Long Duration Energy Storage Market Size, Share & Trends Analysis Report By Technology Type (Hydrogen-based energy storage, Compressed air energy storage, Thermal energy storage, Mechanical gravity storage), By Storage Duration (Medium duration 4 to 10 hours, Long duration, 10 to 100 hours, Ultra long duration above 100 hours), By Project Archetype (Bulk energy shifting, Seasonal storage, Island and remote grid reinforcement), By End Use (Utility resource adequacy, Peaker plant replacement, Grid resilience and blackout prevention) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Long Duration Energy Storage Market Overview

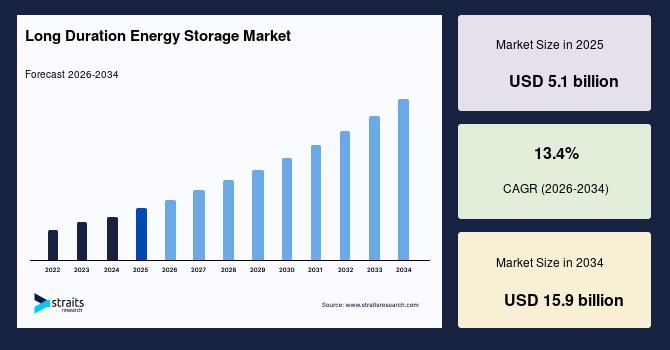

The global long duration energy storage market size is valued at USD 5.1 billion in 2025 and is projected to reach USD 15.9 billion by 2034, growing at a CAGR of 13.4% during the forecast period. The strong expansion of the market is driven by the accelerating integration of long-duration technologies such as hydrogen storage, compressed air systems, thermal solutions, and gravity-based mechanisms, which enhance grid flexibility, support renewable energy firming, and enable reliable multi-hour to multi-day energy supply for utilities and large-scale operators. Growing demand for resource adequacy, peaker plant replacement, and grid resilience further encourages the adoption of long-duration storage as a core pillar of future clean energy infrastructure.

Key Market Trends And Insights

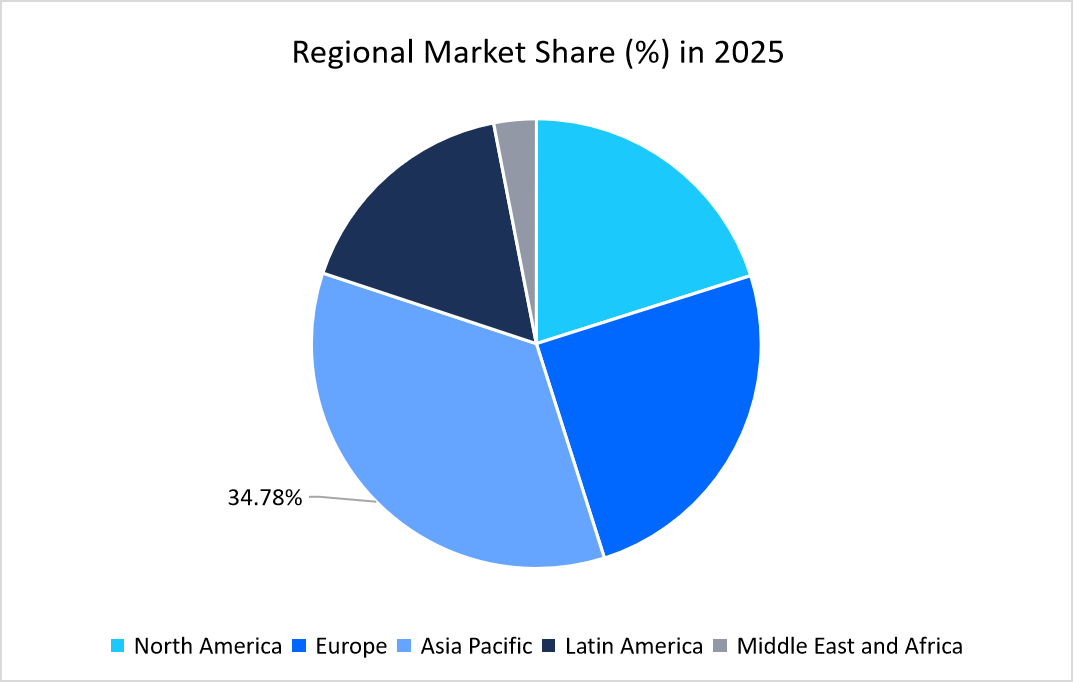

- Asia Pacific dominated the market with a revenue share of 34.78% in 2025.

- Europe is anticipated to grow at the fastest CAGR of 14.92% during the forecast period.

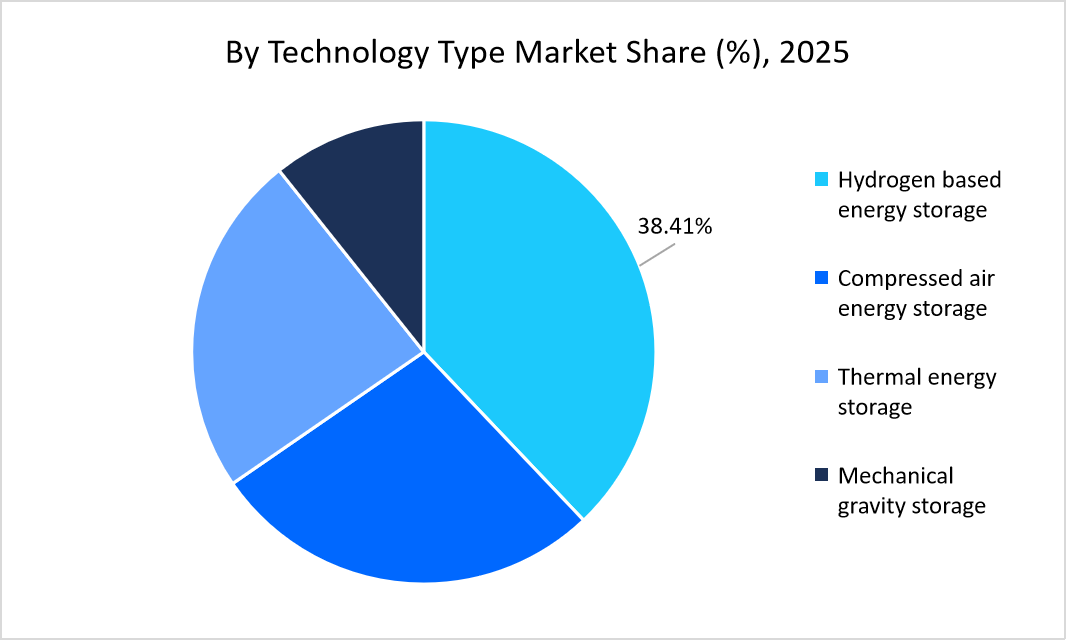

- Based on technology type, the Hydrogen-Based Energy Storage segment held the highest market share of 38.41% in 2025.

- By storage duration, the Long Duration (10 to 100 hours) segment is estimated to register the fastest CAGR growth of 15.12%.

- Based on the project archetype, the Bulk Energy Shifting segment dominated the market in 2025 with a market share of 36.27%.

- By end-use, the Utility Resource Adequacy segment is projected to grow at the fastest CAGR of 14.36% during the forecast period.

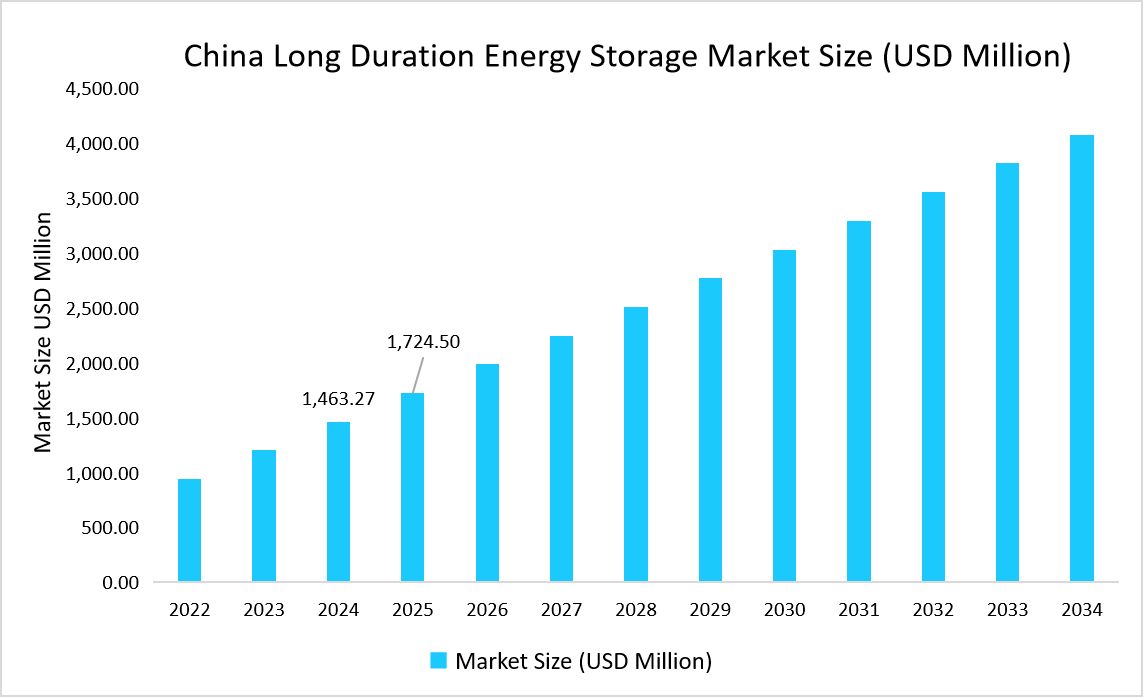

- China dominates the Long Duration Energy Storage Market, valued at USD 1.46 billion in 2024 and reaching USD 1.72 billion in 2025.

Source: Straits Research

Market Size and Forecast

- 2025 Market Size: USD 5.1 billion

- 2034 Projected Market Size: USD 15.9 billion

- CAGR (2026-2034): 13.4%

- Dominating Region: Asia Pacific

- Fastest-Growing Region: Europe

The global long duration energy storage market involves a broad range of advanced storage technologies, including hydrogen-based energy storage, compressed air energy storage, thermal energy storage, and mechanical gravity systems designed to offer multi-hour to multi-day flexibility. These solutions operate at a wide range of storage durations-from medium-duration systems with up to 4 to 10 hours, to long-duration systems from 10 to 100 hours, and ultra-long-duration technologies capable of discharging for more than 100 hours.

Long-duration storage projects are deployed under archetypes such as bulk energy shifting, seasonal storage applications, and island or remote grid reinforcement that enhance the reliability of power systems. Further, these solutions cater to numerous end-use needs such as utility resource adequacy, peaker plant replacement, and large-scale grid resilience. These mission-critical applications assure stability and continuity of operation. Taken together, these technologies and applications will help create a more flexible, decarbonized, and reliable global energy system.

Latest Market Trends

Transition from Conventional Storage Cycles to Multi-Day Grid Flexibility Models

Long-duration energy storage is shifting from traditional short-cycle battery systems to advanced multi-day flexibility solutions that can support grids during prolonged renewable dips, seasonal variability, and contingency events. Conventionally, deployments have been dominated by lithium-ion systems designed for short bursts-typically under four hours, which has very much limited their usefulness for deeper grid balancing and long-haul dispatch.

Utilities and developers have often struggled with multi-day intermittency, high reliance on peaker plants, and insufficient coverage during extreme weather-driven demand fluctuations. Promising long-duration platforms such as hydrogen storage, compressed air systems, thermal storage, and mechanical gravity units are allowing uninterrupted supply from 10 to over 100 hours. This evolution is driven by the need for grid reliability as renewable penetration intensifies.

Rapid Scaling of Hybrid Renewable–Storage Mega Projects

A key emerging trend is the rise of hybrid energy complexes combining large-scale renewables with long-duration energy storage into a single asset class. Earlier renewable projects operated primarily in isolation, dependent on external grid flexibility or fossil-based balancing resources, which has often resulted in curtailment, volatile output, and limited operational control. The ways these are deployed as stand-alone utilities have limited the output of clean energy during demand peaks or times of low generation.

A new generation of hybrid mega projects that combine solar, wind, and long-duration storage in a tightly integrated configuration is upending the design of infrastructure. These systems will be explicitly engineered to provide round-the-clock renewable power, stabilize frequency, and operate as firm capacity resources capable of replacing traditional thermal plants.

Early commercial deployments show that integrated long-duration solutions radically increase the productivity of the assets, drive up the capacity factors of renewables, and unlock the ability of developers to capture multiple value streams through capacity markets, ancillary services, and long-duration energy shifting.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 5.1 billion |

| Estimated 2026 Value | USD 5.79 billion |

| Projected 2034 Value | USD 15.9 billion |

| CAGR (2026-2034) | 13.4% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Key Market Players | Form Energy, Highview Power, Energy Vault, Energy Dome, ESS Inc. |

to learn more about this report Download Free Sample Report

Market Driver

Government-Mandated 24/7 Clean Energy Obligations Accelerate Long-Duration Storage Deployment

A powerful market driver emerging worldwide is the rapid introduction of government policies requiring utilities and large energy buyers to procure 24/7 clean electricity, directly accelerating demand for long-duration energy storage. Several countries are adopting regulatory frameworks pushing beyond simple renewable purchase targets and toward round-the-clock clean power compliance.

As an example, the European Union's revised Electricity Market Design includes provisions to encourage member states to support the development of flexibility assets capable of discharging over multiple hours and days, while the U.S. Department of Energy launched dedicated initiatives such as the "Long Duration Storage Shot" with targets to cut long-duration storage costs by 90% by 2030 and to position LDES as a strategic priority at the national level. In a similar vein, mandates are set in various markets, such as Australia, whereby grid operators have a requirement for firm, dispatchable renewable capacity to meet reliability standards through evening and multi-day demand peaks.

Market Restraint

Limited Grid Interconnection Approvals Slowing Large-Scale Deployment

A major restraint in the long duration energy storage industry is the slow and highly congested grid interconnection process that prevents the timely deployment of multi-hour and multi-day storage assets. In many regions, interconnection queues have grown to unprecedented levels. As an example, official filings from multiple U.S. regional transmission operators indicate that more than 2,000 GW of generation and storage capacity is presently awaiting interconnection studies, reflecting severe bottlenecks in permitting and grid-access evaluations.

The challenge is even more pronounced for long-duration storage projects, requiring high degrees of system impact modeling, seasonal load interactions, and contingency scenarios that push approval timelines from three to seven years. Similar delays have been reported by countries across Europe and Asia as transmission operators struggle to integrate storage into many older grid architectures designed primarily for conventional generation.

Market Opportunity

Expansion of Long-Duration Storage Through Corporate 24/7 Clean Energy Procurement

A key emerging opportunity in the long duration energy storage market is the rapid shift of global corporations toward 24/7 clean energy procurement, which is creating a large new demand segment for multi-hour to multi-day storage assets. Technology leaders, large industrial manufacturers, and hyperscale data center operators are increasingly pledging to match their electricity use on an hourly basis with renewable energy supply, rather than relying on annual renewable energy certificates. That requires firm, dispatchable clean power-something that long-duration storage is uniquely positioned to provide. In recent times, several multinational corporations have structured long-term clean energy contracts that require round-the-clock renewable supply from hybrid portfolios that combine wind, solar, and long-duration storage. Early commercial deployments show that these corporate buyers increasingly favor energy solutions capable of delivering multi-hour reliability during prolonged variability periods.

Regional Analysis

In 2025, the Asia Pacific dominated the market, having a market share of 34.78%. This is undergirded by the rapid deployment of long-duration storage assets along large solar and wind corridors in areas with substantial multi-hour variability in renewables. The region is scaling commercial demonstration plants that integrate hydrogen, thermal, and compressed-air storage into utility grids, thereby providing more stable renewable dispatch.

Many countries within this region also have very strong industrial participation and manufacturing ecosystems, accelerating pilot-to-commercial transitions of multi-day storage technologies. Collectively, the above advancements position the Asia-Pacific as the global anchor for long-duration storage adoption.

Large-scale renewable integration zones and the need for multi-day reliability during periods of low wind and solar output are driving China's long duration energy storage market to expand rapidly. Multiple high-capacity hybrid projects melding hydrogen, gravity systems, and thermal storage have advanced to the later deployment stages, supported by extensive regional infrastructure planning. Utilities in northern and western provinces are adopting long-duration systems in order to stabilize large transmission corridors and reduce renewable curtailment, helping China further strengthen its position as the largest national market in the long-duration storage landscape.

Europe Long Duration Energy Storage Market Trends

Driven by rapid grid modernization and a growing need for seasonal balancing solutions across countries with winter-dominant energy demand, Europe remains the fastest-growing region with a CAGR of 14.92% from 2026-2034. It is increasingly recognized at the regional energy programs level that multi-day and multi-week storage facilities are in an important position to support power systems' deep decarbonization efforts, thus allowing long-duration assets to complement wind-rich northern countries with solar-heavy southern regions. Coordinated research clusters, large commercial trial sites, and cross-border energy projects are fast-tracking the adoption of hydrogen-based and thermal long-duration energy storage across the continent.

Germany's long duration energy storage industry is gathering momentum, with utilities and industrial clusters developing multi-day backup systems that will help balance fluctuating renewable output and growing electrification demand. A number of large industrial parks have started deploying long-duration storage to stabilize production schedules during periods of prolonged low generation. Strategic partnerships between energy developers and manufacturing hubs are also supporting early commercial deployment of long-duration hydrogen and mechanical storage systems. These efforts are positioning Germany as one of Europe's most dynamic contributors to long-duration storage scaling.

Source: Straits Research

North America Market Trends

North America continues to witness steady growth in the long-duration energy storage sector, driven by extensive grid modernization programs and increasing demand for multi-hour stability as a larger fraction of the energy supply is derived from intermittent renewables. Utilities across the U.S. and Canada are increasingly building out multi-day storage assets to manage weather-driven demand surges and renewable production dips. In addition, a number of regional transmission planning initiatives focus on storage-backed reliability corridors, accelerating the deployment of long-duration assets into utility resource portfolios.

Strategic partnerships among major utilities and industrial energy users continue to drive the U.S. long duration energy storage market. Several large data center operators are partnering with energy developers to deploy multi-hour storage systems that provide continuous, clean power coverage during extended renewable variability. These partnerships are helping commercial-scale deployments of thermal, mechanical, and hydrogen-based systems that support sustained operations for critical infrastructure. Early successes from these partnerships will further expand the role of long-duration storage across the U.S., underscoring its importance in meeting rising reliability and resiliency demands.

Latin America Market Trends

Latin America's market for long duration energy storage is gaining momentum as countries diversify their renewable portfolios and look for stable backup capacity in a region of hydropower-dependent grids. The countries that are already pioneering the use of long-duration systems to manage seasonal water shortages and multi-day drought-induced generation gaps include Chile, Brazil, and Colombia. In parallel, regional energy developers also embrace flexible storage to enable remote mining operations and large industrial loads far from transmission hubs, further accelerating demand for long-duration assets.

Brazil's long duration energy storage industry is growing, with a number of industrial clusters and renewable developers advancing multi-hour storage systems to firm up power supply against periods of hydropower variability. Long-duration thermal and compressed-air storage systems are being added to a number of large industrial zones to ensure a consistent energy supply for continuous manufacturing processes. Meanwhile, local energy developers are running long-duration storage pilots to support the growth of solar-rich regions, and Brazil is poised to become an emerging growth center within Latin America's transition to clean energy.

Middle East and Africa Market Trends

The Middle East and Africa region is seeing growing interest in long-duration storage as more countries develop large-scale renewable zones, needing stable multi-hour support during peak periods of climate-driven demand. Long-duration systems are increasingly being deployed to improve power reliability at remote desert grids and to support industrial complexes that require uninterrupted power during severe environmental conditions. The region's increasing focus on renewable diversification and large industrial corridors is opening significant opportunities for the deployment of next-generation storage.

The UAE's market for long duration energy storage is rapidly moving ahead with large energy hubs now integrating multi-hour storage to enable continuous operations in solar-dominant regions. A number of utility-scale projects are integrating long-duration thermal and mechanical systems to stabilize power delivery during extended evening peaks and high-temperature periods. Growing commercial developments and energy-intensive districts are increasingly including long-duration storage to assure operational reliability; hence, the UAE is one of the most proactive adopters of long-duration energy solutions in the region.

Technology Type Insights

The Hydrogen-Based Energy Storage segment dominated the market with a revenue share of 38.41% in 2025. This strong uptick in adoption is driven by a rapid expansion of green hydrogen projects, growing integration of electrolyzers with large solar and wind farms, and expanding utility demand for multi-day to seasonal storage capabilities.

Mechanical Gravity Storage is expected to be the fastest-growing segment, with a CAGR of approximately 15.68% during the forecast period. This fast pace will be realized due to the growing usage of gravity-based systems in areas where topography is ideal, expressions of interest on the part of data centers regarding long-duration backups, and the rapidly increasing appeal of mechanical storage as a low-degradation, long-lifespan alternative to chemical storage.

Source: Straits Research

Storage Duration Insights

The Medium Duration (4 to 10 hours) segment dominated the market share with 44.26% in 2025, owing to strong adoption from utilities that have been pursuing reliable multi-hour flexibility to support evening peak demand and mitigate renewable variability.

The Long Duration segment, which caters to a timeframe of 10 to 100 hours, is expected to achieve the highest CAGR of 15.12% during the forecast period. This growth is driven by an increase in demand to ensure multi-day reliability on account of renewable shortages, rising corporate and utility interest for the supply of clean energy 24/7, and deployment of large-scale hybrid renewable–storage projects.

Project Archetype Insights

Bulk Energy Shifting segment led the market in 2025, with a market share of 36.27%. This leadership is driven by the rapid expansion of large-scale renewable portfolios that require dependable multi-hour to multi-day storage to shift excess generation into periods of peak demand. Utility companies are able to convert intermittent solar and wind output into firm, dispatchable capacity with bulk energy shifting projects, reducing curtailment and enhancing grid stability.

The Seasonal Storage segment is expected to see the fastest growth during the forecast period. This rapid growth is driven by increasing demand from long-duration systems that can bridge multi-week or seasonal mismatches between renewable generation and consumption patterns. As countries progress toward deeper decarbonization targets, seasonal variability-especially in winter-dominant demand regions-presents significant challenges to reliability.

End-Use Insights

The Utility Resource Adequacy segment is expected to register the highest CAGR of 14.36% during the forecast period due to increasing demands for adequate multi-hour to multi-day backup capacity in power grids as they transition towards high renewable penetration. Indeed, utilities are increasingly embracing and deploying long-duration storage against a backdrop of seasonal variability, declining thermal reserves, and peak-demand pressures across more regions to ensure system reliability and prevent supply shortages.

Competitive Landscape

The long duration energy storage market worldwide is reasonably fragmented, with the use of many specialized technology developers, system integrators, and next-generation storage innovators. There are only a few leading players commanding large market shares through their patented technologies, large demonstration projects, and strong partnerships with either utilities, renewable developers, or industrial energy users.

The major companies in the market include Form Energy, Highview Power, Energy Vault, and others. These companies are competing in scaling multi-day storage technologies, securing long-term utility contracts, and expanding commercial deployments across emerging storage applications. Strategic initiatives such as technology commercialization, multi-site project partnerships, and cross-border collaboration enable these players to strengthen their presence in the market and accelerate the global adoption of long-duration energy storage solutions.

Form Energy: An emerging market player

Form Energy, a US-based developer of long-duration energy storage with a core focus on iron-air battery technology, has emerged as one of the leading drivers of growth in the LDES market today. Their technology is designed to store electricity for up to 100 hours, enabling multi-day grid-scale energy storage and significantly better renewable energy firming capabilities.

- In October 2025, the first 100-hour batteries from Form Energy began hitting the grid, marking the first commercial application of multi-day battery storage at scale.

Form Energy, therefore, was one of the major developers in the global long duration energy storage market that utilized its iron-air technology, large-scale manufacturing capacity, and early commercial grid deployments to shape the future of multi-day clean energy storage.

List of Key and Emerging Players in Long Duration Energy Storage Market

- Form Energy

- Highview Power

- Energy Vault

- Energy Dome

- ESS Inc.

- VFlow Tech

- Vionx

- Invinity

- Fluence

- Siemens Energy

- Linde

- Air Liquide

- Wärtsilä

- Tesla Energy

- CATL

- High Renewables

- BASF

- Hydrogenious LOHC

- CalMac

- Abengoa

- Others

Strategic Initiatives

- November 2025: Energy Vault reported robust growth driven by the expansion of its storage projects in Australia and the initial revenue generation from its wholly-owned “Asset Vault” subsidiary, which develops, owns, and operates long-duration storage assets globally.

- October 2025: ESS Inc. signed an agreement with utility Salt River Project (SRP) to deploy a 50 MWh long-duration iron-flow energy storage system under a ten-year energy storage agreement.

- September 2025: Highview Power announced that two of its long-duration energy storage plants, each designed with a capacity of 3.2 GWh, were confirmed as eligible projects under the UK’s Cap-and-Floor framework.

- February 2025: Energy Dome launched the commercial expansion of its CO₂ Battery in Europe, scaling its flagship long-duration storage technology to support multi-day renewable balancing.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 5.1 billion |

| Market Size in 2026 | USD 5.79 billion |

| Market Size in 2034 | USD 15.9 billion |

| CAGR | 13.4% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Technology Type, By Storage Duration, By Project Archetype, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Long Duration Energy Storage Market Segments

By Technology Type

- Hydrogen-based energy storage

- Compressed air energy storage

- Thermal energy storage

- Mechanical gravity storage

By Storage Duration

- Medium duration 4 to 10 hours

- Long duration, 10 to 100 hours

- Ultra long duration above 100 hours

By Project Archetype

- Bulk energy shifting

- Seasonal storage

- Island and remote grid reinforcement

By End Use

- Utility resource adequacy

- Peaker plant replacement

- Grid resilience and blackout prevention

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.