Immunoassay Market Size, Share & Trends Analysis Report By Product (Reagents & Kits, Analyzer, Software and Services), By Technology (ELISA, Rapid Tests, Western Blotting, Radioimmunoassay, Other technologies), By Specimen (Blood, Saliva, Urine, Other Specimen), By Application (Infectious diseases, Endocrinology, Oncology, Bone and mineral disorders, Cardiology, Blood screening, Autoimmune Disorders, Allergy Diagnostics, Toxicology, Other Application), By End-User (Hospitals, Clinical Laboratories, Pharmaceutical & Biotechnology Companies and CRO, Blood Banks, Research & Academic Laboratories, Home Care Setting, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Immunoassay Market Overview

The global immunoassay market size was estimated at USD 28.29 billion in 2025 and is anticipated to grow from USD 29.52 billion in 2026 till USD 42.43 billion by 2034, growing at a CAGR of 4.64% from 2026–2034. The global market growth is attributed to the rising prevalence of chronic and infectious diseases worldwide, growing demand for early and accurate disease diagnosis.

Key Market Trends & Insights

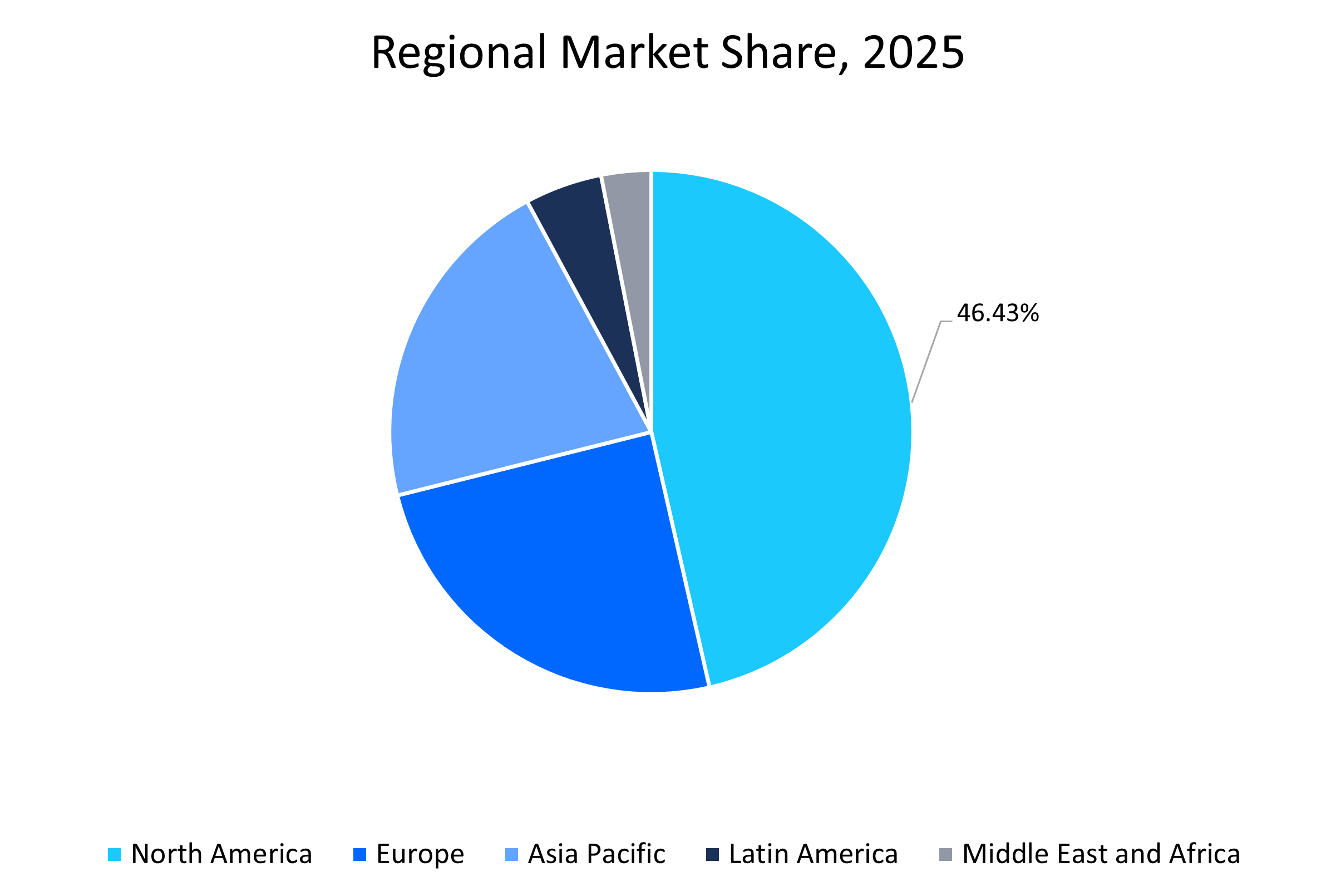

- North America held a dominant share of the global market with a market share of 46.43% in 2025, which is attributed to the advanced healthcare infrastructure, high disease prevalence, and strong R&D investments.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 5.9%, due to rising healthcare expenditure, increasing chronic diseases, and expanding diagnostics access.

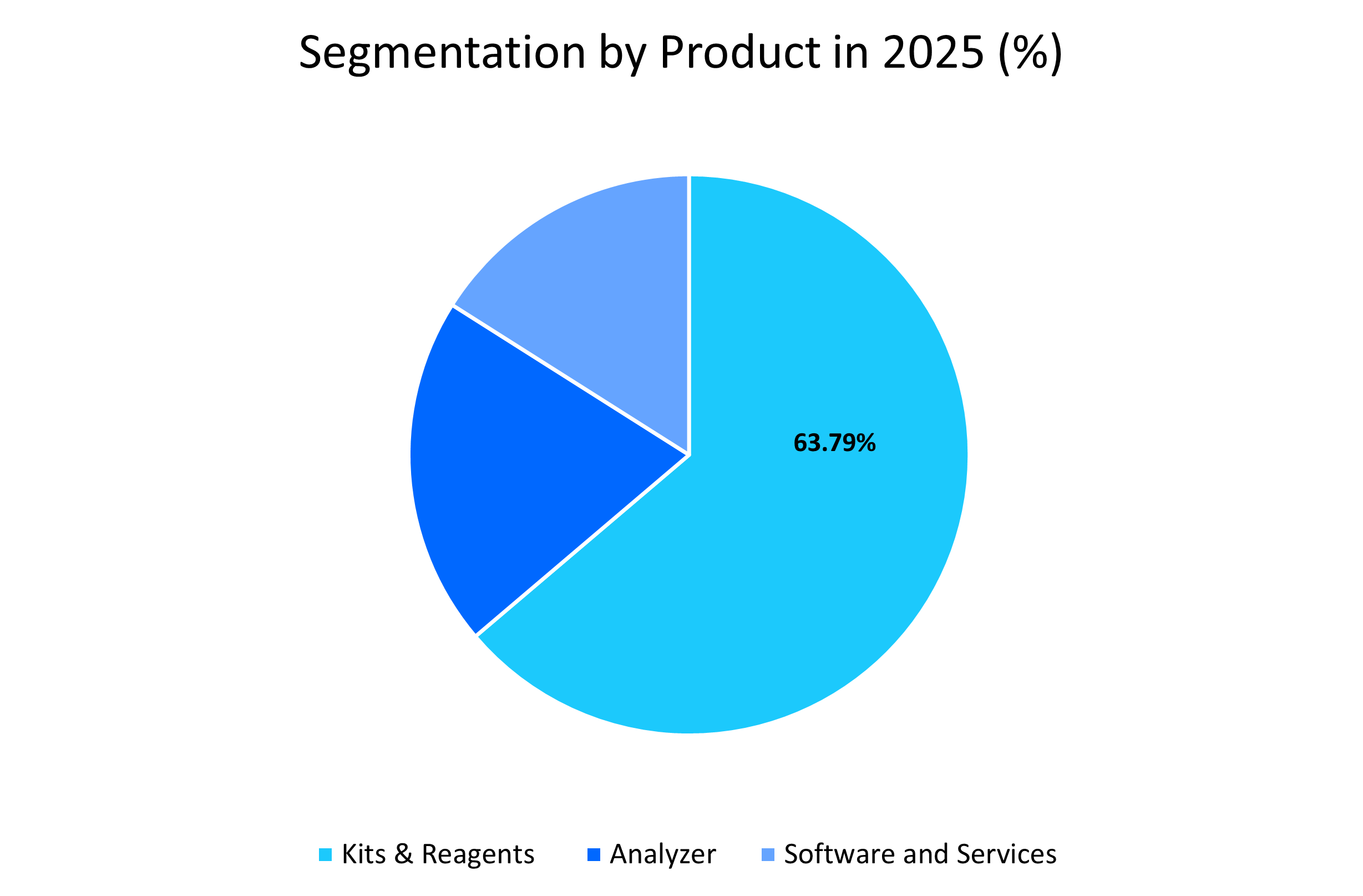

- Based on product, the reagents and kits segment led, holding a market share of 63.79% in 2025 due to their extensive use in clinical diagnostics and research applications.

- Based on technology, the ELISA segment is estimated to grow at a CAGR of 4.56%, due to its high sensitivity, accuracy, and wide applicability in disease detection.

- Based on the specimen, the blood segment led, holding a market share of 40.5% in 2025 due to its reliability, ease of collection, and compatibility with multiple assays.

- Based on application, the infectious diseases segment is estimated to grow at a CAGR of 5.01%, due to the increasing prevalence of viral and bacterial infections globally.

- Based on end user, the hospitals segment led, holding a market share of 31.5% in 2025 due to high patient inflow and adoption of advanced immunoassay systems.

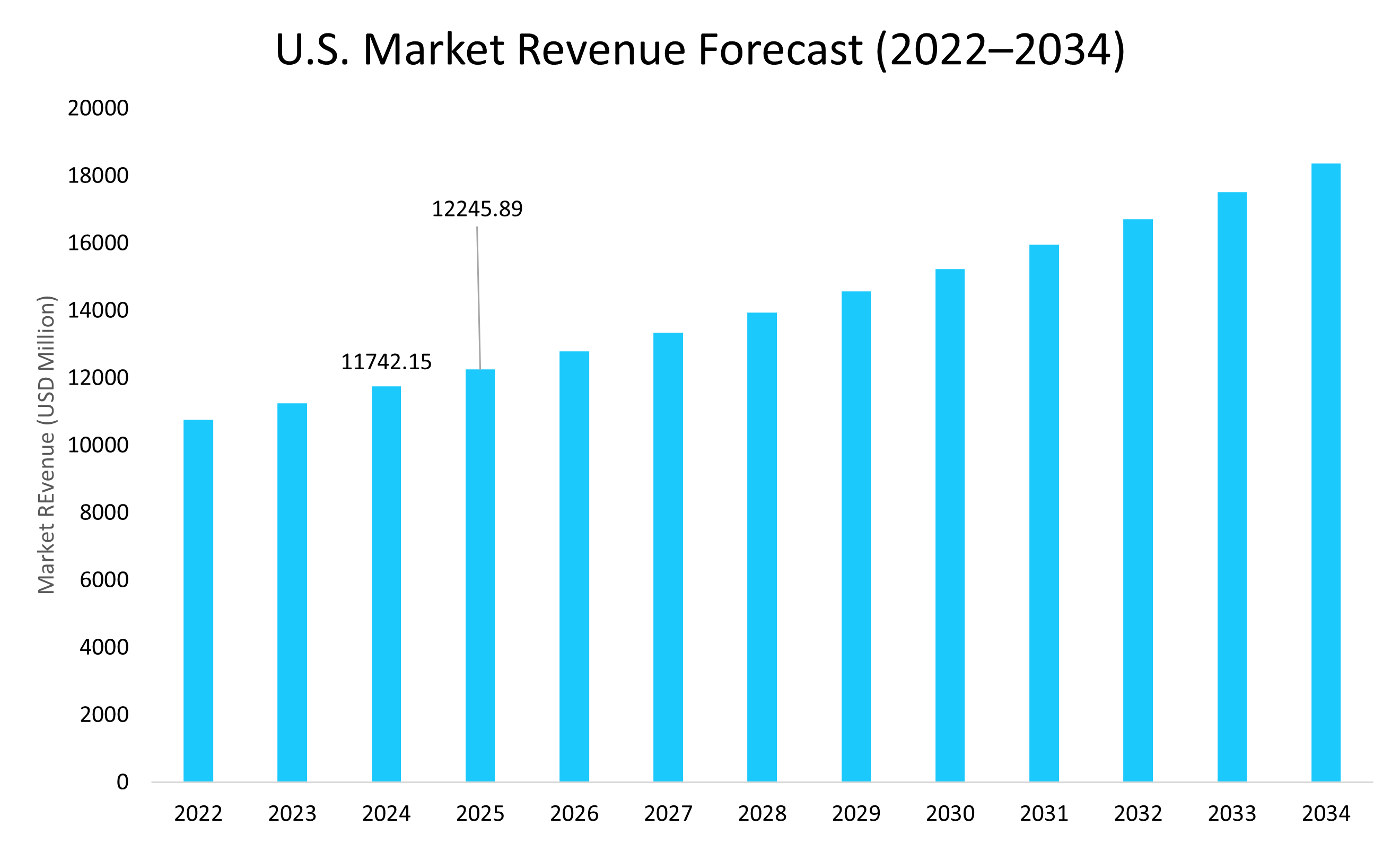

- The U.S. dominates the immunoassay market, valued at USD 11.74 billion in 2024 and reaching USD 12.24 billion in 2025.

Market Size and Forecast

- 2025 Market Size: USD 28.29 billion

- 2034 Projected Market Size: USD 42.43 billion

- CAGR (2026-2034): 4.64%

- North America: Largest market in 2025

- Fastest Growing Region: Asia Pacific

Source: Straits Research Analysis

The global immunoassay market growth is attributed to the rising prevalence of chronic and infectious diseases. Additionally, technological innovations and product approvals are expanding the market’s scope. For instance, in November 2024, NOWDiagnostics launched the First To Know Syphilis Test, the first FDA-authorized over-the-counter syphilis self-test in the U.S., delivering results in just 15 minutes. Such advancements highlight the growing shift toward rapid, accessible, and personalized diagnostic solutions.

Furthermore, the shift toward local manufacturing of rapid diagnostic kits in response to foreign aid cuts is boosting market expansion. For example, in June 2025, Codix Bio Ltd, in collaboration with SD Biosensor and supported by the WHO, began establishing a facility near Lagos to produce HIV and malaria test kits. With an initial capacity of 147 million kits, expandable to 160 million, this initiative ensures stable, local access to essential diagnostics across Nigeria and Sub-Saharan Africa. Collectively, these factors are estimated to drive the global market expansion.

Market Trends

Growing Use of Chemiluminescence Immunoassays over Traditional Elisa Methods

The global immunoassay market is witnessing a significant shift toward chemiluminescence immunoassays (CLIA) due to their higher sensitivity, precision, and faster turnaround times compared to traditional ELISA methods. CLIA is increasingly adopted in hospitals, laboratories, and point-of-care settings to support early disease detection and monitoring.

- For instance, at the Annual American Congress of Clinical Chemistry (ADLM) 2024 held in August, Wondfo introduced advanced devices, including the FC-2100 chemiluminescence immunoassay analyzer, Finecare FIA Meter X1 and X2, and Ucare-6000. The compact FC-2100 offers up to 200 tests per hour with results in just 12 minutes.

Such innovations highlight the rising preference for CLIA systems globally.

Growing Adoption of Point-of-Care Immunoassays

The growing adoption of point-of-care immunoassays is significantly boosting the global market, as these tests provide rapid, accurate, and convenient disease detection at decentralized healthcare facilities. Their increasing use in managing infectious diseases, chronic conditions, and emergency care is enhancing diagnostic efficiency and patient outcomes.

- For instance, in July 2025, Anbio Biotechnology Ltd. unveiled the Anbio AF-100S, a compact, automated, and affordable fluorescent immunoassay (FIA) analyzer designed for rapid point-of-care testing.

Such innovations strengthen accessibility, enabling timely treatment decisions and driving global immunoassay market growth.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 28.29 billion |

| Estimated 2026 Value | USD 29.52 billion |

| Projected 2034 Value | USD 42.43 billion |

| CAGR (2026-2034) | 4.64% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Abbott Laboratories, Hoffmann-La Roche Ltd., Siemens Healthineers, Danaher Corporation (Beckman Coulter), Thermo Fisher Scientific Inc. |

to learn more about this report Download Free Sample Report

Market Driving Factors

Rising Prevalence of Chronic and Infectious Diseases Worldwide

The global market is strongly driven by the rising prevalence of chronic and infectious diseases, creating a growing demand for reliable diagnostic tools. Chronic conditions and infectious outbreaks continue to burden healthcare systems, necessitating advanced testing solutions for early detection and effective management.

- For instance, the WHO 2025 report states that chronic conditions like cancer, diabetes, and cardiovascular diseases cause nearly 74% of global deaths, while as of May 2025, the global SARS-CoV-2 test positivity rate reached 11%, indicating a resurgence of COVID-19 activity.

Immunoassays, with their high sensitivity and specificity, play a crucial role in monitoring disease progression, guiding treatment, and improving patient outcomes globally.

Growing Demand for Early and Accurate Disease Diagnosis

The global immunoassay market is significantly driven by the rising need for early and precise disease detection to improve treatment outcomes. Immunoassays provide high sensitivity and specificity, making them indispensable in diagnosing chronic and infectious diseases.

- For instance, according to an article published in PubMed 2024, a high-sensitivity troponin T assay, measured two hours after symptom onset, delivers 92.2% sensitivity and 79.7% specificity for diagnosing non-ST-segment elevation myocardial infarction, a substantial improvement over conventional assays.

Such advancements highlight the growing reliance on immunoassays for timely and reliable clinical decisions.

Market Restraint

High Cost of Advanced Systems and Reagents

The high cost of advanced immunoassay systems and reagents remains a significant restraint to market growth, particularly in resource-limited settings. These systems require prominent investment in both equipment and consumables, making affordability a challenge for smaller laboratories and healthcare facilities.

- For instance, the price range for new immunoassay systems can start around $30,000 and easily exceed $200,000, with costs depending on the level of automation, throughput, and advanced features.

Additionally, recurring expenses for specialized reagents and maintenance further increase the financial burden, restricting wider adoption in developing regions.

Market Opportunities

Expanding Immunoassay Applications in Veterinary Diagnostics

The veterinary diagnostics sector is emerging as a significant growth avenue for immunoassays, driven by rising awareness of animal health and the increasing prevalence of zoonotic and infectious diseases among pets and livestock. Immunoassays offer rapid, accurate, and cost-effective diagnostic solutions for veterinary clinics and research laboratories.

- For instance, in February 2025, Bioteke Corporation (Wuxi) introduced a series of rapid immunochromatographic assay kits that detect key pet pathogens, such as feline parvovirus, canine distemper, and rabies, within 15–20 minutes.

Such advancements highlight a widening opportunity to diversify applications and capture growth in emerging diagnostic segments.

Regional Analysis

North America

The North American region dominated the market with a revenue share of 46.43% in 2025. The growth is attributed to the region’s high disease burden. According to the CDC, 6 in 10 U.S. adults live with at least one chronic condition, creating consistent demand for advanced diagnostics. Leading players such as Abbott, Thermo Fisher Scientific, and Bio-Rad Laboratories are driving innovation, with Abbott’s BinaxNOW rapid COVID-19 test highlighting the importance of point-of-care immunoassays. The region is also advancing in AI-powered automation and multiplex technologies to improve efficiency. Notably, in April 2024, Bio-Rad launched its ddPLEX ESR1 Mutation Detection Kit, a multiplexed digital PCR assay for oncology, strengthening precision medicine applications and fueling regional market growth.

Asia Pacific

The Asia Pacific region is the fastest-growing region with a CAGR of 5.9% during the forecast timeframe, driven by the growing prevalence of infectious and chronic diseases, rising healthcare awareness, and supportive government initiatives. The WHO South East Asia Region 2024 report stated that chronic diseases are responsible for 55% of all deaths (approx. 9 million people) in 2024, with around half of these occurring prematurely, before age 70. Companies like Roche, Abbott, and Siemens have increased collaborations with Indian and Chinese hospitals to introduce rapid point-of-care kits. Additionally, startups such as Medgenome in India and China’s BGI Group are advancing biomarker-based testing. Government initiatives, including India’s “Ayushman Bharat” scheme and China’s “Healthy China 2030” plan, are expanding diagnostic access to rural populations, further driving market growth.

Source: Straits Research Analysis

Country Analysis

U.s. Market Trends

The U.S. immunoassay market is expanding rapidly, driven by strong investments, advanced R&D, and rising demand for precision diagnostics. For instance, in April 2025, Thermo Fisher announced a USD 2 billion investment, allocating USD 1.5 billion for manufacturing expansion and USD 500 million for R&D, underscoring efforts to strengthen domestic biotech infrastructure and accelerate innovation in diagnostics.

China Market Growth Factors

In China, the market is witnessing strong growth as pharmaceutical R&D firms shift toward locally produced reagents and kits to offset high U.S. import tariffs. Domestic suppliers like Shanghai Titan Scientific and Nanjing Vazyme Biotech are emerging as key partners, with companies such as ChemPartner increasingly sourcing locally, ensuring cost efficiency, faster delivery, and stronger supply chain resilience.

India Market Trends

The Indian immunoassay industry is growing rapidly due to the surging prevalence of chronic and infectious diseases and the increasing adoption of point-of-care diagnostics. For instance, according to the Times of India, in Mumbai from January to mid-August 2025, malaria cases rose 20% (from 4,021 to 4,825) and chikungunya surged 56% (from 210 to 328) compared to 2024, underscoring the urgent need for rapid and reliable diagnostic solutions.

Germany Market Growth Factors

Germany's market for immunoassay is witnessing significant growth, driven by strategic acquisitions and rising disease burden. For instance, in February 2025, Medix Biochemica acquired Candor Bioscience GmbH, a leading immunoassay provider based in Wangen. Additionally, the growing need for disease monitoring is evident, as the Robert Koch Institute (RKI) reported 4,481 tuberculosis cases in 2023, with an incidence rate of 5.3 per 100,000 population, thereby driving the regional market expansion.

Uk Market Trends

The UK immunoassay industry holds significant potential, supported by a strong life sciences ecosystem and rising investor confidence. Beyond clinical demand, growth is increasingly fueled by capital inflows that enable manufacturers to accelerate R&D, scale production, and diversify portfolios. As per Labiotech (2024), the UK biotech industry raised approximately £3.5 billion in equity investment in 2024, marking a 94% increase from 2023, with venture capital funding alone surging 64.8% to £2.06 billion. This robust investment landscape highlights the UK’s role as a leading hub for diagnostic innovation, creating a favorable environment for immunoassay market expansion.

Market Segmentation

Product Insights

The reagents and kits segment dominated the market with a revenue share of 63.79% in 2025. This segment’s prominence is driven by its extensive use in clinical diagnostics and research applications. High demand for ELISA, rapid tests, and Western blot reagents supports consistent market growth globally.

Source: Straits Research Analysis

Technology Insights

The ELISA segment dominated the market in 2025 and is anticipated to expand at a CAGR of 4.56%. ELISA’s accuracy, sensitivity, and wide applicability in detecting infectious diseases, hormones, and biomarkers make it the preferred technology. Its established protocols and reliability in laboratories further reinforce its leading position in the global immunoassay market.

Specimen Insights

The blood segment dominated the market with a revenue share of 40.5% in 2025. Manufacturers are witnessing strong growth in blood-based immunoassays due to their reliability in detecting pathogens, hormones, and biomarkers. Standardized collection and testing protocols simplify product development and regulatory approval. Their compatibility with multiple assay technologies enables versatile, scalable diagnostic platforms, making blood specimens the preferred choice across global healthcare markets.

Application Insights

The infectious diseases segment dominated the market in 2025, and is expected to grow at a CAGR of 5.01%. Rising global prevalence of viral and bacterial infections, combined with heightened demand for early, precise diagnostics, continues to fuel segment expansion. For manufacturers, this translates into sustained opportunities for high-volume test development, product differentiation through rapid and multiplexed platforms, and long-term revenue stability, making infectious diseases the largest and most commercially attractive application area for immunoassay technologies worldwide.

End-User Insights

The hospitals segment dominated the market with a revenue share of 31.5% in 2025. Their dominance is attributed to higher test volumes translating into significant revenue generation, centralized procurement of advanced immunoassay platforms, and stronger bargaining power with suppliers, which reinforces their leading market position.

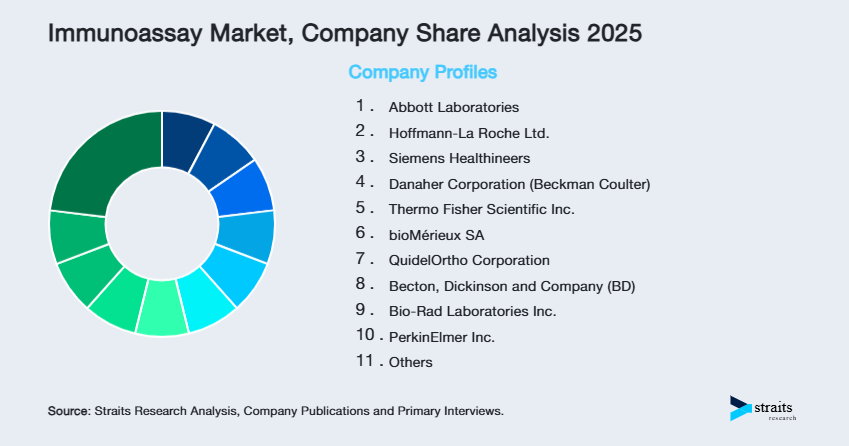

Competitive Landscape

The global immunoassay market is moderately fragmented in nature due to numerous global and regional players competing across diverse immunoassay applications. The top players in the industry are Abbott Laboratories, F. Hoffmann-La Roche Ltd., Siemens Healthineers, Danaher Corporation, Thermo Fisher Scientific Inc., bioMérieux SA, and others.

The industry participants are inclined towards product expansion to meet growing demand, diversify offerings, enhance competitive advantage, adopt advanced technologies, and cater to emerging applications in diagnostics, personalized medicine, and point-of-care testing.

Labcorp: An Emerging Market Player

Labcorp, a leading global life sciences company, offers extensive diagnostic solutions, including immunoassay-based testing. With advanced laboratories, strong R&D, and strategic collaborations, Labcorp plays a vital role in disease diagnosis, drug development, and personalized healthcare services worldwide.

- In April 2025, Labcorp launched a blood-based immunoassay measuring pTau-217/Beta-Amyloid 42 ratio, offering 95% sensitivity and specificity for Alzheimer’s diagnosis. This first-of-its-kind test provides a less invasive, accessible alternative to PET imaging and CSF testing across clinical settings.

List of Key and Emerging Players in Immunoassay Market

- Abbott Laboratories

- Hoffmann-La Roche Ltd.

- Siemens Healthineers

- Danaher Corporation (Beckman Coulter)

- Thermo Fisher Scientific Inc.

- bioMérieux SA

- QuidelOrtho Corporation

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories Inc.

- PerkinElmer Inc.

- Sysmex Corporation

- Agilent Technologies Inc.

- Merck KGaA

- DiaSorin S.p.A.

- Mindray Medical International Limited

- Labcorp

to learn more about this report Download Market Share

Recent Developments

- July 2025- Spear Bio launched SPEAR UltraDetect, a next-generation ultrasensitive immunoassay platform enabling high precision detection of neurological biomarkers like pTau217 and NfL from minimal blood samples. Partnered with Bio-Techne for global distribution, it advances non-invasive neurodegenerative disease diagnostics.

- June 2025- Quanterix received Class 1 Medical Device registration in South Korea for its Simoa HD-X Immunoassay Analyzer, expanding access to ultrasensitive biomarker detection for neurological diseases like Alzheimer’s, strengthening its international footprint in advanced diagnostic solutions.

Analyst Opinion

As per our analyst, the growth of the global market is strongly driven by manufacturers’ focus on developing high-sensitivity, rapid, and automated platforms to meet rising diagnostic demand. Companies are investing in multiplexing technologies, AI integration, and portable devices to expand clinical and point-of-care applications. Strategic collaborations with pharmaceutical firms and rising demand for personalized medicine further create lucrative opportunities, positioning manufacturers to capture wider market share and long-term growth.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 28.29 billion |

| Market Size in 2026 | USD 29.52 billion |

| Market Size in 2034 | USD 42.43 billion |

| CAGR | 4.64% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Technology, By Specimen, By Application, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Immunoassay Market Segments

By Product

-

Reagents & Kits

- ELISA Reagents & Kits

- Rapid Test Reagent & Kits

- ELISpot Reagents & Kits

- Western Blot Reagents & Kits

- Other Reagents & Kits

-

Analyzer

- Open-ended System

- Closed-Ended System

- Software and Services

By Technology

- ELISA

- Rapid Tests

- Western Blotting

- Radioimmunoassay

- Other technologies

By Specimen

- Blood

- Saliva

- Urine

- Other Specimen

By Application

- Infectious diseases

- Endocrinology

- Oncology

- Bone and mineral disorders

- Cardiology

- Blood screening

- Autoimmune Disorders

- Allergy Diagnostics

- Toxicology

- Other Application

By End-User

- Hospitals

- Clinical Laboratories

- Pharmaceutical & Biotechnology Companies and CRO

- Blood Banks

- Research & Academic Laboratories

- Home Care Setting

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.