Knee Replacement Market Size, Share & Trends Analysis Report By Type (Total Knee Replacement, Partial Knee Replacement, Revision Knee Replacement), By Implant Type (Fixed Bearing, Mobile Bearing), By End-User (Hospitals, Orthopedic Clinics, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Knee Replacement Market Size

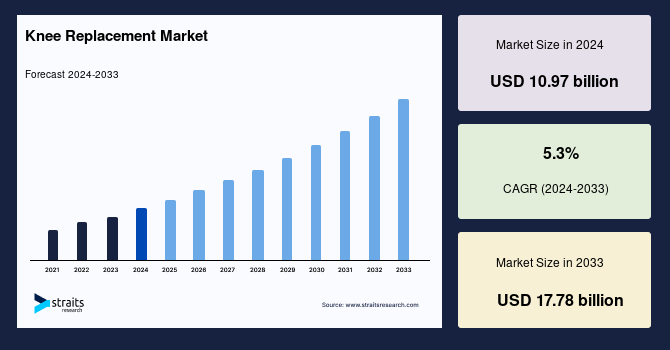

The global knee replacement market size was valued at USD 10.97 billion in 2024 and is projected to grow from USD 11.72 billion in 2025 to reach USD 17.78 billion by 2033, exhibiting a CAGR of 5.3% during the forecast period (2025-2033).

Knee replacement surgery involves the insertion of an implant to replace one or both components of the knee joint surface, often due to arthritis or fractures. The primary driver for the growth in knee replacement procedures is the rise in osteoarthritis, coupled with the aging population and the development of advanced materials used in newer implants. Moreover, the use of minimally invasive surgical techniques is improving patient outcomes and accelerating adoption.

Another key factor fueling market growth is the expansion of healthcare infrastructure, along with the rise of robotic surgeries, which are enhancing the precision and efficiency of knee replacements. As more attention is placed on joint replacement, the demand for knee surgeries continues to rise globally.

- For example, in January 2024, the Mayo Clinic highlighted the significant progress in replacement treatments, citing how osteoarthritis, driven by a growing global population, is contributing to the surge in procedures. Global demand for knee replacements already exceeds 1 million annually, with the U.S. alone expected to see a staggering 673% increase, reaching 3.41 million procedures by 2030.

As surgical techniques improve and replacement becomes more widely accepted, the market is expected to experience significant growth, offering better outcomes and a greater adoption rate worldwide.

Market Trends

Increasing Demand for Robotic-Assisted Surgery in Knee Replacement

Robot-assisted knee replacement surgery is gaining popularity due to its ability to offer greater accuracy, reduce post-surgery complications, and shorten recovery times. This advancement is transforming the way replacement surgeries are performed, with increasing patient and hospital adoption driven by improved clinical outcomes.

- For example, a May 2024 case study released by UT Southwestern and published in the Archives of Orthopaedic and Trauma Surgery revealed that robotic-assisted total knee arthroplasty (TKA) results in shorter hospitalization times and fewer post-operative complications. This growing trend reflects hospitals and patients increasingly weighing the cost trade-off against the significant improvement in clinical results.

As robotic-assisted surgery continues to demonstrate superior precision and efficiency, its market penetration is expected to rise steadily.

Rising Demand for Ai-Driven Knee Implants

The integration of Artificial Intelligence (AI) with knee implants is emerging as a game-changing trend, offering more personalized, precise, and long-lasting implant solutions. AI algorithms analyze patient-specific data, such as medical images and biomechanics, to create custom-designed implants that ensure a perfect fit and optimal function.

- For instance, in December 2024, a blog by Madison Ortho discussed how AI is revolutionizing orthopedic implants, enabling more personalized designs and a wider selection of materials, which contributes to enhanced surgical accuracy.

AI-driven implants are gaining traction due to their potential to improve fit, function, and longevity. As a result, they are anticipated to drive significant demand in the global market, propelling its growth trajectory.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 10.97 Billion |

| Estimated 2025 Value | USD 11.72 Billion |

| Projected 2033 Value | USD 17.78 Billion |

| CAGR (2025-2033) | 5.3% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Stryker (Michigan, U.S.), Aesculap, Inc.– a B. Braun company, Medacta International, DePuy Synthes (Johnson & Johnson Services, Inc.), Zimmer Biomet |

to learn more about this report Download Free Sample Report

Knee Replacement Market Growth Factors

Rising Prevalence of Osteoarthritis & Joint Disorders

The increasing prevalence of osteoarthritis and other joint disorders is one of the primary growth drivers in the knee replacement industry. Many patients suffering from debilitating pain and restricted mobility due to osteoarthritis, rheumatoid arthritis, or joint injuries eventually require knee replacement surgery when conservative treatments fail to provide relief.

- A February 2024 report by the American College of Rheumatology revealed that the number of total knee replacements in the U.S. has reached 790,000 annually, with projections for significant growth due to the aging population. As non-surgical options (medications, physical therapy, joint injections) become less effective over time, knee surgery becomes a necessary next step for many patients.

This trend highlights the increasing demand for knee replacements as healthcare professionals focus on improving patient outcomes through advanced implant technologies and minimally invasive surgical techniques.

Technological Advancements in Surgical Techniques & Implants in Knee Replacement

Recent technological advancements in knee replacement surgeries have significantly improved the precision, longevity, and recovery time associated with the procedure. New implant designs and surgical techniques, such as robotic-assisted surgeries, have revolutionized the field by offering better accuracy and longer-lasting results.

- For instance, in January 2024, Henry Ford Health showcased advancements in joint replacement surgery, including robot-assisted surgeries, nanophydr implants, and smart sensors. These innovations lead to more accurate surgeries, longer-lasting implants, and the ability to monitor patient recovery in real-time.

With a larger eligible patient population and continued advancements in surgical performance, these innovations are expected to reduce revision rates and improve post-operative rehabilitation, further driving the growth of the global knee replacement market.

Market Restraining Factors

High Cost of Advanced Surgical Procedures

One of the key restraining factors in the global market is the high cost of advanced surgical procedures. Techniques such as robotic-assisted surgeries, AI-designed implants, and 3D-printed implants offer improved accuracy and outcomes but come with significant costs. Robotic knee replacement, in particular, is much more expensive than traditional methods and may be out of reach for individuals with limited insurance coverage. Moreover, hospitals and surgical centers face high capital costs for purchasing robotic systems and training surgeons, further driving up the price of these procedures and limiting broader adoption, thus hindering market growth.

Key Market Opportunity

Advancements in Biocompatible Implant Materials for Knee Replacement

Recent advancements in biocompatible implant materials have significantly enhanced the longevity, integration, and clinical outcomes of knee replacements. The development of innovative biomaterials, including advanced alloys, smart implants, and 3D-printed parts, is transforming the knee replacement landscape. These materials not only improve the durability of implants but also aid in post-operative tracking, reducing complications and improving recovery times.

- For instance, in August 2024, Bonetech Medisys showcased cutting-edge technologies in orthopedic materials, including biomaterial alloys and smart implants, specifically designed to improve knee replacement outcomes. These enable better fit and function, reducing the need for revision surgeries and enhancing long-term success rates.

The continuous evolution of biocompatible implant materials presents a significant opportunity to meet the growing demand for personalized, long-lasting solutions.

Regional Insights

North America maintains a dominant position in the global knee replacement market with 40.2% market share, driven by a high prevalence of osteoarthritis, an aging population, and a well-established healthcare infrastructure. The region's robust reimbursement policies further support widespread access to knee replacement procedures. Major industry players’ strong presence and the increasing focus on early diagnosis, along with improved rehabilitation strategies, enhance the appeal of knee replacement surgeries, ensuring sustained market growth across North America. Moreover, the adoption of robotic-assisted knee replacement systems and ongoing medical advancements contribute to market growth.

The U.S. leads the market for knee replacement due to a high prevalence of joint disorders and advanced healthcare infrastructure. A 2023 report by the American Joint Replacement Registry (AJRR) showed a 23% increase in total knee arthroplasty (TKA) procedures, with a sixfold rise in caliper-tracked TKA over six years. This reflects the growing adoption of advanced technologies, further boosting the U.S. market’s progression and reinforcing the country’s leadership in knee replacement surgeries.

Asia Pacific Knee Replacement Market Trends

Asia-Pacific is poised to experience the fastest market growth, driven by a rapidly increasing elderly population and a rising prevalence of osteoarthritis. With ongoing infrastructural development and the growing popularity of medical tourism, more patients are seeking knee replacement surgeries. As the region's economies improve, healthcare spending is increasing, and people are becoming more aware of the benefits of knee replacement procedures. The introduction of government programs designed to enhance orthopedic access and the entry of low-cost implant options by new market players are fueling the region's rapid growth.

China’s knee replacement market is expanding rapidly, fueled by the country’s aging population and improved healthcare facilities. A real-world study in June 2024 highlighted a fivefold increase in TKA procedures over the past decade, with younger patients (<50) now accounting for 6.2% of cases. This growth, combined with enhanced infrastructure and a growing economy, is propelling China’s market toward significant expansion.

India’s market for knee replacement is growing rapidly, fueled by a high incidence of osteoarthritis and the availability of cost-effective surgical solutions. In July 2024, Pristyn Care reported a 90% success rate for knee replacement surgeries, which has significantly boosted patient confidence. With improving orthopedic facilities and skilled surgeons, India’s market is seeing a surge in demand, further accelerated by the country’s growing healthcare accessibility and awareness.

Japan’s knee replacement industry is experiencing significant growth, largely due to its aging population and advancements in surgical technology. The adoption of robotic-assisted surgeries, high-quality implant materials, and minimally invasive techniques has improved both surgical outcomes and patient recovery times. Japan’s universal healthcare system ensures broad accessibility to knee replacement surgeries, contributing to the country’s market growth.

Middle East and Africa Knee Replacement Market Trends

Saudi Arabia’s market for knee replacement is expanding, driven by the country's investment in healthcare as part of Vision 2030. High government spending on health and an increase in osteoarthritis cases have contributed to the growth of knee replacement procedures. The country’s top-tier hospitals, specialized orthopedic units, and a burgeoning medical tourism sector have enhanced the quality of care, making Saudi Arabia a prominent player in the market.

Europe Knee Replacement Market Trends

Germany is one of Europe’s largest markets, driven by the increasing adoption of innovative surgical procedures and a rise in joint disorders. A 2023 study of 2.2 million primary TKA cases found a significant rise in robotic-assisted procedures. The use of computer navigation and robotics has improved surgical precision, patient outcomes, and overall success rates, positioning Germany as a key player in the European market.

France’s knee replacement industry growth is driven by advanced healthcare infrastructure, unique surgical techniques, and strong government support for medical innovation. The country’s well-developed orthopedic centers, skilled surgeons, and ongoing research have improved surgical success rates, positioning France as a leader in knee replacement procedures. These factors, coupled with continuous medical advancements, are fueling regional growth.

Type Insights

Total knee replacement (TKR) leads the market, driven by the prevalence of severe osteoarthritis, the aging population, and continuous innovations in implant technology that enhance durability and functionality.

- According to a 2024 report by the American Academy of Orthopaedic Surgeons (AAOS), over 700,000 total knee replacements are performed annually in the U.S., with a 90% success rate at 15 years and 82% durability at 25 years.

These high success rates, combined with improved mobility and long-term effectiveness, make TKR the preferred choice for patients with end-stage knee arthritis.

Implant Type Insights

The fixed-bearing implant segment dominates the global market due to its higher durability, stability, and cost-effectiveness compared to mobile-bearing implants. With a simpler design, fixed bearings are less prone to wear and loosening, making them particularly suitable for older patients with lower activity levels. These factors contribute to the continued growth of the market as fixed-bearing implants remain the first choice for a wide range of patients, particularly those seeking reliable, long-lasting solutions.

End-User Insights

Hospitals hold the largest share of knee replacements due to their high-quality surgical facilities, expert orthopedic surgeons, and comprehensive post-operative care. Offering a complete treatment package from pre-surgery consultations to rehabilitation, hospitals attract more patients compared to orthopedic clinics. Moreover, hospital-based procedures often benefit from insurance coverage, making them a more accessible option for many patients. This makes hospitals the preferred setting for knee replacement surgeries, thus driving the market’s growth in the healthcare sector.

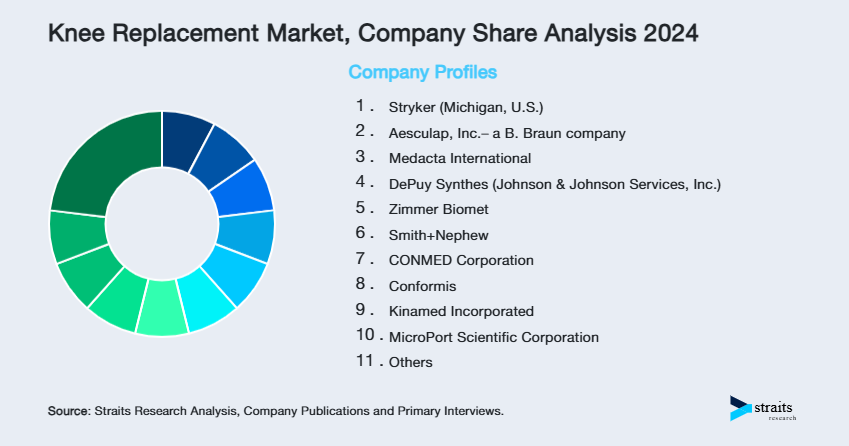

Company Market Share

Key players in the industry are focusing on adopting a range of strategic business strategies, such as strategic collaborations, product approvals, acquisitions, and product launches, to gain a strong foothold in the market. These players are also investing heavily in research and development to innovate and enhance the quality of knee implants, incorporating advanced technologies like robotic-assisted surgeries and AI-driven implant designs.

Stryker: An Emerging Player in the Global Knee Replacement Market

Stryker is a medical technology-based firm focused on orthopedic implants, surgical equipment, neurotechnology, and spine products. Stryker is credited with innovations in joint replacement, robotic-assisted surgery (MAKO), and advanced medical devices, leading to enhanced patient outcomes and efficiency in healthcare globally.

Recent Developments by Stryker:

- In December 2023, Stryker announced its plans to acquire France's SERF SAS, a firm renowned for innovations in hip implants. The acquisition is intended to enhance Stryker's joint replacement business in Europe and around the world.

List of Key and Emerging Players in Knee Replacement Market

- Stryker (Michigan, U.S.)

- Aesculap, Inc.– a B. Braun company

- Medacta International

- DePuy Synthes (Johnson & Johnson Services, Inc.)

- Zimmer Biomet

- Smith+Nephew

- CONMED Corporation

- Conformis

- Kinamed Incorporated

- MicroPort Scientific Corporation

- Corin Group

- SurgTech Inc.

- Allegra

- Amplitude Surgical

- Enovis Corporation

to learn more about this report Download Market Share

Recent Developments

- June 2024 – Zimmer Biomet signed a limited distribution deal with THINK Surgical to distribute the TMINI Miniature Handheld Robotic System for total knee arthroplasty. This partnership complements Zimmer Biomet's ROSA Robotics platform with the addition of a handheld robot solution for accurate implant placement.

- June 2024 – DePuy Synthes gained 510(k) FDA clearance for the VELYS Robotic-Assisted Solution in Unicompartmental Knee Arthroplasty (UKA). The move is an extension of its current total knee arthroplasty platform, increasing accuracy and efficiency in partial knee replacement.

Analyst Opinion

As per our analyst, the global knee replacement market is poised for significant growth, driven by key factors such as the aging population, the rising prevalence of osteoarthritis, and advancements in surgical technologies like robot-assisted knee replacements. The growing adoption of minimally invasive procedures, along with innovations in implant materials and designs, is resulting in improved patient outcomes and longer implant survival.

Despite these promising factors, the market faces several challenges. High costs associated with advanced surgical procedures, such as robotic-assisted surgeries and AI-driven implants, remain a significant barrier for many patients, particularly in regions with less robust insurance systems. Moreover, while technological innovations offer better outcomes, their accessibility is often limited to well-developed markets or high-end healthcare facilities.

However, ongoing innovation, such as the development of smart implants and AI-driven surgical planning, along with the expanding presence of cost-effective implant solutions in emerging markets, are expected to address these challenges and fuel continued market growth in the coming years. With an increased focus on improving surgical efficiency, accessibility, and patient recovery, the market is set to advance steadily.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 10.97 Billion |

| Market Size in 2025 | USD 11.72 Billion |

| Market Size in 2033 | USD 17.78 Billion |

| CAGR | 5.3% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Implant Type, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Knee Replacement Market Segments

By Type

- Total Knee Replacement

- Partial Knee Replacement

- Revision Knee Replacement

By Implant Type

- Fixed Bearing

- Mobile Bearing

By End-User

- Hospitals

- Orthopedic Clinics

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.