS (Exterior Insulation and Finish Systems), ventilated facades, and other proprietary systems deployed across residential, commercial, and industrial structures. The core purpose of exterior wall systems is to provide structural integrity, weather resistance, thermal insulation, and aesthetic appeal while enhancing a building’s overall performance and sustainability profile. The key growth drivers include increasing urbanisation, stricter building codes that emphasise energy efficiency and safety, technological innovations in materials, and the broader adoption of advanced construction techniques that reduce installation time and lifecycle costs.

Market Trends

Rise of Sustainable and Energy‑Efficient Facade Solutions

Sustainability and energy performance have become crucial trends influencing the exterior wall system market. Developers and architects are increasingly specifying wall systems that enhance thermal insulation and reduce carbon footprints, driven by stringent building codes, environmental regulations, and growing consumer awareness of energy costs. Green building certification programs, such as LEED and BREEAM, further encourage the use of environmentally responsible systems that enhance energy efficiency and indoor comfort. As performance expectations rise, sustainable and energy-efficient exterior wall systems boost operational savings and support environmental compliance, thereby strengthening demand across building sectors.

Integration of Digital Design and Building Information Modelling (BIM)

Digital design tools and Building Information Modelling are increasingly shaping decision-making in the market. BIM allows architects, engineers, and contractors to model facade performance early in the design phase, enabling better coordination, reduced errors, and more efficient installation. Digital workflows also improve cost forecasting and shorten project timelines, enhancing overall project efficiency. As digital collaboration becomes standard practice, BIM adoption supports wider use of advanced exterior wall systems and reinforces steady market momentum.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 152.60 billion |

| Estimated 2026 Value | USD 161.82 billion |

| Projected 2034 Value | USD 265.75 billion |

| CAGR (2026-2034) | 6.4% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Schüco International, AluK Group, Kawneer (Arconic), YKK AP Inc., Saint-Gobain Weber |

to learn more about this report Download Free Sample Report

Market Drivers

Urbanization and Infrastructure Growth

Rapid urbanization and sustained infrastructure investment remain key drivers of the exterior wall system market. Growing urban populations are driving an increase in demand for residential, commercial, and mixed-use developments, particularly in high-density cities. Modern construction increasingly requires exterior wall systems that deliver durability, safety, thermal performance, and architectural appeal. High-rise buildings and large developments place greater emphasis on facade integrity, weather resistance, and energy efficiency. The expansion of urban infrastructure supports long-term market growth.

Stricter Building Codes and Energy Regulations

Stricter building codes and energy regulations are significantly influencing the exterior wall system industry. Governments worldwide are enforcing updated standards that require higher insulation levels, improved moisture control, enhanced fire resistance, and greater energy efficiency. These regulatory changes prompt developers and designers to incorporate compliant wall systems into their early planning stages. As compliance becomes mandatory, investment in advanced exterior wall systems continues to rise steadily. This regulatory environment ensures consistent demand for solutions that meet evolving environmental and safety benchmarks.

Market Restraint

High Material and Installation Costs

High upfront costs associated with premium exterior wall materials and system installation remain significant restraints on market growth. Advanced systems, such as unitized curtain walls or high‑performance ventilated facades, involve costly materials, specialized labour, and extended project timelines. For small and mid-sized construction firms, particularly in cost-sensitive markets, these factors can limit adoption and encourage the use of simpler alternatives. Budget constraints and short-term cost considerations hinder the growth of exterior wall systems across certain regions.

Market Opportunity

Retrofit and Renovation Projects in Mature Markets

Retrofit and renovation activities present a strong growth opportunity for the exterior wall system market in mature economies. Many existing buildings were constructed under older standards and lack adequate insulation, weather protection, or modern aesthetics. Upgrading exterior wall systems enhances energy efficiency, improves comfort, and extends the building's lifespan. Several European and North American governments have introduced incentive programs to support building envelope upgrades, encouraging property owners to invest in high-performance facades. These initiatives create consistent demand beyond new construction. By addressing retrofit needs, manufacturers and service providers can diversify revenue streams, strengthen long-term customer relationships, and support sustained market expansion.

Regional Analysis

According to Straits Research, North America dominated the market in 2025, accounting for 35.5% market share. The region is driven by mature construction industries, stringent building codes, and high adoption of advanced façade technologies. The region benefits from strong demand in commercial and high-rise residential projects where energy efficiency, fire resistance, and aesthetic appeal are priorities. The presence of leading manufacturers, coupled with sophisticated contractor networks and regulatory incentives for sustainable construction, ensures steady growth in both urban and suburban developments.

The U.S. is the largest single-country market in North America due to extensive urbanisation, high-rise construction, and regulatory focus on energy-efficient buildings. Developers are increasingly specifying curtain walls, aluminium composite panels, and EIFS for commercial and residential projects to meet sustainability certifications, such as LEED. High disposable budgets for commercial projects and established direct-to-contractor sales networks make the U.S. the growth engine of North America’s exterior wall systems market.

Asia Pacific Exterior Wall System Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 8.5% from 2026 to 2034. Rapid urbanisation, increasing high-rise residential and commercial construction, and rising regulatory focus on fire safety and thermal efficiency drive this growth. Increasing disposable income and a growing middle class support the demand for premium and sustainable exterior wall solutions. International and local players are expanding operations across China, India, and Southeast Asia, offering prefabricated, lightweight, and eco-friendly wall systems. Government initiatives promoting energy-efficient and disaster-resilient buildings accelerate the adoption of these practices.

China is the principal growth engine of APAC, driven by rapid urban development, skyscraper construction, and a focus on energy-efficient façades. Developers are increasingly opting for curtain walls, aluminium composite panels, and ventilated facades to meet safety and environmental standards. Government regulations on energy performance and fire safety, combined with growing consumer demand for aesthetically modern buildings, make China the primary driver of the Asia Pacific’s rapid growth in exterior wall systems.

Source: Straits Research

Europe Market Insights

Europe held a significant market share in 2025, driven by stringent building codes, urban redevelopment projects, and a strong emphasis on sustainability and energy efficiency. The adoption of ventilated façades, high-performance curtain walls, and modern cladding materials is widespread across commercial, residential, and public infrastructure projects. Europe’s market is supported by strong adoption of construction technology, environmental regulations, and high consumer awareness of building longevity and aesthetics.

Germany is the dominant European country, benefiting from a large industrial and commercial construction base, high building regulation standards, and sustainability mandates. A strong preference for durable, low-maintenance, and recyclable materials, coupled with advanced contractor capabilities, reinforces Germany’s leading role in Europe’s exterior wall system market.

Latin America Market Insights

Latin America exhibits steady growth, driven by rising urbanisation, expanding construction in mid-to-high-rise residential and commercial sectors, and enhanced building regulations. Countries such as Brazil and Mexico are increasingly adopting modern exterior wall systems to improve building durability, thermal insulation, and aesthetic appeal. Growth is also fueled by government initiatives to modernise urban infrastructure and align with international construction standards, particularly for export-oriented commercial projects.

Brazil leads the Latin American market due to its strong urban population growth, commercial construction expansion, and increasing adoption of aluminium and composite wall systems. The modernisation of building codes and the increasing presence of international contractors contribute to the steady adoption of innovative exterior wall solutions across Brazilian cities.

Middle East and Africa (MEA) Market Insights

The Middle East and Africa represent a smaller but strategically important segment. The market growth is driven by high-value commercial and residential developments in urban centres, government infrastructure projects, and the expansion of tourism-driven construction. Gulf Cooperation Council (GCC) countries are increasingly specifying aluminium curtain walls, composite panels, and ventilated façades to achieve iconic architectural designs while meeting fire safety and energy efficiency standards. Urban pockets in Africa are gradually adopting prefabricated wall systems in new high-rise and mixed-use developments.

The UAE is the leading country in MEA, supported by large-scale commercial, residential, and tourism-oriented construction projects. Developers are increasingly adopting prefabricated curtain walls, aluminium composite panels, and ventilated façades for skyscrapers and luxury residential projects. High investment capacity, coupled with advanced contractor networks and strong international contractor presence, positions the UAE as the primary market driver in the Middle East.

Product Type Insights

According to Straits Research, Curtain walls dominated the exterior wall system market with a 45% revenue share in 2025, driven by strong adoption in high-rise commercial and premium residential buildings. Their popularity stems from structural flexibility, modern aesthetics, and high daylight penetration. The balance of durability, performance efficiency, and architectural versatility positions curtain walls as the leading product type with sustained demand across large-scale construction projects.

Cladding panels, including metal, composite, and fibre-cement, are the fastest-growing segment, with a projected CAGR of 7.8% in 2025. These panels offer enhanced thermal performance, fire resistance, and aesthetic flexibility, appealing to architects and developers seeking both safety and visual impact. The rising demand for sustainable, lightweight, and low-maintenance materials is driving the acceleration of adoption, particularly in residential and mid-rise commercial projects.

Source: Straits Research

Material Insights

Aluminium-based exterior wall systems lead the material category with a 42% market share in 2025, due to their durability, corrosion resistance, lightweight structure, and recyclability. Aluminium is widely used in curtain walls, cladding panels, and EIFS frameworks due to its structural strength and adaptability to modern architectural designs. The material’s widespread availability and compatibility with sustainable construction trends continue to reinforce its market dominance.

Composite materials, including high-pressure laminates and aluminium composite panels, are the fastest-growing material subsegment, with a CAGR of 8.5%. They offer lightweight construction, fire resistance, and a range of finishes that mimic stone, metal, or wood, attracting designers who seek premium aesthetics at a reduced cost. Rising environmental awareness encourages the use of panels with recycled content.

End-Use Insights

Commercial construction dominates the end-use segment, with a market share of 48% in 2025, driven by rapid urbanisation, infrastructure development, and growing demand for high-rise office complexes, hotels, and retail spaces. Exterior wall systems are essential for meeting energy efficiency standards, fire codes, and aesthetic expectations in large-scale projects. The combination of regulatory compliance, design sophistication, and long-term durability drives the segment’s growth.

The residential building segment is the fastest-growing, expanding at a CAGR of 7.4%. The growth is attributed to rising disposable income, urban population growth, and the increasing adoption of multi-story housing and premium apartment complexes. Exterior wall systems are specified for thermal insulation, moisture control, and aesthetic appeal in high-end and mid-tier residential projects. This adoption accelerates market growth in the residential construction sector.

Distribution Channel Insights

Direct sales to construction companies and developers are expected to hold a 35% market share in 2025, supported by long-term contracts and bulk project procurement. Large construction firms prefer direct partnerships with wall system manufacturers to ensure customisation, quality control, and timely delivery. Direct engagement ensures better technical support, on-site consultation, and seamless integration with building systems, maintaining a competitive edge in distribution.

Dealer and distributor channels are the fastest-growing segment, with a CAGR of 7.6%, driven by expansion in emerging markets where small and mid-sized construction firms rely on local suppliers. Distributors offer access to a range of exterior wall products, installation support, and post-sales services, thereby lowering entry barriers for regional developers. The combination of convenience, technical guidance, and regional availability drives rapid growth through this channel.

Competitive Landscape

The exterior wall system market is moderately fragmented, characterised by a mix of legacy leaders, diversified manufacturers, and emerging innovation-driven players. Established companies dominate the market through their proven expertise in materials science, engineering, and project execution for commercial, residential, and institutional buildings. Mid-tier and newer entrants compete by offering cost-effective, lightweight, or eco-friendly façade solutions, leveraging modular designs, digital marketing, and regional production capabilities.

Schüco International: A Heritage Innovator

Schüco International is a long-standing leader in architectural façades and exterior wall systems, with a legacy spanning over 65 years. The company specialises in aluminium and glass façades, curtain walls, and energy-efficient building envelopes, appealing primarily to premium commercial and high-rise residential projects. Its global presence enables regional customisation, while supporting architects and developers with design software and prefabricated modular systems, allowing for faster installation and compliance with stringent energy codes. Schüco’s focus on premium, durable, and sustainable solutions positions it as a preferred partner for high-value projects.

Latest News:

- In January 2025, Schüco announced its participation in the BAU 2025 trade fair, where it presented solutions for the entire building lifecycle and expanded its "Schüco Carbon Control" range, focusing on reducing the carbon footprint of building envelopes.

List of Key and Emerging Players in Exterior Wall System Market

- Schüco International

- AluK Group

- Kawneer (Arconic)

- YKK AP Inc.

- Saint-Gobain Weber

- Kingspan Group

- Rockwool International

- Jangho Group

- Permasteelisa Group

- Reynaers Aluminium

- AHI Roofing & Cladding

- Hunter Douglas Architectural

- Metawall Systems

- CCL Industries (Facade Solutions)

- Alucobond (3A Composites)

- Permasteelisa North America

- Sapa Building Systems

- WICONA

- FunderMax

- SchlegelGiesse (Façade Components)

- Ubbink Building Solutions

- Architectural Systems

- Kingspan Light + Air

Strategic Initiatives

- October 2025 - Kingspan Group completed the acquisition of Mercor's ventilation and daylighting business. This acquisition expands Kingspan's competence and presence in Europe

- October 2025 - ALUCOBOND PLUS achieved a major milestone in fire safety compliance by successfully passing NFPA 285 testing with an industry-first 7-inch rainscreen air gap.

- July 2025 - Kingspan opened its new Insulated Panel plant in Mattoon, Illinois. This capacity expansion directly supports the rising demand for high-performance insulated wall panels in the North American market.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 152.60 billion |

| Market Size in 2026 | USD 161.82 billion |

| Market Size in 2034 | USD 265.75 billion |

| CAGR | 6.4% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Material, By End-Use, By Distribution Channel: |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Exterior Wall System Market Segments

By Product Type

- Curtain Walls (Unitised and Stick-Built)

- Cladding Panels (Metal, Composite, Stone, and Fibre Cement)

- Exterior Insulation and Finish Systems (EIFS)

- Ventilated Facades

- Prefabricated Modular Wall Systems

By Material

- Aluminum

- Glass

- Stone and Natural Materials

- Fibre Cement

- Composites (e.g., HPL, Aluminium Composite Panels)

By End-Use

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

By Distribution Channel:

- Direct Sales (to construction companies and developers)

- Dealer/Distributor Network

- E-commerce Platforms

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.